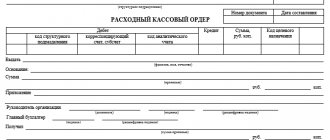

A cash order is a document that records payments made from the organization's cash register. It refers to primary accounting documentation and is most often used when transferring cash to a bank account, paying wages, issuing money on account, reimbursing employees for overexpenditures on expense reports, payments for travel expenses, etc.

It is important to take into account that the amount entered into the “consumables” should not exceed one hundred thousand rubles (everything that exceeds this limit must be carried out by bank transfer).

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

RKO: in Excel

You can also use RKO in excel. It contains the same columns as in the word document - choose the one that is convenient for you.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

RKO is issued in one copy. It is issued by the employee who issues the money, but the recipient also enters some information. How to fill out RKO - read on.

The cash disbursement order is filled in when you withdraw cash from the cash register:

- to the bank for crediting to the current account,

- on account - upon a written application from the recipient, in which he must indicate the amount and period for which he is taking cash,

- for personal use by an employee, for example, for travel expenses or as financial assistance,

- for the needs of the enterprise - in this case, you must indicate a specific purpose for issuing money, for example, for business expenses.

What is it and why is it needed in accounting?

An expense cash order is a monetary document that records the issuance of money from the company's cash desk and serves as a link for (accounting) transactions.

It is in no way tied to maintaining the entire accounting of the enterprise.

The expenditure order is issued on paper due to the need to affix personal autographs of responsible employees (persons).

This is necessary to know. The RKO is also signed by the entity receiving the cash. At the moment, it is prohibited to certify such documentation with an electronic digital signature.

Example of filling out RKO

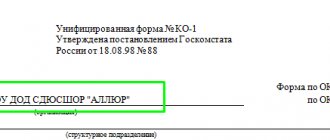

RKO can be issued on paper or electronically. It's easy to fill out the form. Download a sample of filling out a cash flow order that is current in 2021 - you can simply replace the data with your own.

RKO

Get a RKO sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in

- Fill out and print the document online (this is very convenient)

The amount you enter in the KO-2 form should not exceed 100 thousand rubles. Anything that exceeds this limit must be carried out by bank transfer.

Maintaining in electronic form

Reporting in most organizations operating in the Russian Federation is carried out in the form of specialized programs. One of the capabilities of such programs is maintaining documentation, in particular, cash registers, in electronic form.

Registration of the standard form RKO KO-2 is possible in programs such as 1C: Accounting, 1C: Enterprise, Bukhsoft online and their analogues.

Filling out cash registers electronically has many advantages, including:

- no errors in specifying the debit order number - the system automatically assigns the current serial number following the number of the last created document for the disbursement of funds;

- the ability to automatically create all invoices - the program sets them automatically according to the specified basis for the issuance of funds;

- the ability to adjust the specified data (grounds, amounts, full name of the recipient of funds). In this case, the document is simply corrected and printed;

- If paper media is lost, it is always possible to restore data;

Filling in 1C: Enterprise - the ability to automatically generate financial statements based on a database of posted receipts and expenses at the cash desk;

- If you omit any of the fields that must be filled in or if you indicate data that is erroneous (in accordance with the procedure for preparing accounting documentation), the system automatically does not allow the document to be processed.

This method of limitation allows you to avoid a large number of errors made when filling out the KO-2 form manually.

After the electronic form of the document is filled out, it is printed on paper and authorized employees sign. If there is a seal of the organization, they also affix it.

Registration of RKO

An expense cash order can be issued by:

- Chief Accountant,

- an accountant or employee (for example, a cashier) appointed by the manager,

- director (in the absence of a chief accountant and accountant).

RKO is always drawn up on the day the money is issued.

Start filling out the RKO by filling out:

- the full name of the company indicating the organizational and legal form,

- OKPO code,

- form numbers in accordance with internal document flow,

- dates of completion,

- code of the structural unit that issues money. If it is not there, put a dash,

- number of the subaccount in which cash is accounted for,

- analytical accounting code (if required),

- loan (i.e. account number that reflects the disbursement of funds),

- amounts in rubles (in numbers).

Next, the procedure for filling out the RKO is as follows:

- you need to enter the full name of the person you are giving the money to,

- indicate the basis for issuance, for example: salary, financial assistance, business trip expenses, etc.,

- indicate the amount in words,

- enter the name, date and number of the attached document on the basis of which you are issuing money. This could be a payroll, receipt, order, contract, etc.

The cash receipt order must contain the signatures of the director or authorized employee, as well as the accountant. They definitely need to be decrypted.

The next part is filled out by the employee who receives the money. He points out:

- The amount issued is in words, and kopecks are in numbers. The remaining blank part of the line must be filled with a dash.

- Date of receipt of money.

- Passport details.

Signatures are placed by the cashier who issued the money and the employee who received it. Without filling out this part, the RKO will be invalid. In this case, the money will be considered appropriated by the employee who issued it.

The cashier can draw up one cash register at the end of the working day for the entire amount issued during the day, but provided that there are fiscal documents of the online cash register - checks or BSO.

Corrections in the cash receipt order are not allowed.

To avoid mistakes, use the MySklad service - you can fill out online and print a cash receipt order in a few clicks.

Basic rules for drawing up a cash receipt order

The document does not have a standard, uniform template recommended for use. This means that enterprises and organizations can independently develop its form or use one of the common templates.

When developing a cash order, you must always take into account the fact that it must include the name of the organization that issues it, information about who it is issued to, as well as the amount of the amount issued. In addition, the document must be certified by the signature of the head of the enterprise, accountant and cashier.

You can write out a document either in handwritten form (which is becoming less common these days) or on a computer. The “consumables book” is filled out in one copy directly by the employee who is responsible for issuing cash, but some information is entered into it by the recipient of the funds.

It should be noted that the cash order is often accompanied by documents that serve as the basis for issuing cash from the cash register (orders, management instructions, copies of contracts, etc.) and, if the application contains the signature of the director of the enterprise, then the order itself it is no longer necessary to certify it with a signature.

There is no need to put a stamp on the document, since it relates to the internal documentation of the enterprise and, moreover, from 2021 the requirement for legal entities to use seals and stamps in their activities has been canceled.

RKO: fill out online

You just need to enter the amount and basis of payment, select the expense item and recipient, and the system will automatically generate and number the document.

Fill out RKO online

Fill out the RKO online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

In MyWarehouse you can also download a complete list of expenditure orders for all time. This is convenient for reporting - the total amount of funds issued is immediately visible.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Fines

Incorrect maintenance or absence of primary documentation at the cash registers, which also implies the maintenance of cash register services (online or in another form), may result in the imposition of penalties on a legal entity. The procedure is regulated by the Tax Code of the Russian Federation, its article number 120. It states that a gross violation of the norms for accounting for expenses and income, as well as objects of taxation, within one tax period, may cause the imposition of a fine in the amount of ten thousand Russian rubles.

A gross violation may consist in the absence of cash settlements or other primary documentation of cash activities. This may cause the tax service to refuse to confirm the company's displayed expenses for tax payments.

Consumables online when returning by card

How to fill out RKO: difficult cases

Although filling out the RKO is not difficult, in special cases problems arise. We've sorted out the most common ones.

Payment to the supplier through the cash register: how to issue cash settlement

Be sure to request a power of attorney from the supplier’s representative to receive from your company a specific amount under a specific agreement, delivery note, etc. It must be attached to the RKO. Note that:

- When filling out an expense cash order, in addition to the details of the power of attorney, you must indicate the full name of the representative and his passport details.

A power of attorney to receive money without it being signed by a RKO representative does not prove that he received it.

- In the “Bases” line, you must enter the details of the contract, invoice, etc., as well as the names of the goods.

- If payment is made under several contracts at once, it is better to draw up a separate order for payment for each of them. It will be clearly visible how much was paid for each delivery.

- When recording this order in the cash book, you need to indicate the full name of the representative, details of the power of attorney and the name of the supplier.

How to fill out cash settlements for the issuance of accountable amounts: sample

Since August 19, 2021, the Bank of Russia has issued instructions according to which money can be issued on account by order of the director. An application from an accountable is no longer required. The main thing is to indicate the chosen issuance procedure (by application or by order) in the company’s accounting policy.

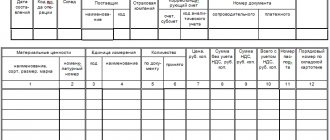

How to keep records and how much to store

Registration and accounting of the cash receipt order is carried out in the registration journal in the KO-3 form, as well as in the cash books (KO-4). The serial numbers of the RKO are entered into the journal. This must be done after they are signed by the chief accountant or director. The journal must be kept in the accounting department of the enterprise or with the director.

Journal KO-3 (form according to OKUD 0310003) is a cover in which the registration data of the institution and a loose leaf are filled out. Two tables are formed on the insert sheet: the left one displays information on PKO, and the right - on RKO.

Incoming and outgoing KOs are stored for 5 years according to the rules established by the head of the organization.

Expert opinion

There is conflicting information on the Internet about cash discipline. Many accountants make the mistake of equating merchants with organizations in status. The rules for cash payments for legal entities are much stricter. Some regulations are not applicable to individual entrepreneurs at all. Thus, private businessmen do not use a chart of accounts, do not keep accounting records, and are not required to comply with the requirements for the intended use of proceeds. Attempts to follow regulations addressed to firms lead to confusion. The result is disputes with tax authorities and lengthy legal proceedings.

Account cash warrant

Legal nuances

In 2014, the regulator softened the requirements for small businesses, abandoning the requirements for setting limits and mandatory cash documents. Refer to clause 4.1. Entrepreneurs who have ensured proper tax accounting are entitled to instructions. Since recording objects of taxation is mandatory in all regimes, the norm covers payers of the simplified tax system, OSN, UTII and Unified Agricultural Tax. Patent holders have the right to refuse cash documents if they keep an income accounting book (KUDIR).

However, businessmen should study the basics of the discipline. The system avoids confusion, facilitates control of financial flows and protects against staff abuse.

What are the consequences of violations of cash discipline?

Since entrepreneurs have no obligation to draw up cash and expense documents, there is no talk of holding them accountable. The merchant has the right to refer to clause 4.1 of Instruction No. 3210-U. The corresponding section frees individual entrepreneurs from the need to maintain journals, use cash registers and cash registers. The condition is proper accounting of taxable objects.

Entrepreneurs face sanctions only for certain types of violations. Thus, negative consequences may occur if the cash settlement limit for a transaction is exceeded. Now the maximum level is at the level of 100,000 rubles. Failure to comply with the standard for contracts with commercial entities is recognized as a misdemeanor. The restriction does not apply to settlements with individuals.

Violators are held accountable under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. Sanctions are prescribed in the range of 4,000 – 5,000 rubles. In addition, the culprit may be charged a fine under Article 120 of the Tax Code of the Russian Federation. Depending on the consequences of the offense, the amount varies from 10,000 to 40,000 rubles.

Cashier functions

The cashier issuing funds performs the following actions:

- First of all, a check is made to ensure that all necessary signatures are present. They check the samples from the card, which is always in the cash register.

- The amount indicated in words must match that indicated in numbers and is written without spelling errors.

- The supporting documents specified in the RKO form must be available. They are attached to the order.

- The recipient's data (passport information, full name) is verified with those indicated in the completed form.

- If there are no comments, the cashier will issue the funds to the recipient.

- The order is sent to the recipient for signature.

- After this, the cashier puts a stamp on the front side and certifies it with his own signature.

If there are visible corrections or erasures in the document, then such a form should not be accepted for execution.

You need to know that the expense order must remain in the cash register and not be given to the recipient of the funds.

The procedure for applying an expense order

When issuing money from the cash register, a settlement account is drawn up. For this purpose, a standardized form can be used or a form developed on its basis, taking into account the existing specifics of the enterprise’s activities.

The document is issued by a person from the accounting department, a cashier or another official who, due to his duties, must deal with the preparation of these documents.

The basis for payment of cash is, in most cases, a statement from employees who are financially responsible persons. It must reflect the purpose of using the money, as well as the director’s visa. The application does not need to be drawn up only in case of payment of salaries to employees.

Attention! From August 19, 2021, according to the Directive of the Central Bank of the Russian Federation, an application for the issuance of money may not be filled out if there is an order or other order from the management of the company on the payment of cash in certain areas.

After the initial preparation of the document, it is transferred to the cashier, where the cashier checks its correctness and the presence of all required details, including the manager’s signature.

If a mistake is made when issuing a consumable, then corrections cannot be made from it. It needs to be reissued. Next, the cashier records the form in the registration journal.

Attention! Before actually paying out the money, the cashier must verify the identity of the recipient. To do this, he must check the data specified in the RKO with the identity card presented to him. In addition, the cashier must enter the basic details of the presented document in the cash register.

After this, the required amount indicated in the consumables is transferred along with it to the recipient, who checks the actual availability of money, and then puts his visa in confirmation of receipt of cash.

Then the RKO is returned to the cashier, who, in confirmation of issue, also puts his signature on this document, as well as the stamp “Paid”. The recipient of the money can be a trusted person, in which case he must also present a power of attorney for the right to represent the interests of the person. In this case, the power of attorney is attached to the consumable.

At the end of the shift, the cashier must submit a report to the accounting department, to which he attaches all cash documents for the day, including expenses.

How is cash issued?

To receive cash from the company's cash desk, an order from the manager is required. It can be in the form of an order or an application for an advance. In the order, these documents must be indicated in the “Bases” column and attached to the consumables (expenditure order) when filing cash documents.

The issuance of cash directly is possible only upon presentation by the recipient of the funds of a passport, the details of which are recorded by the accountant. It is also possible to receive cash by power of attorney, but then it must be drawn up in full form, and the expenditure order must indicate the details of both the person for whom the funds are being received and the actual recipient of the money. In addition, when receiving money without an advance application, the recipient must leave a receipt indicating his passport details and the amount received in words. The responsibilities of the cashier issuing cash include checking all the primary documents on the basis of which money is issued, the identity of the recipient, the compliance of the expense order with the requirements for maintaining cash documentation (you need to check the signature of the manager, chief accountant, seal, and date compliance). Otherwise, the issued amount may be recognized as a deficiency and collected from the responsible person - the cashier or accountant managing the cash register of the enterprise.