Report 6 Personal income tax, when and how to submit personal income tax - personal income tax,

Changes In each 2-NDFL certificate, income and deduction codes must be entered. This

Off-balance sheet account 002 - what is it intended for? Off-balance sheet accounts in accounting are intended to reflect

Employer reporting Olga Yakushina Tax expert-journalist Current as of January 29, 2019 ERSV for 4

Taxation of movable property: history of the issue From 01/01/2015 fixed assets included in 1 and 2

Accounting for third party services Third party services are a type of activity that is not

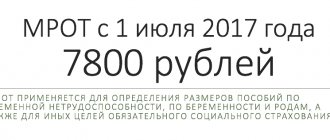

Remuneration Current as of July 1, 2017 Many personnel workers already know that with

Residents of Russia can find basic property tax benefits in Article 407 of the Tax Code

Employer reporting Victoria Pechieva Expert, chief accountant with 12 years of experience Current as of December 26, 2018

March 21, 2021 Benefits Every woman with a social package has the right to paid maternity leave