The process of filling out documentation is not easy. In this article you will learn how to correctly fill out 3-NDFL for 2015, and you will be able to.

[sc:docObr id=»https://grazhdaninu.com/wp-content/uploads/2017/07/Nalogia_Ru_Forma_3-NDFL_2015.pdf» mytext=»3-NDFL declaration for 2015»]

- Download the blank 3-NDFL form for 2015 from this link.

- A sample of the completed 2015 declaration can be downloaded from this link.

- Download the program developed for processing 3-NDFL for 2015 here.

When is the 3-NDFL declaration prepared?

In addition to the planned submission of reports on time, there are situations when it is necessary to prepare Form 3-NDFL in advance. To deduct funds from tax, having sufficient grounds for this, you must contact the tax office and provide reporting. Every taxpayer should know his rights and obligations - this will allow him to take advantage of the opportunity to deduct funds in a timely manner, which will save him a decent amount.

The right to a 13% rate refund to an individual is granted in the following cases:

- as a result of the purchase of real estate;

- if an individual participates in a mortgage;

- when receiving education on a contract basis;

- for payment of pension contributions to an insurance company;

- when participating in charity and other cases.

Section 1: Addendum

You have already entered something in line 070. In line 080, reflect (attention!) the numbers from line 120, which is on Sheet A. Do not fill out line 090 - it is for income received abroad. You now have almost everything you need to complete the remaining lines in Section 1.

We noted above that to calculate the values in line 40 you need data from Sheet I. What information are we talking about here? About those that reduce the tax base, that is, those provided for in subparagraphs 2.5, 2.6, 2.8 and 2.9. But, as you remember, you did not fill them out, since there was no need for this. So on line 040 you don't write anything.

In turn, line 050 is the difference between the number in lines 030 and 040. But since you do not write anything in the second, the data in points 030 and 050 will match. You can easily calculate the amount of tax that must be paid and which must be reflected in line 060.

Generating a report

If necessary, the form is drawn up independently, or online, using special technical means. You can fill out the 3-NDFL declaration online, or using the Declaration program, which is available for download from our website using this link.

The declaration contains the following information:

- all necessary personal data of the taxpayer;

- indication of documents confirming the expenses and income of an individual;

- tax deduction.

Some of the necessary information is transferred to the document using special, legally approved codes.

Program "Declaration 2013"to fill out 3-NDFL for 2013

Program “Declaration 2013”, version 1.2.0 dated March 19, 2015.

(download a free program for filling out a tax return in 2014 in form 3-NDFL for 2013):

1) InsD2013.exe – installation program

2) Installation instructions

3) Abstract

Computer requirements

and software

Minimum hardware requirements:

- RAM of at least 512 MB and 20 MB of free disk space for installing task software.

- Processor class Intel Pentium II 400 MHz.

- Microsoft Mouse or compatible.

- SVGA video adapter with a resolution of 800x600 with 16-bit color depth.

- Printer

Windows operating system and other software:

Operating system Windows 98, Windows 2000, Windows XP, Windows Vista, Windows 7, Windows 8 (with Russian regional settings).

About the “Declaration 2013” program

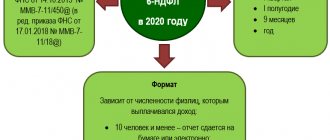

GNIVTS Federal Tax Service of Russia annually develops and offers free programs for filling out the 3-NDFL declaration.

The “Declaration 2013” program is designed for automated completion of personal income tax returns in 2014 (form 3-NDFL and form 4-NDFL) for 2013.

You can also find and download the program distribution kit for free on the website https://www.gnivc.ru/ in the “Software”, “Free Software”, “Software for Individuals” section.

Declaration 3-NDFL for 2013 is filled out in accordance with the order of the Federal Tax Service dated November 10, 2011 No. ММВ-7-3/ [email protected] (as amended by the Order of the Federal Tax Service of Russia dated November 14, 2013 No. ММВ-7-3/ [email protected] ).

This order contains a section dedicated to the procedure for filling out a declaration in form 3-NDFL (Procedure for filling out the tax return form for personal income tax (form 3-NDFL), approved by order of the Federal Tax Service dated November 10, 2011 No. ММВ-7-3/ [email protected] ).

The program automatically generates 3-NDFL declaration sheets based on the data entered by the user:

- for all taxable income received from sources in the Russian Federation and received from sources outside the Russian Federation;

- on income from business activities and private practice;

- data for calculating professional tax deductions for royalties and civil contracts;

- property tax deductions;

- data for calculating the tax base for transactions with securities and financial instruments of futures transactions, the underlying asset for which are securities;

- for calculating standard and social tax deductions.

Instructions for filling out the 3-NDFL declaration

in the program "Declaration 2013"

Filling procedure

Filling out the 3-NDFL declaration is carried out in accordance with the Procedure for filling out the tax return form for personal income tax (form 3-NDFL), approved by order of the Federal Tax Service dated November 10, 2011 No. ММВ-7-3/ [email protected]

The program automatically generates 3-NDFL declaration sheets based on the data entered by the user.

Launching the application

To launch the application, select the appropriate icon on the desktop, in the Start menu -> Programs -> Declaration 2013.

To exit the program, click the button in the upper right corner of the window, or select File->Exit from the main menu

Application interface

The main components of the Declaration 2013 program: main menu, toolbar, navigation bar, main window.

Toolbar

The program's toolbar provides access to various main menu functions with a single click on the corresponding button. Please note that each toolbar button displays a tooltip containing a description of its purpose. The panel view is configured in the Settings menu

Main menu

The menu consists of standard items File, Settings, Help, as well as the Declaration item.

When you start the program, an “empty” declaration is automatically created. At any time, you can save the entered data to disk, load a previously saved declaration, or create a new one. In this case, the name you assigned to the file is displayed in the header. The program has built-in control of the entered data for their presence, if details are required, and their correctness.

Setting conditions

On this screen, you enter the conditions for filling out the 3-NDFL declaration.

If you are not a tax resident of the Russian Federation or you need to submit a declaration in Form 4-NDFL, then select the appropriate item in the Declaration Type panel.

If you submit an initial declaration, 0 is indicated in the adjustment No. field. If you submit a clarifying declaration, then in this field you need to indicate the number of times you do this.

In addition, there is a panel “Income available” with items that divide the entry of the declaration into logical sections:

- if the user is going to enter information about income from income certificates, income from civil contracts, royalties, from the sale of property, etc., i.e. information on income taxed at rates of 13%, 9%, 35% (in the case of a non-resident - 13%, 15% and 30%) with the exception of income in foreign currency and income from business activities and private practice.

- if you have income in foreign currency, then accordingly you need to check the box next to In foreign currency.

- if you have income from business activities, then you need to check the box next to From business activities.

Information about the declarant

On these two windows, information about the taxpayer is entered, corresponding to sheet 2 of the 3-NDFL declaration form. Switching between these two screens is done using the buttons at the top of the main window.

The country code is indicated according to the All-Russian Classifier of Countries of the World (OKSM). If the taxpayer does not have citizenship, the Country Code field indicates the code of the country that issued the identity document.

OKTMO address can be clarified at your tax office.

The TIN field is required for individual entrepreneurs, private notaries, lawyers and heads of farms. Other individuals may not fill it out.

Income received in the Russian Federation

Input is carried out on three screens. Switching between screens is done using the buttons at the top of the main window. The screens are divided by tax rates: 13%, 9%, 35%.

For each rate, the corresponding types of income are entered. A different set of tax rates is available for non-residents: 30%, 15% and 13%

Income taxed at the rate of 13% (30%)

Screen for entering income taxed at a rate of 13% (corresponds to sheet A of the declaration form)

Income taxed at 9% (15%)

Screen for entering income taxed at a rate of 9% (corresponds to sheet A of the declaration form)

Income taxed at 35%

Screen for entering income taxed at a rate of 35% (corresponds to sheet A of the declaration form)

Entrepreneurs

The screen for entering income from business activities corresponds to sheet B of the 3-NDFL declaration form

For entrepreneurial activities, you must indicate the OKVED code by selecting it from the directory. When searching for the code you need, keep in mind that some nesting sublevels for your activity may be empty.

Income received outside the Russian Federation

The screen for entering income in foreign currency corresponds to sheet B of the declaration form

Deductions

Input is carried out on four screens. Switching between screens is done using the buttons at the top of the main window. The screens are divided by type of deduction. On the first screen, standard tax deductions are entered, on the second - social tax deductions, and on the third - property tax deduction for new construction, or the purchase of a residential building or apartment. The fourth screen is used to enter data on losses on transactions with securities of previous tax periods. Other deductions (for example, royalties or property deductions on income from the sale of property, securities) are entered along with the corresponding income - see “Income taxed at the rate of 13%”.

Standard deductions

The screen for entering standard deductions corresponds to sheet G1 of the declaration form

Social deductions

The screen for entering social deductions corresponds to sheets G2 and G3 of the declaration form

Property deduction for construction

Screens for entering property deductions for construction correspond to sheet I of the 3-NDFL declaration form.

In the Cost of the object (share) field, the costs incurred are indicated, and it must be borne in mind that in the final calculation on sheet I in clause 1.11, the program will indicate an amount of no more than 1,000,000 rubles (multiplied by the share of ownership) for a property registration date before 2008 and no more than 2,000,000 rubles (multiplied by the share of ownership) if the date of registration of ownership is in 2008 or later. If an object is purchased in installments, then you should not indicate the total amount of the cost of the object, but only the amount actually paid from the moment payments began until the end of 2011 (not to be confused with the case when the object is paid in full, and you gradually pay off the bank for the loan - in this In this case, you have the right to indicate the entire cost of the object at once).

In the Interest on loans field for all years, the amounts spent on paying interest on target loans are indicated. For those who have been submitting a Declaration for several years, we especially note that the procedure has changed and now in this field you need to enter the amount of interest paid on loans for all years, and not just for the reporting year.

Deductions from the tax agent, both for the reporting year and for previous ones, are taken from 2-NDFL certificates. If they are not indicated there, then these deductions were not provided to you by the tax agent.

The amounts transferred from the 3-NDFL Declaration for 2012 are transferred to the Amount transferred from the previous year fields. If in 2013 you are applying for a deduction for the first time, then these fields are not filled in. According to the Procedure for filling out the 3-NDFL Declaration, the values of these fields are not included in the calculation; the data is used by tax authorities as reference information. The entire calculation is based on the data in the fields total cost and deductions from previous years.

In the fields Deduction for previous years according to the 3NDFL declaration, the amounts of property deductions for construction and loan repayment from the Declarations for previous years are indicated. If in 2013 you are filing a return for deduction for the first time, then these fields are not filled in. If you receive a property deduction for construction and loan repayment for more than two years, then you will have to add up the corresponding amounts, taking them from sheet L of the 3-NDFL Declarations of previous years, and enter the total in the appropriate field in the program.

Accounting for losses on transactions with securities of previous years

Persons who have received profits from transactions with securities and (or) from transactions with financial instruments of futures transactions can deduct losses from previous tax periods, which are entered on this screen.

Preview and Print

In the main program window, on the toolbar, click the View button. You will see the sheets of the created Declaration 3-NDFL.

There are two ways to print the 3-NDFL declaration. In the main program window, on the toolbar, click the Print button, and then the declaration will be printed in its entirety. Or from viewing mode. At the same time, you can select the pages you need for printing if you click on the button with the image of the printer “without a checkmark”.