2-NDFL for 2014

At the end of the year, the company must report on the withheld and paid personal income tax for each taxpayer. To do this, you need to submit certificates to the tax authorities in form No. 2-NDFL.

Employers submit 2-NDFL certificates to the Federal Tax Service twice a year. The first time - until February 1 for persons from whose income they were unable to withhold tax. The second - no later than April 1 for citizens who were paid income and withheld personal income tax. After the certificates are submitted, inspectors begin to study them. And if there are inaccuracies, tax officials may ask for clarification.

As a rule, the procedure for filling out a 2-NDFL certificate does not cause difficulties for an accountant, however, in practice there are cases that are not described in any order. We'll talk about them.

GOOD TO KNOW

The amounts of calculated, withheld and transferred tax in the 2-NDFL certificate for the year must be equal. If these indicators differ, tax authorities may ask for an explanation of the discrepancies.

Should the calculated, withheld and transferred tax amounts in Form 2-NDFL be the same?

If you are submitting 2-NDFL certificates for employees from whom tax was withheld, then ideally the indicators in lines 5.3–5.5 of Section 5 of the certificate should match. That is, the amount of tax calculated, withheld and transferred to the budget must be the same. After all, if you have calculated and withheld the tax, then in any case you must transfer it to the budget no later than the next day. Therefore, the corresponding indicators will be equal.

Difficulties arise when we either did not pay wages or did not transfer personal income tax due to our fault. In such a situation, it should be taken into account that the amounts of employee income (as well as personal income tax amounts withheld from such income) accrued (calculated and withheld) for 2014 are shown when filling out form 2-NDFL specifically for 2014, regardless of the date of actual payment of income .

Line 5.5 of form 2-NDFL indicates the amounts of personal income tax transferred to the budget from these incomes. The amount of personal income tax calculated from the taxpayer’s income in 2014 and not paid until the reporting is submitted to the tax authority is not initially reflected in the 2-NDFL certificate submitted to the tax authority for 2014; line 5.5 is not filled in. After paying this income, in our opinion, you should submit an updated 2-NDFL certificate with completed line 5.5.

GOOD TO KNOW

In the updated form of the 2-NDFL certificate, the number is the same as that of the original certificate, but the date of preparation must be indicated new.

How to show personal income tax in a certificate that cannot be withheld

It is not always possible to withhold and transfer personal income tax to the budget from employee remuneration. For example, an employee was given income in kind. But there are no cash payments from which tax could be withheld in his favor. In this case, you can postpone personal income tax payment to the next month only within the current year. It is impossible to postpone the transfer of tax to the next year or pay it at your own expense, so the Federal Tax Service must deal with the collection of underpayments.

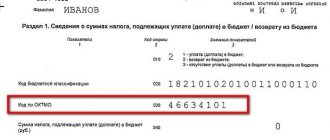

For your part, it is important to notify both the Federal Tax Service and the employee of the impossibility of withholding tax. The notification period is until February 1 of the following year. During the same period, you must submit a 2-NDFL certificate to the inspectorate. To ensure that officials understand that they have received a message about unwithheld tax, indicate the value “2” in the name of the certificate in the “sign” field. Enter the calculated tax amount on line 5.3. Move it to line 5.7 “Amount of tax not withheld by the tax agent.” Income from which tax is not withheld is reflected in section 3 of the certificate.

If you do not inform the Federal Tax Service about the impossibility of withholding personal income tax, the tax authorities may find out about this during an on-site audit. Then they will have the right to fine you 200 rubles for each unsubmitted certificate. (Article 126 of the Tax Code of the Russian Federation). Therefore, to prevent this from happening, submit 2-NDFL certificates on time.

Two certificates in form 2-NDFL

If the salary for the previous year was paid after the deadline for submitting form 2-NDFL with sign “1”, the report will have to be submitted twice. Form 2-NDFL must be submitted for the first time no later than April 1. When filling it out in clause 5.3, you should indicate the amount of calculated personal income tax, including the amount of accrued but unpaid wages, for example, for December 2014. Since the salary has not been paid, tax cannot be withheld from it (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Therefore, in paragraphs 5.3 and 5.4 of Form 2-NDFL will show different amounts. The calculated tax will be greater than the withheld tax. The amount of unwithheld personal income tax must be reflected in clause 5.7 of form 2-NDFL.

In order to avoid claims from the tax inspectorate, we recommend attaching a covering letter to the 2-NDFL form explaining the indicator in clause 5.7 of the 2-NDFL form.

Covering letter attached to certificates in form 2-NDFL with sign “1”, which the company submits before April 1, 2015

We send certificates of income of individuals for 2014 in the form of 2-NDFL in the amount of 7 pieces. We inform you that in certificates No. 1–7 in clause 5.7 the amounts of personal income tax not withheld by the tax agent are indicated.

These amounts arose due to the delay in payment of wages for December 2014.

Cosmos LLC plans to repay wage arrears for December 2014 in May 2015.

The second time after repaying wage arrears, clarifying certificates should be sent to the tax office in form 2-NDFL. In the updated report, the indicator of paragraph 5.3 will coincide with the indicators of paragraphs. 5.4 and 5.5, and the cell in clause 5.7 will become empty. When drawing up a clarifying form 2-NDFL, instead of the previously submitted one, you should indicate:

- in the field “No. ____________” – the number of the previously submitted form 2-NDFL;

- in the “from ____________” field – the new date of preparation of form 2-NDFL.

This is stated in paragraph. 8 of Section I of the Recommendations for filling out Form 2-NDFL.

We also recommend attaching a cover letter to the 2-NDFL clarification form explaining the reason for the change in the indicators. An example of it is shown below.

A covering letter attached to the clarifying certificates in form 2-NDFL, which the company submits in 2015 after issuing salaries for December 2014

We send clarifying certificates about the income of individuals for 2014 in the form of 2-NDFL in the amount of 7 pieces.

We inform you that wages for December 2014 were actually issued to employees on May 05, 2015, and therefore changes were made to section 5 of the certificates in form 2-NDFL:

- the indicator in clause 5.7 has been reset to zero;

- in clause 5.4, the indicator is increased by the amount of tax withheld from the salary for December 2014.

Certificate 2-NDFL and over-withheld tax when changing the status of an employee from non-resident to resident

When an organization employs foreign citizens or employees who often go on business trips abroad, their tax status by the end of the calendar year may change from non-resident to resident if the employee was actually in Russia for at least 183 calendar days over the next 12 consecutive months (clause 2 of Art. 207 of the Tax Code of the Russian Federation). Accordingly, on the income received by such employees, it is necessary to recalculate personal income tax at a rate of 13% instead of 30% (clauses 1, 3 of Article 224 of the Tax Code of the Russian Federation). For such cases, when an individual has acquired the status of a tax resident of the Russian Federation, Ch. 23 of the Tax Code of the Russian Federation provides for a special procedure for the return of personal income tax. In such a situation, the tax refund is made not by the tax agent-employer, but by the tax office. To do this, the taxpayer submits to the inspectorate at the end of the tax period a declaration and documents confirming his status, and the tax authority returns the tax in the manner prescribed by Art. 78 of the Tax Code of the Russian Federation (clause 1.1 of Article 231 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-04-06/6-258). But the tax agent - the employer must:

- issue such employees with 2-NDFL certificates at the end of the year, in which in clause 5.6 “Amount of tax excessively withheld by the tax agent” you need to show the amount of excess tax withheld equal to the difference between the listed personal income tax (clause 5.5 of section 5 of the 2-NDFL certificate) and calculated tax (clause 5.3 of section 5 of certificate 2-NDFL);

- explain to such employees that they need to apply for a tax refund to the Federal Tax Service, where they are registered at their place of stay (for a foreign employee) or at their place of residence (for an employee who is a citizen of the Russian Federation).

IMPORTANT IN WORK

If the overpayment of personal income tax was offset or returned to the employee before the end of the year for which the certificates are prepared, it does not need to be reflected in the reporting. If the amounts are not credited or returned, then the overpayment is recorded on line 5.6.

Information on income in the 2-NDFL certificate from amounts paid in connection with the death of an employee to family members by inheritance

According to Art. 141 of the Labor Code of the Russian Federation, wages not received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of his death. This norm corresponds to Art. 1183 of the Civil Code of the Russian Federation, according to which the right to receive wages, equivalent payments and other sums of money provided to a citizen as a means of subsistence, subject to payment to the testator, but not received by him during his lifetime for any reason, belongs to those living together with the deceased members of his family, as well as his disabled dependents, regardless of whether they lived with the deceased or not.

Clauses 2, 3 art. 1183 of the Civil Code of the Russian Federation provides that in the absence of these persons or if these persons do not present demands for the payment of such amounts within four months from the date of opening of the inheritance, the corresponding amounts are included in the inheritance and are inherited on the general basis established by the Civil Code of the Russian Federation.

According to Art. 1112 of the Civil Code of the Russian Federation does not include rights and obligations that are inextricably linked with the personality of the testator, as well as rights and obligations, the transfer of which by inheritance is not permitted by the Civil Code of the Russian Federation or other laws. So, for example, the obligations of a citizen-debtor that are terminated by his death are not included in the inheritance if the fulfillment cannot be carried out without the personal participation of the debtor or the obligation is otherwise inextricably linked with the personality of the debtor (Article 418 of the Civil Code of the Russian Federation).

In accordance with paragraphs. 3 p. 3 art. 44 of the Tax Code of the Russian Federation, the obligation to pay taxes and (or) fees terminates with the death of an individual - the taxpayer or with recognition of him as dead in the manner established by the civil legislation of the Russian Federation.

In this case, the heirs are charged with the obligation to repay the debt of the deceased person or a person recognized as dead, only for property taxes and within the limits of the value of the inherited property, in the manner established by the civil legislation of the Russian Federation for the payment by heirs of the testator's debts. Based on clause 18 of Art. 217 of the Tax Code of the Russian Federation are not subject to taxation (exempt from taxation) for personal income tax, income in cash and in kind received from individuals by inheritance, with the exception of remuneration paid to the heirs (successors) of authors of works of science, literature, art, as well as discoveries and inventions and industrial designs. At the same time, the Tax Code of the Russian Federation does not establish any restrictions on the exemption from taxation of a taxpayer’s income received by inheritance, depending on the degree of relationship with the testator (letter of the Ministry of Finance of Russia dated July 26, 2010 No. 03-04-06/10-417).

Consequently, the tax agent organization does not have the obligation to withhold personal income tax from the amounts of remuneration due to the deceased employee and paid in accordance with the established procedure to members of his family or to a person who was dependent on the deceased on the day of his death, or to heirs in the manner established by Art. 1183 of the Civil Code of the Russian Federation (clause 18 of Article 217 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 06/04/2012 No. 03-04-06/3-147, dated 02/24/2009 No. 03-02-07/1-87, letter of the Federal Tax Service of Russia dated 08/30/2013 No. BS-4-11/15797).

In other words, when the income lost by a deceased employee is paid to his heirs, personal income tax is not withheld from them, since the indicated income is included in the inheritance mass, and the amount passed on by inheritance is not subject to personal income tax. Such income (clause 18 of Article 217 of the Tax Code of the Russian Federation) of a deceased employee, from which personal income tax was not withheld, is not reflected in the 2-NDFL certificate. This is due to the fact that in this document, in addition to taxable income, only partially taxable income is reflected (for example, related to gifts, material assistance, etc.).

Desk tax audit of 2-NDFL certificates

Certificates submitted by tax agents in form 2-NDFL are neither tax returns nor calculations in the sense of Art. 80, 88 of the Tax Code of the Russian Federation, since they contain only information about income paid to individuals and the amounts of accrued and withheld tax. Therefore, they cannot be the subject of a desk tax audit.

In addition, the 2-NDFL certificate does not contain the data necessary to control the calculation and payment of personal income tax (dates of payment of income to employees, information about the amounts of tax actually transferred to the budget, etc.). Therefore, taking into account the specifics of calculation and withholding of personal income tax by a tax agent depending on the timing of payment of wages for each month (clause 6 of Article 226 of the Tax Code of the Russian Federation), the issue of the correctness of calculation, withholding, completeness of transfer and the amount of penalties can only be resolved during an on-site visit tax audit of a tax agent (resolutions of the Federal Antimonopoly Service of the Ural District dated September 13, 2010 No. Ф09-6098/10-С2, dated October 15, 2009 No. Ф09-8601/09-С3).

- Back

- Forward

Nuances of registration and receipt procedure

The certificate is prepared and issued by the employer’s accounting department at the individual’s place of work. Upon dismissal, this document can be issued to the employee along with the work book. If this does not happen, then he can apply for a certificate from his former employer even after dismissal.

When applying for a certificate, the employee does not have to tell the employer for what purposes he wants to receive this document. However, the law does not provide for liability for the employer for refusing to issue a document.

The certificate can be prepared either electronically or on paper. In the first case, it is filled out on a computer and signed with the electronic signature of the manager. This option for document execution is most often used when the employer submits a certificate to the Federal Tax Service.

If a document is drawn up for an employee, it is usually prepared on paper. In addition to filling out the sections of the certificate with the most complete and accurate information (in accordance with the documents), the certificate must contain the following mandatory details:

- signature of the manager (or chief accountant, if he is authorized to do so);

- seal of the organization (placed in the lower left corner, in a special place for printing).

The signature is made in blue pen and should not be covered with a seal. Corrections in the document are not allowed - if an error was made, you must fill out a blank form again. The employer has 3 working days from the date of the employee’s application to prepare the certificate.

The rules for issuing a child tax deduction in 2021 are described in detail in our article. You will learn how to force your employer to pay your legal salary by reading our article.

How does a nominal salary differ from a real one? The differences are described in detail here.