Form 6-NDFL for the 4th quarter of 2021 was approved by order issued by the Federal Tax Service on October 14, 2015 under No. ММВ-7-11/ [email protected] taking into account changes dated January 17, 2018. The document is divided into 3 blocks:

- information about the tax agent - enterprise, individual entrepreneur submitting the report (data is entered on the title page);

- Section 1 is devoted to cumulative indicators for the period from the beginning of the year (in this case, for the year), accruals for the last reporting month are also included in it, payment for which will be made in the next reporting interval;

- section 2, reflecting data for each month of the last quarter.

The reporting form provides for the reflection of the dates of accrual and payment of income. Wages are calculated on the last day of each month (for the purposes of reporting, it does not matter whether it is a day off or a work day), and it is issued upon the fact on the same day or the next month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). The employer can pay personal income tax on the day of payment of wages to the staff or on the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation).

What form of calculation of 6-NDFL for 2018 is used?

All employers paying benefits to employees are required to calculate, withhold and transfer income tax to the budget. To monitor the timeliness and correctness of calculation, withholding and payment of personal income tax to the treasury, tax officials developed 2 reports: 2-NDFL and 6-NDFL.

6-NDFL is a calculation that allows you to control the timing of withholding and transfer of income tax to the budget by tax agents. The features of this form that distinguish it from the usual 2-NDFL report include:

- frequency of presentation - based on the results of each quarter;

- lack of personification: the report provides information in general for the tax agent and does not contain data for each employee;

All employers who pay income to “physicists” under employment and civil law contracts are recognized as agents:

- organizations;

- individual entrepreneurs;

- private practicing individuals (lawyers, notaries, etc.).

The calculation includes data on accrued income, withheld and transferred personal income tax, as well as on the planned dates for withholding and transferring tax.

Form 6-NDFL was approved by order of the Federal Tax Service dated 10/14/2015 No. ММВ-7-11/ [email protected] The new form 6-NDFL, valid as amended by the order of the Federal Tax Service dated 01/17/2018 No. ММВ-7-11/ [email protected] , will be relevant and for reporting for 2018.

6-NDFL for the reporting campaign for 2021 can be found here.

Basic requirements for filling out form 6-NDFL for 2018

Let's look at the algorithm for filling out a report using a small example.

Example:

The accountant of Satis LLC decided to fill out form 6-NDFL for the first time. First of all, she studied the calculation structure. The form consists of:

- title page;

- section 1, filled in with a cumulative total from the beginning of the year;

- Section 2, which contains information only for the reporting quarter.

Next, the accountant read the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , which spelled out the calculation algorithm, and found out the basic requirements:

- All cells displaying details and totals must be filled in. If there is no data, fix the value “0”.

- Enter all information from left to right, starting with the first sign. In the remaining ones, put a dash through.

- Continuous numbering starts from the first sheet.

- When filling out the form by hand, you can use black, blue or purple ink.

- Double-sided printing and the use of correction products are prohibited.

The accountant then moved on to designing the title page.

Rules for filling out reports

The instructions for preparing this reporting form require compliance with a number of rules and requirements:

- Tax amounts must be reflected only in whole rubles without indicating the amounts of kopecks. In this case, rounding rules apply, according to which up to 50 kopecks are discarded, and above the specified amount they are accepted as a full ruble.

- If an individual’s income is received in foreign currency, they must be recalculated according to the current exchange rate of the Central Bank of the Russian Federation into rubles, which is taken on the day the funds are received.

- This report does not allow any corrections, therefore, if errors or typos are found, you must refill the corresponding sheet.

- When compiling form 6 personal income tax on a computer, you need to print it once on a sheet. Two-way entry of entries for 6 personal income taxes is not provided.

- The report can be stapled using a stapler. It should be located in the upper left corner. The sheets must be fastened carefully, avoiding damage to the sheets.

- If you need to enter numerical values into a report, you should start entering them from left to right. When a column is left empty, it should be underlined.

- You can fill out the report by hand. In this case, you need to use black, blue or purple ink.

Nuances of preparing the 6-NDFL calculation

Let's look at different types of payments.

Salary, benefits and vacation pay

Having studied clause 2 of Art. 223 of the Tax Code of the Russian Federation, the accountant found out that the date of receipt of the salary is the last day of the month for which it was assigned.

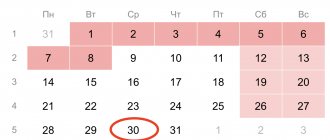

It is the last day of the month that should be indicated on page 100, even if it falls on a non-working date. And if the deadline for paying personal income tax falls on a weekend, then it is shifted to the next working day (letter of the Federal Tax Service dated December 13, 2018 No. BS-4-11 / [email protected] ).

In the example conditions, 09/30/2018 is the date of receipt of salary for September (Sunday). Despite this, the accountant will record exactly this number on page 100.

Having studied clause 6 of Art. 226 of the Tax Code of the Russian Federation, an accountant at Satis LLC learned that the deadline for paying personal income tax on wages and other income, with the exception of tax on vacation pay and benefits, falls on the day following the date of tax withholding. And for vacation and sick leave - on the last day of the month.

Thus, the tax withheld on Friday, November 9, 2018, should be transferred to the budget no later than Monday, November 12, 2018, since November 10, 2018 falls on a Saturday. And the deadline for paying personal income tax on sick leave benefits is November 30, 2018.

Awards

There is a nuance regarding the dates of receipt of income in the form of bonuses:

- When paying bonuses for a year, quarter or for a specific event, for example, an accountant’s day, the date of receipt of income is considered the day of payment (letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

- For a “monthly” bonus, the date of receipt of income is considered to be the last day of the month for which it was accrued (letter of the Ministry of Finance of Russia dated April 4, 2017 No. 03-04-07/19708).

Thus, the date of receipt of the bonus for November will be considered 11/30/2018, and for the bonus for the 3rd quarter - the payment date will be 11/05/2018.

Next, the accountant grouped all payments into a table:

| Section line 2 | Decoding | Accrual | |||||

| Salary for September | Salary for October | Benefit | Prize for 3 sq. | Salary + bonus for November | Payment under GPC | ||

| 100 | Date of receipt of income | 30.09.2018 | 31.10.2018 | 01.11.2018 | 05.11.2018 | 30.11.2018 | 03.12.2018 |

| 110 | Personal income tax withholding date | 10.10.2018 | 09.11.2018 | 09.11.2018 | 05.11.2018 | 10.12.2018 | 03.12.2018 |

| 120 | Tax payment deadline | 11.10.2018 | 12.11.2018 | 30.11.2018 | 06.11.2018 | 11.12.2018 | 04.12.2018 |

| 130 | Amount of income | 310 000 | 298 132 | 7 359 | 15 000 | 322 045 | 27 000 |

| 140 | Amount of personal income tax withheld | 39 026 | 37 483 | 957 | 1 950 | 40 592 | 3 510 |

The accountant transferred all this data to section 2 of the report.

You can fill out form 6-NDFL for 2021 here.

How to correctly fill out the information in the calculation for the 3rd quarter of 2020

Let's look at the procedure for applying the instructions for filling out, using the example of the State Budget Educational Institution of Children's and Youth Sports School "ALLUR".

GBOU "ALLUR" has four employees. Based on the results of the first half of 2020, the institution performed the following operations:

- accrued the total income for all employees - RUB 2,217,431.54;

- provided a standard deduction - 34,400 rubles;

- calculated personal income tax - 283,793 rubles;

- withheld personal income tax from income accrued and paid for the six months - 231,074 rubles;

- paid salaries for December 2021, bonuses for 2021 and withheld personal income tax from these incomes in the amount of 111,872 rubles.

In the third quarter, GBOU DOD SDYUSSHOR "ALLUR" carried out the following operations, broken down by date:

- 07/06/2020 paid vacation pay in the amount of 9,690 rubles, accrued and withheld personal income tax from vacation pay - 1,260 rubles;

- 07/06/2020 paid salaries for June in the total amount of 405,534 rubles, withheld from it and transferred to the personal income tax budget - 52,719 rubles;

- 07/20/2020 paid vacation pay in the amount of 24,363.08 rubles, accrued and withheld personal income tax from vacation pay - 3,167 rubles;

- 07/31/2020 transferred personal income tax from vacation pay paid in July in the amount of 4,427 rubles;

- 07/31/2020 calculated the salary for July - 343,780.25 rubles, calculated personal income tax from the salary - 44,691 rubles;

- 08/06/2020 paid wages for July, withheld personal income tax from it;

- 08/07/2020 transferred personal income tax to the budget from salaries for July;

- 08/17/2020 paid vacation pay in the amount of 98,677.26 rubles, calculated and withheld personal income tax from them - 12,828 rubles;

- 08/31/2020 accrued wages for August in the amount of 258,414.53 rubles, calculated personal income tax from the salary - 33,594 rubles;

- 09/01/2020 transferred personal income tax from vacation pay paid in August;

- 09/04/2020 paid vacation pay in the amount of 122,126 rubles, accrued and withheld personal income tax from them - 15,876 rubles;

- 09/04/2020 paid wages for August, withheld and paid personal income tax to the budget;

- 09/21/2020 paid temporary disability benefits in the amount of 3,918.92 rubles, accrued and withheld personal income tax from the benefits - 509 rubles;

- 09/30/2020 accrued wages for September in the amount of 339,813.70 rubles, calculated personal income tax from the salary - 44,176 rubles;

- On September 30, 2020, I transferred personal income tax to the budget from temporary disability benefits and vacation pay paid in September.

The institution submitted a report for 9 months of 2021 to the tax office on 10/19/2020.

Procedure for submitting 6-NDFL for the 4th quarter of 2018

Form 6-NDFL can be submitted to the Federal Tax Service:

- independently - a person who has the right to act on behalf of the taxpayer without a power of attorney;

- through a representative acting on the basis of a power of attorney;

- via telecommunication channels, certifying the payment with an electronic signature;

- by sending a letter with a list of attachments via Russian Post.

Only small companies and individual entrepreneurs, the average number of which is 24 employees or less, have the right to submit paper calculations. If you have more than 25 employees, you can send the report only via TKS.

Form 6-NDFL is sent to the Federal Tax Service via:

- place of registration of the taxpayer;

- place of registration of a separate unit (SU) in relation to payments to employees of this SB;

- place of its registration or registration of an OP: for the largest taxpayers;

- place of registration - for individual entrepreneurs;

- place of registration as a payer of tax paid under a special regime - for individual entrepreneurs on UTII or PSN.

Reporting methods

Tax legislation defines the following methods that a business entity can use when sending reports in Form 6-NDFL:

- Submission of the form on paper by personal delivery to the tax inspector. To do this, you will need two copies of the report, so that the receiving party could put a mark of acceptance on the second one. This sending option is available for organizations and individual entrepreneurs if their number of employees does not exceed 25 people.

- Through electronic document management. In this case, it is necessary to have an electronic signature, which will be used to sign the electronic file with the report. With this method, it is also necessary to have an agreement with a special operator or appropriate software.

Deadline for submitting form 6-NDFL and sanctions for late submission

The 6-NDFL calculation is submitted to the tax authorities based on the results of each quarter no later than the last day of the month following the reporting period. If the deadline falls on a non-working date, it is moved to the next working day. Based on the results of the 4th quarter of 2021, 6-NDFL should be submitted no later than 04/01/2019.

“Forgetful” taxpayers will face sanctions for late submission of calculations in the amount of 1 thousand rubles. for each full and partial month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). If the delay exceeds 10 working days, the tax authorities have the right to block your bank accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

If you provide false or incomplete information, you will face a fine of 500 rubles. But if you independently identify errors and submit corrections, responsibility is removed.

Should I submit a zero form of the 6-NDFL report for 2018?

Some accountants believe that if there were no accruals of income to employees in the 4th quarter of 2021, then it is not necessary to submit a 6-NDFL calculation, because the employer was not a tax agent during this period.

But you need to remember that tax authorities can fine:

- If accruals were made in any of the previous quarters, and the calculation for the 4th quarter was not presented. In this case, the report must be submitted by filling out only the title page and section 1, since 6-NDFL is filled out on an accrual basis.

- If they decide that you forgot to report.

If you did not conduct any activity in 2021 and there were no accruals, we recommend that you notify the tax authorities that you will not submit the 6-NDFL calculation by sending them a written message in free form. If you decide to submit a zero calculation, the tax authorities are obliged to accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).