Despite the difficult economic situation, supporting young families remains a priority in the distribution of financial benefits, and in the coming 2021 the amount of maternity payments will definitely not decrease.

It is worth noting that today the concept of “maternity leave” is not legally enshrined. This word, which has long and firmly taken root in our vocabulary, summarizes several different periods:

- period before birth (70-84 days);

- recovery after childbirth (70-110 days);

- caring for a baby up to 1.5 years old;

- further care leave from 1.5 to 3 years.

Maximum benefit amount from January 1, 2019

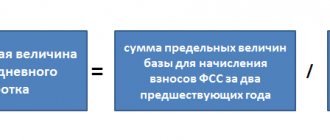

Maternity benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation (from January 1 to December 31). Accordingly, if an employee goes on maternity leave in 2019, then the billing period will be 2021 and 2021 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006).

The maximum maternity benefit that a worker can receive is limited to the maximum average daily earnings. In 2021 it is 2150.684931 rubles. (RUB 755,000 + 815,000) / 730.

Thus, the maximum amount of maternity benefits in 2021 will be:

- 301 095, 89 rub. – during normal childbirth (2150.684931x 140);

- 335 506, 85 rub. – during complicated childbirth (2150.684931 x 156);

- RUB 417,232.88 – with complicated multiple births (2150.684931 x 194).

Payment upon registration

For the birth of a healthy baby, the health status of the mother is extremely important and specialist supervision is advisable from the first weeks of pregnancy. The first of the available payments is designed to motivate the expectant mother to visit a doctor before the 12th week of pregnancy.

With timely registration in 2021, a woman receives 628.47 rubles. (the amount is fixed for all regions). The next indexation of this payment is expected in February 2021. This assistance is paid along with the breed allowance.

You can receive this, albeit not a very large amount, by providing an edit at your place of official work confirming the fact of timely registration in medical school. institution. Expectant mothers who do not have an official place of work can receive a payment by submitting documents to the social security authorities.

Minimum maternity benefits in 2021

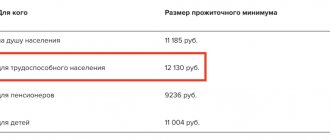

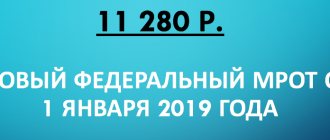

To determine the minimum amount of the BiR benefit, if maternity leave began in 2021, the new minimum wage from January 1, 2021 is relevant - 11,280 rubles.

If maternity leave began on 01/01/2019 or later, then the minimum average daily earnings will be 370.849315 rubles. (RUB 11,280 x 24/730). Accordingly, the minimum amount of the BiR benefit for a standard maternity leave (lasting 140 days) will be 51,918.90 rubles. (RUB 370.849315 x 140 days).

Therefore, with different durations of maternity leave in 2021. There will be different minimum maternity payments:

- RUB 51,918.90 (370.849315 × 140 days) – in the general case;

- RUB 71,944.76 (370.849315 x 194 days) – in case of multiple pregnancy;

- RUB 57,852.49 (370.849315 x 156 days) – for complicated childbirth.

Employers are not required to review the amounts of maternity benefits already paid until 2021. The new amounts apply to those who apply for benefits starting January 1, 2021.

One-time payment for the birth of a child

This type of assistance is paid to a young mother immediately after the birth of the baby. The amount of payments does not depend on the type of child in the family the newborn will be. Also, the amount of assistance is not affected by the social status and income of the parents.

The fixed amount of the one-time payment for 2021 at the birth of a baby is 16,759 rubles (the amount will be indexed in February 2021).

You can get help through the organization in which one of the spouses works, or by submitting documents to the district Social Insurance Fund (if both are not officially employed).

Attention employers

The FSS reported on the website that the minimum maternity leave for 140 days is 51,919 rubles. But be careful!

The Social Insurance Fund determined income based on the minimum average daily earnings. First, we calculated the minimum average daily earnings based on the new minimum wage - 370.85 rubles. (RUB 11,280 x 24 months: 730). Then we multiplied the calculated average earnings by 140 days - 51,919 rubles. (RUB 370.85 x 140 days).

Note!

The employer will overpay the benefit if he pays 51,919 rubles. an employee whose experience is less than 6 months. Indeed, in this case, the monthly benefit should not exceed the minimum wage - 11,280 rubles. And if you take the minimum of the Social Insurance Fund, then for months with 31 days the benefit will be higher than the minimum - 11,496.35 rubles. (RUB 370.85 x 31 days).

How to do it right

For months with 28 or 30 days, you need to calculate the allowance from the average earnings of 370.85 rubles. And for months with 31 days, pay 11,280 rubles. For example, if the maternity leave is from February 1, then the benefit is equal to 51,486.3 rubles. (370.85 rub. x 28 days + 11,280 rub. + 370.85 rub. x 30 days + 11,280 rub. + 370.85 rub. x 20 days).

Read also

28.09.2018

Child care allowance

According to current legislation, both the mother and the father of the baby can go on parental leave, and therefore qualify for appropriate payments. Non-working parents will also be able to receive monthly assistance, but in a minimal amount.

Benefit up to 1.5 years

You can submit documents for accrual of this payment before the child reaches 1.5 years of age.

But, it is important to know that by applying for benefits before the expiration of 6 months. the family will receive the entire amount due from the moment of birth. When making payments after 6 months of age, accruals will be made only from the day the documents are submitted. When calculating the amount, many factors are taken into account:

- how many children were born in the family;

- are there any older children?

- whether the parents are employed and whether insurance premiums have been paid over the past years;

- bet size;

- regional coefficient;

- region of residence.

On average, the child care benefit for children under 1.5 years of age in the second half of 2021 will be:

| Parent status | 1st child | 2nd and subsequent |

| Officially employed | 40% from avg. earnings | 40% from avg. earnings |

| Unemployed | RUB 4,465.20 | RUB 6,284.65 |

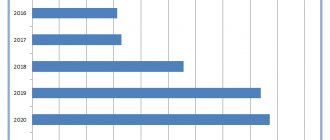

In 2021, payments “for child care up to 1.5 years” will be increased following the increase in the minimum wage and will amount to:

| Parent status | 1st child | 2nd and subsequent |

| Officially employed | 40% from avg. earnings maximum 26,152.39 | 40% from avg. earnings maximum 26,152.39 |

| Unemployed | RUB 4,512 | will be known by 01.01.19 |

Benefit from 1.5 to 3 years

If, after the child reaches 18 months of age, he needs special care, parents are given the right to extend the state-provided parental leave. But payments during this period will be symbolic, only 50 rubles. per month.

The following can receive benefits:

- officially employed citizens of the Russian Federation;

- persons dismissed during the liquidation of the organization;

- individual entrepreneurs;

- students (full-time);

- guardians and adoptive parents;

The family has the right to complete documents within 6 months after the child reaches 1.5 years of age. If for any reason the documents are submitted late, but up to 6 months, the state will pay the entire amount that was due for the past period. If the child is 2 years old and the benefit has not been issued, the family automatically loses the right to this type of payment.

Families with twins and triplets, as well as some categories of beneficiaries and parents living in the resettlement area have the right to maintain benefits for up to 3 years in the same amount as up to 1.5 years of age.

Length of maternity leave

The number of rest days a young mother is entitled to immediately before and immediately after childbirth will depend on various factors. Therefore, the period of such vacation will be different. It equals:

- 140 days. If a woman has a normal birth without any complications with the birth of one baby.

- 156 days. When during the birth of one baby various complications appear that require additional care.

- 194 days. It is due to a young mother who has given birth to two or more babies at once, both during its normal course and during various possible complications.

- 160 days. Workers who were previously exposed to radioactive influence as a result of the Chernobyl disaster or the consequences of a man-made accident recorded at the Mayak production association can count on such a period of leave.

- 70 days. Adoptive parents of one child no older than 3 months can legally receive it.

- 110 days. Due to the adoptive parents of two or more babies, for whom no more than 3 months have passed since birth.

Possible innovations

In August 2021, the All-Russian Popular Front made a proposal to increase the period of paid parental leave from 1.5 to 3 years. According to the ONF, parents whose children did not receive a place in a nursery due to overcrowding could apply for this type of social assistance.

The shortage of preschool institutions is a serious problem in many regions of Russia. Despite the fact that in order to provide the required number of places in nurseries and kindergartens, active work is being carried out, and today many parents cannot register their child in a preschool educational institution, and therefore are forced to give up work even after the child reaches 1.5 years of age . Thus, according to official data, as of February 2021, 272,000 children under 3 years of age were waiting for their place in nurseries.

Maternal capital

Officially, the Maternity Capital program is valid until December 31, 2021. Thus, in 2021, families with 2 or more babies will be eligible for additional financial assistance.

When relying on this type of payment, it is worth considering the following features:

- This payment does not apply to the first-born child, since a separate type of assistance has been introduced

- When twins or triplets are born, the family receives only one payment, as for the birth of 1 baby

- The amount of maternity capital for a particular family is not limited

- When adopting a child, maternity capital is provided if the baby is the second or more in the family

- It will be possible to cash out MK in the form of a monthly allowance only for those families in which each person has less than 1.5 monthly subsistence minimum

Factors influencing the benefit amount

The key influence on the size of payments is, of course, the size of wages. The higher it is, the greater the total amount. But the payment still cannot exceed the maximum amount established by law. The amount of the benefit is also affected by:

- the number of sick days - the more there are, the lower the monthly income, and therefore the benefit;

- the number of vacation days taken without pay, since during this time insurance contributions are not transferred to the Social Insurance Fund;

- number of places of work - for each the amount of benefits is calculated separately.

The lowest payment cannot be less than the current minimum wage. If the final income is less, the benefit will be increased.

The formula for calculation will be as follows: (income for 2 years) / (number of days of income) * (number of maternity days).

Income includes all payments from the employer:

- salary (salary);

- bonuses and incentive payments;

- other surcharges;

- vacation pay;

- travel allowances, etc.

There are 730 days in two years, but when one of them is a leap year, then 731 days are taken for the calculation. The number of days of maternity leave depends on the complexity of the birth.

Features of calculating maternity benefits

If a woman worked before maternity leave, but was fired due to the liquidation of the company, then in order to receive the payment with an application, she will need to contact social security.

Women who are officially employed simultaneously in several organizations have the right to count on payments from different employers. In this case, payments are due if the combination of work activities continues for at least two years. The calculation is made based on the average salary for a given period of time.

If a woman was officially employed for no more than 6 months, then the benefit will be calculated based on the minimum wage. The same amount can be claimed by those women who immediately go from one maternity leave to another.

For female students studying full-time, funds are awarded based on the scholarship for the last two years. For those who are not working, maternity benefits are calculated based on monthly benefits. Women serving under contract in the army receive payments based on the amount of allowance (

A few examples

Olga gave birth to a child in 2021. In 2021 she earned 250 thousand rubles, in 2021 - already 360 thousand.

Since her income did not reach the maximum values, and the pregnancy passed without complications, it is very simple to calculate the amount of her one-time benefit:

(250,000 + 360,000) / 731 * 140 = 116,826 rubles.

Anna has been working for only one year – 2017. Her annual income was 150 thousand rubles. In 2021, Anna went on maternity leave and gave birth to twins.

Since she has not yet worked in 2021, you need to take the minimum wage amount to calculate income for this year. Before July 1, the minimum wage was 6,204 rubles, after that it was 7,500 rubles. As a result, the amount of her benefit will be:

((6*6204) + (6*7500) + 150000) / 731 * 164 = 50,099 rubles.

Vika became a mother for the second time in 2021. She was on maternity leave with her first baby in 2021. Therefore, to receive a higher payment, she decided to use her income for 2013, which amounted to 300 thousand rubles.

In 2021, Vika earned 850 thousand rubles, which is above the established threshold of 755 thousand. The girl's pregnancy was complicated. Its payment is calculated as follows:

(300,000 + 755,000) / 731 * 154 = 222,257 rubles.

Registration of maternity payments

To receive money you will need:

- information about income for the selected period;

- documents about the birth of the child;

- certificate of incapacity for work.

They must be submitted along with the application no later than six months from the date of birth to the personnel department of the enterprise, or directly to the territorial branch of the Social Insurance Fund, if the region where the woman in labor lives is included in the project of direct payments to the Social Insurance Fund.

View the list of regions “Pilot project of direct payments to the Social Insurance Fund”.

Regulatory framework

The amount of maternity benefits and the procedure for their payment are regulated by a special Order of the Ministry of Health and Social Development No. 1012n dated December 23, 2009.

Who exactly has the right to receive benefits, the required documents, the procedure for filing applications, grounds for receipt and other points are prescribed in Law No. 81-FZ of May 19, 1995 “On Benefits” and in Chapter 4 of Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in connection with maternity.”

As Article 217 of the Tax Code of the Russian Federation indicates, no benefits are subject to income or any other tax and are paid in full.

How is it calculated

Calculation of the period of incapacity associated with childbirth is divided into two basic stages. Here they highlight:

- First of all, it is necessary to calculate the period that the woman will be absent immediately before childbirth, as well as after it ends. The starting point is the expected date of birth of the baby. If everything is normal, then the calculation is made based on the provision of sick leave for 70 days before the date of birth, and then the same period immediately after their completion. If it is initially known that childbirth will take place with some possible complications, or this is a multiple pregnancy, then the calculation may increase by the permissible number of days. When the problem arose directly during childbirth, the doctor can extend the existing sick leave for a period not exceeding the maximum allowable value in days.

- After determining the period of prenatal sick leave, this document is submitted to the accounting department of the enterprise to calculate and pay the due amount of sick leave. In this case, it is necessary to determine one day’s earnings (based on income for the previous two years), and then simply multiply it by the number of days of sick leave.

Remember, the calculation of the duration of the rest period and the amount of daily assistance due occurs within certain legal frameworks. The employer has no right to pay less. All payments above the upper limit are made exclusively from company money.

What other payments and benefits are entitled to children by law?

Pregnant women who register early receive 613 rubles per month. At the birth of a baby, one of the parents is given a one-time payment. This year it amounted to 16,350 rubles 33 kopecks. You can receive the payment at your place of work or through the social security authorities.

Since January 2021, Russia began paying benefits for families at the birth of their first child. Its amount is calculated based on the cost of living per child in the region. The average benefit for the first child is 10,160 rubles per month. The amount of benefits for the first child is planned to be indexed every year. Families whose total income does not exceed 1.5 times the subsistence level for each family member can apply for it. For example, in Moscow, in order to receive a payment of 15,252 rubles, the total income of a family of three must be no more than 84,339 rubles. On November 12, the Ministry of Labor proposed not to take into account other state child benefits in the total family income when assigning monthly payments for the first and second child.

At the birth of the second and subsequent children, the family has the right to apply for maternity capital. Its size this year is 453,026 rubles.

The funds can be spent on improving the family’s living conditions, the child’s future education, or the mother’s pension. The President extended the program for another three years.

Payment procedure and terms

The employer calculates benefits based on the documents received from the pregnant employee.

To apply for maternity leave and calculate payments, the employer needs to receive from the woman:

- application for maternity leave and benefits;

- certificate of incapacity for work due to pregnancy;

- certificate from a medical institution.

This type of social support is paid only to working people; the unemployed are not entitled to payment.

You need to accrue funds for payment within 10 days, and pay the day the salary is issued to the organization.

Subsequently, the paid amount to the organization is reimbursed by the Social Insurance Fund.

If a project on direct payments is working in the region, then the documents for the benefit are transferred by the employer directly to the Social Insurance Fund. In this case, the benefit is paid by the Social Insurance Fund directly to the employee.

Learn more about the timing of maternity benefit payments.

Regional features

It should be noted that the maximum allowable charges are based on the amounts of social contributions available in the state, as well as the minimum wage. But, at the legislative level, individual entities are allowed to take on increased social obligations in terms of establishing such indicators that are significant for the population, through the introduction of regional coefficients. Consequently, the size of the limit payments will increase proportionally.

Here you need to take into account that the “ceiling” is of interest only to workers who receive a high level of income. If their wages are within the average, or even slightly above the regional average, the presence of such coefficients will have little effect on the size of their payments.

Among the regional features, one should also highlight the pilot project being implemented by the Russian government since 2021, according to which all social charges are made directly from the Social Insurance Fund, bypassing the employer. You can find out whether your region is participating in this project at your nearest social insurance office. This will in no way be reflected in the amount of payments, but it is quite possible in the speed of accrual and transfer.

In addition to the basic payments received by everyone, many regions established additional one-time incentive assistance for women who gave birth and living on their territory. Their size and transfer procedure should be clarified with local municipalities.

Remember, almost every region of the Russian Federation has its own characteristics of supporting young mothers. You can find out about this from your local administrations.

Maternity benefit 1.5 – 3 years

Previously, deputies tried to introduce a bill supporting young mothers on a long three-year leave. So that they receive monthly money equal to the minimum wage (15 thousand). However, the proposal, without receiving a proper response, was rejected.

Today, payments due to mothers raising children 1.5-3 years old are meager, 50 rubles.

From January 2021 and into 2021, families in need whose income does not exceed 2 minimum subsistence levels in the region will be able to count on tangible assistance for their firstborn and second child, but at the expense of maternal assistance. The amount varies by region. Learn more about the changes and social benefits.

Women who have had multiple pregnancies or live in places with dangerously high levels of radiation are paid more. Such citizens regularly receive (when the child is 1.5-3 years old) 6,000 rubles.

Payments due to a young mother

The types of payments received by families with a child have expanded:

· when registering the mother;

· during childbirth (once);

· pregnancy – childbirth (one time);

· for the firstborn (given monthly, 0-1.5 years);

· care (next leave) 1.5-3 years (payments will be monthly);

· maternity capital (established when the baby is the second child, rules are adopted for the first child).

Financial assistance is also provided to guardians/adoptive parents on the same basis as biological parents. Guardians are paid a salary.

Benefits for unemployed women

If a woman is not employed, she will not receive monthly payments. This is due to the fact that payments are made from contributions that were paid to the Social Insurance Fund.

If a pregnant woman does not work, then no contributions are made to the Social Insurance Fund. However, a person can count on minimal assistance if he is registered with the employment center.