One of the documents that is compiled on the basis of the territorial Federal Tax Service is a report in form 5-NDFL.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

It contains information about the calculated tax base, as well as personal income tax accrued and paid to the treasury for all payers associated with the territory of a particular region.

The report provides information on the total tax base, income tax calculated at various rates, as well as tax deductions.

Typically, the report is compiled for individual industries and regions, and then the data is transferred to a consolidated statement for the entire country.

Who will pay personal income tax at a rate of 13%

The new rules apply to residents and non-residents of the Russian Federation, however, there is a difference between the tax bases.

For residents, the following income is subject to taxation:

- All ordinary income of those who work under an employment contract: wages, bonuses, sick leave, vacation pay, etc.

- Remuneration under GPC agreements.

- From equity participation in organizations.

- Winnings from gambling or lottery.

- Income related to securities (CS), incl. for repo transactions, the object of which are securities, loans with securities, as well as transactions with the Central Bank, accounted for in an individual investment account.

- Income received by participants of an investment partnership.

- Some others.

The income of non-residents, taxed at a higher rate, is very similar, but they are supplemented by income from the sale of property and receiving it as a gift.

All this looks scary until you remember that all this income is taxed at a higher rate only if the threshold of 5 million rubles is exceeded.

In addition, for residents the 13% rate will remain (regardless of the amount) in relation to income received from:

- sales of property, with the exception of the Central Bank;

- receiving a gift in the form of property, also with the exception of the Central Bank;

- insurance payments under insurance and pension contracts.

How will the taxable base for personal income tax be calculated?

The Tax Code introduces a completely new concept for tax calculation purposes - a set of tax bases. To understand whether income has exceeded the threshold, the bases included in the calculation will be added.

Those. if your income for the year was:

- 2 million - salary;

- 1.5 million - remuneration under service contracts;

- 3 million - dividends from an organization where you are a founder,

then when you add it up, it turns out that the total tax base is 6.5 million rubles and you have exceeded the “limit” by 1.5 million.

In this case, the tax calculation will look like this:

- 5 million at a rate of 13% - personal income tax will be 650,000 rubles;

- 1.5 million at a rate of 15% - personal income tax will be 225,000 rubles.

The total tax amount is 875,000 rubles. If you paid personal income tax at the previous rate, the tax amount would be equal to 6.5 million * 13% = 845,000 rubles. The difference is 30 thousand rubles. Considering the amount of income, not such a big loss. For those whose excess is insignificant, the tax amount will definitely not become a sensitive expense.

For your information! For those whose income does not exceed 5 million, nothing will change. And this is the majority of ordinary working citizens. According to statistics, only 1% of taxpayers receive more than 5 million rubles (i.e. approximately 417,000 per month).

But the new system is not yet entirely clear, it seems, even to the tax authorities. Moreover, it will be even more difficult for tax agents to deal with it (taking into account the aggregate calculation and other nuances) and for the citizens themselves. To smooth the transition to new conditions, the law establishes a transition period in 2021 and 2022.

Important information

It is worth knowing that this type of report is submitted 2 times a year. Based on it, a forecast for tax deductions in the next period is formed, which makes it possible to approximately estimate the volume of budget filling. Responsibility for the correct completion of the report and its timely submission lies with the heads of a specific territorial division of the Federal Tax Service.

There is a time limit for filing this type of report. It must be ready 5 days after employers and individuals submit data on 2- and 3-NDFL. Specific dates for submitting data are formed depending on the level of the report - first, data is provided by municipalities, regional summary forms are compiled on their basis, and later a document at the federal level is filled out.

Rules of the transition period for personal income tax

For two years, the principle of calculation will be in force for each individual tax base, and not for their totality.

We use the data from the previous example: 2 million - salary, 1.5 million - under service contracts, 3 million - dividends; Each income is an independent taxable base. And each does not exceed five million rubles. This means that if you receive such income in 2021 or 2022, then the tax rate for you will be the same 13%.

But if, for example, in addition to the above income, you win 10 million in the lottery (that would be great, right?), then based on this base the tax will be calculated at two rates: 5 million at a rate of 13% and 5 million at a rate of 15% personal income tax . Moreover, to determine the total tax base, components are used - tax bases, which are calculated taking into account the use of tax deductions: for children, property and others.

How to fill out 3-NDFL for a tax refund for 2021?

To fill out, take a declaration form approved by Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

In this new form you need to fill out:

- Title page.

- Section 1 to reflect the amount to be refunded.

- Appendix to section 1 - an application for personal income tax refund is generated.

- Section 2 for calculating the refundable amount.

- Appendix 1 for reflecting annual income and withheld personal income tax - to obtain information about the maximum possible tax that can be returned.

- Appendix 5, which shows the amounts of deductions for treatment and medications.

If 3-NDFL is drawn up on paper (manual filling), then you need to align the indicators in the lines to the left, write legibly in black or blue ink, there is only one character in each cell, empty cells are filled with dashes. You cannot correct the indicators, you cannot spoil the information on the pages or the barcode in the upper left corner, the information must be readable.

If you fill out 3-NDFL on a computer and then print it out, then you need to align the indicators to the right, while cell frames are not required, and there is no need to put dashes.

If you are preparing a declaration in a program downloaded from the Federal Tax Service website, then you just need to fill out the required sections, after which the program itself will generate a completed version of 3-NDFL.

Instructions for preparing 3-NDFL in the 2021 Declaration program for deductions for treatment.

The printed sheets of the declaration are signed by the person who will submit it to the Federal Tax Service (the taxpayer himself or his representative). Each page has a serial number at the top and the date of signing at the bottom.

When filling out 3-NDFL in your personal account, the declaration is submitted electronically; you do not need to print out and submit a paper version.

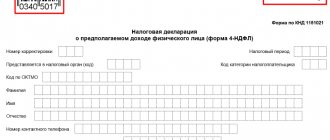

Title page

General information regarding the taxpayer, the person filing the return, as well as information about the tax period and reporting year.

Below you can see how to fill out the title page correctly if 3-NDFL is submitted by an individual - a resident of the Russian Federation independently, without intermediaries.

Filling example:

Section 1

This is the second page of the 3-NDFL tax return; data is reflected here on how much tax the taxpayer is entitled to return for the reporting year.

The amount to be refunded is shown in line 050.

In this case, in line 010 you need to indicate the number 2, which will correspond to the need to return personal income tax from the budget.

The codes KBK and OKTMO are entered in lines 020 and 030.

This section is filled out last, when all the necessary calculations have been made, based on data from other pages of 3-NDFL.

An example of filling out section 1 of form 3-NDFL:

Appendix to section 1

Allows you to generate an application for an income tax refund - indicate the codes KBK, OKTMO, account details, and the amount to be returned.

Filling example:

Section 2

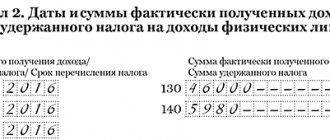

The declaration page where the tax base and refundable tax are calculated. Filling out is carried out on the basis of data on income and withheld tax for the year specified in Appendix 1, and data on social deductions for treatment specified in Appendix 5.

You need to fill in the following lines:

- 001 — tax rate of 13 percent;

- 002 — in order to return personal income tax for treatment, you must indicate 3;

- 010 — total annual income of the taxpayer;

- 030 — annual income from which personal income tax had to be withheld (in most cases corresponds to line 010);

- 040 — the total amount of deductions from page 200 of Appendix 5;

- 060 - personal income tax base - the difference between taxable income and deductions (line 030 - line 040);

- 070 — personal income tax from the tax base that had to be paid for the reporting year, taking into account all deductions (rate from 001 multiplied by base from 060);

- 080 - the tax that is actually withheld and paid for the year is taken from page 080 of Appendix 1;

- 160 — Personal income tax, which must be returned from the budget in connection with expenses for treatment and medicines, is defined as the difference between the tax paid and the one that had to be paid, taking into account deductions (line 080 minus line 070). This indicator is the final value, which is transferred to the summary section 1.

An example of filling out section 2 of form 3-NDFL:

Annex 1

On this page of the 3-NDFL declaration, you need to show how much income the taxpayer received for the year, from whom, as well as the amount of tax withheld from it.

If during the year the income came from different sources, for example, from different employers, then you need to show each one separately.

For each source of income you must fill out:

- 010 - the rate at which this income was taxed (13% for wages);

- 020 - type of income (you can see it here) - 07 for salary;

- 030-060 — details of the source of payments;

- 070 - accruals for the year before taxation;

- 080 - personal income tax, which is deducted from this income.

An example of filling out Appendix 1 of the 3-NDFL declaration:

Appendix 5

On this page, in subsections 2-4, the social tax deduction is calculated, including those provided in connection with the costs of treatment, medicines, operations, medical services, according to the established List.

Subsection 2 specifies the amount of deduction for expensive treatment, which is not subject to the 13 percent refund limit.

Subsection 3 shows the amount of benefits for treatment that is not expensive, as well as for purchased medications that are subject to restrictions (120,000 rubles in total per year for yourself and 50,000 rubles for a relative).

Subsection 4 indicates the total amount of social deduction due to the taxpayer in connection with expenses for medical services. It is from this amount that the taxpayer will be able to return income tax of 13 percent.

Appendix 5 is completed in the following order:

- 110 - the total amount of expenses for expensive treatment without restrictions (must be confirmed by an agreement, payment documents);

- 120 - the indicator from page 110 is written down again;

- 140 - the amount of expenses for treatment that is not considered expensive (the indicator in this line should not exceed the required social deduction);

- 141 - costs for medicines (must be confirmed by prescriptions and receipts);

- 180 - amount of expenses (p. 140 + p. 141) - no more than social deduction (120,000 for yourself and 50,000 for a relative);

- 181 - indicates the social deduction already provided by the employer on the basis of a tax notification during the reporting year, the field is filled in if the taxpayer did not wait until the end of the year to refund the tax, but immediately applied for notification;

- 190 - total amount of social deductions according to the declaration (line 120 + page 180 - page 181);

- 200 - the indicator from page 190 is repeated.

When filling out the 3-NDFL declaration, it is important to understand that the social deduction includes not only the costs of treatment, but also training and insurance premiums under voluntary insurance contracts. Therefore, if a taxpayer wants to return 13 percent not only for treatment costs, but also for training or insurance, then the existing limit must be taken into account and not exceed it - 120,000 rubles. for yourself, and 50,000 rubles. for a family member.

Sample of filling out 3-NDFL to receive a deduction for education for 2020.

An example of filling out Appendix 5 of Form 3-NDFL:

and sample filling

.

.

Who will be responsible for calculating personal income tax at the new rate?

As a rule, all calculations will be made by tax agents. This means that they will fall on the shoulders of the accountants of the employing organizations, those who attract workers under GPC agreements, pay dividends to the owners, etc.

But there may be several such agents. For example, an employee can work part-time, perform contract work for different customers, have shares in different companies, even win completely different lotteries several times. How can all its tax agents find out about each other and the amount of income received? What if the income has already exceeded 5 million? The rule here is: every man for himself. Each tax agent calculates personal income tax on the income it pays and does not have the right to demand proof of other income.

Important! An exception is that if an employee comes to find a job in the middle of the year and this year he has already worked in another organization, he must provide a 2-NDFL certificate from his previous place of work. But this is mandatory if he wants to receive deductions, because without such a certificate, the accountant will not be able to determine either the amount of income or the amount of previously provided deductions.

Another good news for agents: in the 1st quarter of 2021, they will not be subject to sanctions for incorrect calculation of personal income tax (unprecedented generosity, because for personal income tax the amount of penalties depends on the amount of unpaid tax). But, on the other hand, in the first quarter, few people will have a situation where income exceeds the limit and confusion with calculations arises, so the relief is doubtful.

How to reflect 15% personal income tax and corresponding income in reports

Firstly, next year a new form of calculation 6-NDFL will be introduced, and a 2-NDFL certificate will be provided as part of it (for the year). The new form comes into effect with reporting for the 1st quarter of 2021; for 2020 we are still reporting using the old forms.

Secondly, and according to the current rules, there are instructions on how to fill out the calculation if income is received at different rates, the Federal Tax Service reminded this in its Letter dated December 1, 2020 No. BS-4-11 / [email protected] , even examples are attached to the letter filling out a new report.

Therefore, if there is an excess and part of the income will be taxed at a rate of 13%, and part at a rate of 15%, then it is necessary to fill out two sections 1 and two sections 2. If there is income taxed at other rates (for example, 35% personal income tax on savings on interest on a loan received from an interdependent organization), then they will also be allocated separately. In short, there are as many different rates as there are sections 1 and 2 in the report.

Purpose and subjects

This type of reporting is used to analyze statistical data and forecast for future years. Also based on it, you can estimate the real amount of funds coming to the budget from a particular region. Additionally, the report reflects the data of all types of income tax provided, indicating the amounts not subject to taxation and the amount of funds lost due to the use of specific deductions.

Responsibilities for drawing up this voluminous document are assigned to the territorial divisions of the Federal Tax Service. Citizens and accounting departments of organizations are only required to promptly provide data on income taxes from individuals and applications for obtaining NV.

Where will the new personal income tax be paid and for what purposes will it be used?

For the transfer of ordinary personal income tax of 13%, the KBK is established - 18210102010010000110; for the excess tax amount at a rate of 15% - KBK 18210102080010000110.

Attention! Don't forget that in 2021 you will need to fill out payment orders in a new way.

Tax payments are not targeted; they are distributed for various purposes of spending budget funds. But an exception has been made for personal income tax of 15%: this is a targeted tax. The money received by the state will be used to treat children with rare and dangerous diseases.

According to forecasts, the amount of tax that will be collected during 2021 will be about 65 billion rubles. Medicines, treatment, and hospital stays for seriously ill children are very expensive, and these funds are intended for a truly good cause. We can only hope that they will go as intended, and the state will provide the opportunity to transparently and clearly track the movements of these targeted revenues.