The filling procedure is prescribed in Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED-7-11/753. From the 1st quarter of 2021, the 6-NDFL calculation will include the 2-NDFL certificate as an appendix; you will no longer need to submit it separately. The 2-NDFL certificate is filled out separately once a year for each individual to whom income was paid, and the 6-NDFL certificate is submitted quarterly for the entire organization.

Quarterly reporting reflects the total income paid to all individuals. The data in section 1 of form 6-NDFL is shown for the last three months of the reporting period, in section 2 - on a cumulative basis from the beginning of the year. Certificates of income and tax amounts are filled out once a year; they do not need to be submitted with quarterly reports.

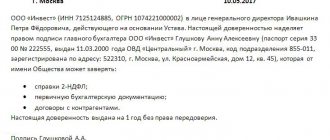

Reporting must be submitted at the place of registration of the organization or individual entrepreneur. For each separate division, a separate 6-NDFL calculation is submitted at the place of its registration (letter of the Ministry of Finance of the Russian Federation dated November 19, 2015 No. 03-04-06/66970, letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Small firms with up to 10 employees are allowed to submit 6-NDFL reports on paper.

If the number exceeds 10 people, you will have to report electronically. This norm applies from 01/01/2020 in accordance with the amendments made to the Tax Code by Federal Law dated 09/29/2019 No. 325-FZ.

The Kontur.Extern system will help you easily and quickly send reports via telecommunication channels.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Deadlines for submitting 6-NDFL

Form 6-NDFL must be submitted no later than the last day of the month following the reporting quarter. And the annual calculation is no later than March 1 of the year following the expired tax period (taking into account clause 2 of Article 230 of the Tax Code as amended by Federal Law No. 325-FZ of September 29, 2019).

Taking into account weekends and holidays in 2021, the following reporting deadlines are provided:

- for 2021 - no later than 03/01/2021;

- for the 1st quarter of 2021 - until 04/30/2021;

- for half a year - until 08/02/2021;

- nine months before November 1, 2021.

The accountant's calendar will help you submit Form 6-NDFL on time.

How to fill out and when to submit the report

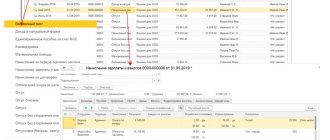

Until the new 6-NDFL reporting is put into operation, a standard form is in force for making calculations for 2021, which consists of a title page and two sections. On page 001 indicate:

- TIN and checkpoint;

- number of the updated (adjustment) report (if necessary);

- tax period date;

- information about the tax office;

- name of the organization or enterprise;

- contact details, full name and signature of the responsible person;

- OKTMO and other data necessary to identify documentation.

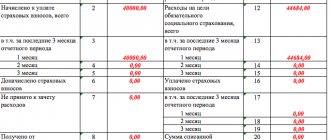

On the second page in Section 1, the rate applied in the reporting period is indicated (line 010) and generalized indicators, which are filled in with a cumulative total:

- information about income and payments (lines 020, 025, 050);

- data on tax deductions (lines 030, 040, 045, 070, 080);

- number of employees who receive income (060);

- tax refund to the taxpayer (090) on the basis of Art. 231 NK.

In Section 2 the following indicators are indicated (blocks of 5 lines 100-140 for each event):

- 100 – day of accrual of funds to the employee;

- 110 – tax withholding day;

- 120 – day of sending deductions to the budget;

- 130 – total income;

- 140 – total tax amount.

Form 6-NDFL is submitted to the inspectorate quarterly. The deadlines for submitting documentation are as follows:

- April 30 – for the 1st quarter;

- July 31 – 6 months;

- October 31 – for 9 months;

- March 01 – for the year.

It is necessary to send information electronically to those tax agents who have 10 or more employees on their staff. With fewer employees, the employer retains the right to send reports on paper.

How to fill out Section 1 “Data on tax agent obligations”

In this section, you need to group income for the last three months by date of receipt. For each group, you need to note the dates of tax withholding and transfer to the budget.

Thus, line 020 indicates the generalized amount of withheld tax for all employees for the last three months, line 021 indicates the date no later than which the tax must be transferred to the budget, and line 022 indicates the generalized amount of withheld tax payable. Lines 030-032 are provided for personal income tax amounts that were returned to employees.

The sum in field 020 must be equal to the sum of fields 022, of which there must be the same number as fields 021. Similar rules are provided for lines 030-032.

Starting from 2021, the date of receipt of income by an individual, the date of tax withholding and the amount of income actually received do not need to be indicated.

Difficult situations

During their work, accountants may encounter difficulties filling out Form 6-NDFL. Therefore, the Federal Tax Service regularly sends cover letters on how to fill out a report and resolve a particular situation. In particular, the letter dated November 2021 No. GD-4-11/ [email protected] contains an overview of the most common violations with information about the reasons for their occurrence and recommendations for correctly filling out the lines. This information will remain relevant in 2021.

For example, incorrect filling of checkpoints and OKTMO occurs quite often. Or the amount in line 050 of Section 1 (fixed advance payment) exceeds the amount of the calculated tax. Or the data in Section 1 is filled in not with an accrual total.

Formation of vacation pay recalculation

When preparing 6-NDFL reports for vacation pay paid to employees in 2021, the procedure for filling out remains unchanged and includes the following conditions:

- the date of receipt of income is the actual date of accrual of vacation pay;

- The date of transfer of tax to the budget is the last day of the month.

Therefore, this payment is reflected separately in the report.

In some cases, it may be necessary to recalculate vacation pay, which will entail submitting an updated reporting form to the tax authority. This situation may arise if:

- an error was made when preparing the calculation and incorrect data was entered, which distorts the tax deduction figures;

- the calculation of vacation pay was changed due to circumstances provided for by law: the dismissal of an employee, his early exit from vacation, the postponement of vacation due to a delay in the accrual of funds.

In the second case, it is necessary to submit an updated form if the change in vacation pay was made downward. If an additional payment has occurred, the total amount is indicated in the reporting for the period in which this payment was actually made.

Separate units

After the signing of Law No. 325-FZ, organizations with separate divisions received the right to choose one tax inspectorate. Previously, reporting on financial interactions with employees of the unit was submitted to the tax authority, where the accounting of this unit is carried out.

If the parent organization and the division are geographically located in different municipalities, the organization can choose one inspection in the municipality to which reporting will be sent. If the parent organization and the division are located in the same municipality, then you can report to the same inspectorate with which the parent organization is registered. It is necessary to decide on the inspection before January 1 of the tax period, that is, for 2021 - before 01/01/2021.

When closing a separate division, settlement form 6-NDFL will be sent to the tax authority to which the parent organization reports. In this case, the TIN and KPP lines indicate the details of the parent organization, and the OKTMO code on the 1st page indicates the closed separate division.

How to fill out Section 2 “Calculation of calculated, withheld and transferred personal income tax amounts”

In the second section, you should show the amount of accrued income, calculated and withheld by personal income tax, generalized for all individuals from the beginning of the tax period. The amounts of accrued dividends, income under labor and civil contracts for the performance of work (rendering services) are recorded in separate lines.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Section No. 2 of the 6-NDFL calculation can be placed on several pages if the organization uses different personal income tax rates.

Appendix No. 1 to the annual report 6-NDFL (replacement of 2-NDFL)

In ZUP 3, filling out Appendix No. 1 has not yet been implemented.

Appendix No. 1 must be filled out when drawing up 6-NDFL for the calendar year and almost completely copies the currently used 2-NDFL .

Section 4 has been added to the Help , which displays the amount of income on which personal income tax is not withheld and the amount of tax not withheld.

We reviewed the introduced changes to 6-NDFL in 2021.

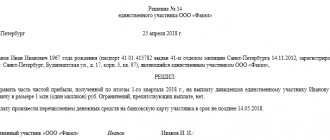

Updated calculation

Organizations and individual entrepreneurs must submit an updated calculation in form 6-NDFL if errors are found in the primary report or false information is provided.

The indication of the updated calculation is written on the title page in the “adjustment number” field (001, 002, 003, etc.). The clarification can be submitted without applications with a certificate. But if changes need to be made to the information from the certificates, you will have to submit the entire calculation.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Let's sum it up

- Starting with reporting for the 1st quarter of 2021, all employers will report on the new form 6-NDFL, approved. By Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected]

- The sections in the new report have actually changed places, and some other innovations have also appeared - they are discussed in this article.

- Certificate 6-NDFL as a separate document will be submitted for the last time based on the results of 2021. Next, a similar document will be submitted as Appendix No. 1 as part of the updated form 6-NDFL.

Who is required by law to submit 6-NDFL?

This calculation is carried out by tax agents - that is, those who are the source of payment of income for an individual. This includes payments:

- under employment contracts;

- civil contracts;

- copyright license agreements;

- lease agreements;

- dividends;

- winnings.

Tax agents are both organizations and individual entrepreneurs.

Under the purchase and sale agreement, the purchasing organization is not a tax agent. When selling property, an individual calculates and pays personal income tax independently.

If the individual to whom the income is paid is an individual entrepreneur or a self-employed person without individual entrepreneur status, he is independently responsible for paying tax on the income paid.

When concluding a GPC agreement with self-employed persons who do not have individual entrepreneur status, you need to be very careful . If an individual loses becomes a tax agent for personal income tax.

ADVICE

We recommend tracking the status of the self-employed on a special service of the Federal Tax Service and including the condition of the contractor’s self-employment in the contract.

How to focus on work?

Based on all of the above, we come to the conclusion that we are not able to solve the situation with constant changes in legislation, because it does not depend on us. But we have a richer toolkit for changing the world for the better - this is to work with ourselves. It is clear that mistakes will occur, but let them be conscious rather than unconscious. To do this, you need to download the new form 6-NDFL and try to read it as carefully as possible.

Emphasize for yourself those nuances in it that we pointed out, and also go through the remaining lines (maybe we missed something). Then try filling it in with random numbers from a fictitious organization as an example. This practice will help you “manually” work with it and determine for yourself what you know for sure and what it would be desirable to clarify. Don’t be shy to call your familiar inspector at the Federal Tax Service, and if one is not available, then take a look at the legal reference system.

In any case, make several attempts to understand the new form in advance so that during the actual preparation of reports fewer problems arise than usual.

Which form 6-NDFL to use for 2020

As already noted, you need to report for 2021 using the previous form 6-NDFL.

Important

For 2021, 6-NDFL is submitted on a form approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450

.

You can free 6-NDFL for reporting for 2021 at the link:

The composition of the 6-NDFL form used for 2021 is shown in the diagram:

6-NDFL reflects only those payments that are subject to personal income tax, taking into account the following nuances:

- if the payment is completely exempt does not need to be reflected in 6-NDFL ;

- if the payment is subject to personal income tax only in excess of any limit (for example, material assistance in the amount of more than 4,000 rubles per year) - the amount of such assistance is reflected in 6-NDFL in full on line 020 of Section 1 and in part of the non-taxable amount - in line 030 of Section 1 .

Title page

Filling out a title usually doesn't pose much of a problem. 6-NDFL is not original: general data about the organization is entered here - TIN, KPP, name, Federal Tax Service code and reporting period. OKTMO is also indicated here.

Section 1

This section is filled out with total indicators calculated from the beginning of the calendar year:

- several lines 010 - 050 of section 1 , since they are filled out in a breakdown - separately for each tax rate;

- lines 060 – 090 are included in the calculation in a single copy - they contain data in total for all rates.

This section reflects those amounts of income and the amounts of tax calculated from them that are considered actually received in the reporting period for which 6-NDFL is compiled.

For different incomes, the date of their actual receipt may vary:

Let's write down the section lines and their decoding in the table with some comments.

Section 2

This section is filled in with data that relates only to the reporting period - that is, to the quarter for which the 6-NDFL calculation is made.

It consists of blocks containing 5 lines:

In section 2 there will be as many blocks of lines 100 - 140 as there are different combinations of dates in lines 100 - 120 in the reporting period.

The payment of income will be included in the calculation of the reporting period to which the latest of the dates reflected on lines 100 - 120 relates.

Why did these changes come up?

Upon completion of the preparatory stage, the final version of the document was accepted and approved. As expected, there will be no fundamental changes or complications. Moreover, it is claimed that filling out the updated form will be easier. Modified reporting, in theory, should make the work of accountants (and, possibly, tax officials) easier. Now there will be no need to be the first to submit and the second to process two separate documents. They will be replaced by the approved hybrid income report 6-NDFL+2-NDFL.

Changes in reporting 2020-2021

SELECTION OF THE IRS FOR PROVIDING REPORTING AND PAYMENT OF NDFL

The new order will only affect OPs within the same municipality (MO).

In order to centrally pay personal income tax and submit reports, the organization is obliged to notify all the Federal Tax Service Inspectors with which the OP is registered no later than January 11, 2021.

If an organization and several of its separate divisions are located on the territory of one Moscow region, then from 01/01/2021 you can transfer personal income tax and submit 6-personal income tax calculations and 2-personal income tax certificates:

- or to the Federal Tax Service Inspectorate at the location of one of such OPs selected by the organization itself (responsible OP);

- or to the Federal Tax Service at the location of the organization.

Federal Law dated September 29, 2021 No. 325-FZ

New form 6-NDFL

- The new form 6-NDFL must be used starting with reporting for the first quarter of 2021.

- The 2-NDFL certificate, which was generated by the employer annually for each employee, has been canceled in 2021.

- 2020 is the last reporting period for which a 2-NDFL certificate must be submitted to the Federal Tax Service, the submission deadline is no later than 03/01/2021.

- A certificate of income and tax amounts of an individual (now it is 2-NDFL) is now included as an appendix in the Calculation in form 6-NDFL.

- The order also approved the form of the income certificate that is issued to the employee.

Order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11/ [email protected]

Statistical reporting P-4

By order of the Federal State Statistics Service, the rules for the formation of a number of statistical reporting forms have been adjusted since 2021.

In particular, adjustments have been made to the statistical reporting form P-4 “Information on the number and wages of employees”:

- If an organization changes the location of its actual activities during the reporting period, information on indicators for the period from the beginning of the year is provided from the moment it began work in another constituent entity of the Russian Federation.

- In the categories of workers included in the calculation as whole units, it is necessary to take into account pregnant women who are released from work until they are given another job.

- If the date of conclusion of the civil process agreement, which provides for a specific period of work, does not coincide with the date of their start, then the period of validity of the civil process agreement is considered to be the period of completion of the specified tasks.

Order of the Federal Service of State Statistics of November 17, 2021 N 706

The procedure for blocking bank accounts for late submission of reports to the Federal Tax Service

- The period of delay in submitting declarations (calculations), after which the tax authorities can “freeze” the taxpayer’s bank account, has been increased from 10 to 20 days.

- Inspectorate employees will have the right to notify about the upcoming freezing of the accounts of organizations that have not submitted a declaration (calculation) on time.

- The established period for such notification is no later than 14 working days before the decision to block is made.

The amendments made will come into force on July 1, 2021.

Federal Law of November 9, 2020 No. 368-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”

NEW FORM OF CALCULATION FOR INSURANCE PREMIUMS (DAM)

The updated DAM form is applied starting with the calculation for 2020.

1.

On the title page you need to indicate data on the average number of employees.

2.

Additional payer rate codes are assigned:

- 20

— for SMEs

- 21

— for those who have been set a zero contribution rate for the second quarter of 2021

- 22

- for payers developing and designing electronic component products and electronic (radio-electronic) products. This code will be needed for reporting for the first quarter of 2021.

3.

The corresponding categories of insured persons have been added:

- MS - persons for whom SMP contributions are calculated from the portion of payments and remunerations exceeding the minimum wage

- KV - persons insured in the compulsory insurance system, with a zero tariff on insurance premiums

- EKB are persons from whose payments and remunerations insurance premiums are calculated according to the tariff for radio electronics manufacturers.

4.

Starting with reporting for the 1st quarter of 2021, it will be necessary to fill out a new Appendix 5.1 (IT companies and radio electronics manufacturers). In Appendix 5.1, organizations will indicate the Payer Code:

- "1" - IT company

- "2" - manufacturer of radio electronics

Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

Reflection of information on the average number of employees as part of the DAM form

By Order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11/ [email protected], the form for submitting information on the average number of employees for the previous calendar year to the tax authority has been cancelled. The form was submitted as a separate report for each year no later than January 20.

In the new form of Calculation of Insurance Contributions, information about the average number of employees must be indicated on the title page.

The amendments come into force on January 1, 2021 and will be applied from the submission of calculations for insurance premiums for 2020.

Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

New form 4-FSS

In connection with the transition to direct payments from the Social Insurance Fund, from 2021 it is planned to use the new 4-FSS form for insurance premiums “for injuries”.

Tables that relate to information about the employer’s expenses are excluded from Form 4-FSS.

A table has been added to Form 4-FSS for employers to indicate classification units, if they have any. The table is not required to be completed and submitted by all employers.

The new 4-FSS report form will need to be used from the 1st quarter of 2021.

Draft Order of the FSS “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases (Form 4-FSS) and the Procedure for filling it out”

OTHER CHANGES

New BCCs for paying personal income tax at a rate of 15%, penalties and fines

For the payment of personal income tax calculated at a rate of 15%, penalties and fines, new budget classification codes have been approved:

- payment amount, recalculations, arrears 182 1 0100 110

- penalties 182 1 0100 110

- fine 182 1 0100 110

Order of the Ministry of Finance dated October 12, 2020 No. 236n

Key rate of the Central Bank of the Russian Federation

The Board of Directors of the Bank of Russia decided to maintain the key rate at 4.25%.

The key rate is used when calculating compensation for delayed payment of wages and penalties for personal income tax and insurance contributions.

If the rate changed during the period of delay, then for the calculation it is necessary to use different sizes of the key rate.

Information message dated October 23, 2021

What problems might arise?

As was said above and noted by users, all the main problems with 6-NDFL occur after changes are made to it, albeit minor at first glance (consider this a popular accounting example). In particular, changing the barcode cannot be called something “frightening” and “disturbing”, which is fundamentally different from the appearance in the form of new columns dedicated to reorganized companies, of which there are tens of thousands throughout the country. It is possible that this particular trick from the Federal Tax Service will become the main trend in clarifying the relationship between taxpayers and fiscal officials. Moreover, there is also an exclusively “human” reason for problems with this form. We are talking here about elementary inattention, which can confuse our colleague during the period of submitting annual reports. As is well known, during this period accountants are especially distracted and it is not clear why

Perhaps these same “external irritants” are not due to malicious intent, but the fact remains that thanks to their “help” accountants make mistakes, and this inevitably leads to new fines for the organization, or to another portion of damaged nerves.

6-NDFL: payment for business trips after dismissal

The employee went on a business trip and then resigned. After his dismissal, he received additional accrual and was paid a certain amount for the business trip. What dates for receipt of income and tax withholding should be indicated in 6-NDFL?

The Tax Service explained (see letter dated 06/08/2018 No. BS-4-11/ [email protected] ) that the average salary paid during a business trip also applies to wages. This means that the date of receipt of this income is the last day of the month, and in the event of an employee’s dismissal, his last working day. It must be indicated in line 100 “Date of actual receipt of income.” In line 110 “Date of tax withholding” you must enter the date of payment.

Where and how to submit personal income tax reports

Personal income tax reporting is submitted to the tax office with which the tax agent is registered. But there are certain subtleties here.

the separate division is registered . At the same time, if several detachments or the head office and detachment are located in the same municipality, then it is permissible to select one inspectorate where to submit personal income tax reports for all detachments of this municipality. notify of your choice , to which you will submit 6-NDFL.

An individual entrepreneur cannot have separate divisions. But it can be registered at one address, and conduct activities (for example, under a patent) at another address. In this case:

- for “patent” employees - 6-NDFL is submitted to the tax office, where the patent is registered;

- for key workers – at the place of registration.

At the same time, if an individual entrepreneur operates at different addresses, has employees at each location and uses the simplified tax system or OSNO, then he must report in form 6-NDFL at the place of his registration.

The 6-NDFL report can be submitted electronically or in paper form. The paper option is only to those who have made payments to no more than 10 people . The rest report only electronically.