The time it takes for money to arrive in your current account from another account, from a card, or after depositing cash through a cash register sometimes becomes a cause of great anxiety. Money that does not arrive in the bank account within the expected time period raises suspicions between business partners, delays commercial transactions, and sometimes even disrupts transactions.

RKO tariffs

A common situation familiar to many:

- The truck arrives to pick up the goods faster than the money appears in the supplier’s bank account.

- If the download does not take place “in a minute”, it starts in advance.

- Towards the end of the process, they again begin to look for money in the account, then demand that the buyer send a payment order with a bank mark.

- When a copy of the order has already arrived, but the money has not yet appeared, a nervous trial begins - who will take responsibility and agree to release the car.

- If none of the managers or employees is ready to take risks, the driver wanders restlessly around the office, the buyer asks for trust over the phone, everyone gets nervous, scolds the bank and each other.

So far no one has been able to indicate the only correct way out of this situation; we will not risk doing this either, but we will only describe the payment processing mechanism and name some standards for such operations.

What is a current account and why does a business need it?

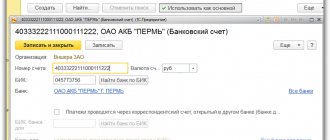

A current account is understood as a special account in a financial institution, with the help of which a legal entity or individual entrepreneur can carry out certain monetary transactions. In the company details, the current account is a combination of 20 numbers that carry certain information.

With a current account you can:

- pay for services and goods non-cash;

- accept payment for your services from other individual entrepreneurs and legal entities;

- store money, keep records of it;

- collect funds;

- pay wages;

- accept payments by bank cards or via online acquiring;

- carry out currency transfers and much more.

Current account holders can also gain access to other banking services - overdraft, interest on the minimum balance, factoring. Without a current account it is impossible to participate in tenders. With its help, it is easier to make payments under compulsory medical insurance, to the Pension Fund and other government agencies

How quickly are funds transferred from a current account to a card?

An entrepreneur/legal entity may need to transfer money from a current account to a bank card in many situations - for example, when transferring salaries to employees of an organization or when withdrawing their funds.

Within one banking company, such transactions are carried out quickly: usually within a few hours. If the money was sent in the morning, it will arrive in the afternoon. Cases when the amount arrives on the card only the next day are very rare. This is mainly explained by either the system load or temporary technical failures.

Speaking about interbank transfers, it should be noted that the transaction here requires a little more time. Practice shows that in the vast majority of examples, money reaches its destination on the day of departure. Maximum within 24 hours.

Only rarely can a situation arise in which the transfer takes up to 5 days. The reasons here are simple - the specifics of interaction between financial institutions and the processing of payment transactions by the processing center.

Options for receiving funds to your current account

Funds can be transferred to the current account in different ways - from counterparties, extra-budgetary and budgetary funds, through the cash register. Charges from current accounts opened with another bank are possible. In any case, each receipt of funds must be correctly recorded using documentation.

Conventionally, the accrual of funds to the company's account can be divided into four groups.

For payment requests - with or without the consent of the current account owner. The procedure is discussed in advance and specified in the agreement between the financial institution and the buyer. The owner of the current account may refuse to make a payment if it is made according to a payment request with acceptance, and he is obliged to clearly formulate the reason for his decision.

Non-cash payments - this category usually includes the transfer of money according to demands, orders, letters of credit, checks and other methods. Each such operation must be documented.

Collection - the client instructs the bank in which the current account is maintained to undertake obligations to receive and credit funds in accordance with the documents provided by the client. Transactions for such payments are processed using a collection order or a request from the current account holder.

In addition, payments to the current account can be made from a regular bank card, credit or debit. Most often, this method is used by individuals who pay for goods or services in favor of the owner of the account. The funds may come from the same bank or another financial institution.

How long does it take to transfer to a current account?

In order to comprehensively cover the topic, we will first study some general information and then pay attention to specific examples.

General information

The efficiency of money transfer is an extremely important parameter of banking services for any business - whether we are talking about individual entrepreneurship or a legal entity. How quickly the payment is processed determines how long it will take to start shipping goods or working with orders.

There is no clear answer to the question about the speed of implementation of a money transfer to a current account. No one can give accurate information, because... There are quite a few different nuances here: it all depends on the nature of the transaction, the banks of the sender of the money and the recipient, etc.

Note 1.

Within the system of one banking company, the transfer occurs quickly - within a few minutes from the moment of sending, or even almost instantly. Sending to another financial institution may well take several days - and this often applies even to a transfer simply to another branch of the bank.

Important! The law obliges banking organizations to credit money no later than the day immediately after the date of receipt of payment from another bank. A similar situation occurs with sending - the amount declared by the client should be sent maximum the next day after the order is processed by the sending organization. However, in practice, often several banks take part in the process, which is why the transaction processing time increases significantly.

The agreement on cash and settlement services rarely contains information about the time interval within which funds should be credited to the company’s account.

In most cases, ruble transactions are credited to the addressee’s account on the day of departure or the next date

– if all the data was correctly indicated in the documents.

Note 2.

The maximum possible period is 5 days. However, this is an exception and almost never occurs under standard conditions.

With currency, everything is much more complicated: on average, the money arrives to the recipient on the PC within two days.

And this means working days. Any – even the most minimal – inaccuracies in the accompanying documentation seriously increase the time spent. Everything is aggravated by the fact that errors are not always detected at the beginning of the operation: it happens that they emerge at later stages.

Time for transferring money to Sberbank PC

Sber is one of the largest representatives of its field of activity in Russia. The bank pays great attention to the quality of the service provided to clients, however, due to the scale of the institution and the reach of the audience, it is impossible to do without any rough edges. Users are willing to put up with various little things, but the issue of speed of money transfers – in particular to a current account – is acute.

Efficiency in transactions is a point on which the interaction between partners, sellers and buyers depends. This is what affects the implementation of large transactions. Such nuances must be taken into account, otherwise there may be a blockage in financial processes.

Let's consider three main situations in connection with sending a transfer through Sberbank:

- A ruble transfer was sent from the regional Sberbank branch where the RS was opened.

If the operation was carried out within one business day, the money will be received by the recipient on the same date. If sent in the evening, funds will arrive in the morning of the next working day. - A ruble transfer was sent from another regional Sberbank branch or even from another financial institution.

As a rule, the shipment arrives early the next day. If the payment is made in the morning, the amount is credited to the current account at the end of the first half of the day. - Payment was made in foreign currency.

Here the situation is more complicated, since much depends on the bank that sends the money. In this case, even Sberbank employees cannot predict how much the funds will go. Practice shows that in most cases everything is limited to two days. However, sometimes the waiting time extends to a week.

The circumstances described reflect only approximate time frames and their limits. The process of transferring money can be influenced by many factors, and therefore the speed of the transaction in seemingly the same situations may vary.

Time for transferring money to RSs of other banks

It should be noted that there are no fundamental differences from the conditions prevailing in the case of Sberbank. All banks strive to process transactions as quickly as possible. And they are all subject to the same legislation.

There are no strictly established standards for transfers between accounts.

The result and content of the procedure depends on which banking companies participate in the event.

There are two general points:

- ruble transfers take up to several hours (the deadline for receiving the shipment is the morning of the next business day);

- Currency transfers take up to two days.

All banks - be it Alfa, Sber, Tinkoff, VTB, etc. – provide approximately the same conditions in terms of time spent on operations.

To understand how long it will take, you need to keep in mind the nature of the transfer (between which payment instruments are carried out), the parties involved in the transaction (financial companies), the time of sending the funds, the day (working day, weekend, holiday), etc.

Nuances of taxation of income to a current account

From the perspective of paying taxes, the receipt of funds into the company's current account should be displayed correctly. In this matter, you need to focus on two factors: the type of taxation and the purpose of the funds. Let's look at specific examples

The receipt of a payment to the current account of an individual entrepreneur working under the simplified tax system must be recorded in documents taking into account its purpose. Income from the provision of a service or sale of a product is taken into account on the day the funds are received into the current account;

In the case of OSNO, it is important how the company makes payments: by accrual or using the cash method. In the first case, the receipt of funds is not reflected in the calculation of taxes. In the second, everything depends on the purpose of the funds.

In the case when the company operates under UTII, everything is simpler. Since the tax is levied on imputed income, the funds received do not in any way affect the amount of taxes. In the case of combining UTII with OSNO, much will depend on the purpose of the payment.

New rules for the fiscalization of payments for non-cash payments

In Article 1.2 of the new edition of Law No. 54-FZ (LINK), a new paragraph 5.3 has appeared, establishing the rules for the fiscalization of payments that do not fall, in particular, under paragraph 5 of Article 1.2 of the law. That is, different from payment for a product or service on the site (in which the procedure for fiscalization, as we already know, is more or less clear).

Payment according to the scheme “to a current account” fits the specified definition quite well - since, according to the criteria known to us, it does not fall under the scope of paragraph 5. The fact is that it regulates payments that are fiscalized using “devices connected to the Internet”, which “provide the opportunity remote interaction between buyer and seller (or the online cash register itself, if it operates automatically). Obviously, when paying for goods using a receipt through a cashier-operator at a bank, no “devices” from the seller are used, and this is practically technically impossible.

In accordance with clause 5.3 of Article 1.2 of Law No. 54-FZ, the seller who has received payment from the buyer according to a scheme different from that regulated by clause 5 (let’s agree that the seller has discovered a receipt in the current account for the amount of payment for the goods), must transfer to the buyer:

- Electronic cash receipt - by sending it (a link to it) to the buyer’s existing contacts.

It is assumed that contacts will be requested in some way before that moment - for example, through an order form on the website or by phone when agreeing on an order.

An electronic check must be sent to:

- no later than the working day following the day of settlement;

- no later than the time of delivery of the goods.

- Paper cash receipt - when issuing goods.

- A paper check - at the first direct contact with the buyer (and before the goods are issued).

The first available option for transferring the cash receipt to the buyer is selected.

In its letter No. ED-4-20 / [email protected] dated December 20, 2018 (LINK), the Federal Tax Service explained that it considers it acceptable, when receiving payment to a bank account, to indicate on a cash receipt or on a strict reporting form the payment form “ELECTRONIC” and not "NON-CASH" until July 1, 2021.

Note that the law still does not explain what the seller should do if the buyer did not provide contact information to receive an electronic check - while the allotted time frame for sending such a check has expired (and before their expiration, the buyer did not appear at the seller’s premises in person to a paper check could have been issued).

Probably, in this case, the position of the Ministry of Finance voiced in the above letter can be considered relevant - that a business entity must, by any possible means, obtain the buyer’s contact information in advance in order to send a check. And in case of claims from inspection authorities, be ready to prove that the necessary measures were taken.

In accordance with the latest amendments to 54-FZ, in the case of accepting payment to a bank account, HOAs, housing cooperatives, SNTs and cooperatives, physical culture, sports and educational organizations, cultural centers are exempt from the use of cash register equipment. Read more about this in THIS ARTICLE.

Accounting for receipts and debits of funds to the current account

From an accounting perspective, the calculation option does not matter much. Here the main role is played by the information displayed in the statement. For example, when accruing funds from counterparties, debit 51, credit 62. When accruing from the Social Insurance Fund, debit 51, credit 69. Payments must be displayed correctly, otherwise serious problems will arise.

To debit funds from a current account, a payment order is first generated, which is submitted to the bank, often electronically, but paper forms can also be used. Then a document “Write-off from the current account” is created, in which the transaction type code must be indicated. You can find it in any accounting reference book.

A current account significantly facilitates the work of individual entrepreneurs, and for legal entities, according to Russian legislation, it is mandatory. It is important that cash receipts and debits are displayed and recorded correctly, taking into account accounting requirements. If these points are observed, no troubles are expected.

Subtleties of accounting

In the accounting sector, the calculation option does not have much significance. Here, the receipt of money into the current account should be reflected taking into account the information specified in the statement:

- In case of transfer of money - to the 51st account (debit) “Current Account”.

- When transferring from counterparties - 51 (debit), 62 (credit).

- Receipt of interest - 51/91-1 (D/C).

- Return from the budget - 51/68 (D/C).

- Compensation from the Federal Social Insurance Fund of the Russian Federation - 51/69 (D/C).

- The money was transferred as a replenishment of capital - 51/75-1 (D/K).

Receipt to the current account is a posting that requires special attention from the accounting department. Incorrect recording of such payments can cause a number of problems (including with the Federal Tax Service).

How to find out whether money has been credited or not

There are several ways to find out whether the money has been credited or not.

Methods

:

- Through your personal account. To obtain information, you need to log into the Internet bank or mobile application and request a statement.

- Call the support line. The information is announced to the sender or recipient. To pass identification, you will need to provide personal and passport information.

- At the bank office. Information is provided to the sender or recipient upon presentation of a passport or other identity document.

Important!

To be aware of all outgoing and incoming transactions on the account, banks offer to activate the SMS notification service. The cost of the service does not exceed 50 rubles per month.

Why might the transfer be delayed?

As mentioned earlier, during money transfers, emergency situations may arise that significantly prolong the transfer period.

This is important to consider if a financial transfer is planned in the future, the timing of which will depend on important circumstances.

Reasons why a money transfer may be delayed:

- Transfer deadline If the money transfer is not completed within 1-3 days, then there is no need to panic. If more than 4 days have passed since the transfer, then you should contact a bank branch;

- Availability of weekends or holidays These factors allow you to increase the translation period at the legislative level. Funds will be sent immediately after the end of weekends or holidays.

- Irregularities in the operation of equipment Despite the fact that all mechanisms are adjusted, equipment can malfunction. If there are any violations, employees strive to immediately begin to fix them, so that immediately after the work is established, the transfer of funds will be carried out.

- Incorrectly filled in details If errors are found when rechecking the details, you must immediately contact the bank branch to resolve this issue. It is worth remembering that there are deadlines for correcting errors, if missed, a refund may become impossible.

- The transfer amount is too large It is very easy to track the status of the transfer! All you need to do is log into your account on the bank’s website by entering your own data.

However, if sending a payment for a long time has the status “awaiting processing”, then you should contact the bank branch to confirm your transfer.

If the transfer limit is exceeded, then it is necessary to “split” the amount and transfer it to the opposite account in parts.