The Federal Tax Service agreed: an entrepreneur using the simplified tax system can take into account expenses when calculating contributions

If an individual entrepreneur uses the simplified tax system with the object “income minus expenses,” he takes into account not only income, but also expenses in the insurance premiums database. The Constitutional Court of the Russian Federation came to this conclusion at the beginning of the year. Now the tax authorities also agree with this position.

Let us remind you: back in April, the Ministry of Finance continued to insist that an entrepreneur in a special regime is obliged to count contributions only from income. However, most district courts favor policyholders. We believe that now, taking into account the position of the Federal Tax Service, there will be fewer disputes.

Document:

Letter of the Federal Tax Service of Russia dated 01.09.2020 N BS-4-11/14090 Read more >>>

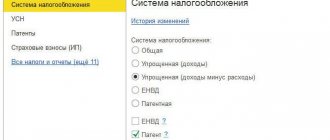

The Federal Tax Service considered the issue of determining the amount of income for the purpose of calculating insurance premiums in the amount of 1% of the amount of the payer’s income exceeding 300,000 rubles for the billing period, individual entrepreneurs using the simplified taxation system (hereinafter referred to as the simplified taxation system) with the object of taxation “income reduced by expenses,” reports.

In accordance with paragraph 9 of Article 430 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), for payers using the simplified tax system, income is taken into account in accordance with Article 346.15 of the Code.

The Constitutional Court of the Russian Federation in its ruling dated January 30, 2020 N 10-O “On the refusal to accept for consideration the complaint of citizen Oleg Sergeevich Zhitny about the violation of his constitutional rights by Article 346.15 and subparagraph 3 of paragraph 9 of Article 430 of the Tax Code of the Russian Federation” (hereinafter referred to as Determination N 10-O) indicated that taxpayers applying the simplified tax system with the object of taxation “income reduced by the amount of expenses”, in order to determine the tax base, take into account both income and expenses accepted in accordance with the criteria and in the manner established by Chapter 25 “ Corporate Income Tax" of the Code, taking into account a number of features (Articles 346.15 - 346.18 of the Code). That is, income and expenses are taken into account for this category of taxpayers in a manner similar to the procedure provided for individual entrepreneurs paying personal income tax (Article 221 of the Code).

Also, Definition N 10-O states that the current legislative regulation of the payment of insurance premiums involves determining the object of taxation of insurance premiums based on the income received by the payer of insurance premiums, using the rules for determining taxable income provided for the corresponding taxation system.

Explanations of the Federal Tax Service of Russia, taking into account the provisions of Definition No. 10-O regarding the calculation of insurance premiums for compulsory pension insurance by individual entrepreneurs using the simplified tax system with the object of taxation “income reduced by the amount of expenses”, were communicated in a letter dated 03/06/2020 No. BS-5-11 /493 chipboard@.

It should also be noted that in Determination 10-O the Constitutional Court of the Russian Federation made reference to Article 346.18 of the Code. According to paragraph 2 of this article, if the object of taxation of the simplified tax system is the income of an organization or individual entrepreneur reduced by the amount of expenses, the tax base is recognized as the monetary value of income reduced by the amount of expenses.

Based on paragraph 7 of Article 346.18 of the Code, a taxpayer who uses income reduced by the amount of expenses as an object of taxation has the right to reduce the tax base calculated at the end of the tax period by the amount of the loss received based on the results of previous tax periods in which the taxpayer applied the simplified tax system and used it as object of taxation is income reduced by the amount of expenses.

Loss means the excess of expenses determined in accordance with Article 346.16 of the Code over income determined in accordance with Article 346.15 of the Code.

Paragraphs 2 and 3 of paragraph 7 of Article 346.18 of the Code establish that the taxpayer has the right to carry forward a loss to future tax periods within 10 years following the tax period in which this loss was received. The taxpayer has the right to transfer to the current tax period the amount of loss received in the previous tax period.

Consequently, the loss on the simplified tax system, in its economic content, is the expenses of previous tax periods provided for in Article 346.16 of the Code, which the taxpayer has the right to transfer to future tax periods.

At the same time, Article 430 of the Code establishes that insurance premiums are determined based on the payer’s income for the billing period, which, in accordance with Article 423 of the Code, is a calendar year.

In this regard, according to the Federal Tax Service of Russia, payers of insurance premiums who apply the simplified tax system with the object of taxation “income reduced by the amount of expenses”, when determining the amount of income for the billing period for the purpose of calculating insurance premiums in the amount of 1%, have the right to take into account the expenses provided for in article 346.16 of the Code, incurred for the specified tax period within the framework of the application of the simplified tax system, and does not have the right to reduce the calculated amount of income by the amount of losses of previous years received based on the results of previous tax periods.

Valid

state councilor

Russian Federation

2 classes

S.L.BONDARCHUK

Federal Tax Service: Letter No. BS-4-11/ [email protected] dated 04/05/2017

Question: In what month are vacation pay accrued (December 2021 or January 2021) to an employee for the purpose of generating a 2-NDFL certificate and a 6-NDFL report, if he goes on vacation from January 9 to January 13, 2021, and vacation pay is paid on December 30 .2016?

Answer: Federal Tax Service in connection with the letter from LLC on the issue of reflecting income in the form of vacation pay in the calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL) (hereinafter referred to as the calculation according to Form 6-NDFL), and the certificate of income of individuals (form 2-NDFL) reports the following.

In accordance with paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), tax agents submit to the tax authority at the place of their registration a calculation in form 6-NDFL for the first quarter, half a year, nine months - no later than the last day of the month following for the relevant period, for the year - no later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected]