The state cannot exist without such a function as collecting taxes. One of the main taxes that significantly replenishes the budget of our country is the personal income tax (NDFL).

Personal income tax payers are:

- individuals who are tax residents of the Russian Federation;

- individuals who are not tax residents of the Russian Federation, but receive income from sources in the Russian Federation (clause 1 of Article 207 of the Tax Code of the Russian Federation).

For tax purposes, individuals mean citizens of the Russian Federation, foreign citizens and stateless persons (clause 2 of article 11 of the Tax Code of the Russian Federation).

PROCEDURE FOR REFUNDING PIT FROM THE BUDGET BY NON-RESIDENTS OF THE RF WORKING ON THE BASIS OF A PATENT

The obligation to pay personal income tax does not depend on the legal status of an individual and is conditioned only by the fact of receiving income in the territory of the Russian Federation or abroad. That is, factors such as the presence (absence) of citizenship, place of birth or place of residence, as well as the grounds for stay or residence on the territory of the Russian Federation are not determining indicators when calculating personal income tax.

Thus, a citizen of the Russian Federation may be a non-resident and, conversely, a resident of the Russian Federation may be a foreigner.

According to paragraph 3 of Art. 224 of the Tax Code of the Russian Federation, a tax rate of 30% is established for most income received by individuals who are not residents of the Russian Federation. In most cases, the income of residents of the Russian Federation is taxed at a personal income tax rate of 13%.

A tax rate of 30% is established for all income received by persons who are not tax residents of the Russian Federation, with the exception of income:

- from equity participation in the activities of Russian organizations, in respect of which the tax rate is 15%;

- from foreign citizens carrying out labor activities specified in Art. 227.1 of the Tax Code of the Russian Federation (for hire from individuals, in respect of whom the tax rate is set at 13%;

- from carrying out labor activities as a highly qualified specialist in accordance with Federal Law dated July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation”, in respect of which the tax rate is 13%;

- from the implementation of labor activities by participants in the State program to assist the voluntary resettlement of compatriots living abroad to the Russian Federation, approved by Decree of the President of the Russian Federation of June 22, 2006 N 637, as well as members of their families who jointly moved to a permanent place of residence in the Russian Federation, in respect of which the tax the rate is set at 13%;

- from the performance of labor duties by crew members of ships sailing under the State Flag of the Russian Federation, for which the tax rate is 13%;

- from carrying out labor activities by foreign citizens or stateless persons, recognized refugees or who have received temporary asylum on the territory of the Russian Federation in accordance with the Federal Law “On Refugees”, in respect of which the tax rate is set at 13% (the norm was put into effect by the Federal Law of 04.10. 2014 N 285-F from October 6, 2014 and applies to legal relations arising from January 1, 2014).

Please note that tax residents of the Russian Federation, when determining the size of the tax base for personal income tax, have the right to take advantage of various tax deductions, the types and procedure for the provision of which are regulated by Art. 218-221 Tax Code of the Russian Federation. Non-residents of the Russian Federation do not have rights to such deductions (clause 4 of Article 210 of the Tax Code of the Russian Federation).

PROCEDURE FOR REFUNDING NDFL TO A TAXPAYER – A FOREIGN INDIVIDUALS IN CONNECTION WITH THEIR ACQUISITION OF RESIDENT STATUS OF THE RUSSIAN FEDERATION

Determination of tax resident status

Tax residents are individuals who are actually in Russia for at least 183 calendar days over the next 12 consecutive months. The period of stay of an individual in Russia is not interrupted by periods of his departure outside the Russian Federation for short-term (less than six months) treatment or training (see also letter of the Ministry of Finance of Russia dated October 21, 2013 N 03-04-05/43779), and since 2014 — also for the performance of labor or other duties related to the performance of work (provision of services) in offshore hydrocarbon fields.

When determining the tax base for personal income tax, all income of the taxpayer received both in cash and in kind is taken into account (Clause 1 of Article 210 of the Tax Code of the Russian Federation).

Please note that responsibility for the correct determination of the tax status of an employee, as well as the calculation and payment of tax in accordance with his tax status, lies with the organization. Therefore, despite the fact that Article 65 of the Labor Code of the Russian Federation contains an exhaustive list of documents that can be requested from an employee when hiring him, in order to accurately determine his tax status, the tax agent has the right to request the relevant documents or copies thereof from an individual. If an individual does not submit the requested documents, the tax agent has the right to apply to the income paid the tax rate established for non-residents - 30% (letter of the Ministry of Finance of Russia dated August 12, 2013 N 03-04-06/32676).

The list of documents that confirm the tax status of an individual is not established by law. In practice, they can be certificates from the place of work, issued on the basis of information from the work time sheet, copies of a passport with marks from border control authorities about crossing the border, receipts for hotel accommodation and other documents on the basis of which it is possible to establish the actual presence of an individual in RF (see, for example, Resolution of the Federal Arbitration Court of the North-Western District of June 30, 2014 N F07-8864/12 in case N A13-18291/2011).

Please note that the period of 183 calendar days is not interrupted by the time of departure from the Russian Federation for short-term training or treatment, and since 2014 - also for the performance of labor or other duties related to the performance of work (provision of services) in offshore hydrocarbon fields. There is no list of restrictions by type of educational institutions, academic disciplines, medical institutions, diseases, as well as by the list of foreign countries, the main criterion is the short-term absence - a period of less than 6 months (Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated October 8, 2012 . N 03-04-05/6-1155).

PROCEDURE FOR CALCULATING PIT FROM THE WAGES OF FOREIGN WORKERS

How to apply for a deduction

When applying for a deduction, special attention should be paid to supporting documents. Depending on the type of compensation, this may be:

- contract of sale and purchase of an apartment, garage, car, etc.;

- mortgage agreement;

- agreement with a medical institution, educational institution;

- certificates confirming disability, veteran status, etc.;

- child's birth certificate.

In case of registration of compensation for treatment, training or when submitting documents for property deduction, you should also prepare payment documents (payment receipts, bank statements), as well as acceptance certificates.

When the rate changes...

To determine the personal income tax rate to be applied, the tax status of the employee is determined by the tax agent for each date of payment of income based on the actual time spent in the Russian Federation.

When determining the tax status of an employee, it is necessary to take into account the 12-month period determined on the date he received income, and this does not have to be the calendar year from January 1 to December 31, it can be any period equal to 12 months, for example from July 12, 2014 to July 12, 2015.

The tax status of an individual may change repeatedly depending on the time of his stay in the Russian Federation and abroad. If an individual becomes a resident of the Russian Federation, then from the moment he acquires resident status, his income must be taxed at a rate of 13% and vice versa, if an individual loses his resident status, then from the moment he loses his status, the income he receives is taxed at a rate of 30% ( Article 224 of the Tax Code of the Russian Federation).

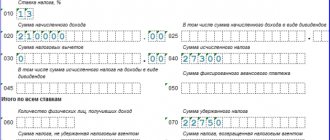

In the event that the tax status has changed from “non-resident” to “resident”, tax legislation provides for the return of personal income tax to the taxpayer in connection with recalculation based on the results of the tax period (clause 1.1 of Article 231 of the Tax Code of the Russian Federation). The refund of the overpayment amount is made by the tax authority with which the taxpayer was registered at the place of residence (place of stay), upon filing a tax return at the end of the tax period, as well as documents (see above) confirming the status of a tax resident of the Russian Federation in this tax period . The procedure for returning the overpayment amount is established by Article 78 of the Tax Code of the Russian Federation.

Previously, in 2011, on the basis of explanatory letters from the Ministry of Finance of Russia, tax recalculation at a rate of 13% was carried out only by the tax authority and only when filing a tax return 3-NDFL complete with documents confirming the status of a resident of the Russian Federation, and the tax authority also returned the overpaid tax. For example, if personal income tax was withheld from a non-resident employee from the beginning of the year at a rate of 30%, and in June the individual received resident status, then the tax agent must then withhold tax at a rate of 13%, but there was no need to recalculate the tax for the period from January to June. This was done by the tax authority on the basis of an individual’s declaration (letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated May 16, 2011 N 03-04-06/6-108).

Later, the Russian Ministry of Finance changed its point of view and, along with mentioning the obligation of the tax authorities to return personal income tax, began to say that if during the tax period an employee acquired the status of a tax resident and this status can no longer change (that is, the individual is in RF more than 183 days in the current tax period), all amounts of remuneration received by an employee from the employer for the performance of work duties from the beginning of the calendar year are subject to taxation at a rate of 13%.

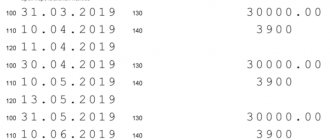

In this case, tax agents should be guided by the provisions of paragraph 3 of Art. 226 of the Tax Code of the Russian Federation, according to which personal income tax is calculated on an accrual basis from the beginning of the year based on the results of each month. Thus, starting from the month in which the number of days of an employee’s stay in the Russian Federation in the current tax period exceeded 183 days, the amounts of personal income tax withheld by the tax agent from his income before he received tax resident status at a rate of 30% are subject to offset by the tax agent when determining the tax base on an accrual basis for all amounts of employee income. In fact, this means that personal income tax is recalculated for the entire period from the beginning of the year at a rate of 13% by the tax agent (Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated April 5, 2012 N 03-04-05/6-443 “On the return of amounts withheld personal income tax in connection with a change in the tax status of an individual").

If, after the offset, it turns out that the amounts of personal income tax withheld from the employee’s income at a rate of 30% were not fully offset at the end of the tax period, and there remains an amount of personal income tax that is subject to refund, only the tax authority can return the amount of overpaid personal income tax for the ended tax period to the taxpayer . To do this, the employee must independently submit a declaration in form 3-NDFL to the territorial body of the Federal Tax Service. The procedure for returning the overpayment amount is established by Article 78 of the Tax Code of the Russian Federation.

At the request of the taxpayer, the amount of overpaid tax (penalties, fines) can be returned to him.

Features of receiving a deduction

When applying for a deduction, a number of important features should be taken into account. We list the main ones:

- According to the Tax Code, you have the right to apply for several deductions at the same time. For example, if you receive a deduction for a child and at the same time sell a car during the year, then you can take advantage of the property and standard deduction at the same time.

- When selling several vehicles during the year, you can apply for a deduction only for 1 vehicle.

- If the cost of the purchased apartment is less than 2,000,000 rubles, then the remainder of the deduction can be used when purchasing housing in the future.

- You may not pay personal income tax at all if you sell an apartment that you have owned for more than 3 years (for housing purchased after 01/01/16 - more than 5 years).

- If the right to a deduction is not declared immediately upon receipt of income (incurring expenses), then the funds can be returned within 3 years.

Example:

Storekeeper JSC StalProm Kukushkin receives a deduction for a child (1,400 rubles). In April 2021, Kukushkin was undergoing treatment, and therefore incurred expenses of 17,302 rubles.

Kukushkin receives a monthly deduction for a child:

(base for calculating personal income tax 19,704 rubles - deduction 1,400 rubles) * 13% = 2,379 rubles.

At the end of 2021, Kukushkin paid personal income tax of 28,548 rubles.

To obtain partial compensation for the cost of treatment, Kukushkin submitted an annual declaration to the Federal Tax Service on 02/02/18. The document indicates the amount to be returned:

RUB 17,302 * 13% = 2.249 rub.

Since this amount does not exceed the amount of personal income tax paid by Kukushkin at the end of the year (28,548 rubles), the compensation was transferred to Kukushkin in full (2,249 rubles).

Algorithm for returning amounts of overpaid personal income tax:

1) filing an application - the taxpayer submits an application to the tax authority at the place of his registration in writing or in electronic form with an enhanced qualified electronic signature via telecommunication channels (clause 4 of Article 78 of the Tax Code of the Russian Federation).

The application form for the refund of the amount of overpaid (collected) tax (fee, penalty, fine) was approved by order of the Federal Tax Service dated March 3, 2015 N ММВ-7-8/ [email protected] (Appendix No. 8).

2) verification of compliance with conditions - the tax authority verifies compliance with mandatory conditions:

- registration of the taxpayer with this tax authority;

- absence of debt for other taxes of the corresponding type (clause 6 of Article 78 of the Tax Code of the Russian Federation) and others.

3) decision-making - based on the taxpayer’s application, the tax authority makes a decision:

- about offset or return of the overpaid amount;

- about refusal to carry out offset (refund);

The forms of the decision on offset, decision on refund, as well as messages about the decision on offset (refund) taken by the tax authority were approved by the same order of the Federal Tax Service dated March 3, 2015 N ММВ-7-8/ [email protected]

4) communication of the decision - within 5 working days from the date of the relevant decision, the taxpayer is sent a message (Appendix No. 3 to Order No. ММВ-7-8 / [email protected] ;), as well as a copy of the tax authority’s decision on the refund.

The refund of the amount of overpaid tax is carried out by the territorial body of the Federal Treasury (TOFK) on instructions issued by the tax authority on the basis of the decision made.

Reverse situation: from 13% to 30%

In practice, the situation may be the opposite, when the employee has lost his tax resident status. In this case, the tax agent is obliged to recalculate the tax at a rate of 30% and withhold it from the employee’s income. Amounts of tax not fully withheld are collected by the tax agent from an individual until these individuals fully repay the tax debt in the manner prescribed by Article 45 of the Tax Code of the Russian Federation. If the employee has already quit, then the tax agent must inform the tax authority in writing about the impossibility of withholding personal income tax and the amount of the taxpayer’s debt (clause 5 of Article 226 of the Tax Code of the Russian Federation). The obligation to pay the difference between the amount of tax calculated at a rate of 30% and actually withheld at a rate of 13% in this case must be fulfilled by the taxpayer himself.

For reference: when taxing the income (including wages) of a foreign worker, the provisions of international agreements between Russia and the country of which he is a citizen should be taken into account. They may provide for a special procedure for taxation of personal income, as well as social and pension insurance.

To eliminate double taxation of personal income tax, a taxpayer may need a certificate confirming the status of a tax resident of the Russian Federation. At the same time, in order for a tax agent to apply a tax rate of 13% in relation to income from employment, the taxpayer does not need to receive special confirmation from the Russian tax authority (Letter of the Federal Tax Service dated October 22, 2014 No. OA-3-17 / [email protected] " On the procedure for confirming the status of a foreign citizen as a tax resident of the Russian Federation").