The 6-NDFL audit is carried out by the tax authority as part of a desk audit of reporting. In order to minimize the risk of identifying errors, the tax agent must carry out self-audit. For this purpose, a number of control ratios are provided, some of which are used to assess the correctness of filling out a particular report, the rest of the formulas are intended for inter-document comparison of indicators. If discrepancies are detected, it may be necessary to provide explanations (if the violation is caused by objective reasons) or submit corrective reports. We will look at how to check the correctness of 6-NDFL in this article.

What programs are used to check personal income tax reporting?

You can check Form 6-NDFL as follows:

- Built-in 1C check - checks the main control ratios in 6-NDFL (except for inter-documentary ones).

- Inter-document relationships – manual control only.

To check 2-NDFL the following are provided:

- Built-in 1C check - identifies errors in personal data in 2-NDFL.

- Tester program – carries out format control.

- Taxpayer legal entity – checks the “mathematics” in 2-NDFL (free program).

Applying benchmark ratios within a report

Accounting programs primarily reconcile data within a form without using additional sources.

Table 1. Reconciliation

| Right | Wrong |

| 020 = > 030 | 020 |

| 040 = ((020 - 030) x 010): 100 | 040 ≠ ((020 - 030) x 010): 100 |

| 020 - 025 ≥ 050 section 1.1 | 020 — 025 |

According to previous test ratios, the reconciliation of personal income tax profits took place taking into account the data in line 030. This method was not effective. Due to the fact that this column contains information about child benefits that should not be displayed in column 020, discrepancies inevitably arise during comparison. To display the data more correctly, inspectors check the tax base for contributions based on personal income tax profits minus dividends: it is necessary that the profit either equals or exceeds the tax base.

Table 2. Applications of control ratios

| Line | Reconciliation subject | Note |

| 010 | The total data must be greater than or equal to one of the components of the consumable part | The total amount of benefits paid should not be less than its part |

| 030 | If the number in column 1 of line 30 is greater than zero, check for the presence of indicators in columns 2 and 3 | If there were insured events, then the number in column 1 must be greater than zero |

| 060 | The relationship between total data and sums of parts | Line 060 ≥ sum of lines 061 and 062 |

If inconsistencies are identified in the provided form 6-NDFL, representatives of the competent authorities will require clarification

When checking line 040, it is necessary to take into account the possible error caused by rounding of data. Example:

- Initial data: number of employees - 30 people;

- total income for 8 months - 352,455 rubles;

- the amount of tax deductions is 32,000 rubles;

- withheld personal income tax - 37,070 rubles.

Checking “mathematics” in 2-NDFL

You can check the “mathematics” (compliance of the calculated tax with the tax base, etc.) in 2-NDFL using the Legal Entity Taxpayer program.

You can download the Legal Entity Taxpayer program on the nalog.ru website using the link →

When you start working with the program, you will need to fill out information about the organization, then download the file with 2-NDFL certificates from the 1C program and upload it to Taxpayer Legal Entity.

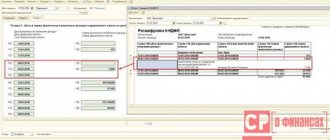

After launching the check, its results in the Taxpayer Legal Entity can be displayed in the following form:

The most valuable thing about the program is that it tests “mathematics”. For example, it compares:

- the amount of personal income tax calculated in the 2-NDFL with the calculated personal income tax calculated;

- the amount of personal income tax transferred and withheld (personal income tax transferred should not exceed the withheld tax);

- the amount of personal income tax withheld with the estimated personal income tax withheld.

Features of the 6-NDFL report

This type of accounting documentation is relatively new, introduced in 2021.

6-NDFL is a mandatory reporting document. The information contained in it concerns employee profits and accrued income tax.

The form must be submitted to the Federal Tax Service quarterly. One of the features is the entry of some data on an accrual basis, which is due to the specifics of wage payment. It is transferred in the month following the month of accrual. Due to the fact that profits are paid in the next month, there are time gaps between the day the tax is withheld and the day the wages are paid. If the first days of the month are non-working days, the gaps that arise between these dates are very significant. The next difference is the presence of information contained in other reporting documents, which allows you to compare and reconcile data.

Control ratios 6-NDFL and 2-NDFL

Inter-documentary relationships between 6-NDFL and 2-NDFL will have to be checked manually.

The general verification scheme for data lines 6-NDFL and 2-NDFL is as follows:

At the same time, line 070 (the amount of personal income tax withheld) and line 090 (the amount of personal income tax returned) of the 6-personal income tax are not involved in the verification due to special rules for filling them out.

In order to obtain summary data on 2-NDFL , you can print the Register (additional since 2014) (Print – Register (additional since 2014):

It will be presented in the following form:

In the report you can see the amount of income and calculated personal income tax as a whole for all individuals, which must be compared with 6-personal income tax .

The most common mistakes

It should be noted right away that due to the large number of violations, the tax service published a letter listing common errors. Tax officials believe that this information will help business accountants reduce the number of inaccuracies when filling out documents and avoid penalties.

Let's look at the most common situations.

Control ratios

Violation of control ratio parameters is one of the most common accounting errors. The following inaccuracies are allowed here:

- Line 020 of the first section: the amount of accrued profit is less than the total income indicated in form 2-NDFL;

- Line 040 of the first section: the specified tax amount is less than what was indicated in form 2-NDFL.

It’s easy to avoid such mistakes if you use electronic services when filling out reporting documentation, for example, Kontur.Extern. Here, control ratios are indicated automatically, which eliminates the influence of the human factor. If the tax agent enters incorrect information, the system displays an error message.

Failure to comply with the explanations of the tax service

Accountants often confuse the procedure for entering tax payment information.

These errors are typical for situations when salaries for January are paid in February, and so on. Most enterprises operate according to this scheme, however, some accountants stubbornly include in the document the amount of tax that should be withheld only in the next reporting period. At the same time, the explanatory letter from the Federal Tax Service clearly states that if wages related to one quarter are paid in the next, a zero value is entered in line 070. Most often, such inaccuracies occur when an employee’s June salary is reflected in the reporting for the first half of the year. In such a situation, information should be displayed in the reporting documentation submitted at the end of 9 months.

To be fair, it should be clarified that such an error is not critical, and therefore does not entail penalties. Moreover, you don’t even need to submit a clarifying report here. The fact is that in case of such a violation, personal income tax does not change. However, when submitting 9-month reports, you need to take into account that information for June does not need to be included here, otherwise the tax amount will be doubled, and this will entail arrears.

Read also: Declaration 3-NDFL in 2021

Financial assistance is not shown in full

Financial assistance includes gifts and other payments due to employees.

For these types of monetary rewards, certain limits are established, within which financial assistance is excluded from the tax base. It follows that financial assistance in full is indicated only in those situations where a separate income or deduction code is provided for payment. If we talk about reporting, then when a code is assigned, financial assistance is indicated in line 020 in the amount of the actual amount. In situations where a code is not assigned, the payment is indicated in the reporting documentation solely within the taxable base. Let us note that the law does not provide for punitive sanctions for such a violation: even if the amount of financial assistance exceeds the stipulated limit, this does not affect the general procedure for calculating tax.

At the same time, you should always remember that financial assistance is displayed in forms 6-NDFL and 2-NDFL, so you need to ensure that there are no discrepancies between the information specified in the documents.

The second section is broken down by tax rates

A fairly common mistake caused by inattention to the recommendations of the Federal Tax Service on the preparation of reporting documentation.

According to the explanations of the tax service, it is not worth breaking down the income of the second section depending on the applied tax tariff. Information is entered into the report in chronological order, and the tax rate at which the tax is applied does not play a significant role. As in previous cases, such a discrepancy is not a significant violation, therefore penalties are not applied here. In fact, if an accountant breaks down both sections of the reporting document by rates, the information is not distorted. Therefore, we are talking about a violation of the rules for drawing up accountable documentation.

An employee submits an order for a tax deduction in the middle of the year

In such situations, the income tax of an individual is subject to recalculation from the beginning of the calendar year.

Despite this feature, it is not necessary to submit a recalculation with clarification according to the completed Form 6-NDFL, although this is not considered an error. The next time you fill out the document, you need to carefully fill out lines 030 and 090. The first column indicates the amount of the deduction, the second - the amount of the refunded tax. Let's look at what this situation would look like using a specific example.

Let's assume that an employee has the right to a property deduction in the amount of 1.5 million rubles. The notification was submitted to the accounting department in the month of June. Until the notification was submitted, the employee received a salary of 200,000 rubles. Tax was withheld from this amount in the amount of 13% or 26,000 rubles. After receiving the notification, the accountant recalculated and returned the amounts previously withheld. In addition, no tax was withheld from the next salary of 40,000 rubles.

In form 6-NDFL, the above manipulations look like this:

- Line 020 indicates the amount of 240,000 rubles;

- Line 070 indicates the amount of tax refunded in the amount of 26,000 rubles.

Adding vacation pay

Let's assume that the accounting department made a mistake when calculating vacation pay for an employee of the company, paying less than the amount due.

Later, the error was discovered, and in the second quarter a recalculation was carried out and the employee received the missing amount. Let's consider how 6-NDFL will be filled out in such a situation. Read also: What is an agency agreement

So, let’s say that a certain Semyonov received vacation payments in the amount of 25,000 rubles at the end of March, and a tax of 3,250 rubles was withheld from this amount. In April, it turned out that the money was not paid to Semenov in full, and the accounting department made an additional payment of 2,000 rubles, which implies a tax deduction of 260 rubles. In the reporting documentation, such a financial transaction is displayed as follows. The first section indicates the entire amount of vacation pay, taking into account the additional payment made. In the second section, the surcharge is displayed in a separate block with lines 100-140 filled in. O in such a situation does not give up.

Common errors

The following types of violations can be distinguished:

- Incorrect completion of calculations, for example, the first section does not display a cumulative total;

- When changing the legal address, reporting is submitted to the tax authority at the previous location of the organization;

- The report is submitted in violation of the established deadlines;

- The OKTMO and KPP fields are filled in incorrectly.

In addition, some large companies submit 6-NDFL in paper form, although if the number of employees exceeds 25 people, only digital format is accepted.

Incorrect completion of the first section

Information on all income items is displayed here, including accrued and withheld taxes. The section is filled in with a cumulative total starting from the beginning of the year. Typical inaccuracies made when filling out look like this:

- Line 020 - income that is not subject to taxation is included;

- Line 070 - displays the tax that is yet to be withheld in the next reporting period;

- Line 080 - includes tax that is not yet subject to transfer;

- Line 090 - displays the difference between accrued and withheld taxes.

Incorrect completion of the second section

The specifics of financial transactions are displayed here.

In particular, the dates of receipt of payments by employees and withholding of due taxes are indicated. It should be noted that this section contains information for 3 months. For example, if reports are submitted for 2021, then the second section covers the period October-December. The most common mistake when preparing the 2nd section is entering data on an accrual basis. In addition, the dates of receipt of income, calculation and withholding of taxes are often confused.

Control ratios 6-NDFL and RSV

6-NDFL and DAM reports :

It may not be fulfilled if the organization pays income not subject to personal income tax.

For example, in line 020 6-NDFL report, will not be reflected, but in line 030 of Appendix 1 of the report on insurance premiums:

- child care allowance up to 1.5 years;

- maternity benefits;

- sick leave accrued in December 2021, but paid in January 2021.

To find the differences between 6-NDFL and RSV, see our life hack - How to find the difference between the amounts in 6-NDFL and RSV

Those. These control ratios may indeed not be met and this is normal. However, in this case, the Federal Tax Service will have to provide explanations about the reasons for their non-compliance.

See - An example of a response to the requirements of the Federal Tax Service to provide explanations for discrepancies in the 6-NDFL and Calculation of insurance premiums reports

Correction of errors and submission of updated 6-NDFL

Note that it’s not all that bad if, after submitting the reports, errors were discovered in the calculations. If inconsistencies are found by the accountant before the tax authorities sent a letter indicating the inconsistencies in the report, the declarant has the right to submit an updated calculation. In this case, the desk check of the first calculation will be automatically stopped and the KNM of the second document will be launched.

If the Federal Tax Service has already issued an order to clarify the calculations, you can follow the path of arguing your figures by providing a package of primary documents and giving explanations. It is the declarant’s right to defend his point of view (see paragraph 4 of Article 88 of the Code).

If the errors indicated in the official paper of the tax authorities are obvious, you should prepare a corrective declaration and submit it within 5 days to the Federal Tax Service.

But even after the issuance of an act with sanctions, further steps are possible to correct the situation (they can be specified in the table with the stages of passing a desk audit above). But it’s better, of course, not to let it come to that.

The main thing to remember here is that the declarant has only 5 days to take all actions to correct errors in the declaration or submit documents confirming the calculation; further penalties will follow.

Control ratios for checking employee salaries

Letters of the Federal Tax Service of Russia dated October 17, 2019 N BS-4-11/ [email protected] and dated January 17, 2020 N BS-4-11/ [email protected] introduced new additional control ratios for 6-NDFL and DAM .

Now the salary amount will be checked:

- The average salary of each employee is >= minimum wage.

- Average salary for the entire organization >= Average industry salary for the region for the last calendar year.

The first control relationship may not be satisfied when, for example, an employee:

- works part-time;

- the period was not fully worked out due to the employee’s absence due to illness, leave at his own expense, etc.

Therefore, you need to be prepared for the fact that the tax office will ask for clarification about non-compliance with these control ratios.

Penalties

If an error is made that distorts reporting documentation, contains incorrect tax amounts, or violates the rights of an employee, punitive measures are applied to the organization.

According to current legislation, punishment is applied in the form of a fine. Today, the penalty amount is 500 rubles for each unreliable document. Please note that the number of errors made when filling out reporting documentation is not grounds for increasing the amount of the fine. However, some mistakes are not grounds for applying punitive sanctions at all. This may include violations that do not affect the amount of tax.

Read also: Reimbursement of training costs

Do not forget that the Federal Tax Service has the right to fine tax agents for late filing of 6-NDFL. This provides for a fixed fine of 1,000 rubles for full and partial months. Let us give an example of the use of punitive measures.

Let’s say he submits reports for the first half of the year. Documents must be received by the tax authority no later than August 1. However, the accountant submits the report on September 12. Here the fact of violation is obvious, and the deadline for filing 6-NDFL is overdue by 1 month and 10 days. Therefore, the company will be fined 2,000 rubles: for a full and partial month.

In addition, the tax office has the right to block the organization’s accounts and fine the manager in the amount of 300-500 rubles for failure to comply with tax reporting deadlines.

How to avoid a fine

There is only one way to avoid penalties: to detect mistakes made before the tax inspector. If the accounting department submits a clarifying report before the Federal Tax Service employees identify inaccuracies, no punishment will be applied.

Penalty for violation in the report on form 6-NDFL

Important! If during the audit the tax authorities do not find any errors in the calculation on form 6-NDFL, then the audit is completed. But if the tax inspector has any questions, he draws up a report based on the results of the audit.

All amounts entered into the report, as well as the dates of receipts, are verified during on-site inspections. However, this does not mean that if the form is filled out incorrectly, the company or individual entrepreneur will not face liability and there is no need to ensure that it is filled out correctly. First of all, you should pay attention to the fact that the company has an internal control system that would allow you to automatically check the correctness of the information entered, and correct them in case of errors. If this is not taken care of in advance, then errors identified by the tax authority will lead to the company being charged a fine, penalties, and additional taxes. If tax authorities find violations in the calculation of 6-NDFL, then their actions will be as follows:

- First of all, a request is sent to an individual, which contains a requirement to provide an explanatory document. This document should contain an explanation of the inconsistencies identified in the report.

- If this document cannot satisfy the requirements of the inspectors, then a violation report will be drawn up.

For all those who must submit 6-NDFL for tax purposes, the ability to check control ratios allows them to reduce the interest of tax authorities in their company. Therefore, before sending the calculation to the tax authority, you should independently check all the control ratios in order to once again make sure that the report is drawn up correctly and the likelihood of fines is minimal.

Conducting an on-site personal income tax audit

An on-site tax audit is carried out based on the requirements of the Tax Code of the Russian Federation.

In one inspection, your company can be checked as follows:

- Taxpayer;

- Payer of fees;

- Tax agent.

In this case, the audit may cover the last three years of your company’s activity.

But it is worth noting that the current period may also be subject to verification, although, judging by practice, this circumstance is rarely used.

This is easily explained: it is easier to check the current period without going to your office, that is, through a desk check.

Another fact due to which the inspector may ignore the current period is the specifics of the taxation procedure itself.

For some tax payments, the results are determined for the current calendar year. It turns out that there is simply nothing to check before the next calendar year begins.

Federal Tax Service inspectors check:

- Timing and completeness of payment of taxes to the budget;

- How correctly the tax rate is applied;

- Correct registration of tax deductions;

- Is the tax base determined correctly?

What documentation may be requested:

- Personnel documentation;

- Statistical forms;

- Tax cards for personal income tax;

- Certificates 2-NDFL;

- Primary financial documentation.

This list is open, since if such a need arises, inspectors may request additional documents.

Order of conduct

The purpose of a desk tax audit of 6-NDFL, like any other, is to find errors or confirm their absence. The procedure for such an audit is no different from desk audits for other types of tax deductions.

The tax inspector acts approximately in the following sequence:

| № | Contents of the verification phase |

| 1 | After receiving 6-NDFL from the tax agent, he checks general information about the organization: is the address, TIN, responsible person and other parameters correctly registered? |

| 2 | 6-NDFL is filled in with an accrual total. Therefore, when studying the information in the first and second sections, the inspector makes sure that the more recent data is not less. If a discrepancy is detected, it means that the calculation was filled out incorrectly. |

| 3 | Verifies control ratios. With their help, the inspector will determine whether the compiled calculation corresponds to the information available at the Federal Tax Service. |

| 4 | Recalculates some parameters in order to identify possible arithmetic errors made by the accountant when filling out form 6-NDFL |

| 5 | After submitting the annual calculation, the tax inspector again verifies the control ratios |

If the inspector has questions

When during the desk tax audit 6-NDFL any errors, inconsistencies or contradictions are identified, the tax agent who filled out the calculation must be notified about them. A request is sent to the responsible person to provide explanations on questions that have arisen or to correct the data entered in the document. Only 5 working days are given for this from the moment the tax agent personally received this request.

If during a desk audit of 6-NDFL it is determined that the agent has not paid the tax in the required amount, the inspector will draw up and send to the organization or individual entrepreneur a document demanding payment of personal income tax. The recipient must fulfill his obligations no later than 8 working days after receiving the paper or within the period specified in the document itself (the latter is possible if, in accordance with Article 69 of the Tax Code of the Russian Federation, more than 8 working days are given to repay the debt).

What else does the tax office check?

In addition to the logical check, the tax authority uses control ratios to check the report. The start of the audit corresponds to the date on which the reports were submitted to the tax authority. First of all, the date on which the report was submitted is checked. If it does not meet the established deadlines, then a violation report will be drawn up. Next, as mentioned above, the control ratios are checked. After this, information about payments to the budget is checked, including the dates on which personal income tax payments were made (

When is it carried out?

Tax inspectors initiate a desk audit only after the tax agent submits the 6-NFDL calculation. Such checks are included in the list of job responsibilities of tax inspectors. To start activities, the Federal Tax Service employee does not need to obtain any decision from his supervisor.

The duration of the necessary measures cannot exceed three months. After this period of desk audit of 6-NDFL, all work must have already been carried out and completed by the responsible tax inspectors.

Checking the 1st section

The first section must indicate the final characteristics for all previous tax periods for all individuals to whom the company paid funds.

If the company paid profits for the past reporting period that were taxed at different rates, you will need to provide the completed first part of the report at each rate on a separate sheet. If personal income tax was calculated at the rates: 13, 15, 30, 35%, then in lines 10 to 50 the head or accountant of the company enters information in any section number 1, and lines from 60 to 90 - only on page 1 this first section. If all payments were made based on the tax rate, then the company fills out the first section once, filling out all lines from 10 to 90.

How tax authorities analyze calculations of ERSV and 6-NDFL

All calculations that you submitted to the inspectorate fall into the unified AIS “Tax-3” software package. The program consists of subsystems. A separate block in the program is reserved for desk checks (see screenshots below).

What does the 6-NDFL check block look like?

The tax program accepts the report and checks it against control ratios. If there are discrepancies with the formulas, inspectors will require clarification. After receiving a message about contradictions, you have five working days to submit clarifications or clarifications. If you remain silent, you will be fined.

The fine is 5 thousand rubles. (Clause 3, Article 88 and Clause 1, Article 129.1 of the Tax Code). In addition, if inspectors find violations, they will draw up a report and assess additional personal income tax and contributions. Next, find out what explanations inspectors most often require and how to respond to requests so as not to be subject to additional charges.

Checking section 2

Registration of section 2 is more difficult than the first. It is quite important not to make mistakes with dates and amounts.

Section 2 provides uniform blocks for placing data by dates and amounts with lines from 100 to 140.

To truly fill out section 2, you will need to show the dates correctly. In order to provide absolutely accurate information, you need to prepare documentation from which you can note:

- Date of actual receipt of income. This date is not the number of funds issued to an individual. There is an amount of income accrual (for pay, for example, this is the end day of the month).

- The date of personal income tax withholding from all income. This is the amount of tax withheld from income, and not the amount of the payment order for tax remittance.

- The end day of the period when the organization was supposed to transfer the personal income tax withheld from this income to the budget.

If these 3 quantities are similar, the accountant groups the information and displays it in one block of lines from 100 to 140. If the dates are different, the blocks are filled in individually for each date, and the number of blocks corresponds to the number of types of dates.

Consequences of a desk audit for legal entities

If your calculation of 6-NDFL did not raise any questions from the tax authorities, then no further events will occur after the audit. However, if any discrepancies are identified, you will be notified and asked questions. You will have to answer them, explaining the correctness of your actions when filling out the calculation, or submit an updated report that eliminates the mistakes made.

Personal income tax agents who violate the rules for entering data into the report face the following penalties:

- If a tax agent submits a calculation with incorrect data to the inspectorate, he will be subject to a fine of 500 rubles. according to Art. 126.1 Tax Code of the Russian Federation.

- If, as a result of checking the calculation, an underpayment of tax is revealed, a fine equal to 20% of the amount owed may be imposed by decision of the tax authority (Article 123 of the Tax Code of the Russian Federation). Tax officials will also send a demand for payment of arrears and the corresponding amount of penalties. The amount of penalties depends on the amount of arrears and the length of delay.

Read about common difficulties when preparing calculations in the publication “How to check 6-NDFL for errors?”

Did not fulfill the conditions for a reduced tariff

The second most common request on the payment calculation desk is questions about reduced tariffs. From April 1, new tariffs apply to affected industries and SMEs - 0 percent and 15 percent for payments above the minimum wage. Each preferential rate has its own control ratios (letters from the Federal Tax Service dated May 29, 2020 No. BS-4-11/ [email protected] , dated June 23, 2020 No. BS-4-11/ [email protected] and dated June 10, 2020 No. BS- 4-11/9607).

The most significant error is that the payer is not a victim or is not listed in the SME register, but has declared benefits to the ERSV. What other ratios will be checked, see the table below. If the formulas do not agree, tax officials will ask you to explain the discrepancies.

How tax authorities will check the 0 and 15 percent tariffs in the ERSV

| Rate | Control ratios |

| 0 percent - for affected companies and individual entrepreneurs | Tariff code (field 001) adj. 1 and 2 = 21 → the payer is the victim, and the company is still in the SME register Category code AP (field 130) etc. 3.2.1 = HF |

| 15 percent of payments above the minimum wage - for SMEs | Tariff code (field 001) adj. 1 and 2 = 20 → the payer is in the SME register Tariff code (field 001) adj. 1 = 20 → there is application 1 with tariff code (field 001) = 01 AP category code (field 130) etc. 3.2.1 = MS → there is other 3.2.1 with AP category code (field 130) = NR AP category code (field 130) etc. 3.2.1 = MS → Payments (field 150) etc. 3.2.1 by AP category code (field 130) HP = 12,130 |

How to answer. Check whether you are entitled to a reduced tariff and whether the ratios in your calculations are met. If not, submit a clarification and pay additional fees.

If you have the right to a reduced tariff, explain this to the tax authorities. For example, you have the right to claim a benefit, but not be in the register if you are late with your report and then submitted it, but the tax authorities have not yet updated the database. Those who did not submit information on the average number of employees and a declaration under the simplified tax system for 2021 by 07/01/2019 were not included in the SME register. However, the companies were promised to be returned to the register if they submitted their reports no later than June 30, 2020 (Clause 5, Article 23 of Federal Law No. 166-FZ of June 8, 2020). If this is your case, but your company is not in the register, draw up an explanation for the tax authorities.

See below for an example explanation. The inspectors assured us that they would accept this answer, but in August they would check whether you were added to the SME register. If not, they will draw up a report and add additional fees.

Results

A desk audit of the 6-NDFL calculation will go unnoticed for you if you followed the rules for calculating and paying tax, as well as filling out the form.

If an accountant finds an error in his calculation on his own, he can send an updated form to the inspectorate. He will have to do the same if the tax authority reveals an error, but in this case penalties may be applied. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Subjects and objects of desk inspection

Desk audits are carried out by territorial tax authorities, and the subjects of the audit are:

- institutions, organizations;

- commercial, manufacturing companies, regardless of the form of economic organization;

- individual entrepreneurs;

- cooperatives, unitary enterprises;

- joint ventures.

The object of the desk audit is the activities of a company or individual entrepreneur (its inactivity) in terms of proper accounting of the income of employees and other individuals, as well as the correctness of calculation, withholding and transfer of personal income tax to the budget.