Document role

The waybill solves several problems at once. This is due to the fact that it records all the important information regarding the operation of the car, including:

- its technical condition;

- mileage traveled;

- driver's working hours;

- completed moves during the shift;

- consumption of fuels and lubricants, etc.

Based on all this data, control is carried out over the use of the vehicle and the driver’s labor efficiency, and in the future, the accounting department of the enterprise calculates wages for the driver, mechanic and dispatcher.

The waybill is filled out for various vehicles: cars, trucks, and special equipment.

Purpose of waybill form 4-M

The voucher is intended mainly for recording fuel consumption and subsequent calculation of the driver’s salary. There is no special state-issued form for the document; each organization can develop its own and use it by approving the appropriate order to this effect. However, the list of information that should be there is strictly regulated by law and includes:

- fuel consumption;

- mileage traveled;

- payment by the customer for transportation services;

- payroll.

Who fills out the form

Maintaining waybills is usually the responsibility of the head of a structural unit, accountant, dispatcher or other employee (sometimes these documents are issued by the head of the organization himself).

ATTENTION! Drivers should not be allowed to fill out waybills.

The driver’s task to correctly prepare the waybill is only to sign an autograph about the acceptance and delivery of the car at the end of the work shift, as well as to make notes about the completed transfers.

The waybill is issued to the driver against signature, and the obligatory condition for its receipt is the submission of the document for the previous day.

In some cases, a waybill can be issued not for one work shift, but for a longer period (for example, for intercity transportation).

Waybill: features for an IP truck

Individual entrepreneurs - owners of trucks used in their business activities are required to fill out waybills for each vehicle.

NOTE! From 03/01/2019, the waybill is issued strictly for a shift or for a flight, whichever is longer. It is impossible to draw up a monthly plan.

As a rule, waybills are issued daily, except in cases where the driver will carry out the order for a long time without returning to the permanent parking place. If several drivers work in shifts on a vehicle, a waybill is filled out for each of them.

From 01/01/2021, new mandatory details for the waybill will apply.

Main innovations:

- A waybill is required for any vehicle operation, regardless of the type and nuances of transportation.

- A new detail “Transportation information” has been introduced.

- It is necessary to indicate the brand of the trailer.

- The responsible person is obliged to indicate the time the vehicle leaves the line and the time it returns.

ConsultantPlus experts spoke about other changes in the waybill. Get free demo access to K+ and go to the Review Material to find out all the details of the innovations.

If the individual entrepreneur who owns the car is also the driver, he is also obliged to issue a waybill for himself. It contains all the necessary information about the dates of work and the distance covered. This data is necessary to calculate the cost of transport services provided, the driver’s salary and the cost of fuel consumed.

If the truck is stopped by the traffic police, the driver must show documents for the cargo - not only transport documents, for example, a waybill, but also a waybill.

When the labor inspectorate checks the entrepreneur’s compliance with labor legislation in relation to hired personnel, waybills will be required, since they can be used to track the driver’s work schedule and determine the correctness of salary calculations. Based on these data, it will be clear whether the entrepreneur complied with the rules of remuneration for overtime working hours (this is relevant if long flights are carried out).

Should I draw up a waybill for an individual entrepreneur without hired workers for himself? Get free trial access to ConsultantPlus and study expert explanations on this issue.

Also, the waybill will definitely be of interest to tax inspectors. After examining these documents, they will receive information about whether transportation costs were calculated correctly.

The storage period for the waybill is 5 years. If the waybill is drawn up incorrectly, the individual entrepreneur and the driver will bear joint responsibility, although penalties are still applied to the entrepreneur.

For more information about the shelf life of such primary documents, read the article “What is the shelf life of waybills (nuances)?”

Features of the document

Unified standards for primary documents have been abolished since 2013, so now employees of enterprises have the right to choose whether to issue a waybill each time in a free form (which is impractical), develop their own unique document form, or use a unified, previously mandatory form. The last option turns out to be the most preferable for many companies, because such a form includes all the necessary details and lines (i.e. there is no need to spend time developing and creating the structure and content of the sheet).

The document is kept in paper (printed) form, information is entered into it with a ballpoint pen of any dark color (other writing tools - felt-tip pens, pencils, etc. should not be used).

When filling out the waybill, you should avoid blots and mistakes. If any mistake does occur, it is better to fill out a new form, but if this is not possible, you need to correct the incorrect data very carefully. You can either cover them up with a corrector, or cross them out and write the correct information on top (by making an o next to them). All edits must be certified by the signature of the person who made them.

After issuing a waybill, the form must be signed by the responsible persons and also certified by the seal of the company (provided that the use of stamps for endorsement of such papers is enshrined in the company’s accounting policy).

Before moving on to the example of filling out a document, let’s say a few words about the procedure for entering information into it.

The form is filled out by the responsible person before the car leaves the garage.

The sheet is signed by: a mechanic who monitors the technical condition of the vehicle, if necessary, a medical worker who certifies the physical condition of the driver, the driver himself and the responsible employee.

Which form of a truck waybill should an individual entrepreneur use?

Before the cancellation of Order No. 68 of the Ministry of Transport dated June 30, 2000, all car owners-entrepreneurs used the PG-1 form approved by this normative act to issue a waybill. After its abolition, until 2013, it was necessary to use forms 4-P or 4-C, introduced into the document flow by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. And since 2013, with the adoption of the Law “On Accounting” dated December 6, 2011 No. 402 -FZ the need to use unified forms has disappeared.

Now entrepreneurs can independently develop their own travel form. It must be created in compliance with the requirements of Order No. 368 of the Ministry of Transport and Law No. 402-FZ.

We discuss issues of preparing a waybill, taking into account the latest changes, in on VK. Join us!

The choice of the form of the waybill must be fixed. Read about how to do this here.

If you need to draw up a waybill, then it can be based on either one of the previously used unified forms (PG-1, 4-S or 4-P), or your own development. Most often, individual entrepreneurs prefer the PG-1 form (the 2021 waybill form for a truck can be downloaded below from the link), since it contains all the details necessary to fill out and is quite familiar for use as a waybill.

A waybill in form 4-C is more suitable for cases when special vehicles are used. As for the 4-P form, it is convenient for entrepreneurs who use an hourly form of payment to pay drivers. In this case, the TTN is a mandatory addition to the 4-P form; its number is entered in the waybill. After completion of the voyage, 1 copy of the waybill must be attached to the issued waybill and stored with it.

All issued waybills are registered in a special journal. The entrepreneur himself is responsible for maintaining such a journal for the individual entrepreneur.

For an algorithm for registering and maintaining a log of waybills , see : Here.

It is quite important that the details confirming fuel consumption are taken into account and filled out in a self-developed form. A correctly completed waybill is a legal basis for the subsequent write-off of fuel and lubricants. This is also mentioned in the letter of the Ministry of Finance dated August 25, 2009 No. 02-03-06/2-161.

About the rules for accounting for expenses of an individual entrepreneur working on the simplified tax system, read the material “List of expenses under the simplified tax system “income minus expenses”” .

Sample of filling out a waybill

So, the following are written in order on the sheet:

- date of its preparation;

- name of the organization and its address;

- OKPO code;

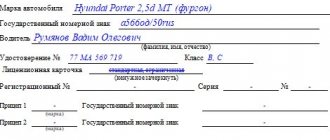

- car make (if the car is foreign-made, the model can be entered in Russian transcription);

- state number and garage number (if available);

- information about the driver: his full name, personnel number, driver's license number, driving class. Information about the license card must be entered if the driver operates using a license.

The second part of the form on the left includes information about the task issued to the driver for the current shift. Here are the following:

- who exactly issued the order: structural unit and name of the enterprise;

- delivery address;

- time of leaving the garage (exactly - in hours and minutes);

- signatures of the mechanic and driver.

After the trip, you should note the time of return to the garage, periods of waiting, downtime, destination of trips, etc., and also confirm all this information with the autograph of the driver.

On the right side of the document the following is indicated:

- first, data on the technical condition of the car at the time of departure: speedometer readings certifying the serviceability of the car, signatures of the mechanic and driver, brand and code of the fuel used;

- then, after returning, the fuel consumption is described in detail (the tanker or fuel technician enters the data here): how much was issued according to the refueling sheet (in liters), how much was in the tank when leaving the garage and when arriving back, consumption (standardized and actual), and also information about savings or overspending;

- then the numbers from the speedometer are entered, and the mechanic certifies all this again with his signature.

On the reverse side of the waybill, information about trips made during the work shift is indicated (in order). Here it is written

- the address from which the car left,

- destination,

- departure and return times,

- mileage traveled,

- driver's signature.

Finally, the form is filled out by an accounting employee who calculates the number of hours actually worked, the kilometers traveled, and, based on this, calculates the driver’s wages.

Storage and liability

Closed waybills must be valid for at least five years (based on Order of the Ministry of Transport of the Russian Federation No. 152 of September 18, 2008). Responsibility for storing the document lies with:

- head of the company;

- officials (responsible for operating the vehicle).

Checking the waybills can be done by:

- traffic police;

- Federal Tax Service;

- GIT.

In the absence of a waybill, a fine may be imposed under Article 12.13 of the Administrative Code: 200 rubles for each unissued waybill.

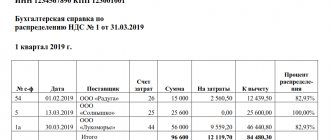

Errors in the waybill and refusal to refund VAT

The legal consequences of errors made in a document such as a waybill can be very unpleasant for the taxpayer. Noteworthy is the case in which the Federal Tax Service refused to recognize the right of an individual entrepreneur to deduct VAT due to the fact that the waybills were filled out incorrectly.

We are talking about arbitration case No. A65-20582/2013. The plaintiff, an individual entrepreneur, bought a car from an LLC and prepared a number of supporting documents - an invoice and an acceptance certificate. The seller issued an invoice to the buyer, which included VAT. It is also known that the individual entrepreneur paid for the car using credit funds.

The individual entrepreneur, having carried out the state registration of the car, submitted a VAT return to the Federal Tax Service, which indicated the amount to be deducted. However, the tax authorities denied the deduction to the individual entrepreneur, considering that the car was purchased not for business, but for personal purposes.

The buyer of the car filed a claim in arbitration, intending to have the Federal Tax Service's decision annulled in court. But his attempts were not crowned with success - the court in 3 instances confirmed the rightness of the tax authorities.

During the hearing, the individual entrepreneur presented to the court copies of travel documents as evidence of using the car for business purposes. However, the judges considered that these sources did not comply with the requirements of the order of the Ministry of Transport, since they did not indicate some important, in the opinion of the court, details. In addition, during the hearings, it was established that in the vehicle acceptance certificate there was an error in indicating the name of the LLC that sold the vehicle to the individual entrepreneur.

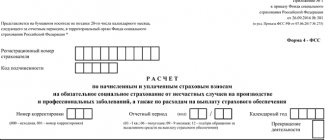

New rules for issuing travel documents from January 1, 2021

The new rules were approved by Order of the Ministry of Transport of the Russian Federation dated September 11, 2020 No. 368 “On approval of mandatory details and the procedure for filling out waybills,” which is valid from January 1, 2021 to January 1, 2027.

The new procedure for drawing up waybills must be applied by legal entities and individual entrepreneurs operating cars and trucks, buses, trolleybuses and trams.

Let's take a closer look at the important changes.

Change 1 - new mandatory detail “Transportation information”

The required detail “Transportation Details” has been added to the waybill. It must indicate the type of message and type of transportation from Art. 4 and 5 of the Federal Law of November 8, 2007 No. 259-FZ.

There are only three types of transportation: regular, by order and by passenger taxi. There are five types of messages, these include:

- Transportation of passengers, luggage and cargo in urban, suburban, intercity and international traffic.

- Transportation in urban traffic within the boundaries of populated areas.

- Suburban transportation between populated areas at a distance of up to 50 km between the borders of these populated areas.

- Suburban transportation between populated areas at a distance of more than 50 km between the borders of these populated areas.

- Transportation in international traffic outside the Russian Federation or into the territory of the Russian Federation crossing the State border, including transit through Russia.

Change 2 - “Information about the vehicle”

Now in the information about the vehicle you must indicate the make of the vehicle and trailer (if any). Previously, only the type and model were indicated.

We will immediately indicate the odometer readings when leaving the parking lot and entering it after the end of the shift. The readings, as before, include full kilometers driven. But in the old version, it was not necessary to enter odometer data when entering the parking lot.

Change 3 - procedure for marking medical examination and technical control

The new rules indicate that the official responsible for the technical condition and operation of transport is responsible for monitoring the technical condition. Now it is indicated that this is done by the technical condition controller. If everything is in order, you need to put o.

The rules also stipulate what mark to put on the waybill after the driver’s medical examination:

- based on the results of the pre-trip examination - “passed the pre-trip medical examination and was allowed to perform labor duties”;

- according to the results of the post-trip examination - “passed the post-trip medical examination.”

Change 4 - electronic form of the travel log

Now the journal can be kept on paper or in electronic form, to choose from. If you conduct electronically, certify the information entered into it with an enhanced qualified electronic signature (ECES). And also be sure to provide for the possibility of printing the magazine on paper.

If you keep a paper journal, keep in mind that all its pages must be numbered and laced.

Responsibility

Administrative liability is provided for hiring employees who have not passed a mandatory medical examination. And if there is no record of the driver undergoing a medical examination or the mark is made not by a qualified doctor, but by someone else, the budget organization will be fined.

The labor inspectorate will fine (parts 3 and 5 of article 5.27.1 of the Administrative Code):

- organization - in the amount of 110,000 to 130,000 rubles;

- officials (for example, a manager) - from 15,000 to 25,000 rubles.

The driver will be punished by the traffic police. For driving an organization's vehicle without a waybill, a fine of 500 rubles is provided (Article 12.3 of the Administrative Code). But for the first time, traffic police inspectors often limit themselves to a verbal warning.

New waybill form in 2021: special requirements

There are no changes to travel plans in 2021. The latest updates came into force in December 2021 (approved by orders of the Ministry of Transport of Russia dated September 18, 2008 No. 152 (as amended on January 18, 2017) and dated November 7, 2017 No. 476). The filling requirements have been supplemented with new mandatory details. At the same time, the round seal on the form has been abolished if its use is not provided for by the Charter.