IFRS: training, methodology and implementation practice for companies and specialists

A joint project of IPB Russia and the magazine “Corporate Financial Reporting. International standards".

Litvinenko Olga Vladimirovna PhD student at Harvard Extension School, Cambridge, MA, USA.

The purpose of a fair value measurement, according to IFRS 13 Fair Value Measurement, is to determine the price at which an orderly sale of an asset or transfer of a liability would occur between market participants at the measurement date in current market conditions. This article discusses the main methods for assessing fair value and their varieties, as well as the criteria for their selection.

A fair value measurement requires an entity to determine the following components (IFRS 13 Appendix B, paragraph B2):

- the asset or liability to be measured (according to the unit of account);

- in relation to a non-financial asset, the underlying assumption that is relevant to the valuation (in accordance with the best and most efficient use of that asset);

- the primary (or most advantageous) market for the asset or liability;

- The valuation technique necessary to determine fair value, taking into account the availability of information to derive the inputs that represent the assumptions that market participants would use in determining the price of the asset or liability, and the level in the fair value hierarchy to which those inputs relate.

In practice, when estimating the fair value of an asset or liability, the most difficult point is the last point, namely the choice of valuation method and its application.

Fair value as an economic concept

Asset valuation is needed in many business situations. It must reliably reflect the state of affairs at the current time, although the market situation is constantly changing. The results of the assessment should be easily interpreted in relation to the interests of different categories of persons. You can evaluate different fixed assets:

- individual objects;

- assets;

- obligations.

IMPORTANT! The determination of fair value has no connection with the mandatory valuation provided for by law and regulations in certain cases, such as, for example, privatization or non-cash contribution to the authorized capital. The state does not regulate fair assessment procedures.

Fair value is the amount that theoretically interested parties can pay for assets or liabilities (IFRS Standard 13).

Fair value characteristics:

- a specific object is assessed;

- categories of this object that are important for market participants are taken into account (for example, the place, time of the transaction, the condition of the asset, the credit risks of the debtor for the obligation);

- Fair valuation is affected by possible restrictions on the sale or purchase of the asset or its use.

Fair, liquidation and collateral value: how do these concepts relate ?

OS objects

The characteristics characterizing fixed assets have been clarified. In the standard these include:

- the presence of a material form;

- intended for use by an organization in the normal course of business in the production and (or) sale of its products (goods), when performing work or providing services, for environmental protection, for provision for temporary use for a fee, for management needs, or for use in activities a non-profit organization aimed at achieving the goals for which it was created (previously there was no indication of the possibility of use for environmental protection);

- intended for use by the organization for a period of more than 12 months or a normal operating cycle exceeding 12 months (previously it also contained an indication that the organization does not intend to resell the item);

- capable of bringing economic benefits (income) to the organization in the future (to ensure that the non-profit organization achieves the goals for which it was created).

Long-term assets for sale are excluded from the scope of application of FAS 6/2020. Previously, they were accounted for as part of fixed assets. Since 2021, this type of assets has been accounted for in accordance with PBU 16/02 “Information on discontinued operations.”

As part of fixed assets, investment real estate objects are separately taken into account and reflected in the accounting statements.

Purpose of using fair value

Reflection in reporting according to international standards (IFRS) of the actual current price of the company’s assets and liabilities is necessary for:

- activities in international markets;

- attracting foreign investors;

- lending from foreign banks;

- creation of joint ventures;

- acquisitions and mergers;

- increasing the cost of capital of the company.

Fair value measurement in accordance with International Financial Reporting Standards .

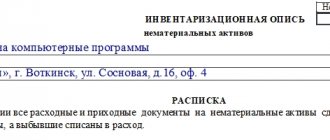

Application of the standard to non-financial assets

The fair value of a non-financial asset is measured based on its highest and best use from the perspective of a market participant.

Highest and best use means the use of an asset that:

- physically possible

- it takes into account the physical characteristics that market participants will consider (for example, location or size of the property); - legally permissible

- it takes into account legal restrictions on the use of the asset that market participants take into account (for example, zoning rules); or - financially feasible

- it considers whether the use of the asset results in income or cash flows that allow adequate investment

When does fair value apply?

Clause 1 Art. 11 of the Federal Law of the Russian Federation dated November 21, 1996 No. 129-FZ “On Accounting” as amended on March 28, 2002 approves the parameters for assessing assets for entering them on the balance sheet separately for each type. For assets acquired for compensation, you must apply:

- measurement at fair value if the asset was paid for in non-cash form;

- market valuation - for standard purchase and sale.

A more accurate translation from the IFRS Standard from English into Russian would be to use the word “measurement” instead of “assessment”, since we are initially talking about non-financial assets.

IMPORTANT! If the value of non-monetary assets transferred as payment for an asset cannot be estimated, a fair valuation will become difficult, then they will have to be valued at current market value.

Transitional provisions

The consequences of changes in the accounting policies of an organization in connection with the start of application of FAS 6/2020 are reflected retrospectively, that is, as if this standard had been applied from the moment the facts of economic life affected by it arose.

To facilitate the transition to the new procedure for accounting for fixed assets in accounting, starting from which FAS 6/2020 is applied, the organization may not recalculate comparative indicators related to fixed assets for periods preceding the reporting one, making a one-time adjustment to the book value of fixed assets at the beginning of the reporting period (end of the period, preceding the reporting one).

For the purposes of this adjustment, the carrying value of fixed assets is considered to be their original cost (taking into account revaluations), recognized before the application of FAS 6/2020 in accordance with the previously applied accounting policy, less accumulated depreciation.

Source:

"Clerk"

Heading:

Fixed assets

fixed assets FSBU 6/2020 depreciation of fixed assets

- Inna Kosnova, Clerk columnist, accounting and taxation expert

Sign up 7800

9750 ₽

–20%

Fair or market value?

These concepts are largely similar; sometimes a fair valuation coincides with the market value (for example, for real estate, land plots, equipment). Market value is most often considered the most expected price that would be paid for it in the presence of free competition.

However, there are significant differences between these concepts. Let's compare fair and market values using different indicators in the table. In this case, other conditions will be considered equal by default:

- awareness of the seller and buyer of the asset;

- they make a transaction of their own free will, without coercion;

- Their market positions are approximately equal.

| № | Base | fair value | Market price |

| 1 | Legislative regulation | International Standards (IFRS) | State standards (RNBO) |

| 2 | Approaches to assessment | Depends on whether the object being assessed belongs to one of certain groups | It is necessary to apply three mandatory approaches (cost, income and comparative) or justify the refusal of any of them. |

| 3 | Form of payment for assets or liabilities | Non-monetary | Monetary or non-monetary, if the financial correspondence of the assets transferred as payment cannot be established |

| 4 | Additional factors | All factors expressing advantages or disadvantages for the parties to the transaction should be taken into account | All subjective factors are ignored, only the “bare” situation is taken into account |

| 5 | Comparison of concepts | More broadly: market value may coincide with fair value | Narrower: not every fair valuation is market value. |

Inventory objects

The traditional approach to identifying OS inventory objects is supplemented by recognition as an independent inventory object:

- each part of one fixed asset, the cost and useful life of which differ significantly from the cost and useful life of the object as a whole (previously - with only a significant difference in the useful life);

- significant expenses of the organization for repairs, technical inspection, maintenance of OS facilities with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months (previously included in period expenses).

Fair value calculation

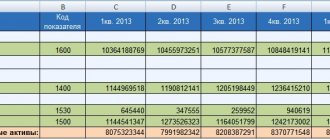

The fair value standard divides the information on which it is based into three levels.

Level 1, market. The most reliable and obvious. A non-financial asset is valued at the same value in an active market at a given point in time (the moment of valuation).

Level 2, adjustment. When an asset or liability is not constant, but relates to a certain period, then its value can only be determined during this period by comparing it with current quotes. Therefore, the fair value will no longer be unconditional, but adjusted for time, place, condition of the asset and market characteristics.

Level 3, unobservable. Sometimes the data to determine the value of an asset or liability cannot be determined directly (they are unobservable); in this case, it is necessary to analyze the maximum available information about the asset.

A fair valuation of an asset will fall into one of these levels:

- the first level determines the undoubted assessment;

- the second and third require additional methods of evaluation and conditioning of choice;

- at the third level, it is necessary to provide information accompanying the assessment: changes in the reporting period, the amount of costs and profits on this asset for the assessed period, a description of the assessment process.

How to account for acquired claims measured at fair value?

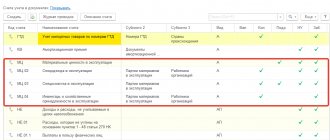

Choosing an approach to measuring fair value

- Comparison with similar assets on the market according to defining indicators: during the period under evaluation, in the same volume, etc.

- The discounted cash flow method is to determine the ability for a stable profit from an asset in the forecast for the estimated period.

- Cost method - based on the analysis of the latest balance sheet values.

Accounting for low-value items

A general approach has been established to the definition of low-value assets that have characteristics of fixed assets, but which may not be accounted for as fixed assets: objects are considered for accounting purposes as low-value based on the materiality of information about them (previously, the cost of such assets did not exceed 40,000 rubles per unit ).

Based on this approach, the organization independently sets a limit on the value of low-value assets.

Costs for the acquisition and creation of such assets are recognized as expenses of the period in which they were incurred (previously, these assets were reflected as part of inventories). At the same time, the organization is obliged to ensure proper control of their availability and movement.

Examples of fair value applications

Example 1. A woodworking company currently has an abundance of boards. She is in dire need of milling equipment and has agreed to exchange it for surplus raw materials. How to determine the amount that needs to be transferred as payment for the machine? To do this, you need to “add the price” of this asset. This would be his fair assessment. To evaluate, you need to take into account the cost of raw materials for this particular company. If the company has regular suppliers, then the fair value will be the sum of the costs of purchasing a batch of boards of similar size from these suppliers. In fact, this will be the quantity that the owner of the milling equipment will agree to accept in exchange.

Example 2. Company 1 has a stake in company 2, which is not currently operating. Previously, they were highly valued on the market. At what price can the company sell them now? A fair valuation does not depend on the previous, no longer current quotes (market valuation), but on other factors, in particular, whether firm 2 is going to resume its activity and how successful the forecasts are.

Example 3. A company is going to enter into a transaction with specialized property - part of the enterprise’s property complex. Such property is almost never sold separately on the market, so fair value will have to be determined differently from market value.