Home — Articles

- General rules

- Step left, step right - penalty?

- Clarification for overpayment

If errors are discovered that lead to an understatement of the tax base, the taxpayer must submit an updated tax return. If this is done after the expiration of the period established for payment of the tax, then in order to be freed from the fine, in most cases it is necessary to pay penalties and arrears even before submitting the clarification. Let's see what happens if we don't share it with the budget on time.

Neglect of overpayment

The procedure for submitting updated declarations is regulated by Article 81 of the Tax Code of the Russian Federation, which obliges an accountant to submit a document if he discovers in the paper he previously submitted the fact of non-reflection or incomplete reflection of information, as well as errors leading to an understatement of the tax amount. But if the amount is too high, it is not necessary to submit a “clarification.”

On a note

When adjusting primary information, you need to take into account some subtleties of the law. The “update” is submitted in the same form as the first declaration. In this case, on the title page in the “Adjustment number” field, you must put the number 1 if this is the first version of the amended document.

This happens in cases where the accountant has discovered documents confirming expenses for the period in which the declaration has already been submitted. The tax was transferred to the budget based on the inflated tax base, and all documents were filed and archived. Filing an amended return will result in expenses that reduce the basis and the amount of the fee. An overpayment of tax is generated on the personal account at the inspectorate. The company does not face any penalties. Why not return the money? However, accountants are not always in a hurry to provide “clarification” in such situations. They first assess the situation and decide whether it is worth “fencing the garden” because of a possibly small amount. Accounting specialists remember that the submission of each declaration is accompanied by a desk audit and is fraught with surprises. Inspectors have the right to request documents during a control event and may find errors in them that were not noticed when checking the initial declaration. In addition, if an organization submits an updated declaration with the amount of tax to be reduced, auditors have the right to conduct a second on-site inspection (clause 10 of Article 89 of the Tax Code of the Russian Federation).

After the clarification was submitted, the organization ceased to exist

After the reorganization of the enterprise, the updated declaration is submitted by its legal successor at the place of its registration or at the place of registration as the largest taxpayer (clause 2.6 of the procedure for filling out the income tax declaration).

See also “How to submit a profit declaration when transforming a company?”

Clause 2.7 of the procedure for filling out a profit declaration stipulates that the title page of the updated declaration submitted by the successor must indicate the TIN and KPP of the successor organization and the name of the reorganized company, and the name, TIN and KPP of the reorganized organization (its separate division) must be indicated separate lines.

In section 1 of the updated declaration submitted by the legal successor for the reorganized organization (its separate division), OKTMO is indicated at the location of the latter (clause 4.1.4 of the procedure for filling out the income tax declaration).

To find out whether a reorganization caused by a merger requires deregistration under a trade tax, read the material “When reorganizing in the form of a merger, it is not necessary to deregister under a trade tax.”

Reduced tax

When filing an amended return to correct errors that led to an understatement of the amount of tax payable, several situations may arise.

First. The accountant noticed an error in the declaration in the current reporting period, immediately after its submission, but before the deadline for submission established in the Tax Code. If he manages to submit an “adjustment” before the end of this period, then it is considered submitted on the day the updated declaration is submitted. In this case, there is no penalty for violating the deadlines. In addition, if the amount of additionally assessed tax is not paid, only penalties are charged on the arrears (clause 2 of Article 81 of the Tax Code of the Russian Federation).

Second situation. The accounting specialist noticed the error after the deadline. In this case, in order to avoid penalties, when submitting corrective information, you need to calculate and pay the amount of penalties for the period from the date of the established deadline for submitting documents to the date of filing the “clarification”. Only after making sure that penalties have been paid can you send an updated declaration. What is the mystery of this particular sequence of actions? If penalties are paid and a return is filed on the same day, the money will not have time to get into the taxpayer’s card. The declaration will be registered as submitted without payment of sanctions, that is, in violation of the procedure. This threatens the company with a fine of 20 percent of the amount of additional tax accrued (clause 1, clause 4, article 81 of the Tax Code of the Russian Federation).

Deadline for filing an updated declaration

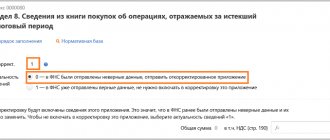

It is necessary to provide an updated declaration at the request of the Federal Tax Service within 5 working days from the date of its receipt. If you fail to meet these deadlines, you may receive a fine.

If you independently discover an error in the primary document, you can submit an amendment at any time, but it is advisable to do this as soon as possible, especially if the defect affects the amount of tax. If the amount is underestimated, it is important to pay penalties and arrears in time and provide clarification before the Federal Tax Service identifies the error. This will help avoid fines for non-payment.

We take into account the nuances

When adjusting primary information, you need to take into account some subtleties of the law. The “updated statement” is submitted in the same form as the first declaration (clause 5 of article 81 of the Tax Code of the Russian Federation). In this case, on the title page in the “Adjustment number” field, you must put the number 1 if this is the first version of the amended document.

The updated declaration includes not only the corrected data, but also all other indicators, including those that were initially correct.

On a note

The accountant noticed an error in the declaration in the current reporting period, immediately after its submission, but before the deadline for submission established in the Tax Code. If he manages to submit an “adjustment” before the end of this period, then it is considered submitted on the day the updated declaration is submitted.

If the adjustment in the document does not lead to an increase in the amount of tax, then such a declaration filed after the expiration of the established filing deadline is not considered to be submitted in violation of the deadline. Moreover, the company has the right to file a return for any tax period, even exceeding the statute of limitations of three years. But the law does not provide for the return of the overpayment amount, since the statute of limitations has expired. Such clarifications are given in Letters of the Federal Tax Service dated December 12, 2006 No. CHD-6-25/ [email protected] and the Ministry of Finance dated August 24, 2004 No. 03-02-07/15.

But the Tax Code does not limit the period for recalculating the base in the event of errors or distortions that led to its increase and an increase in the tax. Therefore, the company has the right to submit a “clarification” to increase the amount of the fee and pay it at any time (Letters of the Ministry of Finance dated 08/04/2010 No. 03-03-06/2/139, dated 04/08/2010 No. 03-02-07/ 1-152).

In practice, sending a “clarification” is preceded by receiving a decision from the tax office to conduct an on-site audit. Accounting begins to urgently “clean up its tails” and discovers errors. Is it possible to send an amended declaration in this case? Yes, there is time from the date of receipt of the decision to the start date of the inspection.

It is also allowed to submit a “clarification” during the audit. The fact is that in this case the declaration will also be checked by “travelers” and the changes made will be taken into account when drawing up the inspection report. If the amount of tax liabilities in the “clarification” increases, then inspectors will not assess additional tax based on the results of the control event. But you still have to pay the fine. If the company independently pays the tax and penalties, then it can count on a reduction in the fine on the basis of subparagraph 3 of paragraph 1 of Article 112 of the Tax Code of the Russian Federation, if the voluntary submission of an “adjustment” and additional payment of the tax are recognized as mitigating circumstances.

The organization has separate divisions

If separate divisions of an organization switch to paying tax through a responsible division (parent organization), then an updated declaration must be submitted at the place of registration of the latter (letter of the Federal Tax Service of Russia dated June 30, 2006 No. GV-6-02/664).

If a centralized tax payment procedure was used in a separate division, then in the event of its liquidation, an updated declaration must be submitted to the place of registration of the responsible division. But if the liquidated division was registered in another subject of the Russian Federation, then the update is submitted at the location of the parent organization (letter of the Ministry of Finance of Russia dated March 17, 2006 No. 03-03-04/1/258, Federal Tax Service of Russia dated April 6, 2006 No. 02-4- 12/23, Federal Tax Service of Russia for Moscow dated September 13, 2007 No. 20-12/087484.3, dated April 17, 2007 No. 20-12/035999).

And more about the nuances

Filing an updated VAT and excise tax return during a desk audit has its own characteristics. According to the explanations that the Federal Tax Service gave in Letter No. AS-4-2/12705 dated July 16, 2013, the law requires the mandatory conduct of an independent “camera study” of the updated declaration. During an on-site audit, inspectors cannot take into account updated data. In addition, if the initial VAT return declares tax to be refunded, and then, before the desk audit report is delivered, an amendment is submitted (also with a refund), then the report on the initial declaration will still be issued. Moreover, if the amount of compensation in the “clarification” is less than in the original document, the companies will reimburse the smaller amount.

Elena Seledtsova

, for the magazine "Calculation"

How to save on VAT without violating the tax code

This e-book contains complete information about what legal ways to optimize VAT are provided for in Russian legislation. They are enough to reduce the tax burden of the enterprise and not take risks >>

If you have a question, ask it here >>

If a company moves and changes its address, then the clarification will need to be submitted to the tax authority with which it will be registered, but the OKTMO code is indicated the same as in the initial declaration (letter of the Federal Tax Service of Russia for Moscow dated October 30, 2008 No. 20-12/101962).

It is necessary to note that all explanations from officials were given at the time when the OKATO code was applied. In connection with the replacement of the OKATO code with the OKTMO code, it must be assumed that all the above conclusions have not lost their relevance at the present time.

In the updated tax returns for past reporting (tax) periods, you will need to indicate the checkpoint that was given in the primary tax return (letter of the Federal Tax Service of Russia dated November 20, 2015 No. SD-4-3/20373).

Error in the declaration: actions of the taxpayer

27 Khabarovsk Territory Date of publication: 08/28/2020

Edition: information portal “Softinfo” of the regional information center ConsultantPlus in Khabarovsk Topic: Declaration of income Source: https://consultantkhv.ru/newspaper/oshibka-v-deklaracii-dejstviya-nalogoplatelshhika/

During a public discussion on the control and supervisory activities of the tax authorities of the Khabarovsk Territory, which took place on July 09, 2020 at the ConsultantPlus RIC in the format of a webinar, a participant in the event asked representatives of the tax authorities to explain the procedure for his actions in the current situation. The participant’s situation, as well as a commentary on it from the legal department of the Federal Tax Service of Russia for the Khabarovsk Territory, is presented below.

Question from a public discussion participant:

The taxpayer, a legal entity, independently found an error. The amount of tax to be paid is quite significant for him. The taxpayer is ready to independently submit an updated tax return, pay tax and penalties. But, according to clause 4 of Article 81 of the Tax Code of the Russian Federation, there will be no fine only if the taxpayer pays the entire amount of tax and penalties before filing a tax return. But he does not have the opportunity to do this.

The taxpayer's main activity is included in the list of industries most affected by the coronavirus infection.

Installment payment of tax provided for in Art. 64 of the Tax Code of the Russian Federation, is possible only for current tax payment obligations or in case of additional tax assessment based on the results of an audit. An independently found error for previous tax periods does not fall under these conditions. If the taxpayer submits a return now and does not pay the tax and penalties in full, the tax office will automatically charge a fine, citing the fact that this is how the program works.

Is there any way to solve this problem legally? The taxpayer wants to receive an installment plan to pay additional self-assessed taxes for previous tax periods and avoid a fine. Where and how should he go? How should a taxpayer act in such a situation?

Answer from the legal department of the Federal Tax Service of Russia for the Khabarovsk Territory:

From the question presented, it is impossible to determine what the due date for payment of the amended tax return is.

If the deadline for payment of the relevant tax falls in 2021, then the taxpayer can use the Rules for providing a deferment (installment plan) for the payment of taxes, advance payments for taxes and insurance premiums (hereinafter referred to as the Rules), approved by clause 5 of Resolution of the Government of the Russian Federation dated 02.04.2020 No. 409 “On measures to ensure sustainable economic development.”

Legal entities and individual entrepreneurs operating in areas most affected by the spread of coronavirus in accordance with the List approved by Government Decree No. 434 dated April 3, 2020 (hereinafter referred to as the List), as amended by resolutions, can exercise the right to grant a deferment (installment plan). Government of the Russian Federation dated 04/10/2020 No. 479, dated 04/18/2020 No. 540, dated 05/12/2020 No. 657, dated 05/26/2020 No. 745, dated 06/26/2020 No. 927.

In accordance with clause 2 of the Rules, a deferment or installment plan may be provided for federal, regional, local taxes, insurance premiums, the payment of which fell due in 2021, with the exception of:

- excise taxes;

- mineral extraction tax;

- taxes paid by tax agents;

- insurance contributions in terms of amounts associated with the formation of funds to finance funded pensions.

The right of designated persons to defer or installment payment of tax payments is established if one of the following indicators is present:

- decrease in income by more than 10 (ten) percent;

- a decrease in income from the sale of goods (works, services) by more than 10 (ten) percent;

- a decrease in income from the sale of goods (works, services) for transactions subject to value added tax at a rate of zero percent by more than 10 (ten) percent;

- receiving a loss according to income tax returns for the reporting periods of 2021, provided that there was no loss for 2021.

The body authorized to make a decision on granting a deferment (installment plan) for the payment of taxes, advance payments of taxes and insurance premiums is the tax authority at the location (place of residence) of the taxpayer.

Applications for deferment (installment plans) are considered if submitted before December 1, 2021.

At the same time, we inform you that if the deadline for payment of the updated tax return does not fall in 2021, then the taxpayer can take advantage of the provisions of Chapter. 9 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), in accordance with which a deferment or installment plan for tax payment is provided.

A deferment or installment plan for the payment of tax may be granted to an interested person whose financial situation does not allow him to pay this tax on time, but there are sufficient grounds to believe that the possibility of payment by the specified person of such tax will arise during the period for which the deferment or installment plan is granted, if presence of at least one of the following grounds:

- damage caused to this person as a result of a natural disaster, technological disaster or other circumstances of force majeure;

- failure to provide (untimely provision) of budget allocations and (or) limits on budget obligations to an interested person and (or) failure to communicate (untimely delivery) the maximum volumes of financing expenses to the interested person - the recipient of budget funds in an amount sufficient for the timely fulfillment by this person of the obligation to pay tax, as well as failure to transfer (untimely transfer) to an interested person from the budget in an amount sufficient for the timely fulfillment by this person of the obligation to pay taxes, funds, including payment for services provided by this person (work performed, goods supplied) for state and municipal needs ;

- the threat of signs of insolvency (bankruptcy) of the interested party in the event of a one-time payment of tax;

- the property status of an individual (excluding property that, in accordance with the legislation of the Russian Federation, cannot be foreclosed on) excludes the possibility of a one-time tax payment;

- the production and (or) sale of goods, works or services by the interested party is seasonal;

- if there are grounds for granting a deferment or installment plan for the payment of taxes payable in connection with the movement of goods across the customs border of the Customs Union, established by the customs legislation of the Customs Union and the legislation of the Russian Federation on customs affairs;

- the impossibility of a one-time payment of taxes, fees, insurance premiums, penalties and fines payable to the budget system of the Russian Federation based on the results of a tax audit before the expiration of the deadline directed in accordance with Art. 69 of the Tax Code of the Russian Federation, requirements for payment of taxes, fees, insurance contributions, penalties, fines, interest, determined in the manner prescribed by clause 5.1 of Art. 64 Tax Code of the Russian Federation.

Based on clause 5 of Art. 64 of the Tax Code of the Russian Federation, an application for a deferment or installment plan for the payment of tax, indicating the grounds, is submitted to the relevant authorized body. The following documents are attached to the application for a deferment or installment plan for tax payment:

- certificates from banks on the monthly turnover of funds for each month of the six months preceding the submission of the said application on the accounts of this person in banks, as well as on the availability of his payment documents placed in the corresponding card file of unpaid settlement documents, or on their absence in this card file;

- bank certificates about cash balances in all bank accounts of this person;

- a list of counterparties - debtors of this person, indicating the prices of contracts concluded with the corresponding counterparties - debtors (the amount of other obligations and the grounds for their occurrence), and the timing of their fulfillment, as well as copies of these contracts (documents confirming the existence of other grounds for the occurrence of an obligation);

- the obligation of this person, providing for the period of change in the tax payment deadline, compliance with the conditions under which the decision to grant a deferment or installment plan is made, as well as the debt repayment schedule expected by him;

- documents confirming the existence of grounds for changing the tax payment deadline specified in clause 5.1 of this article.

Regarding penalties, we note the following.

So in accordance with Art. 122 of the Tax Code of the Russian Federation, non-payment or incomplete payment of tax amounts (fees, insurance contributions) as a result of understatement of the tax base (base for calculating insurance premiums), other incorrect calculation of taxes (fees, insurance contributions) or other unlawful actions (inaction), if such an act is not contains signs of tax offenses provided for in Art. Art. 129.3 and 129.5 of the Tax Code of the Russian Federation, entails a fine in the amount of 20 percent of the unpaid amount of tax (fees, insurance contributions).

According to Art. 112 of the Tax Code of the Russian Federation, the following are recognized as circumstances mitigating liability for committing a tax offense:

- committing an offense due to a combination of difficult personal or family circumstances;

- committing an offense under the influence of threat or coercion or due to financial, official or other dependence;

- difficult financial situation of an individual held accountable for committing a tax offense;

- other circumstances that may be recognized by the court or tax authority considering the case as mitigating liability.

From the above it follows that the legislator has provided the opportunity for taxpayers to reduce penalties, while the range of circumstances mitigating liability for committing a tax offense is defined in the form of an open list using indications of other circumstances.

Currently, an extensive practice has been formed in the application of this norm by taxpayers, courts and tax authorities, as a result of which many mitigating circumstances identified in the process of law enforcement have become generally accepted, and their legitimacy is not questioned. In addition to the provisions normatively enshrined in paragraphs 1 and 4 of Art. 112 of the Tax Code of the Russian Federation, the institution of mitigating circumstances in tax law also includes numerous circumstances identified and recognized as mitigating during the consideration of specific cases.

Thus, answering the taxpayer’s question, we inform you that in this case it will not be possible to avoid penalties, but at the same time, taking into account the epidemiological situation in the Khabarovsk Territory, as well as the admission of guilt and other circumstances mitigating tax liability presented by the taxpayer, the tax authority when considering an updated declaration, it can reduce the fine to a minimum, however, it is worth noting that the amount of penalties for committing a tax offense cannot be reduced to zero rubles in the presence of mitigating circumstances, since this would mean releasing the person from liability for committing a tax offense.

At the same time, paragraph 1 of Art. 81 of the Tax Code of the Russian Federation provides that if a taxpayer discovers in the tax return submitted by him to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable, the taxpayer is obliged to make the necessary changes to the tax return and submit it to the tax authority an updated tax return in the manner prescribed by this article.

The period of misstatement is unknown

If the period of the error cannot be determined, the adjustment is made during the period when the distortion is detected. Such cases are exceptions. In most cases, the period for making an error is known. In what cases is distortion of this nature possible? For example, this is the purchase of materials. When purchasing them, the purchase price was incorrectly reflected in the tax register. In this case, the distortion of the income tax base will be recorded not at the time of capitalization of the material, but at the time of sale. If a company has a large turnover of materials and accounting is performed at average cost, it is very difficult to track the date of sale of the material.

If a distortion causes an overpayment of tax, it is corrected during the period when the deficiency is discovered.

However, one nuance must be taken into account: a company can include in the base of the current period the amount of distortion that provoked an overpayment of tax in the previous period, only if there is a profit in the current period.

If the misstatement leads to a loss for the company, the tax base for the period the misstatement was committed is recalculated. The corresponding provision is given in letter of the Ministry of Finance No. 03-02-07/1/42067 dated July 22, 2015.

The “clarification” was submitted before the end of the desk audit of the primary declaration

Clause 9.1 of Article 88 of the Tax Code of the Russian Federation contains the following rule. If the “clarification” is submitted before the end of the desk audit of a previously submitted declaration, then such verification is terminated. Instead, tax authorities are required to begin a new audit in relation to the updated declaration.

Taxpayers sometimes use this provision to avoid prosecution under Article 122 of the Tax Code of the Russian Federation. As soon as the accountant, having read the act, learns that during the audit of the primary declaration an understatement of the taxable base was discovered, he submits a “clarification” where this violation is corrected. He hopes that the inspectors, before they have time to impose a fine, will complete the verification of the initial declaration. Next, the verification of the updated declaration will begin, and this verification will no longer reveal any shortcomings.

But in practice, not everything often goes smoothly. The fact is that the Tax Code does not clearly indicate which date is the day the desk audit ends. Accordingly, it is not completely clear in which case the “clarification” is considered to have been submitted before the end of the desk audit of the primary declaration.

Officials believe that the inspection is completed after the report on its results is signed. This position is set out in the letter of the Federal Tax Service of Russia dated July 23, 2012 No. SA-4-7/12100 (for more details, see the article “What decision will the inspectors make if the taxpayer declared VAT deductible and then submitted a “clarification””). This means that an updated declaration submitted after the signing of the act cannot serve as a reason to terminate all initial verification activities. In other words, nothing prevents inspectors from making a decision on a fine in connection with distortions found in the primary declaration.

Arbitration practice on this topic is contradictory. Sometimes judges claim that the end date of the “chamber chamber” is the day the decision is signed, and not the inspection report. And if clarifications are presented after the act is signed, but before the decision is made, then the initial check should be stopped. As a consequence, a fine on the primary declaration is impossible (see, for example, resolutions of the FAS of the Volga District dated 07/08/14 No. A57-15314/2013, FAS ZSO dated 07/02/14 No. A03-1691/2013). But there are also opposite solutions. For example, the AS of the Far Eastern District admitted that clarifications submitted after the signing of the act do not oblige employees of the Federal Tax Service to stop the initial inspection and cancel the fine (resolution dated November 7, 2014 No. F03-4545/2014).

It is difficult to predict what verdict the court will render in a similar dispute. And yet, in our opinion, if the fine is significant, it makes sense for the taxpayer to submit a “clarification” with corrections.