The rules for calculating average earnings are the same for all payments, with the exception of sick leave and child care benefits. They are regulated by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. The procedure for taking into account monthly, quarterly and annual bonuses in calculating average earnings has its own peculiarities. It is very important not to make mistakes in the calculations - the correctness of employee accruals depends on this. How to take into account bonuses when calculating average earnings is written in paragraph 15 of Resolution 922. The inclusion procedure depends on the period for which the remuneration is paid.

The need to calculate the average salary

You may need to find out the amount of average monthly, average annual, or calculated earnings for other periods in the following situations:

- when calculating vacation pay and travel allowances;

- to determine the amount of severance pay upon dismissal of an employee;

- upon receipt of accruals during business downtime;

- for an employee transferred to a job with lower earnings, the amount of which should be less than the average at the previous workplace.

The concept of “average earnings” should not be confused with the amount established by the state. The average salary indicator used to calculate alimony and other payments is calculated in a special way and applies to the country as a whole. It is calculated annually, without changing the amount until the end of the billing period.

Average salary in Russia. And also in Moscow, St. Petersburg and in the regions!

conclusions

- Calculation of the average salary is necessary to determine the amount of vacation and maternity pay.

- Not only salaries are taken into account, but also rewards.

- Annual, quarterly, monthly and one-time payments are taken into account.

- Only the remunerations stipulated by the accounting policy of the enterprise are important. If they are accrued unofficially, then they are not recorded.

- When accounting for amounts, you must be guided by the rules established by the relevant regulations.

- It is important to remember some features. For example, only 12 monthly bonuses accrued according to one indicator are taken into account.

- If there are several bases for accrual, then several remunerations can be taken into account.

The need to take into account the annual bonus in calculating average earnings

According to government decree No. 922 of December 24, 2007, all bonus payments must be taken into account when calculating the average salaries of employees. Moreover, if the amounts of vacation pay, travel allowance or severance pay are calculated before the bonus is accrued, a recalculation is required. And then pay the employee the missing amount.

In cases where the employee continuously performed his duties during the period under review (that is, a year), the annual bonus is taken into account in full (100%). But, if during this period he had non-working days, two options for events appear:

- for organizations that calculate the annual bonus based on the fact, and not on the time worked by the employee, only part of it is taken into account in the calculations - in proportion to the period of work;

- in enterprises where annual bonus payments to employees depend on actual working hours, the annual bonus is used in full in the average earnings formula.

As an example, consider a situation where an employee of an organization goes on vacation on January 25, 2021. The calculation is performed in the accounting department at the beginning of the month, taking into account the earnings for the year worked by the employee (see The best accounting programs: comparison, advantages and disadvantages). During this time he received 350 thousand rubles. salaries, 10 thousand rubles. for a five-day business trip and 60 thousand rubles. annual bonus for 2016. Before going on vacation, all personnel of the organization receive an annual bonus in the amount of 70 thousand rubles. (in fact, excluding time worked) for 2017.

The calculation is performed as follows:

- in the calculations, not 247 working days of 2017 are used, but 242, since the employee was on a business trip for 5 days;

- according to the current legislation of the Russian Federation, the bonus for 2016 is not taken into account in the calculations due to the fact that the period for which it was paid does not relate to the previous calendar year;

- annual bonus payments for 2017 are taken into account when determining average earnings only after they have been accrued.

When preliminary calculating vacation pay, 70 thousand not yet paid are not taken into account - as well as 60 thousand for the previous billing period. And the amount received by the employee going on vacation requires recalculation - but not 70,000, but 70,000 x 242/247 = 68,583 rubles are taken into account. And he will be paid vacation pay twice. The main amount immediately, the additional amount - after the bonus for 2017 arrives and changes are made to the formula.

Can a salary be less than the minimum wage?

Basic Rules

The procedure for calculating wages is established by Article 139 of the Labor Code of the Russian Federation. The nuances of carrying out calculations are established by the Regulations of the Russian Federation of January 24, 2007 No. 922. Clause 2 of the Regulations establishes the inclusion of all additional payments in the average salary when calculating it. Additional payments include bonuses. When carrying out work, it is necessary to take into account the actual wages, as well as the actual time during which the employee worked.

Typically, the average salary is calculated annually. This is a standard reporting period. However, it can be different, depending on the needs of the enterprise: quarter, week. The period must be specified in the accounting policies of the organization. The selected period of time should not violate the rights of employees.

The bonus is included in the remuneration only when it is specified in the Regulations on remuneration of the enterprise. Only bonuses given for work in the organization are taken into account.

IMPORTANT! “Anniversary” payments (for example, paid for a decade of service in the company) are not taken into account when performing work. They are not directly related to the employee's merits.

In what cases are annual bonus payments not taken into account?

The Decree of the Government of the Russian Federation provides that when determining the average salary, all types of bonuses reflected in the regulatory documentation of the organization are taken into account. These also include annual bonus payments for the billing period. Accounting is not required only in cases where the company’s documents do not contain a clause that specifies the calculation of annual bonus payments to employees.

If a bonus for the year was assigned not in accordance with the collective agreement or other documentation, but for other reasons, its size will not affect the average salary. The situation can be corrected by changing the provisions of the relevant documents. Or include the annual bonus among other types of payments - one-time ones, which are taken into account in any case.

Minimum wage from January 1, 2021 in Russia - Regional minimum wage and subsistence minimum

We establish rules for calculating bonuses for the quarter

Bonuses paid quarterly are characterized by the following points:

- inclusion in the wage system used by the employer, i.e., thereby equating quarterly bonuses to wages (Article 129 of the Labor Code of the Russian Federation);

- the presence of an undoubted connection with the results of labor activity of each individual employee during the bonus period;

- systematic (regular) accrual;

- attitude towards all members of the workforce or the vast majority of them;

- dependence of the possibility of accrual on the overall results of the employer’s financial and economic activities for the bonus period;

- compulsory accrual to the employee if all the conditions that give him the right to receive bonuses are met.

The inclusion of bonuses in the wage system and the need to develop bonus rules common to the entire team require the employer to create internal regulations (Article 135 of the Labor Code of the Russian Federation) establishing:

- the structure of the wage system, for which documents such as wage regulations or a collective agreement are created;

- employee incentive system, which can be covered both in documents devoted to the remuneration system and in a separate document called the provision on incentive payments (on incentives, on bonuses).

The regulations on incentives in relation to bonuses should reflect:

- a list of all types of bonuses used by the employer;

- frequency of payment of bonuses of each type;

- the range of employees entitled to receive each type of bonus;

- conditions under which the accrual of bonuses becomes possible;

- a system for assessing the labor participation of each employee in the general labor process and translating it into specific bonus amounts;

- description of the procedure for reviewing the results of assessing the labor participation of each employee;

- criteria under which an employee is deprived of a bonus (deprivation of bonuses);

- a procedure that allows an employee to challenge the evaluation of his work performance.

The employer can establish the possibility of simultaneous accrual of several types of quarterly bonuses. But they must differ in the reason (ground) for the bonus. Moreover, each type of bonus may have its own circle of rewarded employees, its own conditions for accrual, its own evaluation system and its own grounds for depreciation.

For information on how to draw up a document combining a description of the wage system and the incentive system, read the material “Regulations on the remuneration of employees - sample 2020”.

Using a one-time bonus in calculating average earnings

One-time bonus payments that require full accounting include the following types of bonuses:

- received for labor performance;

- paid on holidays or anniversaries;

- assigned for the quality of a specific task performed by an employee.

If a one-time bonus was paid for a period of time - an object under construction for several months or exceeding the plan - you need to use formulas. For employees who have fully worked for the specified period, the one-time payment is paid in full. Employees who were on a business trip or did not perform their duties for another reason will be paid less - in accordance with the time worked. An employee who was not registered with the company for part of the period for which the bonus was paid will also receive a smaller amount.

We calculate bonuses based on actual earnings

The most understandable, fairly simple and does not require additional processing of accrual data for subsequent application is to calculate the bonus as a percentage of actual earnings. It allows you to directly take into account when calculating bonuses the time actually worked by the employee during the bonus period (since actual earnings depend on the time worked), which will subsequently turn out to be important for taking these accruals into account in calculating the average earnings.

About when you need to calculate the average salary and how this calculation is carried out, read the article “How to calculate the average monthly salary (formula)?”

For this method of assessing the amount of bonuses, the provisions on incentive payments may establish 2 options for determining actual earnings:

- as the entire volume of actual wages accrued during the bonus period;

- as the average monthly salary, calculated based on bonus quarter data.

To calculate the bonus according to the first option, it is necessary to sum up the entire salary of the employee actually accrued to him for all months of the billing quarter, also including in this salary the amount of monthly bonuses. And then multiply the resulting value by the percentage indicated in the incentive regulations as applied to the quarterly bonus of the corresponding type.

To calculate the second option, the percentage related to the corresponding bonus will need to be applied to the calculated average monthly salary for the bonus quarter. The value of the average monthly salary in this case is obtained by dividing by 3 the total amount of the employee’s salary actually accrued to him for all months of the billing quarter, including monthly bonuses in the total amount.

Practical situation from ConsultantPlus: Is it possible not to pay an employee a bonus during the probationary period? The answer to this question depends on what kind of remuneration system the employer has adopted. You can find out more details in K+ by receiving trial demo access to the legal system for free.

Quarterly bonus in calculation of the employee’s average earnings

Clause 15 of Regulation No. 922 dated December 24, 2007 provides for the procedure for determining average earnings, based on which it follows that when taking into account quarterly bonus payments, the month of accrual is taken into account. And the period during which the bonus is accrued is not taken into account. Therefore, in contrast to accounting for annual bonuses, quarterly bonuses are included in the formula for determining average income if they are received by the employee during the pay period. And, for example, in one year vacation pay can be calculated based on three bonuses for quarters, and in another – on five.

The amounts of quarterly bonus payments are taken in full if the employee has worked all the time for which they were paid. In other cases, recalculation is performed for each quarter in proportion to the time worked - but only within the billing period. For example, we can consider 2 situations:

- The employee worked without breaks from September 2016 to August 2017. In September 2016, he received a bonus in the amount of 10 thousand rubles. for the third quarter;

- The employee performed his job duties during the same period. But a quarterly bonus of 15,000 rubles. received in March 2021 for the first quarter. However, he did not work for good reason throughout February.

In the first case, to determine average earnings, 100% of the quarterly bonus received at the beginning of the billing period is taken. It does not matter that in July and August 2016 the employee was not registered with the enterprise. The main thing is that they fully worked for the year taken as the calculated year. And the formula will include a value of 10,000 rubles.

For the second situation, the month during which the employee did not perform his duties falls into the billing period, as well as the quarterly bonus. This allows you to reduce the amount taken into account when determining average earnings. The bonus payment for the period from January to March 2017 is partially taken into account - with a coefficient of (136+175)/(136+143+175) = 0.685. The figures in the calculation are equal to the number of working hours in January, February and March, respectively. And for the average income formula to determine vacation pay, the value 15,000 x 0.685 = 10,275 rubles will be used.

How to save money with a small salary: everything is simpler than it seems at first glance

The procedure for accounting for bonuses

The accounting procedure is specified in paragraph 15 of Regulation No. 922. The following forms of remuneration will be taken into account:

- Monthly . No more than one payment is taken per 30 days.

- Bonuses for a period of more than a month . For example, they can be quarterly.

- Annual.

- For length of service . Available with extensive work experience.

ATTENTION! If the employee did not work the entire pay period, then the actual remuneration received is taken into account. This point is specified in the letter of the Ministry of Health and Social Development of the Russian Federation dated March 5, 2008.

IMPORTANT! When calculating, working dates are taken into account, not calendar dates.

Results

The nuances of calculating the average earnings of employees of an organization who go on vacation, quit or go on a business trip are fully regulated by the relevant regulations of the Government of the country (see Bonuses when calculating vacation pay in 2021. The procedure for calculating bonuses). In the same document you can find answers to your questions. And, in addition to recalculations in proportion to the time worked, it should be taken into account that all bonuses included in the average income formula must be indicated in the text of the company’s local regulations.

If the organization’s documents do not contain any mention of bonus payments, the amounts are not included in the calculations. Most often this concerns bonuses not related to the work activities of employees. Or material incentives that are not reflected in the contract, which is concluded with an employee without his employment in the company.

Questions from our readers

Ask your question in the comments below and get a free answer! |

If the period has been fully worked out

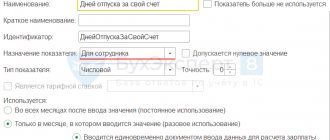

If the billing period is not fully worked out, monthly bonuses should be taken into account in full if the following conditions are simultaneously met:

- the period for which they are accrued (premium period) is included in the calculation;

- bonuses are accrued for the actual time worked in the bonus (working) period.

If the billing period has been worked out in full, include in the calculation bonuses accrued in the billing period, regardless of whether the period for which they are accrued is included in the billing period, and regardless of the accrual conditions (paragraph 5 of clause 15 of the Regulations approved by the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922).

If the billing period has not been fully worked out, the accrued bonus must be recalculated in the following cases:

- if the period for which the bonus is accrued is included in the calculation period, but the bonus is accrued without taking into account the time worked by the employee;

- if the bonus period does not coincide with the calculation period (or simply is not included in it) - and regardless of the conditions for calculating the bonus.

| Premiums taken into account | = | Bonuses accrued to the employee | : | Number of working days (hours) in the billing period according to schedule | X | Number of days (hours) actually worked in the billing period according to schedule |

Such rules are established in paragraph 5 of clause 15 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

If an employee is awarded several monthly bonuses for the same indicator, check how many of them can be included in the calculation. When calculating average earnings, you can take into account no more than one such monthly bonus for each month of the billing period.

For example, if in a billing period of 12 months an employee is awarded 13 monthly bonuses for the same indicator, only 12 of them can be taken into account.

Situation: which monthly bonuses should be taken into account when calculating average earnings. For the same indicator, the employee was awarded more monthly bonuses than can be taken into account

You decide which of these bonuses to take into account when calculating your average earnings.

In this case, various options are acceptable. For example, you can include in the calculation:

- the highest of the prizes;

- the last of the bonuses accrued in the billing period.

The procedure for accounting for bonuses should be specified in the collective agreement, the Regulations on bonuses, or a separate order from the head of the company.

When calculating vacation pay, you can take into account quarterly bonuses that are accrued in the billing period. This is stated in paragraph 15 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

If the billing period has been fully worked out, include bonuses in the actual amount in the calculation. Of course, provided that the bonuses are accrued in the billing period.

- if the period for which the bonus is accrued is included in the calculation period, but the bonus is accrued without taking into account the time worked;

- if the bonus period does not coincide with the calculation period (is not included in it or is partly included) regardless of the conditions for calculating the bonus.

In both of these cases, recalculate the bonus in proportion to the time the employee actually worked in the pay period.

Thus, if on any days of the billing period an employee was sick (was on vacation, went on a business trip, etc.), the reduced amount of bonuses will have to be included in the calculation of average earnings.

| Premiums taken into account | = | Bonuses accrued to the employee | : | Number of working days (hours) in the billing period according to schedule | X | Number of days (hours) actually worked in the billing period according to schedule |

This procedure follows from paragraph 5 of clause 15 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, and the letter of the Ministry of Health and Social Development of Russia dated March 5, 2008 No. 535-17.

Example

To the employee of Smena LLC, V.S. Solovyov. leave is granted for 14 calendar days starting from July 6, 2015. The billing period - from July 1, 2014 to June 30, 2015 - was not fully worked out by Solovyov. In the period from July 7 to July 20, 2014 (10 working days) he was on vacation.

– in July 2014 – for the second quarter of 2014 in the amount of 10,000 rubles;

– in October 2014 – for the third quarter of 2014 in the amount of 8,000 rubles. At the same time, the bonus is accrued taking into account the actual time worked in this quarter;

– in January 2015 – for the fourth quarter of 2014 in the amount of 12,000 rubles;

– in April 2015 – for the first quarter of 2015 in the amount of 15,000 rubles.

In this case, when calculating vacation pay, the last three bonuses must be taken into account in the amount in which they were accrued. After all, the employee worked the first half of 2015 in full, and the bonus for the third quarter of 2014 was calculated taking into account the actual time worked.

But the bonus for the second quarter of 2014 cannot be taken into account in full. After all, it was accrued for a period that was not included in the calculation period. This bonus is recalculated in proportion to the time worked in the billing period.

10,000 rub. : 246 days × 236 days = 9593.50 rub.

If an employee is awarded several quarterly bonuses for the same indicator, check how many of them can be included in the calculation. When calculating average earnings, you can take into account no more than four quarterly bonuses for each indicator. For example, if in a billing period of 12 months an employee is awarded five quarterly bonuses for the same indicator, only four of them can be taken into account.

Such premiums are taken into account regardless of the moment at which the annual premium is accrued - during the billing period or not. The main thing is that the company pays it for the previous calendar year.

That is, if an employee goes on vacation in 2015, only the annual bonus for 2014 can be taken into account. Moreover, if an employee took a vacation, say, in January 2015, and in February he was awarded a bonus for 2014, the vacation pay should be recalculated, taking into account the annual bonus, and the difference should be paid to the employee.

Example

25,000 rub. × 12 months : 12 months : 29.3 days × 14 days = 11,945.39 rub.

(25,000 rub. × 12 months. 25,000 rub.) : 12 months. : 29.3 days × 14 days = = 12,940.84 rub.

Thus, the employee needs to accrue an additional 995.45 rubles. (12,940.84 – 11,945.39).

Example

Employee of Sokol LLC Semenov P.A. goes on vacation in February 2015. The billing period is from February 1, 2014 to January 31, 2015 (a total of 245 working days according to the 5-day working week calendar). In February 2015, the employee was awarded a bonus of 15,000 rubles. – based on the results of work in 2014. That is, the billing period does not coincide with the period for which the remuneration was paid.

15,000 rub. : 245 days × 225 days = 13,775.51 rub.

Situation: what bonuses to take into account if two annual bonuses fall into the billing period at once. An employee goes on vacation in February 2015, in January he was paid a bonus for 2014, and in March 2014 he was paid a bonus for 2013

In this case, only the bonus accrued to the employee for the previous calendar year, namely for 2014, is taken into account. The bonus for 2013 does not need to be taken into account when calculating vacation pay.

These are bonuses that are not tied to any time period. Include one-time bonuses paid for meeting labor targets in the calculation of average earnings (paragraph 2, paragraph 1, letter of the Ministry of Labor of Russia dated July 10, 2003 No. 1139-21). This rule applies if the requirements common to all payments are met. That is, if one-time bonuses are provided for by the remuneration system and accrued in the billing period.

As a rule, one-time bonuses are paid not for a certain period, but upon the occurrence of a specific event (exceeding planned targets, a holiday, etc.). Therefore, when determining the amount of an employee’s earnings for the pay period, take them into account in full.

But at the same time, one-time bonuses not provided for by the remuneration system are not taken into account. In particular, there is no need to indicate amounts paid to employees on holidays, anniversaries, etc. That is, which are not related to labor performance.

If the billing period is not fully worked out, monthly bonuses should be taken into account in full if the following conditions are simultaneously met:

- the period for which they are accrued (premium period) is included in the calculation;

- bonuses are accrued for the actual time worked in the bonus (working) period.

If the billing period has been fully worked out, include in the calculation the bonuses accrued in the billing period, regardless of whether the period for which they were accrued is included in the billing period, and regardless of the accrual conditions.

This is stated in paragraph 5 of clause 15 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

How is the bonus amount calculated?

If an employee has worked the reporting period in full, without absences, the bonus is accrued in the full amount provided for by the terms of the employment agreement.

If there are passes, the additional incentive reward is calculated using the formula:

Where: SP – amount of the due premium; BZ – basic value of the premium; D – number of working days in the period; RD – the number of days actually worked.

The formula is simple and universal. It is applicable to almost any period (month, quarter, half year). The base value refers to the amount of the bonus that is payable in the ideal case, that is, without missing working days.