Definition of special equipment objects

Special equipment in accounting is a term that combines concepts such as special-purpose equipment, fixtures, and tools.

Accounting for special equipment is determined by the Methodological Guidelines for the accounting of special tools, special devices, special equipment and special clothing (hereinafter referred to as Guidelines No. 135n), which were approved by a separate order of the Ministry of Finance dated December 26, 2002 No. 135n. In paragraphs 1–9 of this document describe in detail what is meant by the concepts of special equipment, special devices and special tools, and examples are given. The main features of special equipment are as follows: firstly, it is a means of labor, and secondly, it is used to perform individual operations that go beyond the scope of standard or standard production. In other words, special assets are contrasted with fixed assets that are constantly used to manufacture standard products.

Depending on the specifics of production, the company must specify in its accounting policy which items should be classified as special equipment.

IMPORTANT! Starting from 2021, the procedure for accounting for inventories, including special equipment, changes significantly. Everyone will have to keep records according to the new standard - FSBU 5/2019 “Inventories”. Recommendations from ConsultantPlus experts will help you prepare for the transition to the new rules. Get trial access to the system for free and proceed to the material.

Standard composition

The law does not contain a list of characteristics by which an object is determined. Traditionally, household supplies mean the following objects:

- Office furniture: sofas, tables.

- Communication equipment: telephones.

- Electronic equipment: cameras, tablets, computers.

- Tools for cleaning the internal and adjacent areas of the enterprise: vacuum cleaners, rakes, mops.

- Fire safety tools: fire extinguishers.

- Lighting tools: lamps, lanterns.

- Toilet supplies: towels, hand drying equipment, air fresheners, toilet paper, soap.

- Stationery: pens, pencils, notepads.

- Household appliances for equipping kitchen premises: microwaves, refrigerators, electric kettles.

The list of accessories will depend on the size of the enterprise and the type of its activity. However, the main list is standard.

Accounting for receipt and write-off of special equipment objects

Special equipment is acquired by the organization at its actual cost when transferring property rights to it and in case of independent production. The company has the right to choose the method of accounting and writing off the cost of the special equipment item as expenses. One of the main selection criteria is the service life of specific equipment.

Option 1. Service life of special equipment is more than 12 months

Guidelines No. 135n provide a choice of 2 accounting methods indicated below:

1. Accounting is maintained as required by PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance dated March 30, 2001 No. 26n.

If the cost of special equipment is less than 40,000 rubles, then the enterprise’s accounting department has the right to take it into account as inventories (clause 5 of PBU 6/01), and it can be written off as costs at a time when it is put into production.

If the cost exceeds 40,000 rubles, then the special equipment is recognized as a fixed asset.

Fixed assets are written off as expenses using the institution of depreciation over their useful life.

For details on methods of depreciation of fixed assets, read the article “Rules for calculating depreciation of non-current assets.”

2. The accounting department should reflect the objects of special assets as a debit to the 10th account “Materials”, the subaccount “Special equipment and clothing in the warehouse” in correspondence with accounts 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with different debtors and creditors." In case of independent production, the costs accumulated on accounts 20 “Main production” or 23 “Auxiliary production” will need to be transferred to the 10th account using the subaccount “Special equipment and clothing in the warehouse”. Moreover, this is done even when the equipment item bypasses the warehouse and is sent directly to production (clause 17 of Guidelines No. 135n).

Methodological guidelines establish the need for analytical accounting. In circumstances where a special asset is transferred to production immediately from a warehouse, it is necessary to reflect this operation on the following sub-accounts:

- Dt 10 subaccount “Special equipment and protective clothing in operation” Kt 10 subaccount “Special equipment and protective clothing in the warehouse”.

Companies are also allowed to keep such records off the balance sheet. This is done for the convenience of monitoring safety in circumstances when the special asset is completely written off for production.

There are 3 ways to write this off:

- in direct proportion to the volume of products produced (work performed or services rendered);

- linearly (based on the provisions of clause 24 of Methodological Instructions No. 135n);

- repayment in full at the time of transfer to production (based on the provisions of clause 25 of Methodological Instructions No. 135n).

The cost of special assets is written off by debiting the production cost accounts and crediting account 10 “Materials”, subaccount “Special equipment and clothing in use”.

Example:

The company purchased welding equipment for a special limited edition of garden fences. The cost of the welding machine is 78,000 rubles; the amount includes 18% VAT. It is planned to use this device for 15 months. The accounting policy states that such equipment is accounted for as part of inventories, and the linear method is used for write-off.

Despite the fact that the time of use of special equipment will exceed a year, and the cost is more than 40,000 rubles, it can be taken into account in current assets. The purchase transaction is reflected as follows:

Dt 10 subaccount “Special equipment and clothing in the warehouse” Kt 60 - 66,102 rub.

Incoming VAT reflected:

Dt 19 Kt 60 — 11,898 rub.

The special equipment has been transferred to production:

Dt 10 subaccount “Special equipment and special clothing in operation” Kt 10 subaccount “Special equipment and special clothing in the warehouse” - 66,102 rubles.

The monthly write-off amount for 15 months will be 66,102 / 15 = 4,407 rubles.

Special equipment was written off as expenses in the 1st month of operation:

Dt 20 Kt 10 subaccount “Special equipment and protective clothing in operation” - 4,407 rubles.

Important! Recommendation from ConsultantPlus Write off damaged goods, materials and other valuables that have become unusable, as well as shortages of these valuables, from inventory accounts. Debit their cost...(for more details, see K+).

Option 2. Service life of special equipment is less than 12 months

Accounting is carried out only with the help of Methodological Instructions No. 135n, as discussed in paragraph 1 of this article.

Example:

A ceramics factory has purchased molds for casting that will be used to produce a holiday batch of flower pots. Purchase cost 280,000 rubles. without VAT. It is planned to produce 7,000 pieces. pots in 5 months. The accounting policy states that such devices are taken into account as part of the inventory, and costs are charged in proportion to the volume of production.

Despite the fact that the service life of this special asset is less than 12 months, it should still be written off not at a time, like ordinary inventories, but proportionally. This helps to evenly reflect the cost of production across months, without sudden jumps due to one-time write-offs.

In the 1st month, 1,500 units were produced, in the 2nd - 1,000 units, in the 3rd - 1,700 units, in the 4th - 1,800 units, in the 5th - 1,000 units .

The purchase is reflected by the following entry:

Dt 10 subaccount “Special equipment and clothing in the warehouse” Kt 60 - 280,000 rub.

Special equipment is transferred to production:

Dt 10 subaccount “Special equipment and special clothing in operation” Kt 10 subaccount “Special equipment and special clothing in warehouse” - 280,000 rubles.

The write-off amount in the 1st month will be 280,000 / 7,000 × 1,500 = 60,000 rubles.

The write-off amount in the 2nd month will be 280,000 / 7,000 × 1,000 = 40,000 rubles.

The write-off amount in the 3rd month will be 280,000 / 7,000 × 1,700 = 68,000 rubles.

The write-off amount in the 4th month will be 280,000 / 7,000 × 1,800 = 72,000 rubles.

The write-off amount in the 5th month will be 280,000 / 7,000 × 1,000 = 40,000 rubles.

Special equipment is written off as expenses each month of operation by wiring:

Dt 20 Kt 10 subaccount “Special equipment and clothing in operation.”

Summarize. The table below lists all possible ways to account for special equipment and the cases in which they are applicable.

| Accounting method | Conditions of use |

| The method is available for any equipment and for all cases. |

| The method is available for any equipment and for all cases. |

| The method is available when the useful life of special equipment exceeds 12 months. |

| The method is available if the useful life of the special equipment exceeds 12 months and if its cost does not exceed 40,000 rubles. It is allowed to establish a different value threshold in the accounting policy, but in any case it should not exceed 40,000 rubles. |

Results

Thus, depending on the choice of the organization, on its features and specifics, special equipment can be accounted for as ordinary materials and written off at a time when released into production, or it can be written off evenly as fixed assets or materials.

The accounting policy must describe in detail how the organization reflects special equipment, in accordance with which regulations.

It is worth noting that for different types of special assets, different methods of non-lump sum write-off are possible. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Uniform accounting

A little about uniform and its differences from special clothing. Workwear is a means of protection, and despite the ambiguity of accounting issues during dismissal, for many others it has a clear framework outlined by the current legislation. In addition, there is such a thing as uniforms. It serves to identify an employee as a person belonging to a certain organization or structure. For many professions, wearing a uniform is required by law. Many organizations introduce uniforms in the workplace to improve the quality and speed of customer service and to create the company's image.

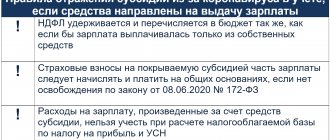

Issues of accounting for uniforms are not always covered by the tax code, and the positions of regulatory authorities are not always coherent and uniform. It should be noted that two options are possible:

- The form is issued to the employee for the duration of his work and is the property of the company;

- The uniform becomes the property of the employee and remains in his possession after dismissal.

In the first case, expenses are taken into account as material costs, in the second, such transfer is reflected as wages with personal income tax. If the issuance of the form is required by law, insurance premiums do not need to be made; otherwise, insurance premiums will be charged. If you regularly have questions, our 1C technical support specialists will be happy to help you. Just call or leave a request on the website, we will contact you as soon as possible.