A strict reporting form is an alternative to a cash receipt, or a document that certifies the fact of cash payment for the sale of goods or services to the public. Previously, entrepreneurs could choose whether to use cash registers or write out this form. However, after changes in the law on the use of cash registers and the transition of business to online cash registers, the requirements for BSO also changed.

Strict reporting forms include a variety of documents on the provision of various services to the population. These include railway, bus and air tickets, various receipts, vouchers, repair orders, subscriptions, coupons and the like.

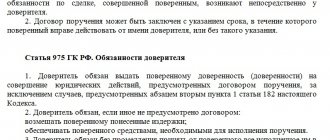

The current version of Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards” has become revolutionary not only in terms of the implementation of online cash registers, but also in terms of requirements and the possibility of using strict reporting forms (SRF) - these are documents that were equal in value to cash receipts and replaced them in the absence of cash registers. Any entrepreneur or organization providing services to citizens had to issue such a document in case of payment in cash or a plastic bank card. Strict reporting included the procedure for producing such forms and the requirements for their execution and storage. These points were regulated by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359. But in 2021, the situation has changed, and not all businessmen have the right to use BSO. We will tell you what BSO is and how the legal requirements for their use have changed.

Under what circumstances does an individual entrepreneur have the right to use strict reporting forms?

The legality of using strict reporting forms for the work of individual entrepreneurs instead of issuing fiscal checks is regulated by Resolution No. 359. This regulatory act allows the use of BSO by entrepreneurs working on the PSO, EVND and simplified tax system, as well as on the Unified Agricultural Tax.

If an individual entrepreneur provides services to individuals, then when accepting cash as payment, he may not use cash register systems in his work. Instead of a cash receipt, he has the right to issue a strict reporting form to confirm the fact of receiving money from the client.

If an individual entrepreneur provides services to organizations, then in this case the payment must be recorded on the cash register, that is, the entrepreneur is obliged to issue a fiscal receipt.

Who is exempt from using CCT?

The list of cases when you can work without a cash register is exhaustive and is indicated in paragraphs. 2, 3, 5, 6 tbsp. 2 of Law No. 54-FZ. These are the situations:

- issuing (receiving) cash using automatic devices for settlements in credit institutions (including electronic means of payment);

- sales of printed media and related products, if the share of sales of printed products is at least half of the turnover, and related products correspond to the assortment list approved by the constituent entity of the Russian Federation;

- sales of securities;

- sales of tickets, coupons, travel documents giving the right to travel on public transport, in vehicle salons;

- sale of food in educational institutions;

- trade at fairs, retail bazaars, exhibitions, at specially designated areas, excluding trade in trading places equipped and ensuring the demonstration and safety of goods;

- fair trade in non-food products, the list of which is established by the Government of the Russian Federation;

- peddling trade (except for the sale of technically complex goods and food that require special storage and sale conditions) in passenger train cars, from trays and hand carts, and other small-scale mechanization equipment;

- sales of ice cream, draft soft drinks in kiosks;

- sales of kvass, milk, vegetable oil, live fish and other excise-free draft goods from tank trucks, sales of seasonal vegetables and fruits by rummage;

- acceptance of waste materials from the population, excluding scrap metal, scrap of precious metals and precious stones;

- providing shoe repair and painting services;

- providing metal repair services - making keys and small metal haberdashery;

- provision of nanny and nurse services;

- sales of handicrafts, if sales are carried out by the manufacturer himself;

- providing services for plowing gardens and cutting firewood;

- providing porterage services at train stations, ports, and airports;

- leasing of real estate (housing) from individual entrepreneurs;

- work in remote settlements, the list of which is approved by a special resolution of the Government of the Russian Federation;

- sales of medicines and medical products by medical organizations located in rural areas where there are no pharmacies, or by FAP pharmacies located in villages and towns;

- sales of goods, services and products for religious and ritual purposes by religious organizations that have the appropriate license in the places where they carry out their activities.

See also the article “Who should switch to online cash registers from July 1, 2021?”

What information is contained in the strict reporting form for individual entrepreneurs?

There is no unified form of strict reporting form for each type of individual entrepreneur activity. Therefore, every businessman has the right to choose the option that fully meets his requirements.

Starting from 2021, individual entrepreneurs can produce BSO independently. They have the right to use the form format that is convenient for their work. However, when choosing a BSO, entrepreneurs should understand that the document form must contain the following mandatory data:

- document's name;

- series and serial number;

- Full name and position of the person financially responsible for issuing and correctly filling out the form;

- signature and seal of the individual entrepreneur;

- TIN;

- name of the services provided;

- price;

- payment amount paid by bank card or cash;

- date of document execution;

- other data characterizing the features of the services provided by the entrepreneur.

What is the BO-18 form?

The form of BSO under consideration is unofficial, but has become very widespread among Russian companies.

It was proposed by the private organization Rosbytsoyuz in 2008, along with several dozen other BSO forms developed for various sectors of the economy. These forms were approved by order of Rosbytsoyuz dated June 30, 2008 No. 14. IMPORTANT! From July 1, 2019, BSOs can only be printed using an online cash register. The document must contain a QR code and have requisites in accordance with Article 4.7 of the Law “On Cash Register Machines” 54-FZ dated May 22, 2003. Printed forms may only be used by individual entrepreneurs without employees until 07/01/2021.

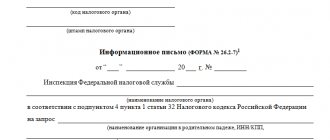

Rosbytsoyuz initiated the development of BSO forms in order to implement the Decree of the Government of the Russian Federation dated May 6, 2008 No. 359, which approved the rules for organizing payments between entities providing services and their clients without the use of cash register equipment. The legality of using the forms proposed by Rosbytsoyuz was also recognized by tax authorities (letter of the Federal Tax Service of the Russian Federation for the Krasnodar Territory dated December 10, 2008 No. 23-12/31467-472).

Thus, all forms proposed by Rosbytsoyuz comply with the requirements of Resolution No. 359. In particular, they are supposed to reflect (clause 3 of Resolution No. 359):

- name of the form, its number and series;

- name of the service provider;

- addresses and TIN;

- type of service provided, its cost;

- the actual amount of payment for the service provided;

- dates of settlement with the client and execution of the form;

- Full name of the individual supplier's employee, his signature, and, if available, his seal.

Resolution No. 359 allows you to include in the structure of the BSO other information that reflects the characteristics of the provision of services in certain business segments.

Form BO-18 (“Receipt-agreement for services of motels, campsites, hotels”) is used by entrepreneurs who:

- directly provide services for the provision of hotel accommodations;

- are intermediaries between such individual entrepreneurs and their clients.

Let's consider the features of its structure.

Where can I get strict reporting forms?

It is possible to issue a BSO for entrepreneurs working under the simplified tax system and providing services in 2021 in only 2 ways:

- Typographic method. Before printing the BSO, it is important to ensure that the document complies with all legal requirements. The form must contain information about the manufacturer, tax identification number, circulation, order number and year of manufacture. If such details are present, then the prepared form can be used for work.

- BSO printing by automated system. This method allows you to generate forms electronically via cash register.

This might also be useful:

- Rules for issuing an employment order

- Rules for drawing up an employment contract between an individual entrepreneur and an employee

- Constituent documents of individual entrepreneurs

- Registration of an individual entrepreneur cash register in 2021

- Registration of individual entrepreneurs via the Internet

- How to open an individual entrepreneur: step-by-step instructions

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to fill out forms correctly?

If the payment between the buyer and the individual entrepreneur is made only in cash, then all fields of the strict reporting form are filled in, except for the “Personal signature” column, if it is present on the document. Data entry into the BSO is carried out by the person responsible for accepting funds to pay for the services provided.

If payment is made by bank card, the employee first makes the payment via the terminal, then fills out the BSO. The buyer is issued a slip check and a document confirming the fact of the settlement transaction.

If the client pays money for services using a mixed type of payment, that is, by plastic card and cash, then in this case both of the above algorithms of action must be followed.

Features of inspection and accounting

Strict reporting forms printed in the printing house are necessarily entered into the Accounting Book indicating the mandatory details, namely numbers, series and names. The account book is a stitched and numbered document, secured with the personal signature of the individual entrepreneur and seal.

Inspection and accounting of forms under the simplified taxation system is carried out by the MOL (financially responsible person), with whom the individual entrepreneur enters into an agreement on accepting cash from buyers and its safety. In the absence of such an employee, the individual entrepreneur is personally responsible for all actions.

Acceptance of strict reporting forms is carried out in the presence of a commission on the day the documents are received by the organization. Their verification is carried out through an external assessment of the BSO, the number of forms, reconciliation of the series and numbers printed on the documents. Then the responsible person draws up an acceptance certificate for the BSO, which is signed by the individual entrepreneur. Only after this is permission given to use the received strict reporting forms in work.

Results

The electronic document includes:

- route/receipt - for air transportation;

- control coupon - for rail transportation;

- receipt of an electronic multi-purpose document - when using travel tickets.

The listed documents refer to strict reporting forms.

Therefore, an electronic ticket can be considered a BSO if the above documents are printed on paper. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

filling

Thus, individual entrepreneurs have the right to legally use strict reporting forms in their work, but only for the provision of services to individuals. Their application, completion and recording must be carried out in accordance with the norms of current legislation. In turn, for settlements with legal entities, the issuance of fiscal checks for individual entrepreneurs is a mandatory procedure. In this case, BSOs are not used in work.

Fines for failure to issue BSO

In all cases where the issuance of BSO is necessary, it must be carried out. Otherwise, regulatory authorities will equate this to failure to issue a cash register receipt. If for any reason the seller does not issue a correctly executed strict reporting form in paper or electronic form, he faces penalties. There are different fines for specific situations:

- for individual entrepreneurs, a fine is charged in the amount of 1/4 to 1/2 of the transferred amount. But the fine cannot be less than 10 thousand rubles;

- for legal entities 3/4 of the amount. In this case, the minimum fine is 30 thousand rubles.

In addition, the law provides for punishment if the seller repeatedly commits these offenses. So, if the total amount of funds received without registering a BSO has reached 1 million or more, sanctions are provided:

- officials on the seller's side are suspended from fulfilling these obligations for a period of up to two years;

- Legal entities and individual entrepreneurs will be prohibited from conducting this activity for three months.

Penalty cannot be avoided if, at the buyer’s request, the form is not handed over or sent by email. Here the seller faces:

- the official is issued a fine in the amount of 2 thousand rubles. In addition, the culprit receives an official reprimand and warning;

- if the violation was on the part of the organization, there is a warning and a fine, the amount of which can reach 10 thousand rubles.

BSO are documents that must not only be prepared properly, but also stored correctly. If regulatory authorities reveal a violation of the rules for storing and recording BSO, a fine of 2-3 thousand rubles is provided.

Do not forget that these forms refer to documents that require strict reporting. That is why a special book is used to record them. All actions performed with the forms are monitored by a responsible employee. In case of violations in accounting and storage, responsibility falls not only on the shoulders of the manager, but also on the employee who is responsible for the forms.