There is no uniform template approved by the state for filling out a power of attorney to represent the interests of a legal entity. Therefore, organizations have the right to independently develop the form of such a document or draw it up in free form. Large companies most often write powers of attorney on letterhead, but this is not a mandatory norm.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Form

Surely everyone understands that the oral form of any agreement does not give it legal force. This also applies to a power of attorney, which must be drawn up on paper. The attorney to whom the document is written will represent the interests of the company. That is why it is signed by the director or other manager. When designing, you can use a regular sheet of paper. Also, a standard template is used for this, which already contains all the important points.

As a rule, registration is carried out in a simple form, without the involvement of a notary. However, there are situations in which the law requires the preparation of a notarial form. The services of a notary are sought in the following cases:

- Registration of a transaction requires the mandatory presence of a power of attorney drawn up in notarial form;

- The attorney carries out transactions and various actions that are subject to mandatory state registration;

- It is planned that the trustee will dispose of the property rights. Moreover, this right is registered in the state register;

- In any circumstances when the principal wishes to record the transaction in a notary office.

Types of powers of attorney

Appearance is greatly influenced by the powers vested in the attorney to carry out certain obligations. For example, a special power of attorney is needed when the attorney needs to carry out similar tasks. For example, a responsible employee of a company regularly receives inventory items. Special powers of attorney also include those that allow company employees to drive vehicles. Practice shows that a special power of attorney is used extremely rarely. Other types of this document are the most popular.

General power of attorney to represent the interests of the organization

This power of attorney gives a full range of powers. Its bearer is allowed to perform various actions while acting as a representative of the company. Here the attorney has no restrictions; he has the right to dispose of the assets and other property of the company, make real estate transactions and perform other significant actions. If a company needs a representative to protect its rights in court, the holder of this power of attorney can become one. He can speak not only in court, but also in other institutions.

( Video : “Everything about drawing up a power of attorney”)

Features of a general power of attorney

The main feature of such a document is that it gives the representative the maximum possible rights. Having such a power of attorney in hand, the representative is allowed to transfer the power of attorney to someone else. Due to the huge range of powers, this power of attorney must be certified by a notary. Moreover, the general's license can be issued not only to employees. The law does not prohibit a company from making third parties its representatives.

As a rule, if an organization issues a general power of attorney, managers act as attorneys, for example, deputy director, head of department and other officials. This is explained by the fact that this type of power of attorney requires maximum responsibility from representatives. The Labor Code states that in this case, the trustee is assigned certain duties, rights and responsibilities. For example, when making transactions under a general power of attorney in the interests of the company, the trustee becomes financially responsible.

One-time power of attorney

When a representative needs to perform a specific action, a one-time power of attorney is issued. For example, this document is needed if the attorney is entrusted with receiving goods, sending documents, selling property, etc. It is worth noting that after the transaction has been completed, the power of attorney automatically loses its force.

Absolutely anyone can play the role of a trustee. The head of the company chooses who to issue a one-time power of attorney himself. Naturally, the personal and moral qualities of the attorney are taken into account. After all, this is the only way the principal will be sure that the attorney will fulfill the instructions assigned to him. This could be one action or several.

It would be useful to indicate the competence of the attorney. For example, if he is issued a power of attorney to receive cargo, then you can indicate that he is allowed to sign the accompanying papers. As a rule, to issue a one-time power of attorney, there is no need to engage a notary. But if the attorney has the opportunity to draw up a deed of power, it will not be possible to do without the services of a notary.

Who can represent the interests of the organization

Until 2012, there was a rule obliging organizations to issue a power of attorney exclusively for their employees. It was the company employee who had the right to represent its interests in various structures. But today the law does not prohibit issuing a permit to any citizen. In fact, the organization is allowed to write it out not only to a former employee, but also to a stranger.

Another company also has the right to represent the interests of the organization. This can often be encountered when two companies cooperate. Often there is a need to replace each other, protecting interests in various authorities. Naturally, the corresponding powers of attorney contain information that one company is authorized to represent another.

If any responsibilities are assigned to employees of the organization, a power of attorney must also be issued to them. But there is no need to draw up such a permit if the attorney is the head of the company. After all, he must always protect the interests of the company. But you need to remember that a power of attorney is necessary for heads of departments and other employees holding high positions.

What documents will be required

The permit is drawn up with the consent of the head of the organization. But first you need to prepare the necessary documentation. These include:

- memorandum of association;

- position;

- extract from the Unified State Register of Legal Entities;

- manager data;

- documents confirming official authority.

This documentation fully reflects all information about the principal and the attorney.

In what cases is it used

You need to understand that it is unlikely that the director of a large company will personally be involved in any day-to-day affairs. Therefore, he can always assign certain responsibilities to his subordinates. Accordingly, a power of attorney is used in all cases when the director delegates some of his powers to other employees. The most common cases include:

Power of attorney to court

When it becomes necessary to protect the interests of an organization in litigation, it is necessary to draw up a trust document with the utmost care. The director of the company must foresee in advance what actions the representative may need to perform. Accordingly, the attorney must have the necessary authority to do so.

Sample

Power of attorney for a car

As you know, there is no need to draw up a trust document to operate a car. But don’t forget, you can’t do without it if you need to perform some actions on the vehicle. For example, take the car in for repairs, register or deregister, and perform other actions. Only the owner should do all this. In the case of an organization, such actions are carried out by the director. However, in most cases, he delegates such powers to the driver.

Sample

Power of attorney to the tax office

Practice shows that quite often various companies have to resolve disputes, submit reports and receive documents from the tax authorities. Typically, the company grants the necessary powers to the chief accountant for this purpose. Although it could be another person. If the employee’s job responsibilities state that he must represent the interests of the company in the tax office, then such a power of attorney can be dispensed with. In other cases, it must be drawn up.

Sample

Power of attorney to receive goods/money

When transactions involving the transfer of material assets are carried out between companies, a power of attorney of this kind becomes irreplaceable. Essentially, the organization appoints a responsible person who is authorized to receive the goods. Usually, a trusted person also acts on the sender’s side. Having delivered the goods, it must receive funds. Naturally, such a representative must also have the appropriate power of attorney.

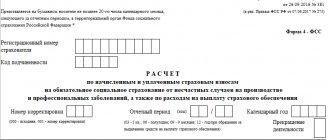

To issue a power of attorney to receive inventory items, it is recommended to use Form M-2. In addition to the tear-off coupon, there are the necessary columns that you just need to fill in with the information necessary to obtain the goods and materials. This form is used for one-time receipt. In situations where a representative needs to receive goods on an ongoing basis, a new document must be drawn up each time. Although it is possible to draw up a “reusable” power of attorney, which is drawn up in form M-2a.

Sample

How to draw up a power of attorney to represent the interests of an organization in 2021

Many companies use the appropriate form for these purposes. Here, responsible persons must enter information in the blank lines. The document must contain the full name of the organization, information about the authorized representative, and a list of powers.

You can use a ballpoint pen to fill it out. If you select manual filling, try to write legibly. A more convenient option is a computer set. After printing, the principal must put a “live” signature here.

Contents of the power of attorney

Particular attention must be paid to the content. After all, it is this information that allows the representative to fully fulfill the assigned obligations, but at the same time he will not be able to exceed his authority. You also need to provide the following information here:

- Legal form of organization;

- Validity;

- Date of signing of the power of attorney;

- KPP codes, INN, OGRN;

- Legal address of the company or its office;

- Position, full name and other passport details of the manager who signs the power of attorney;

- Personal information about the representative;

- A detailed list of assigned powers;

- Director's signature.

Preparation of documentation and applications to a notary

If the power of attorney requires notarization, the head of the company must be present during the procedure.

Video

The authorized representative may not visit the specialist. However, the citizen’s passport data will be required to carry out notarization.

A number of documents are required, the list of which includes:

- passport of the principal and passport details of the person to whom the authority to represent the LLC is transferred;

- the charter of the institution and the order for the appointment of a director;

- company details and sample seal;

- extract from the Unified State Register of Legal Entities received within 30 calendar days.

Notary services must be paid. Their price varies from 1000 to 3000 rubles. It all depends on the specifics of the current situation and the specific city.

Video

Sample power of attorney to represent the interests of an organization

Formatting the main part of the document

The basis is the “body” of the document itself. There should be information here that allows you to easily identify the representative. As a rule, this is passport data from other identification documents. It would be useful to specify where exactly the person on whom the organization entrusts such responsibility lives.

The text needs to reflect the essence of this document. So write that the bearer has the right to act as a representative of the company, protect its interests, and carry out instructions. Indicate that the attorney is allowed to enter into any transactions with various organizations.

As a rule, the trustee accepts obligations to the company by signing the text of the document. The director of the company certifies the consent of the attorney. After the power of attorney is signed, the attorney has the rights to carry out the prescribed transactions.

Document Contents

The top fragment of the document should display information about the company that is the principal, namely, the full details of the enterprise.

Next, in the main part the name POWER OF ATTORNEY is written, indicating the serial number and date of preparation.

As for the textual component of the trust document, it must display complete data about the principal company. Next comes the designation of the legal document that is the basis for the activity. Then all the data of the representative on behalf of the company is written down, namely passport data, registration address and indication code.

The person who has such an act of representation has full rights to act on behalf of the company within the framework of the powers that are specified in it.

Duration of power of attorney

The law specifies several cases when a document loses its force:

- the term has expired;

- liquidation of the trustee organization;

- the representative is declared incompetent or has died;

- the trustee no longer wishes to carry out instructions.

As a rule, such a power of attorney is issued for a period of up to three years. The minimum period is unlimited. It all depends on the orders that will be carried out. It is recommended to specify the deadline in a separate paragraph. It is worth noting that in the absence of a specific period, it will be equal to one year. The date of registration is considered the beginning of this period. Naturally, in order to know when the countdown of this time begins, it is imperative to indicate the date of compilation. In its absence, the document is considered void, i.e. has no legal force.

There are cases in which the validity of a document must begin after a certain time. In this case, you need to indicate the exact date when exactly this should happen. Often the deadline is marked by a specific date, and the action continues until 24 hours of that day.

Often a power of attorney is issued to perform a specific action. At the same time, this is indicated in the document. Accordingly, the power of attorney loses its force immediately after the specified event. It must be taken into account that not every event can be determined whether it took place or not. That is why, if there is not enough information about when the event should take place and how this can be accurately determined, the power of attorney is considered to have no specific validity period. So it is equal to one year.

( Video : “Power of Attorney: new rules”)

There is much debate about the maximum validity period. This is due to the fact that previously the law prohibited issuing a power of attorney for a period of more than three years. However, as of 2013, this requirement was abolished. Thus, in 2021, the power of attorney has no restrictions on the validity period. Although practice shows that many organizations, out of habit, continue to issue such a document for a period of up to three years. As for the minimum terms, there are no restrictions here either. Here everything is decided by the director of the trusting company.

Signatures of the parties

A power of attorney can be called a one-sided document executed by the principal. In fact, there is no need to obtain the consent of the representative to draw it up. At least, this is not provided for by law. If the attorney's signature is missing here, the document will still have legal force.

But practice shows that signatures are almost always affixed by both parties. Representatives also sign a document confirming that they accept the assigned obligations. If an organization gives an employee authority, it implies that he is willing to carry it out. Otherwise, drawing up a power of attorney simply loses its meaning.

How to fill it out correctly

When filling out a power of attorney, please note that errors in the document are not allowed. Corrections and typos are also undesirable. If it was not possible to avoid corrections, it is necessary to formalize them according to the rules: with the signatures/seals of the parties. The date of the document should be written down not in numbers, but in words, in order to avoid discrepancies later. The final sheet of the power of attorney for a representative must be signed by the represented person, the representative, and also, if necessary, by a notary or the head of the organization.