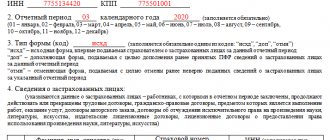

Form 1-T (working conditions) in Rosstat is information about the conditions under which citizens work in the organization:

- about the presence or absence of harmful and dangerous factors;

- on guarantees and compensation provided to employees.

The report is submitted by all employers included in the statistical sample in the current year. The form is changed annually.

Form 1-T is one of many statistical reports that employing organizations are required to submit to Rosstat. Officials regularly update reporting forms and rules for filling them out. This year was no exception; Rosstat updated many reports in order No. 412 dated July 24, 2020. The attachment contains instructions for filling out and a new form.

New report to Rosstat

For 2021, organizations submit a new report in form 1-T (working conditions), the form of which was approved by Rosstat order No. 412 dated July 24, 2020. The full name of the statistical reporting is “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions.”

The information requested by Rosstat concerns 2021. Information is divided into two types:

- The presence of harmful or dangerous factors in workplaces created in the organization.

- Availability and amount of guarantees and compensations that are due to workers employed in hazardous and hazardous industries.

Document Basics

Form 1-T (working conditions), a sample of which can be filled out below, is a mandatory statistical report. It must be submitted to the territorial office of Rosstat after the end of the reporting year. When preparing this report, business entities report on the following points:

- what condition are the workplaces in?

- what compensation is provided to working personnel.

The responsibility for drawing up this document usually falls on the occupational safety specialist. To prepare a statistical report, information is requested from the HR and accounting department. Based on the information collected, government departments are developing inspection plans and measures that will encourage employers to improve working conditions.

Who is obliged to take

The list of those who submit Form 1-T to statistics in 2021 depends on the main type of economic activity (OKVED). Organizations engaged in the following types of activities will have to provide information to territorial statistical offices:

- manufacturing industries;

- mining;

- agriculture and forestry, fishing, hunting and fish farming;

- production and distribution of energy resources, gas and water;

- construction and repair organizations;

- transport companies, carriers;

- providing communications.

The type of ownership and organizational and legal form do not play any role - you will still have to report. The only exception is made for small businesses, and when asked whether small businesses submit information on Form No. 1-T (working conditions), the answer is no: small businesses carrying out the above types of activities are exempt from submitting a report.

Find out more about reporting to Rosstat from the ConsultantPlus review.

to read.

Who should report on Form 1-T (working conditions)

Legal entities annually submit information on working conditions to Rosstat. But not everyone should do this, but only those who are engaged in certain types of activities in accordance with OKVED2. The list of respondents is as follows:

- agriculture and forestry, hunting, fishing and fish farming;

- mining;

- manufacturing industries;

- provision of electricity, gas, steam, air conditioning;

- water supply, drainage, waste collection and disposal, pollution elimination;

- construction;

- transportation and storage;

- information and communication.

Even if you are engaged in one of the above activities, you will not always have to submit the form. Individual entrepreneurs and legal entities from the list of small businesses are exempt from delivery. In addition, liquidated organizations may not submit the form for the previous year if there is already a corresponding mark in the Unified State Register of Legal Entities.

Organizations in which the number of employees on the payroll (excluding those on maternity or child care leave) at the end of 2021 is greater than zero, submit a report in any case, even if there are no employees who are engaged in harmful or dangerous work. If at the end of the year the payroll number is zero, but the organization paid compensation for working conditions, the report must be submitted in the prescribed manner.

If during the reporting period there was no observable event in the organization, you can submit a blank report with a completed title page and blank sheets, or send an official letter to the territorial body with information about the absence of the indicators being studied.

Deadline for submitting the report to Rosstat

The deadline for submitting the 1-T working conditions report for 2021 is 01/21/2021. Considering the duration of the New Year holidays, Rosstat representatives strongly recommend submitting reports in advance. Failure to comply with delivery deadlines will result in fines:

- from 20,000 to 70,000 rubles. — for a legal entity;

- from 10,000 to 20,000 rub. - for responsible and/or officials.

The instructions are contained in Part 1 of Art. 13.19 Code of Administrative Offenses of the Russian Federation. The organization will be punished for providing false information and if the company does not submit a report.

Please note where the 1-T working conditions are submitted and in what form: the form should be submitted to the territorial body of Rosstat in several ways:

- In electronic form via secure communication channels using a digital signature.

- By registered mail. When sending such a shipment, an inventory of the attachments is drawn up.

- In person, by submitting the completed report to the department specialist.

STATISTICAL REPORTING ON REMUNERATION [p.478]

In accounting, as is known, all wages are reflected in the credit of account 70 Settlements with personnel for wages, and in statistical reporting - in reporting form P-4 Information on the number, wages and movement of workers. In both cases, accrued wages are reflected. This point is methodologically very important. You should always distinguish between accruals and payments. In the term expenses this difference is eliminated. Both payments and accruals are expenses. [p.65]

The personnel assessment and remuneration department is engaged in ensuring an objective assessment of the performance of each employee, improving organizational management structures, systematically tracking the number of structural units, introducing modern remuneration systems focused on high-performance work, developing a staffing table and changes to it based on the approved structure, organizing work to compare job descriptions of engineers and conduct certification of workplaces, compiling statistical reporting on labor indicators, etc. [p.653]

To analyze wage calculations, the most popular statistical reporting is Information on the number and wages of employees by type of activity (form No. 1-T). Since January 1, 2001, all organizations have compiled and submitted to the relevant authorities a periodic reporting form Information on the number, wages and movement of workers (form No. P-4) and monthly reporting Information on overdue wages (form No. 3- F). [p.208]

Statistical analysis of production standards, forms and wage systems makes it possible to judge the mechanism of action of the law of distribution of labor in specific enterprises of two forms of ownership. The objectives of statistics arise from the socio-economic significance of wages. They consist of quantifying the size of the reporting wage fund, its composition and structure, and studying the level, dynamics and growth factors of the wage fund. These tasks apply both to the entire wage fund and to its individual components. [p.356]

A summary tabular chart of accrued wages by type of payment on an accrual basis from the beginning of the year for the enterprise as a whole is compiled once a month based on the same array as the previous tabular chart. It serves as the basis for filling out some sections of statistical reporting on labor and wages compiled by type. f. No. 2-t, 4-t and 9. In addition, the tabulagram is intended for analyzing the use of the wage fund, also (together with other tabulagrams) for filling out a certificate to the State Bank to receive money for paying wages. [p.232]

They are used to record the use of working time by employees of an organization, to monitor employees’ compliance with the established working hours, to obtain data on hours worked, to calculate wages, and to compile statistical reporting on labor. In the case of separate accounting of the use of working time and settlements with personnel for wages, it is allowed to use section 1 Accounting for the use of working time of the timesheet in form No. T-12 as an independent document. [p.223]

A timesheet for the use of working time and calculation of wages (Form No. T-12), a timesheet for the use of working time (Form No. T-13) are used to record the use of working time of the organization’s employees, to monitor employees’ compliance with the established working time schedule, to receive data on hours worked, payroll calculations, as well as for compiling statistical reporting on labor. In the case of separate accounting of the use of working time and settlements with personnel for wages, it is allowed to use section 1 Accounting for the use of working time of the time sheet in form No. T-12 as an independent document (Appendix 29). [p.181]

Such an enterprise is formed as a result of the conclusion of a lease agreement between a government agency and an organization of tenants, formed by decision of the workforce. It operates on the basis of the charter approved by the general meeting. When switching to leasing, the enterprise is obliged to undertake the fulfillment of government orders and orders for the sale of products in a volume not exceeding orders accepted for the year of its leasing. Otherwise, in organizing its economic activities, the enterprise is completely independent and is not linearly subordinate to anyone. Control over its activities, as well as accounting and statistical reporting, are carried out in the manner established for cooperatives. The income of a rental enterprise, received from proceeds after reimbursement of material costs, wages, taxes, rent, insurance payments, payments for natural and labor resources, comes at its full disposal. The rental company independently determines the procedure for hiring and dismissing employees, the form and system of remuneration, the procedure for granting days off and vacations. In order to additionally mobilize financial resources, a rental enterprise can take out loans from any bank of its choice, issue fixed-term securities (bonds), and enter the securities market. [p.265]

The daily report of the testing master is the primary document for compiling statistical reporting. The daily report data is used to pay the testing team workers. [p.130]

If we analyze statistical reporting data on labor costs (form 5-z Information on the costs of production and sales of products (works, services)), then in this reporting, as well as in the financial statements (form No. 5, section 6 Costs , produced by the organization) we will find data on actual costs written off for sold products (i.e., included in distribution costs for trade organizations. As the experience of recent years shows, arrears accumulate in wage payments, therefore the accrued wage fund, as a rule, exceeds labor costs, i.e. wages paid. But if the wage arrears did not increase, the differences between accrued and attributed to the cost of production or distribution costs (commercial expenses, according to reporting) are still inevitable part of the accrued production costs in industry, including accrued wages, is retained in work in progress, and in trade, part of accrued wages, along with other accrued distribution costs, remains to be attributed to inventories if they increase, and is not written off for sales. Of course, the opposite process is also possible, if work in progress decreases or inventories in trade decrease, wages will lag behind the write-off of costs of this type of sales. [p.352]

A rental enterprise is formed after the conclusion of a lease agreement between a government agency and an organization of tenants, formed by decision of the labor collective. It operates on the basis of the charter approved by the general meeting. The enterprise is completely independent in organizing its economic activities. Control over its activities, as well as accounting and statistical reporting, are carried out in the manner established for cooperatives. The income of the rental enterprise, received from the proceeds after reimbursement of material costs, wages, taxes, rent, insurance payments, comes at its full disposal. Along with income from business activities, property acquired at the expense of the tenant is also his property. Distribution of income to economic incentive and wage funds [p.70]

PRODUCTION COSTS - costs associated with the production and circulation of manufactured goods. In accounting and statistical reporting they are reflected as cost. They include material costs, depreciation, labor costs, interest on loans, costs associated with promoting the product to the market and its sale. Cost savings are a factor in profit growth and production profitability. By the method of inclusion in the cost of production [p.220]

USSR is statistical reporting form No. 2-t (team), which reflects information on the number of teams and the number of workers in teams (complex, specialized and cross-cutting), as well as their characteristics according to wage systems and forms of wage distribution. Based on these data, one can judge only the quantitative characteristics of the team organization of work, but not its effectiveness. [p.124]

In statistical and accounting reporting, labor costs separate out expenses that are not related to the wage fund and social payments. These, in particular, include travel expenses, expenses paid in exchange for daily allowance, the cost of uniforms issued free of charge, remaining for personal use, or the amount of benefits in connection with their sale at reduced prices, income from shares and other income from the participation of employees in the property of the enterprise , institutions, organizations (dividends, interest, payments on equity shares, etc.) insurance contributions to the Pension Fund, Social Insurance Fund, compulsory medical insurance funds, State Employment Fund of the Russian Federation payments from extra-budgetary (state and non-state) funds, in in particular, benefits for temporary disability, pregnancy and childbirth, at the birth of a child, child care, expenses for the maintenance of housing, educational and preschool institutions, first-aid posts, dispensaries, canteens, rest homes, libraries, sports facilities, etc., owned by enterprise or maintained on the basis of equity participation, etc. [p.138]

A consolidated tabulation chart of accrued wages by type of payment and category of personnel on an accrual basis from the beginning of the year for the enterprise as a whole (form No. 39) is compiled on the basis of the consolidated array OB-11. Used to control the expenditure of the wage fund throughout the enterprise. The presence in the tabulation chart of information for the reporting month and from the beginning of the year on an accrual basis characterizes the dynamics of these expenses. This tabulagram is the basis for filling out some sections of statistical reports on labor and wages for the month, quarter and year (type forms No. 2-t, 4-t, 9). It is also used to check accounting data on accrued wages for the reporting period and from the beginning of the year on an accrual basis. [p.232]

The table consists of two sections. In the first - Results of the summary of accrued wages, accrued wages are grouped in such areas as categories of employees (workers, managers, specialists, employees) and the ratio of accrued wages to the wage fund and paid from other sources. Inside the table, in addition, accrued wages are divided by type of accrual (piecework, time-based, average earnings, etc.). This will allow you to quickly and painlessly draw up statistical reports and monitor the composition of wages. In the second section - Summary data on settlements with workers and employees, summary data on settlements with employees are reflected, data on all deductions, payments and deposits of wages are summarized, which serve as the basis for entries in order journals. [p.471]

LIABILITY FOR VIOLATION OF THE PROCEDURE for submitting state statistical reporting - according to the legislation of the Russian Federation, is possible in the form of a warning or a fine in the amount of three to eight times the minimum monthly wage established by law for a violation expressed in failure to provide reports and other data necessary for conducting state statistical observations, distortion reporting data or violation of deadlines for submitting reports, and for the same actions committed again within a year after the imposition of an administrative penalty - in the form of a fine in the amount of eight to ten times the minimum monthly wage established by law. [p.151]

DEPARTMENT OF LABOR AND WAGES ORGANIZATION - a functional unit of the organization that carries out standardization and organization of labor, tariffication of labor processes, development of remuneration systems, organization and planning of labor and wages, taking into account the conditions and regimes of work and rest, management of all types of work motivation - high level wages, favorable conditions for a career, providing the necessary independence at work, creating conditions for the implementation of the ideas of one or another employee, interest in their work, ensuring the necessary independence for management and specialists, creating, if necessary, a more flexible work schedule, ensuring an environment which recognizes the employee’s merits, creating a healthy psychological climate at work, ensuring the employee’s confidence that he will not lose his job, good material support for old age, a favorable management style, ensuring satisfaction with his work, creating opportunities for self-realization of the employee as an individual, ensuring the presence of an element of competition in labor development and improvement of a system for assessing the work of personnel formation of a collective agreement and organizing control over the progress of its implementation control over compliance with the Labor Code of the Russian Federation in the field of standardization and remuneration of labor, internal regulations organization of work on certification of workplaces development of work schedules for the organization (one-, two- and three-shift mode) and coordination of work schedules of structural divisions, technical and economic analysis. indicators of structural divisions for labor; compilation of statistical reporting on labor indicators. [p.443]

Enterprises and organizations of any form of ownership are required to submit reports within the established time limits in the approved form. Since May 1992, the Law of the Russian Federation On Liability for Violating the Procedure for Submitting State Statistical Reports, which defines the legal liability of enterprises, institutions, organizations and associations for violating the procedure for submitting state statistical reporting and other data necessary for conducting state statistical observations, came into force. The law grants the state statistics bodies of the Russian Federation the right to apply to managers and other officials of enterprises, institutions, organizations and associations, regardless of their form of ownership, administrative penalties in the form of a warning or a fine in the amount of three to eight times the minimum monthly wage established by law for violation of the reporting procedure state statistical reporting, expressed in failure to submit reports and other data necessary for conducting state statistical observations, distortion of reporting data or violation of deadlines for submitting reports, and for the same actions committed repeatedly within a year after the imposition of an administrative penalty - in the form of a fine in the amount from eight to ten times the minimum monthly wage established by law. [p.36]

High-quality preparation and timely submission of operational reports to the management of the OJSC, statistical reporting forms to the NOKGS 3.65. Preparation of operational reporting on the nomenclature and volumes of industrial production, works and services, sales of shipments, sales of payments, main indicators of the financial and economic activities of the JSC, calculation of the index of physical production volume. Compilation of data on the expected fulfillment of JSC performance indicators. Accounting for manufactured products by product range (including gross output) 3.66. Preparation of reports on the performance indicators of structural divisions (volumes of sold, commercial products in current and comparable prices, labor productivity per employee, man-hour, etc.). Checking the performance indicators of departments before summing up the results of work at the bonus commission 4.11. No claims from NOKGS [p.231]

Capital invested in material circulating assets, as an integral part of the indicator of bourgeois statistics, the wealth of a nation, in its content is close to the concept of material circulating assets, stocks and reserves - one of the elements of national wealth, calculated by the statistical authorities of socialist countries. In the statistical practice of socialist countries, a clear division is made between the material conditions of labor, circulation funds and stocks of material assets in the non-productive sphere. Bourgeois statistics essentially considers the material working capital of enterprises and circulation funds as one economic category, which is contrasted with the part of the working capital advanced for wages. The source of information on material circulating assets, stocks and reserves in socialist countries are periodically conducted censuses and current reporting data. In capitalist countries, statistical study of this element of the nation's wealth is carried out only on the basis of accounting data, which are summarized in the national savings account in the section costs of increasing working capital. Gold reserves of the state in the balance sheet of the national economy are included in the reserves indicator in the system of national accounts; this type of working capital is taken into account as part of financial assets. Bourgeois statistics consider financial resources as one of them. components of capital invested in tangible working capital. This, in addition to gold reserves, includes shares of monopolies and other securities. In the statistical practice of socialist countries, financial resources are not included in accumulated national wealth. They are an independent element of the country's national wealth. [p.584]

Being a leading methodological authority in the field of eco-fuel. works, P.-e. O. directs and coordinates the work of all production units in organizing technical and economic planning, maintains statistical and operational records, as well as analysis of the implementation of basic technical and economic. plan indicators for workshops and the enterprise as a whole, instructs workers of workshops and departments on the issues of setting up operational and statistical data. accounting, compiles and submits operational and statistical data to higher organizations. reporting. Together with other departments and services of P.-e. O. takes direct part in drawing up production preparation plans and cost estimates for the development of new products, in the development or revision of regulations on the remuneration of workers, engineers and employees in accordance with the instructions of higher organizations, in summing up the results of socialism. competition and determination of all types of bonuses for incentive systems for workshop personnel, in giving opinions on reconstruction projects and technical re-equipment of both the enterprise as a whole and its individual production units. The department carries out methodological management of the activities of public organizations leading economic. work at an enterprise (for example, Public Bureaus (groups) of economic analysis). [p.246]

Responsibility for violation of the procedure for submitting statistical reporting. This liability is provided for by the Law of the Russian Federation “On liability for violation of the procedure for submitting state statistical reporting” dated May 13, 1992 No. 2761-1. In case of failure to submit reports and other data, distortion of reporting data or violation of deadlines for the submission of reports, a fine in the amount of three to eight times the minimum monthly wage established by law may be imposed on managers of enterprises and other officials or a warning may be given, and for the same actions committed repeatedly within a year after the imposition of an administrative penalty - a fine in the amount of eight to ten times the minimum monthly wage established by law. In addition, the enterprise compensates the statistical authorities for damages incurred in connection with the need to correct the results of consolidated reporting when presenting distorted data or violating the reporting deadlines. Additional work to correct the results of the consolidated reporting is drawn up in an act for the work performed, which indicates the amount of costs incurred (damage caused). In accordance with the Regulations on the claim procedure for the settlement of disputes, approved by Resolution of the Supreme Council of the Russian Federation of June 24, 1992 No. 3116, a claim is sent to the enterprises that submitted distorted data, to which is attached a copy of the act of work performed and other documents for the settlement of the dispute . If an enterprise refuses to voluntarily compensate for the damage caused, then compensation is ensured through an arbitration court. [p.121]

Based on accounting, a dynamic model of the functioning of the control object is built. Its unity is manifested in the organic relationship and interdependence of management and financial accounting and statistics. They complement each other and often use the same information. Many forms of statistical and management reporting are compiled jointly by employees of economic and accounting services (reports on production costs, on labor and its payment, production volume, etc.). [p.36]

Instructions for filling out the form

The use of forms and tables other than the unified form 1-T is unacceptable. In such a situation, the statistical authorities will not accept the report, and then the company will have to pay a fine.

According to the decision of Rosstat, the current instructions for filling out form 1-T working conditions are described in the same order No. 412 dated July 24, 2020. The document consists of three parts:

- a title page indicating the details of the reporting organization;

- the first section, which discloses information about the presence of harmful and dangerous factors;

- the second section, which provides information on the amounts of guarantees and compensation.

Let's consider the order of filling out each part.

Filling out indicators

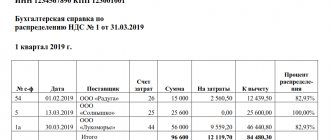

Information is provided for the organization as a whole (on line 01

) and by actual types of economic activity (on free

lines from 02

to

13

) on the number of employees, wages accrued to them and social payments for the reporting year;

information about unlisted employees is given on line 14

.

Column 4. Average number of employees (without external part-time workers and unlisted employees)

Average number of employees per year ( column 4

) is determined by summing the average number of employees for all months of the reporting year and dividing the resulting amount by 12.

The average number of employees per month is calculated by summing the number of employees for each calendar day of the month, that is, from the 1st to the 30th or 31st (for February - on the 28th or 29th), including holidays (non-working days) and weekends, and dividing the resulting amount by the number of calendar days of the month.

Columns 5 - 6. Fund of accrued wages of payroll employees and external part-time workers

To the wage fund (according to columns 5, 6

) includes amounts of remuneration accrued by organizations in monetary and non-monetary forms for hours worked and unworked, compensation payments related to working conditions and working hours, additional payments and allowances, bonuses, one-time incentive payments, as well as payments for food and accommodation that are systematic.

Column 7. Accrued social payments to payroll employees and external part-time workers

In social payments ( column 7

) includes amounts of funds associated with social benefits provided to employees, in particular, for treatment, rest, travel, employment (without benefits from state extra-budgetary funds).

Organizations using a simplified taxation system provide information in the form on a general basis.

If the organization did not pay wages and other payments in the reporting year, then the information on the form is provided without filling out this data. According to the form, during the reporting period, it is possible for the respondent to send either a duly signed report that is not filled in with indicator values, or an official letter to the relevant territorial body of Rosstat about the absence of indicators in the reporting period.

Detailed methodological instructions for filling out form indicators are set out in the Instructions for filling out federal statistical observation forms NN P-1, P-2, P-3, P-4, P-5 (m), posted on the official website of Rosstat in the information and telecommunication network “Internet” at: www.gks.ru/Information for respondents/Federal statistical observation forms and accounting (financial) reporting forms:

- Album of federal statistical observation forms, collection and processing of data, which is carried out in the system of the Federal State Statistics Service/20. Labor market;

- Orders of Rosstat on approval of Instructions for filling out federal statistical observation forms (since 2008).

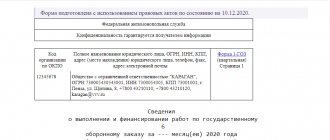

Title page

In this section we indicate the full name of the reporting enterprise, postal address and OKPO code.

IMPORTANT!

Carefully study the instructions on how to report to Rosstat using Form No. 1-T (working conditions) if the organization has separate divisions: in this case, write both the name of the separate division and the name of the legal entity. The address line indicates the actual location of the unit.

Who is required to submit reports in Form P-4

Most legal entities involved in medium and large businesses must report to the state using this form. Moreover, if any company has representative offices and branches, then a separate form must be filled out for each of the separate divisions.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

It is worth noting that some enterprises and organizations are exempt from the need to submit form P-4 to the statistical accounting service. In particular, organizations engaged in small businesses, as well as public organizations and various cooperatives have the right not to transfer it. However, it should be remembered that such a possibility must be agreed upon and approved by the state statistical agency.

Individual entrepreneurs are also not required to submit this type of statistical reporting by law.

First section

This part of the report should indicate the number of workers who are employed in hazardous or hazardous industries. All employees should be taken into account, with the exception of women on maternity leave or parental leave.

We indicate the total number of employed workers in line 01 without taking into account production factors.

In line 02, indicate the number of employees employed in hazardous industries, in accordance with the special assessment of workplaces. If one employee is exposed to several harmful factors, then count it only once.

In lines 03–13, decipher line number 02 according to the highlighted categories (factors). If one workplace is exposed to several harmful factors, consider such sites in each category.

In line 12, indicate workers exposed to increased physical stress when performing work duties, and in line 13 - mental stress.

IMPORTANT!

Fill out the first section with information without taking into account the availability of guarantees and compensation for special working conditions for employees.

How to fill

The use of any arbitrary forms developed by the enterprise is not permitted. You should report only on the form approved by order of Rosstat. Appendix 1 to the department's order No. 412 dated July 24, 2020 also contains instructions on how to fill out Form 1-T line by line in each section.

Let's look at what a sample report on labor protection at an enterprise looks like (1-T (working conditions)) for 2021. Let's start with the title page (header).

A cap

In the header of the form indicate:

- name of the organization (full and short);

- postal address of the enterprise and its index;

- actual location of the company.

If the actual address does not coincide with the legal address, then indicate the actual (postal) address. For a separate division without a legal address, a postal address with a postal code is indicated.

After filling out the header, move on to the sections.

First section

It must indicate how many employees of the enterprise are exposed to dangerous and/or harmful factors at the enterprise. All employees of the enterprise are accepted for registration. The exception is women on maternity leave and parental leave.

Line 01 contains data on the total number of employees at the enterprise without taking into account the factors affecting them.

In line 02, fill in the indicator for the total number of “employed in work with hazardous working conditions.” These data are filled in based on a special assessment. The number of workplaces that are recognized as harmful or hazardous to health is taken into account. If an employee is exposed to several risk factors, then it should be taken into account only once, without taking into account the number of factors in force.

Lines 03-13 - decoding of line 02 for individual harmful factors affecting humans. If a workplace is exposed to several risk factors, then such an employee must be taken into account for each factor separately.

Line 12 describes the employee's physical activity.

Line 13 characterizes the intensity of the mental process.

All data in the first section is provided without taking into account the availability of guarantees and compensation for employees.

Second section

In section No. 2 we write information about guarantees and accrued compensation. Do not take into account information about the calculation of regional and climatic coefficients in the table.

In column 3, indicate your total expenses for the year. Reflect the amounts of payments due to women in column 4. Fill in column 5 with the amounts of expenses incurred at the end of the year. For example, if an employee received additional payment during the reporting period, and resigned at the end of the year, then do not include the amount of accruals for the dismissed employee in column 5.

How to submit a report on part-time employment P-4 (NZ) without stress and calls from Rosstat

In addition, from 2021, the updated quarterly form No. P-4 (NZ) “Information on part-time employment and movement of workers” must be used.

Information on underemployment and movement of workers (hereinafter referred to as report P-4 (NZ)) must be submitted by everyone who is not a small business. If your staff is less than 15 people, taking into account part-time workers and executors under GPC agreements, you do not need to submit reports (clause 75 of Rosstat order No. 772 dated November 22, 2017). The average number is calculated using the formula.

Formula for calculating the average number of employees per quarter

To calculate the average number of employees per month, you need to sum up the number for each calendar day of the month according to the time sheet and divide by the number of calendar days in the month.

EXAMPLE.

WILL BE NOT ENOUGH In the organization, the average number of employees in July is 13 people, in August - 17 people and in September - 11. The average number of employees for the third quarter is 14 people (13 + 17 + 12): 3 = 14. Indicators must be in whole numbers. In this example, the company does not have to submit a report to Rosstat, because the average number of employees per quarter does not exceed 15 people.

According to paragraph 2 of Rosstat Order No. 566 dated September 1, 2017 (hereinafter referred to as Order No. 566), the report for each separate division is filled out separately.

Report submission deadlines

By January 21, it is necessary to submit a 1-T report with indicators for the past year to the statistical authorities. Several options for submitting a report are acceptable:

- by email from your office desk;

- by registered mail;

- provide documents to the address of the statistics department.

Failure to comply with deadlines for submitting a report, providing false information, as well as refusal to submit a report are subject to an administrative offense. In this case, the company faces a fine of up to 70 thousand rubles, responsible officials - up to 20 thousand rubles (Article 13.19 of the Code of Administrative Offenses of the Russian Federation).