Notifying the tax office about a change of director is a mandatory procedure required to register this event in the register of legal entities. This must be done within 3 days by submitting an application to the Federal Tax Service of the Russian Federation. The article contains a list of documents, an algorithm of actions, general rules and deadlines for submission, responsibility for violation.

Often in practice the question arises: if there is a change of director, is it necessary to submit documents to the tax office? The answer is simple: yes, it is necessary, and a fine is provided for late notification of the Federal Tax Service. A director is usually the sole executive body of a legal entity, its head, who performs important functions, including representing the organization before third parties and government agencies.

To know who acts on behalf of the legal entity, the tax office includes information about the highest sole executive body in the Unified State Register of Legal Entities. To submit new information to the Federal Tax Service, you need to fill out an application to the tax office about a change of manager. This is a simple procedure that does not require payment of state duty. But all formalities must be followed to avoid fines or re-application.

Why should you report?

The General Director has the authority to engage in business activities and make decisions on behalf of the company without a power of attorney. Therefore, information about such persons should be reflected in the general state register of legal entities - Unified State Register of Legal Entities). Such requirements are established by the legislation of the Russian Federation. Also see “Employment contract with the general director: sample 2021.”

Registration through the tax authority indicates that the director has the right to sign agreements with counterparties, and they have legal force. Therefore, when there is a change of leadership, even after local acts are drawn up, the actions of the new head are not yet significant from the point of view of the law. Also see “Order for appointment to the position of General Director: how to complete it.”

Another reason why you need to inform about the change of the main employee at the Federal Tax Service is administrative responsibility for failure to comply with this requirement. And in order to prevent all possible troubles, you need to promptly send a notification of a change in the director of the company, on the basis of which the inspectors will make the necessary adjustments to the Unified State Register of Legal Entities.

Deadlines for notifying the Federal Tax Service

The change of director must be reported to the tax authority within those working days from the date the new director takes office. Both the previous director and the current one can inform the tax office about a change in management. If the notice deadlines are not met, the company faces penalties. In the event that the period within which the notification was sent deviates slightly from the established one, then the company can only get by with a warning. If the period significantly deviates from those required by law, a fine may be up to 5,000 rubles. The company faces the same fine if it knowingly submits false information in the notification.

When to report

Current domestic legislation obliges firms to report a change in their management to the inspectorate at the place of registration no later than three working days from the moment the new employee began performing duties. Moreover, both the new and the previous chapter have the right to submit documentation.

If the notice period for a change of director , the following sanctions are applied to the legal entity:

- warning (if tax authorities do not consider the violation serious);

- fine 5000 rub. (with a significant deviation from the mentioned period).

A similar penalty is provided for cases of submitting false information. Despite the fact that difficulties may arise if the notification is filled out incorrectly.

Termination of powers of the previous director and appointment of a new director

It will be necessary to prepare minutes of the general meeting of participants (if there are several participants) or a decision of the sole participant (if there is only one participant) to terminate the employment contract with the director and transfer powers to the new director. The decision to change the director in the Protocol (decision) must be notarized if the Charter does not provide for an alternative procedure (notarization of the participant’s decisions). The decision must indicate the reason for the director’s dismissal:

- own desire (director’s statement);

- agreement of the parties (agreement);

- decision of the participants to terminate the employment contract with the director (failure to fulfill job duties, administrative violation, etc.).

It will be necessary to issue an order to terminate the employment contract and accept from the director the affairs, property, and documents of the company according to the act. Previously issued powers of attorney will continue to be valid unless this is specifically stated in the order (internal document) and their public revocation is ordered by publishing an essential fact in the State Registration Bulletin (external document).

After this, it is necessary to pay salaries, compensation, severance pay, bonuses and other agreed payments.

You will need to make a note of dismissal in the director’s personal card, familiarize it against signature, make a note of dismissal in the paper work book (electronic work book) and hand it over to the director.

After transferring the powers of the director to the new manager, registration steps must be completed.

How to fill out

The document in question contains a request to make changes about the new director to the register. The notification form has number P14001. It was established by Federal Tax Service order No. ММВ-7-6-25 and is designed to read information by machine. Therefore, it is important to know some nuances:

- The form must be filled out by hand in block letters;

- black ink is used to write data;

- no errors or corrections are allowed;

- spaces are needed between words;

- if a word needs to be transferred, no signs are placed;

- when a word begins on a new line, and the previous one completely fits into the previous one, leave an empty cell (the computer will mistake it for a space).

Further on the link you can view and download the official form of notification of a change of general director - PDF file.

Now let’s talk about how to fill out the sections of the notice of dismissal of a director (a sample can be found below).

- Title page. Enter the full name of the company, legal form, INN and OGRN. Addresses are indicated in full compliance with KLADR. In the “Application submitted” cell, enter the number 1 – due to changes in information about the legal entity.

- Sheet K - contains information about a person who has the right to act on behalf of the enterprise without a power of attorney. The page is filled out for the new and previous manager. In the section “Reason for changing information” you need to put the numbers 2 or 1, respectively – termination of authority/assignment of responsibilities.

- Sheet P - reflects information about the person who presented the notification. Information about it is carefully entered into sheets P2 and P3. The option to receive confirmation from the tax authority is also marked.

The notice must be certified by a notary to confirm authenticity and give legal significance.

Please note: Blank pages will not be sent. And it is advisable to attach the minutes of the general meeting or the decision of the participants to speed up the registration process.

The following are excerpts from a sample notice of dismissal of a director (change of CEO).

Who to notify about a change of director

Expert Firmmaker Maxim Zhitnikov: “The registration authority will independently inform the funds when there is a change of director. The organization must notify its counterparties (bank, supplier, buyer). Typically, this obligation is provided for in all contracts. How to notify a counterparty about a change of director? It is enough to notify an ordinary counterparty by a simple written message. The bank will need to provide a decision on changing the director, a record sheet and a passport of the new director, and go through the procedure of personal identification as a new director. In some cases, it will also be necessary to re-register the organization’s keys and digital signature certificates to the new manager. When fulfilling a government order, an enterprise will also need documents and the list may be wider.”

How to submit documents

The rules of the tax service regulations state that an application to change the general director can be submitted to the Federal Tax Service in different ways:

- personally to the tax office (can be done by the former or new manager (you will need to issue a power of attorney), as well as a notary);

- through a multifunctional center;

- by Russian post (it is advisable to declare the value and make an inventory of the investment);

- in electronic form through the website of the Federal Tax Service, using a special service, or using a single portal of public services;

- through a notary who certified the signature on the notification (for the procedure for submitting documents, see Article 86.3 of the Fundamentals of Legislation on Notaries).

After submitting the documentation, the applicant is given a receipt containing a list of submitted materials and the date of the response. Within five working days, the inspection makes the necessary corrections, and at the end of the procedure, issues a Unified State Register of Legal Entities entry sheet. It officially confirms the registration of the new manager.

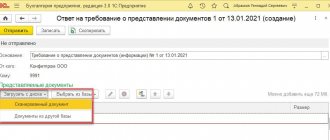

Making changes to the Unified State Register of Legal Entities in electronic form

The taxpayer’s personal account on the official website of the Federal Tax Service allows you to perform actions to change the director without a personal visit to the notary and the tax office. This is possible due to the fact that access to the office is provided only with an enhanced qualified electronic digital signature (EDS).

In this case, scanned and digitally certified documents (application on form P14001 and minutes of the meeting of participants) must be formed into a single transport container and sent to the Federal Tax Service using the service for submitting electronic documents for state registration of legal entities. If all technical requirements were met when sending, the tax authority is obliged to process such an application within 5 days. In this case, a paper copy of the registration sheet will be issued in person, through a representative with a notarized power of attorney, or sent by mail to the specified address.

The service for electronic submission of information to the Unified State Register of Legal Entities can be used not only in person, but also through a notary, if the latter has access to his personal account. So, the notary can send the application for processing himself, saving you from the need to go to the Federal Tax Service.

The dismissal of a director is sometimes accompanied by a conflict with the founders. For information on how to resign as a director without the consent of the owner, read the material “How to resign as a director without the consent of the founders?”

How to get

The procedure for issuing a notice of a change of general director depends on how you submitted the documentation (see table).

| Way | Bottom line |

| In person or by mail to the tax authority | The applicant receives a sheet of the Unified State Register of Legal Entities in the manner indicated in the application |

| Appeal to multifunctional) | It is necessary for the director or representative of the company to come to this organization |

| Notarial office | To get an answer, you need to contact a specialist who took part in the registration process. |

| Electronic portal | The result is sent to the applicant's email. If desired, you can request the document in writing. |

Reasons for refusal to register changes in the Unified State Register of Legal Entities

The list of grounds for refusal of state registration is named in the order of the Ministry of Finance dated September 30, 2016 No. 169n:

- failure to provide the full package of documents required to receive the service;

- submission of papers to the Federal Tax Service not at the place of registration (registration);

- submission of documents during the period when the company is in the process of liquidation;

- lack of a notarized form;

- signing of an application in form P14001 by an unauthorized person;

- discrepancy between the information about the director in the application and his passport data;

- receipt by the Federal Tax Service of objections from an individual regarding the entry of his data into the Unified State Register of Legal Entities;

- receipt by the tax authorities of a judicial act containing a ban on registration actions;

- provision of documents containing false information, etc.

Who else should I tell?

The general director is the person interacting with current accounts, so when there is a change in management, the banking institution must be notified about this. You will need to change your card, account access key, etc. Bankers will require a number of documents, including a copy of the Unified State Register of Legal Entities. There is no need to report changes to the pension fund, Social Insurance Fund or health insurance.

During the registration procedure, it is important to be able to correctly prepare all documents. Including notification of a change of general director . Taking into account the recommendations discussed and following our instructions, you can safely complete all formalities.

Read also

28.11.2017

When is it necessary to change the director?

The question of changing the director arises in the following cases:

- The employment contract has ended. The solution is to conclude an agreement with the previous or new director of the Labor Code of the Russian Federation, formalize changes in the Unified State Register of Legal Entities (in case of appointment of a new director);

- established by the Charter has expired The solution is to extend the term of authority (decision or protocol); there is no need to formalize changes in the Unified State Register of Legal Entities;

- An illegal change of director is a takeover of society by fraudsters. The solution is to cancel the actions, contact the tax and law enforcement authorities, a new safe charter, monitoring changes;

- Transfer of powers of the sole executive body to the manager . The solution is to replace an ordinary director with a manager (individual entrepreneur or specialized management organization) for tax optimization;

- Changing the name of the executive body (Director, General Director, President, Chairman). The solution is to register changes in the Unified State Register of Legal Entities;

- Change of participant - a new participant has the right to change the director and chief accountant. The solution is registration according to the Labor Code of the Russian Federation and changes in the Unified State Register of Legal Entities;

- Voluntary dismissal - retirement, transfer to a position, agreement of the parties, violation of an employment contract, transfer to civil service, joining the army, etc. The solution is to register changes in the Unified State Register of Legal Entities;

- Involuntary dismissal - theft, shortages, losses, improper performance of duties, disciplinary violations, removal from office. The solution is a financial audit of the enterprise, registration according to the Labor Code of the Russian Federation and changes in the Unified State Register of Legal Entities;

- Disqualification of a director - violation of labor and labor protection legislation, fictitious or deliberate bankruptcy, concealment of property or information during bankruptcy, improper management of a legal entity, transactions outside of authority, the presence of unreliable Unified State Register of Legal Entities. It's not a common occurrence, but it happens. The solution is to challenge or wait until the end of the period of disqualification;

- Accident or death of the director . The solution is to formalize changes in the Unified State Register of Legal Entities, if the founding director is the procedure for entering into an inheritance and trust management of shares;

- Liquidation of a company - change of director to liquidator. The solution is to launch the liquidation procedure of the company;

- Bankruptcy of the company - change of director to arbitration manager. The solution is to launch a bankruptcy procedure for the company.

There are many situations. Regardless of them, most decisions contain a procedure for state registration of a change of director. We'll tell you about it later.

Requirements for filling out the notification

The notification is filled out according to the approved form (P14001). Data from this form is read only by machine, so when filling it out, the following requirements should be taken into account:

- Fill out the form in block letters by hand;

- The form must be filled out in black ink only;

- Errors or corrections are not tolerated;

- Between two words an indentation is required - a space;

- When hyphenating a word, dashes are not used;

- If a word ends on a line in the last cell, then a new one is written after the space, leaving one empty cell.

Changing the general director in an LLC step-by-step instructions 2021

Information regarding the current General Director of the organization is contained in the Unified State Register of Legal Entities, and during the execution of any contracts, the other party is obliged to clarify the degree of competence of the person acting as the head of the company.

When management changes, the company is obliged to inform the tax authorities about this and make appropriate entries in the Unified State Register of Legal Entities.

In this instruction, our lawyers have tried to outline step-by-step the procedure for changing the General Director of an organization and registering these changes in the Unified State Register of Legal Entities.

This instruction almost does not affect the preparation of personnel documentation within the enterprise.

Change of general director on a “turnkey” basis (including all expenses and submission of documents by proxy) - 9,200 rubles.

How to correctly change the General Director in an LLC?

Let's look at this step by step, with recommendations, in accordance with the requirements of 2021.

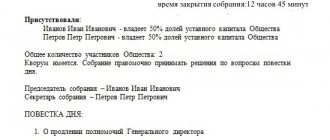

Step 1. Decision making by the general meeting or the sole participant of the Company. Make minutes of the general meeting of the company's participants, or provide a single decision to replace the director. Two items should definitely be included in the “Agenda”:

- Removal of powers from the former director and termination of employment relations with him.

- Assignment of authority to the new manager.

Example:

"1. Release Ivan Ivanovich Ivanov from his position as General Director of the Company.

2. Appoint Petrov Petrovich to the position of General Director of the Company.”

Step 2. Dismissal of the former director and preparation of documentation on the powers of the new director (execution of personnel documents).

It is important to take into account that even after the dismissal of the former manager, the powers of attorney issued by him do not cease to be valid on their own.

Step 3. Filling out an application in form P14001 and notarizing the authenticity of the signature of the new director on it.

It is better to check the necessary documents with the notary you plan to go to; usually the following are required:

- Passport of the new General Director

- certificates of TIN and OGRN of the company,

- LLC charter,

- decision to change the director.

Whether an extract from the Unified State Register of Legal Entities is needed or not - you need to check additionally with a notary. Sometimes an electronic one from the Federal Tax Service is enough, or a notary personally makes a request for data from the register.

Step 4. Making changes to the Unified State Register of Legal Entities.

Within 3 days (excluding weekends) from the date of approval of the decision or protocol, a certified application P14001 must be submitted to the registration authority (tax office). Failure to comply with the three-day period may result in penalties in accordance with Art. 14.25 Code of Administrative Offenses of the Russian Federation (5 thousand rubles).

What else can be included in the documentation package?

In accordance with clause 2 of article 17 and clause 1 of article 18 of the Federal Law of August 8, 2001 N 129-FZ and clause 22 of the order of the Ministry of Finance of Russia of September 30, 2021 N 169n, it is enough to submit an application to the registration authority according to form P14001. But you need to be prepared for the fact that some Federal Tax Service Inspectors ask for a decision on changing the General Director. There is no need to pay state duty.

It is important to note: submission of documentation regarding changes in information about the executive body is carried out to the tax authority where the LLC is registered. In large populated areas there are separate Federal Tax Service Inspectors performing these functions (in Moscow - MIFTS No. 46). The Federal Tax Service portal contains contact details of the Federal Tax Service Inspectors carrying out registration at different legal addresses.

Step 5. Receive the Unified State Register of Legal Entities with changes in the tax sheet.

The time for the procedure for changing a director is established by law and is 5 working days, not including the days of submitting and receiving documentation.

Step 6. Notifying the bank where the current account is opened about the change of manager.

They usually bring to the bank:

- decision and protocol on the change of director;

- Unified State Register of Legal Entities sheet;

- order on vesting powers of a new manager;

- a card with a sample signature of the new manager.

Frequently asked questions:

How to fill out form P14001 when changing the director?

Instructions and rules for filling out for state registration of changes (including P14001) were approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6 / [email protected] Various situations of changing information about an LLC, which must be registered, require the use of only those necessary for of this sheets.

The requirements are the same as for the application form P11001: only capital letters are used; data must be entered in black ink or typed in Courier New font, 18 pt; with a seal strictly on one side of the sheet, etc. You can get more detailed guidance by reading the order of the Federal Tax Service.

Which sheets of P14001 are filled out when changing the General Director of an LLC?

In the most common situation, the following sheets are filled out:

- title page with information about the LLC;

- sheet K - page 1 (for the dismissed manager);

- sheet K - pages 1 and 2 (for the new director);

- sheet P – all 4 pages (information about the applicant).

Who applies for a change of director - the old or new director?

Information regarding the new director has not yet been entered into the Unified State Register of Legal Entities, and the former director has already lost his powers. What should I do?

Until recently, the former director could well have signed an application as a person registered in the Unified State Register of Legal Entities (letter of the Federal Tax Service dated October 26, 2004 N 09-0-10/4223). However, the decision of the Supreme Arbitration Court of the Russian Federation dated May 29, 2006 N 2817/06 abolished this possibility due to a contradiction with the Law “On LLC”.

The courts often emphasize that the former director’s powers are legally terminated with the approval of the decision made by the participants. This means that only the new manager is authorized to sign application P14001.

It is worth considering: the authenticity of the signature in the P14001 application is always certified by a notary and the signing of this document is carried out only in the presence of a notary.

Either the director himself or his representative by notarized power of attorney can submit documents to the registration authority. Options for submitting via digital signature or by post are possible.

If you still have any questions regarding the independent registration of a change of director in an LLC or you want to place an order, you can use the feedback service, write to us by email or just call.