From September 1, 2014, the sending and receiving of declarations is carried out in accordance with the order of the Federal Tax Service of the Russian Federation dated July 31, 2014 N ММВ-7-6 / [email protected] “On approval of Methodological recommendations for organizing electronic document flow when submitting tax returns (calculations) in electronic form via telecommunication channels." Also, this order, from September 1, 2014, invalidates the order of the Federal Tax Service of Russia dated November 2, 2009 N MM-7-6/ [email protected]

When submitting reports signed with a certificate of an authorized representative, an information message about the representation is sent with each declaration (see What are the features of submitting tax reports through an authorized representative?).

Electronic document management with the Federal Tax Service

Any company or individual entrepreneur can switch to electronic document management with the tax office on its own initiative - the Federal Tax Service only encourages this. However, according to current legislation, certain groups of taxpayers are required to submit reports via the Internet. 50 employees, must submit reports electronically .

The exchange of documents with the Federal Tax Service is carried out through one of the electronic document management (EDF) operator companies, a list of which can be found on the tax service website. Before sending, each document must be signed with a qualified electronic signature (CES) - this applies to both taxpayers and tax officials.

The tax service document is first prepared on paper in the prescribed manner. Late on the next business day, it is converted into electronic format and sent to the taxpayer. The date of sending the document is confirmed by the EDF operator.

VLSI

Enterprises can use the VLSI platform simultaneously in several modes, each of which is adapted to interact with the other. The most popular mode among users is the use of electronic document management.

VLSI capabilities:

- verification of counterparties;

- preparing and sending reports to government agencies;

- search for tenders on different platforms and procurement analytics;

- collection of fiscal reports remotely;

- maintaining accounting, personnel and warehouse documentation;

- business process management;

- implementation of a CRM system for high-quality work of the sales department.

The SBIS EDI system has a free version that allows users to receive documents from counterparties, work with primary accounting documentation and create reports for government agencies. For ease of use, mobile applications have been developed that run on the iOS and Android operating systems.

The free version of VLSI does not allow users to send electronic documents. To do this, they need to activate a paid service package. The minimum tariff costs only 500 rubles. in year. For this money, companies will be able to receive: one electronic signature, the ability to send zero reporting, 50 outgoing packages per quarter, access to internal chat and video communication.

Confirmation of receipt of an electronic document

Based on paragraph 5.1 of Article 23 of the Tax Code, entities that must report electronically are also required to ensure the acceptance of documents from the tax inspectorate. The fact that the document has been received must be reported to the Federal Tax Service within 6 days from the time it was sent by the tax authorities. To do this, in response to the received document, you need to send an electronic receipt of its acceptance or a notification of refusal of acceptance.

The implementation of this rule must be treated with the utmost care, especially if a notification of a summons to the tax authority has been received, as well as a requirement to provide documents or explanations. If you neglect the response receipt or send it late, then 10 days after its end, the taxpayer’s bank account may be blocked at the request of the Federal Tax Service. These powers of the tax service are established by the norm of subparagraph 2 of paragraph 3 of Article 76 of the Tax Code of the Russian Federation.

It is worth clarifying that the sanctions apply only to those taxpayers who are required to exchange documents with the Federal Tax Service via the Internet. For those who decide to submit reports electronically voluntarily, such sanctions do not apply. In this case, if the tax office does not receive a receipt for acceptance of the document within the prescribed period, it will be sent to the taxpayer by mail.

Refusal to accept documents by a taxpayer may occur for the following reasons:

- if the document does not comply with the approved format;

- if there is no EPC of the tax authority on it or it does not correspond to the actual one;

- if the document was sent incorrectly.

In these cases, a notification of refusal to accept the document is sent to the Federal Tax Service. If the refusal is due to the first or second reasons, Federal Tax Service specialists make the necessary amendments to the document and send it again.

An important point is the date of receipt of the document

The date of receipt of the document has important legal significance, because it is from this date that the period allotted to the taxpayer to perform certain actions is counted. Thus, it is necessary to respond to a request for clarification, which the tax office may send as part of a desk audit, within 5 working days from the date of its receipt. Such a date, according to clause 11 of the Procedure, is considered to be the date indicated in the document acceptance receipt .

For example, a company received a request for clarification that must be satisfied within 5 business days. The document acceptance receipt indicates the date of October 21, 2015. Therefore, the response to this requirement must be sent during the period from October 22 to October 28, 2015 (the period is extended due to non-working days).

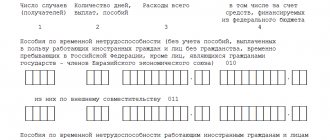

Introductory information

From January 1, 2015, taxpayers who must submit reports to the Federal Tax Service via the Internet have a new obligation.

They must ensure that they receive documents from the tax inspectorate in electronic form through an EDF operator (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). Let us remind you that VAT payers, as well as organizations (or individual entrepreneurs) that employ more than 100 people, are required to submit tax reports via the Internet. Having received documents from the inspection, the taxpayer must send an electronic receipt to the tax authorities. This should be done within six working days from the date the documents were sent by the tax authorities.

In this case, special attention should be paid to obtaining certain documents. The fact is that from January 1, 2015, tax authorities have the right to suspend transactions on taxpayers’ bank accounts and electronic money transfers if the taxpayer does not send a receipt for the following documents (subclause 2, clause 3, article 76 of the Tax Code of the Russian Federation):

- requirements for the submission of documents;

- requirements for providing explanations;

- notifications of summons to the tax authority.

(For more details, see “Failure by the taxpayer to provide an electronic receipt for the receipt of documents from the inspection is grounds for blocking the account”).

In addition, taxpayers can switch to electronic document management with the tax office not because of legal requirements, but voluntarily. In this case, the inspection will also be able to send them various documents electronically.

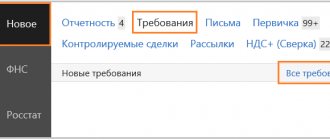

Receipt of new documents

Since it is necessary to respond to messages from the Federal Tax Service within a very limited time frame, it is obvious that the accountant needs to constantly monitor new documents. Moreover, daily checking of the data exchange system with the Federal Tax Service for the receipt of new documents is required by paragraph 6 of the Procedure.

However, this does not require logging into the data exchange system every day. Some EDI systems make it possible to track new messages from the Federal Tax Service using other methods. For example, in the Kontur.Extern system developed by SKB Kontur, you can connect an alert via SMS or email. If a new document is received from the tax office, the accountant will receive an email or SMS notification.

"EUPHRATES"

The EUFRAT system differs from others by the presence of unique software developments that no competitor has. Advantages:

- EUFRAT includes the Nika DBMS, which frees companies from purchasing additional software;

- nice interface;

- mechanism for managing access rights.

A standard license costs from 5200 to 7300 rubles. per workplace, the more users are connected, the lower the price will be.

List of documents that the Federal Tax Service can send via the Internet

The new Procedure for sending documents used by tax authorities in the exercise of their powers provides for 48 items that are allowed to be sent through the information system. Their full list can be found below.

| № | Name |

| 1 | Request for explanation |

| 2 | Notice of controlled foreign companies |

| 3 | Notification of calling the taxpayer (fee payer, tax agent) |

| 4 | Tax notice |

| 5 | Decision to suspend transactions on the accounts of a taxpayer (fee payer, tax agent) in a bank and transfers of his electronic funds |

| 6 | Decision to cancel the suspension of transactions on the accounts of the taxpayer (fee payer, tax agent) in the bank and transfers of his electronic funds |

| 7 | Decision to conduct an on-site tax audit |

| 8 | Decision to suspend an on-site tax audit |

| 9 | Decision to resume on-site tax audit |

| 10 | Certificate of on-site tax audit |

| 11 | Decision to conduct an on-site tax audit of a consolidated group of taxpayers |

| 12 | Decision to suspend an on-site tax audit of a consolidated group of taxpayers |

| 13 | Decision to resume on-site tax audit of a consolidated group of taxpayers |

| 14 | Act on preventing access of tax authority officials conducting a tax audit to the territory or premises (except for residential premises) of the person being inspected |

| 15 | Resolutions on conducting an inspection of the territories, premises of the person in respect of whom a desk tax audit is being carried out, documents and objects |

| 16 | Decision to extend or refuse to extend the deadline for submitting documents (information) |

| 17 | Resolution on seizure, seizure of documents and objects |

| 18 | Protocol on seizure, seizure of documents and objects |

| 19 | Resolution on appointment of examination |

| 20 | Protocol on familiarization of the person being inspected with the decision on the appointment of an examination and on clarification of his rights |

| 21 | Tax audit report |

| 22 | Notification of the time and place of consideration of tax audit materials |

| 23 | Decision to postpone consideration of tax audit materials due to the failure to appear of a person whose participation is necessary for their consideration |

| 24 | Decision to involve a witness, expert, or specialist in the consideration of a tax offense case |

| 25 | Protocol of consideration of tax audit materials; |

| 26 | Decision to carry out additional tax control measures |

| 27 | Decision to prosecute for committing a tax offense |

| 28 | Decision to refuse to prosecute for committing a tax offense |

| 29 | Decision to take interim measures |

| 30 | Decision to cancel interim measures |

| 31 | Decision to replace interim measures |

| 32 | Decision to suspend the execution of decisions of the tax authority taken in relation to an individual |

| 33 | Decision to suspend the execution of decisions of the tax authority taken in relation to an individual |

| 34 | Decision to cancel the decision to bring to justice for committing a tax offense in terms of bringing an individual to justice for committing a tax offense |

| 35 | Act on the discovery of facts indicating tax offenses provided for by the Tax Code of the Russian Federation (with the exception of tax offenses, cases of detection of which are considered in the manner established by Article 101 of the Tax Code of the Russian Federation) |

| 36 | A decision to hold a person accountable for a tax offense provided for by the Tax Code of the Russian Federation (with the exception of a tax offense, the detection of which is considered in the manner established by Article 101 of the Tax Code of the Russian Federation) |

| 37 | A decision to refuse to hold a person accountable for a tax offense provided for by the Tax Code of the Russian Federation (with the exception of a tax offense, the detection of which is considered in the manner established by Article 101 of the Tax Code of the Russian Federation) |

| 38 | Decision on reimbursement (in whole or in part) of value added tax amounts |

| 39 | Decision to refuse reimbursement of value added tax amounts |

| 40 | Decision on reimbursement (in whole or in part) of the amount of value added tax claimed for reimbursement |

| 41 | Decision to refuse reimbursement (in whole or in part) of the amount of value added tax claimed for reimbursement |

| 42 | Decision on reimbursement of the amount of value added tax claimed for reimbursement in a declarative manner |

| 43 | Decision to refuse to reimburse the amount of value added tax claimed for reimbursement in a declarative manner |

| 44 | Decision to cancel the decision to reimburse the amount of value added tax claimed for reimbursement in a declarative manner |

| 45 | Decision to cancel the decision to reimburse the amount of value added tax declared for reimbursement, in connection with the submission of an updated tax return for value added tax |

| 46 | Decision on reimbursement of the amount of excise tax claimed for reimbursement |

| 47 | Decision to refuse (in whole or in part) to reimburse the amount of excise tax claimed for reimbursement |

| 48 | Reasoned conclusion |

ELMA

The ELMA system differs from others in its wide range of business solutions. It consists of a set of applications for managing an organization. They can be used both together and separately.

ELMA system line:

- Electronic document management. The application allows you to organize office work and conduct electronic document flow. Thanks to the WorkFlow mechanism, the system quickly adjusts to the needs of the organization.

- Business process management. ELMA builds flexible information systems. To create effective business processes, the program uses the international standard BPMN.

- Monitoring indicators. The application allows you to properly structure the management of your company. Its use will help improve performance indicators.

- CRM. This line does not need to be purchased separately; it comes as an addition to any standard package. CRM allows you to manage sales and track relationships with counterparties.

- Project management. ELMA easily organizes project activities in an organization. This makes it possible to monitor standard business processes and manage a budget project.

- Internal portal. All components of ELMA are based in a single internal portal. It is impossible to buy it separately, since it is additionally installed with any application. The portal includes: company structure, tasks, calendar, communication with users, data storage.

The cost of the ELMA system depends on the selected package. The price of a standard platform is 45,000 rubles. The price includes: 1 personal and 1 competitive license, ELMA server, ELMA Designer, Internal portal, ELMA CRM, and ELMA ECM+ application. You can add advanced features for an additional fee.

Special cases: documents not included in the list

The list above does not contain two documents that can also be sent to the taxpayer electronically. We are talking about the requirement to submit documents and the requirement to pay taxes . The fact is that for these documents, their own regulations have been developed, which are approved accordingly by orders of the Federal Tax Service No. ММВ-7-2/ [email protected] dated 02/17/11 and No. ММВ-7-8/ [email protected] dated 12/09/10.

To process these requirements, the recipient is given significantly less time - the document acceptance receipt must be sent no later than the next business day after its receipt. The date indicated in the receipt for acceptance of the document is considered the day of its receipt - the period allotted for fulfilling the requirement is counted from it.

Thus, taking into account two types of requirements not included in the above list, the tax service can now send the taxpayer 50 different documents .

"Logics"

Until 2012, the Logic program was called “Boss-Referent” and was very popular among organizations. The name change did not affect the quality of the product; as before, it allows you to effectively manage office work. Main advantages:

- high level of data protection;

- the ability to build complex document approval schemes;

- ease of use.

The cost of the license depends on the number of connected employees. 49 users - 5900 rub. per seat, from 50 to 199 - 5200. If access is opened for more than 200 employees, the license is sold at a minimum cost - 4900 rubles.

List

A complete list of EDF operators is maintained and constantly updated on its official website www.nalog.ru by the Russian Tax Service. Here is the exact link (for the Moscow region):

https://www.nalog.ru/rn77/taxation/submission_statements/operations/

The following is a current list of electronic document management operators through which you can submit reports electronically.

| No. | Name of company | Company address | TIN of the organization | Web site |

| 1 | CJSC PF SKB Kontur | 620017, Ekaterinburg, Kosmonavtov Ave., 56 | 6663003127 | https://kontur.ru/ |

| 2 | ANO BELINFONALOG | 115093, Moscow, Podolskoe highway, 5/8, office 444 | 3123101188 | https://www.belinfonalog.ru/ |

| 3 | OJSC InfoTex Internet Trust | 127287, Moscow, Stary Petrovsko-Razumovsky proezd, 1/23, building 1 | 7743020560 | https://iitrust.ru/ |

| 4 | LLC InfoCenter | 600005, Vladimir, Oktyabrsky Prospekt, 36 | 3328430017 | https://www.icentr.ru/ |

| 5 | LLC Electronic Business Systems | 650099, Kemerovo, Sovetsky Ave., 74/1, office 218 | 4205011410 | https://www.e-tax.ru/ |

| 6 | Tensor Company LLC | 150000, Yaroslavl, Moskovsky prospect, 12 | 7605016030 | https://tensor.ru/ |

| 7 | LLC KORUS Consulting CIS | 194100, St. Petersburg, Bolshoi Sampsonovsky Avenue, building 68, letter “N” | 7801392271 | www.esphere.ru |

| 8 | Taxkom LLC | 115095 Moscow, st. Pyatnitskaya, 54, building 2, PO Box No. 1 | 7704211201 | https://taxcom.ru/ |

| 9 | ARGOS LLC | 196191, St. Petersburg, Leninsky Prospekt, 168 | 7810225534 | https://www.argos-nalog.ru/ |

| 10 | LLC Rus-Telecom | 115093 Moscow, st. Podolskoe highway, house 8/5 | 6731071801 | https://www.rus-telecom.ru/ |

| 11 | Sibtel-Crypto LLC | 620017, Tyumen, st. Shirotnaya, 29, bldg. 2/2 | 7203158243 | https://www.s-crypto.ru/ |

| 12 | CJSC Kaluga Astral | 248023 Kaluga, Tereninsky lane, no. 6 | 4029017981 | https://astralnalog.ru/ |

| 13 | LLC ROC Partner | 410005 Saratov, st. Bolshaya Sadovaya, 239, office 42 422 | 6454066437 | https://parc.ru/ |

| 14 | LLC NPP Izhinformproekt | 426008, Izhevsk, st. Borodina, 21, of. 207 | 1831014533 | https://www.infotrust.ru/ |

| 15 | OJSC SKB-bank | 620026, Ekaterinburg, st. Kuibysheva, 75 | 6608003052 | https://www.skbbank.ru/ |

| 16 | JSC RC Praktik | 127051, Moscow, st. Neglinnaya, 17 | 7714143134 | https://www.a-practic.ru/ |

| 17 | LLC DSCBI Mascom | 680038, Khabarovsk region, Khabarovsk, st. Yashina, 40 | 2721110853 | https://mascom-dv.ru/ |

| 18 | JSC GNIVC | 127381, Moscow, st. Neglinnaya, 23 | 7707083861 | https://www.gnivc.ru/ |

| 19 | UFMF FSUE CenterInform | 191123, St. Petersburg, st. Shpalernaya, 26 | 7841016636 | https://center-inform.ru |

| 20 | LLC RSC Info-Accountant | 360000, Kabardino-Balkarian Republic, Nalchik, st. Tarchokova, 19 | 721009708 | https://www.rsc-infobuh.ru/ |

| 21 | LLC Comprehensive Security Services | 634021 Tomsk, Frunze Ave., 117a, office 501 | 7017154234 | https://kub.tomline.ru/ |

| 22 | CJSC Server-Center | 690650, Vladivostok, st. Nerchinskaya 10, office 315 | 2539038819 | https://www.serverc.ru/ |

| 23 | CJSC TsEK | 603000, N. Novgorod, St. Novaya, 15 | 5260013152 | https://www.nalog.cek.ru/ |

| 24 | LLC Electronic Express | 119991, Moscow, st. Leninskie Gory, building 1.p.77 | 7729633131 | https://www.garantexpress.ru/ |

| 25 | Edisoft LLC | 199178, St. Petersburg, Nab. Smolenki River, 14, lit. A | 7801471082 | https://ediweb.ru/ |

| 26 | ICC ETALON LLC | 429000, Chuvash Republic, Cheboksary, Moskovsky Ave., 17, building 1 | 2130029371 | https://www.etalon-ikc.ru/ |

| 27 | FSUE CenterInform | 191123, St. Petersburg, Shpalernaya st., 26 | 7841016636 | https://center-inform.ru |

| 28 | LLC Link-Service | 456501, Chelyabinsk region, Sosnovsky district, Kremenkul village, Solnechkaya Dolina quarter, 1 | 7438014673 | https://www.link-service.ru/ |

| 29 | LLC Information Medical Center | 443010, Samara, st. Nekrasovskaya, 56 "B" | 6317036857 | https://imctax.parus-s.ru/ |

| 30 | JSC Firm NTC KAMI | 107241, Moscow, st. Uralskaya, 21 | 7733091756 | https://www.kami.ru/ |

| 31 | JSC TaxNet | 420021, Kazan, st. Kayuma Nasyri, 28, | 1655045406 | https://www.taxnet.ru/ |

| 32 | LLC UC GIS | 198097, St. Petersburg, Stachek Ave., 47 | 7805544260 | https://ca.gaz-is.ru/ |

| 33 | JSC Novokuznetsktelefonstroy | 654041, Novokuznetsk, st. Kutuzova, 15 | 4220016317 | https://www.rdtc.ru/ |

| 34 | CJSC CERTIFICATION CENTER | 195112, St. Petersburg, Malookhtinsky pr. 68 | 7806122720 | https://nwudc.ru/ |

| 35 | Bestcom Group LLC | 655017, Republic of Khakassia, Abakan, st. Lenina, 76 | 1901042390 | https://bestcom-group.ru/ |

| 36 | LLC E-Portal | 644023, Omsk, 17th Rabochaya st., 101v | 5503065726 | https://www.e-portal.ru/ |

| 37 | LLC Siberian Telecommunications | 7202106274 | https://sibtel.ru/ | |

| 38 | LLC STC Tesis | 400005, Volgograd, V.I. Lenin Ave., 33A | 3445076225 | https://www.ntc-tezis.ru |

| 39 | Guard-Inform LLC | 300041, Tula, Lenin Ave., 46, office 407 | 7107065081 | https://www.ginf.ru/ |

| 40 | LLC UC Askom | 355003, Stavropol, st. Lenina, 293 | 263504985 | https://www.ackom.net/ |

| 41 | NN FSUE CenterInform | 603098, Nizhny Novgorod Gagarina Ave., 28, letter A | 7841016636 | https://www.r52.center-inform.ru/ |

| 42 | LLC ESOTEL-Rustelcom | 677008, Yakutsk, st. Gogolya, 1 | 1435106300 | https://www.esotel.ru/ |

| 43 | LLC Safe Information Technologies | 400001, Volgograd, st. Kalinina, 19 | 3445050474 | https://www.binteh.ru |

| 44 | Technocad LLC | 115114, Moscow, Paveletskaya embankment, 8 building 6, office 601-602 | 5009046312 | https://www.technokad.ru/ |

| 45 | CJSC STC STEK | 454080, Chelyabinsk, st. Entuziastov, 12b | 7451019159 | https://www.stek-trust.ru/ |

| 46 | LLC Rosta | 344010, Rostov-on-Don, Voroshilovsky Ave., 52, office 67 | 6163143849 | https://www.rostagroup.ru/ |

| 47 | LLC Center for Accounting Services | 353925, Novorossiysk, Dzerzhinsky Ave., 211 | 2315096691 | https://cacbu.ru |

| 48 | Documentary Communication Center LLC | 360099, Novosibirsk, st. Potaninskaya, 3a | 5406631969 | https://www.cds-sib.ru |

| 49 | LLC KDS | 302028, Orel, Lenin St., 45 | 5754003919 | https://www.kds-trust.ru/ |

| 50 | Petrocrypt LLC | 185035, Petrozavodsk, st. F. Engelsa, 10, office 600 | 1001146614 | https://www.petrotax.ru/ |

| 51 | CRYPTEX LLC | 445043, Samara, Moskovskoe highway 3, office 404 | 6315629971 | https://cryptex.pro |

| 52 | ANO IO Business Bulletin | 308012, Belgorod, Kostyukova st., 36a | 3123082552 | https://www.nalogtelecom.ru/ |

| 53 | CJSC Infanet | 428003 Republic of Chuvashia, Cheboksary, Yaroslavskaya st., 30 | 2128053070 | www.infanet.ru |

| 54 | JSC Eridan | 600022, Vladimir, st. Stavrovskaya, 8 | 3328419341 | https://nalog33.ru/ |

| 55 | OGBU Belgorod Information Foundation | 308000, Belgorod, Sobornaya square, 4 | 3123077111 | https://bif.belregion.ru/ |

| 56 | LLC Computer Technologies | 241011 Bryansk region, Bryansk, Sofia Perovskaya st., 83 | 3234042788 | https://www.ipct.ru/ |

| 57 | LLC Business Networks | 440008, Penza region, Penza, st. Suvorova, 122A | 5835068079 | https://penza-net.ru/ |

| 58 | KrvF FSUE CenterInform | 610000, Kirov, Lenin St., 85 | 7841016636 | https://www.r43.center-inform.ru/ |

| 59 | ITs Vybor LLC | 214000 Smolensk, Kommunisticheskaya st., 6 | 6730025009 | https://icvibor.ru/ |

| 60 | LLC Russian Company | 625003, Tyumen, st. Zheleznodorozhnaya, 52 | 7204141323 | https://www.rk72.ru/ |

| 61 | LLC TEL | 660135, Krasnoyarsk, Vzletnaya st., 3 | 2465097373 | https://www.nalog.scn.ru/ |

| 62 | LLC MO PNIEI-KrasKript | 660077, Krasnoyarsk, st. 78th Volunteer Brigade 2, office 242 | 2466077563 | https://www.kraskript.com/ |

| 63 | JSC Center for Informatization of the Republic of Mordovia | 430030, Republic of Mordovia, Saransk, st. Vlasenko, 32 | 1326134964 | https://www.delmor.net/ |

| 64 | LLC UNCIB | 424000, Republic of Mari El, Yoshkar-Ola, Mashinostroiteley str., 8G, office 313 | 1215136109 | https://uncib.ru/ |

| 65 | NvsF FSUE CenterInform | 630091, Novosibirsk, st. Frunze, 5 | 7841016636 | https://www.ci54.ru/ |

| 66 | LLC UC Siberia | 634050, Tomsk, Lenin Ave., 40 | 7017311494 | https://www.cbsib.ru/ |

| 67 | UlnF FSUE CenterInform | 432027, Ulyanovsk, st. Radishcheva, 143, building 3 | 7841016636 | https://www.r73.center-inform.ru/ |

| 68 | LLC Center for Electronic Services | 420124, Kazan, st. Chistopolskaya, 20b | 1657055576 | https://esc-kazan.ru/ |

| 69 | MUP ARTSIS | 440044, st. Suvorova, Penza | 5835038469 | https://www.arcis.ru/ |

| 70 | LLC NPF Forus | 664003, Irkutsk, st. Uritskogo, d8 | 3812023430 | https://www.forus.ru/ |

| 71 | LLC INET | 650099, Kemerovo, Sovetsky Ave., 61 | 4205016288 | https://www.kemnet.ru/ |

| 72 | LLC Slavservice-Svyaz | 302020, Orel, Naugorskoe highway, no. 5 | 5753024987 | https://slavservis.ru/ |

| 73 | LLC North-West Customs and Logistics Service | 197342, St. Petersburg, st. Torzhkovskaya, 4 | 7814325226 | https://www.sztls.ru/ |

| 74 | LLC Tver CRYPTO-graphic systems | 170100, Tver, st. Novotorzhskaya, 3 | 6901060158 | https://www.tvercrypto.ru/ |

| 75 | LLC Alliance | 667010, Kyzyl, st. Oyuna Kursedi, 54 | 1701037508 | 0 |

| 76 | LLC TK Contact | 394062, Voronezh, st. Yuzhno-Moravskaya, 2 | 3666125016 | https://ktkt.ru/ |

| 77 | Datacom LLC | 685000, Magadan, st. Sovetskaya, 5 | 4909080434 | https://dtcom.ru/ |

| 78 | CJSC Certification Center | 109012, Moscow, st. Ilyinka, 4, room 94 | 5260112900 | https://www.ekey.ru/ |

| 79 | AOOOOI ORSODIN | 675000, Blagoveshchensk, st. Kalinina 141, office 30A | 2801063817 | https://orsodin.ru |

| 80 | LLC Pascal | 385000, Maykop, st. Pervomaiskaya, 208 | 105053578 | ?www.pascal.ru |

| 81 | LLC Salon 2116 - email | 305001, Kursk, st. Karl Liebhnechta, 5 | 4630004308 | ?www.docmail.ru |

| 82 | Service TV LLC - Info | 153003, Ivanovo, st. Paris Commune, 16 | 3730011113 | ?www.stv-it.ru |

| 83 | Perm branch of OJSC Rostelecom | 614096, Perm, st. Lenina, 68 | 7707049388 | www.ural.rt.ru |

| 84 | LLC "National Certification Center" | 111024, Moscow, st. Aviamotrnaya, 8a | 7722766598 | www.nucrf.ru |

| 86 | Argos SPb LLC | 196191, St. Petersburg, sq., Constitution, no. 7 lit. A, room 109-N | 7810447985 | www.argos-nalog.ru |

| 87 | OOO " | 460009, Orenburg, st. Tswillinga, 102 | 5610069482 | https://www.mtron.ru/ |

| 88 | LLC "Evrika" | 432017, Ulyanovsk, st. Spasskaya, 5, office 69 | 7326020252 | www.evrica73.ru |

| 89 | NOU "Educational Informzashita" | 394029, Voronezh, st. Leningradskaya, 134 | 3662097504 | www.2410000.ru |

| 91 | LLC "SZTLS" | 197183, St. Petersburg, st. Dibunovskaya, 50, office 219 | 7801219478 | www.sztls.ru |

| 92 | LLC "Information Security Center" | 656052, Barnaul, st. Severo-Zapadnaya, 159 | 2225100262 | www.secret-net.ru |

| 93 | LLC "UTs "SOYUZ" | 127006, Moscow, st. Sadovo-Triumfalnaya, 18, office. I, room 1 | 7710963520 | www.ucsouz.ru |

| 94 | LLC "Solar" | 620137, Ekaterenburg, st. Vilonova 6, no. 249 | 6670241877 | 0 |

| 95 | LLC "Regional Certification Center" | 400137, Volgograd, 10th Anniversary of Victory Boulevard, 17 B | 3443084990 | 0 |

| 96 | Severstal-infocom LLC | 162602, Cherepovets, st. Lenina, 123A | 3528007105 | 0 |

| 97 | Falcon Plus LLC | 163002, Arkhangelsk, st. Velskaya, 1 | 2901063507 | www.falconplus.ru |

| 98 | LLC "Ilim Center" | 660055, Krasnoyarsk, st. Cosmonaut Bykovsky 11 | 2465294396 | 0 |

| 99 | BU UR "Resource Information Center of the Udmutra Republic" | 426069, Izhevsk, st. 7th Podlesnaya, 24 | 1833046026 | www.ricudm.ru |

| 100 | JSC "SIBERIA" | 173021, Veliky Novgorod, st. Nekhinskaya, 61 | 5321149717 | www.siberiya.net |

| 101 | Nebo LLC | 420074, Kazan, st. Peterburskaya, 52 | 1655233505 | www.nebopro.ru |

| 102 | LLC NPF ISB | 634034, Tomsk, Lenin Ave., 28 | 7017091200 | www.npf-isb.ru |

| 103 | Alfa-service LLC | 125375, Moscow, st. Tverskaya, 7 | 7735513121 | www.4trust.ru |

| 104 | CJSC "Taxnet-service" | 420021, Kazan, st. Kayuma Nasyri, 28 | 1655109956 | 0 |

| 105 | JSC "Energy Systems and Communications" | 115114, Moscow, 1st Kozhevnichesky lane, 6, building 1, room 14A | 7709364346 | 0 |

| 106 | OOO "SISLINK" | 125493, Moscow, st. Avangardnaya, 3 | 7743801719 | www.cislink.com |

| 107 | LLC "TsZI "GRIF" | 152914, Rybinsk, Pobedy Boulevard, 17 | 76100814123 | www.czi-grif.ru |

| 108 | Eastern Communications LLC | 677005, Yakutsk, st. Stadukhina, 63/1 | 1435302087 | 0 |

| 109 | NTSsoft LLC | 620062, Ekaterenburg, st. Chebysheva, 4 | 6670237020 | www.ntssoft.ru |

| 110 | LLC "Certifying | 308007, Belgorod, st. Michurina, 48 B | 3123304163 | https://www.belinfonalog.ru/ |

| 111 | LLC "Index PC" | 119002, Moscow, Plotnikov lane, building 19/38, building 2 | 7704882182 | 0 |

| 112 | LLC "ETP GPB" | 117342, Moscow, Miklouho-Maklaya, 40 | 7724514910 | https://etpgpb.ru |

| 113 | CJSC "Information Center" | 127349, Moscow, Altufevskoye sh., 37, bldg. 1 | 7701553038 | 0 |

| 114 | LLC "Business Studio" | 347740, Rostov, st. Urozhaynaya, 77, apt. 2 | 6111984819 | 0 |

| 115 | System Group Rus LLC | 115088, Moscow, Yuzhnoportovy proezd, 18, building 1 | 7723749362 | https://systemservice-tsd.ru/ |

| 116 | LLC "Electronic Communications" | 115280, Moscow, Leninskaya Sloboda, 26 room 82 | 9715218298 | |

| 117 | Fintender-Crypto LLC | 656056, Barnaul, Maxim Gorky, no. 29 | 2225129102 | www.ft-crypto.ru |

| 118 | MASKOM-Techline LLC | 680038, Khabarovsk, st. Yashina, 40 | 2722050371 | www.mascom-it.ru |

| 119 | Bifit EDO LLC | 105203, Moscow, st. Nizhnyaya Pervomaiskaya, 46 | 7719443460 | www.bifit.com |

Read also

31.08.2017