It is more convenient to start filling out the declaration with sections 2, 2.1 and 3. Then section 1 and the title page are filled out.

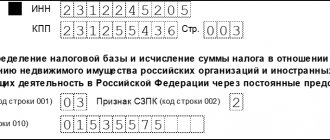

The lines “TIN” and “KPP” in each section of the declaration are filled in automatically from the client’s registration card in the “SBIS” system. The page serial number is also filled in automatically.

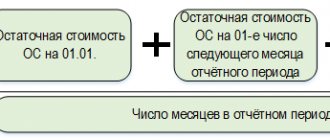

- Title page

- Section 1. Amount of tax to be paid to the budget

- Section 2. Determination of the tax base and calculation of the amount of tax in relation to real estate subject to taxation of Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices

- Section 2.1. Information about real estate subject to tax at the average annual value

- Section 3. Calculation of the amount of tax for the tax period on a real estate object, the tax base in respect of which is determined as the cadastral (inventory) value

Property type code

Attention! If line 010 indicates the address of the place of business activity, then this field is not filled in. Line 010 indicates the address of the place of business activity: code of the subject of the Russian Federation, postcode, city, district, locality, street, house number, etc.

Attention! It is not allowed to indicate two or more entities in one application. The field “Code of the tax authority at the place of business activity” is filled in if the individual entrepreneur does not have a specific address for the place of carrying out his activities and is not registered with the tax authorities in the subject in which he plans to carry out activities, at his place of residence or as a taxpayer using PSN .

Title page

On the title page of the tax return, the organization must fill out all the necessary details, except for the section “To be completed by an employee of the tax authority .

When filling out the “Adjustment number” in the primary declaration for the tax period, “0” is automatically entered; in the updated declaration for the corresponding tax period, you must indicate the adjustment number (for example, “1”, “2”, etc.).

In the “Tax period” , the tax period code and the year for which the declaration is being submitted are automatically indicated. If the declaration is submitted for the tax period, then the code “34” is indicated - the calendar year; if the declaration is submitted for the last tax period during the reorganization (liquidation) of the organization, the code “50” is entered in the specified field.

When filling out the line “Submitted to the tax authority (code),” you must select from the directory the code of the tax authority to which the tax return is submitted. This code is indicated in the documents on registration with the tax authority (certificate of registration with the tax authority, notice of registration with the tax authority of a legal entity as the largest taxpayer, etc.).

In the “By location (accounting)” , select a code, the list of which is given in the drop-down list. Organizations classified as the largest taxpayers choose code “213”. If the declaration is submitted by Russian organizations that are not the largest taxpayers, then they indicate the code “214”, etc.

When filling out the “Taxpayer” , the name of the organization is reflected, corresponding to the one indicated in the constituent documents.

Attention! The fields “Form of reorganization (liquidation)” and “TIN/KPP of the reorganized organization” are filled in only by those organizations that are reorganized during the tax period.

In the “Form of reorganization (liquidation)” , the reorganization code is indicated in accordance with the directory.

Next, indicate the details “TIN/KPP of the reorganized organization” .

When filling out the “Contact phone number” , the organization’s phone number specified during registration is automatically reflected.

When filling out the field “On ____ pages”, indicate the number of pages on which the declaration is drawn up. The field value is filled in automatically and recalculated when the composition of the declaration changes (adding/deleting sections).

When filling out the field “with supporting documents or their copies on ___ sheets”, the number of sheets of supporting documents and (or) their copies (if any) is reflected. Such documents may be: the original (or a certified copy) of a power of attorney confirming the powers of the taxpayer’s representative (if the declaration is submitted by the taxpayer’s representative), a document confirming payment of tax outside the territory of the Russian Federation, confirmed by the tax authority of the relevant foreign state, etc.

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

- Manager - if the document is submitted by the taxpayer,

- Authorized representative - if the document is presented by a legal or authorized representative of the taxpayer.

In this case, the full name of the head of the organization or an authorized representative is indicated, as well as the name and details of the document confirming his authority.

The date is also automatically indicated on the title page.

Property type code 03 what is it

Foreign companies that do not have permanent representative offices in Russia submit the title page, sections 1 and 3 of the property tax declaration to the tax office. All text and numeric indicators with cells must begin to be filled in from the leftmost cell. There may be blank cells on the right in which dashes are placed. When entering your Taxpayer Identification Number (TIN), you also need to put dashes in the last two blank cells. First of all, fill out the title page, section 2 (or 3 - foreign companies that do not have permanent representative offices in Russia) of the declaration.

Foreign companies that operate in Russia through permanent establishments must also fill out Section 2. And Section 3 is intended for those foreign companies that pay property tax on real estate that is not related to their activities through a permanent establishment (in particular, due to the lack of such). Accountants are already accustomed to the fact that if you need to enter a certain amount in the declaration, you need to fill in the cells not from left to right, as usual when writing, but from right to left, starting with the smallest digit of the number. The new advance calculation for property tax is an exception: when filling it out, both numerical and text indicators (by the way, they are filled in in capital letters) must be entered into the cells from left to right.

This is interesting: Is a change in the mother’s surname included in the birth certificate of a child aged 16?

Property type code 3 what is it

Tax Guide. Practical guide to corporate property tax Since the declaration may contain several sections. 2, then for their identification special codes are provided, which are entered in the line “Property type code”. These codes are established by Appendix No. 5 to the Procedure for filling out a tax return (clause 1, clause 5.3 of the Procedure for filling out a declaration).

Property tax is considered local and is paid by individuals. persons annually until 01.01. next tax period. after receiving a notification from the tax service. The payment is paid at the location of the object. You should know that the tax period is 12 calendar months. private home ownership; an apartment, except those that are part of an apartment building; unfinished housing; garage; etc.

Property type code 03 what is it

title page; Section 1 “Amount to be paid to the budget”; Section 2 “Determination of the tax base and calculation of the amount of tax in relation to the taxable property of Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices”; Section 3 “Determination of the tax base and calculation of the amount for the tax period for real estate of a foreign organization not related to its activities in the Russian Federation through a permanent representative office.”

- in relation to real estate objects that are part of the Unified Gas Supply System (hereinafter referred to as the Unified Gas Supply System) in accordance with Federal Law of March 31, 2021 N 69-FZ “On Gas Supply in the Russian Federation” (Collected Legislation of the Russian Federation, 2021, N 14 , Art. 1667; 2021, N 35, Art. 3607; 2021, N 52, Art.

Section 1. Amount of tax to be paid to the budget

Section 1 is completed in relation to the amount of property tax payable to the budget at the location of the organization; the place where the permanent representative office of the foreign organization is registered with the tax authority; location of the real estate.

Section 1 is filled in automatically based on the information reflected in sections 2 and 3.

This section includes the following details:

- code according to OKTMO , according to which the tax amount is payable (automatically transferred from the corresponding lines of sections 2 and 3);

- budget classification code (BCC) , in accordance with which property tax must be paid (automatically transferred from the corresponding lines in sections 2 and 3);

- the amount of tax payable to the budget at the place of submission of the declaration according to the relevant KBK and OKTMO (calculated automatically);

- the amount of tax calculated for reduction based on the results of the tax period (calculated automatically).

The indicator “Amount of tax payable to the budget” at the end of the tax period is defined as the difference between the amount of tax calculated for the tax period and the amounts of advance tax payments calculated during the tax period. In this case line 030 will be filled in only if the amount of tax calculated for the tax period exceeds the amount of advance payments calculated during the tax period. Otherwise, line 040 .

The value of line 030 is defined as follows:

1. In the absence of section 2 c o in the declaration, on the line “Property type code” - by summing:

- differences between the values of lines 220 and the sum of the values of lines 230 and 250 of all sections 2 of the declaration with the corresponding codes according to OKTMO;

- the differences between the values of lines 100 and the sum of the values of lines 110 and 130 of sections 3 of the declaration with the corresponding OKTMO codes, i.e.:

page 030 = [page 220 - (page 230 + page 250)] section 2 + [page 100 - (page 110 + page 130)] section 3 according to the corresponding OKTMO and KBK codes (if the calculated value > 0)

2. If the declaration contains section 2 c o on the line “Property type code” - by summing:

- differences between the values of lines 220 and the sum of the values of lines 230 and 250 of all sections 2 of the declaration with o, “02”, “03”, “05”, “07”, “08”, “09” and “10” on the line “Type code property" with the corresponding OKTMO codes, minus the minimum of the values:

- the difference in the values of lines 220 and 250 of section 2 of the declaration on the line “Property type code” ;

- the value of line 260 of section 2 of the declaration from o to line “Property type code” ,

- the differences between the values of lines 100 and the sum of the values of lines 110 and 130 of sections 3 of the declaration with the corresponding OKTMO codes, i.e.:

page 030 = [page 220 - (page 230 + page 250)] with codes “01”, “02”, “03”, “05”, “07”, “08”, “09”, “ 10" - min [(p.220 - p.250) with code "04" or p. 260 with code "04"] of section 2 + [p.100 - (p.110 + p.130)] of section 3 by corresponding codes OKTMO and KBK (if the calculated value is > 0).

If the value calculated in this way is less than 0, then 0 is automatically indicated in line 030 , and the resulting value is displayed in line 040 .

Also in section 1, in the field “I confirm the accuracy and completeness of the information specified on this page,” the date is automatically indicated.

How to fill out a property tax return

After you enter the code of the territory for which you will pay the tax and the cadastral number of the property, fill in the cost indicators and other information to calculate the tax. So, on line 020, indicate the cadastral value of the property as of January 1 of the reporting year. Fill in line 025 only if part of the cadastral value of the property is not subject to tax.

On line 270, reflect the residual value of all fixed assets that are listed on the organization’s balance sheet as of December 31 of the reporting year. The exception is fixed assets that are not recognized as objects of taxation in accordance with subparagraphs 1–7 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation. There is no need to indicate their residual value on line 270. The cost of fixed assets specified in subclause 8 of clause 4 of Article 374 of the Tax Code of the Russian Federation should not be excluded from the calculation.

Lines 010, 020, 030, 050 of section 2.1.

On line 030 (it needs to be filled out only if there is no information on line 010 or 020) the inventory number of the object is indicated. This can be either an inventory number assigned to an object in accordance with guidelines for accounting of fixed assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n), or an inventory number assigned by technical inventory authorities (for example, in accordance with the order of the Ministry of Economic Development of the Russian Federation dated 08.17.06 No. 244, by order of the State Construction Committee dated 08.26.03 No. 322, by order of the State Construction Committee dated 12/29/2000 No. 308, by Decree of the Government of the Russian Federation dated 12/04/2000 No. 921).

Property type code 03 what is it

If there is no data to fill out the indicator, make a dash along the entire length of the indicator. Text indicators in cells are entered from left to right in capital letters. Integer numeric indicators are also from left to right, with a dash in the last empty cells.

Since the new advance calculation no longer contains special sections for calculating the tax on real estate that is part of the Unified Gas Supply System, as well as those located in the territories of different constituent entities of the Russian Federation (section 4 of the previous form) and for calculating the average cost of non-taxable fixed assets (section 5 of the previous form). Foreign companies that operate in Russia through permanent establishments must also fill out Section 2. And Section 3 is intended for those foreign companies that pay property tax on real estate that is not related to their activities through a permanent establishment (in particular, due to the lack of such).

This is interesting: Administrative responsibility of disabled people of group 2

Changes

When the tax calculation procedure changed, disputes began to arise between cadastral authorities and taxpayers. Revaluation occurs every three years. For this reason, it is important to be able to appeal the commission’s decision. There are the following reasons for changing the rating:

From which objects to pay?

Such property should be transferred to the “Fixed Assets” accounting account. It is taxable, and the object may be in joint or temporary use. In addition, organizations pay taxes on residential premises that are not included in properties for sale.

From 2021, the tax on movable property was abolished. But the Tax Code did not stipulate how to distinguish between movable and immovable property. The definition is in Article 130 of the Civil Code, where real estate is everything that is firmly connected to the land. For example, buildings, structures, structures. Therefore, the editors of the UNP learned what is considered real estate from Olga Khritinina, 2nd class adviser to the State Civil Service of the Russian Federation.

Tax incentive codes for property tax – 2021257

However, not all benefits presented in the Tax Code of the Russian Federation have established codes. The Federal Tax Service proposes to use property tax code 2021257 in such cases, which is used for fixed assets - movable property items registered from 01/01/2021. Exceptions for the application of tax benefit 2021257 for property tax are specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of the Russian Federation dated December 12, 2021 No. BS-4-11/25774).

The rest of the movable property from 01/01/2021 began to be regarded as subject to this tax, but by virtue of clause 25 of Art. 381 of the Tax Code of the Russian Federation, fixed assets registered after 01/01/2021 are exempt from taxation. An exception to this rule is property registered as a result of:

accountant

Let us recall that depreciable property is distributed among depreciation groups in accordance with its useful life (Clause 1, Article 258 of the Tax Code of the Russian Federation). When assigning a property to a depreciation group, the organization must be guided by the classification of fixed assets, which in turn is based on the All-Russian Classifier of Fixed Assets (OKOF). Previously, the classification of fixed assets was developed on the basis of the All-Russian Classifier of Fixed Assets OK 013-94S (OKOF codes consisted of 9 characters). Starting this year, the new OKOF classifier “OK 013-2014 (SNS 2008)” has been in effect (approved by order of Rosstandart dated December 12, 2014 No. 2020-st). At the same time, the updated OKOF codes may contain 12 characters (and not 9, as before).

Features of the formation of a declaration and tax calculation for property tax

According to clause 1.2 of the Procedure for filling out a tax return for corporate property tax (hereinafter referred to as the Procedure), given in Appendix No. 3 to the order of the Federal Tax Service of Russia dated March 31, 2021 No. MMV-7-21/271, the declaration is submitted in the following composition:

For preferential property (for which the Tax Benefit “Exempt from Taxation” value is set in the Property Tax Rate information register), you must also fill in the tax rate established in accordance with Article 380 of the Tax Code of the Russian Federation by the law of the constituent entity of the Russian Federation.

Systematization of accounting

For example, if the law of a constituent entity of the Russian Federation establishes a benefit for this category of taxpayers in the form of payment to the budget of 80% of the amount of calculated tax, then the value for the line with code 200 should be calculated as follows: 1/4 of the value of the line with code 180 x (100% - 80%) : 100%.

On the line with code 190, the tax benefit code 2021000, established by the law of the constituent entity of the Russian Federation for the corresponding category of taxpayers, is indicated in the form of a reduction in the amount of tax payable to the budget.

How to select property tax return codes for 2021

However, in addition to this, almost any organization that has any movable property on its balance sheet can receive tax breaks. The exception is situations where such property became the property of the company as a result of a bilateral transaction between various organizations that carry out joint activities. In addition, the benefit cannot be obtained in the event of a company reorganization.

For example, some residential premises also fit into this category. Suppose a legal entity bought certain real estate for the purpose of further resale, while the house or apartment will not be subject to taxation.

Filling out the benefit code in the property tax return

Instead of code 2021257, enter code 2021000. After the “/” sign, indicate from left to right the number, clause and subclause of the article of the regional law that establishes the benefit. It’s okay if the structural units of the article are named differently (instead of a subparagraph - a paragraph, instead of a paragraph - a part). For each structural unit, four familiar places are allocated. Fill in empty spaces with zeros.

In line 130 of section 2 of the calculation for the first quarter, you cannot indicate code 2021257, which was used to designate the benefit under clause 25 of Art. 381 Tax Code of the Russian Federation. After all, the benefit is no longer federal; its fate is decided by the regions.

Property type code 03 what is it

In the OS cards there is a field Type of property, for which we have defined the following possible values: 1 Real estate 2 Real estate for the gas transportation system 3 Property on the continental sea/shelf 4 Movable property 5 Other property

This is interesting: If the owner is not registered in the apartment, is he obliged to pay for utilities?

And they lived with this normally for some time: they put down either 1 or 4, i.e. either movable or immovable. It's not time to file your property tax return yet. And now doubt creeps in that we interpreted this field correctly, because... the declaration groups the data by this field and transfers the type of property from the card to the declaration field “Property type code”, i.e. “Type of property” in the card should be understood in the same way as “Code of type of property” in the declaration. But for the “Property Type Code” codes with other semantic loads must be used: 1 - Real estate objects of the Unified Gas Supply System (Unified Gas Supply System) 2 - Real estate objects of a Russian organization located in different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation ( on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation) 4 - Property of a Russian organization that is located on the territory of another state and in respect of which the organization paid tax outside the Russian Federation 3- In all other cases

Class OKVED 68 - Operations with real estate

- leasing and operation of own or leased real estate: apartment buildings and other residential buildings, apartments, non-residential buildings and premises, including exhibition halls and warehouses, land plots;

Class OKVED 68 contains the following codes with a detailed description of the type of activity and interpretation:

— provision of services by agencies for working with real estate: provision of intermediary services in the purchase, sale and rental of real estate, provision of consulting services in the purchase, sale and rental of real estate;

– 2010338 – organizations in relation to newly commissioned facilities that have a high energy efficiency class, if in relation to such facilities, in accordance with the legislation of the Russian Federation, the determination of their energy efficiency classes is provided, within three years from the date of registration of the specified property (clause 21 of Art. 381 Tax Code of the Russian Federation); – 2010340 – organizations in relation to property located in the internal sea waters of the Russian Federation, the territorial sea of the Russian Federation, on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, used in the implementation of activities for the development of offshore hydrocarbon deposits, including geological study, exploration, preparatory work (clause 24 of article 381 of the Tax Code of the Russian Federation); – 2010341 – organizations recognized by funds, management companies, subsidiaries of management companies in accordance with Federal Law dated July 29, 2017 No. 216-FZ “On innovative scientific and technological centers and on amendments to certain legislative acts of the Russian Federation” (clause 27 Article 381 of the Tax Code of the Russian Federation); – 2010342 – organizations that have received the status of a project participant in accordance with Federal Law No. 216-FZ, in relation to property recorded on their balance sheet and located on the territory of an innovative scientific and technological center, for 10 years starting from the month following the month of installation accounting of the specified property (clause 28 of article 381 of the Tax Code of the Russian Federation).

OKFS - All-Russian classifier of forms of ownership

The objects of classification are the forms of ownership that are established by the Civil Code of the Russian Federation, the Constitution of the Russian Federation and Federal laws. According to these regulatory documents, in Russia there are such forms of ownership as municipal, state, private and others.

- Formation of cadastres, registries, registries, information resources that contain information about subjects of civil law;

- Ensuring the compatibility of information systems, carrying out automated processing of social and technical and economic information;

- Solving analytical problems in the taxation system, in the field of statistics and other areas of the economy that are related to the disposal and management of property;

- Analysis and forecasting of socio-economic processes, development of recommendations related to economic regulation.

OKFS codes

In these information and reference sections, the Yualis law firm offers you basic information about government authorities (tax inspectorates of Moscow and the Moscow region, district and magistrate courts, pension, medical and social insurance funds, as well as other addresses and coordinates of government services) so that visitors our site it was convenient to always have this reference information at hand.

- creation of information resources, registers and cadastres, registers containing information about subjects of civil law

- analysis and forecasting of socio-economic processes, development of advice on regulating the economy

- solving analytical issues in the field of statistics, in the taxation system and other areas of the economy related to the management and disposal of property

- carrying out automated processing of technical, economic and social information (TESI), ensuring the identity of information systems

Disassembling OKFS 16 - what is this code and what is its importance

The code is assigned by the state statistics service after applying for state registration of citizens and organizations. The territorial body of the Federal Statistics Service sends a notification by mail about the code assigned to a specific person. Such information can be obtained by directly contacting the state statistics service or through its official website.

Using the OKFS code 16 “Private property”, you can calculate absolutely any legal entities in the creation of which individuals participated.