Reason for change

Corresponding additions from 01/01/2020 to Art. 170 of the Tax Code of the Russian Federation, which regulates the procedure for allocating tax amounts to costs of production and sale of goods (works, services), subsection was introduced. “a” and “b” clause 2 of Art. 2 of the Law of September 29, 2019 No. 325-FZ.

The main reason for the innovations is to exclude the possibility of using VAT evasion schemes during the reorganization of companies and the subsequent application of special tax regimes by the successor.

Also see: What's changing for VAT in 2021: overview.

Main

- When reorganizing enterprises in any form, primary responsibility for submitting any reports falls on the legal successor of the reorganized enterprise.

- The reporting deadlines are the same for all business entities.

- During the reorganization, it is customary to draw up an act of transfer of documentation belonging to the reorganized enterprise. If the reorganization is carried out in the form of division and separation, drawing up an act is mandatory. Without this document, state registration may be refused and the reorganization will not be completed legally.

New responsibility

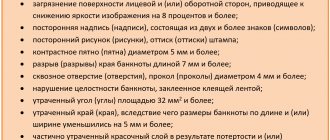

As a result, the new sub. 2 clause 3 and clause 3.1 art. 170 of the Tax Code of the Russian Federation obliged the legal successor (there may be several of them) to restore the amount of value added tax on goods (work, services), including fixed assets, intangible assets and property rights received during the reorganization, which were previously accepted for deduction by the reorganized company.

The condition for the existence of the obligation to restore VAT: the continued use by the successor of the accepted values in transactions not subject to value added tax in connection with the transition to special tax regimes. But that's not all.

So these are the situations where:

- transition to OSN;

- the use of goods/works/services in activities not subject to VAT has begun;

- transition to the simplified tax system or UTII;

- combining the general system of taxation and imputation;

- goods/work/services were received from the seller as an advance payment, from which the reorganized company accepted VAT for deduction (when the legal predecessor, as a buyer, transferred the advance payment and claimed VAT deduction from it, and the shipment of the goods (or the return of the advance upon termination or change of the contract) has already been made successor, who also claims a deduction);

- the seller retroactively reduced the cost of goods/work/services that were supplied to the reorganized company.

Financial statements

During reorganization, the newly formed enterprise undertakes the obligation to submit year-end reporting for its predecessor within three months after the end of the year (Article 23-1(5) of the Tax Code). A copy of the reporting is submitted, in addition to the Federal Tax Service, to the statistics service. The period for which information is included in it: from the beginning of the year until the date preceding the date of state registration of the results of the reorganization.

How are the financial statements of an organization prepared during reorganization in the form of merger ?

The assignee also prepares reports for himself – the so-called introductory reports. It is formed from the data transferred by the predecessor on the basis of the transfer deed and adjusted to the amounts of business transactions that took place after its preparation. Typically, the act is drawn up as close as possible to the date of reorganization, and then the data, together with the adjustment amounts as of the registration date, are entered into the balance sheets and transferred to the successor (Federal Law No. 402 of 06-12-11, Articles 16-6,7) . Additions to the act are recorded.

Attention! Public sector organizations are exempt from compiling primary reporting.

The first reports after the reorganization are not submitted to the regulatory authorities: the obligation to submit them arises only at the end of the year.

How to draw up and approve a transfer deed during the reorganization of a legal entity ?

VAT recovery period

As a general rule, in each case listed above, we are talking about the corresponding tax periods.

In addition, as of 01/01/2020, the issue of the VAT restoration period when the successor transfers to UTII or the simplified tax system has been resolved:

| Situation | Solution |

| General rule | In the tax period preceding the transition to the simplified tax system or UTII |

| As a result of the reorganization, a new company was created and it applies the simplified tax system or unified income tax. | In the first quarter, from which the special regime is applied |

| A company on a common system joins an organization on the simplified tax system or UTII | In the quarter following the one in which an entry about the termination of the activities of the affiliated organization was made in the Unified State Register of Legal Entities |

Transfer deed

Despite the fact that the transfer deed, as one of the main documents during reorganization, is mentioned in Art. 16-7 Federal Law No. 402, which deals with financial statements during the reorganization of legal entities. persons, its preparation is not mandatory. According to Art. 59-2 and Art. 58 of the Civil Code of the Russian Federation, it is necessary only if the reorganization is carried out in the form of division and separation. Without a transfer deed signed by the parties, in this case there may be a refusal of state registration of the successor enterprise (Article 59-2, paragraph 2). This is stated in the joint letter of the Ministry of Finance with the Federal Tax Service No. GD-4-14 / [email protected] dated 14-03-16.

Question: How to fill out and submit reports on Form 2-NDFL during reorganization? View answer

The transfer act is formed on the principle of compliance with the provisions of Art. 59 (1) Civil Code of the Russian Federation. It contains information about the receivables and payables of the reorganized enterprise, with special emphasis on disputed contracts and obligations under them. In addition, when compiling it, they are guided by Order of the Ministry of Finance No. 44n. The Order contains instructions for the preparation of reports by the accounting service during the period under consideration.

The transfer certificate includes:

- financial statements;

- inventory records (liabilities, property);

- package of primary documentation for accounting areas;

- decryption of debts;

- a document confirming the fact of entry in the Unified State Register of Legal Entities on the formation of legal successors.

Attention! All debtors and creditors of the enterprise must be notified of the reorganization and the fact of notification must be reflected in the transfer deed.

How to recover VAT

As a general rule, the assignee recovers VAT on the basis of issued invoices (copies thereof) and attached to the transfer deed or separation balance sheet, based on the value of the transferred goods (work, services) and property rights indicated therein. And in relation to transferred fixed assets and intangible assets - in an amount proportional to the residual (book) value without taking into account revaluation.

If the legal successor does not have invoices, restoration is carried out on the basis of an accounting certificate-calculation using the tax rates in force at the time of purchase of the goods.

Also see “Sample and purpose of an accounting statement-calculation”.

From 01/01/2020 new sub. 2 p. 3 art. 170 of the Tax Code of the Russian Federation obliges organizations that combine the general taxation system and UTII to restore VAT taken for deduction on goods/work/services (including fixed assets, intangible assets, property rights) that they will use in imputed activities.

Moreover, VAT must be restored in the quarter when the organization begins to combine regimes. That is, goods and other valuables are transferred or begin to be used.

Read also

11.11.2019

Personal income tax reporting during reorganization

Since January 2021, a rule has appeared in the Tax Code regulating the procedure for submitting final personal income tax reports for a reorganized company.

So, if before the moment of reorganization the company did not have time to submit forms 2-NDFL and 6-NDFL, then its legal successor must do this (clause 5 of Article 230 of the Tax Code of the Russian Federation). Such reporting must be submitted to the Federal Tax Service at the place of registration of the legal successor. An important detail: an organization that reports both as a tax agent and as a legal successor must submit separate forms 2-NDFL and 6-NDFL. In other words, you should report twice: the first time for your predecessor, and the second time for yourself. Let us remind you that starting with reporting for 2021, you need to use form 6-NDFL with the amendments made by order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11 / [email protected] (see “New form 6-NDFL will be used for reporting for 2021"). Also, for reporting for 2017, you need to use form 2-NDFL with the changes made by order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected] However, you can report for 2021 using the previous form 2-NDFL (see “ 2-NDFL for 2021: tax authorities allowed reporting using the old form").

Please note: when submitting 6-NDFL and 2-NDFL, those tax agents who use web services to prepare and check reports (for example, the Kontur.Extern system for sending reports) will feel most comfortable. There, all necessary updates and current test programs are installed automatically, without user intervention. If the tax agent has chosen a form that does not correspond to the reporting period, or has filled out the form incorrectly, the system will certainly warn him about this and tell him how to correct the errors.

Fill out, check and submit 6-NDFL and 2-NDFL through “Kontur.Extern”

Table 1

How to fill out 2-NDFL and 6-NDFL for a reorganized company

| Field name | Form 2-NDFL | Form 6-NDFL |

| Reorganization (liquidation) form code | 1 - transformation 2 - merge 3 - separation 5 - connection 6 - separation with simultaneous joining | |

| By location (registration) (code) | 215 (for the largest taxpayers - 216) | |

| Tax agent | name of the reorganized organization or its separate division | |

| TIN/KPP of the reorganized organization | TIN and KPP of the reorganized company or its division | TIN and KPP of the reorganized company or its division. In this case, the TIN and KPP of the legal successor are indicated at the top of the title page |

| OKTMO code | OKTMO of the reorganized company or its division | OKTMO at the location of the workplace of the employee of the reorganized company |

| Sign | 4 - if the legal successor submits a certificate to the Federal Tax Service; 3- if the legal successor issues a certificate to an individual at his request | |

Labor relations with employees of the reorganized organization.

Based on Part 5 of Art. 75 of the Labor Code of the Russian Federation, a change in the jurisdiction (subordination) of an organization, its reorganization (merger, annexation, division, separation, transformation) or a change in the type of state or municipal institution cannot be the basis for terminating employment contracts with employees of the organization or institution.

In part 1 of Art. 75 of the Labor Code of the Russian Federation states that when the owner of an organization’s property changes, employment contracts can be terminated only with the head of the organization, his deputies and the chief accountant. At the same time, dismissal of these employees is possible only for a period not exceeding three months from the date the new owner acquires rights to the organization’s property. This right does not apply to other employees of the organization (Part 2).

The successor organization must reflect the fact of reorganization of the legal entity in the work books and personal cards of employees with reference to the decision of the owners on its implementation. In addition, it is necessary to conclude additional agreements to employment contracts with employees and reflect in them a change in the employer and other essential conditions, if any change.

Legal consequences of the end of the last tax period of an affiliated legal entity

Paragraph 1 of Article 55 of the Tax Code of the Russian Federation sets out the legal consequences of the end of the last tax period of an affiliated legal entity. It should be noted that these legal consequences will relate to the legal successor of the merged entity, which will cease to exist independently at the end of the last tax period.

From the content of paragraph 1 of Article 55 of the Tax Code of the Russian Federation, two legal consequences can be distinguished: the obligation of the assignee to determine the tax base for the relevant tax (in this case, the income tax) and to calculate the amount of tax payable. This provision does not contain a direct indication that the legal successor has an obligation to submit an income tax return for the legal predecessor. At the same time, the obligation to determine the tax base and calculate the tax established by paragraph 1 of Article 55 of the Tax Code of the Russian Federation cannot be abstract. Moreover, the very essence of tax legal relations as public-legal relations, that is, based on the presence of power in one subject of the legal relationship in relation to another, presupposes the possibility of control by the tax authorities over the actions of the taxpayer. At the same time, it seems doubtful whether the obligation to determine the tax base and calculate the tax is fulfilled in the absence of the obligation to submit a declaration. Indeed, if we assume that there is no obligation to submit a declaration, then, firstly, it is not clear how and on what basis the tax base and tax amounts should be determined, and, secondly, in the absence of a material medium reflecting the taxpayer’s fulfillment of these duties, it is impossible for the tax authority to exercise control powers over the taxpayer’s performance of these duties. The only document provided for by the Tax Code of the Russian Federation, on the basis of which the tax base and the amount of tax payable can be calculated, is a tax return.

In accordance with paragraph 1 of Article 80 of the Tax Code of the Russian Federation, a tax return is a written statement of the taxpayer about the objects of taxation, about income received and expenses incurred, about sources of income, about the tax base, tax benefits, about the calculated amount of tax and other data that serves as the basis for calculation and payment of tax. Consequently, the determination of the tax base and the calculation of income tax by the successor must be carried out on the basis of the corresponding declaration.

The reorganization procedure, based on the norms of the Tax Code of the Russian Federation, in no way affects the deadlines for submitting declarations to the tax authority, even if this declaration was drawn up based on the results of the last tax period of the affiliated organization.