Publicity of reporting

There are a number of companies that are required to publish financial statements. That is, the data of their activities must be available to all interested parties (Clause 9, Article 13 of the Federal Law of December 6, 2011 No. 402-FZ).

You can find out whether an organization must publish reports by analyzing the law governing the company's activities. For example, self-regulatory organizations are required to publish reports (clause 11, clause 2, article 7 of Federal Law No. 315-FZ of December 1, 2007).

Joint-stock companies must disclose their annual reports (Clause 1, Article 92 of Law No. 208-FZ of December 26, 1995).

Reports must be published before June 1 (clause 46 of Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43N).

Submit your financial statements on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

Requirements for the preparation of annual financial statements

The main requirement is the reliability of the data, i.e. the indicators must be so reliable that any user of the reporting (whether external or internal) should not doubt the indicators of the enterprise’s economic activity.

The requirement for timeliness of data also affects the quality of the annual reporting; data must be reflected exactly in the reporting period in which they occurred.

Also, all indicators must be comparable, i.e. There must be an interconnection between these forms and accounting registers and declarations.

The principle of completeness indicates that all reporting data must be reflected in full; if completeness is lacking, then this fact must be reflected in the explanatory note.

How to draw up a balance sheet

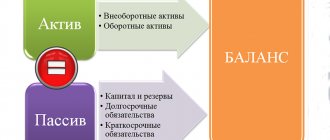

The balance is compiled based on data on accounts at the end of the year. Includes two sections, the results of which must be equal. It's an asset and a liability. The balance sheet was once called Form No. 1.

Types of balance sheet: simplified and complete. The first option may be small businesses. The rest present a balance sheet with a detailed breakdown by item.

The deadline for submitting the balance sheet for 2021 is 03/31/2021.

In 2021, the balance sheet form approved by Order of the Ministry of Finance dated April 19, 2019 No. 61n is in force. Among the latest changes, you now need to indicate in the form:

- whether a mandatory audit is carried out;

- audit firm data;

- Amounts in thousands of rubles and in millions can no longer be reported;

- activity code according to OKVED2.

Why do you need accounting?

While the business is not large, it seems that it is possible to keep all the information about cash flows and obligations in your head, or it is enough to write down the most important things in a notebook, but keeping accounting is pointless. This is true to some extent: the smaller the business and the number of transactions, the easier it is to track transactions. But competent accounting allows not only to record the facts of economic life. Thanks to him you can:

- Assess the real financial position of the enterprise

- Monitor the company’s performance and identify discrepancies with forecasts

- Find reserves

- Identify profitable and unprofitable transactions

- Monitor compliance of activities with legal norms

- Submit reports on time, following the schedule

According to Law 402-FZ, individual entrepreneurs and branches of foreign companies may not maintain accounting - all other enterprises are required to do this and submit specific reporting forms to the tax office.

Example of filling out a balance sheet

Flags LLC was created in 2021. At the end of the year, the chief accountant (who is also the director) compiled a balance sheet based on the balance sheet for the accounting accounts. Since this is the first year of activity, there are no figures for the previous two years. Account balances are presented in the table.

| Account debit balance | Amount, thousand rubles | Account credit balance | Amount, thousand rubles |

| 01 | 100 | 02 | 14 |

| 10 | 74 | 60 | 40 |

| 19 | 37 | 62 | 45 |

| 50 | 15 | 66 | 39 |

| 51 | 88 | 69 | 14 |

| 70 | 37 | ||

| 80 | 10 | ||

| 84 | 115 |

Line 1150 of the balance sheet records the difference between accounts 01 and 02, that is, the residual value of fixed assets is reflected.

Balances on account 10 are entered in line 1210. VAT must be taken into account in line 1220. All funds are reflected in line 1250 of the balance sheet asset (15 + 88 = 103).

For authorized capital there is line 1310, and for retained earnings there is line 1370.

The balance of account 66 (loans) is reflected in line 1510. All debt to creditors is in line 1520 (40 + 45 +14 +37 = 136).

At the end of filling out the balance, you need to compare lines 1600 and 1700 - they must be equal. In the example, the balance sheet total is 300 thousand rubles.

balance sheet

Download a blank balance sheet

Submit your financial statements on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

How to choose an accounting program

There is no ideal software that would suit both a nut shop and a window factory. When choosing a program, think about what it should be able to do and what needs it should meet. Here is a list of parameters that are worth considering:

- preparation of reports in accordance with the special tax regime and organizational and legal form;

- possibility of synchronization with a cash register;

- ability to run on different devices, including mobile;

- availability of reminders about reporting deadlines;

- ability to generate reports in figures and graphs;

- degree of difficulty in handling;

- price.

Programs designed for non-specialists are easier to use: they provide hints, generate reports based on ready-made schemes, and simplify the analysis of financial data.

Income statement

Also, many people habitually call this report Form No. 2. There are no line codes in the approved form. They need to be entered independently, based on the encoding presented in Appendix No. 4 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Changes were also made to the financial results report form. Some line names have changed, and some of them have been excluded. These changes will come into effect for 2021 reporting.

When drawing up a balance sheet, you can be guided by the final account balance. To report on financial results, you will need account turnover.

So, a summary of the report lines:

Code 2110 - turnover on the credit of account 90 “Revenue”. Let's assume that Flagi LLC earned 11,000 thousand rubles.

Code 2120 - turnover on the debit of account 90. The cost of goods, products sold, work, etc. is written here. Let's say Flags LLC attributed costs to cost in the amount of 7,000 thousand rubles.

Code 2100 is the difference between lines 2110 and 2120. That is, in our example, the calculation is as follows: 11,000 - 7,000 = 5,000.

Code 2210 - turnover on the debit of account 90. In this line we will write down the commercial expenses (account 44) of Flagi LLC, which amounted to 1,500 thousand rubles.

Code 2220 - turnover on the debit of account 90 “Cost of sales” in correspondence with account 26. The accountant will write down the amount of 1,300 thousand rubles in the report.

Code 2200 = line 2100 - 2210 - 2220. The profit of Flagi LLC will be 2,200 thousand rubles. (5,000 - 1,500 - 1,300).

Code 2340 - turnover on the credit of account 91 (amounts on lines 2310 and 2320 are not taken into account).

Code 2350 - turnover on the debit of account 91 minus line 2330.

Code 2300 = line 2200 + line 2310 + line 2320 + line 2340 - line 2330 - line 2350.

Code 2410 - accrued income tax (20% of line 2300). LLC "Flags" had a profit of 144 thousand rubles. This means that the tax is 29 thousand rubles. (144 x 20%).

Code 2400 = 2300 - 2410 - 2460. You also need to take into account lines 2430 and 2450 (either subtract or add depending on the sign of the line).

financial results report

Download a blank financial results report form

Peculiarities of preparation of financial statements by different companies

The nuances of preparing financial statements depend on the legal form of the company, the applied taxation regime, and the scale of its activities.

Let's look at the most common cases:

- This article will tell you how to draw up a balance sheet for an LLC.

- About the features of accounting and preparation of financial statements in an LLC using a simplified system, read the article “Accounting for an LLC using the simplified tax system: submitting reports.”

- Instructions for filling out a simplified balance sheet are presented in this article.

- The legislation of the Russian Federation allows some companies to submit not all forms of financial statements. Check to see if your business qualifies as a small business and learn what kind of reporting you need to file. Details are here.

- Read more about the features of a small business balance sheet here

IMPORTANT! Entrepreneurs are not required to keep records and submit financial statements. However, we recommend that you prepare at least a balance sheet every year, since it provides visual information about the property used in business activities, financial results and the size of receivables and payables. The publication “How to Read a Balance Sheet (Practical Examples)” will tell you what other information can be gleaned from the balance sheet.

- Pay attention to the liquidation balance sheet - it is compiled if a decision is made to close the company. In this case, an interim liquidation balance sheet is first formed, and then the final one. For more information about the liquidation balance sheet, read the article “Where to submit the liquidation balance sheet.”

Drawing up company financial statements is a responsible and complex job, which is usually carried out by chief accountants. If you want to learn how to fill out and submit reports, as well as understand the nuances of preparing reports for various types of companies, read the materials in our “Accounting Reports” section.

Statement of changes in equity

This report breaks down all of the company's capital movements in detail. The report consists of three sections. By the name of the line, you can easily understand what information should be entered for a particular code.

Among accountants, the form is also called Form No. 3.

In our example, Flagi LLC had no activities in 2021 and 2017, so the corresponding lines in the report will be empty.

Line 3311 is equal to balance line 1370. The total for line 3300 will coincide with the amount for line 1300 of the balance sheet. Section 2 of the report is not completed, since Flags LLC did not have any adjustments.

Section 3 of the report will tell users about the availability of net assets. In our case, they are equal to 125 thousand rubles. (total assets less current liabilities, 300 - 175 = 125).

statement of changes in equity

Download a blank statement of changes in capital form

Who should lead and deliver?

There are two types of accounting reports: interim and annual, sent, respectively, for the main and additional reporting periods. Any organization, regardless of its activities, must submit financial statements at least every year - during the annual reporting period, which may change if the organization was reorganized, registered or liquidated during the year.

Sample accounting form. balance

Important! It is necessary to submit reports every month or quarter if this is established by law for a given type of organization or by its owner.

Persons responsible for accounting as a whole should be responsible for accounting. Accounting includes entire structural divisions in large organizations and one or two accountants in small start-up companies. The law defines several categories of persons who can prepare reports:

- Chief Accountant;

- Other employees are specialists;

- Specialist. firms that accept delegation;

- Owner of the company.

The Law “On Accounting” also defines the following:

- Which persons are completely exempt from registration;

- Who has the right to keep simplified records;

- Which persons are obliged to conduct it in accordance with all standards.

Responsible persons must submit reports only to the location of the main branch of the company and to the inspectorate where it is registered. In this case, reports are generated for the entire organization as a whole, including divisions and branches. An organization can submit reports to the tax office at the location of its branch, but is not required.

Cash flow statement

Presented as part of annual reporting. Previously, the report was called Form No. 4.

Let's look at filling using an example.

Cash balances of Flagi LLC as of December 31, 2020:

Cash at the cash desk - 15,000 rubles.

In the bank account - 88,000 rubles.

The amount of revenue from the sale of goods without VAT is 11,000,000 rubles.

The loans received amounted to 39,000 rubles, and there were no repayments.

Payments on current debts amounted to 10,936,000 rubles.

How to do without an accountant

If you can’t yet hire an experienced specialist, there are other ways to handle accounting.

If you are an individual entrepreneur, you can not keep accounting records and limit yourself to financial ones, which will allow you to track cash flows.

If you are an LLC that meets the criteria for a small business, try to do the accounting yourself - take short-term accounting courses or use special programs that do not require special economic knowledge. Some services offer a free trial period and business solutions to choose from. For example, the Accounting Department of Sberbank has three of them.

If you apply several tax regimes, accounting will be complex - in this case, qualified assistance is desirable. Hire a trainee operations operator who can process primary documentation, or outsource accounting, or use different software for operations in each mode. The costs of these services will be fully repaid.

Error correction

An accountant may discover errors in a company's accounting that distort accounting and, accordingly, reporting.

If an error is discovered before reporting is generated, it is corrected by the date of the reporting year. There are two nuances here:

- The error was found in the reporting year. In this case, reversing entries are made in the month of discovery.

- The error was found by the accountant in the new year. Then you need to make corrections to the accounting in December.

If the reports have already been submitted, errors should be corrected for the current year. The postings will contain account 84. If significant errors are identified after submitting the reports, the reports will not be resubmitted. The adjusted figures will need to be reflected in the reporting for the current year by adjusting the opening balance in the balance sheet and other reports.

Similar instructions for making corrections are presented in PBU 22/2010.

Submit your financial statements on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Reporting period for accounting

For financial statements, the reporting period is currently set at 1 calendar year. Accounting reports are submitted to the Federal Tax Service and statistical authorities within the deadlines established by the Tax Code of the Russian Federation and Law No. 402-FZ. For more information about the deadlines for submitting reports, read the article “When is the balance sheet submitted (deadlines, nuances)”.

The main government body user of financial statements is the tax inspectorate. You can submit reports not only in person or by Russian Post, but also through the Federal Tax Service website. This publication will tell you how to do this.

Preparation of financial statements with Extern

From 2021, organizations must submit financial statements only in electronic form. This can be done through the official website of the Federal Tax Service, but all the numbers will have to be entered manually, which often leads to errors. In addition, you will still have to spend money on issuing an electronic signature.

All new Extern users can submit reports online for free while the Test Drive promotion is in effect. To do this, you only need registration in the service and an electronic signature. Extern allows you to report to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, FSRAR, RPN and the Central Bank of the Russian Federation.

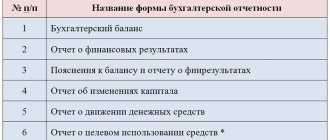

To prepare financial statements, go to the section “Federal Tax Service → Create new → Forms No. 1-6 Accounting statements.” Fill out the reporting in the system interface and go through the automatic verification. If Extern finds errors, it will highlight them and ask you to correct them before sending. Explanations for reporting can be generated using the Expert service; it helps with the analytical part: data on the financial position, comparability of data for the reporting and previous years, etc. Sign the finished report with an electronic signature and send it to the tax office.

How financial reporting helps in managing an organization

Financial reporting is the basis for making management decisions. In order for a manager to understand in which direction it is best to develop the organization and how to adjust the current strategy, he must have up-to-date and reliable information about the results of its activities and financial position. Such information is collected in accounting registers throughout the year and subsequently reflected in the financial statements.

Since efficiency is important for management decisions, some companies prefer to prepare interim financial statements or introduce additional forms from management accounting.

Financial statements have internal and external users. Internal employees are employees of the organization: economist, accountant, manager, general director, etc. They rely on reporting and accounting information to improve the company’s financial results.

External users are creditors, investors, counterparties, shareholders, tax inspectors, etc. Using reporting, they monitor the financial position of the company, assess its reliability and solvency, and the completeness of fulfillment of obligations to the budget and counterparties.