Inventory is a procedure during which property and liabilities are checked for availability, suitability and compliance with accounting information. This process is regulated by an order or directive approved by the manager or a substitute person, using the standard INV-22 form.

The order determines the list of persons who are entrusted with the functions of organizing and conducting an inventory, establishes a list of objects being inventoried (property and financial obligations), and also limits the period of the audit, determines the date by which all inventory documentation must be transferred to the accounting department for verification and processing and consolidation of results.

When is an inventory report drawn up?

Responsible persons who are directly involved in the inspection draw up all related documents.

The main one is the inventory act. All scan data, its features and results are displayed here. It is worth noting that the type of verification performed determines the type of unified form required for a particular situation. In essence, this document officially confirms what assets are available on the organization’s balance sheet. All assets of the organization are subject to inspection. After all, this is the only way to find out whether the reporting documents correspond to reality. There are situations in which verification must be carried out without fail. For example, it must be carried out before preparing the report at the end of the year. The law also requires that an inventory be taken during the reorganization or complete liquidation of a company. These actions are also carried out in cases where new employees take the position of director or financially responsible employee.

In addition, the act is drawn up in the following situations:

- The company rents or sells property;

- There are suspicions of theft and damage to property;

- After fires, disasters and other force majeure events;

- In any situation where the head of the company deems it necessary to conduct an inspection.

Conditions for conducting inventory in 2021

In order for responsible employees to begin carrying out the inventory, a corresponding order must be issued from the director.

The manager also appoints employees who are part of the inspection team. You need to know that the inspection is carried out exclusively in the presence of the financially responsible employee. Next, the commission proceeds directly to the inspection. It includes various actions: taking measurements, counting, weighing. Inspectors make sure that the property is actually in its place. All information is entered into the act, which is then compared with the reports of the accounting department. With simple calculations, you can identify whether there are discrepancies. If there are any, responsible employees find out the reasons.

The last stage of verification is the correct recording of its results. If deficiencies and discrepancies are found, an investigation begins to identify those responsible. As a rule, these are the persons responsible for the property. Responsible employees face administrative punishment.

( Video : “Procedure for carrying out inventory, accounting for surpluses and shortages”)

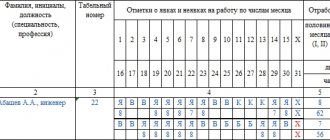

Control log form INV-23

To summarize and systematize information about orders for inventory, they are registered in a special standard journal form INV-23.

The full name of the form is the Logbook for monitoring the implementation of inventory orders. This form was approved back in 1998 by the State Statistics Committee of Russia and is still used to this day.

Registration of orders for inventory in the INV-23 journal is a mandatory procedure, enshrined in clause 2.3 of Methodological Instructions No. 49 06/13/1995.

Objects to be checked

All property that is on the organization’s balance sheet is subject to inventory:

- financial investments;

- fixed assets;

- intangible assets;

- raw materials and finished products;

- inventories held for production;

- various financial assets;

- money, both cash and non-cash.

The financial obligations of the organization are also checked.

These can be credits, debts, loans, etc. Naturally, all this must be accompanied by appropriate agreements, which allow for a correct inventory. There are situations when a check is carried out for a specific department. However, a complete inventory, which is usually carried out at the end of the year, will require maximum effort. Its data is used in the preparation of annual reports. It is this type of check that brings together absolutely everything that may be on the company’s balance sheet.

A complete inventory allows you not only to determine the actual availability of property, but also to check how correctly it is displayed in accounting documents. In addition, the commission makes sure that the equipment is used correctly and the raw materials are stored, and checks how correctly the property is treated. If necessary, certain comments are indicated.

Documentation of inspection results

Naturally, the fact of verification must be documented.

For these purposes, orders, acts, accounting journals, inventories, and collating documents are drawn up. All documents prepared during the inventory process must have at least two copies. There are many standardized forms used for specific situations. They should indicate the following information:

- Company name;

- Title of the document;

- description of objects subject to inventory;

- indication of measurement units, cost and quantity;

- inspectors, their positions and signatures with transcripts.

The legislation does not prohibit adding any new items to the unified form, or changing existing ones. However, you need to remember that the listed points must be left unchanged.

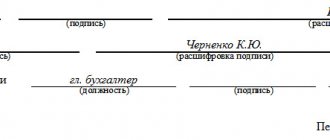

Filling out the cover of the INV-23 magazine

The cover of the INV-23 form contains general information of the following nature:

- General information about the organization - name, OKPO, OKVED (for the main direction), structural unit if necessary. The division may not be indicated, but the wording “as a whole for the organization” can be written if all INV-22 orders approved at the enterprise are subject to registration in the journal;

- Logging period – the start and end dates of filling are indicated;

- Information about the person responsible for making registration entries in the journal - position and full name.

The procedure for carrying out inventory in the Russian Federation

Before starting the inventory, which will be carried out in anticipation of the annual reporting, it is necessary to take care of the correct execution of all necessary documents. Thus, the verification process can be divided into stages:

- Issuance of an order. The manager must create a written document, which will become the basis for the inspection. A unified form is used for this. Information about the inspectors, property, and inspection deadlines is provided here in detail. The date by which the commission is obliged to carry out all actions related to the inventory is also indicated.

- Typically, the commission includes accounting employees, managers of individual departments, technologists, and economists. It could also be other specialists. As a rule, the head of the department is appointed senior. The inspectors must be accompanied by a financially responsible employee.

- Before the inspection, the responsible employee gives a receipt, which will indicate that all incoming and outgoing documents processed over a certain period are correctly compiled and submitted to the accounting department. The receipt also states that the materials were written off according to the law.

- All measuring instruments that will be used are also checked. The balances that are listed in the accounting department are determined. Specialists record the available documentation before the inspection begins.

- The check itself consists of weighings, recalculations, and measurements. When inspectors take a break, the property must remain secured or locked.

- Preparation of matching statements. This allows discrepancies to be identified. After the inventory, a protocol is drawn up where the commission’s findings are entered.

How to draw up an inventory report

The act is drawn up in at least two copies.

It is forbidden to make any edits here. Avoid blots and typos. The corresponding lines indicate the objects being inspected, weight, quantity, etc. When drawing up the report, the signatures of all specialists who are part of the inspection team are required. It must be remembered that if one signature is missing, the document will be considered invalid. After completing the inventory, the employee responsible for these valuables documents the correctness of the commission’s work and indicates that he has no complaints about the inspection.

Download the inventory report in 2021

- Blank form INV-1

If it is necessary to provide information regarding inventory, this form is used. Actual data and accounting information are displayed here.

- Blank form INV-1a

This document provides information about the review related to intangible assets. At the same time, documents are checked that allow the company to use these assets.

- Blank form INV-3

This form is used in cases where inventory items are being checked. As a rule, inventory takes place in warehouses where they are stored. If expired or unusable goods and materials are identified, an additional disposal certificate is issued.

- Blank form INV-10

There are situations when fixed assets are subject to inspection, the repair or construction of which has not yet been completed. This includes machinery, buildings, equipment, and various structures. The audit reveals how actual costs correspond to the costs indicated in accounting documents.

- Form INV-11

The form is designed to verify expenses that relate to future periods. Here, accounting information is compared with actual costs, which are confirmed by primary documents.

- Form INV-15

The form is filled out when taking inventory, which concerns cash. Typically, the check concerns the company's cash register, where actual money, checks, stamps, etc. are checked.

- Form INV-16

Verification regarding strict reporting documents and securities is carried out using this form.

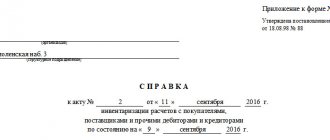

- Form INV-17

Information regarding settlements with suppliers, creditors, buyers and other counterparties is recorded here. The audit allows you to compare accounting data with debts that actually exist.

- Form INV-18

This is exactly the form the matching statement has. It is used when the inventory concerns fixed assets. Here it is recorded how the actual state of affairs differs from the accounting records.

- Form INV-19

This comparison sheet records data relating to inventory items, during the recalculation of which the inspection team identified deviations.

- Blank form INV-22

Before starting the inspection, the head of the company must issue an appropriate order. It is for these purposes that the INV-22 form is used. The deadlines, the composition of the commission, the procedure for carrying out the inventory and its volume are displayed here. Once signed by the director, the document is handed over to a senior member of the inspection team.

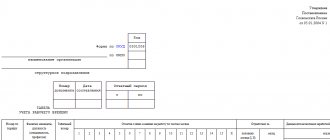

- Blank form INV-23

In essence, this form is a journal in which the correctness of the inventory is entered. All orders issued by management before the inspection are recorded here.

- Blank form INV-24

This act includes the results of inventory control checks.

- Blank form INV-25

The results of all control checks, which are intended to determine the correctness of the work of specialists, are entered not only in a special act, but also in a journal in the INV-25 form.

Results

An important point in the inventory procedure is the organization of recording orders for its implementation.

It allows you not only to compile a list of such documents, but also to monitor the quality and timeliness of various inventory procedures, as well as to effectively plan further inspections. Form INV-23 is one of the most optimal options for solving these problems. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.