If other inventory documents mainly systematize material assets, then the INV-17 act presents the results of a study of settlements with counterparties. Among the latter, we indicate not only enterprises, but also employees in respect of whom the debt has arisen.

A form is filled out based on a certificate of account status - INV-17p. This provides information on receivables and payables, which are then detailed in the form.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Form No. inv-17 act of inventory of settlements with buyers, suppliers and other debtors and creditors”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Conditions: mandatory and initiative

The rules of conduct are determined by the business entity itself, except in cases where such an inspection is mandatory. Cases of mandatory inspection are given, for example, in paragraph 27 of Order of the Ministry of Finance No. 34n. Thus, it is imperative to check the composition and value of the company’s assets and debts:

- before starting the preparation of annual financial statements;

- in cases of theft or damage to property, suspicion of abuse;

- when changing the materially responsible person (hereinafter referred to as the MOL);

- during reorganization or liquidation of the organization;

- in case of natural disasters (fire, flood and other cases of force majeure), etc.

To confirm the safety of property, as well as to verify the actual availability with the data reflected in the records, the management of the organization can at any time initiate monitoring in the interests of the owner. This is especially true for manufacturing and trading companies, where cases of theft are, unfortunately, not uncommon.

Found documents on the topic “Form N INV-17 calculations with the budget”

- Certificate for the act of inventory of settlements with buyers, suppliers and other debtors and creditors (Appendix to the unified form N INV-17) Documents of the enterprise's office work → Certificate for the act of inventory of settlements with buyers, suppliers and other debtors and creditors (Appendix to the unified form N INV- 17)

- Inventory report calculations with buyers, suppliers and other debtors and creditors (Unified form N INV-17)

Enterprise records management documents → Inventory report of settlements with buyers, suppliers and other debtors and creditors (Unified Form N INV-17)The document “Act of Inventory of Settlements with Buyers, Suppliers and Other Debtors and Creditors (Unified Form n Inv-17)” in format can be obtained from the link “download file”

- Form No. inv-17 inventory report calculations with buyers, suppliers and other debtors and creditors

Accounting statements, accounting → Form No. inv-17 act of inventory of settlements with buyers, suppliers and other debtors and creditorsact of inventory of settlements with buyers, suppliers and other debtors and creditors form no. inv-17 (enterprise, organization) form no. inv-17 approved by the resolution of the State Statistics Committee of the USSR dated December 28....

- Sample. Inventory report calculations with buyers, suppliers and other debtors and creditors. Form No. inv-17 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

Accounting statements, accounting → Sample. An act of inventory of settlements with buyers, suppliers and other debtors and creditors. Form No. inv-17 (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)... act of inventory of settlements with buyers, suppliers and other debtors and creditors no. +-+ codes +- form no. inv-17 according to OKD 0309016 +- organization according to OKPO +- structural unit of the organization +- basis for carrying out…

- Help for the inventory report calculations with buyers, suppliers and other debtors and creditors (Appendix to the unified form N INV-17)

Enterprise records management documents → Certificate for the inventory report of settlements with buyers, suppliers and other debtors and creditors (Appendix to the unified form N INV-17)...for the act of inventory of settlements with buyers, suppliers and other debtors and creditors (appendix to the unified form n inv-17)" in format you can get the link "download file"

- Sample. Calculation payment for booking and accommodation by bank transfer calculation. Form No. 7-g

Accounting statements, accounting → Sample. Calculation of payment for booking and accommodation by bank transfer. Form No. 7-gapproved by order of the Ministry of Finance of the Russian Federation dated December 13, 1993 no. 121 form no. 7-g hotel calculation of payment for booking and accommodation by bank transfer name of the organization…

- Inventory label (Unified form N INV-2)

Enterprise records management documents → Inventory label (Unified Form N INV-2)The document “inventory label (unified form n inv-2)” in format can be obtained from the link “download file”

- Inventory inventory of intangible assets (Unified form N INV-1a)

Enterprise records → Inventory list of intangible assets (Unified Form N INV-1a)The document “inventory list of intangible assets (unified form n inv-1a)” in format can be obtained from the link “download file”

- Form No. inv-4 inventory report of goods shipped

Accounting statements, accounting → Form No. inv-4 act of inventory of goods shippedact of inventory of goods shipped form no. inv-4 (enterprise, organization) form no. Inv-4 was approved by the Decree of the State Statistics Committee of the USSR dated December 28, 1989...

- Cash Inventory Act (Unified form N INV-15)

Enterprise records management documents → Cash Inventory Report (Unified Form N INV-15)The document “Cash Inventory Act (unified form n inv-15)” in format can be obtained from the link “download file”

- Act of inventory of future expenses (Unified form N INV-11)

Enterprise records management documents → Inventory report of deferred expenses (Unified Form N INV-11)The document “act of inventory of future expenses (unified form n inv-11)” in format can be obtained from the link “download file”

- Statement of results identified by inventory (Unified form N INV-26)

Enterprise records management documents → Statement of results identified by inventory (Unified Form N INV-26)The document “statement of records of results identified by inventory (unified form n inv-26)” in format can be obtained from the link “download file”

- Inventory inventory of fixed assets (Unified form N INV-1)

Enterprise records management documents → Inventory list of fixed assets (Unified Form N INV-1)The document “inventory list of fixed assets (unified form n inv-1)” in format can be obtained from the link “download file”

- Order (decree, order) on conducting an inventory (Unified form N INV-22)

Documents of the enterprise's office work → Order (decree, order) to conduct an inventory (Unified Form N INV-22)The document “order (decree, instruction) on conducting an inventory (unified form n inv-22)” in format can be obtained from the link “download file”

- Inventory report of unfinished repairs of fixed assets (Unified form N INV-10)

Enterprise records management documents → Inventory report of unfinished repairs of fixed assets (Unified Form N INV-10)The document “Act of inventory of unfinished repairs of fixed assets (unified form n inv-10)” in format can be obtained from the link “download file”

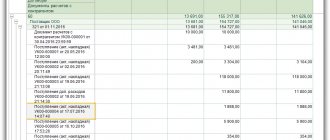

Filling out the tabular part of the application form

The main part of the help is presented in a table with nine columns:

| Column number | Explanations for filling out the column |

| 1 | Line numbering is sequential, starting from one. |

| 2 | The full correct name of the third party organization acting as a debtor or creditor (the column is supplemented by the requirement to record the contact number and registration address of each of the partners acting in the role designated in one of the above categories). |

| 3 | The reason that caused the debt to arise (for example, for the provision of a specific list of services or the sale of commercial products). |

| 4 | The date from which the debt factor began to exist. |

| 5 | Decoding of the amounts of accumulated debt of debtors, expressed in monetary terms. |

| 6 | Monetary debt relating to obligations to creditors. |

| 7-9 | A type of document that regulates the existence of debt for each partnership. For each reflected debt, documentary evidence must be provided, indicating the following details:

|

The process of issuing a certificate is completed by indicating the personal signature of an employee of the accounting department of the enterprise with certain powers, with the presence of a decoding of the position and initials.

Related documents

- Form No. inv-4 inventory report of goods shipped

- Form No. inv-6 act of inventory of materials and goods in transit

- Form No. MB-8 act on write-off of low-value and wear-and-tear items

- Form No. 2-ap (quarterly) (approved by Letter of the Central Bank of July 20, 1993 No. 45 “on the provision of reporting on Form No. 2-ap (monthly) and on Form No. 2-ap (quarterly)”)

- Form No. 2-ap (monthly) (approved by Letter of the Central Bank of Russia dated July 20, 1993 No. 45 “on the provision of reporting on Form No. 2-ap (monthly) and on Form No. 2-ap (quarterly)”)

- Form No. 7-tvn “report on temporary disability and injuries at work” (approved by the Post of the State Statistics Committee of Russia dated 07.07.93 No. 127)

- Form of a report on the activities of an enterprise with an average number of employees up to 200 people (form No. 1-MP, postal - quarterly) (approved by the Post of the State Statistics Committee of Russia dated January 19, 1993 No. 09)

- Report form on the availability and flow of funds from state extra-budgetary funds (form No. 8-f, postal - annual, quarterly) (approved by Resolution of the State Statistics Committee of Russia dated September 11, 1992 No. 147)

- Balance sheet as of March 31, 2012

- Interim liquidation balance sheet

- Information on the credit institution's funds received and used according to the interim liquidation balance sheet

- Order on accounting policies for accounting and taxation purposes

- Order on the accounting policy of a non-profit public organization

- Order on accounting policy

- An example of an accounting policy for an organization with a simplified tax system

- Sample liquidation balance sheet

- Sample liquidation balance sheet of LLC

- Sample interim liquidation balance sheet

- Interim liquidation balance sheet of LLC

- Interim liquidation balance sheet

Uncollectible accounts receivable

Accounts receivable may arise under the following circumstances:

- the borrower did not repay the loan that the organization issued to him;

- the company employee did not report on the amounts he received for reporting;

- the supplier has already received an advance payment, but has shipped the products to the buyer;

- the buyer did not pay for the goods supplied to him, services provided or work performed.

Accounts receivable in accounting must be written off in the following cases:

- after the statute of limitations has expired;

- in other cases when the debt becomes impossible to collect, for example, upon liquidation of the company.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Form No. Inv-17 Inventory Act of Payments with Buyers, Suppliers and Other Debtors and Creditors” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Objects to be checked

When comparing data, the presence of completely different assets and liabilities of the company can be analyzed. Here are the most common objects (liabilities):

- fixed assets (buildings, structures, equipment, transport, inventory, etc.);

- intangible assets (exclusive rights to software products, trademarks, etc.);

- goods;

- components and materials;

- products;

- funds (cash, in accounts with credit institutions);

- the amount and terms of debts and obligations.

MOLs are responsible for the safety of material objects: storekeepers in warehouses, cashiers, and other responsible persons. When hired, such employees sign an agreement on full financial responsibility for the property entrusted to them.

Order of conduct

The decision to conduct data comparison in any case is made by the management of the organization. This decision is formalized by an order, which indicates information about the inspection being carried out:

- objects;

- deadlines;

- site (dislocation);

- members of the inventory commission;

- chairman

The order form can be downloaded below.

Before the start of the inspection, the MOL submits a receipt to the accounting department stating that all documents confirming the receipt and expenditure of the property entrusted to them have been transferred in full (clause 2.4 of Order No. 49 of the Ministry of Finance). During the process, inventory records are compiled, which are then transferred to the accounting department to reconcile actual data with accounting data. If discrepancies are detected between actual and accounting data, the reasons for the discrepancies are identified. These may include:

- re-grading of goods;

- defect not written off in a timely manner;

- deviations from technological write-off standards (with the standard accounting method);

- errors in acceptance and deregistration;

- theft, incl. theft.

Based on the results of the inspection, a decision is made to take into account the identified shortages and surpluses. Identified surpluses are taken into account, and shortages are either recovered from the guilty parties, or, if it is impossible to write off from the guilty parties, written off as losses.