Form SZV-M is a unified form approved by the Pension Fund of Russia in Resolution No. 83p dated 02/01/16.

The document is a monthly report on the earnings of the working staff of the institution. The final date for submitting these reports is set on the 15th day following the reporting month. The legislation of the Russian Federation does not provide for mitigating circumstances that justify the responsible person for not submitting a report in a timely manner. At the same time, in practice, levers can be found to mitigate the punishment.

Late reporting: fines 2021

Organizations and individual entrepreneurs making payments and other remuneration to individuals are required to submit a report in the SZV-M form to the territorial divisions of the Pension Fund of Russia. This obligation is enshrined in 2021 in paragraph 2.2 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” The same law also provides for liability in the form of fines for late delivery of SZV-M. Article 17 of the law states that failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) false information will entail a fine of 500 rubles in relation to each insured person.

If you want to know how much you will be fined for late submission of SZV-M in 2021, then you need to multiply 500 rubles by the number of individuals about whom you must report - employees and those with whom your organization has entered into civil law contracts.

Example

Let’s assume that the organization is late submitting the SZV-M report for January 2021. It had to be submitted no later than February 15th. However, in fact, the report was submitted to the Pension Fund only on February 22. A total of 105 people are listed in the report. Therefore, the fine for late submission of SZV-M in 2021 will be 52,500 rubles (500 × 105). Below in the table we present the amount of fines for late submission of SZV-M in 2021. As an example, we give fines from 1 to 25 individuals in the report (inclusive).

| How many individuals are there in SZV-M | Amount of fine |

| 1 | 500 rub. |

| 2 | 1000 rub. |

| 3 | 1500 rub. |

| 4 | 2000 rub. |

| 5 | 2500 rub. |

| 6 | 3000 rub. |

| 7 | 3500 rub. |

| 8 | 4000 rub. |

| 9 | 4500 rub. |

| 10 | 5000 rub. |

| 11 | 5500 rub. |

| 12 | 6000 rub. |

| 13 | 6500 rub. |

| 14 | 7000 rub. |

| 15 | 7500 rub. |

| 16 | 8000 rub. |

| 17 | 8500 rub. |

| 18 | 9000 rub. |

| 19 | 9500 rub. |

| 20 | 10,000 rub. |

| 21 | 11,000 rub. |

| 22 | 11,500 rub. |

| 23 | 12,000 rub. |

| 24 | 12,500 rub. |

| 25 | 13,000 rub. |

Incorrect data for several employees

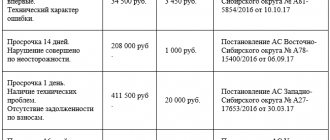

In the following example, we will talk about challenging not the very fact of imposing a fine, but its amount.

The organization employs 100 people. SZV-M was submitted on the last day of the deadline, but was not accepted. The reason is that incorrect information was provided for three employees (SNILS or Taxpayer Identification Number). The accountant has no choice but to correct the errors and submit the form later than the 15th. The Fund considered that the report was submitted in violation of the deadline and imposed a fine of 500 rubles for each insured person . That is, the amount of the fine was 50 thousand rubles.

The insurer did not agree with this. In his opinion, the fine should be calculated based on the number of persons for whom incorrect data was indicated on the originally submitted form. With this calculation, the fine should be only 1.5 thousand rubles. Who is right?

Again, there is no consensus among the arbitrators on this matter. There were decisions when the judges took the side of the Fund (resolution of the Far Eastern District Court of November 21, 2017 No. F03-4421/2017). But there are also opposite outcomes of the proceedings, for example, the resolution of the Court of Justice of the West Siberian District dated 08/23/17 No. A27-22235/2016. It states that a report with errors regarding individuals cannot be considered not submitted in full . Accordingly, it is unlawful to calculate the fine based on the total number of insured persons.

Thus, taking into account the practice of arbitration courts, insurers have a chance to challenge such a fine. Whether to use it or not depends on the scale of the “disaster.”

Reduced fine

In 2021, as before, the legislation does not provide that the fine for late submission of the SZV-M report can be reduced due to mitigating circumstances. In principle, there is no mechanism for reducing the fine.

However, it is worth noting that the absence of such norms in the legislation does not mean that the fine for late delivery of SZV-M cannot be reduced in any way. An organization or individual entrepreneur can apply to the court at the location of the PFR unit that issued the fine with a claim to partially invalidate the decision to prosecute and ask to reduce the sanctions (clause 5 of the reasoning part of the Resolution of the Constitutional Court of the Russian Federation dated January 19, 2016 No. 2-P) . Among the mitigating circumstances, one can indicate the commission of such a violation for the first time, a short period of delay, etc.

Note that in practice there have been cases when judges reduced the fine for SZV-M by 100 times - from 19,000 rubles. up to 190 rub. (decision of the Arbitration Court of the Sverdlovsk Region dated September 12, 2021 in case No. A60-33366/2016).

Another organization asked the court to reduce the fine by half - from 43,000 to 21,500 rubles. The court reduced it by that much (decision of the Arbitration Court of the Orenburg Region dated September 9, 2021 in case No. A47-6249/2016).

For more information about this, see the article: “Recent judicial practice on SZV-M: how to reduce fines.”

Forgotten employees

The accountant submitted the SZV-M in a timely manner, but due to carelessness did not include one employee in the form. To correct this oversight, a supplemental form was submitted with the employee's information. However, the accountant did not manage to submit it on time. As a result, a fine of 500 rubles followed.

If there is only one forgotten employee or there are several, it doesn’t matter. But in large companies, such forgetfulness can result in very tangible problems.

Is it legal to impose a fine in such a situation? After all, only the supplementary form was submitted beyond the deadline for submitting reports, while the primary one was submitted on time. Arbitration practice is ambiguous, for example:

- Resolution dated December 25, 2017 No. F03-5001/2017. The judges sided with the Pension Fund. The argument is this: in the supplementary form, information about forgotten employees was submitted for the first time. They were missing in the original form, therefore information about them was received by the fund late.

- Resolution of the AS of the East Siberian District dated October 5, 2017 No. A78-1989/2017. The court supported the insured. In his opinion, the supplementary form SZV-M is, in essence, a correction of errors in the original report . And no fine is imposed for this.

So, judicial practice suggests that in such a situation there is still a chance to challenge the fine. So if the amount is really significant, you should go to court.

Fine for non-compliance with order

Since 2021, the legislation on personalized accounting has introduced a new fine related to SZV-M. Note that it is not related to the out-of-date presentation of monthly reporting. The new fine concerns the method of submitting the SZV-M.

Please note that in 2021 it is possible to report using the SZV-M form “on paper” only if the report includes information for less than 25 people. If the report includes 25 or more insured persons, then you need to submit the report in the form of an electronic document signed with an enhanced qualified electronic signature (paragraph 3, paragraph 2, article 8 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) ) registration in the compulsory pension insurance system").

If in 2021 an organization or individual entrepreneur does not comply with the specified requirement regarding the method of submitting the SZV-M, then inspectors from the Pension Fund of the Russian Federation will have the right to impose a new fine of 1000 rubles. Since 2021, this fine has been added to Article 17 of Federal Law No. 27-FZ dated April 1, 1996.

Error in the original SZV-M form

The policyholder submitted the SZV-M on time, but after that he discovered an error in it. To correct it, he submits an updated form, but this happens later than the 15th.

, the Instructions for maintaining personalized records , came into force . Paragraph 39 of this document states that sanctions are not applied to entities that independently correct their mistakes. However, during inspections of earlier periods, Pension Fund specialists often impose fines .

Let us say right away that in such cases, arbitrators usually side with the policyholders. Examples are the resolutions of the Far Eastern District AS dated 04/10/17 No. F03-924/2017 and the Volga District AS dated 01/17/18 No. F06-28745/2017. Argument: since the policyholder independently discovered and corrected the error before the Fund learned about it, it is unlawful to impose a fine.

The same thing is said in the resolution of the Administrative District of the North Caucasus District dated September 20, 2017 No. A20-3775/2016. The only difference is that it deals with the submission of reports in electronic form.

How the Pension Fund will collect fines in 2021

The procedure for collecting fines for late submission of SZV-M and for failure to comply with the procedure for submitting a report is described in Article 17 of Federal Law No. 27-FZ of April 1, 1996. The procedure for collecting fines consists of several stages. So, in particular, an act will be drawn up. Then you will be required to pay a fine for late submission of the SZV-M. It will need to be paid within 10 calendar days from the date of receipt. Or, a longer period may be set for payment of the fine directly in the requirement itself. In 2021, you will need to pay the fine for late submission of SZV-M at KBK 392 1 1600 140. It has not changed.

In 2021, PFR units have the right to collect any fines for SZV-M exclusively in court. This is directly stated in Article 17 of the Federal Law dated 04/01/1996 No. 27-FZ (as amended by the Federal Law dated 07/03/2016 No. 250-FZ). Pension Fund authorities do not have the right to write off fines for SZV-M directly from bank accounts.

It is worth noting that in 2021, the PFR authorities actually had the right to write off fines for SZV-M in a pre-trial manner and write off fines directly from the accounts of payers. This possibility was provided for in Article 17 of the Federal Law of April 1, 1996 No. 27-FZ. However, starting from 2021, the Pension Fund does not have such an opportunity.

Read also

20.11.2017

Administrative fine for the manager

In addition to the fine for the company, the Code of Administrative Offenses provides for administrative liability for officials - from 300 to 500 rubles. Here the courts are in no hurry to help the manager. Even if the company managed to defend itself and was not fined, the directors will most likely be fined.

See also “Penalties for supplementary SZV-M must be paid to the director.”

But the situation with entrepreneurs has recently changed. If an individual entrepreneur acts as both an insurer for hired personnel and an official, he cannot be issued 2 fines. We talked about the details here.

What can they be fined for?

Form SZV-M is submitted every month to the Pension Fund of the Russian Federation by all institutions and individual entrepreneurs who employ employees who receive wages, including under GPC agreements.

You can receive a fine in 2021 for the SZV-M report for a number of reasons:

- For overdue reporting deadline SZV-M.

- For errors in reporting (if the full name, SNILS, TIN of working personnel are filled out incorrectly).

- For the incorrect form of the submitted SZV-M report.

Note. In 2021, an institution may be subject to a new financial penalty for SZV-M, even if it submitted reports on time and without errors.

- So, if a company or individual entrepreneur employs 25 or more people, a report in the SZV-M form must be sent only in electronic form. Failure to comply with this requirement is subject to financial penalties.

- At the same time, if the company employs less than 25 people, the company’s management has the right to decide on the form for sending SZV-M reports: paper or electronic.

How to avoid a fine and not pay money?

You can appeal a fine imposed if there are no grounds for its imposition. For example, if the C3V-M was provided on time and filled out without errors, and the Pension Fund employees made a mistake with the details or made other errors.

To appeal such a fine, you will need to send a statement of claim to the court, attaching the following materials:

- Copies of the C3V-M report.

- Requests from the Pension Fund for collection.

- Receipts for transfer of state duty.

- Bank payment order proving repayment of the fine.

To prevent reporting failures, the head of the institution needs to appoint a serious employee who has due responsibility for the assigned area of work, and in whose eyes there should always be a table with reporting deadlines.