In warehouses, keeping records of the movement of goods is mandatory. To do this, the financially responsible person fills out a special journal for each transaction for the receipt or consumption of goods, notes the balance of goods or the resulting quantity after arrival. We tell you how to enter information into the journal for recording the movement of goods in a warehouse using the TORG-18 form.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Form TORG-18: what is it intended for and where is it used

The TORG-18 form is approved by law and is intended to record the movement of goods in the warehouse. The form is used by trading companies to reflect information about the movement of inventory items in the warehouse (receipt/expense) and the balance of goods on a certain date. The company can use the indicators specified in the TORG-18 form as follows:

- based on information about inventory balances, company management can analyze data on inventory balances and make a decision on the need for additional purchases (or, conversely, to reduce the quantity of purchased products);

- Based on data on inventory turnover (income/expense), a company can monitor the sale of goods, obtain data on the level of demand for a particular product, and, as a result, adjust purchases (production).

Who fills out TORG-18

According to the law, responsibility for filling out the form can be assigned to the person who is financially responsible for the availability of goods in the warehouse. As a rule, the document form is filled out by the warehouse manager, since this person is the MOL and is responsible for the safety of the warehouse goods. This procedure for filling out the document is applicable for small enterprises and small firms.

Basic requirements and recommendations for filling out

The form of the TORG-18 form is approved by the Resolution of the State Statistics Committee. This Decree also contains the basic requirements for filling out the document. We will describe the basic requirements and recommendations for filling out the form:

In order for a document to be recognized as valid, it must indicate all the necessary details, namely:

- full name of the organization;

- division, data about which is entered into the Journal (for example, “Warehouse No. 5”);

- organization codes (OKUD, OKPO, OKPD).

- information about the filling period (for example, “for the 1st quarter of 2017”, “for March 2021”, etc.).

- The front part of the Journal must contain information about the MOL responsible for filling out the form (“warehouse manager Petrushkin V.L. signature”).

- Data in the Journal should be entered in the context of the name of the product (item). Information on the movement and balances of inventory items must be generated separately for each type of goods. Thanks to this filling method, the Journal is very convenient for monitoring the availability of balances and analyzing the movement of a particular product.

- The Journal form is used in conjunction with incoming and outgoing invoices for the receipt/issue of goods. It is these documents that are the basis for entries in the Journal. At large wholesale companies and at enterprises that trade in a wide range of different goods, information is entered into the Journal on the basis of accumulative statements. This document consolidates information about the receipt/expense of goods per day (by product range). Based on the accumulative sheet, the storekeeper reflects information in the Journal at the end of the day (for each product separately).

We fill out the delivery note TORG-12 according to the sample

The TORG-12 consignment note is a document that accompanies the delivery of inventory items. The form is not mandatory for use.

What is the TORG-12 form

Trade waybill 12 is quite often used by organizations to register inventory items (hereinafter referred to as goods and materials), measured in pieces or weight.

The head of the organization may not use this form (see Federal Law-402 “On Accounting”).

The consignment note (you can download it below) has a number of advantages, which we will discuss in this article.

You can download bargaining 12 at the end of the article.

Form TORG-12 is included in the album of unified forms (OKUD 0330212). However, with the entry into force of Law 402-FZ, primary documents do not necessarily have to be in a unified form. It is enough that the document contains the entire list of mandatory details specified in the law.

However, the unified form of bargaining 12 (can be lower) is so convenient that many entrepreneurs have not abandoned its use for several reasons:

- It is familiar and understandable.

- Meets regulatory requirements.

- If necessary, it will serve as a basis for resolving controversial situations, for example, claims regarding the quality of purchased goods (Law No. 2300-1).

- Confirms the fact of receipt or shipment of goods (Article

458 of the Civil Code of the Russian Federation). - Is the rationale for the adoption of VAT.

- Serves as confirmation of the expiration of the warranty period (Law No. 2300-1), etc.

Basis for registration of TORG-12

If the sale of goods is envisaged, then the basis for registration is the contract.

As a rule, the price and quantity of transferred products are indicated in the contract or in annexes (specifications). An option is possible when, under the terms of the contract, the price of the goods is determined by the current price list of the company, and the quantity is determined in the application from the buyer.

An alternative to the form is a universal transfer document (Letter of the Federal Tax Service of Russia dated October 21, 2013 N ММВ-20-3/).

Bargaining 12, filling rules

The TORG-12 invoice is prepared by the seller. The form contains information about the seller, buyer, name of the product, its quantity and cost, information about the financially responsible persons who shipped and received the goods.

| Count Torg-12 | Bargaining 12, filling rules |

| Shipper organization, address, telephone, fax, bank details | The name fits both full and short |

| Structural subdivision | The most complete information (name, contact details) |

| Provider | Full and short name, address and bank details |

| Consignee | Same as for the supplier |

| Payer | The purchasing organization is indicated (if it independently purchases and pays for the cargo) |

| Base | Indicate the details of the contract or work order on the basis of which the transaction took place |

| OKUD and OKPO codes, type of activity according to OKDP | The codes assigned to the organization by the statistics body upon registration are indicated. |

| Tabular section TORG-12 | The supplier lists the goods sold, their units of measurement and quantity, gross and net weight, price and VAT rate. The amount of goods with and without VAT is also indicated here. |

| The consignee received the cargo | Signature of the manager or employee who has the right to sign (order, power of attorney) |

| Accepted the cargo | Signature of the materially responsible person receiving the goods (storekeeper, driver, manager, etc.) |

| By power of attorney No. | Power of attorney details of the employee who received the cargo. Not to be filled in if the manager signed the line “The cargo was received by the consignee” |

| The consignee received the cargo | To be filled in if the cargo is received by the head of the organization |

| Supplier side printing location | The supplier's seal is affixed, if available. |

| Printing location on the consignee side | The consignee's stamp is affixed. If the cargo is received by proxy, then stamping is not required. |

| Date indicator | The actual shipment date must match the date on the invoice |

Document retention periods

The accountant should begin counting the retention period after the end of the reporting year. To determine the period, let us refer to Art. 17 402-FZ: for all primary documents this period is five years.

It is necessary to adhere to it for the TORG-12 invoice, but only if with this document the organization does not confirm the amount of loss carried forward to the future. If this happens, then, in accordance with Art.

283 of the Tax Code of the Russian Federation, the document can be stored longer.

Responsibility for compilation and accounting

Employees of organizations should pay attention to the details of filling out the document. This often helps to minimize the legal and tax risks of companies.

Pay attention to the seal! So, for example, a seal is not a mandatory requisite (it is not named in the list of mandatory requisites in 402-FZ). But in TORG-12 the seal must be there, because it is provided by the form.

On this issue, disagreements may arise when offsetting VAT with the tax office. On the other hand, if the consignee received the goods under a power of attorney certified by the organization’s seal, then it is not necessary to include it in the invoice.

In this case, it is enough to attach a power of attorney to the invoice and ensure that these two documents are stored together.

Persons who signed the invoice on the part of the seller and the consignee bear, among other things, criminal liability in the event of, for example, theft or theft of goods. Therefore, accountants need to pay special attention to the presence of all the necessary signatures in the document when accepting it for accounting.

TORG-12 is also filled out by the buyer in case of returning the goods to the supplier. In this case, the “reverse” implementation occurs. The rules for filling out the document in this case remain unchanged.

Bargain 12, sample filling 2021

Consignment note, sample filling

Return invoice, bargaining 12, sample download

Consignment note, form, download in word

Trading form 12, form xls, download

Source: https://ppt.ru/forms/ttn/torg-12

How to make changes to the form

The form of the TORG-18 form is approved, but, at the discretion of management, it can be changed in accordance with the specifics of the company’s activities. The company has the right to supplement the form with columns, sections and lines, if necessary. The main condition for making changes to the TORG-18 form is that the new form must be approved by the company’s accounting policy. In this case, it is better to develop a new form (taking into account the company’s requirements) and issue it as an annex to the accounting policy. When annually revising the accounting policies, the company may also modify the TORG-18 form.

We prepare a log book for inventory items in a warehouse: step-by-step instructions from A to Z

The TORG-18 form is quite simple to fill out. The main thing to remember when preparing the Journal is the accuracy in the reflection of information and the completeness of entering all the necessary data.

Step 1. Design the cover of the Magazine.

When designing the Journal, special attention should be paid to the cover of the document. On the first page, be sure to indicate the necessary details (name, organization codes). Also on the front side of the Journal the period that covers the entered data must be indicated. Depending on the volume of trade turnover and the number of various items, the reporting period of the Journal can be a year, quarter, month, decade, etc. The greater the turnover and the wider the range, the shorter the Journal accounting period will be.

Full name, position and signature of the MOL entering information into the Journal - these details are mandatory for reflection on the cover of TORG-18. Data can be entered into the TORG-18 Journal by a warehouse manager (relevant for a small company) or a storekeeper (if we are talking about a large company with several warehouses or a large turnover). In the latter case, it is advisable to supplement the cover of the document with information about the position and full name of the warehouse manager, as well as his control signature.

Step 2. Enter information about the movement and stock of goods.

Data on the movement and balance of goods should be reflected as follows:

- upon receipt (dispatch) of goods, enter the day of the transaction in the “Date” column. The basis for entries in the Journal can only be primary documents (receipt and expense invoices, accumulative statements). The date of the invoice (statement) must correspond to the date indicated in the Journal;

- in column 2 “Document number” you should indicate the number of the invoice (statement) on the basis of which the entry is made;

- depending on the type of operation (receipt or expense), the storekeeper makes an entry in column 3 or 4. If the data is entered on the basis of an accumulative sheet, then the Journal reflects the amount of receipt (issue) per day;

- Having carried out arithmetic calculations, the storekeeper makes an entry in column 5 “Balance”:

Remaining + Arrival – Expense,

where RestNach is a quantitative indicator of the balance of goods before the start of the operation;

Receipt/Expense – quantity of goods according to the receipt/expenditure invoice;

- if there is any information that relates to the operation and may affect the quantitative (qualitative) indicators of the product, then it is entered in column 6.

Step 3. Correct the Journal data.

In certain situations, the storekeeper may need to make changes to the Journal and adjust already reflected indicators (for example, a mechanical error was made when entering data). In this case, the erroneous data should be crossed out and the correct indicator should be entered. The changes made should be certified with the signature “Corrected believe”.

When correcting the Journal, it is important to remember the following: newly entered (corrected) data must be supported by documents. In other words, adjustments to the Journal can be made only if the new data fully corresponds to the invoices and statements. In order to avoid any risks regarding incorrect filling out of the Journal, all corrections should be supported by internal notes from the storekeeper, which indicate the reason for the corrections and the basis (documents).

Step 4. Stitch the Magazine.

At the end of the period indicated on the cover of the Magazine, the document should be bound, indicate the number of completed pages, and then certified with the company seal and the signature of the manager. Read also the article: → “Form KS-3 (Certificate of the cost of work performed and expenses)”

Sample filling

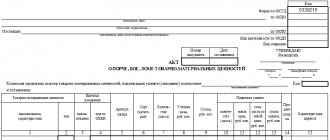

Here is an example of filling out the TORG-18 form.

JSC Midas is engaged in the trade of porcelain tableware. The Midas assortment includes two types of goods: the Aurora table service and Galatea cups. As of 05/12/17, the balance of sets in the warehouse was 104 units, the balance of bowls was 807 units. 05/15/17 the warehouse manager Sukhomlin received:

- invoice No. 704pr for the Aurora table service – 12 units;

- invoice No. 314ras for “Galatea” cups – 46 units.

Sukhomlin made the following entries in the TORG-18 Journal:

| Name of product | Dinner set "Aurora" | ||||

| Unit | |||||

| date | Document Number | Coming | Consumption | Remainder | Note |

| 15.05.17 | 704pr | 12 | – | 116 | – |

| Name of product | Coffee cups "Galatea" | ||||

| Unit | |||||

| date | Document Number | Coming | Consumption | Remainder | Note |

| 15.05.17 | 314ras | – | 46 | 761 | – |

Invoice according to the unified form M-15

The movement of materials from one organization to another, or within one’s own, must necessarily be carried out on the basis of the appropriate document . Invoice M-15 “Release of materials to third parties” is drawn up in case of transfer of inventory items .

Form M-15 is the primary accounting document and confirms the fact of the transfer of material assets. This could be the movement of materials between departments of one organization or the transfer of valuables to a third-party company.

The one who ships the materials uses the invoice as a consumable document and the basis for their write-off. The recipient, on the contrary, uses this document as confirmation of receipt.

Consignment note M-15 allows you to identify the following data :

- the date of preparation of the document, therefore, the date of the actual shipment of materials;

- who is the supplier and who is the recipient of the goods and materials;

- all information about the transferred material assets, their name, quantity and value.

All those who took part in this operation automatically become responsible persons.

Prescribed by

The release of inventory items is concluded on the basis of an order from the manager or an agreement concluded between organizations. In addition, orders and powers of attorney can serve as the basis for the transfer, without which it is impossible to receive materials.

Persons who have the right to issue an invoice for the release of materials to the third party:

- accountant responsible for the inventory area in the accounting department;

- a storekeeper acting on orders or on the basis of a power of attorney;

- an authorized employee performing his duties in this structural unit.

In what cases is it compiled?

The M-15 form is approved by the State Statistics Committee of the Russian Federation, Resolution No. 71a of October 30, 1997.

According to it, this document allows you to confirm the fact of release and transfer of inventory items.

As for the sale of goods, a similar form TORG-12 .

An invoice for the release of materials to third parties is required in the following cases:

- Transfer of material assets to another division of the organization for any needs or for use in production.

- Issue of materials when concluding an agreement with a third party for your own needs.

- Transfer of inventory items for safekeeping.

- When customer-supplied raw materials are released for processing both within one’s own organization and externally.

Responsible storage

After concluding a storage agreement, one organization has the right to transfer material assets to another for storage, which must be returned in their original condition.

In this case, the other company does not receive ownership of the goods and materials transferred to them. Such an action may well be carried out on the basis of the M-15 .

Provided raw materials

The release of materials as raw materials for processing, if accompanied by transportation by transport, is issued with a 1-T consignment note . But with direct transfer, you can only get by with the M-15. This applies only to divisions of one enterprise.

If the release is made externally, then both an M-15 and 1-T invoice are issued.

Documents for download (free)

- Form No. M-15

- Sample according to form No. M-15

Like any official document that records and proves the transfer of any valuables or funds, the invoice for the release of materials has the required details :

- date and number of the invoice;

- the full name of the person who issues the goods and materials;

- full name of the recipient of the materials;

- information on the basis of which this leave is carried out;

- the exact name of the goods being transferred;

- number of units issued;

- signatures of all persons responsible for carrying out this operation.

As for the seal, there is no specific place for it on the form, this means that the invoice is valid even without it. The main thing is the presence of other mandatory details.

Despite the fact that the M-15 invoice form is unified and is available in almost all programs in its original form, preserving all rows and columns, each organization can approve the changes made to it .

The form itself can be simplified or some points added. This is necessarily reflected in the accounting policy of the enterprise.

Sequence of actions when releasing goods and materials

To properly conduct a transaction for the transfer of materials, it is necessary to adhere to a certain algorithm of actions :

- All necessary documents are drawn up, on the basis of which an M-15 consignment note is created.

- The invoice is filled out in accordance with all the rules by an accountant or other authorized person in two copies.

- The invoice itself and all documents authorizing shipment and export are given to the manager for signature.

- After this, it is signed by the chief accountant.

- After the transfer of goods and materials, the invoice is signed by materially responsible persons, both issuing and receiving. It is mandatory to indicate the position and transcript of the signature.

- The first copy is taken by the recipient company. The second copy, along with all the necessary reporting documents, is submitted by the responsible person to the accounting department.

- Based on the received documents, the accountant formalizes the operation by creating accounting entries.

Filling out the form

You can fill out the invoice either manually or using special equipment. The main thing is that all the necessary details are present.

First of all, fill out the header of the document with the adjacent table:

- The invoice number is indicated in order after the previous one.

- Full name of the organization.

- OKPO code.

- Next, the date of document execution is entered into the table.

- Transaction code, if required.

- Information about the sender, structural unit and type of activity.

- Information about the recipient, structural unit and type of activity.

- Information about the person responsible for the supply, his structural unit, type of activity and contractor code. The name of the responsible person is not indicated in this table.

- The Ground line must be filled in; the name, number and date of the document that serves as permission to carry out this operation are entered in it.

- The lines “To” and “Through whom” are also filled in.

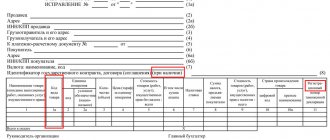

After completing the top part of the document, you can proceed to filling out the main table :

Column number

| 1 | The number of the corresponding account and its subaccount are indicated |

| 2 | Specify the analytical accounting code, if necessary. |

| 3 | Full name of the material value, brand, grade, article, size and other available clarifying data |

| 4 | The nomenclature number is entered, each material has its own personal one, in the absence of one, the cell is not filled in |

| 5 | Unit of measurement code according to the All-Russian Classifier of Units of Measurement |

| 6 | Name of the unit of measurement applied to this material |

| 7 | The number of inventory items issued, which is planned for accounting |

| 8 | The number of goods and materials issued, which was actually produced |

| 9 | Enter the price of materials sold per unit, in rubles |

| 10 | The total cost of all materials, obtained by multiplying the number of units by the price, in rubles |

| 11 | The amount of VAT itself, which is levied on these materials, in rubles |

| 12 | The total amount obtained by adding the total cost of goods and materials and the amount of VAT |

| 13 | The inventory number of the material value is indicated |

| 14 | Indicate your passport number, if available. |

| 15 | Sequence number corresponding to entries in the warehouse card |

Below are places for signatures , indicating the position, signature and transcript:

- Vacation was authorized (usually by the manager).

- Chief accountant (or his deputy).

- Released (usually by a storekeeper or workshop manager).

- Received (usually by a storekeeper or shop manager).

If the invoice is filled out manually, this must be done in legible, neat handwriting. If an error is made, the incorrectly written information must be crossed out with one line, and the correct data must be written in the empty space. Below, in fine detail, you need to indicate “Corrected Believe” signature.

In the event that any information is missing and lines or cells must be left blank, they must be filled with a dash . This is necessary in order to avoid entering false information into them.

All invoices are numbered in order, taking into account the number of the previous one. At the beginning of each year, the numbering is updated and starts from No. 1.

Reflection of release of material assets in accounting

In addition to collecting the necessary documents, for complete and correct accounting, the result of the operation performed is reflected in the accounting records. For this, account 10 “Materials” , which corresponds with other accounts, depending on the operation:

- Dt 20 Kt 10 - materials are transferred to the main production;

- Dt 23 Kt 10 - materials are transferred to auxiliary production;

- Dt 25 Kt 10 - material assets go to general production expenses;

- Dt 26 Kt 10 - material assets go to general business expenses;

- Dt 91.2 Kt 10 - disposal of materials due to the gratuitous transfer of inventory and materials;

- Dt 91.2 Kt 68.2 - VAT on the cost of goods and materials transferred free of charge.

In order to avoid questions about why the accounting of inventory items does not correspond to the actual ones, you need to carefully, and most importantly, legally document all operations performed with them. This will help protect the company from theft, and the presence of all signatures will be evidence in case of controversial issues.

We recommend other articles on the topic

Source: https://znaybiz.ru/buh/plan-schetov/sklad/nakladnaya-m-15.html

Where to submit TORG-18, submission deadlines

Due to legislative changes that came into force on January 1, 2019, the TORG-18 form is not a mandatory document. In connection with this law, there are no obligations to submit a document to the Federal Tax Service or State Statistics Service. There are also no deadlines for filling out the form. At the same time, if the company uses the form, regulatory authorities have the right to request the Journal as a document for verification. The company can provide it only if there is a written request.

If the company does not draw up TORG-18 to reflect the accounting of goods in the warehouse, then any liability for the company in this case is not provided. Since the form is not mandatory, regulatory authorities cannot fine the company for failing to fill out the form. At the same time, companies using the form may provide for internal liability for incorrect reflection of information in the Journal. The measure of responsibility and the procedure for penalties from the responsible person should be fixed in internal regulatory documents.

Packing list. Form and sample according to the form TORG-12 2021

The consignment note is one of the main primary accompanying documents and is issued whenever the goods are transferred from the seller to the buyer.

It can be used both between two organizations and between a legal entity and an individual.

The use of this document is widespread, since it is in use at many enterprises where goods are released.

FILES Download a blank bill of lading form .xls filling out the bill of lading .xls

Why do you need a bill of lading?

A consignment note is required for all participants in a purchase and sale transaction. Using this document, the buyer can check the unloaded products (quantity, volume, quality, etc.) with the information provided in it, and the seller can take into account the goods remaining in the warehouse.

In cases where the purchaser of a product is dissatisfied with its quality or other parameters, he can use this document to return the entire batch of goods or replace it with similar products. In the event of controversial situations that require resolution in court, the consignment note acquires legal force and serves as evidence in court.

Quite often, this type of document is used in their work by forwarding drivers and carriers of goods, for whom it is a kind of “safeguard”, certifying that the goods have not been stolen, but are being transported legally. At the time of shipment of products, drivers transfer the consignment note from the sender to the consignee.

Rules for issuing a consignment note

The responsibility for preparing a consignment note is usually assigned either to employees of accounting departments, or to storekeepers or other authorized employees of the enterprise.

There is no unified sample of a consignment note accepted for general use, so each organization can develop and approve its own form or use a template. The number of tables and rows in a document is not limited, so if necessary, the document can be expanded or narrowed, depending on the situation.

The invoice must always contain the following information:

- name and details of the organization that supplies the goods,

- buyer information,

- information about the product: name, quantity, price and total cost of the product.

If the selling company works with VAT, this is also indicated in the document. The delivery note must be signed by the responsible person.

It is not necessary to put a stamp on it, since from 2021, legal entities (as well as individual entrepreneurs) have the right not to use seals and stamps in their work.

The consignment note may contain only one sheet, or it may contain several if it carries many different types of products. In cases where it is drawn up on several pages, this must be noted on its first sheet.

A delivery note is drawn up in two copies, one of which remains with the seller of the goods and subsequently serves as the basis for writing off inventory, and the second is handed over to the consumer and can be the basis for deducting VAT.

Separate annexes (for example, an act of transfer of goods) can be attached to the delivery note. If such applications take place, this must also be noted in the main document.

Errors when filling out the TORG-18 form

Despite the ease of filling out the TORG-18 form, the MOLs that draw up the Journal often make the following mistakes:

- Filling out the Journal not by item, but by product groups. Information on the movement of goods must be entered separately for each item.

- Entering data out of chronological order. If information about a product is entered later than the date of the transaction, the balance of the product may be reflected incorrectly.

- Simultaneous entry of data on heterogeneous goods. If a company’s warehouse receives goods of the same type (for example, flour), but in different units of measurement (some in kg, some in bags), then an entry in the Journal should be made separately for each unit of production.

Features of filling out the electronic form

The vast majority of trading companies use the electronic form of the TORG-18 Journal. The electronic form TORG-18 in various configurations of 1C software has become widespread:

- Trade management;

- Complex automation;

- Manufacturing plant management, etc.

1C allows you to fill out a report automatically, which significantly reduces the number of mechanical errors and simplifies the process of entering and adjusting data. In addition, the undeniable advantage of the electronic form is the convenience of data sampling and analysis.

Also on the accounting software market there are other automated programs that allow you to prepare a report in electronic form, as well as services with which you can generate a report online (Torg-soft, Free-soft, etc.).

If a company uses an EDS (electronic digital signature) to sign financial and statistical documents, then the company has the right to introduce a similar practice for TORG-18. In this case, it is important to comply with basic conditions, such as technical feasibility and the existence of a signed agreement with a special telecommunications operator.

Why do you need a consignment note TORG-12, rules for its registration

Accounting and tax accounting in any organization cannot be imagined without taking into account primary documents. One of them is a consignment note in the form TORG-12. It is a primary document drawn up when any product or goods are released to customers.

The form itself, according to which this document is drawn up, is unified and mandatory for all organizations.

The technical specifications are drawn up in two copies: one remains with the seller, the other is sent to the buyer. The option that the second party receives gives it the right to capitalize inventory items.

The first option is the basis for writing off the sold goods.

Who draws it up and signs it?

Based on Law No. 402 Federal Law “On Accounting” and on the basis of document No. 63-FZ “On Electronic Signatures”, an invoice can be generated and stored in both paper and electronic form . Moreover, not so long ago the Federal Tax Service approved an XML file format in which every taxpayer will be able to send it to the Federal Tax Service using the Internet.

Such a document is signed by the organization’s director and chief accountant, and there may also be other authorized persons.

Those employees who can sign the invoice must be selected and formalized in the appropriate power of attorney or order.

Paper TORG-12 is signed with five signatures :

- The buyer signs in the “shipment received” column. Only an authorized person from the buyer has the right to sign here. The representative may be included in the power of attorney or have the right to do so on the basis of the Charter.

- The line “cargo accepted” is filled in by the financially responsible person who directly accepts this cargo. Such a person can be either a representative of the person purchasing or a carrier from a third-party organization. At the same time, if the goods are accepted by the managers themselves, a power of attorney is not needed, and the corresponding field remains empty.

- On the seller’s side, three employees sign: an accountant, a manager and the person who is directly responsible for the shipment. As a rule, if the organization is large, the signature is placed by one employee. This role is played, for example, by an operator associated with warehouse accounting and accounting. But before entrusting him with the corresponding right to sign, this must be legally confirmed by order.

The same person can sign in the line “received the goods”, as well as opposite the inscription “received the goods”. In this case, the signature is placed directly opposite the line “received the goods”.

Electronic form

In the case of an electronic form, the order, form and signature do not change. A distinctive feature is that the invoice is drawn up in one copy, which includes two files. One of the files must be generated from the buyer's side, and the other from the seller's side.

To sign such a document, not a simple, but an electronic signature is used. The electronic document is signed on one side by the buyer and on the other by the seller.

How to fill it out? Step by step order

A consignment note is a unified document that regulates the sale of inventory items to third parties.

Therefore, it must contain information about the name of the product, quantity, selling price, as well as the total cost and value added tax.

TORG-12 must certainly have the details of both the buyer and the seller.

It provides space for a stamp, and all necessary signatures must be present.

At the same moment when the invoice is drawn up and issued, the seller is obliged to issue another important document for the release of goods - an invoice.

Required details include:

- name of the organization that draws up the document;

- document's name;

- a number that corresponds to the date of compilation;

- name of the business transaction;

- in what units of measurement the implementation takes place;

- the names of the positions of the persons who perform the sales action;

- signatures of persons responsible for the implementation process.

This document is unified, which means there are special requirements for its completion. If it is filled out incorrectly, with errors, then the right to justify the write-off of inventory items is lost. Also, it cannot be used as a justification for expenses in tax accounting.

The very top section of the form contains information about the organization that ships the goods. The following must be filled in:

- Name;

- TIN;

- current account number;

- Bank BIC;

- index;

- legal and actual addresses;

- telephone and fax.

The columns “Payer” and “Supplier” indicate information identical to what is written in the sections “Consignee” and “Consignor”.

The “Base” field must contain the contract number and its date on the basis of which the shipment is carried out.

The summary table with the product must correspond in content to the invoice.

How to fill out the tabular part

- Where a product code must be indicated, the company places it on the basis of the price list. It can also be affixed based on the product classifier. However, this information is advisory and not mandatory.

- Units of measurement must be filled in. This also requires a classifier.

- The type of packaging can be, for example, a box. The quantity of goods in one package is indicated in the “quantity in one place” . How many packages will be shipped in total is indicated in the “number of places” .

- “weight” column is filled in only when we are talking about a weight product and not a piece product.

- The product price is indicated in the appropriate column excluding value added tax. Column 13 indicates the tax rate. In most cases it is 18%. The next column contains the amount of the calculated tax. And in the last column the cost of the goods is entered, including VAT.

- Total field contains the total of all lines corresponding to the goods.

It is imperative that each of the fields in the invoice is filled out . Even if the value is not provided, a dash is added.

A consignment note can act as an appendix (which is indicated in the field “The consignment note has an attachment to...”) to TORG-12.

You can watch the detailed process of document generation in the 1C program in the following video:

Corrections to the document

Based on the laws of the Russian Federation, if errors are found in TORG-12, corrections must be made in both copies.

At the same time, crossings are made in them, certified by the signatures of both the seller and the buyer.

The date corresponding to the day, month and year of the changes must be indicated next to the signature.

As a rule, when errors are discovered in primary documents, new ones are drawn up to replace them. However, the legislation does not accept this method of correcting documentation.

As for electronic documents, there are no strict rules for correction. In this case, each organization sets them for itself independently.

Accounting and storage

The laws of the Russian Federation do not establish any strict regulations for recording invoices. Each company can install them themselves. As a rule, in organizations during warehouse accounting, commodity reports are compiled. Invoices are attached to this report in chronological order.

If an organization or individual entrepreneur uses a simplified taxation system, they are required to keep a book of income and expenses. This book is compiled precisely on the basis of primary documentation, which includes invoices.

Source: https://ZnayDelo.ru/document/tovarnaya-nakladnaya-torg-12.html