Accounting for accounts receivable on account 62

The rules that need to be kept in mind when working with account 62 “Settlements with buyers and customers” are indicated in the chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Count 62 is used to reflect:

- accounts receivable (hereinafter referred to as receivables) of buyers and customers for goods, works, services sold (hereinafter referred to as GWS);

- accounts payable in the form of advances received.

Turnover in the debit of account 62 occurs when reflecting the debt of buyers when the sale of goods and services takes place. The second side of the posting will be income accounts 90.1, 91.1 or account 46 for the gradual reflection of income from long-term work. Thus, receivables are reflected simultaneously with revenue. In accordance with the accounting rules, revenue is shown in accounting if a number of conditions are met (clause 12 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n):

- existence of a legally valid right to receive proceeds;

- availability of total revenue value;

- having confidence in receiving payment;

- a transfer of ownership was carried out, i.e. the buyer accepted the GWS;

- the presence of the total value of the corresponding expenses incurred to obtain this revenue.

If at least one condition is not met, then the payment received by the organization should be reflected as accounts payable, and not repay accounts receivable.

When payment is received from the buyer, account 62 is credited, and a debit entry is made in the cash accounts.

Analytics of 62 accounts should allow checking its balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices, and payment terms. To ensure transparency of reporting, overdue debt must be reserved by posting Dt 91.2 Kt 63 (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In the balance sheet, receivables are shown minus reserves. Debts that cannot be repaid and debts with an expired statute of limitations must be written off (clause 77 of the PBU) at the expense of the reserve by posting Dt 63 Kt 62, and if they were not reserved, then they are written off to the financial results of Dt 91.2 Kt 62. When In this case, for another 5 years, the written off debt is reflected on the balance sheet (account 007) in order to track changes in the financial condition of the debtor and the possibility of repaying the debt.

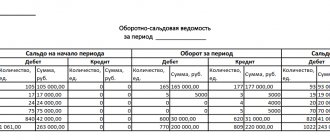

Balance sheet for account 62

It is important before closing the month and drawing up a report on the financial condition of the enterprise to check that the accounting registers are filled out correctly. One of the verification options is the formation of a balance sheet (hereinafter referred to as TSA) for the period under audit:

What the balance sheet shows for account 62 and how to read SALT is shown in the following table:

| Accounting section name | Initial balance | Turnover for the period | Final balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| Score 62 | Buyer's debt balance | Remaining debt to the buyer | Amount of shipped products (goods, services) | Payment from buyers for the period | Buyer's debt balance | Remaining debt to the buyer |

Accounting for advances received

Payment of goods and materials prior to their shipment or transfer is accounted for separately on account 62; subaccount 62.2 “Advances received” is usually used, while subaccount 62.1 “Settlements with buyers and customers” is used to account for receivables from buyers. In the balance sheet, advances received are included in accounts payable, that is, they are shown as a liability; it is impossible to show advances minimized from accounts payable. In addition, upon receipt of an advance payment, the supplier must charge VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Example:

In July, Pchelka LLC (buyer) and Vasilek LLC (seller) signed an agreement for the purchase of paving slabs worth RUB 944,590. In the same month, Pchelka LLC made a full prepayment. The following entries are made in the accounting of Vasilek LLC:

Dt 51 Kt 62.2 - 944,590 rub. — an advance payment from Pchelka LLC has been received into the bank account;

Dt 76 subaccount “VAT on advances received” Kt 68 subaccount “VAT” 144,090 rub. (944,590 × 18/118) - VAT is charged upon receipt of an advance payment.

In August, Vasilek LLC shipped all the paving slabs to the buyer and recorded the following entries:

Dt 62.1 Kt 90 — 1,944,590 rub. — revenue accrued;

Dt 90.3 Kt 68 subaccount “VAT” - 144,090 rubles. — VAT is charged on sales;

Dt 68 subaccount “VAT” Kt 76 subaccount “VAT on advances received” 144,090 rubles. — previously accrued VAT on the prepayment received is accepted for deduction;

Dt 62.2 Kt 62.1 - 944,590 rub. — the previously received prepayment has been offset.

For more information about the actions of the seller when receiving an advance payment, read the article “What is the general procedure for accounting for VAT on advances received?”

The procedure for issuing reports

It is allowed to issue money against an advance report only to employees of the enterprise. Accountable amounts are issued in cash from the cash register or transferred non-cash to a bank card.

The main rule when issuing money is that the employee must account for the previously accountable amount received. At enterprises, as a rule, an order is assigned to persons who have the right to receive funds on account, since an agreement on financial liability is concluded with them:

When paying money to an accountable person, the following rules must be followed:

- Check the balance of the accountable person (according to the accounting register data). Reason: clause 6.3 of the instructions of the Central Bank of the Russian Federation No. 3210, which states that it is prohibited to issue funds for reporting to an employee who has not reported on a previously received amount.

- Receive a written statement from the employee in any form, reflecting the main details: purpose of receipt, required amount, deadline for submitting the report, date. The application must be endorsed by the head of the company or an authorized person.

A 3-day period has been established when the employee must account for the accountable amounts received, return the funds to the cash desk and submit a report. If the employee does not report on time, then the amount received by him should be withheld from the employee’s income and personal income tax should be charged (Article 137 of the Labor Code of the Russian Federation). Wherein:

Important: deductions from an employee can only be made upon written application and no more than 20% of wages (Article 138 of the Labor Code of the Russian Federation).

If a debt (especially a large amount) of an accountable person has been registered for a long time, then the tax inspector, during an audit, can re-qualify such a payment as a loan or consider it income (paragraph 3 of Article 137 of the Labor Code of the Russian Federation) and charge additional personal income tax.

The maximum amount for reporting is not provided for by law, but it is worth considering that if an employee settles accounts with contractors on behalf of the enterprise, then under one agreement you can pay no more than 100,000 rubles.

Advance report

The employee reflects all cash expenses in the advance report. An employee can spend accountable amounts on the purchase of goods, materials, fixed assets, intangible assets, and payment for the business needs of the company.

The diagram shows the types of expenses for account 71 and the primary documents that should be attached to the expense report:

If an employee has an overspend on accountable amounts, that is, the employee has spent his personal funds, then the company has the right to reimburse it subject to established procedures.

Payments by bill of exchange

The instructions for the chart of accounts also pay attention to the peculiarities of settlements with bills of exchange. If the buyer issues his own bill of exchange to the supplier, then the debt is not repaid, but by this action a deferred payment is issued and a guarantee of payment is issued. To account for bills received, it is recommended to allocate a separate sub-account, for example, 62.3 “Bills received”. The following entries are made in the seller's accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 62.3 | 62.1 | Received own bill from buyer |

| 51 | 62.3 | Received funds upon presentation of a bill of exchange |

| 51 | 91.1 | Interest received on the bill |

Another situation arises if the debt is paid by a bill of exchange from third parties. Such a bill of exchange is recognized as a financial investment and is accounted for in account 58. The entries shown in the table are made in the supplier’s accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 58.2 | 62.1 | Received a third party promissory note as payment |

Issuance of accountable amounts: postings

An employee can receive money on account:

- cash;

- in non-cash form (for example, to a corporate or salary card).

The transfer of money to the employee is shown by posting Dt 71 Kt 50, where:

- 50 - account used for cash issuance;

- 51 – account for non-cash transfers.

The employee may be issued train or plane tickets in “kind” form. They are considered monetary documents reflected in subaccount 50.3.

Example 1

Ivanov A.S. went on business trips 3 times in August 2021 - to St. Petersburg, Nizhny Novgorod and Kazan. He had to buy a plane ticket for the first trip himself in cash, for the second - with money from a salary card, for the third business trip a ready-made ticket was issued by the employer.

The accountant will reflect these transactions in the registers:

- issuance of money on account for a ticket to St. Petersburg: Dt 71 Kt 50;

- transferring funds to a card to purchase a ticket to Nizhny Novgorod: Dt 71 Kt 51;

- issuance of a ticket to Kazan: Dt 71 Kt 50.3.

Next, the employee spends the funds received. Let's consider what postings are used to account for such expenses.

Results

For different types of debt, the chart of accounts provides for special accounts. One of them is account 62, which can be either active or passive, since it is used to account for both debt from buyers and customers, and creditors in the form of advances and prepayments received.

Read about accounting for accounts receivable in the article “Keeping records of accounts receivable and accounts payable.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account 62 which is reflected in debit and credit

Account 62 in question is active-passive in accounting. Therefore, it can reflect both the organization’s debt to customers (credit balance) and the buyer’s debt to the organization (debit balance). Thus, the debit balance on account 62 indicates that products, goods, services have been shipped and there is a debt from buyers for goods shipped or services provided.

The credit of accounting account 62 displays funds from the sale of products (goods) and for services rendered, as well as prepayments and advances received. But payments and advances are accounted for in different subaccounts:

- Subaccount 62.01 – takes into account payments received in the general manner;

- Subaccount 62.02 – takes into account advances received from customers.

Thus, the credit balance on account 62 means that the enterprise has a debt to customers for advances received.

What subaccounts are used?

On account 62, it is necessary to record both the process of shipping products to customers or providing services to consumers, and the receipt of payment from them.

To do this, the following subaccounts can be opened on the account:

- Account 62.01 - to reflect the payment that was transferred under normal conditions;

- Account 62.02 - to account for advances received from buyers for future supplies of products;

- account 62.03 - for accounting for bills received from buyers.

Additional accounts may also be opened for each of these sub-accounts, depending on the payment currency. In addition, for his convenience, an accountant can organize analytical accounting for each counterparty or concluded agreement.

In addition, it is allowed to keep records in the following context:

- According to the actual payment method (advance payment, payment upon delivery, etc.);

- By the deadline for payment for the supply (whether there was a delay or the repayment period did not occur);

- By the presence of the bill (whether it was presented, whether the maturity date has arrived, etc.).

Attention! The accountant has the right to independently decide how to build accounting for customers in the enterprise. Analytics should allow you to check account balances for overdue debts.

Debit shows the debt of counterparties to us

The debit of account 62 shows, as the name suggests, accounts receivable, that is, the amount of debt of counterparties to our organization. If we consider the subaccounts to account 62 of accounting, we can find out details about accounts receivable. For example, the debit of subaccount 62.01 reflects the amounts of shipments made. The debit of subaccount 62.02 shows advances offset against shipments made. The debit of subaccount 62.03 includes bills received on account of shipments made. That is, we see that any debt of the buyer (in the form of goods (work, services) received but not paid for, a bill issued, an offset, previously paid advance) will be reflected in the debit of any subaccount of account 62.

Spending of accountable amounts: postings

An employee can spend the funds received for various purposes permitted by law and the employer. The expense recognized as justified is shown on the credit of account 71 in correspondence with the debit of the accounts:

- 08 - if expenses are related to the purchase of fixed assets;

- 10 - if the employee purchased inventories;

- 41 - if the employee purchased goods for his company;

- 20, 26, 44 and other production (related to the main activity) accounts - if expenses necessary to solve the economic problems of the employing organization have been made.

Buying airline tickets from the example above is just a production expense. Ivanov, as we already know, bought the tickets himself on his first and second business trips. Despite the different methods of settlements with the airline (cash and non-cash), the accountant will draw up two identical correspondence:

- for purchasing a ticket to St. Petersburg by an employee at the airline ticket office: Dt 20 Kt 71;

- by purchasing a ticket to Nizhny Novgorod through the airline’s website using the card: Dt 20 Kt 71.