Declaration 3-NDFL 2021 for 2021

In addition to the above changes, the composition of some sheets that reflect calculations of income and tax deductions also looks new. For example, the calculation of standard, social and investment deductions will need to be reflected in one application (No. 5).

Initially, the format of the certificate that was in force until today was approved by order of the Federal Tax Service dated No. / [email protected] From 2021, a new form 3-NDFL is being introduced. The amended sample declaration was approved by the Federal Tax Service by order dated October 3, 2020 No. ММВ-7-11/ [email protected] This is a document recording the income and expenses of individuals for the reporting year.

The declaration must be filled out by hand or on a computer. In the latter case, you can use existing sample forms or the “Declaration for 2020” program.

When is the document submitted?

The declaration form is filled out in accordance with the previously established form. If reporting relating to tax payments is submitted, then the document is transferred within the twelve-month calendar period following the reporting year, but not at any time, but before the end of April. The later you submit the form for processing, the longer the tax office specialists will register the information provided, however, timely submission protects you from penalties and other unpleasant consequences.

Didn't manage to submit your declaration on time? Do you want to know what the consequences are for failure to submit reports on time? Read more about the statute of limitations for tax offenses and how to reduce the amount of the fine in our article .

The form is provided to the service department corresponding to the place of residence of the citizen reporting to the tax system.

You can provide paper in the following ways:

- in person, by visiting the inspectorate with a prepared package of documents necessary to obtain a deduction or tax report;

- by sending by mail with a valuable letter, while receiving notification of delivery;

- by sending through the taxpayer’s personal account on the official web resource of the service.

Procedure for filling out 3-NDFL

in line 150 - the total amount of expenses for new construction or acquisition of real estate object (objects), accepted for the purposes of property tax deduction for the reporting tax period on the basis of the Declaration. This amount should not exceed the size of the tax base calculated in line 140 of Appendix 7;

If part of the property tax deduction provided for in Article 220 of the Code was provided to the taxpayer in previous tax periods, the value of line 170 of Appendix 7 is determined as the difference between the sum of the values of lines 080 of Appendix 7 and the sum of the values of lines 100, 120 and 150 of Appendix 7.

Additional documents

Submission of the 3-NDFL declaration form is accompanied by the preparation and submission of an additional list of documents, without which the right to receive a deduction will not be confirmed, therefore, the money will also not go to the account of the taxpayer who was too lazy to take care of the documents.

Since deductions have different purposes, the general list of documents for them does not contain all the items necessary for each case. Let's look at it first, and then add elements for specific areas of refund.

So, the general elements of the list of documents for each type of deduction are presented:

- the required declaration form 3-NDFL, filled out in accordance with the established rules;

- taxpayer identification number;

- the main document of a Russian citizen or another equivalent document;

- a certificate from the payer’s place of work containing data on the income he receives and the amount of tax deductions that went to the treasury for personal income tax payments;

- a statement written on behalf of the payer, which also indicates the bank details necessary for the receipt of funds.

Now let’s consider an additional list of documents required to obtain a property tax deduction provided when a payer purchases housing:

- an agreement indicating the conclusion of a transaction for the sale of housing or the participation of the payer in shared construction;

- papers represented by payment documents that allow obtaining information on payment for purchased real estate;

- a certificate from the Unified State Register of Real Estate, issued to owners who have officially registered new housing;

- an act according to which the housing was officially transferred for use; however, if the housing was purchased under a sale agreement rather than an equity participation agreement, the provision of this paper is not mandatory.

For housing purchased on credit, we also provide:

- agreement with a credit institution on the provision of a targeted loan;

- a certificate stating that interest was withheld from the payer for a one-year period;

- payment documents indicating receipt of due loan payments.

If housing is purchased not by one owner, but by spouses, it is necessary to add to the existing lists a copy of the marriage certificate issued by the spouses during marriage.

When receiving a deduction for raising a child whose health condition is normal, you must also provide:

- his birth certificate;

- copies of parent's passports;

- if the parents are adoptive parents or trustees, then the relevant documents must also be submitted to the inspectorate.

If repairs and finishing work are being carried out, as well as independent individual construction of a country house, you must provide:

- documents confirming payment for construction materials, as well as finishing ones;

- papers from the construction crew performing the work.

To receive a refund for tuition, you must provide a certificate from a university or other educational institution. People who reimburse the costs of treatment also collect official confirmation of their diagnoses, referrals from their attending physician to undergo certain procedures and purchase specific medications.

Date of registration of ownership of the apartment in 3 personal income tax

** * When selling real estate, ownership of which was obtained after 01/01/2020, the sale price will be compared with the cadastral value of the property as of January 1 of the year in which the re-registration of ownership takes place.

Here you need to be extremely careful to avoid any mistakes or oversights. Let’s say right away that the tax deduction is issued exclusively for an amount of no more than two million rubles. In fact, you will need to make all calculations based on this amount (if the amount of your purchase exceeds two million rubles). That is, the maximum tax deduction is 260 thousand.

Date of re-registration of the apartment to be inherited

The moment the ownership right arises is the day of death of the actual owner of the property or the date of probate of the will. Both individuals and legal entities are required to enter into the right of inheritance within 6 months from the date of proclamation of the will/death and during this period undergo state registration of property rights. If this procedure is not completed within six months, entering into a proprietary relationship becomes possible only through legal proceedings.

Fill out the 3rd personal income tax declaration for 2021 online for free

Due to the fact that 04/30/2020 is a day off due to the transfer from Saturday 04/28/2020, 05/01/2020 is the Spring and Labor Day, and 05/02/2020 is also a day off due to the transfer of the day off from Sunday 01/07/2020 (Art. 112 of the Labor Code of the Russian Federation, Government Decree No. 1250 dated October 14, 2020), you can submit the 3-NDFL declaration for 2020 on May 3, 2020.

Tax return form 3 Personal income tax, the new form in 2021, contains about two dozen sheets, but this does not mean that they all need to be filled out. According to the instructions, only those sheets are filled out that are necessary to achieve the goal (receiving a deduction, calculating the tax to be paid). If the taxpayer, for example, has set himself the goal of receiving a deduction for treatment, then he does not need to fill out the Appendix, which indicates the cost of the real estate being sold.

This is interesting: Young Family Program 2021 Karelia Allocation of Subsidies

Deadlines for filing a declaration to receive a deduction

As soon as you have filled out the 3-NDFL certificate, and also collected the remaining necessary documents included in the package submitted to the tax service specialists for consideration, you can begin the process of obtaining a deduction. As for the time frame within which documents must be submitted, it is very long, there is no need to rush.

Time restrictions for filing a declaration

If you decide to submit a return form for the previous 3 years, you must prepare the appropriate number of copies. The department to which documents are provided corresponds to your place of residence. Call the help desk, give the address and they will help you determine the specific inspection where you need to go to get the document.

Note! You have the right to demand that the second copy of the declaration, which you keep, be affixed by a tax inspector with a personal signature, date, and service seal, which will further indicate the timely submission of the document for processing.

According to the provisions of the Russian Tax Code, the declaration for the transfer of information on tax payments is submitted for processing before May of the following reporting year. This obligation does not apply to tax deductions. In this case, no strict time frame has been established, however, there are some rules that we will now consider:

- in order to submit an application for a deduction and other documents, you must wait until the beginning of the next calendar year, that is, a new taxation period, that is, for 2015 in 2021, for 2021 in 2021, etc.;

- filing a declaration to receive a partial refund of the tax paid is possible only for the past three years, that is, having purchased an apartment in 2011 and deciding to receive it in 2021, you will only be able to submit an application for compensation of expenses for 2013-2015.

As for tax deductions of a standard or social nature, they can be obtained earlier than the end of the calendar year by submitting a corresponding application to the tax agent-employer. From 2021, this rule also applies to property deductions, however, receiving funds in this way is not profitable, because a small amount will be added to your salary, 13% of the funds received. But you can get all 260 or 390 thousand at once, for example, by contacting the tax office.

When is the best time to file a return for income tax refund on the purchase of an apartment?

By establishing this restriction, the tax authorities created an unclear situation - to the question of when it is necessary to submit a declaration for the return of compensation, the answer seems clear, on April 30. But this applies to people who need to declare income. If we are talking about an income tax refund from the purchase of an apartment, then you can submit the document on any day of the year. When purchasing residential space in January 2020, you are allowed to claim the right to property benefits throughout the entire 2020 year.

Thus, if the period for receiving a tax deduction has arrived, a person has used it within the limits of previously existing restrictions (130 thousand rubles), then after a couple of years he cannot receive an additional amount, because he has already used his right.

sovetnik36.ru

Some time ago, property owners had in their hands a permanent document indicating the appropriation of real estate.

This indicates the type of real estate that was acquired by the taxpayer.

Now, if it is necessary to obtain official information about a specific apartment, the interested person can order an extract from the Unified State Register. What does this certificate contain, why exactly is it needed and how to get it? Let's look at it in our article. Appointment of an extract from the Unified State Register for an apartment.

This document is a certificate confirming the ownership rights of a certain person, his registration as the owner, and it also contains information about the characteristics of the property.

It is provided to both authorized persons and representatives upon presentation of a supporting document. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. Call: +7(499)703-35-33 ext.

664 It's fast and free! In addition to the fact that the declaration document serves to legitimize income, it may be required to obtain a tax deduction for the purchase of real estate.

It can be submitted either in person to the Federal Tax Service or electronically.

The personal income declaration consists of five pages: Solve your problem without leaving home! Promotion: 350 rubles FREE until May 30, 2021 Ask your question, and within 6 hours a property expert lawyer will study it and provide you with a solution. Plus indicate the date of registration of rights.

- Approximate value of the property – cadastral, market, etc.

- Cadastre number.

We recommend reading: Social Security contributions for disabled people 2021

Differences between paper and electronic forms The statement can be provided in both electronic and paper form. Information in both electronic and paper versions remains identical and has equal legal force.

The difference is in their type and order of receipt:

- For some, it’s easier to order an electronic one and generally work with such files. You can order such a document either online or in person by visiting a Rosreestr or MFC branch.

How to fill out 3-NDFL correctly

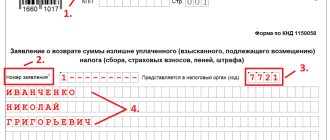

On the title page, indicate the total number of completed pages and the number of attachments - supporting documents or their copies. In the lower left part of the first page, the taxpayer (number 1) or his representative (number 2) signs the document and indicates the date of signing. The representative must attach a copy of the document confirming his authority to the declaration.

When filling out the declaration, no mistakes or corrections should be made; only black or blue ink is used. If 3-NDFL is filled out on a computer, then the numerical values are aligned to the right. You should print in Courier New font with a size set from 16 to 18. If you do not have one page of a section or sheet of 3-NDFL to reflect all the information, use the required number of additional pages of the same section or sheet.

Which deduction should an investment account owner choose?

Tax legislation allows IIS owners to choose the type of investment deduction.

The types of investment deductions for IIS and their brief description are presented in the figure:

Both types of investment deductions have nuances:

- Tax deduction for contributions to IIS

You can return your personal income tax as early as the next year after placing funds in an individual investment account, but if the account is closed early (before three years from the date of conclusion of the agreement), the entire refunded personal income tax must be returned (plus penalties are paid). After closing the IIS, you are required to pay personal income tax on the amount of income generated.

This is the most suitable option for people who have official income (taxable with personal income tax at a rate of 13%) and do not plan to invest funds for a long time and receive solid income from it.

- Tax deduction on income from IIS

The basis for the deduction is income (positive financial result) for the period of validity of the IIS, determined according to the norms of Art. 214.9 Tax Code of the Russian Federation. To receive the deduction, at least three years must pass by the closing date of the contract. A deduction for income is available if during the period of validity of the contract the deduction for IIS contributions was not used.

The deduction is suitable for situations where an individual plans to make long-term investments, replenish an individual investment account in an amount exceeding 400 thousand rubles and receive large incomes.

Date of registration of ownership of the apartment in 3 personal income tax

To obtain a tax deduction, you need: either a registration certificate and a purchase and sale agreement, or an acceptance certificate and a share participation agreement. In addition, the taxpayer must have taxable income at a rate of 13%.

In paragraph 1 of Sheet L, in accordance with subparagraph 2 of paragraph 1 of Article 220 of the Code, information is indicated on new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them (hereinafter also referred to as the object), for which the property is calculated tax deduction, and documented expenses incurred by the taxpayer for this object:

Law and Law

Contents [Show] Hello, tell me, when filling out the 3-NDFL declaration for property tax deduction (resale apartment, purchased with a mortgage, one owner), in the “Date of registration of ownership of the apartment” column, write the date in the purchase and sale agreement (we have it 04/25/15) or the one that appears on the certificate of ownership from the Registration Chamber (05/5/15)? Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (2) Free assessment of your situation Indicate the date that is written in the certificate.

Ask your question to a lawyer! Free assessment of your situation Irina Afinogenova Lawyer, Ivanovo Anna, the date of registration is the date indicated in the Certificate of Registration of Rights as the date of registration in the Unified State Register (indicated at the bottom of the Certificate) 03/05/2018 8,136 Views To receive a property deduction, citizens must submit a package of documents to the tax authority, including a personal income statement. As a rule, it is not difficult to fill out; difficulties may arise only in one question: how to correctly enter the type of property in form 3-NDFL?

We suggest you look into this issue. 3-NDFL is a declaration of income of individuals.

According to current legislation, if a citizen is engaged in individual entrepreneurship or receives income in addition to his main place of work, he must submit this document to the tax service. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

Call It's fast and free!

In addition to the fact that the declaration document serves to legitimize income, it may be required to obtain a tax deduction for the purchase of real estate. It can be submitted either in person to the Federal Tax Service or electronically.

The personal income declaration consists of five pages:

Declaration 3 personal income tax for 2021

In the current declaration form 3-NDFL (approved by order of the Federal Tax Service dated December 24, 2014 No. MMV-7-11/671, as amended by order dated October 25, 2020 No. MMV-7-11/822), codes for types of income in 2021 are found on two sheets - A and B. Since income can be received by a person, both from sources in Russia and from foreign ones.

This is interesting: Temporary Residence on the Territory of the Russian Federation for Ukrainians in 2021 Personal Income Tax

If you have difficulties filling out and submitting the 3-NDFL declaration, you can use the services of organizations that carry out activities such as transferring information to the Federal Tax Service. Employees will answer any questions that arise, draw up documents themselves, and hand them over in the presence of a power of attorney.

Under what conditions can you receive a deduction?

To be able to receive a deduction, a citizen must fulfill certain conditions. Since there are three grounds for granting an investment deduction, we present a general set of conditions:

- The person who invests the funds must have Russian citizenship and make a contribution specifically to the Russian economy. Otherwise, there can be no talk of any deduction

- A citizen can have only one investment account, which must function for at least three years

- Such an account must be replenished annually, but not by more than 1 million rubles. As proof of the contribution of money, the investor must have in hand a document confirming payment

- To apply for a deduction, a citizen must receive official income and transfer personal income tax from its amount

These requirements are mandatory for anyone planning to receive an investment deduction.

Program for filling out the 3-NDFL declaration for 2021

This section contains two screens, switching between which is done using the buttons. Select the screens one by one and enter the required information. In this case, page 2 of the declaration will be filled out.

This list is intended for entering income by type of payment source. We add information about monthly income for the calendar year, for which you need to click on the + to the left of the words “ Month, income .”. To delete erroneously entered data, you must use " - ". In the drop-down menu, you must fill in the fields (information must be taken from the 2-NDFL certificate).

Filling out the form

Filling out the forms prepared by the government is a purely bureaucratic procedure, so it definitely cannot be easy; there are too many nuances that need to be taken into account. However, you should not exaggerate the level of complexity of filling out the document. You yourself, without the help of professional lawyers, will be able to cope with entering information into the appropriate lines and receive the required 13% return.

You can enter information in three main ways:

- using software developed by the Federal Tax Service, downloaded on the official electronic resource of the Federal Tax Service, into which you will need to enter the available information, after which the program will independently generate and print the completed form;

- by independently filling out the relevant sections of the form and downloading the form itself;

- by paying money to third-party specialists from companies providing similar services.

We recommend that citizens with no experience prefer the option of using a program, the stages of working with which are intuitively clear to every citizen. At the same time, you will protect yourself as much as possible from errors and various inconsistencies in the form, which can lead to negative consequences.

Is it possible to submit a 3-NDFL declaration through State Services

- Individual entrepreneurs and those engaged in private practice (notaries, lawyers, etc.);

- those who received income under civil contracts (hire, rent, etc.);

- those who sold property that belonged to them by right of ownership;

- who are Russian citizens and have received income in another state;

- who received winnings from risk-based games (lotteries).

Authorized users can use the EPGU to send information to the Federal Tax Service. The declaration can be completed online and submitted to the tax office after signing with an electronic signature.

What construction costs cannot be included in the deduction?

- declaration 3-NDFL;

- extract from the Unified State Register of Real Estate for a residential building;

- copies of documents confirming the costs of building a house. In most cases, these documents will be:

- for services of individuals - a copy of the agreement with the individual, a copy of the receipt (or for non-cash payments - a copy of the document on the transfer of funds);

- for the services of organizations - a copy of the contract with the construction company, copies of payment orders (or for cash payments - copies of cash receipt orders, receipts);

- for the purchase of materials - copies of receipts (sales receipts);

- tax refund application;

- documents confirming the tax paid (certificate 2-NDFL);

- a copy of an identity document;

Deduction amount

The regulatory authorities changed their position on this issue several times. According to the latest opinion of the Federal Tax Service and the Ministry of Finance of Russia, expenses associated with finishing a residential building, made after registering ownership of the house, can be included in the property deduction, even if the deduction for the construction of the house has already been provided to you (Letters of the Federal Tax Service of Russia dated April 22, 2020 No. BS -4-11/ [email protected] , Ministry of Finance of Russia dated April 22, 2020 No. 03-04-05/23340). Moreover, after receiving an extract from the Unified State Register (certificate), the property deduction can be declared in the current amount, and later increased for expenses incurred in the future.

Subtleties of the register of documents for 3-NDFL

- 2-NDFL;

- 3-NDFL;

- agreement on the provision of medical services;

- documents confirming payment for medical services;

- documents confirming the presence of family ties (if the deduction is obtained for close relatives);

- certificate of registration of marital relations (if the deduction is obtained for the wife or husband);

- application for the return of the specified amount of funds.

At the beginning of the document, information about the person filling it out must be indicated, that is, TIN, full name, as well as the year for which this document is drawn up, while at the end of the document the date of its execution and signature are indicated.

Maximum amounts eligible for refund

According to the letter of the law, the state has established a certain upper limit on the amount to be returned in each case.

Table 1. What is the maximum amount that can be returned

| Deduction | Maximum amount |

| If a taxpayer purchases real estate in the form of a house, apartment or other residential property, and also builds it independently, completes unfinished construction, carries out construction and finishing work, the amount of expenses, part of which must be covered, is 2 million Russian rubles. | 260 thousand rubles |

| When the purchase, construction, repair or decoration of real estate was carried out, and a targeted loan was used, for example, a mortgage, a portion of 3 million rubles must be returned. Please note that in this case, funds are issued to cover interest on the targeted loan taken. | 390 thousand rubles |

| When paying for training at any relevant institution, for yourself, children or siblings under the age of 24, you apply for a so-called social deduction, the amount of which will be 13% of 120 thousand rubles. | 15 thousand 600 rubles |

| To pay for treatment for yourself or family members, as well as minor children. In the case where the treatment was expensive, all actual expenses are compensated in the amount of the original 13% of their amount. | 15 thousand 600 rubles |

| The standard deduction received for children brings each parent a certain amount each month. |

|

3-NDFL declaration

According to the law, you can submit a declaration to the tax authority for another person only with a notarized power of attorney. It does not matter who this person is to you - a spouse, a parent or a third party. The only exception to this rule is if you are the person's legal representative (for example, a guardian or parent of a minor child).

This is interesting: The apartment was donated to the son after his divorce, but the son remained a debtor to his ex-wife in court. The ex-wife can take the donated apartment to pay off the debt.

If you have received any income that is subject to declaration (for example, you sold an apartment, garage, cottage or car), then by April 30 of the next year you are required to submit 3-NDFL to the tax authority, and by July 15 - to pay the tax calculated in the declaration on income. The natural question is, what will happen if you did not submit 3-NDFL on time or did not pay the tax.

What to indicate in such a 3-NDFL field as the type of ownership of the object

To receive a property deduction, citizens must submit a package of documents to the tax authority, including a declaration of income of individuals. As a rule, it is not difficult to fill out; difficulties may arise only in one question: how to correctly enter the type of property in form 3-NDFL?

We suggest you look into this issue.

3-NDFL is a declaration of income of individuals.

According to current legislation, if a citizen is engaged in individual entrepreneurship or receives income in addition to his main place of work, he must submit this document to the tax service. In addition to the fact that the declaration document serves to legitimize income, it may be required to obtain a tax deduction for the purchase of real estate.

It can be submitted either in person to the Federal Tax Service or electronically. The personal income declaration consists of five pages:

- 4 page or sheet A - information about sources of income;

- Page 3 - calculation of the tax base;

- Page 2 - information about income and taxes is entered;

- 1 page - information about the taxpayer is indicated, including full name, address and passport details;

- Page 5 or sheet D1 - data on tax deductions for the purchase or construction of real estate.

3-NDFL is submitted until April 30 of the year following the one in which the property transactions were carried out.

Let's say you purchased an apartment in September 2021 and want to get a refund for it.

Difficulties in filling out can begin literally from the first paragraph of sheet D1.

In this case, you need to declare income by April 30, 2021.

Clause 1.1. (010) is listed as “Object name code” - what is it and what number should I put there? Let's look at the possible code options:

Download the program declaration 3 personal income tax for 2021 for free website IRS

4 OKTMO code. If you do not know the OKTMO code of your municipality, follow the following link “OKTMO Code”. In the page that opens, select the name of your region and enter the name of your municipality. After this you will find out the OKTMO code.

Many individuals - income tax payers have recently been actively mastering computer technologies. And the Russian tax department understands this, so it invites everyone to download the program for 3-NDFL for 2020 for free in 2021. Of course, in the new version – taking into account all the changes.

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice. Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business!

Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case.

Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use. Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Submission to the authorities. Tracking. Control of every movement of the case.

There is always a possibility that the client does not need to go to court or draw up a claim and other documents, since there is no prospect of winning and the client will waste time and money, or worse, worsen his situation. This is why our company’s lawyers first do a free analysis of the situation, study the available documents, and only after that offer solutions, if any.

Why

Inventory for the 3-NDFL declaration: register of documents

The register is used to control submitted papers. For example, when filing 3-NDFL in person, a tax specialist can check all documents submitted to the tax office for compliance with the list. This will also help avoid the loss of documents when sending them via postal parcel - postal workers will be able to check the list and, if any of the documents are lost, will respond personally.

To ensure that no precedents or disputes arise in a tax organization, the paperwork for the declarant to generate 3-NDFL must be described in the letter (register) attached to it. This process can be carried out in free form, but it is necessary to indicate at what position the form is submitted, and the period for which the profit report is provided, the name of the tax organization and information about the applicant-applicant himself.

Declaration 3NDFL. Filling out the title page

All individuals who received income in addition to regular wages are required to report for the amounts received and transfer personal income tax to the budget.

The declaration form changes periodically; starting with the 2021 report, a new form is used. According to tax authorities, it is easier to fill out than the previous form.

Regardless of whether the report is submitted to declare income or receive a deduction, the cover page is filled out in the same way.

On the title page, the number of the adjustment is placed in order and, in the form of a code, the period and year for which the declaration is submitted, and the tax authority to which the taxpayer is assigned are indicated. This is followed by information about the taxpayer himself: his code, full name, date and place of birth. The next block is information about the citizen’s passport, telephone number. The taxpayer's signature and the date of filing the report are placed in the lower left corner.

Declaration 3 personal income tax 2021: correct filling, delivery, sample

Declaration 3 of personal income tax 2020 can be filled out by all citizens of the Russian Federation who have any income. Foreign individuals who have their own business activities in Russia should also prepare a declaration. The personal income tax return must indicate property tax.

In order to return funds for study or treatment of a disease, you need to present a number of documents, including declaration 3 personal income tax 2020 , and each of them must have a special stamp. All documents provided must serve as proof that tuition fees have been paid (money is returned only in case of paid tuition).

10 Jun 2021 lawurist7 305

Share this post

- Related Posts

- Length of Service for Teachers in Russia 2020

- Old-age pension for citizens working in resettlement zones

- Do they give a certificate at the MFC at the place of registration?

- Benefits for contract workers in stock

How to fill out 3-NDFL for IIS in 2021

Information from January 16, 2021.

To receive a tax deduction for IIS, we will need a 3-NDFL declaration. You can fill it out yourself:

There is nothing complicated in filling out the 3-NDFL declaration, and now we can verify this: to draw up the declaration ourselves, we will use a special program recommended by the Federal Tax Service.

This program has the unexpected name “Declaration” and, as follows from the description on the website, “allows you to automatically generate tax returns in forms 3-NDFL and 4-NDFL. As you fill out the data, the program automatically checks its correctness, which reduces the likelihood of errors.”

For us, the most important thing is that it allows you to save the declaration in .xml format - this is the format in which the Federal Tax Service Inspectorate accepts the electronic version of the declaration.

Currently it can be found at this link:

In the future, as new versions are released, the path to the download link may change. In this case, you can simply search the IFTS website using the keyword “Declaration Program”:

In the search results we will see a link to this program:

Install and launch the program.

Let's make sure we have on hand:

- Help 2-NDFL

- Passport (if we don’t remember all its details by heart)

The program's start screen looks like this:

As you can see, there is a vertical menu on the left, and by default the topmost item of this menu is active - “Set conditions”. As you fill out the information, we will move through these tabs from top to bottom. For now, let's fill out everything on this tab.

Tab "Set Conditions"

We need to fill in or check the following fields:

How to find the tax office number? Using this link we go to the tax website, to a special section for searching for the details of the Federal Tax Service:

To enter an address, click on the drop-down menu and enter the address:

After confirming with the “OK” button, we will see the search result:

The Federal Tax Service code is what we need. From here we take the code of the municipality (OKTMO).

We return to the program, click on the button and select yours from the list of tax inspectorates:

If this is the first declaration submitted this year, then leave the adjustment number as “zero” (this is true for 99% of cases).

So we filled in:

- Inspection number

- Correction number (default “zero”)

- OKTMO number

Let's check whether the checkboxes and selectors are set correctly and move on to the next tab.

Tab “Information about the declarant”

On the vertical menu on the left, open the “Information about the declarant” tab, after which we will be taken to the page for entering personal data. Fill in all the data:

How to find out your TIN

There are two ways: complex (useful for the future) and simple.

A simple way is to take a 2-NDFL certificate, because we should already have it in our hands (otherwise why would we fill out this declaration), and our TIN is indicated in it:

Another way to find out your TIN is to use the service from the tax service: follow the link and get to the data entry page. Fill them out and click the “send request” button:

After 1-2 seconds we can already see the result:

So, we entered our personal data and TIN into the program.

This is where we need the information we received when we looked for our tax office number. Along with the number, we also received OKTMO - the code of the municipality.

Filling out the information on the “Declarant Information” tab is complete. As you can see, there is nothing complicated. Let's move on to the next tab:

Tab “Income received in the Russian Federation”

Now it’s time to get a 2-NDFL certificate, if we haven’t already done this in the previous step, when we needed to find our TIN. Now we will transfer into the program the data from our 2-NDFL certificate, which we received from the employer (or from several certificates, if we withheld personal income tax in the previous year in several places or for different reasons).

First, we create an account card for the employer (tax agent):

After clicking “+”, a tax agent (employer) card template will appear:

We take all the data for filling out these fields from the 2-NDFL certificate, section “Data about the tax agent”:

In general, of course, it is strange that different concepts are used to denote the same entity in the program and in the certificate: “source of payments” and “tax agent”; this makes it a little difficult for beginners to understand.

We fill out the card with the data from the 2-NDFL certificate and confirm the entry by pressing the “Yes” button:

We will discuss the fate of the “calculation of standard deductions” checkbox below.

Attention! In this TIN and OKTMO card you need to indicate not ours, but the employer! The employer's OKTMO code, which we enter at this stage, may differ from the individual's OKTMO code, which we entered on the “Set conditions” tab.

Attention! You need to transfer data from the 2-NDFL certificate LITERALLY - that is, letter by letter exactly. If you write “Young Promising Company” in the “Name of payment source” field, and in the 2-NDFL certificate it is called “YOUNG PROMISING COMPANY,” then there may be problems.

Standard tax deductions in the 3-NDFL declaration

Now we will discuss the question of how to take into account standard tax deductions (for a child, etc.) in the 3-NDFL declaration and whether it is necessary to tick the box.

Let's look again at our 2-NDFL certificate and find section “4. Standard, social and property tax deductions":

If this column is empty, then when filling out the card of this tax agent (in program terms this is called “source of payment”), we leave the checkbox empty.

If in our 2-NDFL certificate this section is filled out, as in this example:

then you need to tick the box.

If a person works in several jobs, then he will have several 2-NDFL certificates, therefore, there will be several sources of payments, but such a checkbox can only be assigned to one employer (source of payments).

So, after filling out this card, the tax agent or “source of payment” should appear in the list:

Next, we need to enter data on the income associated with this source of payments, click on the plus sign, and you will have to click on it more than once:

A form for entering information will appear:

In this form we need to fill in the fields:

- Revenue code

- Amount of income

- Month of income

We take information from the 2-NDFL certificate:

You will have to repeat entering this information as many times as there are lines in our 2-NDFL certificate.

After entering all the data, we will get something like this:

We compare the final results with what is indicated in the 2-NDFL certificate:

All totals must match! In our example the following coincide:

- total income: 514944

- amount of taxes withheld: 64031

Well, that’s it, we can say that we have almost completed the 3-NDFL certificate. It just requires a few clarifications.

If there are several employers, data must be entered from each 2-NDFL certificate. In this case, in the “sources of payments” field we will see a list of employers for whom we received 2-NDFL certificates and entered data into the program:

Entering data from several 2-NDFL certificates only makes sense if we “don’t have enough” personal income tax to return. If, according to certificates from two places of work, we have already accumulated tax of 52,000 rubles or more, then if we have a third 2-NDFL certificate, this income can no longer be indicated in the declaration.

Now let's look again at the standard deduction (see above). We find that 2-NDFL certificate (if there are several of them), where they are present:

Next, enter information about standard deductions:

After clicking “+”, we will see a form for filling out data on standard deductions:

We fill in all the fields, and in the end we get the picture, taking into account standard tax deductions:

Now on the vertical menu you can move to the next tab “Deductions”.

Deductions tab

Filling out the data here will be very simple. Since we have already entered data on standard tax deductions at the previous stages, we can leave the “Standard” menu item blank:

Next, open the section “Investment and losses on the Central Bank”:

In the field “Amount of deduction provided for in clause 2, clause 1, art. 219.1 of the Tax Code of the Russian Federation" we enter the EXACT total amount of income to our IIS in the previous tax period (provided, of course, that we want to receive a deduction for the first type of IIS - that is, for the amounts contributed).

If the amount exceeds 400 thousand, then we bet 400 thousand!

If you enter any amount in this field that exceeds 400 thousand, the program will immediately correct it to 400,000 rubles.

Check, print, save

To check our 3-NDFL declaration, you need to click on the appropriate button in the top horizontal menu of the program:

You must check and wait for the confirmation message:

Next, it is recommended to save the working version of our declaration first in the program’s own format:

In general, it is recommended to save throughout the entire time you work in the Declaration program:

This will allow us to return to editing at any time. Or, if we find a mistake, fix it.

Next, click “View” to see in what form the declaration will be printed:

We will only need to print it if we send paper documents to the Federal Tax Service (by mail or during a personal visit). Here and further we will consider the option of sending documents through the website of the Federal Tax Service, without a personal visit anywhere - this is both easier and more convenient, therefore, we do not need to print anything.

However, it makes sense to save the declaration in some generally accepted format, such as PDF:

Now we save our 3-NDFL declaration in .xml format. This format is very unreadable if you open this file on a computer, but it is in this format that the Federal Tax Service accepts the electronic version of this document:

We select a folder on the computer to save the electronic version of the declaration and receive a message about successful saving:

The file name consists of a long combination of characters and numbers, this is normal. Attention! You cannot change the file name! You will have to leave it on your computer in a folder with exactly that name (you can simply put it in the desired folder, and then name the folder as needed).

That's all!

So, the whole process takes 20-30 minutes, but as mentioned above, you can order the production of a 3-NDFL declaration on an online service on the Internet:

Next, we will consider the process of preparing and sending all documents to the tax office through the taxpayer’s personal account on the Federal Tax Service website - this is an alternative method of preparing a declaration, which has its pros and cons, however, it is better for inexperienced people to prepare 3-NDFL in the program.

On the forum you can discuss this article or ask pressing questions about preparing the 3-NDFL declaration in 2021.