Payers of the single tax on imputed income report their income quarterly. The reporting campaign in this mode is short - only 20 days after the end of the quarter.

If the deadline falls on a weekend, it is moved to the first working day. Accordingly, the deadlines for submitting the UTII declaration in 2021 are as follows:

- for the 1st quarter – April 20, 2020;

- for the 2nd quarter – July 20, 2020;

- for the 3rd quarter – October 20, 2020;

- for the 4th quarter – January 20, 2021.

Note! tax regime has been abolished since 2021 . Payers of UTII need to choose another taxation option. On January 20, 2021, the last UTII declaration is submitted.

You can fill out the UTII declaration by hand, on a computer or using a specialized service. If you have chosen the option of preparing your own reports, then you can download the form valid in 2021 and view sample completions here.

And for those who want to simplify and speed up the preparation of their UTII declaration, we recommend using our online service. We will tell you how to work in it in this article.

Prepare a UTII declaration for only 149 rubles

Changes in the new UTII declaration in 2021 for individual entrepreneurs

With the introduction of online cash registers, it became necessary to change the standard tax return form. These changes were needed to receive reimbursement for the purchase of online cash registers and fiscal drives.

Since 2021, a new form of UTII declaration has been in force, for a single tax on imputed income, in accordance with the order of the Federal Tax Service No. MMV-7-3 / [email protected] dated June 26, 2018.

In section 3, line 040 “Amount of expenses for the acquisition of cash registers” was added

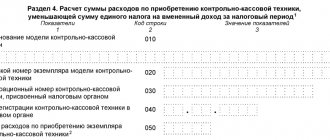

For this purpose, section No. 4 was added to the document, called “Calculation of the amount of expenses for the acquisition of a cash register, which reduces the amount of UTII for the tax period.” It will display information about the online cash register, which can be used to receive reimbursement for expenses (clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

Filling out section 3

In section 3, calculate the total amount of tax payable for all places and types of activities on UTII (line 040). This section is formed based on the data from all sections 2. The order of filling out the lines is as follows:

| Line | Index |

| 005 | On line 005, indicate the taxpayer's characteristics: • 1 – for organizations and individual entrepreneurs paying income to individuals; • 2 – for individual entrepreneurs without employees. |

| 010 | The sum of the values of lines 110 of all sections 2 of the declaration. |

| 020 | Amounts of paid insurance premiums and paid disability benefits (only for taxpayer indicator – 1). |

| 030 | Filled out as an individual entrepreneur without employees. You need to enter the amount of insurance premiums “for yourself”. |

| 040 | You need the difference between lines 010 and 030. The resulting tax amount must be greater than or equal to zero. |

Here is a possible sample of section 3 of the declaration for the 1st quarter of 2017.

Due dates

A quarter on UTII is a tax period. The declaration is submitted by the 20th day of the 1st month following the tax period.

If this day turns out to be a weekend or holiday, then the due date is shifted towards the next working day.

In 2021, tax return filing deadlines have the following time periods:

| Quarter 2021 | Due date, until |

| I | April 20, 2021 |

| II | July 20, 2021 |

| III | October 20, 2021 |

| IV | January 20, 2021 |

Where to submit and how to fill out the declaration online?

All organizations and entrepreneurs on UTII submit declarations at the actual location of their business. If activities are carried out in an area other than the place of registration, you need to de-register where the registration took place and register where the activities are carried out.

In case of provision of services:

- retail trade associated with distribution or distribution;

- placing advertisements on cars, buses or minibuses;

- transportation of goods;

- taxi and public transport.

There is no real possibility of determining the specific place of activity, so individual entrepreneurs in this case submit declarations at the place of residence.

The declaration can be submitted in several ways:

- using the post office;

- personal appeal to the Federal Tax Service;

- online, through the OED operator or personal tax account

- a convenient and simple service for filling out a UTII declaration, it can be saved in PDF and Exel format - see here.

If there are many points on UTII with one type of activity

If an entrepreneur has several points on UTII that do the same thing in one locality, in this case one tax return is submitted. But all physical indicators must be added together and indicated in the second section of the declaration.

If they operate in different localities, then each municipality must submit its own declaration.

If there are many types of activities on UTII

When an entrepreneur is engaged in several types of UTII activities in the territory of one branch of the Federal Tax Service, a single declaration is submitted with the completion of several additional sheets from section No. 2.

When engaging in several types of activities in different cities or villages, you need to submit a new declaration to each Federal Tax Service with all the sheets from section No. 2 that are needed.

To submit a declaration online, you will need to obtain an electronic digital signature.

Negative nuances

There are some disadvantages of the electronic method of filing the UTII declaration. These include: (click to expand)

- The need to visit the Federal Tax Service office to obtain confirmation of acceptance of the declaration. Tax employees put a stamp and signature on the paper form of the UNDV declaration.

- There are glitches in the system. This unpleasant factor sometimes comes into play on the last day of delivery. Therefore, you should not delay, but it is better to submit the declaration in advance.

Important! Individual entrepreneurs must periodically visit the Federal Tax Service office to receive advice on changes in tax legislation.

This also applies to those who submit declarations through electronic services.

Penalty for late submission of declaration

For late filing of a UTII tax return, a fine of 5 to 30% of the amount of unpaid tax for each full and partial month is assessed; it cannot be less than 1,000 rubles (Article 119 of the Tax Code of the Russian Federation).

If the tax was paid on time, but the tax return was not submitted to the relevant authorities within the established time frame, then the entrepreneur may be fined 1,000 rubles. If the delay exceeds 10 working days, the Federal Tax Service may block the current account of a business entity.

Requirements for filling

It is very simple to fill out a tax return for individual entrepreneurs who are on UTII, however, despite the simplicity, there are certain requirements that must be met:

- All physical and cost indicators are filled in in whole units, according to the principle of mathematical rounding. The exception is the K2 coefficient; its value is rounded to the third decimal place.

- It is prohibited to indicate kopecks in the tax return.

- All pages of the tax return must be numbered. Numbering is done in a specially designated window consisting of 3 characters. When filling it out, you need to use all three characters, so, for example, the first page will be designated “001”, the second “002”, etc.

- All values are indicated from the first cell, from the left edge of the document; if there are empty cells, a dash is placed in them.

- If there is no need to fill in certain data, then in the column where they should be, a dash is placed in all cells.

- All fields must be filled in capital block letters.

- The declaration must be filled out strictly in black, purple or blue ink.

- When filling out using computers, Courier New is indicated as the printing font; the size is 16-18 pt.

- The title and first pages of the declaration must necessarily contain the signature of the person on whose behalf the document is being submitted. The seal is placed only on the title page, if the organization has one, in a specially designated place.

- There is no need to staple or staple the declaration.

- The tax return must not contain spelling or other errors or corrections.

- Double-sided printing is strictly prohibited.

- There is no need to indicate fines and penalties in the declaration.

OKVED codes

The declaration must explain what the main activities of the organization or individual entrepreneur are. For these purposes, you need to indicate the OKVED code. At the same time, in all declarations submitted from January 1, 2021, it is necessary to indicate codes according to the new OKVED2 classifier. However, if “clarifications” are submitted for periods expiring before 2021, then indicate in them the same codes that were entered in the initial declarations (Letter of the Federal Tax Service of Russia dated November 9, 2016 No. SD-4-3/21206).

How to find out the new OKVED

If you do not know your new OKVED code, use transition keys. You will find them on the website of the Russian Ministry of Economic Development at the link economy.gov.ru. Download the key “OKVED 2001 - OKVED2”. On the contrary, you can see the new code.

Let's give an example of a completed title page of the UTII declaration for the 1st quarter of 2021.

Instructions for filling out a tax return

The tax return contains three sections and a cover page. For convenience, filling should be done in this order:

- title page;

- section 2;

- section 3;

- section 1.

Filling out the title page is necessary to identify the individual entrepreneur by the tax service.

Title page

Here is the information that will help you do this:

TIN . For individual entrepreneurs it is filled in completely, for organizations this document has a 10-digit number, so the two empty cells at the end of the column are filled in with a dash.

Checkpoint . Individual entrepreneurs do not need to fill out this item.

The TIN and KPP fields are filled out identically on all subsequent pages.

Correction number. The serial number of the amended declaration is indicated. If it is “0—”, then it is primary.

Taxable period . It is necessary to indicate the tax period code corresponding to the declaration being submitted.

| Period code | Name of period |

| 21 | I quarter |

| 22 | II quarter |

| 23 | III quarter |

| 24 | IV quarter |

| 51 | I quarter during reorganization (liquidation) of the organization |

| 54 | II quarter during reorganization (liquidation) of the organization |

| 55 | III quarter during reorganization (liquidation) of the organization |

| 56 | IV quarter during reorganization (liquidation) of the organization |

Reporting year . The reporting year of the declaration being submitted is indicated here.

Submitted to the tax authority (code) . Look for the code of the tax office office where the tax return is submitted using the Federal Tax Service Inspectorate service.

At the place of registration (code) . The code of the place where the declaration must be sent to the Federal Tax Service is indicated.

| Location code | Name of place |

| 120 | At the place of residence of the individual entrepreneur |

| 214 | At the location of the Russian organization that is not the largest taxpayer |

| 215 | At the location of the legal successor who is not the largest taxpayer |

| 245 | At the place of activity of the foreign organization through a permanent representative office |

| 310 | At the place of activity of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 331 | At the place of activity of the foreign organization through a branch of the foreign organization |

Taxpayer . Line by line fill in the last name, first name and patronymic of the individual entrepreneur.

OKVED.

Contact phone number . We fill it out in any format.

On the pages . Number of pages in the declaration.

With supporting documents or their copies attached . In this paragraph you need to indicate the number of additional sheets (power of attorney) provided along with the tax return. If there are none, then you need to put a dash.

Confirmation of the accuracy of the information provided . The number 1 or 2 is placed here. The first value indicates the director of the company, the second indicates the representative of the company.

At the end, the last name, first name, and patronymic of the person who signed the tax return is indicated. If the signatory is the director of the organization, then you need to additionally put a seal if it is provided for by the internal charter of the organization. In the case when a company representative is applying for his visa, it is necessary to indicate the details of the document confirming his authority.

Section 2

An individual entrepreneur operating under several economic activity codes is required to draw up documentation of the second section in a number of sheets equal to the number of OKVED documents. If he conducts activities in 10 types, then he must have 10 sheets with section 2 in his tax return.

Code p.010 . Designed to indicate the type of activity code; all codes can be found here.

Code p.020 . It is necessary to fill in the full address of the place of business activity (if line “010” indicates the type of activity with code 05, 06, 10 or 16, then organizations in line “020” need to write the legal address, and individual entrepreneurs – the address of the place of residence).

Code p.030. The OKTMO code is filled in - find out here.

Code p.040 . The basic yield is indicated . The value at this point can range from 50 to 12,000 rubles.

Code p.050 . Designed to indicate the value of the deflator coefficient K1.

In 2021, the deflator coefficient K1 changed, now its value is 1.915 ; in 2021, entrepreneurs calculated indicators for the tax return based on the size of this coefficient equal to 1.868.

Code p.060 . The deflator coefficient K2 is indicated. It takes different values for tax reduction depending on the region where the activities of an individual entrepreneur are located.

You can find out its meaning on the official website of the Federal Tax Service (select your region at the top of the site, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section).

Code p.070-090 . Designed to display physical indicators.

Column 2. Designed for entering data on physical indicators by type of activity monthly during the quarter. Indicators must be rounded according to the rules of mathematical rounding. Any change in a physical indicator during a month is reflected in the declaration starting from the month in which it occurred.

When carrying out one type of activity, within one locality with one OKTMO, there is no need to fill out additional sheets of section No. 2. In this case, all indicators are simply summed up.

Column 3. Designed to indicate the number of days in which business activities were carried out. It is intended only for those individual entrepreneurs who have just started their activities or have completed them.

Attention! There is no need to indicate data if the entrepreneur has not withdrawn or registered as a taxpayer of the UTII special regime with the Federal Tax Service; in simple words, it is intended only for those who have just started their activities or have completed them.

Example: An entrepreneur submits a declaration for the 4th quarter. If he registered on October 26, and was deregistered on November 6, then in this case, in line 070, you must indicate the value “7-”. Line 080 should contain the value "5-". Line 090 remains with dashes. If there were no withdrawals and registrations for the quarter, you must put 3 dashes in the entire column.

Column 4 . Lines 070-090 are designed to automatically enter the tax base for all months of the tax period. If the entrepreneur did not register or deregister as a taxpayer during this period, the tax base is calculated as follows:

With. 070, 080, 090 column 4 = p. 040 × s. 050 × s. 060 × s. 070, 080,090 gr. 2

If there was a withdrawal or registration of an entrepreneur, calculations occur in relation to the number of calendar days for which the activity was carried out as a UTII payer.

- With. 070 column 4 = p. 040 × s. 050 × s. 060 × s. 070 gr. 2 × s. 070 gr. 3/ number of days in a month.

- With. 080 column 4 = p. 040 × s. 050 × s. 060 × s. 080 2 × s. 080 gr. 3/ number of days in a month.

- With. 090 column 4 = p. 040 × s. 050 × s. 060 × s. 090 2 × s. 090 gr. 3/ number of days in a month.

Code page 100 . Designed to display automatic data on the amount of the tax base for the quarter, the amount of lines 070-090 4 columns.

Code page105.

Designed to enter data on the tax rate of 15%, or the rate established by various municipalities.

Code page 110 . Designed to indicate the tax amount for the quarter.

page 110 = page 100 * page 105 / 100

Section 3

Line 005 . If an individual entrepreneur does not make payments to staff, the number “2” is entered; in all other cases, the number “1” must be entered.

Line 010 . Total amount of single tax. Here you need to indicate the total income on line 110 from all completed sheets for all types of activities indicated in section 2.

Line 020 . Designed for entering data on hospital benefits and insurance premiums. It is also intended for making expenses and payments in accordance with paragraph 2 of Article 346.32 of the Tax Code of the Russian Federation.

Line 030 . The amount of fixed insurance premiums for an individual entrepreneur is indicated.

Line 040. The total amount that the entrepreneur must pay to the state.

- for p.005 = "2": p.040 = p.010 - p.030 ≥ 0

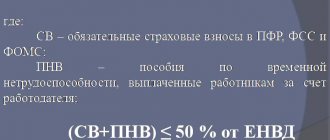

- for p.005 = "1": p.040 = p.010 - (p.020 + p.030) ≥ 50% p.010

Section 1

Line 010 . The code OKTMO is filled in - find out here.

Line 020 . This line displays the amount of UTII tax that is paid to the budget (Line 040 section 3).

If a UTII subject carries out business activities using one OKTMO code, then line 020 is equal to line 040 from section 3. If the payer carries out activities in different localities, line 020 is calculated using the following formula:

(Art. 040 times 3 * (sum of Art. 110 of all pages of sections 2 for this OKTMO code / Art. 010 times 3))

An example of filling out a UTII declaration with a deduction using CCP

For those who do not know how to submit a declaration for the second quarter of 2019, taking into account the deduction at the online cash register, we will provide a sample of filling out this document. For example, a young business woman provides hairdressing services and is registered as an individual entrepreneur. She has 2 employees on her staff. In May, she bought an online cash register. The total expenses turned out to be higher than the maximum amount of compensation of 18,000 and amounted to 22,000 rubles.

The completed version can be seen in the images below:

The first is when we did not include a deduction for cash register

The second is when we included the deduction for cash registers

Filling out section 1

Lastly, based on the data in sections 2 and 3, you need to fill out section 1 of the UTII declaration for the 1st quarter of 2021. In section 1 please indicate:

- on line 010 – code of the municipality on whose territory the “imputed” activity is carried out;

- on line 020 - the amount of UTII payable for each municipal entity (each OKTMO).

In section 1, line 010 can be generated several times if a company or individual entrepreneur is engaged in “imputation” in several municipalities that are subordinate to one Federal Tax Service.

If an organization operates in the territory of several municipalities under the jurisdiction of one Federal Tax Service, then calculate the single tax payable for each OKTMO as follows:

- add up the amounts of UTII for the 1st quarter of 2021 for all types of activities carried out on the territory of each municipality (indicators of lines 110 for all sections 2 of the declaration for the 1st quarter, which indicate the same OKTMO);

- divide the total amount by the tax amounts for all municipalities (indicator for line 010 of section 3 of the declaration for the 1st quarter);

- multiply the total by the amount of UTII accrued for payment for the first quarter (line 040 of section 3 of the declaration).

The final indicators in section 1 of the declaration for the 1st quarter of 2017 may look like this example:

completed UTII declaration for the first quarter of 2021 in Excel format.