The act of writing off goods in the TORG-16 form is useful in cases where goods in the organization’s warehouse have become unusable and need to be written off. This document confirms the legality of the actions of the storekeeper or other financially responsible person.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The document will be especially useful for food organizations, pharmacies and other companies that deal with perishable goods.

Important point! Write-offs cannot be made without the knowledge of the head of the organization. An order or instruction must be drawn up on his behalf.

If the amounts for which goods are written off are insignificant, and the process of deregistering goods is carried out regularly, then the manager can issue an order of the appropriate content, implying regular write-offs. But still, a reference to the order will be required for the act of writing off goods in the TORG-16 form.

It is worth noting that the procedure for writing off inventory items (inventory) is carried out only in the presence of a commission, the members of which are responsible and sign on the paper that the write-off was carried out according to all the rules. They also check whether the numbers in the document correspond to the actual quantity of goods being written off.

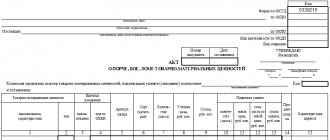

Form TORG-16. Certificate of write-off of goods

The act of writing off goods in the TORG-16 form is useful in cases where goods in the organization’s warehouse have become unusable and need to be written off.

This document confirms the legality of the actions of the storekeeper or other financially responsible person. FILES

The document will be especially useful for food organizations, pharmacies and other companies that deal with perishable goods.

Important point! Write-offs cannot be made without the knowledge of the head of the organization. An order or instruction must be drawn up on his behalf.

If the amounts for which goods are written off are insignificant, and the process of deregistering goods is carried out regularly, then the manager can issue an order of the appropriate content, implying regular write-offs. But still, a reference to the order will be required for the act of writing off goods in the TORG-16 form.

It is worth noting that the procedure for writing off inventory items (inventory) is carried out only in the presence of a commission, the members of which are responsible and sign on the paper that the write-off was carried out according to all the rules. They also check whether the numbers in the document correspond to the actual quantity of goods being written off.

Sample food disposal act

Food disposal methods

Foods that are considered unfit for consumption should not simply be thrown into the trash. Such goods must be disposed of according to all rules. Food products that are approaching their expiration date may be sold with a corresponding label. Usually such goods are sold at a discount. If the product is spoiled, it must be disposed of. This is usually done by suppliers and manufacturers. There are several main ways to dispose of food:

- Burial . Damaged goods are transported to special landfills or landfills. But you need to understand that not every product is subject to such disposal. When certain products rot, harmful microorganisms enter the soil. Attention is also paid to packaging, the decomposition of which has a negative impact on the environment. This method is most often used when disposing of vegetables, fruits and other organic goods.

- Burning . Everything is clear here; illiquid products are placed in fireproof tanks, where combustion occurs. Often, the ash obtained in this way is used to make fertilizers.

- Biorefinery . Used primarily to destroy organic products. A special compost pit is used here. It creates special conditions that accelerate the decomposition process. The resulting humus is then used to fertilize the soil.

- Grinding . There are factories that use special equipment. It is capable of shredding not only goods, but also any packaging. The result is a kind of shaving. After adding binders, this mass is used for the production of building materials.

- Feed production. Not all waste can be fed to animals. The list of such products is strictly regulated.

Elements of the act

The paper must be on at least two sheets. Each sheet contains a table. In the presented samples, the first table contains 13 rows, the second – 12. If necessary, the number of rows can be increased. Then the entire document will occupy more sheets. However, even in this case, it will be considered a unified form and is unlikely to provoke questions during inspections.

For your information! Since 2013, legislation has significantly relaxed the requirements for document flow in organizations. The TORG-16 form is no longer the only correct one for writing off unusable goods. You can document the fact of write-off on any form. The main thing is that it contains all the necessary details and the form is accepted by order of the manager and is present in the company’s accounting policy.

Most managers, storekeepers and accounting workers tend to use this particular form of document, since the data will be placed in it conveniently and compactly. In addition, it does not raise any questions when conducting re-registration by controlling organizations.

First page of the act

The act of write-off of goods in the TORG-16 form begins with a reference to Goskomstat Resolution No. 132 of December 25, 1998 in the right-left corner of the page. It was this resolution that established this form as a unified form for writing off goods. It has been used for a long time, and it still remains relevant.

After the link to the legislative framework there is a miniature table with codes. The OKPO code is already indicated, it remains unchanged when using this form - 0330216. It is already printed. In addition, it must contain the code according to OKPO, the type of activity according to OKDP and the coding of the type of operation. To the left of the code table there is space to indicate the full name of the organization and if there is a structural unit. The latter can be a warehouse, workshop, storeroom, etc.

An important point is the basis for drawing up the act. One column is allocated for it at the top of the document. In addition to the name of the document, it must contain its number and date of signing.

Since during the write-off of goods the risk of fraud on the part of employees increases, on each write-off act there is a separate space for the approval of the manager. The completed act must bear the signature of the manager with a transcript, position and date of issue. The act is assigned a number. It and the date of signing are placed immediately after the title of the document.

Form of the act

There is no uniform form for these purposes established by law. Although you still need to know about some rules. The Goskomstat decree states that the recommended templates for writing off products are forms TORG-15 and TORG-16. Until 2013, these forms were considered mandatory for writing off goods and registering their damage. However, this does not at all prohibit organizations from developing and approving their own form. Practice shows that in almost all situations existing forms are used. They are considered quite convenient and understandable. In addition, you can enter additional information here if necessary.

Where is it used?

As a rule, this act is used in enterprises that are engaged in the production and transportation of products, their sale and storage. Accordingly, this category includes various stores, warehouses, shopping centers, and food processing enterprises. If products are not sold within the expiration date, they are subject to write-off. This procedure is accompanied by the execution of a special act.

As you might guess, the sale of such a product will cause serious problems with the law. The smallest punishment that an organization faces involves a fairly large fine. This is why unconsumable products are written off. In essence, they are returned to managers and other representatives of suppliers and manufacturers. They are the ones who determine the future fate of the products. Such actions have many advantages:

- positive impact on the environment;

- the ability to send illiquid assets for processing;

- reduction of waste in landfills, since discarded goods are not thrown into trash bins;

- reducing the risk of spreading dangerous infections.

( Video : “Disposal of expired food”)

First table

After the header in the attached form there is a fairly simple table. It contains columns that should contain information about:

- Dates of receipt and write-off of the goods described in each line. Indicated for each name separately. It is unacceptable to place different products on the same line.

- The number and date of the delivery note. It is the connecting link of the act and is needed for the correct formation of financial statements.

- Reasons. They represent signs of deterioration in quality, which led to the impossibility of using the inventory items listed in the table for their intended purpose. There is also a column for indicating the code if the company has adopted the encoding. But usually these fields are left empty.

The reasons for write-off are varied:

- Damage. Intentional or unintentional. The appointment of a financially responsible person is precisely necessary for such cases.

- Marriage. Factory or identified later during inventory.

- Violation of the integrity of the packaging.

- Expiration of the implementation period. This is the most common reason for write-offs.

When closing an organization, unsold goods are also subject to write-off.

Filling out the form for the act of writing off goods in the TORG-16 form can only be done in printed form. On the reverse side of the sheet there must be signatures by a commission convened specifically for such a case, and in most cases not all employees of the institution have electronic signatures. Usually they resort to mixed filling: the columns of the tables are formed electronically, the act is printed, and then all financially responsible persons leave their signatures, and the organization’s seal is affixed (if any).

Possible reasons for disposal

As a rule, when it comes to disposal, we mean food products that have already expired. This is natural, because such goods are already prohibited from being sold. However, products can be written off for other reasons:

- a manufacturing defect was detected;

- the seal of the packaging was broken;

- damaged packaging;

- the products were stored in improper conditions;

- the appearance of the product raises doubts about its quality;

- the product is potentially hazardous to health;

- products are considered prohibited on the territory of the Russian Federation.

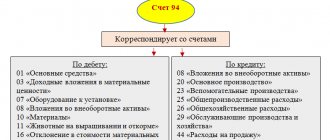

At the final

When a write-off occurs, the reason must be determined. For example, if a product is not sold before its expiration date, this will be considered a loss borne by the organization. In essence, this is a natural decline. If it turns out that the goods are damaged, for example, due to the fault of the carrier, then claims will be made against him. It is often discovered that a product has a manufacturing defect. The manufacturer replaces such products.

Who draws up the act and when?

One person cannot decide that products need to be scrapped. After all, some products, such as vegetables, do not have an expiration date. Accordingly, the quality of the product must be determined through visual inspection. A special commission is being created for this purpose. It usually includes an accountant, the head of the organization, and a merchandiser. The possibility of involving outside experts cannot be ruled out. For example, if there is a suspicion of a manufacturing defect, the manufacturer sends its representative.

There are also supervisory bodies that carry out an independent assessment, issuing a written opinion. Even before the products are disposed of, an early inventory is carried out. This is also done by the specialists who are members of the commission. As you might guess, a product is subject to write-off if it becomes unfit for consumption. But at the same time, it is necessary to identify the reason why the products need to be written off. After all, this is what will influence the accounting procedure.

Second page

On the second page there is a table that should provide data on:

- Code and full name of the product.

- OKEI code and the name of the unit of measurement by which the written-off inventory value is measured. This can be a unit, kg, gram, etc.

- Quantity. This column usually contains only one number. If the previous column does not indicate units of measurement, then it is assumed that the number of occupied spaces in the warehouse is indicated here.

- Masse. The total weight of all goods written off in a specific line and one piece (if possible) is indicated.

- Price and value.

- Other data that is fundamentally important when writing off. This column is called “Note”.

After the second table, the total write-off amount is indicated separately in words. Directly below it are signed by the chairman and all members of the commission who were present during the write-off and guarantee that the procedure was carried out correctly. After them, the financially responsible person signs. All “autographs” must have a transcript. The positions of the persons who placed them are written next to them.

The act of writing off goods in the TORG-16 form is completed by the decision of the manager as to what this write-off should be attributed to. This may be a write-off as expenses or the appointment of a financially responsible person responsible for the shortage. If the latter, then the employee will be required to compensate for the damage caused.

Certificate of write-off of goods

- Unified form TORG-16

- OKUD 0330216

- Applicable from January 1, 1999

- Approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132

1. By what subject is it applied?

It is used by organizations when identifying damage or loss of quality of goods that are not subject to further sale.

2. How many copies are compiled?

Compiled in triplicate.

3. Which employee compiles

The report is drawn up by members of the organization’s commission, which identifies damage and loss of quality of goods that are not subject to further sale.

After the act is signed by the members of the commission and the financially responsible person, it is approved by the head of the organization.

4. What confirms

Confirms the fact of write-off of goods that have lost quality and are not subject to further sale.

5. Application procedure

The report is drawn up by members of the commission when damage or loss of quality of goods that is not subject to further sale is detected.

If necessary, a representative of sanitary or other supervision is present when drawing up the act.

The act indicates the details of the goods (name, price, quantity), signs of deterioration in quality (reasons for write-off).

After the act is signed by the members of the commission and the financially responsible person, the decision to assign the value of the written-off goods is made by the head of the organization and approves the act.

The first copy of the act is transferred to the accounting department and is the basis for writing off losses of inventory items from the financially responsible person.

The second copy of the report remains in the department where the goods were damaged.

The third copy of the act remains with the financially responsible person, from whose account the spoiled goods are written off.

6. Storage location

One copy of the act is kept in the accounting department of the organization.

The second copy of the act is stored in the department of the organization in which the write-off goods were damaged.

The third copy of the act is kept by the financially responsible person, from whose account the spoiled goods are written off.

>Document form

- Download form TORG-16 in the following formats: - MS-Excel;

- Sample of filling out the TORG-16 form.

Registration of an act of damage, damage, scrap of inventory items

Filled out by whom?

To carry out an inventory and draw up a report on damage, scrap, and damage to goods, the head of the organization issues an order to create a special commission (at least three people), which includes a representative of the administration and a financially responsible person. The document is filled out by one of the commission members in triplicate.

Content

To draw up a document, you can take a unified form in the TORG-15 form or develop your own template based on it. Practice shows that a unified form is easy to fill out and understandable to representatives of regulatory authorities, so it is better to use the approved TORG-15 form. Let's look at the order of filling it out:

- At the top of the document the full name of the organization is indicated, indicating the legal address, telephone number and structural unit in which the inventory is carried out.

- Below is information about the full name of the supplier, indicating its full details, including bank details (current account, BIC, checkpoint).

- In special columns the document number and the date of its preparation are indicated.

- Title of the document: “Act on damage, scrap, destruction of inventory items.”

- A table consisting of fifteen columns is filled in:

- The name and characteristics are written down. For example, “Gingerbread “Mint”.

- Product code.

- Unit of measurement, name. For example, "pieces."

- Unit of measurement, code OKEY (all-Russian measurement code).

- Product article.

- Variety (category). For example, “1st grade”.

- Quantity (mass).

- The accounting price per unit of goods. For example, "75".

- Total amount for all goods. For example, "750".

- Then there is a section that includes four columns, which indicate:

- quantity (weight) of goods;

- new price (cost after markdown);

- total cost;

- markdown amount (the difference between the total amount for the product before and after the price reduction).

- The 14th column indicates the discount percentage.

- The last column indicates the characteristics of the defect. For example, “packaging violation”.

- The reason for the loss is indicated below the table. If the cause is technological processes or physical conditions, then in the line below, data on the perpetrators is not entered, otherwise the surname, first name, patronymic and position of the person responsible for the fight, scrap or damage to goods are indicated.

- On the back of the form, fill out the section entitled “Credit scrap (scrap).” It contains data about the product if it is impossible to further sell or use it.

Attention! When filling out, you must fully indicate the name of material assets, information about the supplier, the reasons and circumstances that led to damage to the goods.

Are mistakes acceptable?

The document must be drawn up without blots or errors. In case of corrections, it is better to reissue it. Calculations of markdowns or write-offs of goods must be made correctly, otherwise this will be the basis for the tax service to refuse to include expenses in taxable profit.

In case of errors in filling out and calculations, recovery of damages from the guilty party will be impossible.

Who signs?

The document is drawn up in triplicate and signed by all members of the commission and the financially responsible person. At the bottom of the act, under the calculations made, after checking the correctness of filling, the chief accountant signs. The papers are handed over to the manager, who, after making a decision, puts his signature on the front side of the act at the top of the form near the number and date of preparation.

How to fill out the TORG-16 act

Form TORG-16 is issued in 3 original copies. The first of them is transferred to the accountant to reflect in the accounting records the fact of writing off inventory items and charging the amount of recovery from the guilty person, if this person has been identified. Another copy of the completed write-off document remains in the department where it was compiled, and the third is kept by the person financially responsible for the inventory.

The manager is obligated to approve the act completed and signed by all members of the commission, as well as to issue an order to establish the source of repayment for the damage received.

If the commission manages to identify the person responsible for the damage to goods and materials, then the losses are covered by his income (usually this is a financially responsible person). And if the culprit cannot be identified, then the loss can be covered by profit or included in the cost. The latter is allowed within the limits of natural loss.

For more information about the procedure used for writing off losses, read the article “Procedure for writing off commodity losses (nuances).”

Form TORG-16 includes the following basic information:

- date of write-off and, accordingly, receipt of goods to the company;

- details of the incoming invoice (date and number) according to which the receipt of the goods being written off was registered;

- the reason why inventory items are written off and its code (if codification has been developed);

- name of inventory items and their cost;

- total write-off amount;

- list of commission members indicating their positions and full names;

- decision made by the manager on the source of coverage for damage.

For information on how to record write-offs, read the article “Accounting for write-offs of goods when applying the simplified tax system.”

How to draw up an act correctly

As already mentioned, there are two forms for drawing up the act. But TORG-16 is more suitable. This form is not focused on a specific situation, but on the general write-off of goods. There are columns for the necessary details. Therefore, there should be no problems with filling. You just need to enter the required information in the appropriate fields.

Registration rules, mandatory items

The act must be drawn up in triplicate. One is sent to the general archive of the institution, the second is located in the accounting department. The third copy is given to the employee who was responsible for this product. Under certain circumstances, Rospotrebnadzor may require products to be written off. In this case, this structure must also receive a copy of the act.

Of course, depending on the specific situation, some changes may be made to the form. At the discretion of the commission, various columns can be added here, or unnecessary ones can be deleted. But you need to remember that there are basic points that must be present in this document:

- date of arrival of goods;

- write-off date;

- information about invoices;

- what caused the write-off;

- names of all products;

- cost of illiquid goods;

- total amount of damage;

- Full names of commission members and their positions.

How to correctly fill out the Write-off Act TORG-16.

The TORG-16 form consists of two pages. The first page states:

- name of the enterprise and its structural unit (if any);

- enterprise code according to OKPO, OKDP;

- document (order, instruction) on the basis of which the act is drawn up; its number and date;

- act number and date of its execution.

Next, fill out a table indicating:

- date of receipt of the goods (according to the TORG-12 consignment note or 1-T consignment note);

- date of write-off of the goods;

- TN number and date;

- reason for write-off (expiration date, violation of packaging integrity, defects, etc.);

- write-off reason code (if a coding system has been introduced).

The remaining unfilled lines are crossed out.

Try the program for Business.Ru stores, which will allow you to fill out forms in a couple of clicks. Automate accounting and tax reporting, always be aware of all mutual settlements with employees, control cash flows in the company, and a personal calendar will promptly remind you of important events. Check out the full functionality of the Business.Ru program for free>>> On the second page the following is noted:

- name of the product, its code;

- unit of measurement of the product and code of the unit of measurement according to OKEI;

- quantity of goods;

- weight of one item of goods and its net weight;

- price for one item of goods and the total cost of goods;

- reason for writing off the goods.

The total amount to be written off is indicated in numbers at the bottom of the table in the “Total” column, and in words in the line “Write-off amount”.