6-NDFL – a quarterly report submitted by employers on the total calculated, withheld and paid income tax. The calculation must be submitted within a month from the end of the reporting period (1st quarter, half year, 9 months). For a year – until 01.01 of the next year inclusive. In this article we will analyze in detail tax deductions in 6-NDFL and the rules for filling out the form.

In contrast to the annual certificates of 2-NDFL, the indicators in 6-NDFL are presented in a generalized form - in the first section for the period from the first day of the year, in the second section - for the last quarter of the period. You can submit the calculation in electronic or paper form, while those employers who employ more than 25 people on average during the year can submit the form only in electronic format.

imushchestvennyy_vychet_v_6-ndfl.jpg

An employee who has the right to a property deduction has the right to use any convenient method for receiving it: draw up a declaration at the end of the year and return the money from the Federal Tax Service or receive it from the employer on the basis of a special notice, approved. By Order of the Federal Tax Service dated January 14, 2015 No. ММВ-7-11/ [email protected] All income tax accruals and deductions for companies and entrepreneurial employers are reflected quarterly in Calculation 6-NDFL.

We’ll tell you how to reflect property deductions in 6-NDFL and give examples.

The company provides the employee with a social deduction

The employee received a notice of social deduction from the inspectorate. The employee brought the application for deduction and notification to the company in the second quarter.

From 2021, employees have the right to receive a deduction for medical treatment from their employer. To do this, the “physicist” applies to the inspectorate with an application according to the form from the letter of the Federal Tax Service of Russia dated December 7, 2015 No. ZN-4-11 / [email protected] The employee attaches to it a contract for treatment, receipts and other documents confirming expenses.

The inspectorate issues a notification within 30 calendar days from the moment the “physicist” submitted the application (approved by order of the Federal Tax Service of Russia dated October 27, 2015 No. ММВ-7/11/ [email protected] ). The employee brings the notice to the company and attaches it to the application in free form. The employer provides a deduction from the month in which the employee brought these documents (paragraph 3, paragraph 2, article 219 of the Tax Code of the Russian Federation).

The company takes into account deductions when calculating the tax base. In line 030 of the 6-NDFL calculation, reflect only those deductions that have already been provided to the employee during the reporting period. On line 130, report income without deductions. And in lines 070 and 140 the company will reflect the actual personal income tax withheld, that is, calculated from income minus deductions.

For example

On May 4, the employee brought a notice of the right to a social deduction and wrote a statement. Deduction - 46,700 rubles. The company began providing the deduction in May. The employee’s salary for May is 50,000 rubles, the employee fully used the deduction in the second quarter. Personal income tax from May salary - 429 rubles. ((RUB 50,000 - RUB 46,700) × 13%).

In just six months, the company accrued income to 15 employees (including the employee to whom it provided a deduction) - RUB 2,398,000. Income was shown in line 020.

The calculated and withheld personal income tax in lines 040 and 070 is equal to 305,669 rubles. ((RUB 2,398,000 - RUB 46,700) × 13%).

The company recorded the deduction in line 030 - 46,700 rubles.

She filled out Section 1 of the half-year calculation as in sample 68.

Top

Who is entitled to deduction

You can receive a deduction from your employer before the end of the tax period (clause 8 of Article 220 of the Tax Code):

for construction, purchase of housing (or a share in it) and land for individual housing construction;

on interest paid on loans, loans for the purchase of new housing or land.

Tax agents-employers do not provide property deductions for other types.

To receive a property deduction, an employee must:

obtain from the Federal Tax Service a notice confirming the right to a deduction, which indicates its amount;

write an application to the employer, attaching to it the document received from the tax office.

Beginning in the month of application, the employer will provide a deduction on accrued income until the end of the year, or until the deduction is fully spent. If the employee who submitted the application has the right to standard deductions (for children, for example), then first you need to take into account the standard deductions, and only then the property deductions.

When to display

It is necessary to reflect a tax refund for an individual in Form 6 Personal Income Tax if:

- the person is officially in an employment relationship on a general basis or under an employment contract;

- the employee receives funds that are subject to the standard deduction for individuals in the amount of 13%;

- the employer has received an application in its name to exercise the right to return funds;

- the employee provided notification from the tax authorities about the possibility of withdrawing the deduction.

The right is not granted if funds from maternity capital, another type of budgetary funds were used to purchase real estate, or if the payment was made by the employer, since the profit from them is not displayed in the tax office.

How to reflect a property deduction in 6-NDFL

in the amount of income received, if the deduction is greater than the income itself. If the employee’s notice, for example, indicated the amount of 1,500,000 rubles, and the accrued wages since the beginning of the year are 250,000 rubles, then line 030 includes the provided deduction equal to income -250,000 rubles.

in the amount of the accrued deduction if the amount according to the notification is less than the income for the period. For example: if the balance of the property deduction according to the notification is 20,000 rubles, and the accrued salary is 30,000 rubles, in line 030 you need to put 20,000 rubles.

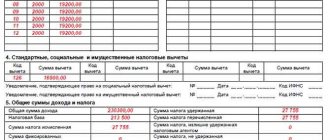

Manager Krasnov brought a notice in January 2021 to provide a property deduction in the amount of 800,000 rubles, and wrote a statement. Krasnov’s salary is 50,000 rubles monthly. How to show the property deduction provided to him in 6-NDFL for the 1st quarter of 2021:

Salaries accrued for the 1st quarter: 50,000 x 3 months = 150,000 rubles.

The actual deduction provided will also be 150,000 rubles.

In the 6-NDFL report for the employee:

Regulatory regulation and stages of personal income tax return

To solve the problem, you first need to consider the regulatory regulation of personal income tax returns. The procedure for returning personal income tax to the taxpayer is described in Art. 231 Tax Code of the Russian Federation.

Stages of personal income tax return:

- excessively withheld personal income tax was detected;

- inform the employee about this within 10 working days;

- the employee must write a statement;

- within 3 months the organization must return personal income tax;

- Personal income tax refunds are made strictly to the employee’s bank account, i.e. You cannot return personal income tax through the cash desk.

Recalculation since the beginning of the year

It often happens that employees submit a deduction application to the employer not in the first month of the year, but later. Then you have to recalculate the tax from the beginning of the year and return the overpaid amount to the employee. The tax liabilities of an individual are recalculated in the current period. Excessively withheld tax is returned, previous accruals are not corrected, all changes are reflected in the month in which they occurred (letter of the Federal Tax Service dated April 12, 2017 No. BS-4-11/6925).

In this case, the property deduction in 6-NDFL must be shown as follows:

The director of the company brought to the accounting department a notice and application for a property deduction in April 2021 in the amount of 1,600,000 rubles. For all months since the beginning of the year, wages were accrued in the amount of salary - 100,000 rubles. The accountant recalculated the tax in April and returned the excess withheld amount to the director’s salary card.

salary accrued for January - March: 100,000 x 3 months = 300,000 rubles;

withheld income tax for January - March: 300,000 x 13% = 39,000 rubles.

salary accrued 100,000 x 6 months = 600,000 rubles;

income tax for the 1st quarter was recalculated and returned in the amount of 39,000 rubles.

In fact, the property deduction was provided in the second quarter; the data must be indicated in the reporting for the half-year:

An employee wrote an application for child support in the middle of the year.

The employee submitted an application for a child deduction in the second quarter. But he had the right to deduct since the beginning of the year. The company provided deductions for previous months in the current one.

An employee who has children is entitled to receive a standard deduction. To do this, the “physicist” writes an application and presents the child’s birth certificate, a copy of the passport and other documents confirming the right to the deduction (Article 218 of the Tax Code of the Russian Federation). The deduction is due to the employee from the month of birth of the child.

Deductions must be provided from the beginning of the year if the employee could receive a deduction all year, but submitted the application only in the second quarter. The company provides deductions up to the month in which the employee’s income exceeded 350 thousand rubles.

The company considers personal income tax as a cumulative total. Therefore, deductions for all previous months can be applied when calculating the tax base for the current period. In line 030 of the 6-NDFL calculation, reflect the deductions that were provided during the reporting period. Line 040 shows the calculated tax, and line 070 shows the tax actually withheld. In line 130 of section 2, fill in accrued income, not minus deductions.

For example

The company has one director. He has one child, seven years old. On May 11, the employee wrote an application for a child deduction. Income from January to April inclusive - 160,000 rubles.

Salary for May - 90,000 rubles. When calculating personal income tax on salaries for May, the company applied deductions for previous months - from January to May (5 months). The deduction for these months is 7,000 rubles. (1400 rubles × 5 months). The company withheld personal income tax of 10,790 rubles from the May salary. ((90,000 rub. - 7,000 rub.) × 13%).

Salary for June - 90,000 rubles. Personal income tax - 11,518 rubles. ((90,000 rub. - 1,400 rub.) × 13%).

Section 1

The company issued salaries for June only in July. Therefore, personal income tax from the June salary was not reflected in line 070. Income for the six months in line 020 was RUB 340,000. (160,000 + 90,000 + 90,000). Deductions in line 030 are equal to 8,400 rubles. (1400 rubles × 6 months). Calculated personal income tax in line 040 is RUB 43,108. ((RUB 340,000 - RUB 8,400) × 13%). Withheld tax in line 070 is RUB 31,590. ((RUB 160,000 + RUB 90,000 – RUB 7,000) × 13%).

Section 2.

Salary for April - 90,000 rubles. — the company issued on May 5. On the same day, I calculated and withheld personal income tax without taking into account deductions - 11,700 rubles. (RUB 90,000 × 13%). The date of receipt of income is April 30. The company issued salaries for May on June 6. The date of receipt of income is May 31. The company issued salaries for June in July, so it did not reflect the payment in section 2 of the half-year calculation. The company filled out the calculation as in sample 69.

Sample 69. How to fill in children's deductions in the calculation

Top

Clarification of the date of receipt of income in the document “Personal Tax Return”

Starting from ZUP 3.1.8 releases, the actions described in this section SHOULD NOT be performed, otherwise this will lead to errors during subsequent personal income tax deductions.

To check the correctness of the reflection of information on the return of personal income tax and its transfer, you can generate a report Analysis of personal income tax by month (Taxes and contributions - Reports on taxes and contributions - Analysis of personal income tax by month) grouped by Employee and Month of the tax period.

In general, the amount of personal income tax paid by the employee is returned by I.P. – zero, but there is a positive and negative amount for January and February, respectively:

It turns out that in the program:

- for January 2021: personal income tax withheld but not returned was recorded. The amount of tax paid remains;

- for February 2021: personal income tax withheld and over-returned was recorded. A negative amount of tax paid appeared.

If necessary to:

- the amount of personal income tax returned corresponded to the amount of tax withheld not only for the period as a whole, but also for each month;

- the amount of personal income tax paid became zero not only for the period as a whole, but also for each month,

then you need to manually correct the information in the Personal Income Tax Return document, breaking down the total amount to 2,600 rubles. (automatically falling in February) for two periods: January and February for 1,300 rubles:

After this, you need to update the tax information in the Statement to the Bank document by clicking the corresponding Update Tax button.

Next, repost the document Transfer of personal income tax to the budget.

As a result, in the accumulation register Calculations of tax agents with the personal income tax budget, the negative transfer for the employee will be divided into 2 lines - for January and February:

In the report Analysis of Personal Income Tax by Month, the listed personal income tax for the entire period and for each month will become zero. The amounts of returned and transferred personal income tax will coincide not only for the period as a whole, but also for each month:

Transfer of personal income tax to the budget in the month of tax refund

In the month when the tax refund occurred, the amount of personal income tax transferred by the organization to the budget is reduced by the amount of the returned personal income tax.

To do this, in the Statement to the Bank document, you must uncheck the Tax is listed along with the salary checkbox:

As a result, when conducting the Statement, information on amounts paid to the employee and personal income tax withheld will be recorded.

In order to reflect the fact of tax transfer in the program, you need to create a document Transfer of personal income tax to the budget (Taxes and contributions - Transfers of personal income tax to the budget).

Amount to be transferred: 7,800 (total personal income tax withheld) – 2,600 (personal income tax refund) = 5,200 rubles:

When posting the document Transfer of personal income tax to the budget in the accumulation register Calculations of tax agents with the budget for personal income tax, a negative transfer will be written off for the employee for whom the return was made, and for other employees the amounts deducted from them will be registered as transferred:

Please note that starting from ZUP 3.1.10.135, ZUP 3.1.11, the movements when transferring personal income tax in case of its return have changed - CHANGES IN ACCOUNTING OF TRANSFERRED NDFL IN THE CASE OF TAX REFUND (ZUP 3.1.10.135, ZUP 3.1.11)

Personal income tax refund

You can check the amount to be refunded using the service Analysis of personal income tax for refund (Salary – Service – Analysis of personal income tax for refund):

To register the personal income tax refund amount, the employee must create a personal income tax return document (Taxes and contributions - personal income tax return).

In the Month field, select the month in which the personal income tax refund will be reflected. By clicking the Update refund amounts button, the amount is automatically loaded - 2,600 rubles. with the date of receipt of income – 02/28/2017:

Payment of the refund may be made along with the payment of wages.

The amount to be paid will be: 10,000 (salary) + 2,600 (personal income tax refund) = 12,600 rubles:

Please note that payment of personal income tax refund must be made only through a bank (according to Article 231 of the Tax Code of the Russian Federation). If an employee’s salary is paid through a cash register, then to return personal income tax in the program, you must enter a separate statement - the document Statement of Accounts (Payments - Statement of Accounts). In the Pay field, in this case, you must specify the value Personal Tax Return and select the previously entered document Personal Tax Return.