The procedure for obtaining a property deduction Documents when purchasing housing in a new building Documents when purchasing a secondary property Documents when purchasing a land plot

In order to return the tax for the purchase of an apartment, you must provide a set of documents to the tax office. This kit may vary for different situations. We will look at the most common options.

Watch the video in which we talk in detail about what a tax deduction is when buying an apartment, who is entitled to the deduction, what documents need to be prepared and how they can be submitted to the tax office.

How to calculate the property deduction and how much personal income tax will be returned to the account - in examples and explanations from experts of the online service NDFLka.ru.

What is a tax deduction

Every taxpayer who receives income and pays personal income tax at a rate of 13% has the right to claim preferential compensation in the event of certain expenses.

A deduction is the amount of benefit by which a citizen’s tax base is reduced. It is issued only by those citizens who are residents of the Russian Federation and receive income subject to personal income tax at a rate of 13%. All earnings that are subject to taxation as a general rule are reduced by the amount of the annual income tax. The result will be a reduced tax base. Citizens also have the right to submit an application to the territorial Federal Tax Service for compensation for the share of overpaid personal income tax.

A citizen has the right to receive a benefit both through material compensation from the territorial Federal Tax Service and from the employer by providing the necessary documents for a tax deduction and an application for processing a refund. Often the list of documents includes various kinds of confirmation registers - various certificates and notifications.

Only residents of the Russian Federation receive the benefit, whose income is taxed at a rate of 13%. Those employees who are exempt from paying taxes or pay personal income tax at other rates (for example, 6%, 9%, 15%, 30%) are not entitled to file tax deductions for the reporting year.

The current tax legislation regulates the rules for returning money to citizens.

Let's sum it up

The main thing in interacting with the tax office when receiving a deduction is to correctly draw up all the necessary documents. It is important that their form and the information contained within comply with the rules established by law, otherwise you risk a lot of temporary delays through your own fault and earn penalties for providing knowingly false information, which will hurt your pocket.

Be careful and you will succeed

Types of tax deductions

Depending on the type, the documents for tax deductions also change. An article about what a tax deduction is will help you understand the current types of deductions. The Tax Code states that taxpayers have the right to claim the following tax deductions:

- Standard - Art. 218 Tax Code of the Russian Federation. Employees receive standard benefits directly from their employers. Organizations act as tax agents. Standard tax deductions are issued for oneself and for children (one child, disabled children). Standard compensation is applied at the employee’s request from the beginning of the year until the salary reaches the limit of 350,000 rubles.

- Social - Art. 219 of the Tax Code of the Russian Federation. Compensates for overpaid personal income tax for paid training of the employee himself or his immediate family, expensive treatment, charity, formation of the funded part of a pension, or in the case of voluntary pension insurance. Such compensation is received from the employer in the current year after writing an application and providing supporting documentation (checks, contracts). The employee has the right to submit a package of documents for compensation to the territorial Federal Tax Service. They apply to the tax office only after the end of the reporting year.

- Investment - Art. 219.1 Tax Code of the Russian Federation. Those citizens who, during the reporting period, carried out transactions with securities, deposited money into a special investment account, or received profitability from transactions carried out through an individual investment account are entitled to receive it. Compensation is provided starting in 2021. They receive a refund both from the Federal Tax Service after a year and from the employer. For this purpose, an application and supporting documents are prepared.

- Property - Art. 220 Tax Code of the Russian Federation. Provided for the purchase of an apartment or other residential real estate, construction of housing, sale of property, or purchase of property from another taxpayer for state or municipal needs. The property deduction is issued either at the territorial inspectorate or at the employer, providing the necessary application and appropriate documents. Such compensation has a certain limit. The maximum for purchasing housing is 260,000 rubles (limit amount is 2,000,000 rubles × 13%). Taxpayers also compensate repaid interest on loan and mortgage agreements and agreements for refinancing previously taken loans. Limit - 390,000.00 rubles (3,000,000 rubles × 13%).

- Professional - Art. 221 Tax Code of the Russian Federation. A professional tax deduction is provided in case of income generation by individual entrepreneurs and persons engaged in private practice (lawyers, notaries, etc.). Taxable income includes royalties and earnings under civil contracts. Receive a professional tax deduction directly from the tax agent paying the income by submitting an application and all required attachments. Compensation is also issued by inspectors of the Federal Tax Service.

Documents for personal income tax refund when purchasing housing on the secondary market

Documents confirming ownership of housing when purchasing on the secondary market are an agreement on the purchase of an apartment or room and a certificate of state registration of ownership. Since the issuance of this certificate has been discontinued since 2021, instead of it the taxpayer has the right to submit an extract from the Unified State Register of Rights to Real Estate and Transactions with It (USRP). A request for an extract is made on the State Services portal.

The rest of the list of documents for income tax refund when purchasing an apartment corresponds to the standard package.

How to apply for a tax deduction through an employer or the Federal Tax Service

Almost every taxpayer asks questions: how to compensate for expenses, how to restore education costs or receive social compensation. The table lists what documents are needed to apply for a tax deduction by type of benefit.

| Type | What documents are needed |

| Standard |

|

| Social |

|

| Property |

|

| Investment |

|

With such documents we issue a tax deduction through the Federal Tax Service.

| Type | What documents are needed |

| Standard | If a citizen has violated the deadline for submitting documentation to the employer (the application must be submitted to the accounting department before the end of the reporting year), then he submits to the Federal Tax Service a 3-NDFL declaration, an application for income tax and similar supporting documents. |

| Social for treatment |

|

| Social for training |

|

| Property | The most popular type of tax benefit. Applies to purchased property and to a loan or mortgage issued for the purchase of housing. Here are the documents needed for property deduction:

|

| Investment |

|

Procedure for applying for a tax deduction

The procedure and sequence of actions for each type of benefit are similar. If a citizen applies for compensation through an employer, then the application is generated directly during the reporting period. For example, when applying for a standard tax deduction, we write an application addressed to the manager and attach copies of all supporting documents (birth certificate, marriage certificate, certificate or certificate of disability, guardianship documents, etc.).

The procedure for processing a refund through the Federal Tax Service is the same for all types of deductions. The package of documents is submitted strictly after the expiration of the reporting period - the next year after the purchase of housing, payment for education or treatment, transactions with securities, etc. The application is submitted throughout the year following the reporting year; the filing deadline is not regulated in any way. Together with the application for a tax deduction, a declaration in form 3-NDFL is submitted as part of the package of supporting documents. Federal Tax Service specialists have determined what documents are needed to submit a 3-NDFL return for tax deduction in 2021:

- passport of a citizen of the Russian Federation;

- certificate of income from the employer in form 2-NDFL;

- all necessary copies (agreements, checks, certificates, certificates, certificates of interest and amounts paid, payment orders).

A citizen has the right to choose whether to return overpaid income tax to his current account or offset it against future periods.

Documents are submitted directly to the tax inspector. All originals are duplicated with copies, along with copies - all originals for review. The applicant has the right to submit an application through the taxpayer’s personal account on the website https://www.nalog.ru.

IMPORTANT!

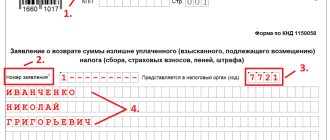

From 01/09/2019, a new application form for the return of personal income tax (KND 1150058), approved by order of the Federal Tax Service of Russia dated 02/14/2017 No. ММВ-7-8/ [email protected]

Document requirements

All documents are submitted in original with copies attached. After checking the documents, the originals will be returned to the applicant, except for the declaration and certificates 2-NDFL. The application form is standard. In it, the applicant must indicate the year of compensation, its amount, the name of the employers, and a list of attached documents.

Additionally, the application indicates the details for transferring funds. This could be the borrower's bank account, card account, loan account (for sending money to pay off debt).

Return deadlines

A declaration certifying the taxpayer’s income and confirming the amount of income tax paid is submitted to the Federal Tax Service after the expiration of the reporting period in which payment for the service occurred, which makes it possible to return personal income tax.

Submit documents throughout the year following the reporting year. Memo to taxpayers: benefits (regardless of their type) are refunded only for the last 3 years. For pensioners, a refund for the previous 4 years is possible. It turns out that in 2021, citizens will be refunded the overpaid funds for 2021, 2021, 2019 (2021 is also available for pensioners).

After submitting documentation to the Federal Tax Service, a desk audit is mandatory. The inspector checks the papers within three months. After the check, the citizen will receive a notification of a positive or negative decision on return. If the answer is satisfactory, the funds will be transferred to the current account specified in the application within 1 month after a positive decision is made.