Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 07/28/2017

Reading time: 5 min

0

241

Line 090 of the VAT declaration in section 3 is filled in upon the fact of tax restoration, if the representative of the declaration acts as a buyer and enjoys the right to deduct “advance” VAT when making full or partial payment to his supplier for the upcoming delivery of goods.

- The procedure for deducting VAT to the supplier upon issuance of partial prepayment

- Reinstatement of VAT to the supplier on partial prepayment

- Line 090: Data Display Guide

VAT restoration during reorganization

If the legal successor works under the general regime and receives during the reorganization the technical and technical services that the previously reorganized company took into account in VAT deductions, then nothing needs to be restored.

If the successor organization received technical and technical information from the reorganized company and will use these technical and technical information either in other activities that are not subject to taxation, or in other activities that are not subject to VAT, then it must necessarily restore the VAT that was declared. deductible, and VAT of the reorganized company (clause 3.1 of Article 170 of the Tax Code of the Russian Federation).

Therefore, during the reorganization, the successor must first of all figure out whether the reorganized company has claimed a deduction, as well as where the GWS will be sent, and into what activity - taxable or not subject to VAT.

According to the changes, the restoration of tax amounts by the legal successor is carried out on the basis of invoices issued to such an organization and attached to the transfer deed or separation balance sheet, based on the value of the transferred goods (work, services), property rights indicated in them, and in relation to the transferred fixed assets and intangible assets - in an amount proportional to the residual (book) value without taking into account revaluation.

Submission of any types of reports to all regulatory authorities: Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, RAR, RPN.

To learn more

If there are no invoices, then the restoration of tax amounts is carried out by the legal successor on the basis of an accounting certificate-calculation using the tax rates in force at the time of acquisition of goods and services, property rights, fixed assets by the specified organization, to the cost of goods and services, property rights, and in relation to fixed assets and intangible assets - in an amount proportional to the residual (book) value without taking into account the revaluation specified in the transfer act or separation balance sheet.

How to restore

We will determine the key rules for how to restore VAT previously accepted for deduction.

First of all, we note that tax that was not declared for deduction by the Federal Tax Service does not need to be restored. There is also no need to restore the fiscal levy on transactions affecting costs previously included in expenses for taxable transactions (Letters of the Ministry of Finance of the Russian Federation No. 03-07-11/47 of 02/16/2012, No. 03-07-11/57730 of 10/08/2015).

If it is still necessary to correct the amount of tax liabilities, then we proceed in the following order:

- We determine the amount that needs to be reflected in accounting. That is, the correct amount of fiscal obligations.

- We issue a supporting document. This could be a corrective invoice, an accounting certificate, an order for a contribution to the management company, a notification to the Federal Tax Service about the transition to special regimes, a notice of exemption from VAT, etc.

- We make adjustments to the tax return (line 090 of section 3 of the declaration). Please note that when correcting prepayment amounts, you must indicate the VAT amount from the advance invoice in line 110.

- We record corrections in accounting and tax records. Take the amount of the restored fee into tax accounting as part of other expenses when calculating income tax. In addition to the restored fee for contributions to the management company. We have described below what accounting entries to make.

Now pay the restored obligations to the Federal Tax Service. The transfer procedure, as well as the terms of payment, are determined in accordance with the general procedure. There are no exceptions.

Restoration of VAT upon transition to UTII

The changes, which will come into force on January 1, 2021, will allow companies and individual entrepreneurs to reduce recoverable VAT amounts. But to do this, they will need to carefully maintain separate records.

Thus, taxpayers who, after the transition to UTII, will continue to pay VAT (for other types of activities), can restore VAT only after they begin to use the corresponding GWS, fixed assets or intangible assets in the activities transferred to UTII.

According to the new edition of paragraphs. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, the tax in this case is restored in the period when the taxpayer began to use these objects in the specified manner.

How the changes will affect accounting policies

The changes will affect separate accounting of both taxable and non-VAT-taxable transactions. Therefore, it is important to look at what is registered specifically for you, whether you have separate accounting.

If you are a legal successor or an organization that combines “imputation” with the general taxation regime, then separate accounting must be mandatory. And it needs to be written down in the accounting policy. It is important to determine what non-VAT-taxable transactions are, how the proportion for the distribution of input VAT is calculated, and how to maintain separate accounting.

Thanks to separate accounting, it will be possible to determine at what point it is better to classify an object as an activity subject to UTII in order to easily restore VAT in the most appropriate period.

Accounting

How to reflect the operation “VAT previously accepted for deduction has been restored” - the posting depends on the circumstances.

Option #1

In general, record the following entries in your accounting records:

- Dt 19 Kt 68-02 - VAT on property, property rights, intangible assets used in non-taxable transactions has been restored;

- Dt 20, 26, 44, 91-2 Kt 19 - the restored tax is included in the expenses of the corresponding category.

Prepare these postings if:

- the asset is used in non-taxable transactions;

- tax exemption received;

- a transition to simplified (special) tax regimes was carried out;

- budget subsidies and investments have been received.

Option No. 2

If the restoration needs to be carried out from the amount of the advance (prepayment), make the following entries:

- Dt 60, 70 Kt 68 - the tax on the advance amount has been restored.

Reflect this entry if input VAT was taken into account in full, forgetting about the deduction for the advance payment. And also if the counterparties returned the advance to you due to termination of the contract or change in its terms.

Option No. 3

If the cost of a product, work, or service was reduced as a result of receiving a discount from the seller, reflect:

- Dt 19 Kt 60 REVERSE - reflects the tax related to the discount;

- Dt 68-02 Kt 19 REVERSE - the amount of the declared deduction in the amount of tax related to the discount from the seller (supplier, contractor, performer) has been reduced.

If the decrease in value arose as a result of an accepted claim, reflect:

- Dt 76-2 Kt 68-02 - the tax was restored to satisfy the claim against the supplier, contractor, seller.

Option No. 4

When transferring assets to the authorized capital, we prepare the following accounting entries:

- Dt 19 Kt 68-02 - the fee is restored on assets transferred as a contribution to the authorized capital;

- Dt 58-01 Kt 19 - the restored amount of the fee is taken into account in the initial cost of the share in the management company.

When transferring real estate to the endowment capital of an NPO, reflect:

- Dt 19 Kt 68-02 - the collection on the value of the transferred real estate has been restored;

- Dt 91-2 Kt 19 - the restored fee is included in other expenses.

Changes to VAT for exports and a new list of documents to confirm the zero rate

These changes come into effect on April 1, 2021. They will affect those who declare a zero rate and export. According to the changes, the list of documents that need to confirm this zero rate is changing.

For international postal shipments or for express cargo, a customs declaration register is added to the list of documents. It is maintained electronically. This register will need to be included in the package of documents that are collected to confirm the zero rate. Without it, the package of documents will be incomplete, and tax authorities can easily refuse to apply the zero rate.

Elena Strokova, 3rd class adviser to the State Civil Service of the Russian Federation, expert consultant on taxes and accounting, tells more about the changes:

Recovering from received prepayments

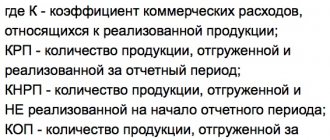

The prepayment received can be considered revenue from the sale of products. VAT taxation will be calculated according to the accrual method. This means that the calculation of profit is the earliest occurrence in the form of payment or shipment.

As soon as the taxpayer receives an advance payment, he must immediately issue an invoice for this advance (necessarily in two copies). The first copy is given to the consumer, and the second is entered into the sales book. Within five days from the date of payment, the obligation to issue paper must be fulfilled.

After the products have been shipped, the invoice is entered into the purchase book, and the new document is reflected in the sales book as a sale. That is, the amounts are restored during shipment.

In some cases, the amount of the deposit payment and the amount of shipped material assets may be different. The taxpayer must refund the difference, or issue an invoice for the excess.

Clarification of the procedure for deducting VAT on intangible assets

The changes will take effect from January 1, 2021. It is necessary to pay attention to the new editions of clause 6 of Art. 171 and paragraph 1 of Art. 172 of the Tax Code of the Russian Federation.

In the case of the creation of intangible assets, deductions of tax amounts presented to the taxpayer upon acquisition of GWS, property rights, or actually paid by him when importing goods into the territory of the Russian Federation for the creation of such intangible assets, can be accepted after registration of the corresponding GWS, property rights.

Sign up for webinars and online courses on accounting and taxation to stay up to date with important changes.

To learn more

Operations that are not covered by Art. 171.1 Tax Code of the Russian Federation.

According to paragraph 10 of Art. 171.1 of the Tax Code of the Russian Federation, the provisions of this article do not apply to operations provided for in paragraphs. 17 – 19 p. 2 art. 146 of the Tax Code of the Russian Federation, namely:

- when transferring real estate free of charge into the ownership of a non-profit organization that is engaged in the popularization and holding of Formula 1 races, or when transferring into state or municipal ownership a piece of real estate intended for holding sporting events in speed skating (clause 17);

- when transferring real estate objects free of charge to the state treasury of the Russian Federation (clause 19).

- As for paragraphs. 18 clause 2 art. 146 of the Tax Code of the Russian Federation, it refers to heat supply facilities, centralized hot water supply systems, cold water supply and (or) sanitation, and individual facilities of such systems. Thus, VAT recovery is not carried out:

- when transferring, free of charge, to state authorities (local self-government) the results of work on the creation and (or) reconstruction of these objects that are in state or municipal ownership and transferred for temporary possession and use to the taxpayer in accordance with lease agreements,

- when transferring such objects created by the taxpayer during the validity period of the lease agreements, if this taxpayer concludes concession agreements in relation to these objects in accordance with Part 1 of Art. 51 of the Federal Law of July 21, 2005 No. 115-FZ “On Concession Agreements”.

New VAT benefits for civil aviation in 2021

Amendments to Ch. 21 of the Tax Code of the Russian Federation, which was introduced by Federal Law No. 324-FZ of September 29, 2019, expanded VAT benefits. They come into effect on January 1, 2021.

Thus, a zero VAT rate is established for the import into Russia of civil aircraft subject to registration in the State Register of Civil Aircraft of the Russian Federation, and aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft on the territory of Russia (Article 150 of the Tax Code of the Russian Federation) .

A number of transactions related to civil aviation are also exempt from VAT:

- for the sale of civil aircraft registered in the State Register of Civil Aircraft of the Russian Federation;

- for the transfer or leasing of civil aircraft registered (subject to registration) in the State Register of Civil Aircraft of the Russian Federation;

- for the sale of aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft in Russia.

Page 080 in section 2

Section 2 is filled out by tax agents for each of the companies with which the enterprise or individual entrepreneur collaborated.

But page 080 is not filled out by each of the tax agents, but only by those who, according to clause 37.8 of the Procedure, had the authority during the reporting period and sold, guided by clause 4 of Art. 161 Tax Code of the Russian Federation:

- confiscate;

- property sold by court decision, except that which belonged to the bankrupt;

- ownerless items accepted for balance, including treasures;

- purchased values;

- property inherited by the Russian Federation (clause 4 of article 161 of the Tax Code of the Russian Federation).

In addition, page 080 in section 2 is filled out by tax agents acting on behalf (under commission, agency agreements) of foreign entities after concluding an intermediary agreement who are not registered in Russia as VAT payers (clause 5 of Article 161 of the Tax Code of the Russian Federation).

Page 080 of this section reflects the amount of VAT calculated on shipped goods. The value is necessary for the correct reflection in page 060 of the fee payable in the budget. If there is no tax amount on line 080, the amount reflected on 090 is recorded in 060.