Violations of tax legislation requirements for filling out and timely submitting Form 6-NDFL to the Federal Tax Service will entail a fine of 1,000 rubles. for each month of failure to submit a report, the regulator provided for a number of other sanctions.

All tax agents - individual entrepreneurs and organizations paying remuneration to individuals under employment and civil law contracts in the reporting period - are required to submit Form 6-NDFL. Such a report contains information for each employee about:

- accrued and paid amounts of money;

- tax deductions due to an individual;

- calculated, withheld and transferred to the budget income tax.

Business entities that do not have employees during the tax period and, accordingly, do not pay remuneration to individuals, are not required to fill out this form and are exempt from submitting it to the tax office. That is, there is no need to submit zero 6-NDFL reporting.

Examples of errors in form 6-NDFL

In addition to incorrect accounting calculations, accountants make other mistakes when submitting these reports:

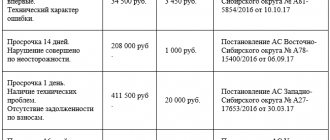

| Error in 6-NDFL | How does the Federal Tax Service interpret the error? | Correct option |

| Line 020 indicates completely non-taxable income (optionally, maternity payments) | The tax agent did not calculate and withhold personal income tax on all taxable income | Completely non-taxable payments from Art. 217 of the Tax Code of the Russian Federation in 6-NDFL do not reflect |

| Typos in the personal income tax amount: for example, instead of 5,000 rubles. line 140 says 50,000 rubles. (in this case, personal income tax was transferred correctly - 5,000 rubles). | The tax agent did not pay the entire calculated personal income tax to the budget | Personal income tax payable on line 140 and the tax amount indicated in the payment order must be equal |

| In line 120, the deadline for paying personal income tax on vacation pay is the next day after its issuance. In this case, personal income tax was paid on the last day of the month | The tax agent paid personal income tax in arrears | In line 120 enter the last day of the month in which vacation pay was issued |

| Section 1 contains indicators not on an accrual basis, and Section 2, on the contrary, contains amounts on an accrual basis from the beginning of the year | The tax agent issued 6-NDFL not in accordance with the Procedure, approved. By order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ) | The following lines of 6-NDFL Section 1 are filled in with an accrual total: 020, 025, 030, 040, 045, 060, 070, 080, 090. All total lines of Section 2 of the 6-NDFL calculation are detailed quarterly |

Common mistakes

It is important to fill out the report correctly, avoiding common mistakes

The inspection regularly submits reports containing similar inaccuracies. Experts identify the following common mistakes:

- Line 20 reflects the actual amount of payments to employees, not payments and benefits;

- Line 30 reflected non-taxable payments related to the category of property and social deductions (provision of child benefits);

- Line 70 reflects the amount of personal income tax withheld as of the reporting date (if the amount of salary for May is entered when it is actually issued in June, an explanation must be provided);

- Line 100 indicates the date of receipt of income in accordance with the code, and not the actual day of issuance of funds (a separate clarifying document is drawn up to explain the situation);

- Line 120 indicates the amount from the personal income tax payroll (accountants often confuse this day with the deadline under the Tax Code).

As a result of the desk audit, additional violations are revealed. The numerical indicators of deductions from line 030 cannot exceed the parameters from line 020. And the numerical indicators of deductions from line 070 cannot exceed the actual annual parameter of the transferred tax.

Note! If clarifying documents are provided, the inspector must check them for possible inaccuracies and errors. Therefore, the data in the report and the information provided must match. If an explanation is made, the responsible specialist from the accounting department must indicate for what reasons the changes were made.

Major violations

Organizations are required to submit a 6-NDFL report to the territorial tax authority. It contains generalized information about the income of individuals received for a certain period from a tax agent.

The law establishes sanctions for failure to submit or incorrect submission of reports under 6 personal income taxes.

Fines for failure to provide 6 personal income taxes are established only in cases where the organization hires employees with wages. If there are no employees, there is no personal income tax. There is no obligation to submit this report.

The form is filled out only according to the approved form, which should not be violated. Not only a fine is established for failure to submit 6 personal income taxes, but also a penalty for mistakes made.

All violations are divided into two main groups:

- The invoice was submitted late or not submitted;

- Mistakes were made.

Who should report

There is utmost clarity on this issue: the reporting form in question is regularly submitted once a quarter by all business entities - individual entrepreneurs, LLCs, joint-stock companies, state unitary enterprises, etc., which pay income to individuals. Otherwise, they will face a fine of impressive size for today for failure to submit 6-NDFL.

Please note that these entities are also simultaneously required to generate certificates on the 2-NDFL form. This document contains information on each individual person who received a payment from the company.

Late delivery

The declaration is submitted based on the results of the 1st quarter, 6 months and 9 months. You must be on time by the last date of the reporting period. The annual calculation is submitted no later than April 1 of each year. The inspection will fine regardless of the period of delay. Even being a day late will have consequences.

To avoid penalties, it is important to submit reports on time, avoiding delays

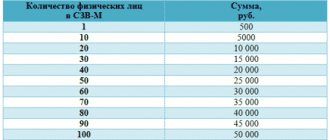

Penalty for late submission of SZV-M in 2021

The fine for 6 personal income taxes not submitted on time depends on the length of the delay. If the delay is less than a month, the organization may be fined 1,000 rubles. For the next month of delay, the amount increases by another 1000 rubles. According to Art. 15.6 of the Code of Administrative Offenses of the Russian Federation, the director is assessed a penalty of 300-500 rubles for submitting a report on time.* A court decision is not required.

Note! Inspectorate employees begin counting the delay from the next day after the deadline for settlements.

Deadlines

Reporting is provided within the following deadlines:

- The last day of the month following the reporting period, if we are talking about a quarterly period;

- April 1 of the following year, which follows the reporting year.

As a result, the presentation of a quarterly report depends on the number of days in a particular month, while the annual report remains unchanged. If the time to submit a report falls on a weekend or holiday, it is postponed to the next business day. In 2018, there will be no penalty for failure to submit 6 personal income taxes on time if you adhere to the following periods:

- 05/03/2018 for the 1st quarter;

- 07/31/2018 for 6 months;

- 10/31/2018 based on the results of 9 months.

Penalty for mistakes made

It is necessary to carefully fill out the reports, checking with real documents

Fine for late registration of a car in 2018

Punishment is also provided in cases where an incorrect report with errors and inaccuracies is submitted. According to paragraph 1 of Art. 126.1 of the Tax Code of the Russian Federation, the fine for false information in 6 personal income taxes is 500 rubles.

It doesn't matter how many errors are found. Penalties are established not for each discrepancy, but for their very fact. If the taxable person himself identified inaccuracies and decided to clarify the calculation, he will not have to pay a fine.

Examples of fine calculations

Consul LLC submitted a VAT return for the 3rd quarter of 2021, for which the filing deadline is October 25, 2020, and 3 days later - October 28, 2021.

The amount of payment under the ND amounted to 900,000 rubles, of which 300,000 rubles were transferred in arrears.

Since the delay was 3 days, the penalty for violation is calculated as follows: 300,000 × 5% × 1 (month of missed deadline) = 15,000 rubles.

The Federal Tax Service would limit itself to a fine for late submission of a VAT return in the amount of 1,000 rubles if the company paid the tax on time.