We list the basic rules used in 2021 to calculate sick leave.

Temporary disability benefits are paid by the employer. And only then he can receive compensation from the Social Insurance Fund. Here's how it works:

- at the expense of the policyholder - for the first three days (only in case of illness or injury of the employee);

- at the expense of the Social Insurance Fund budget - for the main period, starting from the fourth day of the employee’s incapacity for work;

- at the expense of the Social Insurance Fund budget - from the first day, in case of temporary incapacity for work due to caring for a child, a sick family member, or after-care in a sanatorium, etc. (in all cases except illness and injury).

In 2021, the number of regions included in the FSS pilot project was expanded. In them, the employer pays sick leave for the first three days of illness, and then payments are made by the Social Insurance Fund. That is, it does not reimburse them to the employer later, but immediately does it for him. A similar procedure applies from the first day for sick leave for caring for a sick family member or for pregnancy and childbirth.

Temporary disability benefits are calculated based on the employee’s average salary over the last two calendar years. These two years precede the current one, in which temporary disability occurred. To calculate the average salary, all payments for which insurance premiums were calculated are taken. To calculate the average daily earnings, divide the amount of accrued wages for two years by 730 - the number of days in two years.

SDZ = Accrued salary × 24 / 730

The settlement period for the benefit is 2 years. If at this time the employee had no income or the average monthly salary was less than the minimum wage, then the calculations should be based on the minimum wage - 12,130 rubles in 2021. That is, the average employee’s earnings for the billing period will be 24 minimum wages or 291,120 rubles.

There are a number of other cases in which sick leave will be calculated based on the minimum wage as a punishment. Thus, the patient should not violate the regime prescribed by the doctor and skip medical examinations and examinations. If the illness or injury is caused by intoxication, then the benefit is calculated according to the minimum wage for the entire period of incapacity.

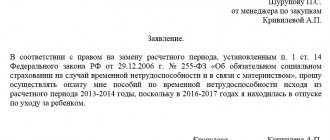

In some cases, the law allows you to replace years in the billing period. For example, if an employee was on maternity leave in 2021, then to calculate sick leave in 2021, you can take 2017 and 2021.

Sick leave calculator in 2021 online

To quickly calculate sick leave, use the free online calculator from the Kontur.Accounting service. The calculations will only take a couple of minutes.

- Enter data about the period and cause of incapacity from the sick leave and check the box if a violation of the regime on the part of the employee was established.

- Indicate data on the employee’s income for the last 2 years, the regional coefficient and the employment coefficient if the employee does not work full time.

- Indicate the insurance period and receive the benefit amount taking into account the insurance period.

Payment of sick leave in 2021

The benefit is paid for calendar days, that is, for the entire period of incapacity for which the sick leave was issued. There are several exceptions; their full list is contained in paragraph 1 of Article 9 No. 255-FZ of December 29, 2006. The amount of the benefit depends on the employee’s insurance length:

- if the length of service is less than 6 months, the monthly benefit amount is equal to the minimum wage, taking into account regional coefficients established in the region or locality;

- if the length of service is less than 5 years, the benefit amount is 60% of average earnings;

- if the employee’s work experience is from 5 to 8 years, the amount of sick leave is 80% of average earnings;

- if the length of service exceeds 8 years, the amount of sick leave is 100% of average earnings.

If an employee stops working for the organization, but within 30 days after dismissal he becomes unable to work due to injury or illness, he must be paid 60% of his average earnings. For information on the dependence of the amount of benefits on length of service in different cases, see Art. 7 No. 255-FZ dated December 29, 2006.

Calculate your length of service according to your work record book. It includes work under an employment contract; state civil, municipal, military and other service; activities of individual entrepreneurs and other activities during which the person was insured in case of temporary disability or maternity.

From 2021, the minimum and maximum average earnings and, accordingly, temporary disability benefits will change. How exactly, read on.

Most workers want to know what the maximum and minimum amount of sick leave will be in 2021.

Minimum allowance.

The minimum benefit amount based on average earnings in 2021 will be 398.79 rubles. in a day. Let us explain, this is where this amount came from.

Benefits are calculated from average earnings, which are determined from payments for the two previous calendar years. And this average earnings cannot be less than the amount calculated from the minimum wage (Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

From January 1, 2021, the minimum wage will be 12,130 rubles. (Order of the Ministry of Labor of Russia dated August 9, 2019 No. 561n). Accordingly, the minimum average earnings is 398.79 rubles. (RUB 12,130 x 24 months: RUB 730). In this regard, from January 1, 2021, pay sick leave based on the new minimum of 398.79 rubles.

Maximum benefit.

The maximum average daily earnings from which sick leave will be paid in 2021 will be 2,301.37 rubles. We'll tell you how to calculate this indicator.

Average earnings cannot be more than the figure calculated on the basis of the maximum contribution bases for the two calendar years for which the employee’s income is calculated.

You will calculate sick leave for 2021 based on payments for 2021 and 2021. The maximum bases for social contributions over these years amounted to 865,000 rubles. and 815,000 rub. (Government Decrees No. 1426 dated November 28, 2018 and No. 1378 dated November 15, 2017).

Thus, the maximum average earnings in 2021 will be 2301.37 rubles. (865,000 rub. + 815,000 rub.) : 730 days.

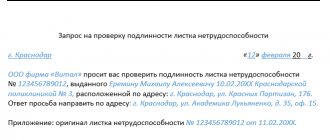

General information about sick leave

A sick leave certificate is an official document with a stamp that confirms the temporary disability of a working citizen. The updated form of the certificate of incapacity for work was approved by Order of the Ministry of Health and Social Development of the Russian Federation No. 347 n. dated April 26, 2011.

In fact, a sick leave certificate is an official document that confirms a valid reason for an employee’s absence from the workplace. The sick leave record reflects the time period of the “vacation” and the reason for its opening.

There are many valid reasons, the justification of which leads to the issuance of sick leave. To make the procedure for filling out the form much faster and easier, instead of long names and expressions, you can simply enter the appropriate codes. At the same time, the doctor’s time is significantly saved, and text filling of information is reduced to a minimum. The list of codes can be found on the back of the form.

The certificate of incapacity for work, being a financial document, is regulated by the following regulatory framework:

- Labor Code of the Russian Federation;

- Order of the Ministry of Health and Social Development “On approval of the procedure for issuing certificates of incapacity for work” dated June 29, 2011 No. 624n .

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ .

The sick leave must reflect clear terms, full name. patient, and full name medical worker who issued the sick leave. The authenticity of the financial document is confirmed by the seal of the medical organization. The Letter of the FSS of the Russian Federation No. 14-03-18/15-12956 dated October 28, 2011 (clause 2, paragraph 2) states that the seal impression can contain only 2 text options:

- “for sick leave”;

- "for certificates of incapacity for work."

The current disability form has a high degree of protection against counterfeiting. At the very top of the document, in different corners, there are elements of its protection:

- In the upper right corner there is a barcode containing 12 digits;

- In the upper left corner there is a binary code that completely eliminates the possibility of falsification.

According to FSS statistics, as a result of thorough checks of machine-readable forms, the number of fake sick leave certificates in Russia at the end of 2021 decreased by more than 20%. Complex security codes on forms help reduce the number of counterfeit sheets.

In 2021, verification of sick leave certificates will become even more stringent, and there is hope that electronic sick leave will eventually reduce falsification to zero. On the official website of the FSS there are recommendations explaining how you can identify a fake certificate of incapacity for work. Now it is no longer possible to turn to “your” doctor for help in obtaining a sick leave certificate. No law-abiding doctor will put a false start or end date on sick leave. The Federal Social Insurance Fund of the Russian Federation monitors each paid certificate of incapacity for work.

A necessary condition for issuing a sick leave certificate is that the medical worker has the appropriate position and a license to carry out medical activities. Recently, it has been additionally checked whether the doctor who issued the sick leave certificate has a license to examine the temporary disability of a working citizen.

Based on a correctly completed form, the employee is legally paid a benefit, the amount of which, like any citizen’s income, is subject to income tax of 13% ( Article 217 of the Tax Code of the Russian Federation ).

Typically, the first 3 days of sick leave are paid by the employer, and the subsequent days - by the territorial body of the Social Insurance Fund. An exception is the temporary disability of an employee due to caring for a sick family member, quarantine and treatment in a sanatorium. In the listed cases, temporary disability benefits are paid in full from the budget of the Social Insurance Fund of the Russian Federation.

The Social Insurance Fund compensates the employer for the costs of paying disability benefits. But in the regions participating in the “Direct Payments” pilot project, when the Social Insurance Fund pays full benefits to an employee, the funds are directly transferred to the citizen’s bank card, excluding compensation of funds to the employer from the chain of the system.

According to statistics from the Social Insurance Fund, at the end of 2021, over 40 million sick leaves were issued to citizens of the Russian Federation, and more than 300 billion rubles were allocated to pay for them.

Circumstances in which a working citizen has the right to receive sick leave

The legislation of the Russian Federation provides for special life situations and circumstances when a working citizen is officially allowed not to attend the workplace.

An incomplete list of the most important and common reasons for registration of sick leave by citizens of the Russian Federation:

- Illness of the citizen himself (infectious, cold - in severe form, exacerbation of chronic diseases requiring treatment in hospital, surgical intervention);

- Employee injury;

- Caring for a sick family member;

- Sanatorium and resort treatment in the Russian Federation, prescribed by the attending physician;

- Quarantine (including for a child under 7 years of age who attends kindergarten);

- Maternity leave. In this case, a certificate of incapacity for work is issued by an obstetrician, with whom the woman is officially registered for pregnancy at 30 full weeks. The duration of sick leave is 70 calendar days before childbirth and the same amount after childbirth. In case of multiple pregnancy, sick leave starts from the 28th week and continues until 110 days after the day of delivery.

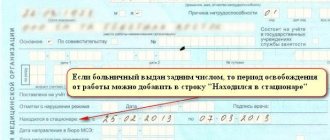

The importance of correct filling

Like all government forms, the disability certificate is machine readable and requires special attention to complete. When drawing up a certificate of incapacity for work manually, the doctor must use exclusively black ink, and also follow the following rules:

- Fill out the sheet with letters of the Russian alphabet;

- Assign one symbol to each cell;

- Leave a space (one empty cell) between the last name and first name and in the name of the organization, if required;

- Use only capital letters when filling out;

- The doctor who issues sick leave must be familiar with the document on the rules for issuing sick leave, namely, Letter of the Federal Social Insurance Fund of the Russian Federation dated August 5, 2011 No. 14-03-11/05-8545 .

The employer must pay special attention to the correctness of filling out the employee’s sick leave, otherwise, if errors are made, the Federal Social Insurance Fund of the Russian Federation has the right to refuse reimbursement of expenses. And then the employer will receive unexpected financial damage in the amount of the benefit payment.

If an error is detected, the attending physician may issue a duplicate sheet.

Interesting fact! If a financial document is lost, the right to receive benefits by a temporarily disabled citizen is legally retained for another six months (this time is given for the possibility of restoring the document in the form of a duplicate - Article 12 Part 1 of Federal Law No. 255 of December 29, 2006).

How to calculate sick leave benefits in 2021

Step-by-step instructions for paying an employee’s sick leave in 2020 are as follows.

Step one.

Determine how many days of sick leave need to be paid, for which days the employee will receive income, and for which days not. The procedure depends on the cause of disability, which is recorded on the sick leave certificate. The code is indicated in the first two cells. For example, if the employee himself is ill, there are no limits; for sick leave for child care, on the contrary, there is a limit. Details in the table below.

Table. How to determine how many days of sick leave to pay

| Disability code | Cause of disability | How many days do you need to pay? |

| 01 or 02 | Illness or injury of an employee who is not disabled and not working under a fixed-term contract for a period of up to 6 months | The entire period (Part 1, Article 6 of Law No. 255-FZ) |

| 01 or 02 | Temporary disability of a disabled employee for any reason other than tuberculosis | No more than 4 months in a row or 5 months in a calendar year (Part 3 of Article 6 of Law No. 255-FZ) |

| 01 or 02 | Disease other than tuberculosis or injury of an employee with whom a fixed-term employment contract has been concluded for a period of up to 6 months | No more than 75 calendar days of validity of the employment contract (Part 4 of Article 6 of Law No. 255-FZ) |

| 01 or 02 | Illness or injury of an employee during the period from the date of conclusion of the employment contract until the day of its cancellation | No more than 75 calendar days under the contract, counting from the day on which the employee was supposed to start work (Part 4 of Article 6 of Law No. 255-FZ) |

| 03 | Quarantine of an employee, child or other incapacitated family member | All days of quarantine (Part 6, Article 6 of Law No. 255-FZ) |

| 06 | Prosthetics in a hospital for medical reasons | The entire period of sick leave, including travel time to the hospital and back (Part 7, Article 6 of Law No. 255-FZ) |

| 08 | Aftercare of an employee in a sanatorium-resort organization | The entire period, but not more than 24 calendar days (Part 2 of Article 6 of Law No. 255-FZ) |

| 09 | Caring for a sick relative other than a child while being treated at home | No more than 7 calendar days for each case and no more than 30 calendar days per year for all cases of caring for this relative (clause 6, part 5, article 6 of Law No. 255-FZ) |

| 09 | Caring for a sick child under 7 years of age during treatment at home or in hospital | The entire period of sick leave, but not more than 60 calendar days per year (Part 5, Article 6 of Law No. 255-FZ) |

| 09 | Caring for a sick child from 7 to 15 years old during treatment at home or in hospital | No more than 15 days for each case and no more than 45 calendar days per year (Part 5, Article 6 of Law No. 255-FZ) |

| 13 | Caring for a sick disabled child under 18 years of age | No more than 120 calendar days per year (Part 5, Article 6 of Law No. 255-FZ) |

| 14 | Caring for a child in case of a post-vaccination complication or malignant neoplasm | The entire period (Part 5, Article 6 of Law No. 255-FZ) |

| 15 | Caring for a child with HIV infection while in hospital | The entire period (Part 5, Article 6 of Law No. 255-FZ) |

Also on the topic: Combat veterans: payments due for housing and communal services and other benefits

Step two.

Find out the employee's insurance record and determine the amount of benefits. Depending on the insurance period, the benefit will be equal to 60 to 100 percent of average earnings (Part 1, Article 7 of Law No. 255-FZ). See the table below for details.

Table. How to determine the amount of sick leave benefits

| Insurance experience | Benefit amount |

| 8 years or more | 100% of average earnings |

| From 5 to 8 years | 80% of average earnings |

| From 6 months to 5 years | 60% of average earnings |

| Less than 6 months | The benefit is calculated from the minimum wage |

Step three.

Calculate average earnings for benefits. The formula for calculating average earnings is as follows:

| Average daily earnings for benefits | = | Payments for 2021 and 2021 | : | 730 |

In the calculation, include payments for which you have calculated insurance premiums, for example, salary, bonus, vacation pay, etc. Do not include non-taxable payments, say, sick leave or financial assistance in the calculation. To calculate, you will need a calculator.

If the employee worked in 2021 and 2021 in another place, take payments from a special certificate from the previous employer.

Regardless of whether the employee has worked full time for two years or less, include 730 days in the calculation.

Step four.

Compare the average earnings with the minimum and maximum values. As already mentioned, the minimum average earnings in 2020 are 398.79 rubles, the maximum – 2301.37 rubles.

If the actual average earnings turned out to be less than the minimum, pay sick leave based on the minimum wage - 398.79 rubles per day. If it is more than the maximum, calculate the benefit from 2301.37 rubles. in a day.

Step five.

Calculate the benefit amount. If the employee's work experience is more than six months, determine the benefit from average earnings. The formula is:

| Sick leave benefit | = | Average earnings | X | Number of paid sick days | X | Benefit amount as a percentage of average earnings |

For young professionals who work for less than six months, the amount of the benefit cannot exceed the minimum wage. The formula is as follows:

| Maximum sick leave benefit for an employee with less than six months of service | = | RUB 12,130 | : | Number of calendar days in a month | X | Number of paid sick days |

Step six.

Accrue benefits in accounting. Benefits for illness or injury of the employee themselves are financed from two sources: funds from the employer and the Social Insurance Fund in a certain amount. Accrue the benefit for the first three days of incapacity from the company’s funds, make the entry:

DEBIT 20 (44) CREDIT 70

— benefits have been accrued for the first three days of incapacity.

The benefit for the remaining days of illness or injury is financed by the Social Insurance Fund. For the remaining benefit amount, make an accounting entry:

DEBIT 69 subaccount “Social insurance payments” CREDIT 70

— benefits have been accrued for the remaining days of incapacity for work.

If an employee brings sick leave to care for a sick child or other family member, the benefit will be calculated in full from the Social Insurance Fund.

Step seven.

Pay benefits to the employee minus personal income tax.

By law, you are required to accrue benefits to the employee no later than 10 calendar days after he brought sick leave. And you need to pay the money after the amount has been accrued, on the next day the salary is paid (Part 1, Article 15 of Law No. 255-FZ). Personal income tax must be withheld from the benefit and transferred to the budget. The procedure for insurance premiums is different.

When should you apply for sick leave?

The law contains exact deadlines within which the employee must present sick leave for payment.

If it was drawn up due to the illness of the employee himself, or he was caring for a close sick relative, then payment for it will be made within 6 months from the date of receipt.

If the slip was issued due to going on maternity leave, then you can receive benefits for it within 6 months from the end of this leave.

If the sheet was issued due to caring for a child under 1.5 years of age, then you can receive payment for it within 6 months from the moment he reaches this age.

Important: if the period allotted for payment has ended, then only the Social Insurance Fund has the right to make a decision. In this case, it is necessary to provide compelling evidence that the employee did not have the opportunity to apply for payment within the period established by law.

Calculation of sick leave in 2021: new examples

Let us show the calculation of sick leave in 2021 using two examples.

In the first example, we will calculate sick leave based on average earnings.

Example. Calculation of sick leave in 2021 based on average earnings

The employee brought sick leave to the organization for the period from January 15 to January 25, 2021, inclusive. The sheet contains the reason for incapacity for work - code 01. The employee’s insurance period as of January 15 is 6 years 8 months. Taxable payments for 2021 are equal to 598,000 rubles, for 2021 – 734,200 rubles. We will show you how an accountant will calculate benefits.

The cause of incapacity is the employee’s illness (code 01). Therefore, you need to pay for 11 calendar days of illness.

The benefit amount is 80% of average earnings, since the insurance period is more than 5, but less than 8 years.

The actual average earnings are 1824.93 rubles. [(RUB 598,000 + RUB 734,200) : 730 days]. This amount does not exceed the maximum amount and is greater than the minimum. Therefore, benefits must be calculated based on actual earnings.

The total amount of the benefit is 16,059.38 rubles. (RUB 1,824.93 x 11 days x 80%).

In the second example, we will consider calculating sick leave based on the minimum wage.

Example. Calculation of sick leave in 2021 based on the minimum wage

An employee with 4 months of insurance coverage brought sick leave for the period from January 10 to January 13 inclusive. There were no payments for 2021 or 2021. The reason for disability code is 01. We will show you how an accountant will calculate the amount of benefits.

The cause of incapacity for work is the employee’s illness; benefits must be paid for all 4 days of illness. Since there were no payments for 2021 and 2019, the average earnings must be calculated from the minimum wage. It is equal to 398.79 rubles.

Since the employee’s work experience is less than five years, the benefit must be determined based on 60% of average earnings.

The amount of the benefit from average earnings is 957.1 rubles. (RUB 398.79 x 4 days x 60%).

This amount must be compared with the minimum wage, since the employee’s work experience is less than six months. The maximum from the minimum wage will be 1449.03 rubles. (RUB 11,230: 31 days x 4 days).

This is more than the allowance from average earnings. This means that the accountant will accrue 957.1 rubles to the employee.

Paying sick leave for coronavirus in 2021

Calculate and pay for sick leave during coronavirus according to temporary rules. They were established by the Government by its resolution No. 294 dated March 18, 2020. Temporary rules are valid from March 20, 2021 until July 1, 2021 when issuing certificates of incapacity for work, assigning and paying benefits for temporary disability during the period of quarantine due to the spread of the new coronavirus infection (2019-nCoV).

Also on topic: Instructions: concluding an employment contract

The temporary rules apply only to those insured persons who arrived in Russia from the territory of countries with registered cases of coronavirus, as well as to those who live with them. Temporary disability benefits must be assigned and paid to such persons on the basis of a certificate of incapacity for work, which, at the request of the insured, will be generated and posted in the FSS information system in the form of an electronic document.

The employee must independently submit an application through the personal account of the insured person and attach documents to it. Then he will be issued a sick leave, only in electronic form. Please note that in order to issue such a sheet, an employee needs to obtain a full account on the public services portal. It will allow you to log in to your personal account on the FSS website.

To issue sick leave, an individual fills out an application for the issuance of an electronic certificate of incapacity for work in his personal account on the FSS website. The application must indicate:

- last name, first name, patronymic (if available);

- date of birth and address of place of residence or place of stay;

- SNILS and compulsory health insurance policy numbers;

- number and date of issue of a Russian citizen’s international passport;

- information about the consent of an individual living together who is not registered on the public services portal to submit an application for the issuance of an electronic certificate of incapacity for work on his behalf;

- other information to confirm the fact of cohabitation.

Scanned copies of the following are attached to the application:

- pages of a Russian citizen's international passport with confirmation of crossing the Russian state border (the first page with a photograph, pages with marks on crossing the Russian state border);

- an electronic travel document (ticket) or an electronic image of a travel document or other documents confirming stay on the territory of a foreign state (in the absence of a mark on crossing the Russian border in the international passport of a Russian citizen);

- documents on joint residence with individuals who arrived in Russia from the territory of countries where cases of the new coronavirus infection have been registered (for those living together with insured persons who arrived in Russia from the territory of countries where cases of the new coronavirus infection 2019-nCoV have been registered).

The benefit will be assigned and paid to the employee by the fund branch at the place of registration of the policyholder within the following periods:

- for the first seven calendar days of temporary disability - within one working day from the date of receipt from the insurer of data for the assignment and payment of benefits, but no later than the end of the 7th calendar day of temporary disability;

- for subsequent calendar days of temporary disability - within one calendar day from the date of termination of temporary disability.

In other cases, use the general procedure for assigning, calculating and paying benefits. Sick leave during quarantine is fully paid for by the Social Insurance Fund. Sick leave for quarantine must contain code “3” in the line “Reason of incapacity for work.”

Calculate sick leave benefits according to the general rules and assign them within 10 calendar days after the employee provides sick leave. Pay the benefit on the next day after appointment, which is set for salary payment.

Procedure for receiving benefits

Temporary disability benefits are calculated only after presentation of a sick leave certificate, which can be issued in paper or electronic form.

Until 2022, the old procedure for paying sick leave is in effect, when the first 3 days are paid by the employer, the remaining days by the Social Insurance Fund. This applies to general illnesses and injuries. If you voluntarily contributed money to the Social Insurance Fund, cared for family members, were in quarantine or had prosthetics, then the funds will come entirely from the Social Insurance Fund.

Since 2012, the “Direct Payments” project has been launched, when sick leave is fully funded by the Social Insurance Fund. In this case, the employer only accepts documents from the sick person. Within 5 days, he must transfer them to the Social Insurance Fund, and it, in turn, will accrue and transfer the money to the sick person’s account within 10 days.

Not all regions have switched to this scheme yet, but from 2022 it will spread throughout the country.

An example of calculating sick leave in 2020

In 2021, no changes are expected in the calculation and payment of sick leave compared to 2021. However, the minimum wage for 2020 will change and will be 12,130 rubles. The maximum salary for the base for contributions for 2021 is 815,000 rubles, for 2021 - 865,000 rubles. If you calculate the benefit from a larger amount, the Social Insurance Fund will not reimburse you for the costs. The number of days in the billing period is 730, for maternity leave - 731. Let's consider an example of calculating sick leave in 2020.

Ivanov Ivan Petrovich was ill from January 11 to January 25, 2021. His insurance experience is 7 years, the calculation period for calculating benefits is 2018 and 2021.

Step 1. We calculate Ivanov’s earnings for the previous two years. In 2021 it amounted to 720,000 rubles, and in 2021 - 850,000 rubles. Both amounts are below the permissible limits (815,000 and 865,000 rubles, respectively), which means we take the actual amounts for calculation. Thus, in the billing period his earnings are 1,570,000 rubles.

Step 2. Find the average daily earnings: divide 1,570,000 by 730. We get 2,150 rubles 68 kopecks.

Step 3. Determine the average daily benefit amount taking into account length of service. The length of service is 7 years, which means the amount of sick leave benefits will be 80% of the average daily earnings: 1,720 rubles 54 kopecks.

Step 4. Amount of benefit to be paid: multiply the daily amount of benefit by the number of days of incapacity for work: 1,720.54 × 15 = 25,808 rubles 1 kopeck.

Payment term

A sick leave certificate is issued to the employee at the end of the illness so that it is paid at his place of work. The sheet must be handed over to an accountant, who will process it, calculate the benefit, and transfer the amount along with the next payment of salary or advance payment.

Payment days in the company must be fixed in an internal act and brought to the attention of all employees.

Payment for sick leave is made on the next such day, and the amount is given in person, excluding personal income tax.

If the company does not comply with the established deadlines, the employee has the right to appeal to the labor inspectorate, prosecutor’s office, or court.

Attention: when applying, the employee must fill out a statement detailing the circumstances of the violation. You must also attach supporting documents to the form.

Such documents include:

- A copy of the sick leave certificate;

- A copy of the employment agreement with the employer;

- Pay slip indicating the amount of accrued sick pay;

- A copy of the payment order or card statement indicating the payment amount;

- Other documents that can confirm the employer’s violation of the sick leave payment procedure.

What is the minimum and maximum disability benefit in 2021?

If the employee had no earnings for the two previous years, or the average earnings were below the minimum wage, then the minimum wage is applied when calculating benefits. Let's consider an example of calculating sick leave for 15 days with average earnings below the minimum wage.

Step 1. Multiply the minimum wage by the number of months of the billing period: 12,130 × 24 = 291,120 rubles.

Step 2. Divide this amount by the number of days in two years: 291,120 / 730 = 398 rubles 79 kopecks.

Step 3. Average daily benefit, taking into account length of service: 398.79 × 80% = 319 rubles 3 kopecks.

Step 4. Then the amount of benefits for payment will be: 319.3 × 15 = 4,789 rubles 50 kopecks.

The law establishes a procedure for calculating the maximum amount on the basis of which benefits can be calculated for an employee. If you want, you can pay more, but you will not be able to receive reimbursement from the Social Insurance Fund. In 2021, the daily amount of temporary disability benefits cannot be more than 2,301.37 rubles.

815,000 + 865,000 = 1,680,000 / 730 = 2,301.37 rubles.

Take this into account for employees whose salary over the last two years averaged more than 70,000 rubles per month.

Sick leave for pregnancy and childbirth (BiR)

The duration of maternity leave is, as a rule, one hundred and forty days: the first seventy days are the prenatal period and the subsequent ones are the postpartum period. In case of difficult childbirth, an additional certificate of incapacity for work is issued for another 16 days. If the pregnancy is multiple, the benefit is issued for a period of 194 days (84+110).

Also on the topic: Registering an individual entrepreneur on your own: step-by-step instructions 2020

The calculation period, as in the case of sickness benefits, is the two previous calendar years. But then the significant differences begin.

Firstly, the days into which the earnings accrued in the billing period are divided are not necessarily equal to 730. It can be 731 if one of the years of the billing period has 366 days, 732 if both years are leap years. Secondly, excluded periods are subtracted from this number, which include:

- disease;

- maternity leave;

- parental leave;

- a period when the employee does not work, but receives any payments that are not subject to contributions.

Thirdly, it remains possible to replace one or two years of the billing period if at that time the employee was on maternity leave or caring for a child up to one and a half or three years old. Instead, you can take any previous year. The most important thing is that the benefit in this case will be greater than without this replacement. In this situation, the employee must write a statement indicating which years she wants to replace with others.

An example of calculating sick leave according to BiR

For example, employee V.G. Petrova worked at the company for five years. In the years preceding her maternity leave, she was on leave to care for her first child.

Petrova returned to work in April 2015. And from October 3, 2015, I went on maternity leave again. During the billing period, she was accrued only sick leave according to BiR and benefits for up to one and a half years. They are not subject to contributions and, therefore, there is no salary amount for calculating benefits.

The employee wrote a statement and the years preceding her pregnancy were replaced with those in which she worked full time - these are 2012 and 2011.

So,

Average daily earnings of benefits under the BIR = Earnings for the two calendar years preceding the period of the BIR (taking into account the maximum values) / 730 (731 or 732) – days of excluded periods.

Next, we compare the calculated average daily earnings with the maximum amount, which remains the same as in the case of regular sick leave. That is, in 2015 it is 1,632 rubles. 88 k. If the calculated amount is less, then we multiply it by the days of benefit, but if it is more, then we take the maximum amount. That is, in 2015, the maximum that can be received for maternity leave will be 1,632 rubles. 88 k. *140 days = 228,603 rub. 20 k.

Let's look at the calculation using an example:

Enterprise employee D.E. Sidorova is going on leave from 01/17/2015, which will last 140 days (from January 17 to June 4, 2015).

Work experience exceeds 6 months.

The years for calculating benefits are 2013, 2014.

Salary for this period: 618,100 rubles. and 752,234 rubles, respectively.

From these amounts, contributions to the Social Insurance Fund have been paid in full.

Since the employee’s earnings exceed the limit values, the calculation should be made based on the maximum amount of 1,192 thousand rubles.

There are 730 days in the billing period, of which Sidorova was on sick leave for 19 days, therefore, we will calculate the average daily earnings based on the calculation of 730-19 = 711 calendar days:

(568 thousand rubles + 624 thousand rubles)/711 days = 1,676.51 rubles.

This is more than the maximum value of the benefit for one day, therefore we calculate the benefit based on the maximum daily amount of 1,632 rubles. 88 k.

RUB 1,632 88 k.*140 days. =228,603 rub. 20 k.

Since maternity leave is not subject to income tax, the entire calculated amount is subject to payment.

Who pays for sick leave?

The law establishes that if an employee has issued a sick leave, it must be paid from the following sources:

- The first 3 days of illness - payment is made from the organization’s funds;

- All remaining days are reimbursed from the Social Insurance Fund.

The exception is payment for maternity leave and parental leave. These funds are fully repaid by social insurance. If sick leave is issued to care for a child due to his illness, these funds are also paid in full at the expense of the Social Insurance Fund.

If sick leave is a continuation of another sick leave, they are combined into one insured event. The employer pays for the first three days of illness only on the first form, and all other days of illness are covered by social insurance.

Currently, there is a pilot project in the country under which payments from social insurance funds are made by the fund itself, and not by the organization. To do this, a sick leave application is submitted to the fund electronically, and it is necessary to indicate the details for crediting funds.