Salary

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of February 1, 2018

What is the minimum wage established in Moscow from January 1, 2021? What are the Moscow minimum wages used for? What is the impact of the minimum wage in Moscow since 2018? How to refuse to join the tripartite agreement on the minimum wage in Moscow? Let's talk about the details of the regional minimum wage in Moscow.

Minimum wage: decoding the concept

The acronym MROT, widely used since the 1990s, stands for minimum wage.

And today the importance of this indicator is difficult to underestimate, because this is the basis from which the minimum amounts of sick leave and benefits for pregnant women are calculated, as well as mandatory insurance payments of self-employed persons for periods until the end of 2021 (from 2021 this link has been canceled). To learn about the amounts in which self-employed persons pay contributions starting from 2021, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?” .

Previously, this universal indicator also served to calculate some taxes, fines and a number of obligations under civil contracts, in which the condition of linking to the minimum wage was introduced. But currently the minimum wage is not applied for these purposes.

Who will receive a salary increase in 2021?

In theory, everyone, but practice does not always coincide with theory.

Salary indexation to inflation

In 2021, all employers are required to increase employee salaries based on the Labor Code. The employer is obliged to index wages according to the increase in consumer prices (Article 134 of the Labor Code of the Russian Federation).

In 2021, according to Rosstat, the consumer price index amounted to 4.9%. Accordingly, this is the minimum percentage of salary increase in 2021.

If an organization or individual businessman does not provide an increase in wages, then the employee, in accordance with Art. 353 of the Labor Code of the Russian Federation has the right to file a complaint with the regulatory authorities.

“The indexation procedure itself is not established by law, the legislation only establishes the employer’s obligation to carry it out,” Svetlana Krasnyanskaya, head of the HR service of the legal group Yakovlev and Partners, clarifies to the Prime agency.

Minimum wage in Russia

The Federal Law on the minimum wage is adopted by the State Duma of the Russian Federation annually. The essence of each new law comes down to amending Art. 1 and 2 of the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ. So, in Art. 1 indicates the new minimum wage established in the Russian Federation for the current year (for example, for the minimum wage in 2021, in force from May 1, 2018, - 11,163 rubles per month), and in Art. 2 determines the start of the new minimum wage (for example, the start of the 2018 minimum wage is 05/01/2018).

The minimum wage applied from January 1, 2019 is equal to the subsistence level of the working-age population for the 2nd quarter of 2018. Its value is 11,280 rubles.

The minimum wage established by the State Duma of the Russian Federation is called federal. In addition to the federal minimum wage, regional minimum wages may be established in the constituent entities of the Russian Federation.

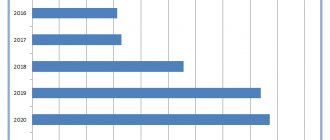

Read about the dynamics of the federal minimum wage and the relationship between its value and the level of the subsistence level in the Russian Federation here .

Minimum wage and Moscow salary: dependence

Moscow employers (organizations and individual entrepreneurs) must set a salary no less than the Moscow minimum wage (RUB 18,742) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If your refusal has been sent, then the salary in Moscow from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). For many employers, the difference is noticeable: 9253 rubles. = (RUR 18,742 – RUR 9,489).

The Moscow minimum wage, applied from January 1, 2021, already includes a tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow minimum wage. This procedure follows from clause 3.1.3 of the Tripartite Agreement.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

What is included in the minimum wage

Art. 133 of the Labor Code of the Russian Federation provides that the salary of an employee who has worked a full month and fulfilled all his job duties cannot be lower than the minimum wage. Therefore, if an employer is checked to ensure that employees’ wages comply with the minimum wage approved for the current year, the inspector will check the level of the salary established for him with the minimum wage in force in the region.

Read about which of the components of the salary cannot be set less than the minimum wage in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

Is it permissible to pay less than the minimum wage?

If an employer deliberately underestimates the minimum wage in relation to employees, he will be punished. According to Article 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours and fulfilled his job duties never falls below the established federal value. The labor inspectorate is responsible for identifying unscrupulous employers who underestimate wages during scheduled and unscheduled inspections. For detected violations, employers will have to pay quite large fines. According to Article 5.27 of the Code of Administrative Offenses of the Russian Federation, the violating organization will have to pay a fine:

- from 30,000 to 50,000 rub. - for the first violation;

- from 50,000 to 70,000 rub. - for repeated violation.

In this case, the amount of the fine will have to be multiplied by the number of employees against whom the offense was committed. For example, for one employee with a salary less than the minimum wage you will have to pay 30,000 rubles, and for two - 60,000 rubles.

There is no need to fear sanctions for employers who have a salary lower than the minimum wage in Moscow in 2021 (see the figures for your region), but who, in addition to it, pay bonuses, incentives and compensation payments so that the total remuneration of the employee is higher or equal to the minimum.

If employees receive less than the established amount, management should take care of increasing remuneration in advance. To do this you need:

- make changes to the staffing table;

- issue an order to increase salaries;

- sign an additional agreement with employees.

Minimum wage in 2018–2019 in the regions

The minimum wage established in the region cannot be less than the federal minimum wage. It is determined by an agreement between representatives of the government of a constituent entity of the Russian Federation, trade unions and employers. Employers in the region who have not submitted to the government of a constituent entity of the Russian Federation compelling reasons for not joining this agreement are required to apply the regional minimum wage when setting wages (Article 133.1 of the Labor Code of the Russian Federation).

To learn about the cases in which additional payment is made up to the minimum wage, read the article “Additional payment up to the minimum wage for external and internal part-time workers .

When in Moscow to rely on the federal minimum wage

Let us highlight several situations when in Moscow in 2021, instead of the regional minimum wage, it is necessary to use the federal one (even if there was no refusal to join the agreement).

Calculation of benefits

To calculate social benefits, use the federal minimum wage, not the regional one. Let us remind you that “minimum” social benefits are received by employees with earnings below the minimum wage or with short work experience (up to 6 months) (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Accrual of vacation pay

The federal, and not the regional, minimum wage should also be taken into account when calculating vacation pay. The average monthly earnings calculated for calculating vacation pay cannot be lower than the minimum wage (clause 18 of the Regulations, approved by Government Resolution No. 922 of December 24, 2007). Therefore, you need to compare the calculation result with this indicator. And if the comparison is not in favor of the employer, you will have to make an additional payment up to the federal minimum wage.

Minimum wage in Moscow

In Moscow, the minimum wage is also established by signing a regional agreement between the capital government, local trade union associations and Moscow employers' associations. Currently, the agreement dated December 15, 2015, relating to the period 2016–2018, is in force. It stipulates that the minimum wage for Moscow is revised quarterly and brought to the subsistence level of the working population. However, if the cost of living decreases, then the minimum wage is not subject to reduction, but remains equal to that in force in the previous quarter.

In all other aspects, the minimum wage in Moscow is subject to the general requirements of the minimum wage legislation.

Minimal salary

The institution of the minimum wage, by its legal nature, is intended to establish the minimum amount of money that should be guaranteed to the employee as remuneration for the performance of labor duties, taking into account the subsistence level.

According to the rules of Part 3 of Article 133.1 of the Labor Code of the Russian Federation:

Based on Article 133.1 of the Labor Code, the regional minimum wage is mandatory for use as part of the remuneration of employees of state institutions financed from the budgets of constituent entities of the Russian Federation, as well as municipal institutions. Federal government, budgetary and autonomous institutions are not required to apply the regional minimum wage.

What is the minimum wage in 2018–2019 in Moscow

The minimum wage (Moscow) from 10/01/2017 was increased to 18,742 rubles. in accordance with the increase in the cost of living in the region (Resolution of the Moscow Government dated September 12, 2017 No. 663-PP).

Based on the results of the 3rd quarter of 2021, the cost of living in Moscow turned out to be lower than in the 2nd quarter of 2021, therefore the minimum wage has not changed since 01/01/2018 and amounted to 18,742 rubles. Since November 1, 2018, the cost of living in Moscow has increased slightly and amounted to 18,781 rubles. (Decree of the Moscow Government dated September 19, 2018 No. 1114-PP).

Minimum wage in Moscow

| The period from which the minimum wage is established | Minimum wage (rub., per month) | Regulatory act establishing the minimum wage |

| from January 1, 2021 | 20 589 | “Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 09.19.2018, Moscow Government Resolution dated 09.10.2019 N 1177-PP |

| from January 1, 2021 | 20 195 | “Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 09.19.2018, Moscow Government Resolution dated 09.10.2019 N 1177-PP |

| from 01.10.2019 | 20 195 | “Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 09.19.2018, Moscow Government Resolution dated 09.10.2019 N 1177-PP |

| from July 1, 2021 | 19 351 | “Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 09/19/2018, Moscow Government Resolution dated 06/11/2019 N 672-PP |

| from 01/01/2019 | 18 781 | “Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 09/19/2018, Moscow Government Resolution dated 06/11/2019 N 672-PP |

| from November 1, 2021 | 18 781 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 15, 2015, Moscow Government Decree dated September 19, 2018 N 1114-PP |

| from May 1, 2021 | 18 742 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 15, 2015, Moscow Government resolution No. 663-PP dated September 12, 2017 |

| from January 1, 2021 | 18 742 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 15, 2015, Moscow Government resolution No. 663-PP dated September 12, 2017 |

| from 01.10.2017 | 18 742 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 15, 2015, Moscow Government resolution No. 663-PP dated September 12, 2017 |

| from July 1, 2021 | 17 642 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 15, 2015, Moscow Government resolution No. 355-PP dated June 13, 2017 |

| from October 1, 2021 | 17 561 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/15/2015, Moscow Government Resolution dated 09/06/2016 N 551-PP |

| from January 1, 2021 | 17 300 | “Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/15/2015 |

| from November 1, 2015 | 17 300 | “Agreement on the minimum wage in the city of Moscow for 2015 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 18, 2014 (as amended on October 30, 2015) |

| from June 1, 2015 | 16 500 | “Agreement on the minimum wage in the city of Moscow for 2015 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 18, 2014 (as amended on May 26, 2015) |

| from April 1, 2015 | 15 000 | “Agreement on the minimum wage in the city of Moscow for 2015 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/18/2014 |

| from January 1, 2015 | 14 500 | “Agreement on the minimum wage in the city of Moscow for 2015 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/18/2014 |

| from June 1, 2014 | 14 000 | “Agreement on the minimum wage in the city of Moscow for 2014 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 11, 2013 (as amended on April 24, 2014) |

| from January 1, 2014 | 12 600 | “Agreement on the minimum wage in the city of Moscow for 2014 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/11/2013 |

| from July 1, 2013 | 12 200 | “Agreement on the minimum wage in the city of Moscow for 2013 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 12, 2012 |

| from January 1, 2013 | 11 700 | “Agreement on the minimum wage in the city of Moscow for 2013 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 12, 2012 |

| from July 1, 2012 | 11 700 | “Agreement on the minimum wage in the city of Moscow for 2012 between the Moscow Government, Moscow trade union associations and Moscow employer associations” dated November 30, 2011 |

| from January 1, 2012 | 11 300 | “Agreement on the minimum wage in the city of Moscow for 2012 between the Moscow Government, Moscow trade union associations and Moscow employer associations” dated November 30, 2011 |

| from July 1, 2011 | 11 100 | “Agreement on the minimum wage in the city of Moscow for 2011 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/02/2010 (as amended on 07/01/2011) |

| from January 1, 2011 | 10 400 | “Agreement on the minimum wage in the city of Moscow for 2011 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated 12/02/2010 |

| from May 1, 2010 | 10 100 | “Agreement on the minimum wage in the city of Moscow for 2010 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 22, 2009 |

| from January 1, 2010 | 9 500 | “Agreement on the minimum wage in the city of Moscow for 2010 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” dated December 22, 2009 |

| from September 1, 2009 | 8 700 | “Agreement for 2009 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 24, 2008 |

| from May 1, 2009 | 8 500 | “Agreement for 2009 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 24, 2008 |

| from January 1, 2009 | 8 300 | “Agreement for 2009 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 24, 2008 |

| from September 1, 2008 | 7 650 | “Moscow tripartite agreement for 2008 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 11, 2007 (as amended on September 2, 2008) |

| from May 1, 2008 | 6 800 | “Moscow tripartite agreement for 2008 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 11, 2007 |

| from September 1, 2007 | 6 100 | “Moscow tripartite agreement for 2007 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 12, 2006 |

| from May 1, 2007 | 5 400 | “Moscow tripartite agreement for 2007 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 12, 2006 |

| from September 1, 2006 | 4 900 | “Moscow tripartite agreement for 2006 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated November 28, 2005 |

| since May 1, 2006 | 4 100 | “Moscow tripartite agreement for 2006 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated November 28, 2005 |

| since October 1, 2005 | 3 600 | “Moscow tripartite agreement for 2005 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 29, 2004 |

| since May 1, 2005 | 3 000 | “Moscow tripartite agreement for 2005 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 29, 2004 |

| since October 1, 2004 | 2 500 | “Moscow tripartite agreement for 2004 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 22, 2003 |

| since May 1, 2004 | 2 000 | “Moscow tripartite agreement for 2004 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 22, 2003 |

| from the 2nd half of 2003 | 1 800 | “Moscow tripartite agreement for 2003 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 15, 2002 |

| from January 1, 2003 | 1 500 | “Moscow tripartite agreement for 2003 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 15, 2002 |

| from September 1, 2002 | 1 270 | “Moscow tripartite agreement for 2002 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 4, 2001 |

| from January 1, 2002 | 1 100 | “Moscow tripartite agreement for 2002 between the Moscow Government, Moscow trade union associations and Moscow associations of industrialists and entrepreneurs (employers)” dated December 4, 2001 |

Moscow tripartite agreement for 2021-2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations (as amended by Moscow Government Resolution No. 1177-PP dated September 10, 2019)

(extraction)

Contracting parties: The Moscow Government on behalf of the executive authorities of the city of Moscow (hereinafter referred to as the Government), the Moscow Federation of Trade Unions (hereinafter referred to as the IFP) on behalf of the Moscow trade union associations (hereinafter referred to as the Trade Unions), the Moscow Confederation of Industrialists and Entrepreneurs (employers) (hereinafter referred to as the ICIE) (p) on behalf of Moscow associations of employers (hereinafter referred to as Employers) (hereinafter referred to as the Parties) in accordance with the Labor Code of the Russian Federation, Moscow City Law No. 4 of November 11, 2009 “On Social Partnership in the City of Moscow” entered into a Moscow tripartite agreement on 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations (hereinafter referred to as the Agreement).

The main goals of this Agreement are to ensure coordination of the interests of workers, employers and executive authorities of the city of Moscow in regulating social and labor relations and related economic relations aimed at improving the level and quality of life of the population, sustainable functioning and further development of economic sectors of the city of Moscow, ensuring and expansion of state guarantees in matters of employment and social protection of the population, payment and labor protection of workers based on the principles of social partnership.

Section 3. IN THE FIELD OF WAGES OF EMPLOYEES, INCOME AND LIVING STANDARDS OF THE POPULATION

The parties undertake:

3.1. Consider that the amount of the minimum wage in the city of Moscow is revised quarterly and is established in the amount of the subsistence minimum for the working population of the city of Moscow, approved by a resolution of the Moscow Government. In the event of a decrease in the cost of living in the city of Moscow, the minimum wage remains at the same level.

3.2. Establish the amount of the minimum wage from the first day of the month following the month of entry into force of the resolution of the Moscow Government approving the subsistence level of the working-age population of the city of Moscow.

3.3. Consider that the amount of the minimum wage in the city of Moscow is not a limitation for the implementation of higher guarantees for wages and includes the minimum amount of payments to an employee who has worked the monthly standard of working hours established by the legislation of the Russian Federation and has fulfilled his labor duties (labor standard), including tariff rate (salary) or remuneration under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments made in accordance with Articles 147, 151, 152, 153, 154 of the Labor Code of the Russian Federation.

3.4. Publish quarterly in the media of the Parties, and also propose to post on the official website of the Territorial Body of the Federal State Statistics Service for Moscow on the Internet information and telecommunications network the value of the living wage approved by the Moscow Government in the city of Moscow.

The article was written and posted on June 22, 2021. Added - 02/16/2018, 05/03/2018, 10/14/2018, 11/30/2019, 01/09/2021

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Results

The abbreviation MROT stands for minimum wage.

It is installed at both the federal and regional levels. The federal minimum wage increases 1–2 times a year. The regional minimum wage may be revised more often, but in any case cannot be less than the federal minimum wage. The size of this parameter determines the minimum salary level and the minimum amount of sick leave payments and child benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How will salaries be calculated for public sector employees starting in 2021?

Starting in 2021, the Government is introducing a new system for calculating salaries for public sector employees. Instead of regional authorities, the requirements for sectoral wage systems will now be set by the Government. President Vladimir Putin signed the corresponding law on November 9, 2021. What's changing?

The new scheme for calculating salaries of public sector employees includes a base rate and a tariff scale of 18 categories, reports Parliamentary Gazette. Each industry will have its own requirements.

According to the law, the Cabinet of Ministers will not only regulate the differentiation of salaries and rates of public sector employees, but also determine compensation and incentive payments and the conditions for their appointment.

The amounts of compensation payments and their list will become uniform. These include, for example, compensation for work in areas with an unfavorable climate, harmful or dangerous working conditions, at night, on weekends and holidays, for combining professions or positions, etc.

However, this does not mean that doctors, teachers or educators in all regions will receive the same salary.

The principles for calculating remuneration for labor will indeed be general, but the cost of living in the regions and other local features will also be taken into account.

“This will make it possible to harmonize the conditions of remuneration for workers in the same field in different regions”

,” Deputy Head of the Ministry of Labor Andrei Pudov explained earlier the essence of the amendments.

It is planned to introduce the new payment system in stages in 2021-2025, and the Government will indicate specific deadlines for the transition to the new system for each industry.

What is the minimum wage set in St. Petersburg in 2021

For budgetary organizations of St. Petersburg, the minimum wage from January 1 is 12,792 rubles, that is, equal to the federal one.

For non-budgetary entrepreneurs, the Minimum Wage Agreement dated December 27, 2019 is in force, according to which the minimum wage for the extra-budgetary sector in St. Petersburg from January 1, 2021 is set at 19,000 rubles

- higher than the federal value.

However, organizations have the right to refuse the regional minimum wage and pay employees at the level of state employees, that is, the federal minimum.

About the minimum wage in Moscow

Who, if not the state, can ensure the labor rights of citizens? Well, or at least regulate the minimum wage. At least once a year, the Government of the Russian Federation approves a Resolution with a new minimum wage figure.

The value is based on the subsistence level, that is, on the minimum amount a person needs for a month of life in the Russian Federation. After all, you cannot receive less than you are given to spend. This rule is formulated in Art. 133 Labor Code of the Russian Federation. Also, the employer does not have the right to pay employees less than the minimum wage. For this he may be held liable:

- or to an administrative fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation;

- or a year in prison under Article 145.1 of the Criminal Code of the Russian Federation.

The minimum wage is a single value for the whole of Russia, and it does not change in the regions. Another indicator is established there - the minimum wage. To resolve this issue, a tripartite commission is being assembled, which includes representatives from the authorities, employers and trade unions. In Moscow, the tripartite commission operates on the basis of the Law “On Social Partnership” dated November 11, 2009, No. 4.

The adopted Agreement on new tariffs must be published in the newspaper “Tverskaya, 13” or in the journal “Bulletin of the Mayor and Government of Moscow”. The employer has 30 days to argue its unwillingness to join the new rules. This is stated in the Labor Code. However, in reality, the Moscow minimum wage is the same minimum wage, because... is also tied to the subsistence level, only to the metropolitan level. Accordingly, you cannot pay less than the minimum wage; this will result in liability.

How to switch to a new minimum wage

Any subject of the Russian Federation (including Moscow) can set its own minimum wage. But it cannot be lower than the minimum wage approved by federal law (Article 133.1 of the Labor Code of the Russian Federation). From May 1, 2021, the federal minimum wage is 11,183 rubles.

If the salary in Moscow to be calculated for November and December 2018 is lower than the minimum wage (18,781 rubles), then the employee must be paid extra. You can set the surcharge in two ways:

- increase salary;

- establish in a local act (for example, a separate order or Regulation on remuneration) an additional payment up to the minimum wage. That is, it should be directly stated that employees are given an additional payment up to the regional minimum wage. Then there will be no need to review salaries or change employment contracts.

An employee whose salary in Moscow is less than the new minimum wage may demand:

- additional payment for the period of validity of the new minimum wage from November 1, 2018;

- compensation for delayed payment from November 1, 2021 (Article 236 of the Labor Code of the Russian Federation).

The minimum wage in Moscow from November 1, 2021 does not affect the amount of benefits. Benefits are calculated based on the federal, not regional minimum wage.