Home / Labor Law / Payment and benefits / Sick pay

Back

Published: 06/10/2016

Reading time: 8 min

0

5911

The sick leave certificate provides for the inclusion of many types of codes, and both health workers and accountants or personnel officers of organizations must enter the codes.

Understanding the codes is not as difficult as it seems at first , you just need to know where to find the necessary information.

- Why is coding needed?

- How to read codes?

- Codes of dangerous diseases Socially significant

- Dangerous

- String "other"

Registration of a newsletter with code “05”

The hospital bulletin is issued at the antenatal clinic at the place of registration by an obstetrician-gynecologist (paramedic or family doctor) to a woman at 30 weeks of pregnancy. Its standard duration is 140 days. Of these, half is provided before childbirth, and the rest after it. Thus, it turns out that 70 days of rest are provided and paid to the woman before childbirth and the same amount after.

In case of early labor (22-30 weeks), as an exception, a bulletin is issued from the first day of birth for the entire vacation period. If, for example, a multiple pregnancy is detected, it is possible to issue sick leave at the 28th week of pregnancy for a period of 194 days. Social benefits are assigned under these circumstances based on the documents submitted, namely:

- A woman's application for leave.

- Bulletin with code "05".

- Certificates of early registration.

If necessary, the above list is accompanied by information from the previous place of work about earnings, etc. All maternity leave dates are specified in detail in the sick leave bulletin.

A woman has the right to go on maternity leave later than required by law. Please note that if you go on maternity leave later, the established deadlines will not be moved. The basic information that must be included in the sick leave is:

- personal information of the woman (full name, date of birth, place of work);

- early registration mark;

- date of issue of the bulletin, its validity period (start and end);

- doctor's signature and seal.

At the request of the woman and if there is such an opportunity, the medical institution can issue her an electronic bulletin or issue a regular sick leave on paper.

An electronic bulletin and a paper sick note are equivalent.

FSS RF.

What does the employer fill out?

Codes indicating the conditions for calculating the benefit amount:

- 43 – exposed to radiation and having benefits when granting benefits.

- 44 – worked in the Far North before 2007.

- 45 – if there is a disability.

- 46 – when concluding an employment agreement for a period of up to six months.

- 47 – if the illness occurred within 30 days (calendar) from the date of termination of the employment relationship.

- 48 – violation of hospital regulations for valid reasons.

- 49 – illness for more than 16 weeks.

- 50 – illness for more than 20 weeks.

- 51 – for those employed part-time.

Part of the certificate of incapacity for work is filled out in a medical institution. Therefore, responsibility for incorrectly filled out codes or columns rests entirely with the attending physician, as well as the management of the hospital, clinic or clinic.

Assignment of social benefits using a ballot with code “05”

Maternity sick leave is generally calculated based on the provisions of the Federal Law of the Russian Federation No. 81 of May 19, 1995 (on state benefits for citizens with children), as well as guided by the norms of the Federal Law of the Russian Federation No. 255 of December 29, 2006 (on social benefits for illness). To receive the required social payment on the ballot, you must first register it.

| General procedure for registering social benefits using a ballot with code “05” (what a pregnant woman needs to do) | Explanatory information |

| Register at the antenatal clinic | When registering before the 12th week of pregnancy, a woman is entitled to a one-time payment. For 2021, its size is 613 rubles. 14 kopecks |

| Submit a sick note from your doctor | Registration is carried out in relation to each specific case separately: upon the onset of 30 (or 27, 28) weeks of pregnancy. In the form, code “05” is written on the corresponding line. |

| Submit the ballot to the accounting department (personnel department) of your organization (at place of work) | At the same time, you should write an application for leave, noting its beginning and end, indicating a request for assignment and payment of social benefits. If necessary, you must also attach the required documents (for example, a certificate of income from previous places of work) |

| Read the order for maternity leave under signature | Actually, upon completion of this stage, social benefits are calculated and paid |

Thus, a sick leave certificate with code “05” is the main document that provides a woman with the right to maternity leave.

What guides a medical institution when choosing a code for sick leave?

The contents of the certificate of incapacity for work (approved by Order of the Ministry of Health and Social Development of April 26, 2011 No. 374n) are strictly regulated. Doctors are required to follow the established procedure for filling out the fields allocated for the medical institution. What information needs to be indicated on the sick leave certificate is established by Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624.

What codes are used in this or that case are described in Chapter. IX of this document.

The list of values is also located on the back of the form.

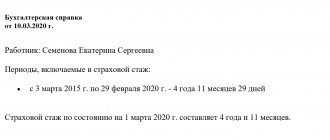

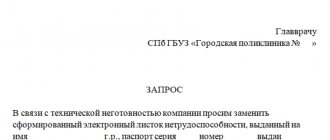

Example 1. Application for maternity leave and social benefits

The application is written by the woman in any form. As is customary, it states:

- Full name of the head of the organization;

- the applicant's initials, as well as her position and the department in which she is registered;

- a request for maternity leave from a specific date and for the assignment of social benefits;

- link to the hospital bulletin indicating its details.

The following form can be considered as a sample.

How to respond to error messages

Having received a protocol with an error instead of an ELN, act depending on the error code. For example, what does status 020 mean in an electronic sick leave? This error indicates that the certificate of incapacity for work has not been closed by the medical institution, the illness has not ended, and the employee has not started work. Wait until the employee is discharged and submit your request again. Proceed in the same way if you receive an error with code 010; 040 or 050.

IMPORTANT!

Special situation - what does status 090 mean in email. sick leave is the cancellation of the ELN. Such sick leave is not subject to payment. In this case, inform the employee that his ELI has been canceled and the benefit will not be assigned or paid.

The ELN available for calculating benefits has the status “Closed”, which means status 030 in the electronic sick leave certificate. Only after receiving a document with such a code, the employer has the right to begin calculating benefits.

Amount and payment of social benefits for sick leave with code “05” for 2021

The right to pay maternity leave by ballot is enshrined in Art. 255 and t. 256 of the Labor Code of the Russian Federation and applies to all working and studying women. This norm also applies to the unemployed who are listed in the employment center.

Payment for maternity leave (letter with code “05”) is made from the funds of the Federal Social Insurance Fund of the Russian Federation in the amount of 100% of the SDZ for 140 days (for the general case). The payment is calculated for each pregnant woman individually. For calculation purposes, the following factors are taken into account.

| Basic data for calculating social benefits | Details |

| Billing period and salary during this time | The total earnings for the previous 2 years are calculated. For example, for social benefits in 2021 this is: period 2016-2017 |

| Total number of days in the specified billing period | 730 days (or 731 if one year was a leap year) |

| Number of days to be subtracted in the period | Their availability and quantity are determined in accordance with the law (excluded, for example, are sick days on ballots, personal leave, etc.) |

| Minimum wage this year | If you have little or no income, as well as with work experience of up to 6 months, calculations are based on the minimum wage. For the current year, its value is 9,489 rubles. (without regional coefficients) |

| Current limits on social payments | For 2021, the maximum amount of social benefits can reach 282,106.70 rubles, and the minimum - 43,615.65 (for normal childbirth during the required 140 days of maternity leave) |

Formula for calculation: average daily earnings * number of days of maternity leave according to the ballot (140, 156 or 194 days, respectively). You can calculate the amount of social benefits yourself using the calculator on the website of the Federal Social Insurance Fund of the Russian Federation. If a woman works for more than 2 years for several employers, then each of them must pay maternity leave.

What does the number 05 mean?

Code 05 on a certificate of incapacity for work means that it was issued to a woman for pregnancy and childbirth. Based on this sick leave, in accordance with the norms of the Labor Code of the Russian Federation, maternity leave is granted.

The document is drawn up at the antenatal clinic.

What does additional encoding 020 mean?

When applying for an extension of sick leave for pregnancy and childbirth, the reason for the incapacity for work is written on it and the number 020 is indicated in the “additional code” column.

Extension of the period of release from work, which was established on the initial sick leave, is possible only with a medical report from the maternity hospital or maternity ward of the hospital. The period of release from work is extended :

- for 16 days if there were complications during childbirth;

- for 54 days if a multiple pregnancy was established during childbirth.

In such cases, an additional certificate of incapacity for work is issued.

Common mistakes when issuing a ballot with code “05”

Error 1. Only a woman who is preparing to give birth to a child can receive a hospital bulletin with code “05” (for pregnancy and childbirth). Accordingly, only she is assigned and paid social benefits according to such a ballot, which replaces her salary.

At the same time, a father, grandmother or other relative can apply for leave to care for a newborn child. To apply for it, the potential vacationer will need to present a certificate from his mother’s place of work stating that she did not take such a vacation, i.e., it remained unclaimed.

Error 2. Social benefits, which are due during maternity leave, are not paid for those days when salaries were calculated. Social benefits and salary are also not assigned at the same time.

So, for example, if a pregnant woman went on maternity leave later than she was supposed to, then social benefits will be assigned and paid from the first day of leave, but not earlier than that.

Procedure for working with ELN

More and more medical institutions are switching to issuing electronic certificates of incapacity for work. To handle them, special formats have been developed that use coding of many operations. Let's figure out how to set up an employer's work with electronic sick leave, what the status of electronic sick leave is 030, 010, 020 and others, and what to do if you receive a sick leave certificate with an error.

IMPORTANT!

The Ministry of Labor proposed to abolish paper sick leave! Draft law 01/05/07-20/00106462 on a complete transition to electronic certificates of incapacity for work is being developed.

To start working with electronic certificates of incapacity for work, the employer must:

- Conclude an agreement on interaction with the regional branch of the Social Insurance Fund.

- Obtain an electronic digital signature and install the necessary software to work with it (cryptoprovider).

An organization has the right to exchange data with the fund:

- through the employer’s personal account on the FSS website>;

- through an authorized telecommunications operator (“Tensor”, “Kontur”, etc.).

To request an electronic identification number, all you need is its number and full name. sick person, his SNILS. The FSS will send a sick leave certificate based on this data. But sometimes, instead of the requested document, the employer receives an error notification.

Answers to frequently asked questions

Question No. 1: Is maternity leave paid for a non-working woman?

No, because maternity leave is provided and paid for by those who work or study. Unemployed women, in fact, have nowhere to apply for it. Therefore, they are deprived of this social benefit.

Exception: if a woman is fired due to layoffs or bankruptcy of the organization and no more than a year has passed since that moment. Then the unemployed mother is paid social benefits according to the ballot. For your information, an unemployed woman can receive the social benefits that are due in her situation only by registering with the employment center.

What do you need to know about disability certificate codes?

The line contains cells for entering two-digit codes, which are filled out by the doctor. The codes indicate the reason for which sick leave is issued to the employee. Here are the reasons and designation codes:

- sanatorium treatment - 08;

- quarantine (being among infectious patients) - 03;

- sick leave due to a child’s illness - 12;

- maternity leave - 05;

- general illness - 01;

- socially significant disease - 11.

- prosthetics in hospital - 06;

- (outside work) - 02;

- — 09;

- poisoning - 10;

- occupational disease - 07;

- or its consequences - 04;

Functions of disability codes

This digital form of indicating the cause of disability has a number of advantages over conventional handwritten certificates and carries the following functions:

- Protection of medical confidentiality. Not all employees want to share their health problems with accounting or their manager. This type of indication of the cause of disability for the most part allows the employee to keep this secret. For example, the number 9 means that the employee is not sick himself, but a minor child requires his care. The baby’s illness does not play a role in this and is not indicated.

- Convenience. Such a short designation helps optimize the work process of both the attending physician, the accounting or human resources department, and then the Social Insurance Fund employees. Calculation of necessary payments to an employee is also simplified with the help of this designation.

- Save space and time. Now the doctor does not need to write the full long name of the disease, which the accountant will then not be able to understand.

- Going international. All disease codes are developed by the government in accordance with international requirements and standards. This is a way to bring medicine to a new level and the possibility of convenient processing of sick leave in those companies where the organization’s management and accounting department are located outside the territory of the Russian Federation. Also, if the patient was treated outside of Russia, the codes assigned by foreign doctors will match ours. For example, code 10 everywhere will mean special research, poisoning or another condition that is different from a general disease, but makes the employee temporarily disabled.

Code options

Codes are divided into three types:

- Double digit. It must be marked by the doctor when issuing a certificate of incapacity for work and is most often indicated for the standard duration of sick leave. This code reveals the cause of disability (for example, a domestic injury - 02, a separate injury received at the workplace - 04, pregnancy and childbirth - 05, caring for a family member - 09). Usually it is placed in cases where hospital stay and further more detailed explanation of the cause of the disease to the employer are not required. This code is called the main code.

- Clarifying code. This may be followed by two more numbers, which are intended to clarify the diagnosis made by the attending physician. This happens in cases where the patient is recognized as disabled due to illness (32) or an additional period is necessary for further treatment of the patient (37). Also, moments of non-compliance with medical orders and violation of hospital regulations may be indicated here, which may affect how and in what amount the time an employee is absent from the workplace is paid.

All possible codes and their nature that may appear on this document are indicated there. For example, reason for disability 01 is a designation of a general illness, that is, the employee could have been suffering from the flu or another illness at that time, which did not require more complex additional examinations or further treatment in a hospital.

The indicated reason 11 speaks of a so-called special disease (the full list is approved by the government of the Russian Federation), for example, a mental personality disorder or diabetes mellitus.

Sick leave payment

By specifying disability codes, insurance payments are calculated for an employee in his absence from work.

To calculate the amount of payments, you need to know your full length of service:

- for up to 5 years of service, the daily sick leave payment will be 60% of the employee’s average earnings;

- with experience from 5 to 8 years – the payment increases to 80%;

- Only upon reaching 8 years of total experience will this amount be 100%.

Average earnings are calculated based on the last two years of work, that is, all amounts received during this period are calculated and divided by the number of days. This is the average daily wage. If it is less than the minimum subsistence level, then all payments are considered according to the minimum wage.

Who is responsible for making these payments - the organization or the Social Insurance Fund - also depends on the specific case and the codes entered on the sick leave. For example, if you receive a domestic injury (code 02), payment for the first three days off comes from the employer’s pocket, and then is paid for by the Social Insurance Fund. If you receive a work injury at the workplace (code 04), payments for all sick days are made from the Social Insurance Fund.

Disability codes are a useful tool in filling out sick leave, containing comprehensive information for the employer about the reasons for the employee’s absence from the workplace. Thanks to these codes, the work of medical workers is optimized and the work of accounting and the Social Insurance Fund is simplified in calculating the payments necessary for the patient.

Sick leave form

Since 2011, the Russian Federation has had a special form of sick leave. It was made primarily to reduce the number of cases of forgery and illegal issuance of this document, as well as to optimize the work and processing of these documents.

A sick leave or certificate of incapacity for work is issued during illness, injury and absence from work for other reasons related to health (for example, undergoing complex serious examinations or necessary sanatorium-resort treatment for the final stage of recovery from a severe disease).

After receiving this paper by the employer, the employee has the right to insurance payments for sick days. We are, of course, only talking about employees who are officially employed on the basis of an employment contract. Only in this case does it make sense to receive sick leave.

The codes for the cause of disability, as well as the form of the certificate itself, were approved in 2011 by Order of the Ministry of Health 347n and have not changed since then.

The entire sheet, including these codes, is filled out in printed form on a computer or in black ink (not with a ballpoint pen!) in block letters and numbers that do not protrude beyond the margins of the form. If these rules are not followed, sick leave may not be accepted by the employer and/or the Social Insurance Fund, which bears the main payments to temporarily disabled employees.