Checking payment using an insurance certificate

check payment of sick leave according to SNILS after pre-registration on the State Services portal in your FSS personal account, you must select the “Temporary Disability Sheets” section. You can find just one ELN or all of them at once using the filter by filling out the SNILS line. By clicking on a specific sheet, detailed information on the bulletin will be presented, including accrued benefits.

It is also possible to check your bank account and filter by status, date of formation or registration number. The data is in a single database, so when a document is edited by a medical institution, employer or other authorized persons, the changes will in any case be reflected on the FSS website.

It is also useful to read: How to check taxes using SNILS

How to reimburse the costs of financial support for preventive measures from the Social Insurance Fund

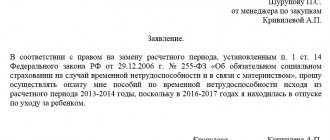

The employer pays for preventive measures at his own expense, and then receives compensation from the Social Insurance Fund budget within the amount agreed with the Fund’s department.

To do this, before August 1 of this year, you need to submit an application for permission to finance preventive measures and prepare documents justifying the need for the measures. And before December 15, you need to submit an application for reimbursement of expenses incurred.

“The debt of the Fund branch to the policyholder, formed due to the excess of expenses over accrued insurance premiums as of July 1, 2019, is subject to compensation at the request of the policyholder. The policyholder has the right to direct up to 20% of the amounts of insurance premiums accrued by him for the previous calendar year to financially support preventive measures. This could be mandatory periodic medical examinations (examinations) of employees whose work is associated with harmful and (or) dangerous production factors,” explains Natalya Vladimirovna Matveeva, acting. O. deputy manager, head of the inspection department of the State Administration - regional branch of the Federal Social Insurance Fund of the Russian Federation for the Republic of Karelia.

Ekaterina Slobozhanina and Elena Kulakova, experts of the online reporting system Kontur.Extern

How to find out the number of the certificate of incapacity for work

As a rule, the need to verify data on a sick leave certificate arises when the employer doubts the authenticity of the document, as well as the lawful actions of the employee. The other side of the issue is the employee’s doubts about the accrued benefits.

Having SNILS in hand, an employee can find out the electronic sick leave number and all related information. To do this, go to the official website of the FSS and log in to your personal account (lk.fss.ru). In the section “Certificates of Incapacity for Work” there is a form where you can search for documents by SNILS number.

The status of b/l may change, depending on the stage of its processing:

- 010 – ELN is active;

- 020 – sick leave extended by 2 weeks;

- 030 – ELN is closed;

- 040 – considered by the commission;

- 050 – adjustments have been made;

- 060 – change of information by the policyholder;

- 070 – benefit calculated;

- 080 – payments made;

- 090 – ELN is inactive.

Reference! Processing of electronic sick leave takes place in a strict order. For example, an employer will not be able to access the electronic health information while it is in the possession of a medical organization. It is also impossible to correct sheets that have already been paid.

Letter to the Social Insurance Fund about checking sick leave if the check on the portal did not produce results (sample)

A request to the Social Insurance Fund to verify sick leave is made in any order and must contain the following information:

- about the policyholder: company name, INN/KPP/registration number in the Social Insurance Fund, legal address and telephone number;

- to whom, by whom and when issued, as well as the number of the certificate of incapacity for work;

- where and how the fund should send the response;

- about applications;

- signature of the head of the company and date of preparation.

The original sick leave certificate must be attached to the application. After verification, the department will return it.

Applications can be made on our website.

Since the FSS has the right to prepare a response within up to 30 days, you can contact a medical organization to check the authenticity of the sick leave. The request form is free. An example of the wording can be found in the Ready-made solution from ConsultantPlus, having received trial access to the system for free.

What is an electronic form of a document?

The document has the same legal force as a regular paper certificate of incapacity for work. An electronic sick leave is generated in a database and certified with the digital signatures of a specialist, and, if necessary, the head of a medical organization or the chairman of a commission.

The patient does not receive an electronic certificate of incapacity for work. All information is reflected in a database, which can be checked by the employer, the Social Insurance Fund and the insured person himself.

How to reimburse the amount of excess expenses from the Social Insurance Fund

Regions that will soon join the Direct Payments project could still have an overpayment on the transition date—the cost of paying benefits exceeded the amount of insurance premiums. In this case, they have the right to receive reimbursement from the Social Insurance Fund for the amount of overspending or to offset it against upcoming payments.

To do this, the policyholder must contact the territorial office of the Social Insurance Fund at the place of registration for a refund and submit:

- an application for reimbursement or allocation of funds for the payment of insurance coverage for each type of insurance separately;

- a statement of calculation, which is submitted when requesting money for payment of insurance coverage or a 4-FSS report;

- copies of documents confirming the validity and correctness of expenses.

If you have taken advantage of the credit, keep track of its balance to avoid falling behind on contributions to VNiM.

Why is it necessary?

First of all, there are no queues. An electronic certificate of incapacity for work relieves the employee of the tedious wait for a paper form. The latter, as a rule, needs to be additionally certified by the office of the medical institution or related specialists.

Advantages of electronic sick leave over paper sick leave:

- no errors;

- there is no need to organize accounting and storage of paper forms;

- electronic sick leave cannot be lost or damaged;

- prompt receipt of information on the sheet for both the employer and the employee.

How can an employer view an email?

Let's now find out how to find an email for an employer. Today, all large and medium-sized employers are obliged to connect to a special Social Insurance Fund database, with which you can keep track of electronic slips.

At the same time, you need to understand that if an employee fills out an electronic form, the employer is obliged to fill out his part of the form using a computer after the employee of the organization is discharged from the hospital.

The electronic card also allows the employer to receive a compensation payment from the Social Insurance Fund for the employee, and the amount of financial assistance in the case of paper and electronic registration does not differ. In general, the procedure for filling out forms and receiving compensation is as follows:

- The employer enters into a special agreement with any regional branch of the Social Insurance Fund to provide access to the database.

- The employer registers in a special social insurance program called the Unified IIS “Sotsstrakh”. Accounting and registration of all electronic and paper documents is carried out in this program.

- The employer undertakes to train an accountant at his own expense so that he learns how to use the Social Insurance program. The law also allows you to hire an additional accountant who already knows the rules for using the program.

- After completing the training, an accountant must receive from some government agency (for example, the MFC) a special electronic signature, which will confirm electronic certificates about the employee undergoing treatment. The employer must bear all official expenses for registration.

- The design is ready. If a person has opened a certificate for undergoing treatment, then upon completion of treatment the employee is obliged to inform the accountant of a special code, which is the identification number of the certificate. After this, the accountant, using the Social Insurance program, finds the employee’s sheet and fills out his part of the certificate. Then he calculates and pays compensation for treatment within no more than 10 days after receiving the certificate, and also submits information about sick leave to the Social Insurance Fund - after some time, the employer receives monetary compensation for the person’s treatment from the Social Insurance Fund.

How the system works

When an employee goes to a medical institution for help, the doctor gives him a unique sick leave number. The employer's accounting can track all the data necessary for calculating payments.

Sick leave can be issued by specialists working in clinics, dispensaries and hospitals. Each doctor has his own unique electronic signature, through which he certifies the electronic signature.

Employees cannot receive forms of such a plan:

- ambulance services;

- Forensic Medicine Department;

- sanatorium institutions;

- blood collection stations.

Important! An employee has the right to refuse to issue an electronic certificate of incapacity for work in favor of a classic paper sick leave. To do this, you will need to write a corresponding application.

How to get an electronic sick leave

The insured person is given the opportunity to choose the form of sick leave. You should find out in advance about the possibility of an accountant creating an electronic document. Often unpleasant situations arise when an employee’s virtual certificate of incapacity for work is not accepted.

In such circumstances, the medical institution resets the electronic version and provides a paper version of the document. It is recommended to clarify in advance whether the policyholder can accept the virtual form of the document. If he is ready for this option, you can do without any difficulties.

Important!

It should be understood that using the FSS personal account and generating sick leave is the right of the policyholder, and not a direct obligation!

When filling out the document, the employee must provide written consent to the processing of personal information and the generation of a certificate of incapacity for work online. As a result, there is no need to confirm the document with the seals of the head physician and the registry.

The sick leave certificate acquires an identification code that allows you to quickly find the form in the FSS LC. After presenting it at your place of work or giving the code number to an accountant over the phone, it will quickly be found in the database.

Features of calculating payments on a certificate of incapacity for work

Regardless of the chosen format of the certificate of incapacity for work, the principle of its calculation does not change. Sick leave payments for the first three days are borne by the employer, while the rest of the period is paid by the Social Insurance Fund. But in some cases there are exceptions.

The Social Insurance Fund makes disability payments from the first day if the employee:

- in quarantine;

- cares for a family member;

- is undergoing further treatment in a health facility;

- is undergoing prosthetics.

Sick leave benefits are paid for all days specified in the document form. If during this time the employer did not accrue wages (disciplinary violations, suspension from work), then the payments are canceled.

The amount of the benefit depends on the actual length of service of the employee:

- production < 5 years – 60% of earnings;

- from 5 to 8 – 80%;

- after 8 – 100%.

The actual length of service is reflected in the work book. In case of loss of the latter, the terms are calculated based on certificates and contracts from previous employers. In the absence of these, the employee can contact the local branch of the pension fund, where, upon request, he will be given wage information on paper.

Average earnings are calculated taking into account income from the previous two years. The maximum amount for calculating benefits in 2021 is 1,680,000. It includes the bases of the two previous calendar years: 815 and 865 thousand for 2021 and 2019, respectively. The resulting average earnings are then divided by 730 to obtain the daily average.

For example , an employee received 650,000 in 2021, and 750,000 in 2021 with an actual work experience of 6 years. We add 650,000 + 750,000, divide by 730, multiply by the length of service of 80% and get 1,534 rubles. This is the amount of the daily allowance.

The resulting figure is multiplied by the number of days spent on sick leave, from which personal income tax should be subtracted.

That is, within 10 days, according to the document drawn up, the employee will receive:

- 650,000 + 750,000 = 1,400,000. Average earnings for 2021 and 2019.

- 1,400,000 / 730 = 1918. Average daily earnings.

- 1918 x 80% = 1534. Length of service.

- 1534 x 10 = 15,340. Number of days on sick leave.

- 15,340 x 13% = 1994. Personal income tax.

- 15,340 – 1994 = 13,346 rubles. Sick leave benefit for 10 days.

In some cases, sick leave payments are calculated according to the minimum wage (minimum wage), which for 2021 is 12,130 rubles.

Scenarios when payments are calculated according to the minimum wage:

- the employee did not have any earnings during the pay period;

- actual experience is less than six months;

- the employee’s monthly income is below the minimum wage;

- violation of hospital regulations;

- A certificate of incapacity for work was issued for disciplinary violations: alcohol, drugs.

If an employee was employed in two jobs at the same time (part-time work), then he needs to obtain two certificates of incapacity for work from a medical institution. Each employer must pay him benefits.

How to prepare for the transition to the Direct Payments project

To ensure that employees receive benefits on time, the employer needs to prepare for the Direct Payments project.

- Explain to employees the new procedure for paying benefits and the change in terms of receipt.

- Tell employees about ways to receive benefits: to a personal bank account, to a Mir card or by postal order. Ask them to open a personal account, order a card, or provide accurate information about their place of registration and place of residence.

- Collect applications for benefits from employees who are on parental leave (Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578). Prepare documents and registers of information on applicants.

- Submit to the Social Insurance Fund a list of recipients of monthly child care benefits who will continue to receive it after joining the pilot project. This must be done at least a month before the transition, that is, before June 1, if you join the pilot from July 1.

- Switch to electronic sick leave in advance.

- Implement or modify software for generating electronic registers. Get an electronic signature or check if your existing signature is suitable for submitting documents for benefits.

- Learn how to create registers and upload them to the FSS gateway in External test mode.

Please note that from January 1, 2021, payment of maternity benefits, monthly child care for a child up to one and a half years old, a one-time benefit at the birth of a child, as well as a one-time benefit for women registered in the early stages of pregnancy is carried out only on the MIR card "(letter from the Federal Social Insurance Fund of the Russian Federation dated July 5, 2019 No. 02-08-01/16-05-6557l).

How to track a payment

You can check the correctness of accrual of payments for temporary disability in your personal account on the FSS website. To access the data, you will need to register on the “Portal of State Services of the Russian Federation” at the address: www.gosuslugi.ru.

The resource has two account options – simplified and verified. To access FSS data, you will need the latter. To confirm your identity, you need a passport and SNILS. You can submit documents in person to one of the service centers, or undergo verification through an online client of one of the banks, or receive a registered letter from the State Services by Russian Post.

After authorization on the FSS website with a confirmed account, all resource tools will become available to the user. They also allow you to check the accrual of benefits payments: in the insured person’s account, select the “Temporary Disability Sheets” section, and then click on the desired ENL.

In your FSS personal account, you can get information on individual rehabilitation programs, providing technical equipment to those in need, stand in line for sanitary-resort treatment, and also get acquainted with information on benefits for accidents and occupational diseases.

It is also useful to read: How to find out your TIN using SNILS

Who can check the status of sick leave?

The reconciliation can be carried out by:

- FSS itself;

- employee of the enterprise. He is also the insured person;

- the medical institution that issued the sick leave;

- employer;

- doctors who conducted a medical and social examination to determine the disability group or extend sick leave beyond the prescribed period.

Data can only be obtained through your personal account. To do this, you need to complete a simple applicant registration form. Depending on the status of the inspector, access to your personal account will be different.

Legislative regulation

The unified form of sick leave was published in 2011 and enshrined in order of the Ministry of Health and Social Development No. 624n. According to Order No. 347n of the Ministry of Health, this form is printed documentation with a degree of protection under the index “B”.

Doctors working in hospitals, clinics and dispensaries have the right to issue certificates of incapacity for work. The document cannot be issued by employees of the following services:

- Ambulance;

- blood transfusion stations;

- sanatorium or other health-improving institution;

- forensic medical expert group.

With the adoption of Federal Law No. 86-FZ, it became possible to issue sick leave certificates electronically. Their verification is carried out using an electronic signature, which should exclude cases of forgery. However, a complete transition to this system did not occur. Therefore, checking the authenticity of a sick leave certificate never ceases to be relevant.

Paper, signs, seals: how sick leave is checked at work

All personnel officers know that the certificate of incapacity form was introduced by Order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n, and the rules for filling it out are contained in Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n. It follows from them that a traditional paper certificate of incapacity for work is a secure printing product, therefore it is made of special paper, has FSS watermarks, and the cells to be filled out differ in color. You also need to take into account that the number of the real sick leave is stamped in the printing house, so it can be felt with your fingers. If the sick leave certificate is fake, then the surface of the paper will be smooth and you won’t be able to feel the number to the touch.

Another important point is the presence of seals. Although businesses were allowed to refuse them, medical institutions are still required to certify with seals the certificates of incapacity and duplicates they issue. Without them, documents cannot be considered valid.

Also pay attention to text blocks. All information must be written down in black ink or printed. In this case, violation of the boundaries of the cells provided for in the form is not allowed. An exception is made only for seal impressions of medical institutions: they may be larger than the space allocated on the sheet. But they should not hide any information.