Tax authorities require full reporting from all business entities, including individual entrepreneurs. One of them is the income statement. It is important to remember that even in the absence of activity in the reporting period and in the case when there is no profit, each registered entrepreneur must provide zero 3 personal income tax for individual entrepreneurs . The rules for filling it out and the features of delivery will be discussed in this article.

What is a zero declaration

Officially, the Tax Code of the Russian Federation does not use the concept of “zero” for declarations, but in practice this concept is well known and is even mentioned in letters from the Ministry of Finance. Zero is called reporting in which there are no significant numerical indicators, for example, income of individual entrepreneurs or amounts of tax payable. Instead they are filled with dashes or zeros.

Not only declarations under the simplified tax system, but also for personal income tax, VAT, profit and other regimes where tax is calculated from income received can be zero. But there cannot be a zero declaration on UTII, because real income is not taken into account for calculating tax here. If there is a corresponding physical indicator on the imputation in the reporting quarter, tax will have to be paid.

There are no special forms for zero declarations for each regime. Reporting is submitted in the same form as declarations with significant numerical indicators. In addition, a single simplified declaration has been developed, which allows you to report the absence of taxable objects for several taxes at once. We'll tell you more about it below.

Which individual entrepreneurs are required to submit a personal income tax return?

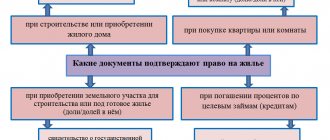

Not all entrepreneurs are required to report personal income tax. This needs to be done only for those individual entrepreneurs who apply the general taxation system. In addition, declaration 3 of personal income tax is mandatory for individual entrepreneurs on UTII if the entrepreneur has sold property or received income from operations that are not subject to the single tax. Similarly, a certificate 3 of personal income tax is required for individual entrepreneurs on the simplified tax system in case some situations arise. These include in particular the following cases:

- the entrepreneur received an interest-free loan from a third-party organization, provided that there were no other transactions with this organization (the situation is set out in the letter of the Ministry of Finance of Russia dated 08/07/2015 No. 03-04-05/45762). In this case, an individual entrepreneur using the simplified tax system receives material benefits from savings on interest, which, by virtue of the norms of the Tax Code of the Russian Federation, is not subject to a single tax, but specifically to the personal income tax.

- loss of the right to use the simplified tax system during the reporting year.

- receiving income from the sale of property as an individual and not as an entrepreneur.

Who must report on the zero declaration of the simplified tax system

A zero declaration under the simplified tax system for 2021 for individual entrepreneurs is required for the following situations:

1. An entrepreneur has registered, submitted a notice of transition to a simplified system, but is not engaged in business at all. In practice, this happens if individual entrepreneurs were registered only in order to pay insurance premiums for themselves and build up the length of service for calculating a pension.

2. An individual entrepreneur combines several tax regimes, for example, simplified tax system and UTII or simplified tax system and patent. And although he receives income from business, it is not within the framework of the simplified taxation system. This situation is more controversial, because there are a number of letters (dated October 10, 2012 No. 03-11-11/298), where the Ministry of Finance expresses a different point of view. In particular, if an entrepreneur combines the simplified tax system and UTII, but at the same time conducts activities only on imputation, then he does not need to report under the simplified regime.

In fact, in the case of combining regimes, it is still better to submit a zero declaration under the simplified tax system. In the same commented letter, the individual entrepreneur reports that he did not report under the simplified procedure for one year, because the tax office told him so. And the next year he was fined for failing to submit a zero declaration under the simplified tax system.

3. The simplifier has temporarily suspended business activities for the period of being on leave to care for a child under one and a half years old, a disabled person, an elderly person, or completing military service on conscription. These are the so-called grace periods for paying insurance premiums for yourself. And in order to prove not only these life circumstances, but also the lack of income, the simplifier must submit zero declarations.

A zero declaration under the simplified tax system must be submitted within the same time frame as the reporting of a working individual entrepreneur. Article 346.23 of the Tax Code of the Russian Federation sets the deadline for submission no later than April 30 of the year following the reporting year, i.e. 04/30/2021. For simplified LLCs, this deadline is a whole month earlier - no later than March 31.

Prepare a simplified taxation system declaration online

General rules apply

The businessman must submit the zero report within the same period as other obligated individuals - before April 30, 2017 (taking into account the postponement - May 2 inclusive).

Moreover: like a standard declaration, sample zero 3-NDFL 2021 for individual entrepreneurs can cause a fine if you miss the specified deadline. A delay of 10 business days will give tax authorities grounds to freeze the movement of money through a merchant’s bank accounts.

For more information about this, see “When is the deadline for submitting 3-NDFL for 2021.”

Composition of reporting

Zero reporting for individual entrepreneurs without employees includes only sheets of the annual declaration according to the simplified tax system for 2021. Entrepreneurs do not keep accounting records, so an accounting report is not submitted to the Federal Tax Service. Another plus for individual entrepreneurs is that they are not automatically recognized by employers as organizations. Registration as an insurer is carried out only after concluding an employment or civil contract with employees at the request of the employer.

If you did not conduct business and did not enter into such contracts, then you are not an insurer, so you do not submit reports for employees. You are also not required to submit reports on paying insurance premiums for yourself. It is only necessary to submit a zero report to the tax office for individual entrepreneurs at the place of registration (STS reporting for 2021), see the sample filling below.

Where to file the 3rd personal income tax return

Declaration 3-NDFL is provided at the place of your tax registration. This is considered the place of your permanent registration (registration in your passport). This is established by paragraph 7 of Article 83 of the Tax Code. Where exactly you received the declared income does not matter.

Example

Situation 1 You are registered in Moscow. You are renting an apartment located in Samara. The declaration must be submitted to the MOSCOW tax office (at your place of registration).

Situation 2 You are registered in Samara, but sold an apartment in Moscow. The declaration must be submitted to the SAMARA inspectorate (at your place of registration).

There is only one exception to this rule - if you do not have permanent registration in Russia (for example, you are homeless or a foreigner). In this case, you can submit a declaration at your place of temporary stay. There are situations when you do not have a place of temporary residence (for example, you live abroad, but receive income in Russia). The Tax Code does not provide instructions on how to submit a declaration in this case. Tax authorities recommend providing it at the location of the property (if you sold it or rent it out).

You can find out the number and address of your inspection using the Russian Federal Tax Service service. Here it is enough to indicate your address at the place of registration.

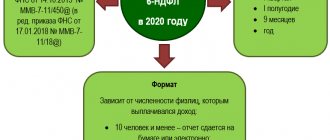

Reporting form

Note! In 2021, a new form of the simplified tax system declaration was approved, but the report for 2020 is still submitted using the old form. The new form is relevant for individual entrepreneurs and LLCs that cease operations after March 20, 2021.

The form of the annual declaration under the simplified tax system for 2021 was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] and is valid for reporting for the periods from 2015 to March 20, 2021.

If an individual entrepreneur’s zero reporting is submitted using an outdated form, it is considered not submitted. Of course, if you personally submit the report to the inspectorate, they will tell you that the form does not match, but if you sent the declaration by mail, you will assume that it was submitted, although this is not the case.

Before you fill out a zero declaration under the simplified tax system, please note that different tax objects (Income and Income minus expenses) have their own sheets. You only need to fill them out, not the entire form.

| USN Income | USN Income minus expenses |

| Title page | Title page |

| Section 1.1 | Section 1.2 |

| Section 2.1.1 | Section 2.2 |

| Section 2.1.2 (only for those who are registered as a trade tax payer) |

In addition, regardless of the simplified version, entrepreneurs who have received targeted funding fill out section 3.

Sections 1 and 2

The completed declaration 3-NDFL 2021 for individual entrepreneurs is zero, so it will not contain monetary and settlement indicators, but we still must fill out some fields of sections 1 and 2.

In section 2 , where the tax is calculated, the following is indicated:

- entrepreneur's TIN,

- FULL NAME.,

- Tax rate (line 001).

The remaining lines of the section (010-140) are marked with dashes.

In section 1 , despite the fact that 3-NDFL is zero, for individual entrepreneurs the 2021 sample will contain, in addition to the entrepreneur’s TIN and his full name, the following indicators:

- line 010 – set the code “3”, meaning no additional payments or personal income tax refund,

- line 020 – indicate the KBK valid in 2021 for the payment of income tax by entrepreneurs 182 1 0100 110,

- line 030 – OKTMO code is indicated in accordance with the OK 033-2013 classifier. The code indicates the territory of the municipality, and can consist of 8 or 11 digits.

Lines containing tax amounts (040-050) will have dashes.

Having filled out the declaration, all its sheets are numbered consecutively, each page is signed by the individual entrepreneur and the date of completion is indicated.

Filling procedure

It will take you no more than 15 minutes to prepare a zero declaration using the simplified system if you fill it out on a computer. Manually filling out reports is also allowed, but you will spend more time on this, because you need to write carefully, in capital block letters. In addition, if there is any inaccuracy, you will have to fill out the declaration again. No errors, omissions or corrections are allowed here. To fill out, you must use a pen with black, blue or purple ink.

Please note: the procedure for preparing a zero declaration can be significantly simplified and speeded up if you use a specialized online service.

Prepare a simplified taxation system declaration online

We will consider a sample of filling out a zero declaration for individual entrepreneurs without employees of the simplified tax system of 6 percent for 2021, as the most popular option. If you have the simplified tax system Income minus expenses, the declaration is filled out in the same way, only other sections are submitted (1.2 and 2.2).

Initial data:

- Individual Entrepreneur Akimov Vyacheslav Sergeevich

- Phone: 8 (495) 134-2021

- INN: 501207543208

- Tax authority at the place of registration: MRI Federal Tax Service of Russia No. 20 for Moscow Region (Balashikha) 5012

- OKTMO: 46704000

- Type of activity: Retail trade in non-specialized stores

- OKVED code: 47.19

- Hired workers: none

- Income for 2021 – 0 rub.

- The following must be completed: title page, sections 1.1 and 2.1.1. An individual entrepreneur is not a payer of the trade tax, because so far it is paid only in Moscow.

- The reporting period for the simplified version is the calendar year.

Follow the instructions for filling out our example, and you will pass your zero without any problems.

Title page

The table provides comments on filling out the title page:

| Line | Information to be entered | A comment |

| TIN | 501207543208 | The TIN is entered in full accordance with the certificate issued by the tax authority at the place of registration of the individual entrepreneur. |

| Correction number | 0— | If the primary declaration is submitted, the adjustment number is not indicated and the value “0” is entered in this cell. If a clarification is submitted, then its number is reflected in this field: 1-if the first, 2-if the second, etc. |

| Taxable period | 34 | Since the tax period for the simplified tax system is a calendar year, the value of this cell is always equal to 34. |

| Reporting year | 2020 | The indicated line reflects the year for which the individual entrepreneur is reporting. In our example, this is 2021. |

| Submitted to the tax authority | 5012 | This line indicates the code of the tax authority (the first 4 digits) with which the individual entrepreneur is registered and where the declaration under the simplified tax system is submitted. As a rule, the inspection number coincides with the first 4 digits of the registration certificate (TIN). |

| Taxpayer | Akimov Vyacheslav Sergeevich | Individual entrepreneurs in this block indicate line by line their last name, first name and patronymic. Please note that the phrase “individual entrepreneur” is not indicated in this block. |

| Economic activity type code | 47.19 | For this line, the individual entrepreneur must reflect the code of the main activity. Do not forget that starting with reporting for 2021, the declaration indicates the code according to the new OKVED-2 classifier (OK 029-2014 (NACE rev. 2)), even if you were registered according to OKVED-1. |

| Phone number | 8 (495) 134-2021 | The number indicated on this line must be valid so that if any questions arise, the inspection inspector can call it |

| Reliability and completeness... | 1 | 1 – if the reports are submitted personally by the individual entrepreneur 2 – if the declaration is submitted by a representative of the entrepreneur by proxy. In this case, the data of the representative (full name) and details of the power of attorney must be indicated in the lines below. |

Section 1.1

In this section, you only need to indicate the OKTMO code at the place of business. You can find out the code of your municipality on the Federal Tax Service or from a certificate with statistics codes. All other lines must be filled with dashes. At the very end of the sheet, do not forget to put the date when filling out the document and sign.

Section 2.1.1

In this section, only 5 lines are filled in:

- 102 – in which it is necessary to indicate whether the individual entrepreneur is an employer. If not, then the value “2” is entered in this cell; if it is, then “1”.

- 120-133 – according to these 4 lines, you need to indicate the size of the tax rate for the object of taxation. If the individual entrepreneur does not have a benefit that allows him to apply a reduced rate or if it is not established for the entire region, then write down the basic rate - 6.0.

As for lines 140-143, they are not filled in. Although a non-working entrepreneur still pays insurance premiums for himself, these payments are not reflected here. The wording for these fields is “the amount of insurance premiums that reduces the calculated tax,” and in the zero declaration there is no tax payable.

Tax reporting most often occurs during a personal visit to the Federal Tax Service. To receive an acceptance note from the tax preparer, bring two copies of the completed form with you. You can send it by mail with a notification and a list of the attachments, then one copy is enough. Proof of delivery will be a postal receipt and return receipt. If you have an electronic signature, then you can use it when submitting a report through TCS channels.

Free tax consultation

Comments

View all Next »

Alina 04/29/2015 at 05:46 pm # Reply

020 - indicate: object of taxation “income” - 182 1 05 01011 01 1000 110; object of taxation “income minus expenses” - 182 1 0500 110. And in the declaration: 020 this is “The amount of the advance payment due no later than the twenty-fifth of April of the reporting year p. 130 - p. 140 section. 2.1"

Olga 12/07/2015 at 02:08 # Reply

Good afternoon When filling out a zero declaration, the Russian language changes to symbols. How to fill it out correctly? Thank you

Natalia 12/07/2015 at 10:09 am # Reply

Olga, download in Excel format, I just checked, it is filled out in Russian.

Makism 03/07/2016 at 10:42 am # Reply

Hello! Can you help me if the declaration has not been filed for 4 years due to circumstances that the tax office does not understand (personal). How can I submit a zero declaration for all these years (the individual entrepreneur collapsed long ago, so there were no income or expenses, debts only accumulated in the pension). The tax filing date for all years will be fresh, that is, this year, but for all 4 or you need to register exactly the 13th year, 14th, 15th, 16th (that is, it turns out retroactively). And can you submit, for example, 1 declaration per year or will there be several of them per year (do you need to write down all the details quarterly)?

Natalia 03/08/2016 at 09:53 # Reply

Maxim, good afternoon. It is necessary to submit a separate declaration for each year, indicating in each of them the year for which it is submitted: 2013, 2014, etc., for 2021 it is still too early to submit. The simplified tax system declaration is submitted once a year until April 30 of the year following the reporting year. The filing date in each declaration is set to the date on which you will file. For each failed declaration, you will need to pay a fine of 1,000 rubles. If the declaration is zero, then there will be no penalty.

ALINA 03/12/2016 at 05:39 pm # Reply

Good afternoon. When filling out the simplified tax system declaration for 2015, the following picture is obtained: line 130=2310; str131=6210; str132=15990; p133=21210. Line 140=5568 (contributions to the Pension Fund); str141=11136; str142=16704; line 143=32272 (contributions to the Pension Fund + advance payment according to the simplified tax system). Accordingly, when calculating str020=-3258. What should I reflect on line 20 and how should I fill in all the other lines?

Regita 03/19/2016 at 12:47 # Reply

Hello. I have the following question for you: is it necessary to file a declaration if you were registered as an individual entrepreneur on 08/03/2015 and immediately after receiving the individual entrepreneur certificate, you filed an application for a patent, which was received only on 09/01/2015? There was no activity in August. Thank you.

Natalia 03/19/2016 at 01:57 pm # Reply

Regita, good afternoon. If you have not submitted an application for the application of the simplified tax system, if you have submitted an application for the PSN no later than 30 days after the date of registration of the individual entrepreneur, then you do not need to submit a declaration. If before submitting an application for the simplified tax system you submitted an application for the use of the simplified tax system, then you must submit a declaration of the simplified tax system by 04/30/2016. If the application for PSN was submitted by you after 30 days from the date of registration of the individual entrepreneur, this means that before receiving the patent you were registered on OSNO, therefore, you must submit 3-NDFL and a VAT return.

Elena 03/23/2016 at 10:04 # Reply

Natalia, good afternoon. And I have an almost similar situation. patent since February 2, individual entrepreneur registered since January 10. As I understand it, I need to submit a declaration - there were no activities in January, an application was written for the simplified tax system. So the question is: submit a zero declaration? or write for the whole of 2015 (there was a patent since February)?

Natalia 03.23.2016 at 14:15 # Reply

Elena, you need to submit a zero declaration for the entire 2015.

Albert 03/23/2016 at 08:44 pm # Reply

Which TIN should I put?

Hello! Tell me, please, is the tax authority’s TIN and KPP entered on all sheets or your own?

Natalia 03.23.2016 at 21:58 # Reply

Albert, good evening. You put your TIN on all sheets of the declaration, but the individual entrepreneur does not have a checkpoint.

Svetlana 03/24/2016 at 14:09 # Reply

Hello!

The individual entrepreneur had no activities, no income, the system produced income. Contributions to the Pension Fund were paid, do they need to be reflected in the declaration?

Natalia 03.24.2016 at 18:52 # Reply

Hello Svetlana! No, you do not need to report contributions on your return.

Tatyana 04/06/2016 at 09:52 # Reply

Hello. An LLC was opened in January 2021. simplified tax system 6%. No activity yet. You need to submit quarterly zero reporting. Please tell me which form to fill out.

Natalia 06/27/2016 at 16:59 # Reply

Tatyana, the simplified tax system declaration is submitted once a year, and not quarterly.

Elena 04/18/2016 at 12:34 pm # Reply

Hello. Please tell me if the individual entrepreneur did not conduct business, but paid expenses on the current account into the current account. How to fill out the declaration correctly. Income - expenses system. Thank you

Natalia 06/27/2016 at 16:56 # Reply

Elena, how to fill out the declaration correctly is written in the article to which you wrote a comment. If there is no income, put “0”. But you had to pay your contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund on time.

Svetlana 05/22/2016 at 01:30 pm # Reply

Where in your form 020 - indicate: the object of taxation “income” - 182 1 0500 110; object of taxation “income minus expenses” - 182 1 0500 110? You don’t have a line for KBK in your declaration!!! Neither in Excel nor in PDF

Natalia 06/27/2016 at 16:52 # Reply

Svetlana, good afternoon. The object of taxation is indicated in section 1.1, line code 001. BCC is not indicated in the declaration.

View all Next »

What is the penalty for failing to submit a zero declaration?

Although the reporting period for individual entrepreneurs on the simplified tax system lasts as long as 4 months, do not delay your visit to the inspection. At first glance, the fine for not filing a zero declaration is small - 1000 rubles. Moreover, Article 119 of the Tax Code of the Russian Federation provides for a more serious sanction for violating the deadline for submitting tax reports - from 5% to 30% of the amount of tax unpaid according to the declaration. And considering that there is no data on income in the zero declaration of the simplified tax system, then there is no arrears here.

But the fact is that if the delay in submitting reports exceeds 10 days, the Federal Tax Service has the right to suspend operations on the individual entrepreneur’s current account. Of course, this measure is not particularly effective if the entrepreneur’s business does not work or there is no current account at all.

It’s worse if an individual entrepreneur operates on a different taxation system and has a valid current account. Then an unsubmitted zero return under the simplified tax system will greatly complicate running a business, even if the entrepreneur reported on time under another tax regime.

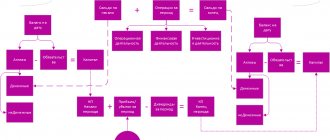

How to submit the 3rd personal income tax return

Declaration 3 personal income tax can be:

- submitted by you to the inspectorate in person (the day of its submission is considered the day of delivery to the tax authorities);

- sent by mail (the day of its provision is considered the day the declaration is handed over to the postal worker for sending)

- sent through the taxpayer’s personal account on the Federal Tax Service website (the day of receipt is considered the date of receipt of a special receipt from the tax authorities, which should appear in the personal account).

In the first case (when transferring in person), draw up a declaration in two copies. Give the first one to the inspectorate. The second one will remain with you. Request that the tax inspector accepting the declaration put a stamp on your copy indicating acceptance of the declaration indicating the current date.

In the second case (sending by mail), send the declaration by a valuable letter with a list of attachments and, preferably, with acknowledgment of delivery. Be sure to save the inventory (it is certified by the postal worker), the mailing receipt and the subsequently received notification (if the letter was sent with a notification). These documents will confirm the fact that the declaration was sent to the tax office and the date of such sending. Whether the tax authorities receive the declaration or not is not important. You have fulfilled your responsibilities. In this situation, the declaration is considered submitted to the tax office on the day it is handed over to the postal worker. This is provided for in paragraph 4 of Article 80 of the Tax Code.

If you need to document certain expenses, then copies of the necessary documents are attached to the declaration. Declaration 3 of personal income tax is submitted to the tax office (or sent by mail) along with them. Do not forget to indicate on the title page of the 3-NDFL declaration the number of sheets of the documents that are attached to it. For this purpose, on the title page of the declaration there is a special cell “... with the attachment of supporting documents or their copies on... sheets.” In addition, all documents attached to the declaration must be listed in the inventory (when sending documents by mail).

Single simplified declaration instead of the simplified tax system declaration

As we have already noted, instead of a zero declaration under the simplified tax system, you can submit a single simplified declaration. It only has one page, making it even easier to fill out.

But the fact is that you can pass the EUD only if two conditions are met:

- absence of an object of taxation (for the simplified tax system this is income from activities);

- lack of cash movements in the current account and cash register (in the case where an entrepreneur combines simplified taxation with another regime, this is hardly possible).

In addition, the deadline for submitting a single simplified declaration is 20 days after the end of the reporting period. For the annual declaration under the simplified tax system, this will be January 20.

So, if you did not know about this possibility, you can submit the EUD already for 2021, and for 2021 you must report using the usual simplified taxation system declaration form.