Bank, cash desk

Olga Yakushina

Tax expert-journalist

Current as of May 10, 2019

Insurance contributions to the Social Insurance Fund in case of temporary disability and in connection with maternity (VNiM) are paid by all employers. In order for the contribution amounts to be credited as intended, all document details must be accurately indicated. We will tell you how to correctly fill out a payment order to pay insurance premiums to the Social Insurance Fund.

FSS sample and fields Payments: accident, Payment on NS, pz

Insurance premiums are mandatory payments that organizations or individual entrepreneurs pay from their own funds for the social insurance of their employees.

In some cases, individual entrepreneurs are required to pay insurance premiums “for themselves” (clause 3 of article 8 of the Tax Code of the Russian Federation, article 3 of Law No. 125-FZ). The procedure for calculating and paying insurance premiums depends on the type of social insurance. Compulsory social insurance can be of the following types:

- pension insurance (“pension contributions” or “OPS”);

- insurance for temporary disability and in connection with maternity (“social contributions” or “VNiM”);

- health insurance (“medical contributions” or “CHI”);

- insurance against industrial accidents and occupational diseases (injury contributions).

In 2021, insurance premiums must be paid no later than the 15th of the next month after accrual. In 2021, the deadlines for paying insurance premiums are as follows:

- for December 2021 – 01/15/2018

- for January – 02/15/2018

- for February – 03/15/2018

- for March – 04/16/2018

- for April – 05/15/2018

- for May – 06/15/2018

- for June – 07/16/2018

- for July – 08/15/2018

- for August – 09/17/2018

- for September – 10/15/2018

- for October – 11/15/2018

- for November – 12/17/2018

- for December – 01/15/2019

Below we provide a breakdown of the main fields of the payment order that must be filled out in order to transfer insurance premiums in 2021.

In payment slips for contributions to the Federal Tax Service, companies put code 01 in field 101 “Payer Status”, individual entrepreneurs - 09. At the same time, code 09 is used by individual entrepreneurs in 2021 both when paying insurance premiums “for themselves” and when transferring funds for employees. Previously, tax authorities recommended setting code 14.

Code 08 is not needed for payments to the Federal Tax Service. It is used only when paying insurance premiums to the Social Insurance Fund “for injuries.”

The budget classification code is a mandatory payment requisite. It is reflected in field 104. The meanings of the codes are given below.

KBK for the Federal Tax Service

| Payment type | KBK |

From employee benefits | |

| Pension payments at a general and reduced rate | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Additional pension payments for workers engaged in hazardous work | |

| Contributions at an additional rate that does not depend on the results of the special assessment | 182 1 0210 160 |

| Contributions at an additional rate depending on the results of the special assessment | 182 1 0220 160 |

| Penalty | 182 1 0200 160 |

| Fines | 182 1 0200 160 |

| Additional pension payments for workers engaged in heavy or dangerous work | |

| Contributions at an additional rate that does not depend on the results of the special assessment | 182 1 0210 160 |

| Contributions at an additional rate depending on the results of the special assessment | 182 1 0220 160 |

| Penalty | 182 1 0200 160 |

| Fines | 182 1 0200 160 |

For temporary disability and maternity | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

For compulsory health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

Individual entrepreneur contributions for himself | |

| Pension | |

| Fixed contributions to the Pension Fund | 182 1 0210 160 |

| Contributions at a rate of 1 percent on income over RUB 300,000. | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Medical | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

| Payment type | KBK |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

The article contains all the current FSS KBK against accidents for 2018, examples of filling out payment orders, reference books that will help you in your work, and useful online services.

See other useful documents at the end of the article.

Check report

The 20-digit digital code KBK determines the type and purpose of non-cash payment contributed to the budget or withdrawn from the budget.

Legal entities and entrepreneurs enter the KBK in the 104th field of the payment card when making mandatory tax or non-tax payments in non-cash form.

This information helps the bank transfer the payment correctly - to the right budget and to the right administrator. In this regard, the KBK is a mandatory requisite.

Check KBK

Note: BCC 2021 for taxes can be found at this link

Payment orders to the Social Insurance Fund in 2021 for the transfer of insurance contributions to the Social Insurance Fund of the Russian Federation and the Social Insurance Fund are issued by payers when making payments from their accounts, in accordance with the rules established by:

- Regulations of the Central Bank of the Russian Federation dated June 19, 2012 N 383-P “On the RULES FOR FUNDS TRANSFERS”

- Order of the Ministry of Finance of the Russian Federation of November 12, 2013 No. 107n “On approval of the Rules for indicating information in the fields of payment documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation”

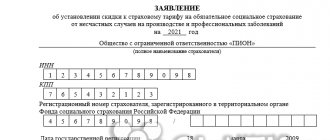

Below is a sample of filling out a payment form for the Federal Social Insurance Fund of the Russian Federation for insurance against industrial accidents and occupational diseases (injuries).

Note: In addition to contributions for “injury”

From 01/01/2017, the Federal Tax Service will administer the procedure for calculating and paying insurance premiums to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund.

Unified Social Insurance Fee - ESS - provisions relating to the collection of contributions are given in the new Chapter 34 of the Tax Code “Insurance Contributions”. Base for calculating insurance premiums; fee payers; object of taxation; The billing and reporting periods will remain unchanged.

More on the topic New MTPL form 2021 2020

When filling out the fields of the injury payment form, you must ensure that the following fields are filled out correctly. Read more about KBK FSS...

KBK for payment of insurance premiums to the Social Insurance Fund 2020

Details of the new cbk for payment of contributions in 2021 to the Social Insurance Fund (injuries) for organizations and individual entrepreneurs are given.

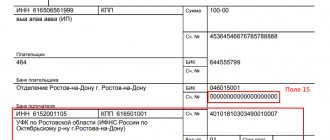

When transferring insurance premiums, indicate status 08 in field 101. Note: Taxpayer status codes

(60) – “TIN” of the payer, (102) – “KPP” of the payer - indicate the taxpayer identification number (hereinafter - TIN) of the payer and the reason for registration code (hereinafter - KPP) in accordance with the certificate of registration with the tax authority (Federal Tax Service of Russia);

(8) – “Name of the payer” – the name of the payer is indicated;

In this case, 14-17 categories of the KBK (income subtype code) are used for separate accounting of insurance premiums, penalties, fines and interest:

- 1000 – amount of insurance premiums;

- 2000 – amount of penalty for the corresponding payment;

- 3000 – the amount of the fine according to the legislation of the Russian Federation;

- 4000 – other receipts (if the payer fills out a payment document indicating an income subtype code different from the income subtype codes 1000, 2000, 3000, the Pension Fund of Russia body clarifies payments indicating the income subtype code 4000 in order to reflect them according to income subtype codes 1000, 2000 , 3000);

- 5000 – the amount of interest accrued in case of violation of the deadline for the return of insurance contributions for compulsory pension insurance and compulsory medical insurance, and interest accrued on the amount of excessively collected insurance contributions for compulsory pension insurance and compulsory medical insurance, on the corresponding payment.

In the payment field for ns and pz (105), the value of the OKTMO code of the municipality in whose territory funds are mobilized is indicated (the value of the territorial Office of the Pension Fund of the Russian Federation).

Note: 1. OKTMO codes

2. Correspondence table OKTMO and OKATO

Field (106) indicates the value 0 (ZERO).

Field (107) indicates the value 0 (ZERO).

Field (108) indicates the value 0 (ZERO).

Field (109) indicates the value 0 (ZERO).

Field (110) indicates the value 0 (ZERO).

In the “Code” detail, field (22) of the order for the transfer of funds, a unique identifier for the UIN accrual is indicated. The requirement to fill in the “Code” details applies to orders for the transfer of funds, the forms of which are established by Bank of Russia Regulation No. 383-P.

In the payment purpose field (24), additional information necessary to identify the purpose of the payment and the payer’s registration number in the FSS system of the Russian Federation are indicated. When issuing payment orders for the transfer of insurance contributions to social insurance, it is recommended to indicate the registration number of the payer in the territorial social insurance fund.

If the payment order for the transfer of insurance premiums indicates an accident or injury incorrectly:

- Federal Treasury account;

- KBK;

- name of the recipient's bank.

then the obligation to pay contributions is considered not fulfilled.

Note: Clause 7 of Article 26.1 of the Federal Law of July 24, 1998 No. 125-FZ.

Other errors do not prevent the transfer of money to the budget, which means they will not lead to the accrual of penalties. Such shortcomings include: incorrect TIN or checkpoint of the recipient.

Note: Legal entities - firms, employers, individual entrepreneurs for employees

Payment to the Federal CC of the Russian Federation for “injuries” Fill out payment forms for free in the accounting web service

for the payment of various payments to the Social Insurance Fund of the Russian Federation

Types of payments

For non-cash payment

When paying in cash at the bank

1. CONTRIBUTIONS – voluntary insurance in case of temporary disability and in connection with maternity (lawyers, notaries, entrepreneurs – for themselves)

2. CONTRIBUTIONS – insurance of employees against accidents at work and occupational diseases

3. PENALTY - for arrears in case of failure to pay the due date for insurance of employees against industrial accidents and occupational diseases

4. FINE – for violating the deadline for registration in the regional branch of the Fund

5. FINE – based on the results of the audit for understating the base for accident insurance premiums

At the same time, the status “14” was completely excluded from the rules for filling out payment orders, and this issue was put to rest.

However, if the payment order is filled out for payment to the Social Insurance Fund (for accident insurance contributions), “08” is written in field 101.

Sample payment order for payment of insurance premiums to the Social Insurance Fund

We have numbered each payment order detail and provide detailed recommendations for filling it out.

| Number | Props | Filling Features |

| 1 | Number | We indicate the date of completion and serial number of the payment order |

| 2 | Document date | |

| 3 | Payment type | Leave the field empty |

| 4 | Taxpayer status |

|

| 5 | Suma in cuirsive | We write all words in this field of the payment order without abbreviations. The value of kopecks is indicated in numbers. For example, “five rubles 12 kopecks” |

| 6 | TIN | We indicate the full name, INN and KPP of the payer as contained in the registration documents. In the electronic payment, the data is filled in automatically |

| 7 | checkpoint | |

| 8 | Name | |

| 9 | Amount in numbers | An example of writing an amount containing kopecks: 123-25 (one hundred twenty-three rubles 25 kopecks). Example of writing the amount without kopecks: 565= (five hundred sixty-five rubles) |

| 10 | Account number | We indicate the bank details of the premium payer (the policyholder). The bank's BIC always contains 9 characters, the current account and correspondent account - 20 each. The last three digits of the BIC coincide with the last three digits of the correspondent account |

| 11 | BIC bank | |

| 12 | Correspondent account | |

| 13 | Payer's bank | We fill out the paper document in accordance with the details of the payer’s bank. Data is entered automatically in the electronic payment |

| 14 | payee's bank | Contributions to VNiM are transferred to the territorial department of the federal treasury (UFK). In parentheses we additionally indicate the name of the tax office where the payer is registered. You can find out the details of your tax office on the Federal Tax Service website. |

| 15 | Recipient's TIN | |

| 16 | Recipient's checkpoint | |

| 17 | Recipient's name | |

| 18 | BIC of the recipient's bank | |

| 19 | Recipient's account | |

| 20 | Type of operation | Type of operation when transferring insurance premiums - “01” |

| 21 | Purpose of payment | Leave it blank |

| 22 | Code | Leave it blank |

| 23 | Payment due date | Leave it blank |

| 24 | Payment order | Budget payments have the fifth priority of payment |

| 25 | Res. Field | Leave it blank |

| 26 | Payment Description | We indicate the full name and month for which we pay insurance premiums. To facilitate the identification of contributions in case of errors in the KBK or OKTMO, we recommend indicating the registration number of the policyholder in the Social Insurance Fund system |

| 27 | Signature | The order is signed by the head of the organization or the entrepreneur whose signatures are indicated on the bank’s sample signature card |

| 28 | Bank mark | Payers do not fill out |

| 29 | Seal | Place for a seal imprint (if you use one) |

General for payment orders in 2021

To pay through the banking system of the Russian Federation, you must comply with the requirements of the relevant departments. The approved form of the payment order form is enshrined in Appendix 2 of the Regulations of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012. And in Appendix 3 of Regulation 383-P the meanings of payment order codes are indicated. The filling procedure is set out in Order of the Ministry of Finance No. 107n dated November 12, 2013.

Since 2021, there have been fundamental changes in the administration of contributions related to insurance by tax authorities:

- pension;

- medical;

- social in case of temporary disability and maternity.

Insureds form transfers for the corresponding insurance payments in the same way as taxes on wages and payments to individuals under contracts for work performed or services rendered.

Since 2021, Chapter 34 of the Tax Code of the Russian Federation “Insurance contributions” has come into force. As a result, there have been changes in reporting and other related regulations that govern this area. For example, Order of the Ministry of Finance No. 132n dated 06/08/2018 was introduced regarding the application of the BCC.

Payments administered by the tax authorities are transferred to the Federal Tax Service, and for accident insurance - to the Social Insurance Fund.

Sample payment order for compulsory health insurance (FFOMS 5.1%) in 2021

An example in case of temporary disability and in connection with maternity (FSS 2.9%) in 2021.

Below we provide a sample payment order for the payment of insurance pension contributions in 2021 (OPS). Payment for this type of contribution must be sent to the Federal Tax Service.

Below we provide a sample payment order for the payment of social contributions in 2021. These contributions are contributions for temporary disability and maternity insurance (VNIM). Payment for this type of contribution must also be sent to the Federal Tax Service.

Below we provide a sample payment order for the payment of insurance premiums for compulsory health insurance in 2021 (CHI). Payment for this type of contribution must also be sent to the Federal Tax Service.

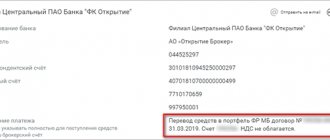

Recipient: UFK for Moscow (Governmental institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation)

More on the topic Automotive lawyers Ivanovo

INN 7710030933 Checkpoint 770701001

BIC of the recipient's Bank: 044525000

Recipient's BANK: Main Directorate of the Bank of Russia for the Central Federal District of Moscow (Abbreviated name - Main Directorate of the Bank of Russia for the Central Federal District)

Recipient's ACCOUNT NUMBER: 40101810045250010041

KBK 393 11700 180 – voluntary contributions from the entrepreneur

KBK 393 1 1600 140 – fine

KBK 393 1 1600 140 – administrative fine

...link...link

[rsya61]

An example of a payment order for injuries in 2021

The recipient of payment in 2021 for all types of contributions (except for contributions for injuries) are the tax inspectorates:

- at the address of the organization or its separate division;

- at the place of residence of the individual entrepreneur.

Fill out this field according to the rules prescribed in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. In the “Payment recipient” field, indicate the name of the Federal Treasury authority and the name of your Federal Tax Service in brackets. If you make a payment “for injuries”, then in brackets there will be an indication of the branch of the Federal Social Insurance Fund of Russia.

Below we give an example of a payment order for insurance premiums for insurance against industrial accidents and occupational diseases. Where to pay insurance premiums for injuries in 2021? As before, insurance premiums for injuries are administered by the Social Insurance Fund. This is where contributions payments need to be sent.

If the payment order for the transfer of insurance premiums contains incorrect payment parameters:

- Federal Treasury account;

- KBK FSS contributions 2020;

- name of the beneficiary bank of the regional branch of the social insurance fund.

then the obligation to pay contributions is considered

Other errors do not prevent the transfer of money to the budget; payment of contributions means they will not lead to the accrual of penalties. Such shortcomings include: incorrect TIN or KPP of the recipient

Note: Legal entities are employers of individual entrepreneurs paying for employees.

How to correctly fill out a payment order to the Federal Social Insurance Fund of the Russian Federation in 2021 in case of an accident? This is a very important question because if the money goes “by”, then the organization or individual entrepreneur will face penalties and fines.

Below is a form for a sample of filling out a payment order and a collection order in social insurance upon request to the Tax Service.

So, we examined the FSS KBK for personal injury and PZ penalties for insurance premiums to the FSS for the correct preparation of instructions for contributions.

Each type of payment administered by the Federal Tax Service has its own distinctive features. These include:

- KBK (sector 104 of the payment order) - it is individual for each type;

- payer status (sector 101) - depends on the organizational form of the payer and the type of transfer.

Let's take a closer look at an example of a payment order for insurance premiums 2021.

Step 1. At the top of the document, the status of the payer of the payment document is indicated. Filling out 101 fields is defined by adj. 5 Order 107n. Status in the payment slip for insurance premiums 2021:

- organizations indicate code 01;

- individual entrepreneurs - 09.

The number and date are also indicated. The transfer amount is indicated without rounding.

Step 2. Information about the payer and recipient, as well as the bank details of the parties, are filled out in the same way as for regular payments with counterparties.

Step 3. In sector 21 (“Priority”), indicate the values 3 or 5, depending on the order of the transfer by the bank: 3 - priority, 5 - in calendar order.

Step 4. Specify the BCC values determined by the payment and payment procedure.

This table will be useful for filling out.

Step 5. Sector 105 (OKTMO) is filled in in accordance with Order of Rosstandart dated June 14, 2013 No. 159-ST.

Step 6. In field 106 (“Base”) indicate:

- “TP” - current transfer;

- “TR” - when paying off debt at the request of the tax inspectorate.

Step 7. In sector 107 (“Tax period”), indicate the month and year for which the money is transferred.

Step 8. In the payment documents, at the request of the regulatory authorities, in fields 108 and 109 (document number and date), the details of the document on the basis of which you are making the transfer are duplicated. This could be a tax claim, arbitration awards, etc.

Step 9. Leave “Type” (field 110) empty, there is no need to fill it out.

Step 10. In “Assignment” (field 24) you indicate what transfers you are making and for what period.

Below are examples of payment orders for insurance premiums in 2020 to the Federal Tax Service.

If an organization is late in submitting reports on insurance premiums, the tax authorities will issue a fine in the amount of 5 to 30% of the amount not paid within the period established by the legislation on taxes and fees, but not less than 1000 rubles.

Since the report contains information about three types of insurance, the tax office in Letter of the Federal Tax Service of Russia dated 05.05.2017 No. PA-4-11/864 stated that the amount of the fine should be divided proportionally to the tariffs.

When paying a fine of 1000 rubles, you must transfer:

- RUR 733.33 — for pension payments (1000 / 30 × 22);

- 170 rub. — for medical payments (1000 / 30 × 5.1);

- 96.67 rub. — for social payments (1000 / 30 × 2.9).

There is another type of payment associated with violation of legal requirements - penalties. The procedure for filling out a payment for penalties does not differ significantly from a regular payment to the budget, but, as mentioned above, there are features for each type of transfer:

- Own BCC (field 104) - each contribution to the budget has an individual BCC for penalties.

- The basis (field 106) depends on the fact of determining a violation of legal requirements. Code “ZD” - calculated and paid independently. At the request of the tax office - code “TR”. And in the case of an inspection report - code “AP”. The list of field codes is given in Order 107n.

- Field 107 “Tax period” will depend on the basis of the payment. Codes “ZD” or “AP” in field 106 will correspond to code “0” in field 107. If penalties are transferred for a specific period, then the field indicates the period for which the transfer is made. If a penalty is paid on demand, field 107 shall indicate the period specified in the request.

Payments for insurance premiums in 2021 are a document by which the payer instructs the bank to transfer funds in accordance with the specified BCC.

More on the topic What is e-OSAGO and how to apply for it

In 2021, the Federal Tax Service continues to administer contributions from all organizations and individual entrepreneurs for compulsory pension insurance, compulsory medical insurance, as well as compulsory social insurance in case of temporary disability and in connection with maternity.

Let's try to figure out how to fill out payment orders correctly and what has changed in the order of their preparation.

ConsultantPlus TRY FREE

Get access

The basis for such changes was a new section of the Tax Code of the Russian Federation under number XI, “Insurance premiums in the Russian Federation” and chapter 34 “.

Payments for compulsory social insurance against industrial accidents and occupational diseases remained under the jurisdiction of the FSS. Their payment is made in the same way as in previous periods.

The passions over the misunderstanding regarding the status of the taxpayer have subsided: the Central Bank, the Ministry of Finance and the Federal Tax Service have agreed that the status in the payment for insurance premiums in 2021 for legal entities is indicated as “01”, when paid by an individual entrepreneur - “09”.

Payment period

This year, payment documents for the transfer of insurance premiums are processed within the same deadlines.

Insurance payments must be transferred to legal entities before the 15th day of the month following the reporting month. If this day falls on a weekend or holiday, the payment date is postponed to the next business day.

For example, in 2021, April 15 is Monday, therefore, there will be no postponements.

Other deadlines have been established for individual entrepreneurs:

- OPS from income up to 300,000 rubles. — until December 31, 2021;

- OPS for income above 300,000 rubles. - until July 1 of the year following the reporting year;

- Compulsory medical insurance - until December 31, 2021

When filling out payment orders, you must follow some rules.

- Regardless of what period the payments relate to, in 2019 payments for compulsory insurance are sent to the Federal Tax Service.

- The amount in bills for compulsory insurance is indicated in rubles and kopecks.

- Don't forget to indicate the period to which the payment relates! For legal entities, this is always a MONTH, the format is presented in the example of a payment for insurance transfers. To avoid mistakes, DO NOT COPY the previous payment. Create insurance premium payments anew each time and carefully fill out all the data, then carefully check in the printed form format, since otherwise you may miss, for example, an incorrect taxpayer status.

- Incorrect indication of the Treasury current account where payments are sent is a reason not to credit the money for its intended purpose. Be careful, use the sample payment slip for insurance premiums 2021 as a hint.

- Particular attention should be paid to field “104”, where the BCC is entered. These codes change quite frequently, so please make sure they are up to date.

In order to avoid mistakes when filling out the document, use the example of a payment order for insurance premiums 2021 shown below.

In 2021, when paying insurance premiums, it is necessary to use the new BCC.

For legal entities, when paying insurance contributions from employee salaries, the following codes are used:

- OPS - 182 1 0210 160;

- Compulsory medical insurance - 182 1 0213 160;

- compulsory social insurance in case of temporary disability and in connection with maternity – 182 1 02 02090 07 1010 160;

- compulsory social insurance against industrial accidents and occupational diseases - 393 1 02 02050 07 1000 160 (paid to the Social Insurance Fund).

According to subparagraph 2 of paragraph 1 of Article 419 and paragraph 1 of Article 430 of the Tax Code of the Russian Federation, an individual entrepreneur is obliged to pay contributions for compulsory health insurance and compulsory medical insurance. Individual entrepreneurs are not required to pay payments in case of temporary disability and maternity, but can do so on a voluntary basis.

The Tax Code clearly defines the amounts of transfers for compulsory medical insurance and compulsory health insurance. If a businessman’s income does not exceed 300,000 rubles, he will pay for the needs of the OPS:

- RUB 29,354 - in 2021;

- RUB 32,448 — in 2021

If the income exceeds 300,000 rubles, then in addition to the indicated amounts it is necessary to add 1% of the amount exceeding 300,000. The amount of deductions for mandatory pension insurance cannot exceed:

- RUB 234,832 — 2021;

- RUB 259,584 — 2021

As for fixed payments for compulsory medical insurance for individual entrepreneurs, they will be:

- 6884 rub. — 2021;

- 8426 rub. — 2021

Individual entrepreneurs must use the following codes:

- compulsory pension insurance (“for yourself”) - 182 1 02 02140 06 1110 160;

- medical insurance for an individual entrepreneur for himself - 182 1 0213 160.

Payment order: filling in the fields

When filling out the payment form, payers should be guided by Regulation No. 383-P, namely, Appendix 1, which provides a list and description of all document details. Let's consider which field in the payment order is intended for what, and how to fill it out.

Payment order - field codes 3 -7

- Fields 3 and 4 - payment number and date.

Numbers are listed in chronological order and should not contain more than six digits. The date is indicated in the format “DD.MM.YYY”.

- Field 5 “Type of payment”.

It may have the meaning “urgent”, “telegraph”, “mail”, or something else established by the bank, or not be indicated at all. For electronic payments, indicate the code set by the bank.

- Fields 6 “Amount in words” and 7 “Amount”.

In field 6, the amount is indicated in words with a capital letter, without abbreviating the words “ruble” and “kopeck” in the corresponding case. In this case, kopecks are indicated in numbers, for example, “One hundred rubles 21 kopecks.” Field 7 is intended to indicate the amount in numbers, with rubles separated from kopecks by a “dash” (for example, “258-60”). When the amount is expressed in whole rubles, kopecks may not be reflected in field 6, and in field 7 a “=” sign is placed between rubles and kopecks (for example, “258=00”).

Payment order – fields for payer details

- Field 60 “TIN” and 102 “KPP”.

The payer's TIN in field 60 is indicated by the legal entity and individual entrepreneur. From 01/01/2021 In the “TIN” field, taxpayers who are foreign organizations and individuals who are not registered with the Russian Federal Tax Service can indicate a zero value when paying non-tax payments (Order of the Ministry of Finance No. 199n dated 09/14/2020). And from July 17, 2021, when transferring funds withheld from an individual’s income to the budget to pay off his debt, the TIN of this individual must be indicated in field 60.

The checkpoint in field 102 in the payment order reflects only the legal entity. Individual entrepreneurs indicate “0” instead of checkpoint.

- Field 8 “Payer”.

Legal entities indicate their name (full or abbreviated), and individual entrepreneurs indicate their surname, first name, patronymic (in full), and the status “(IP)” is indicated in brackets. When transferring payments to the budget, including tax payments, the individual entrepreneur additionally indicates his address at the place of residence or stay, highlighting it with a “//” sign on both sides. For example: “Ivanov Ivan Ivanovich (IP) //g. Moscow, st. 9th Parkovaya, 120, apt. 15 //" (clause 4 of Appendix No. 1 to Order of the Ministry of Finance No. 107n dated November 12, 2013, as amended on April 15, 2017).

- Fields 9 “Payer’s account”, 10 “Payer’s bank”, 11 “BIK”, 12 “Account. No."

Field 9 is intended to indicate the payer's 20-digit bank account number.

The name of the bank in which the payer’s account is opened (field 10) and its BIC - a nine-digit bank identification code (field 11) are also indicated. The payer's bank correspondent account consists of 20 characters and is reflected in field 12.

Payment recipient details - assignment of fields in a payment order

- Field 13 “Recipient's bank”.

The name of the payee's bank is reflected here.

Note! When filling out payments for the transfer of taxes from 01/01/2021, in this field after the name of the bank, the name of the treasury account should be indicated through the “//” sign. For example: “Barnaul branch of the Bank of Russia // UFC for the Altai Territory, Barnaul.”

- Field 14 "BIK".

The corresponding BIC of the payee's bank is indicated.

Note! When transferring tax payments from 01/01/2021, you must indicate the new BIC values of the recipient's banks.

- Field 15 “Account. No."

In general, the correspondent account number of the recipient's bank is indicated here.

Note! When transferring payments to the budget, this field remained empty until 2021. But from 01.01.2021, when paying taxes, a new detail must be indicated in field 15 - the recipient’s bank account number, which is part of the single treasury account (TSA).

- Field 17 “Act. No."

The recipient's bank account number.

Important! For budget payments from 01/01/2021, new treasury account numbers must be indicated in this field.

All of the above changes applied when filling out payment slips for the transfer of tax payments from 01/01/2021, as well as new details of treasury accounts and TSA accounts are given in the letter of the Federal Tax Service dated 10/08/2020 No. KCH-4-8 / [email protected]

- Fields 16 “Name of recipient”, 61 “TIN”, 103 “KPP”.

The name of the recipient of the money is indicated by analogy with the name of the payer: for legal entities - full or abbreviated name, for individual entrepreneurs - full name. completely and “IP” status. For example, “Start LLC”, “Mikhail Petrovich Alexandrov (IP)”.

When paying tax payments, in field 16 enter the name of the corresponding Federal Tax Inspectorate, and in brackets - the corresponding administrator of budget revenues (IFTS, extra-budgetary fund). For example, “Office of the Federal Treasury for Moscow (Inspectorate of the Federal Tax Service of Russia No. 43 for Moscow).”

Payment order - fields with decoding 18-23

- Field 18 “Type of operation”.

The code for the payment order is indicated here – “01”.

- Field 19 “Payment due date” is not filled in.

- Field 20 “Payment purpose code”.

Typically, field 20 in the payment order was not filled in. But from June 1, 2020, it is necessary to indicate one of three codes intended to indicate the type of income of an individual, in accordance with Directive of the Central Bank of the Russian Federation No. 5286-U dated October 14, 2019. In field 20 of the payment order in 2021 and beyond, enter the following value:

- “1” - when transferring wages, vacation pay, bonuses, sick leave, financial aid, severance pay, as well as payments to individuals under GPC agreements, etc. payments, penalties for which are limited in the amount of 50%-70% (Article of Law No. 229-FZ of October 2, 2007);

- “2” - for payments that cannot be collected, i.e. alimony, maternity leave, etc. (Article 101 of Law No. 229-FZ);

- “3” - payments transferred in connection with compensation for harm to health and state compensation in connection with man-made and radiation disasters, from which it is possible to recover only alimony for minors and compensation for damage in connection with the death of the breadwinner (clause 1, 4 clause 1 Article 101 of Law No. 229-FZ).

You can find a sample of filling out a payment order here.

- Field 21 “Payment order”.

The priority is indicated by the corresponding number from 1 to 5. According to the provisions of the Civil Code of the Russian Federation (Article 855), the priority in field 21 is indicated by the following codes:

- “1” - if the payment order transfers alimony, amounts of compensation for harm to life/health according to the executors;

- “2” - transfer of severance pay, royalties, wages according to executive lists;

- “3” - payment of wages under employment contracts, payment of taxes and insurance contributions as required;

- “4” - other payments under executive documents;

- “5” - voluntary payment of taxes and insurance premiums, settlements with counterparties and all other transfers.

Field 22 in the payment order - “Code”

In this field you should specify one of the identifiers, consisting of 20-25 digits:

- UIN (unique accrual identifier) - for settlements with the Federal Tax Service and funds for debts, fines, penalties. The code is assigned by the department in the corresponding payment request. If the code is not assigned or the payment to the budget is not made upon request (for example, when paying current taxes), “0” is indicated in the UIN field in the payment order;

- UIP (unique payment identifier) – for settlements of non-budgetary payments. The code is assigned by the organization receiving the payment and is communicated to the payer if such a condition is provided for in the contract. When the UIP is not assigned, the value “0” is also indicated in field 22 in the 2021 payment order.

You cannot leave the code field empty in the 2021 payment order.

- Field 23 “Reserve field” - not filled in.

Tax fields in a payment order

The fields of the payment order indicated below in 2021 must be filled in when transferring taxes, insurance payments, state duties, penalties, and fines to the budget.

- Field 101.

In the 2021 payment order, this field indicates the status of the person making the transfer, in accordance with the appendix to the Order of the Ministry of Finance No. 107n dated November 12, 2013 (as amended on April 5, 2017), for example:

“01” - payment is made by the taxpayer-legal entity;

“02” – tax agent payment;

“08” - transfer of insurance premiums for “injuries” to the Social Insurance Fund by legal entities and individual entrepreneurs;

“09” - the transfer is made by the individual taxpayer;

“10” – taxpayer-private notary;

“11” - taxpayer-lawyer, etc.

- Field 104.

The payment order reflects the 20-digit budget classification code (BCC) established for each type of tax, insurance premium, penalties, fines for them, etc. For 2021, the BCCs were approved by Order of the Ministry of Finance No. 99n dated 06/08/2020. If the code is entered incorrectly, the payment will go to the budget, but the payer will be required to clarify the payment so that it is credited as intended.

- Field 105.

In the payment order, field 105 is intended to indicate the OKTMO code. The code consists of 8 or 11 digits and indicates the corresponding territorial entity. A taxpayer can find out the OKTMO code from his Federal Tax Service or using a special service on ]]>FIAS website]]> by indicating his address in the search form.

- Field 106.

In the 2021 payment order, this field indicates the letter code of the basis for the tax payment. All codes are given in clause 7 of Appendix 2 to Order of the Ministry of Finance No. 107n dated November 12, 2013. In particular, in field 106 in the payment order indicate:

“TP” - for payments of the current year;

“ZD” - in case of voluntary repayment of debt for expired periods without the requirement of the Federal Tax Service;

“TR” - repayment of debt at the request of the tax authorities;

“PR” - payment of debt suspended for collection;

“AP” - payment of debt according to the inspection report;

“AR” - the debt is repaid according to a writ of execution, etc.

From 10/01/2021 the list of codes will be reduced: in particular, the codes “TR”, “PR”, “AP”, “AR” will be excluded, and instead of them the code “ZD” will be indicated - debt repayment (including voluntary ) for past periods. At the same time, excluded codes will be used as part of the document number in field 108.

- Field 107.

In the payment order, field 107 is intended to indicate the tax period for which the payment is made. The indicator has the format “xx.xx.xxxx”, where:

- the first two characters indicate the frequency of payment (“MS” - month, “QV” - quarter, “PL” - half-year, “GD” - annual),

- the second two characters are the serial number of the month, quarter, half-year. For annual payment indicate “00”,

- last 4 digits – reporting year.

For example, field code 107 in a payment order for 2021 may look like this: “MS.05.2021” - payment of tax or insurance premiums for May 2021, “KV.03.2021” - payment of tax for the 3rd quarter of 2021, “GD.00.2020” » - the tax is paid based on the results of 2021.

An exact date can also be entered in the tax field 107 in the payment order, for example, the date of tax payment according to the installment plan (code “RS” in field 106), the deadline for deferred payment (code “OT” in field 106), etc.

- Field 108 and field 109.

In the payment order, field 108 is reserved for indicating the document number - the basis for the corresponding payment, and field 109 - for the date of this document. For example, when paying arrears at the request of the Federal Tax Service No. 12345 dated 11/02/2020, “12345” and “11/02/2020” will be indicated in these fields, respectively. For current tax payments, “0” is indicated in field 108, and in field 109 the date of signing the corresponding declaration/calculation is indicated.

Note! From October 1, 2021, this procedure will change. Field 108 in the 2021 payment order (from October) when repaying debts for expired periods, i.e. when “ZD” is indicated in field 106, it must be filled out in a new format, including:

“TR0000000000000” – number of the Federal Tax Service’s request for payment of taxes, fees, and insurance premiums;

“PR0000000000000” - decision number when suspending collection;

“AP0000000000000” - number of the decision to prosecute/refuse to prosecute for a tax offense;

“AR0000000000000” - number of the executive document (production).

At the same time, the date of the specified documents will be entered in field 109 in the 2021 payment order.

- Field 110 of the payment order in 2021 (payment type) is not filled in.

Field "Purpose of payment" in the payment order

To decipher the purpose of the payment, field 24 is intended. If the payment is not made to the budget, indicate here the name of the goods (services) being paid, details of the relevant agreement, sales documents, invoices, etc., as well as the amount of VAT (or indicate “VAT not subject to” ). For example, “Payment for building materials under supply agreement No. 23 dated October 25, 2020. Incl. VAT 20% - 65200-00", "For rent in February 2021, VAT is not assessed."

From 06/01/2020, field 24 in payment slips for the transfer of wages and other payments to employees from whom the employer has made deductions according to executive documents is specially filled in: first write the name of the payment, then - to whom and for what period it is made, then put the sign “//” , the abbreviation “VZS” and again “//”, the amount withheld and the sign “//”. For example, payment of wages after deduction of alimony in the amount of 7,800 rubles. will be reflected in field 24 as follows: “Transfer of wages for January 2021 to Petr Sergeevich Ivanov//VZS//7800-00//.”

When paying taxes, insurance premiums, fines, penalties, etc. The payment field in the payment order must contain a brief explanation of the transferred amount, for example: “Organizational property tax for 2020”, “Personal income tax on wages for January 2021”, “Insurance contributions for compulsory pension insurance for the payment of insurance pensions for March 2021.”

Fields 43 and 44

The fields are filled in when submitting payments on paper. In field 43, the payer's seal (if any) is affixed, according to the sample stated on the bank card. Field 44 is intended for affixing signatures by authorized persons of the payer - they must match the signatures on the sample signature bank card.

Details of the Social Insurance Fund Moscow 2021 official website Contributions for compulsory social insurance

Have the BCCs changed for contributions to the Social Insurance Fund in 2021? There were no changes to the social insurance codes left as in 2021 Below is the List of income classification codes (KBK FSS) also reserved by the Ministry of Finance of the Russian Federation to reflect payments to the FSS of the Russian Federation for organizations and individual entrepreneurs.

| KBK number | Purpose of transfer |

Insurance against injuries at work and occupational diseases | |

| 393 1 0200 160 | Insurance premiums for employees for “injuries” |

| 393 1 0200 160 | KBC for paying penalties to the FSS from the National Tax Service in 2021 |

| 393 1 0200 160 | Fines - amounts of monetary penalties |

Deadlines for payment and tariff of insurance contributions to the Social Insurance Fund

The tariff for the Social Insurance Fund is 2.9%. If the total amount of accruals to an employee exceeds 865,000 rubles from the beginning of the year, the rate of contributions to the Social Insurance Fund for VNiM changes to zero.

For insurance contributions to the Social Insurance Fund, the deadline for transferring to the budget is set until the 15th day of the next month inclusive. If the deadline for payment falls on a holiday or weekend, the deadline is postponed to the first nearest working day (Article 6.1 of the Tax Code of the Russian Federation).

Read more about the deadlines for paying insurance premiums in 2021 here.