The year in which the tax deduction began to be used is the 365 days for which the individual applying for a reduction in the tax base declared income tax compensation for the first time in the declaration. Why this term was invented, how to correctly determine this year, as well as where to indicate it in the 3-NDFL form and how to fill out some other fields on the same page will be explained in the article.

- Download the blank 3-NDFL form for free here.

- See an example of a declaration here.

- Use the program for 3-NDFL by going here.

Filling out 3-NDFL

When planning to independently fill out a declaration in form 3-NDFL, taxpayers with little experience in this matter are faced with a bunch of questions.

This article will help you answer some of them. Let’s figure out what needs to be indicated in 3-NDFL in the column “year of start of using the deduction.” But before that, let’s remember what the 3-NDFL document and the tax deduction itself are.

A declaration in form 3-NDFL, as one of the types of documentary report, contains information about the financial movements of the taxpayer during one year.

The report is not allowed in free form, but has a strictly defined form by order. 3-NDFL includes the following main features, features and characteristics.

- The front sheet contains digital encoding about the tax authority where the document is submitted, the tax period marked, plus information about the taxpayer according to the passport.

- The section on tax calculations following the front sheet indicates the status of the tax: payable to the budget, subject to return to the taxpayer, or the absence of both. The section also contains KBK and OKTMO numbers.

- The general calculation of the tax base, as the actual amount of the taxpayer’s financial income and the tax paid on it, is another section of the declaration in form 3-NDFL.

- Sources of income are an integral part of the report. This is subject to mandatory indication with the amounts and types of income (salary, bonus, profit from individual activities, etc.). For each type of income there is a corresponding form to fill out, which is called in capital letters of the Russian alphabet A, B, C, or G.

- A type of tax deduction, also subject to a detailed description on forms specially created for this purpose. These are sheets D1, D2, E1, E2, F, Z, I.

The 3-NDFL declaration, as already mentioned, may contain distinctive features, depending on the purpose of filing the declaration with the Federal Tax Service and the subject that caused this need. More specifically it could be:

- Declaration of amounts of financial income and taxes withheld from them. Declaration 3-NDFL may have characteristic features depending on the subject of the declaration: rental of housing, sale of property, individual entrepreneurship, etc.;

- refund of overpaid tax, in other words, tax deduction. It is also divided into several types: standard, social, property.

Thus, we come closer to an integral part of the topic of the article - tax deductions. This is income tax paid by the taxpayer in the time and manner prescribed by law. Upon expiration and closing of the financial year, a person who has paid all taxes in good faith has the right to return all or part of this amount.

This right arises when a citizen performs certain actions. These actions include:

- tuition payment;

- payment for treatment;

- buying a home;

- birth of children;

- receiving benefits.

An important point in a citizen’s presentation of his right to the Federal Tax Service for the return of a tax deduction by filing a 3-NFDL declaration is: the closure of the past financial year. That is, if you have not yet paid all due taxes for the current year, then you cannot claim their refund.

In short, it means the first annual period in which a tax deduction from the budget was returned to the taxpayer.

In more detail, we should start from the tax deduction return rule. Buying or building a home is always an expensive expense. And often the amount to be refunded is several times greater than the tax actually paid by the citizen for the past year.

That is, submit 3-personal income tax for property deductions every year until the due amount is fully repaid. This method of partial payment of a tax deduction is referred to as a “reduction of the tax base.”

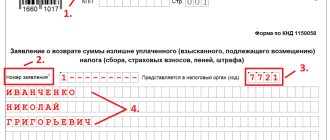

Clause 1.11, indicating the year in which the deduction began to be used, must be completed in the declaration in Form 3-NDFL in the specially designated sheet D1.

To make this more transparent, let’s give a small example. The moment of registration of ownership of the apartment occurred in 2014, and already in the following year, 2015, the citizen filed his first declaration. This means that when re-drawing declarations in 2021, 2017 and subsequent years, the year 2015 is entered in the “year of start of using the deduction” window.

The concept of “the year the deduction began to be used” seems simple at first glance, but many taxpayers who fill out the 3-NDFL declaration on their own are wondering what year is meant in this context. In order to avoid making mistakes and correctly indicate the information in the form, you need to develop an understanding of this definition.

How to correctly fill out the remaining lines of the declaration

The standard form contains 19 sheets.

The data is entered by the interested party independently:

Filling out the 3-NDFL declaration additionally depends on the type of property being sold:

Making corrections to the finished copy is not permitted, as is fastening sheets - this may interfere with the ability to read the barcode. All amounts are written only in Russian rubles. An indicator of less than 50 kopecks is rounded down (and vice versa). All expenses incurred are confirmed using the attached documentation.

Printing of sheets is allowed only on one side. Mandatory fields must be filled out to make a future tax deduction. Entering information manually is possible using a dark pen. Printed and capital characters are used. You need to start entering information from the leftmost cell.

If there is no data, you must put a dash in the space provided. If the applicant wishes to generate the form on a computer, then he needs to align the numerical values to the last line. Dashes are not required.

Each declaration is made in two copies. One of them is transferred to the Federal Tax Service official for processing, and the second remains in the hands of the payer, taking into account the reflection of the inspection officer’s note on acceptance. Each page contains a resolution from the direct applicant or from a notary participating in the process.

Sample of filling out form 3-NDFL when purchasing an apartment:

Property deductions when selling property

If an individual receives income from the sale of property, then the amount of this income is subject to taxation. But the state provides deductions that you can take advantage of, thereby reducing the tax or completely avoiding paying it.

Tax is paid on the sale of property acquired before 01/01/2016 and owned by:

- less than 3 years - these are residential houses, apartments, rooms, dachas, garden houses, land plots or shares of the specified property. The deduction is provided in the amount of 1 million rubles.

- other property owned for less than 3 years. The deduction is provided in the amount of 250 thousand rubles. Tax is paid on the sale of property acquired after 01/01/2016 and owned by:

- less than 5 years - these are residential houses, apartments, rooms, dachas, garden houses, land plots or shares of the specified property. The deduction is provided in the amount of 1 million rubles.

- other property owned for less than 3 years. The deduction is provided in the amount of 250 thousand rubles.

If the above-mentioned property is owned for more than the specified period, upon its sale there is no object for taxation, and accordingly, no tax is paid.

Trying to avoid paying taxes, individuals resort to various tricks, underestimating the transaction amount in sales contracts. In connection with this, Federal Law No. 382-FZ of November 29, 2014 amended the Tax Code of the Russian Federation, which entered into force on January 1, 2016. According to the changes, if the amount under the purchase and sale agreement is less than 70 percent of the cadastral value of the real estate object being sold, then 70 percent of the cadastral value is taken to calculate the tax.

When filing a return, an individual can reduce taxable income by the amount of documented expenses if transactions from the purchase and sale of the same object occurred during the same tax period.

Another feature is tax deductions for the sale of houses and land plots on which these houses are located. If you are selling a plot of land with a house and this is all indicated in one purchase and sale agreement, a deduction in the amount of 1 million rubles is provided for one agreement, the land and the house will be taken into account as one object. If there are two purchase and sale agreements, one for a residential building and the second for a land plot, then a deduction of 1 million rubles will be provided for each object sold. When selling other property owned for less than 3 years, a deduction in the amount of 250 thousand rubles is provided, but in these cases it is more reasonable to take advantage of the deduction for the costs of acquiring this property, since it is not limited in time.

The deadline for filing declarations and paying taxes on the sale of property is limited. The declaration in form 3-NDFL must be submitted before April 30 of the year following the year of transactions with property. The tax payment deadline is July 15 of the year of filing the return. Penalties and fines for failure to submit returns and failure to pay taxes are large. Situations in property transactions are different. In order to avoid paying penalties and fines, it is better to seek advice from a tax specialist and do everything on time. The year ends, and with the beginning of the new year the declaration campaign begins. I would like everyone to take maximum and full advantage of the benefits provided by the state in the form of tax deductions, file returns on time, return overpaid taxes and pay mandatory taxes.

Submission deadline

After the specified time has expired, the right to deduction automatically ceases to apply. The countdown begins from the date when the individual spent the funds.

| Social compensation | If a citizen spent money on insurance of his own health or life, then the tax can be returned within 3 years. A similar condition is established for those persons who have made expenses for charitable and medical purposes. |

| Compensation for property | The Federal Tax Service does not provide time limits for the corresponding accruals. You can return your personal income tax at any time, but no more than once in your entire life. |

| Classic throwback | Intended to reduce the tax base. Valid for young parents. The right is granted from the first month of the child’s birth. |

| Professional Indemnity | Individual entrepreneurs and citizens engaged in private practice must deduct the tax paid by April 30 of the year that follows the reporting period to the Federal Tax Service. |

When is the tax deduction applied?

Citizens of the Russian Federation who are officially employed and make income tax deductions can count on a tax deduction. This category does not include individual entrepreneurs. Receiving a tax deduction means that the employee will not be charged income tax or the personal income tax paid earlier will be returned.

If a citizen works unofficially or is unemployed, he cannot count on a tax deduction.

Payers who have carried out transactions in the following categories can count on a tax deduction:

- Purchase of an apartment or other residential real estate (their share);

- Purchase or construction of a private home;

- Purchase of land;

- Reimbursement of costs associated with paying interest on a mortgage loan;

- Reimbursement of interest costs on a refinanced mortgage loan.

Obtaining a tax deduction is not possible when purchasing real estate with the help of government benefits (maternity capital, “military mortgage”, “young family” program, etc.).

The deduction can be received after submitting a declaration according to f. 3NDFL to the Federal Tax Service. The deadline for filing a tax return is defined as: within 365 days of the next calendar year after the transaction. You can submit a declaration within 3 years, so the question often arises about the initial year of using the deduction.

For example:

The apartment was purchased in 2021, i.e. the payer will be able to file a tax deduction return throughout 2021.

The deadlines for filing a declaration for other reasons should not be confused. If additional income is received, the declaration is submitted in the 1st quarter of the year following the transaction, the tax must be paid by July 15 of this year.

Features for a pensioner

All tax payers, including persons of retirement age, are subject to a single condition, according to which the right to make a deduction arises from the year of receipt of the official certificate of ownership or transfer deed (after purchase under an agreement on shared participation in construction work).

There are two possible situations. Under the first, the refund is carried out for an employed pensioner, and under the second, for persons who do not have a job and receive social security on a monthly basis.

Deduction for treatment and purchase of medicines

The deduction is provided in the amount paid by the taxpayer during the calendar year for medical services provided by medical organizations and individual entrepreneurs engaged in medical activities and having the appropriate licenses, as well as in the amount of the cost of drugs for medical use prescribed by the attending physician or purchased by an individual at his own expense.

You can use the deduction both for your own treatment and for the treatment of your spouse, parents, your own and adopted children under the age of 18, and children under guardianship under the age of 18. The type of treatment must be named in a special list (Resolution of the Government of the Russian Federation of March 19, 2001 No. 201).

The deduction amount cannot exceed 120 thousand rubles. Expenses for expensive medical treatment are also included in this category of deductions. The list of medical services and medications for expensive treatment is also approved by the Government of the Russian Federation. The list includes expensive medical services for surgical treatment, transplantation, therapeutic and complex treatment, nursing of premature babies, IVF, etc. There are no spending restrictions. The deduction is provided in the amount of actual expenses incurred for these medical services, but not more than the taxpayer’s taxable income for the calendar year. If a taxpayer wants to take advantage of a deduction for the treatment of close relatives, then all documents (agreement, payment receipts) must be issued for him, and not for relatives receiving paid medical care. The wording in the documents should be as follows: “The agreement was concluded with Ivanov for the provision of medical services.

The deduction can be used in any of the three ways described above. The list of documents required to confirm expenses for treatment is exactly the same as for education. When paying for expensive treatment, you must additionally provide a certificate from a medical organization or individual entrepreneur stating that the treatment falls under this category.

Social tax deductions, with the exception of deductions for expensive treatment and education of children, are provided in the amount of actual expenses incurred, but in total no more than 120 thousand rubles for the tax period. The fixed amount for the education of children, which can be used to receive a deduction, is 50 thousand rubles. Deductions for expensive treatment are applied in the amount of expenses actually incurred, within the taxable income of the taxpayer, there are no restrictions.

Column location

There are two ways to submit a return to receive the deduction:

- Online. On the Federal Tax Service website through the taxpayer’s Personal Account, it is possible to automatically generate a 3-NDFL declaration by filling out the required form. Or upload an electronic document.

- On paper. When entering information into a printed form, the applicant must be careful - use only a ballpoint or fountain pen, blue or black, do not go beyond the edges of the allocated cells, put a dash if the cell is empty, etc.

When filling out a paper form, the start of using the deduction is reflected in subclause 1.11 (line code 110) on sheet D1.

What are the deductions?

A deduction is an amount for certain expenses that reduces an individual's taxable income. Only individuals paying personal income tax can take advantage of the deduction.

The Tax Code of the Russian Federation provides for the following deductions: - standard tax deductions. As a rule, they are provided by the employer at the individual’s place of work. They have a fixed amount, which depends on the taxpayer category, the number of children and the amount of income;

— social tax deductions (expenses for training, treatment and purchase of medicines, expenses for the funded part of the pension and non-state pension provision, voluntary pension insurance, voluntary life insurance, as well as expenses for charity). These deductions in a fixed amount reduce the taxable income of an individual received during the calendar year. The deduction is provided both by the employer, upon written application of the individual, and by the Federal Tax Service - when the taxpayer fills out the 3-NDFL declaration. Deductions for charitable expenses are provided only by the inspectorate;

— investment tax deductions. The deduction is provided to individuals who carry out certain transactions with securities, deposit funds into an investment account, and receive income from transactions related to the investment account. The deduction is provided by the tax agent through whom all of the above operations and actions take place, or by the tax authority;

— property tax deductions. The right to these deductions for an individual arises when selling property and buying housing, constructing housing, purchasing a plot of land for building housing, or purchasing housing from the state. When purchasing housing, land, or building housing, you can take advantage of the deduction by submitting 3-NDFL to the Federal Tax Service or by providing a notification to the employer. When selling property, the deduction is provided only by the tax authority;

— professional tax deductions. The deduction is provided to individual entrepreneurs, notaries and individuals engaged in private practice, lawyers who have established a law office, individuals providing services and performing work under civil contracts, individuals receiving royalties, provided that these categories of taxpayers cannot document their expenses associated with generating income. A deduction is provided in the amount of 20 percent of the amount of income received. You can receive a deduction from the tax authority when filling out 3-NDFL or from your employer by submitting an application;

— tax deductions when carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions. A deduction is provided if expenses from the above operations exceed income, that is, a loss is received. The resulting loss is taken into account for 10 years, starting from the year the loss was received. You can use the deduction only by submitting 3-NDFL to the inspectorate.

These are all types of deductions prescribed in the Tax Code of the Russian Federation. They can be used by individuals who are registered at their place of work in accordance with the labor code and receive an official salary, as well as individual entrepreneurs who apply the general taxation system and pay personal income tax. We will look in more detail at the tax deductions that are used most often. Such deductions include social and property.

How to submit

Procedure:

- Collection of the main package of documentation.

- Filling out a standard declaration.

- Submission of papers for consideration to the territorial division of the tax office (at the applicant’s place of permanent residence).

- Waiting for the completion of the desk audit.

- Receiving funds.

Methods for filing a declaration:

| Independent interaction with authorized agents of the tax authority | At your place of permanent residence. |

| By mail | Dispatch occurs via registered mail at the place of registration (receipt receipt is required). |

| Through a specialized service | In your personal account on the official portal of the federal inspection. |

When sending a registered letter, the date of submission is taken to be the day recorded on the postmark.

Package of papers in 2021:

- official certificate of ownership;

Sample certificate of state registration of rights

Real estate transfer and acceptance certificate

Sample certificate 2-NDFL

Sample application for tax refund

Bank account details

Instructions for registration

The question of how to get a standard deduction does not lose its relevance. Registration of standard deductions for children or for the employee himself can be done through the employer or through the Federal Tax Service. When filing a tax refund from an employer, you will need to complete the following steps:

- Write an application for an income tax refund.

- Prepare documents confirming the legality of its receipt.

If the refund is issued through the Federal Tax Service, then you can apply for it only at the end of the calendar year for which the taxpayer wants to receive a personal income tax refund. The following documents will be required:

- Certificate of income.

- 3NDFL reporting.

- Documents evidencing the right to reduce the tax base for calculating income tax.

- Application for a deduction.

Documents that confirm the applicant's right to receive this standard type of compensation include:

- Birth or adoption certificate (if the taxpayer is an adoptive parent).

- Marriage certificate.

- Certificate of disability (if there are disabled children).

- Certificate from the place of study (if the age of children who are full-time students is over 18 years old).

- In case of payment of alimony, a writ of execution for the transfer of alimony will be required.

- If the application is submitted by one of the parents who is not officially married, providing for children without paying child support, then a receipt from the second parent will be required stating that the person applying for the deduction is involved in providing for the children.

In order to accurately calculate the amount of compensation due, it is necessary to list the children in the order of their birth. The first-born is the eldest in age, regardless of whether a tax refund is granted to him or not.

How to fill out sheet D1

Blots, corrections, strikethroughs, etc. are not allowed; if they are present, the inspector will not accept the document from the applicant. It is also necessary to make sure that the applicant’s signature is on all sheets where this is required.

The start of using the deduction is the year for which the declaration is submitted, and not the year in which he decided to exercise his right.