Let's create a balance sheet from accounts or turnover.

Balance sheet is the size of assets, capital, liabilities, accounts as of a certain date. (Or is a system for storing economic information for an enterprise)

The balance consists of:

- ASSET: Section 1, Section 2.

- PASSIVE: Section 3, Section 4, Section 5.

Let's look at the main (popular) balance sheet items where the numbers come from. Two methods are OPTION 1 from the turnover (for the main accounts) and OPTION 2 (more detailed, more complex for most accounts with a detailed description)

What is a balance sheet

Buh.

A balance sheet is a report that shows the financial performance of a company, namely the balances of its accounts as of any date. Most often, organizations prepare the following types of balance sheets:

- introductory (at the time of commencement of activity);

- current (as of a certain date, usually at the end of the year);

- liquidation (at the time of liquidation of the company);

- dividing (during reorganization in the form of division or separation);

- unification (in case of reorganization in the form of affiliation or merger; this balance sheet is introductory at the time the newly created legal entity begins its activities).

The balance sheet clearly shows the financial condition of the company. If you compare it with a similar report compiled, for example, a year ago, you can track the dynamics of the organization’s development.

Check the financial condition of your organization and its counterparties

Definition

The balance sheet is, first of all, a summary of the financial viability of an organization. With its help, you can understand the actual state of affairs in the company, how profitable or unprofitable it is. It is formed by grouping and generalized reflection of data on the company’s property and the sources of its formation.

Classification

This information will be useful both to the management of the enterprise and to possible creditors and investors. The balance sheet shows the state of assets, liabilities to third parties and equity as of a certain date. As a rule, the balance sheet is formed on an accrual basis for one year, broken down into quarters. The balance must also be submitted to the tax office and statistical authorities.

Balance Sheet Structure

In most cases, the balance sheet of an enterprise is a table divided into two parts: assets and liabilities.

A balance sheet asset is information about the property and liabilities that the company uses in its business activities. They may bring benefits in the future. Assets consist of two sections:

- Fixed assets. This includes property that is used for a long time. In particular, fixed assets, intangible assets, etc.

- Current assets: inventories, accounts receivable, VAT and more.

Balance sheet liabilities are the sources of funds that make up the asset. The passive has three sections:

- Capital and reserves. These include the legal entity’s own funds: authorized capital, additional capital and others.

- Long term duties. They show the company's accounts payable that have existed for a long time: bank loans received for a year or more; deferred tax liabilities and so on.

- Short-term liabilities. With their help, you can understand the size and structure of accounts payable, which is unstable and actively changing. Among other things, these are deferred income and bank loans received for up to a year.

IMPORTANT. The total amount of an asset is always equal to the total amount of a liability. The reason is that each transaction is reflected in accounting using the double entry method using two accounts: the first as a debit, the second as a credit. Lack of equality between asset and liability indicates an error.

Financial investments (excluding cash equivalents)

Section II “Current assets” reflects financial investments whose circulation (maturity) period does not exceed 12 months.

Financial investments include:

- state and municipal securities;

- securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills);

- contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies);

- loans provided to other organizations;

- deposits in credit institutions;

- receivables acquired on the basis of assignment of the right of claim;

- other similar investments.

Balance sheet form (form)

Previously, the balance sheet bore the official name “Form No. 1”. But in 2011, the Ministry of Finance made changes, and now it is called simply “Balance Sheet”. However, the former name is still used among specialists.

The current form of the balance sheet was approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. There is an option that is generally used by all companies (given in Appendix No. 1 to this order). Each line is marked with a special code. For example, intangible assets - 1110, inventories - 1210, short-term borrowed liabilities - 1510, etc.

Fill out and print your balance sheet using the current form for free

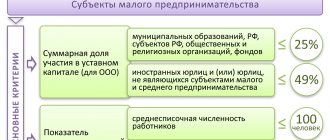

For organizations that have the right to use simplified accounting methods and submit simplified reporting, a separate balance sheet form has been developed. It is given in Appendix No. 5 to Order No. 66n.

Balance lines 2021: decoding of the 3rd section

The third section of the liabilities side of the balance sheet contains information about the presence of equity capital and reserves in the company. The balance breakdown will be as follows:

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| UK | 1310 | Amount of authorized capital | K/t 80 |

| Own shares purchased from shareholders | 1320 | This is a negative indicator on the balance sheet (indicated in parentheses), indicating the balance of the company's shares, which it bought back from participants for intended resale or cancellation | D/t 81 |

| Revaluation of non-current assets | 1340 | The amount of additional valuation of fixed assets and intangible assets resulting from revaluation (revision of the initial value of property), recorded in the account. 83 | K/t 83 (in terms of additional valuation of fixed assets and intangible assets) |

| Additional capital (without revaluation) | 1350 | The amount of additional capital without taking into account the revaluation carried out, for example, upon receipt of property - the credit balance on the account. 83 | K/t 83 (except for revaluation amounts) |

| Reserve capital | 1360 | The amount of the formed reserve fund or other funds formed by distribution from the company’s profits is the credit balance of the account. 82 | K/t 82 |

| Retained earnings/uncovered loss | 1370 | Balance sheet line 1370 - decoding reflects the result of the enterprise's activities: the amount of profit remaining in the company after taxes or the amount of loss. A credit balance means the presence of retained earnings, a debit balance means a loss. | One way:

|

| Total for Section III | 1300 | Total line by section | Sum of section row indicators |

How to fill out a balance sheet using Form 1

In each balance line you must indicate the balance of the corresponding account, or the sum of the balances of several accounts. For example, in the line “Value added tax on purchased assets” the balance of account 19 with the same name is entered. In the line “Cash and cash equivalents” - the amount of balances in accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts” and some others.

There are several basic rules that must be followed when filling out your balance:

- show debit and credit account balances in detail (do not “collapse”);

- fixed assets and intangible assets should be reflected at their residual value (that is, at their original cost minus depreciation);

- Show goods for resale at the purchase price (without trade markup), even if they are accounted for at the sales price;

- data on property and liabilities in the annual balance sheet must be confirmed by inventory results.

REFERENCE. Starting with reporting for 2021, data on balance sheet items is filled out strictly in thousands of rubles (previously it was possible in both thousands and millions). These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Other current assets

Other current assets include:

- the cost of missing or damaged material assets, in respect of which a decision has not been made to write them off as production costs (sales costs) or to the guilty parties;

- VAT amounts calculated on advances and prepayments (partial payments);

- amounts of excise taxes subject to subsequent deductions;

- amounts of overpaid (collected) taxes and fees, penalties and fines, contributions for compulsory insurance, for which no decision has been made on offset (refund from the budget);

- amounts of VAT accrued upon shipment of goods (products, other valuables), the proceeds from the sale of which cannot be recognized in accounting for a certain time;

- own shares (shares) purchased from shareholders (participants) for the purpose of resale.

Balance due dates

Legal entities are required to submit an annual balance sheet to the tax office. This must be done no later than three months after the end of the reporting year. This is stated in part 2 of article 18 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” and in subparagraph 5 of paragraph 1 of article of the Tax Code of the Russian Federation.

If we talk about reporting for 2021, then it must be submitted no later than March 31, 2021.

ATTENTION. Previously, the balance also had to be submitted to the statistical authorities. But starting with reporting for 2021, this obligation has been abolished. In 2020, balance sheets and other financial statements will only need to be submitted to the Federal Tax Service.

Prepare, check and submit financial statements to the Federal Tax Service via the Internet Submit for free

Drawing up and filling out the BB

To draw up and fill out a balance sheet, you need to enter data into two parts: Asset and Liability. In the form, they are presented in the form of two tables and are intended to display financial transactions within the company and in interaction with other enterprises.

Example of completed data on an Asset

To draw up a balance, you must fill out all lines of the form. They need to include data characterizing the financial position of the organization. Each line has its own serial number. It contains the name of the indicator that should be reflected in it. The total amount is derived by summing sequentially all the rows of the first two sections.

The Passive lines are filled in in a similar way:

Example of entering data on Passive

The balance line should not be left blank. If the amount to be deposited is zero, this fact is explained in the accompanying documents. All figures must be in thousands and millions and reduced by three or six zeros. For example, the cost of a building on the company’s balance sheet is 20,000,000 rubles. In the report, this amount should be recorded as 20,000 thousand rubles. The choice of indicators that will be used when filling out should be made in the header of the form.

Don't underestimate the importance of the balance sheet. It is a direct reflection of the financial viability of the company. On its basis, significant management decisions can be made that affect its life, uninterrupted operation and further economic development.

Presentation methods

In previous years, organizations had a choice of how to submit their balance sheet to the Federal Tax Service: on paper or via the Internet.

But as of reporting for 2021, there is no such choice. From now on, companies have only one option - to submit their balance online (via telecommunications channels through an electronic document management operator). An exception is made only for small businesses. They have the right to report for 2021 both on paper and according to the TKS. They will submit the balance sheet for 2021, like everyone else, online. Such changes were made to the Accounting Law by Federal Law No. 444-FZ dated November 28, 2018.

Having received the report, inspectors analyze it. They examine assets and liabilities and compare them with information reported on tax returns. The structure of the balance sheet allows employees of the Federal Tax Service to get a general idea of the state of affairs of the company.

Classification

It is customary to distinguish two main types of balance:

- Statistical. Reflects indicators on the date of formation. They are classified according to the following criteria: current, opening, separation, final, liquidation, balance sheet, separate, consolidated, sanitized, consolidated, inventory.

- Dynamic. Shows financial data for the company by turnover for a given period. This could be a chess balance sheet and a turnover sheet.

All balance sheets differ from each other in the purpose of their preparation. It is customary to classify them according to the following criteria:

- by source of compilation;

- by the nature of the activity;

- by reflection object;

- by time of compilation;

- by volume of information;

- by form of ownership;

- according to the cleaning method.