Expenses are an integral component of generating income, no matter how paradoxical it may sound. After all, the creation of a company and the maintenance of all business processes are inextricably linked with such concepts as investments (capital investments) and operating expenses. The latter, in turn, are divided into constants and variables. In this article we will look at issues related to planning fixed expenses . Let us explain what their significance is, how fixed costs differ from variable ones, and what place cost planning plays in the process of developing an organization’s business plan.

Variable business expenses

Return to Selling expenses

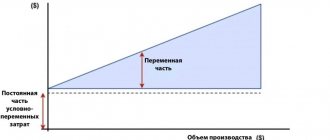

Variable selling expenses are a type of cost, the value of which, unlike fixed costs, changes with changes in production volumes. Variable and fixed costs add up to total costs. The main feature that determines variable costs is their disappearance when production stops.

Examples of business expenses:

• Costs of raw materials and materials. • Costs of energy and fuel consumed during the production process. • Wages of workers involved in production.

As a first approximation, we can assume that variable costs grow in direct proportion (linearly) with an increase in production volumes and sales of products. Thus, when calculating the break-even point, a proportional increase in variable costs with increasing volume is assumed.

The break-even point in physical terms is 20 units of some products. With such a volume, profit (green line) is equal to 0. With a smaller volume (to the left), the enterprise’s activities are unprofitable, and with a larger volume (to the right), it is profitable.

The increase in variable costs does not always occur in proportion to the increase in volumes; for example, if a night shift is introduced when production volumes increase, then the pay for the night shift is higher than for the day shift.

There are proportional variable, regressive variable and progressive variable costs:

• Proportional costs - increase at the same rate as the volume of production and sales of products. For example, if production volume increases by 10%, proportional costs will increase by 10%.

• Regressive variable costs - Their growth rate lags behind the volume growth rate.

Financial model of the enterprise

Why is this necessary? In order to have a correct idea of future income, what level the enterprise’s fixed and variable expenses will have, to understand where it will need to go and what financial policy to use when making decisions.

The basis for building a successful business is its commercial component. According to economic theory, money is goods that can and should generate new goods. If you start your own business, you need to understand that its profitability must come first, otherwise the person will engage in philanthropy.

Management expenses of a trade organization

A trading organization, like any other, incurs commercial and administrative expenses in the process of conducting business. In general, for the former in accounting, account 44 “Sales expenses” is intended, for the latter - account 26 “General business expenses”. However, as practice shows, trading organizations (we are talking about companies that are engaged exclusively in the purchase and sale of goods) often reflect not only commercial, but also administrative expenses on account 44. Is this approach correct?

The rules for the formation in accounting of information on the expenses of commercial organizations, including those engaged in trading activities, are established by PBU 10/99 “Expenses of an organization” <1>. According to paragraph 4 of this document, the expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into expenses for ordinary activities and other expenses (that is, those expenses that are not expenses for ordinary activities).

<1> Approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

Expenses for ordinary activities are considered to be expenses related to:

- with the manufacture and sale of products;

- with the purchase and sale of goods;

- with the performance of work (provision of services).

Based on this classification, for an organization engaged in trading activities (purchase and sale of goods), expenses for ordinary activities include expenses associated with the acquisition and sale of goods . In other words, all expenses (unless they are other) should be considered associated with the acquisition and sale of goods.

Based on clause 7 of PBU 10/99, expenses for ordinary activities are added up:

- from expenses associated with the acquisition of raw materials, supplies, goods and other inventories;

- from expenses arising directly in the process of processing (refinement) of inventories for the purposes of production (performance of work, provision of services) and their sale, as well as sale (resale) of goods. These are expenses for the maintenance and operation of fixed assets and other non-current assets, as well as for maintaining them in good condition, commercial expenses, administrative expenses, etc.

In the profit and loss statement, expenses are reflected subdivided into the cost of goods sold (products, works, services), selling expenses, administrative expenses and other expenses (clause 21 of PBU 10/99). In p.

What is included in the concept of “representation expenses” according to the norms of the Tax Code of the Russian Federation?

The norms set out in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, suggest the allocation of a special category of expenses among the enterprise’s expenses - entertainment expenses (PR). They can be presented:

- costs associated with organizing official events (for example, business breakfasts, meetings, negotiations ), servicing invited persons within the framework of these events;

- transport and catering expenses aimed at supporting official events;

- payment for services provided by a freelance translator, if the company organizing the event asked him for help.

Entertainment expenses are the above expenses that reduce taxable income and are incurred by the taxpayer to organize the reception of representatives of other organizations who participate in negotiations in order to establish and maintain cooperation, as well as to receive participants who arrive at a meeting of the governing body of the company.

The concept of entertainment expenses for the purpose of reducing the tax base for income tax does not include negotiations with individuals and individual entrepreneurs. However, there are letters from the Ministry of Finance in which the department allows the possibility of classifying the costs of negotiations with clients - individuals as entertainment expenses (see letters dated 07/05/2019 No. 03-03-06/1/49848, dated 06/05/2015 No. 03-03 -06/2/32859, etc.).

Taxpayers reducing their income tax base by the amount of entertainment expenses very often leads to disputes with tax authorities. Get trial access to the Tax Guide from ConsultantPlus and find out for free when entertainment expenses can be justified, and which expenses are better spent on the company’s net profit.

Selling expenses

Selling expenses (also called selling expenses) are expenses associated with the sale of finished products (non-manufacturing expenses), the acquisition and sale of goods (distribution costs). In accordance with the Instructions for using the Chart of Accounts, account 44 “Sales expenses” is intended to summarize information on expenses associated with the sale of products (goods, works and services). The comments to this account indicate that organizations engaged in trading activities can reflect expenses (distribution costs) on account 44:

- for the transportation of goods (transportation costs). This may include:

- expenses associated with payment for transport services of third-party organizations for the transportation of goods (payment for transportation, delivery of wagons, weighing of goods);

- expenses for payment for the services of organizations for loading goods into and unloading vehicles, fees for forwarding operations and other similar services;

- the cost of materials spent on vehicle equipment (shields, hatches, racks, shelving) and insulation (straw, sawdust, burlap);

- expenses for temporary storage of goods at stations, piers, ports, airports, etc.;

- expenses associated with the maintenance of access roads and non-public warehouses;

- for remuneration of the main trade and production personnel of the organization, taking into account bonuses for production indicators, incentive and compensatory payments and payment of insurance premiums;

- for the rental and maintenance of buildings, structures, premises, equipment and inventory. Such expenses include:

- rental costs of trade and warehouse buildings, buildings and premises, structures, equipment and inventory and other individual fixed assets;

- costs for heating, lighting, water supply, sewerage and other utilities;

- expenses for keeping premises clean, cleaning adjacent areas (yards, streets, sidewalks), garbage removal;

- the cost of items and means for maintaining the premises (lime, mastic, burlap, brushes, brooms, brooms, etc.);

- the cost of electricity consumed to drive lifts, elevators, conveyors, vending machines, cash registers, etc.;

- expenses for checking and marking scales, water meters, electric gas meters and other measuring instruments;

- expenses for maintenance and repair of alarm devices;

- expenses for fire safety measures;

- payment to third-party organizations for fire and security guards (warehouses, shops, etc.);

- expenses for maintenance by third parties of lifting and transport mechanisms and other equipment;

- for storage, part-time work, sub-sorting and packaging of goods. This includes:

- the actual cost of materials (wrapping paper, bags, glue, twine, nails, shavings, sawdust, straw, wire) consumed during part-time work, processing, sorting, packaging and packaging of goods;

- fees for the services of third-party organizations for packaging and packaging of goods;

- expenses for the maintenance of refrigeration equipment (cost of electricity, water, lubricants, etc.), payment for the services of third-party organizations for the maintenance of refrigeration equipment;

- actual cost of ice consumed to cool goods;

- for advertising:

- for the design of shop windows, exhibitions, sales exhibitions, product sample rooms;

- for the development and printing of advertising publications (illustrated price lists, catalogues, brochures, albums, prospectuses, posters, posters, advertising letters, postcards, etc.);

- for the development and production of sketches of labels, samples of original and branded bags, packaging, etc.;

- for advertising events through the media (ads in print, broadcasts on radio, television);

- for illuminated and other outdoor advertising;

- for the acquisition, production, copying, duplication and demonstration of advertising films and videos, etc.;

- for the production of stands, dummies, billboards, signs;

- for markdowns of goods that have completely or partially lost their original quality during display in shop windows, sales areas of stores and at exhibitions;

- entertainment expenses;

- other expenses similar in purpose.

The organization writes off the expenses accumulated on the debit of account 44 to the debit of account 90 “Sales”:

- or completely. This is also stated in paragraph 9 of PBU 10/99: commercial expenses can be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities. Note that the same goes for management expenses;

- or partially. With this method of writing off commercial expenses from trading organizations, transportation costs are subject to distribution (between the goods sold and the balance of goods at the end of each month). It turns out that the organization classifies transportation costs as semi-variable expenses. The remaining expenses (conditionally fixed) associated with the sale of goods are charged monthly to the cost of goods sold.

Let us emphasize that commercial expenses are written off to the debit of account 90, because it is there that the cost of goods sold is formed (when revenue from the sale of goods is recognized in accounting, their cost is written off from account 41 “Goods” to the debit of account 90). The only thing: you need to decide whether they are written off monthly in full or distributed (in terms of transportation costs) taking into account the balance of goods.

Interdependence of production costs

The relationship between variable costs and fixed costs is an important indicator. Their interdependence in relation to each other is the break-even point of the organization, which consists in the amount of sales that the enterprise needs to make in order to be considered profitable and have costs equal to zero, that is, absolutely covered by the company’s income.

The break-even point is determined using a simple algorithm:

Break-even point = fixed costs / (cost of one unit of goods - variable costs per unit of goods).

As a result, it is easy to see that it is necessary to produce products of such a production volume and at such a cost that it can cover fixed costs that remain unchanged.

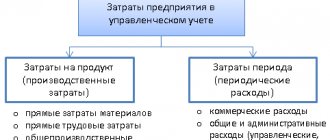

General running costs

Now let's talk about management costs, which mean expenses associated with managing and maintaining an organization. These costs do not depend on sales volume, but on the structure of the organization, the activity of the administration’s business policy, and the duration of the reporting period. How should the sales organization classify these costs?

In accordance with the Instructions for using the Chart of Accounts, account 26 “General business expenses” is used to summarize information about expenses for management needs not directly related to the production process (these are management expenses). This account may reflect:

- administrative and management expenses;

- expenses for maintaining general business personnel not related to the production process;

- depreciation charges and expenses for repairs of fixed assets for management and general economic purposes;

- rent for general business premises;

- expenses for payment of information, auditing, consulting, etc. services;

- other administrative expenses similar in purpose.

The comments to account 26 indicate that the expenses recorded on this account are written off, in particular, to the debit of accounts 20 “Main production”, 23 “Auxiliary production” (if auxiliary production produced products and work and provided services to the outside), 29 “Service industries and farms” (if service industries and farms performed work and services outsourced). There is a second option for writing off general business expenses: as semi-fixed expenses, they are written off in full to the debit of account 90.

Please note: the above recommendations apply to organizations that are involved in the production process. On account 26, such companies record expenses that are not directly related to this process (these are so-called overhead costs). However, we are considering a situation where the company is engaged in trading activities (not involved in the production process).

The instructions for using the Chart of Accounts contain some exception to the general rule. Organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., except for organizations engaged in trading activities) , use account 26 to summarize information on the costs of conducting this activity. These organizations write off the amounts accumulated on this account as a debit to account 90. Thus, the Instructions, in essence, indicate that trade organizations cannot use account 26 to summarize information on expenses for their activities that are not related to production process.

What is not included in the organization's entertainment expenses?

Some organizations include in the expenses under consideration those expenses that are associated with official events, but from the point of view of the Tax Code of the Russian Federation are not classified as representational. In particular, they cannot be classified as representative, based on the provisions of paragraph 2 of Art. 264 Tax Code of the Russian Federation:

- expenses for organizing entertainment for guests;

- Providing medical services to guests.

Entertainment expenses - how not to exceed these expenses by attributing them to unlawful expenses? In general, when determining the list of PR, you can rely on a simple rule according to which expenses should not be classified as representative expenses if:

1. They are not directly listed in paragraph 2 of Art. 264 Tax Code of the Russian Federation.

2. They are not allowed to be included in entertainment expenses by clarifications of the Federal Tax Service or the Ministry of Finance.

Thus, the letter of the Ministry of Finance of the Russian Federation dated August 16, 2006 No. 03-03-04/4/136 states that the purchase of souvenirs for guests of an official event should not be considered as PR. However, for souvenirs with the symbols of the organization, the Federal Tax Service and the courts of Moscow and the region make an exception (see letter of the Federal Tax Service of Russia for Moscow dated April 30, 2008 No. 20-12/041966.2, resolution of the Federal Antimonopoly Service of the Moscow District dated January 31, 2011 No. KA-A40/17593 -10 in case No. A40-55061/10-99-250, FAS Moscow District dated October 5, 2010 No. KA-A41/11224-10 in case No. A41-18513/08).

The letter of the Ministry of Finance dated December 1, 2011 No. 03-03-06/1/796 indicates the illegality of writing off expenses for an entertainment program (buffet table, boat, artists) to PR, which was organized after the official part of the event.

Costs incurred as part of events that are not of an official nature, for example, an informal dinner with partners in a restaurant cannot be classified as PR costs (letter of the Federal Tax Service in Moscow dated December 23, 2005 No. 20-12/95338).

Is it possible to include expenses for alcohol as part of the entertainment package? Find out here.

Drawing conclusions

Considering that the organization we are interested in is engaged exclusively in trading operations, all expenses, except for the cost of purchasing goods, should be considered related to the purchase and sale of goods and must be taken into account in accounting on account 44. Such an organization will use account 26 only if it begins to carry out other activities related to the production process.

At the same time, this does not mean that all these expenses should be indicated as business expenses in the income statement. An enterprise may well decide to reflect both commercial and administrative expenses in this form if this information is important to users of the statements (to be more precise, relevant). Where does this come from?

In accordance with clause 6.1 of the Concept of Accounting in the Market Economy of Russia <2> the information generated in accounting should be useful to users.

Information is considered useful if it is relevant, reliable and comparable. From the point of view of interested users, information is relevant if its presence or absence has or is capable of influencing the decisions (including management) of these users, helping them evaluate past, present or future events, confirming or changing previously made assessments. In turn, the relevance of information is influenced by its content and materiality.

<2> Approved by the Methodological Council on Accounting under the Ministry of Finance of Russia, the Presidential Council of the IPB RF on December 29, 1997.

Since Russian accounting legislation is rapidly moving closer to the requirements of IFRS, we consider it appropriate to look at IAS 1 “Presentation of Financial Statements” <3>, in which we are interested in the section “Information to be presented in the statement of comprehensive income or in the notes”. In accordance with paragraph 99 of this Standard, an entity must present an analysis of expenses recognized in profit or loss using a classification based on either the nature of the costs or their function within the entity, whichever provides reliable and more relevant information . That is, we find the same requirement - relevance.

<3> Put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated November 25, 2011 N 160n.

In IAS 1, enterprises are offered a choice of one of two options for disclosing information about expenses in the statement of comprehensive income for the period (for us this is the profit and loss statement) (company management chooses the most appropriate and reliable way of presenting information).

The first form of analysis is the “cost nature” method. It aggregates expenses based on their nature (for example, depreciation of fixed assets, purchases of materials, transportation costs, employee benefits, and advertising costs). This method is considered easy to implement because costs are not reassigned based on their functional classification.

The second form of analysis is the cost function or cost of sales method, which classifies costs according to their function as a component of cost of sales or, for example, distribution or administrative costs. When using it, an enterprise must, at a minimum, disclose its cost of sales separately from other expenses. An example of classification based on the cost function method is as follows:

| Indicator name | ||

| Revenue | X | |

| Cost of sales | (X) | |

| Gross profit | X | |

| Other income | X | |

| Sales costs | (X) | |

| Administrative expenses | (X) | |

| other expenses | (X) | |

| Profit before taxes | X | |

As we can see, it is this form of analysis that is used by Russian companies when reflecting expenses in the income statement. IAS 1 paragraph 103 describes this method as providing users with more relevant information than classifying expenses by nature. However, its use may require arbitrary allocation and significant professional judgment.

O.V. Davydova

Journal expert

"Trade:

Accounting

and taxation"

Confirmation of entertainment expenses in 2020: documents

Entertainment expenses - what are these expenses in terms of their documentary evidence?

Any expenses in order to reduce the tax base, by virtue of the provisions of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, must be documented. The Tax Code of the Russian Federation does not reflect the lists of documents by which a company can certify the facts of making relevant expenses.

In practice, these documents most often are:

- order from the director to hold an official event;

- cost estimate for the relevant event;

- event expense report;

- act on write-off of expenses;

- official event program;

- agreements with service providers ordered for the purpose of holding the event;

- primary documents reflecting calculations for relevant services.

If a company regularly holds official events, the main document confirming PR may be a local regulation on PR. This document regulates the procedure for accounting for relevant expenses with the specific purpose of reducing the tax base. If the PR regulation is adopted by the company, then the documents indicated above in the list will supplement it. Moreover, they must be drawn up on the basis of forms approved as annexes to the regulations on PR.

It is worth noting that the above list of documents with which the PR can be confirmed was formed not on the basis of business practice (although its role in this case is also important), but on the basis, first of all, of rule-making. The fact is that virtually each of the types of sources discussed above was, one way or another, recommended by the Ministry of Finance in letters that the department publishes with some frequency in order to clarify the procedure for accounting for PR.

When carrying out events, as a rule, a responsible person is appointed, to whom money is given on account. ConsultantPlus experts tell you in detail how to correctly prepare an advance report for hospitality expenses. If you are not yet registered in the system, get trial online access. It's free.

See “How to properly document entertainment expenses - an example?”

Business expenses include expenses for the following operations:

— packaging and packing of finished products;

— delivery of products to the departure station;

— loading into vehicles;

— commissions to intermediary organizations;

— maintenance of premises for storing products at points of sale;

— remuneration of salespeople in production organizations;

— carrying out analyzes of products during their release;

— advertising;

— entertainment expenses;

— procurement, delivery and transportation of goods in trade organizations;

— wages in trade organizations;

— rental of retail premises and finished product warehouses;

— maintenance of retail premises and finished product warehouses;

— storage of goods;

— insurance of shipped goods and commercial risks;

— covering shortages of goods within the limits of natural loss;

— maintenance of procurement and receiving points;

— keeping livestock and poultry at reception points and bases;

- other expenses similar in purpose.

Commercial expenses are monthly fully or partially written off from account 44 “Sales expenses” to the debit of account 90 “Sales”, subaccount 90-2 “Cost of sales”. The write-off procedure is established by the organization's accounting policy.

Are expenses classified as representative expenses under the simplified tax system?

Entertainment expenses - how can these expenses be taken into account in different tax systems? PRs can reduce the tax base only for those firms that operate under the general tax system. In Art. 346.16 of the Tax Code of the Russian Federation, which contains a list of costs that reduce expenses for the simplified tax system “income minus expenses”; entertainment expenses are not indicated. This circumstance does not allow reducing the tax base under the simplified tax system for entertainment expenses.

Read about entertainment expenses under the simplified tax system in the article “Acceptable expenses under the simplified tax system in 2021 - 2021.”

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Manual on financial statements◄ ►Largest joint stock companies in Russia◄

The main measures to reduce costs (costs associated with production) are:

1. Stopping unprofitable production;

2. Introduction of innovative, resource-saving, low-waste (or non-waste) technologies. For example, switching from heating using electricity to heating with gas; replacement of gasoline engines in cars with gas equipment; firing office workers and hiring freelancers; installation of IP telephony; transferring employees from regular computers to laptops (or netbooks); use of energy-saving lamps, etc.

3. Purchasing raw materials and supplies at lower prices and on more favorable terms, as well as optimizing the scheme for their purchase and transportation;

4. Reducing costs associated with storage and ownership of inventories (rental of warehouse premises and their maintenance, logistics costs, insurance, etc.) and equipment. For example, choosing a room with optimal characteristics (ceiling height, flat floor, convenient location)

at the lowest price; proper placement of equipment and supplies; more complete use of production capacity (including the transition to three-shift work); optimization of costs for equipment maintenance and repair. If possible, it is suggested to save on finished products if you can work to order; on work in progress, if the production process is not too long; on raw materials and materials, if the speed of their acquisition does not cause downtime.

5. Automation of enterprise activity planning by purchasing or creating appropriate computer programs. As a result, the planning process will be cheaper, a system for rationing all operations in production activities will be introduced, the registration and inventory of inventories will be automated, the enterprise will get rid of excess inventory and will not allow downtime in production.

6. Reducing inventory losses due to obsolescence, damage (rotted, burned, physically damaged)

, theft and uncontrolled use.

Why calculate fixed costs for a company (examples of their practical application)

The practical significance of calculating fixed costs lies mainly in the use of the corresponding indicator to determine the very break-even point of the business. It can be considered achieved after the enterprise’s revenue becomes equal to the sum of all its expenses, including fixed costs .

Another possible option for the practical application of the results of calculating fixed costs is optimizing the business model by legally and expediently reducing relevant costs. For example, if it turns out that the structure of fixed costs is dominated by staff salaries (together with payments to state funds), the company’s management may decide to transfer a number of labor functions to outstaffing, in which contributions to state funds are not required.

True, the labor compensation itself under an outstaffing contract may increase (since the company for which the agency employee works will, one way or another, need to make payments for him to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund). But, as a rule, savings can be made, for example, by reducing the working hours of an outstaffing employee’s presence at the enterprise.

Variable and fixed costs of an enterprise in examples and explanations

If there is a stock that will soon spoil, it is proposed to return it to the supplier, reduce the price on it, set a premium for its sale, sell it to a competitor, intensify an advertising campaign for its sale, throw it away to free up space in the warehouse.

7. Reducing the number of defective products. For example, the introduction of quality control for raw materials and materials, increasing the level of responsibility of the organization’s personnel, compliance with technology and production regulations, timely and high-quality debugging and cleaning of equipment, etc.

8. Tightening control. For example, installation of electricity, water and gas meters for all main areas of activity; compiling maps of energy costs per shift and comparison with other shifts and previous reporting periods; justification of the need for each type of expense, implementation of control over the physical and moral condition of inventories; increasing control over the timely execution of planned expenses.

The main measures to manage commercial expenses (costs associated with the sale of products (usually when they are reduced, sales volume also decreases, so all measures to manage them must be fully justified)

) are:

1. Optimization of the enterprise personnel motivation system. Namely, the division of salaries into permanent and bonus parts. In this case, the share of the bonus should be from 30% to 80% of the total salary (depending on the position). Introduction of a point-rating system that provides for the awarding of points for the performance of job duties (depending on the quality and quantity of work performed). As a result, if an insufficient number of points is collected, fines, reprimands and dismissals of employees should follow; if their number is in an acceptable range, only the main part of the salary should be paid, and if it is exceeded, the bonus part.

2. Using only those advertising measures that bring profit to the company.

3. Application of the most profitable product distribution schemes. For example, closing retail space and selling goods from a warehouse or delivering them to order; purchasing retail space instead of renting it; leasing or subleasing of unused retail space; improving the quality of customer service; location of retail space in the most advantageous places; correct placement of goods on display windows; creating an appropriate sound background; and so on.

The main measures to reduce management costs (costs not directly related to the production and sales of products) are:

1. Reducing costs for non-production buildings and structures;

2. Elimination of unreasonable costs for the management apparatus;

3. Reducing bureaucratic barriers;

4. Increasing the speed of information flow;

5. Refusal of the social package and external social programs. The social package includes: flexible working hours; training employees at the expense of the enterprise and purchasing educational literature; provision of a company car, cell phone, payment for gasoline, communications, free access to the Internet and the ability to print an unlimited number of documents; “subscription” maintenance of employees’ personal vehicles at the service center; providing them with targeted interest-free loans ( car, apartment

);

congratulating them on personal holidays and gifts from the company; organizing corporate events and sports activities ( paying for the gym

), etc.

Date added: 2014-01-03; ; Copyright infringement?;

You can't work at a loss

Profit is equal to the difference between income and costs, which are divided into fixed and variable expenses of the enterprise. When expenses are greater than income, profit turns into loss. The main task of an entrepreneur is to ensure that the business generates maximum income with minimal use of available resources.

This means that you should always strive to sell as many goods or services as possible, while reducing the level of costs of the enterprise.

If everything is more or less clear with income (how much you produced, how much you sold), then with expenses it’s much more complicated. In this article we will look at fixed and variable costs, as well as how to optimize costs and find a middle ground.

In this article, expenses, costs and expenses, as well as in economic literature, will be used as synonymous words. So what types of costs are there?

What exactly can the amount depend on?

It is necessary to consider several main categories of expenses and factors that influence their creation:

- Delivery of goods. Directly depends on the available transportation distance, established transport tariffs, product weight, including also the type of transport.

- Not only loading, but also unloading. They may change due to a decrease or increase in the weight of goods, including prices for the service per 1 ton.

- Packaging materials and available containers. Their cost is calculated by volume and cost per unit. The first value is directly related to the volume of the product and the necessary materials for packaging 1 unit. The business expenses of a company of this type are those that cannot be eliminated. This is explained by the fact that the aesthetic appeal of packaging is considered one of the main factors in increasing the level of demand for products, so it is not advisable to consider the possibility of savings in this situation. The expenses of such a group can be recouped by increasing sales volumes. In addition, we can talk about market analysis, advertising and other marketing research.

Upon completion of the analysis of all commercial costs without exception, it is imperative to make a decision on the option to reduce them, as well as formulate clear recommendations on the issue of mastering the procedure.