General requirements

Not only the Tax Code of the Russian Federation, but also some legislative acts regulate the procedure for dealing with reserves, and since 2021, significant changes have been made to this process. So, doubtful debt for each debtor is identified by deducting from it your accounts payable to him. The limit value subject to reserve based on the results of the last reporting period is calculated and taken as a larger figure from 10 percent of the proceeds in the current period or based on the results of the previous year.

How to create a reserve in accounting

Doubtful debts are reserved based on the judgment that it acts as an estimate and it, in turn, takes into account deviations in the valuation of assets, receivables and other existing liabilities. It is with the help of this kind of reserves that it is possible to correct accounting statements in the interests of correctly reflecting the state of affairs in the company at the reporting date.

Taking into account accounting regulations, the company is obliged to reserve certain funds in the event that a receivable debt is considered doubtful. As a conclusion, we can say with confidence that the process of creating reserves is an obligation, but not a right, of all companies of any legal form. When calculating the amount to reserve, take into account absolutely all counterparties, both those who participated in the advance and those who act as the borrower.

It is important to know that reserves should be created after an inventory of calculations. The law does not provide for periods for the formation of reserves, so companies have the right to set it in their own way, but you should not do this less often than you provide reporting to users for review. There may be good reasons for not using the reserve and such balance is added to the final financial result at the end of the year when the annual balance sheet is prepared. Accounting in this case affects the debit turnover of 63 accounts and the credit turnover of 91.01. Upon the occurrence of a new inventory, if the debt remains listed as doubtful, you accrue a new reserve for it. Amounts allocated for reservations are considered other company expenses.

Features of reflecting reserves in tax accounting

The provision for doubtful debts in 1C 8.3 is reflected in the interests of two types of accounting, and in tax doubtful debt is recognized as a receivable for the sale of products when it was not repaid on the established dates under the contract between the parties and there is no security or guarantee for it. You should not recognize as such those debts for the supply of products and services from suppliers, including advances and debts of borrowers, as well as payment of penalties and fines. The Ministry of Finance outlined this position in its clarifications.

Payers who advance profit reserves calculate it every month, while everyone else does this procedure quarterly. The amounts for reserves are added to non-operating expenses and it directly depends on how long the debt has been on the company’s balance sheet. It is worth considering:

- half of the debt with a period of formation from 45 to 90 calendar days (inclusive).

- completely with a period of occurrence exceeding 90 calendar days.

At the end of the reporting date, the amount of the calculated reserve should be compared with the remaining previously reserved amount and the conclusion is drawn:

- when the reserve is calculated to be less than its balance on the balance sheet, the resulting margin is attributed to non-operating income;

- the opposite situation of the appearance of a reserve value greater than that taken into account on the company’s balance sheet indicates the addition of the balance to non-operating expenses.

The balance of the reserve value means the difference between the previously accrued reserve and the value calculated by the accountant at the new reporting date.

Formation of reserves taking into account counter accounts payable

According to paragraph 1 of Article 266 of the Tax Code of the Russian Federation (as amended by Federal Law No. 401-FZ of November 30, 2016, hereinafter referred to as Law No. 401-FZ), from January 1, 2017, the amount of doubtful accounts receivable in relation to each counterparty should be determined minus accounts payable before that counterparty. However, neither the Tax Code nor accounting regulations contain a clear definition of accounts payable. In accounting, accounts payable means, in fact, any accrued debt to a creditor, including those obligations for which the due date has not yet arrived (PBU 9/99, PBU 10/99).

At the same time, from some norms of the Tax Code of the Russian Federation it can be concluded that such debt for tax purposes means the taxpayer’s obligations that were not fulfilled (repaid) by him within the prescribed period (for example, clause 18 of article 250, clause 21 of clause 1 Article 251 of the Tax Code of the Russian Federation).

This point of view is also supported by the fact that doubtful accounts receivable include precisely overdue debts to the taxpayer (clause 1 of Article 266 of the Tax Code of the Russian Federation). On the one hand, it would be logical to reduce this doubtful debt by the overdue debt to the counterparty.

On the other hand, before official clarifications or clarification of standards, it is safer to include in accounts payable all obligations, including those for which the due date has not yet arrived. This is exactly the approach implemented in 1C: Accounting 8, starting with version 3.0.46.19. For the purposes of automatic formation of a reserve, counter payables that reduce doubtful accounts receivable in relation to a counterparty are considered to be any outstanding debt to this counterparty, including those reflected in the accounts:

- 60.01 “Settlements with suppliers and contractors”;

- 66 “Settlements for short-term loans and borrowings”;

- 67 “Calculations for long-term loans and borrowings;

- 76 “Settlements with various debtors and creditors.”

Please note that in the program, doubtful debts can only be reduced by accounts payable accounted for under contracts in rubles. It should also be borne in mind that now in the program, doubtful debts for calculating reserves are defined in a new way in accounting. Therefore, the organization must reflect such a change in its accounting policies.

Let's change the conditions of Example 1 and see how the calculation of reserves for doubtful debts changes from 2021 if the taxpayer has a counter-obligation (accounts payable) to the debtor counterparty.

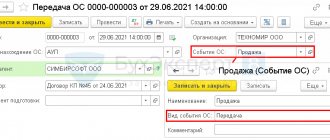

Provision for doubtful debts in 1C 8.3

For your convenience and saving time and labor resources, the developers have made the process of creating reserves automatic and your participation here is reduced to a minimum. In the table below we will look at where to look for such functionality.

| No. | Accounting type | Characteristic |

| 1 | Accounting | The command is placed in the accounting policy in the main menu settings |

| 2 | Tax | In the interest of taxing company profits, please refer to the tax and reporting settings form in the main menu |

According to the regulations, the procedure for creating reserves for doubtful debts is not active. To satisfy accounting tasks in the accounting policy, you must activate the switch for the formation of provisions for doubtful debts. When you need to reserve a certain amount in tax accounting, then in the customizable parameters for taxes and reports in the income tax menu, you will need to activate the switch for the formation of reserves for doubtful debts. When closing a month, when at least one of the listed flags is checked, regulations for calculating reserves for doubtful debts will be added. Even if you do not have any reserves, the form will be generated automatically by the machine, but will not have any movements in the accounting registers.

What is meant by the concept of doubtful debt? When automatically creating reserves, regardless of the type of accounting, the software accepts the outstanding debt on accounts 62.01 and 76.06. An important feature that should not be forgotten is that only ruble contractual relationships with counterparties can be reserved.

Rules for creating reserves

In “1C: Accounting 8”, support for accounting for provisions for doubtful debts in accounting and for profit tax purposes is specified in the Accounting policies of organizations form in the section Settlements with counterparties.

An organization can set the indicator for automated accounting of provisions for doubtful debts only in accounting, only for income tax purposes, or for both types of accounting simultaneously.

Users of “1C:Accounting 8” should take into account that in the current version of the standard configuration, reserves in accounting are accrued “according to tax accounting rules,” but without applying a 10% limit on revenue.

Only outstanding debt in accounts 62.01 “Settlements with buyers and customers” and 76.06 “Settlements with other buyers and customers” is considered as doubtful debt for the purposes of forming reserves.

If you set the indicator for the formation of reserves in the Settlements with counterparties section, you must also specify an item for accounting for expenses (income) on doubtful debts - the directory element Other income and expenses with the type Other non-operating income (expenses).

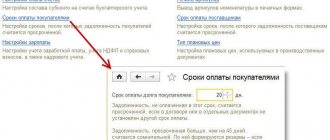

To count the period for the occurrence of doubtful debts, the indicators Customer Payment Due Date in Accounting Parameter Settings (Fig. 1) and Validity Period in the description of the contract with the counterparty are used.

Rice. 1

The date from which the period for the occurrence of doubtful debts is calculated in the program is determined as follows:

- if the contract sets a payment deadline, then the debt is considered doubtful if it is not repaid (in whole or in part) after the specified number of days;

- If the contract does not specify a validity period, then a debt is considered doubtful if it is not repaid (in whole or in part) after the number of days specified in the accounting settings, starting from the date the receivable arose.

Example 1

| In the accounting settings, the payment period for customers is specified - 10 calendar days. LLC "White Acacia" under the purchase and sale agreement on January 12, 2012 sold LLC "Yellow Acacia" goods in the amount of 118,000 rubles. The payment period for goods is no later than 30 days. The receivables of Yellow Acacia LLC will be considered doubtful if they are not repaid on 02/11/2012. If we change the conditions of the example and assume that the deadline for payment for goods in the agreement with Yellow Acacia LLC is not established, but the invoice issued to the buyer indicates that the invoice is due no later than 10 calendar days, then the receivables of Yellow Acacia LLC will be considered doubtful if it is not repaid on 01/22/2012. |

Please note that for the purposes of creating reserves for doubtful debts, the program does not check whether the receivables are truly doubtful, i.e., not secured by guarantees, collateral, etc.

This check can be established indirectly through the value of the indicator The payment period under the contract has been established.

If the organization has received security for the debt from the buyer or it has confidence in its solvency, then to exclude the debt from the calculation of reserves for it, it is enough to indicate in this indicator a deliberately “long” payment period (in calendar days).

Example 2

| Belaya Akatsiya LLC entered into an agreement with Trading House LLC for the supply of goods during 2012. Under the terms of the contract, the supply of goods is made monthly according to the agreed nomenclature, payment for each batch of goods is made no later than 10 calendar days from the date of shipment. From the experience of business communication with the buyer, the organization has confidence in his solvency, even if there are delays in payment for each shipment. To exclude debt on monthly shipments from the calculation of reserves for doubtful debts in the event of late payments, it is enough to indicate in the agreement with the counterparty such a payment period (in days) so that it falls, for example, on the expiration date of the agreement as a whole. |

Calculation of the period of occurrence of doubtful debt

For that. To clearly understand when a debt becomes doubtful, a number of parameters are provided. So, among them are:

- the payment deadline under the contract is specified in the form of the agreement with the counterparty;

- the moment of debt payment by counterparties is specified in the initial settings and can be accessed through the administration team.

Another nuance that is worth paying your attention to is determining the countdown date for the appearance of doubtful debts and the machine sets it like this:

- when the contract stipulates a clear date for payment, the debt becomes doubtful when it is not at least partially repaid within the specified period after the appearance of the receivable;

- If there are no specific terms for payment in the executed agreement between the parties, the status of doubtful is assigned when, in the customizable accounting policy parameters, the number of days has passed from the appearance of receivables on the balance sheet.

Please note that when making a reservation, the machine does not control the validity of the debt as doubtful in the absence of guarantees for it. But this can be done in another way, in order to control this moment using the form, the payment deadline under the agreement is set in the agreement card with the counterparty. That is, when the company has received a guarantee from the debtor for the debt and you assume that the client is solvent, then it is worth removing this debt from the list of doubtful ones. You have the right to do this by extending the period for payment of the debt by days.

Regulations on reserves

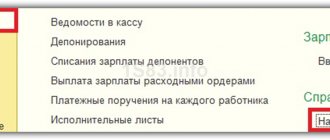

The machine prompts the user to reserve debts every month. But this may not always be necessary for those companies that report income taxes once a quarter, and is it worth doing the extra work every month? Of course not, it will be enough to reserve finances quarterly. You can refuse such a monthly regulatory option at the time of closing the period by using the skip option command. The regulation itself includes two stages:

- Calculation of doubtful debt. As already mentioned, in 2017 a decision was made if there are different types of obligations with one supplier, the accounts receivable are reduced by the amount of the accounts payable and the machine has such a change in legislation.

- The reserve amount has been calculated and entered into the accounting registers. The amount of the reserve is calculated as a percentage of the amount of debt based on the timing of late payment. In the interests of tax accounting, the amount to be reserved is limited to the amount according to the regulations for calculating shares of write-off of indirect expenses. In this case, the reserve norm for accounting for income tax is determined.

It has already been mentioned that the upper limit of the reserve is limited to 10 percent. This means that when the total reserve for the duration of the debt is greater than the established limit, then the reserve for each debt is considered a non-operating expense multiplied by a coefficient. This indicator is the ratio of the amount of reserves according to the standard to the entire amount of reserves calculated according to the timing of the debt.

Performing calculations for accrual of reserves

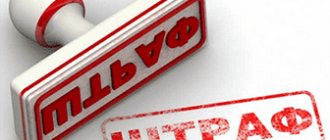

The accrual and adjustment of reserves for doubtful debts in accounting and for profit tax purposes in 1C: Accounting 8 is carried out using the regulatory operation Calculation of reserves for doubtful debts. In the Month Closing form, the 1C: Accounting 8 program suggests performing this operation if the accounting policy has the checkbox for creating reserves in at least one of the accounts (accounting or tax).

By default, the program suggests performing this routine operation monthly. Organizations that submit income tax returns once a quarter, in order to comply with the principle of rational accounting, can also calculate reserves once a quarter (in March, in June, in September and in December).

To refuse to perform the routine operation Calculation of provisions for doubtful debts, it is enough to select the Skip operation item in the operation menu before performing month-end closing in the first and second months of each quarter (Fig. 2).

Rice. 2