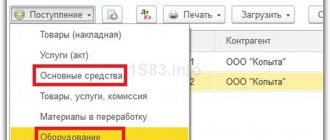

- Purpose of the article: Displaying information about available land plots, residual value of machinery and equipment, buildings, etc.

- Line number in the balance sheet: 1150.

- Account number according to the chart of accounts: Debit balance - credit balance.

Note from the author! Line 1150 can display information about the debit balance of the account for subaccounts 01-04 (in terms of fixed assets) and the debit balance of the account. The company makes the decision to include data independently (if the data is unimportant, the balances can be displayed on line 1190).

Fixed assets are understood as assets of an organization intended for long-term use for the purposes of the company.

According to the accounting rules, in order to accept acquired assets on the balance sheet as fixed assets, certain conditions must be simultaneously met:

- Asset purpose:

production of company products, performance of work, services;use for management needs;

leasing – transfer of an asset for temporary use and possession to third parties or temporary use.

- The useful life of the object is more than 12 months or during the operating cycle (when the cycle is more than a year).

- When purchasing an asset, the company does not have the goal of further resale of the object.

- The use of an asset affects the company's income: the asset's ability generates economic benefits for the firm with continued use.

Note from the author! Assets acquired solely for rental purposes are shown on the balance sheet as income-generating investments in tangible assets.

Fixed assets are expensive objects used by the company for a long time:

- buildings, structures;

- production equipment (for example, machines);

- control devices and computer technology;

- transport;

- expensive household equipment;

- livestock;

- perennial plantings;

- natural resources: land, water, etc.

Line 1150 – balance sheet asset: this displays the residual value of non-current assets - fixed assets (original cost minus accrued depreciation) as of December 31 of the financial year. For non-depreciable property, the original cost of the item is displayed.

Note from the author! Natural resources (land, subsoil, water) and unfinished construction projects are not subject to depreciation.

The final figure in accounting should be reflected as the final debit balance of account 01 minus the credit balance of account 02.

The reporting displays information as of the current period, December 31 of the previous year, and December 31 of the year preceding the previous one.

Balance sheet structure

Each part of the balance sheet groups assets and liabilities into sections. So, on the left side there are two sections - non-current and current assets, and the right side consists of three sections, separately combining capital and reserves, long-term as well as short-term liabilities.

In turn, the positions in each section are encoded with special four-digit codes established by Appendix No. 4 to Order No. 66n. Encryption of lines is necessary in reporting submitted to regulatory authorities - the legislator approved this procedure in order to systematize statistical data when generating information in general for an industry, region or country. A balance sheet compiled to review results within an enterprise may not contain codes - there is no need for them, but it is more convenient to generate a report and post accounting data, correlating them with the code number. Let's figure out how the current balance line codes are deciphered, what information is grouped in each of them, and how the indicators are formed.

Actual expenses for the purchase, manufacture, construction of fixed assets

In order to form the initial cost of a fixed asset, at which it will subsequently be accepted for accounting, it is necessary to sum up the expenses actually incurred by the company for the purchase (construction, production) of a fixed asset item. Such costs may include:

- non-refundable tax amounts;

- state fees for the right to purchase fixed assets;

- the cost of the purchased fixed asset (specified in the purchase and sale agreement);

- the amount of payment for setting up the property, bringing it into a condition suitable for use;

- the amount of payment for the service of delivering a fixed asset to the place of its use;

- duties and fees collected by customs;

- amounts of payment to construction contractor companies under the contract for the construction of an environmental facility;

- remuneration for the services of intermediaries in transactions related to the acquisition of an asset;

- fees for specialist consultations, legal advice, information support, etc.;

- other expenses, if they are directly related to the acquisition (independent production) of an OS item.

Explanation of balance sheet lines 2021 in section 1

In the current balance sheet form, the assets are allocated lines from 1100 to 1600. Let's start with deciphering the balance sheet lines of the 1st section “Non-current assets”, where it is accumulated, incl. information about the presence of assets with low liquidity in the company - fixed assets (fixed assets) and intangible assets (intangible assets). The lines of this section record their residual value, i.e. the difference between the original price and accrued depreciation.

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| Intangible assets (IMA) | 1110 | The residual value of intangible assets (patents, licenses, software) is the difference between the debit balance of the account. 04 and the balance on the loan account. 05 | D/t 04 (not taking into account R&D) – K/t 05, or D/t 04, if the account is not applied. 05, and depreciation is taken into account on the account. 04 |

| Research and development results | 1120 | The company's expenses on completed and positive results, but not related to intangible assets, scientific developments (R&D) are taken into account in separate sub-accounts to the account. 04 | D/t 04 for R&D expenses |

| Intangible search assets (IPA) | 1130 | Costs for searching and evaluating mineral deposits - the right to conduct exploration, collecting information about the subsoil, the results of exploration drilling, the cost of assessing the feasibility of development. Accounted for as part of capital investments, indicated in the balance sheet minus accrued depreciation | D/t 08 – K/t 05 for related to search intangible assets |

| Material prospecting assets (MPAs) | 1140 | Material component of search and exploration costs | D/t 08- K/t 02 in terms of MPA |

| Fixed Assets (Fixed Assets) | 1150 | The residual value of fixed assets (buildings, equipment, tools, machines) is the debit balance of the account. 01, reduced by the amount of accrued depreciation on the fixed assets, i.e. on the credit balance of the account. 02. On line 1150 of the balance sheet, the explanation (example) could be as follows: if for an OS object with an initial cost of 100 thousand rubles. depreciation in the amount of 20 thousand rubles is accrued, then in the balance sheet its value will be 80 thousand rubles. (100 – 20) | D/t 01 – K/t 02 (except for wear and tear on fixed assets taken into account on account 03) |

| Profitable investments in material assets | 1160 | The residual value of assets, for example, equipment, listed on the account. 03 and intended for rental/rental | D/t 03 – K/t 02 in terms of depreciation accrued on the property recorded on the account. 03 |

| Financial investments | 1170 | Information about the company's investments to make a profit. Debit balance on long-term investment accounts: — loans to personnel (account 73/1), - for deposit accounts (account 55/3) and financial investment account 58. If a reserve was created for the depreciation of investments (account 59), then the balance in account. 58 is reduced by the credit balance on the account. 59 | D/t 55/3 + D/t 58 – K/t 59 (when creating a reserve) + D/t 73/1 for long-term interest-bearing loans |

| Deferred tax assets (DTA) | 1180 | Formed if tax accounting does not coincide with accounting, it reduces the amount of income tax. | D/t 09 |

| Other noncurrent assets | 1190 | Line 1190 of the balance sheet (decoding): indicates property the value of which is recognized as insignificant, for example, uninstalled equipment, capital investments or expenses that the company will incur outside the reporting period - account. 07, 08, 97 (regarding a one-time payment for the right to use an intellectual resource) | D/t 07 + D/t 08 (except for those related to exploration assets) + D/t 97 (for expenses with a write-off period of more than a year) |

| Total for Section I | 1100 | Total line by section | Sum of filled section lines |

Definition

Fixed assets 1150 are:

- building,

- buildings, structures

- working and power machines and equipment,

- measuring and control instruments and devices,

- Computer Engineering,

- vehicles,

- tool,

- production and household equipment and supplies,

- working, productive and breeding livestock,

- perennial plantings,

- on-farm roads

- and other relevant objects.

Fixed assets also take into account:

- capital investments for radical improvement of land (drainage, irrigation and other reclamation works);

- capital investments in leased fixed assets;

- land,

- environmental management objects (water, subsoil and other natural resources)

Fixed assets are the most important resource used by enterprises. They determine the material potential of the organization.

Explanation of the balance sheet according to the lines of section 2

In the 2nd section of the balance sheet there are lines reflecting the value of the most liquid assets available in the company at the reporting date - working capital:

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| Reserves | 1210 | Explanation of line 1210 “Inventories” in the balance sheet includes:

| D/t 10 + D/t 15 + D/t 16 (or – K/t 16) + D/t 20 + D/t 21 + D/t 23 + D/t 28 + D/t 29 + D/ t 41+ D/t 43 – K/t 42– K/t 14 + D/t 44 + D/t 45 |

| VAT on purchased assets | 1220 | Debit balance of the account. 19 “VAT on purchased MC” | D/t 19 |

| Accounts receivable | 1230 | Combine debit balances on settlement accounts with suppliers, customers, employees - 60, 62, 70, 71, 73 (excluding long-term interest-bearing loans on account 73/1), 75, 68, 69.76 (VAT on advances reflected on these are not taken into account). The credit balance of the account is subtracted from the resulting value. 63 “Reserves for doubtful debts”, if a reserve was created | D/t 60 + D/t 62 – D/t 63 + D/t 68 + D/t 69 + D/t 70 + D/t 71 + D/t 73 (except for loans on account 73-1) + D/t 75 + D/t 76 (minus VAT on advances issued and received) |

| Financial investments (except cash equivalents) | 1240 | Investments in short-term periods (less than a year) to make a profit. Sum up the debit balances on accounts 55/3 and 58 (minus the credit balance of the reserve for impairment of short-term investments on account 59), 73 | D/t 58 – K/t 59 + D/t 55/3 + D/t 73-1 (for short-term transactions) |

| Cash and cash equivalents | 1250 | They generate information about the balances of funds in bank accounts and the cash desk of the company, for which they sum up the debit balances on accounts 50 (except for the subaccount for monetary documents 50/3), 51, 52, 55, 57, 58 (in terms of cash equivalents - securities , shares, etc.) | D/t 50 (except 50/3) + D/t 51 + D/t 52 + D/t 55 (except 55/3) + D/t 57 + D/t 58 (for investments in securities) |

| Other current assets | 1260 | The value of assets not included in the listed lines, for example, the debit balance of an account. 50/3 (when taking into account monetary documents), the amount of shortages and losses in the account. 94 | D/t 50/3 + D/t 94 |

| Total for Section II | 1200 | Total line by section | Sum of filled section lines |

| BALANCE | 1600 | Total for balance sheet assets | Sum of lines 1100 and 1200 |

Lines 1210 (210), 1220 (220), 1240 (250), 1250, 1260 and 1200 (290)

The previous line 210 corresponds to the current line 1210 of the balance sheet; the accounting department enters data on the remaining inventories into it.

Line 1220 of the balance sheet as before —

line 220. It must contain data on VAT, which was issued by the supplier, but was not accepted for deduction until the report was drawn up. This is essentially the debit balance of account 19.

Line 1240

of the balance sheet with a breakdown

was previously line 250. It reflects investments whose maturity does not reach a year.

Line 1250 is the company’s monetary assets in national and foreign currencies, as well as other resources. This refers to accounts 50, 51, 52 and 55.

Line 1260 contains all other assets that did not find a place in the above section lines.

Line 1200 in the previous version of the form was line 290

of the balance sheet.

The final results for section 2 are reflected here.

Balance lines 2021: decoding of the 3rd section

The third section of the liabilities side of the balance sheet contains information about the presence of equity capital and reserves in the company. The balance breakdown will be as follows:

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| UK | 1310 | Amount of authorized capital | K/t 80 |

| Own shares purchased from shareholders | 1320 | This is a negative indicator on the balance sheet (indicated in parentheses), indicating the balance of the company's shares, which it bought back from participants for intended resale or cancellation | D/t 81 |

| Revaluation of non-current assets | 1340 | The amount of additional valuation of fixed assets and intangible assets resulting from revaluation (revision of the initial value of property), recorded in the account. 83 | K/t 83 (in terms of additional valuation of fixed assets and intangible assets) |

| Additional capital (without revaluation) | 1350 | The amount of additional capital without taking into account the revaluation carried out, for example, upon receipt of property - the credit balance on the account. 83 | K/t 83 (except for revaluation amounts) |

| Reserve capital | 1360 | The amount of the formed reserve fund or other funds formed by distribution from the company’s profits is the credit balance of the account. 82 | K/t 82 |

| Retained earnings/uncovered loss | 1370 | Balance sheet line 1370 - decoding reflects the result of the enterprise's activities: the amount of profit remaining in the company after taxes or the amount of loss. A credit balance means the presence of retained earnings, a debit balance means a loss. | One way:

|

| Total for Section III | 1300 | Total line by section | Sum of section row indicators |

The procedure for filling out a simplified statement of financial results

| Report line | Accounting account |

| 2110 "Revenue" | Difference of indicators: · Turnover on the credit of the “Revenue” subaccount to the “Sales” account · Turnover by debit of the “VAT” subaccount to the “Sales” account |

| 2120 “Expenses for ordinary activities” | Amount by debit of subaccounts to account 90 “Sales”, on which accounting is kept: · Cost of sales · Business expenses · Administrative expenses |

| 2330 “Interest payable” | The amount of accrued interest on loans for the current year is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2340 “Other income” | Difference of indicators: · Turnover on the credit of the subaccount “Other income” to account 91 “Other income and expenses” · Turnover on the debit of the “VAT” subaccount to account 91 “Other income and expenses” |

| 2350 “Other expenses” | Difference of indicators: · Turnover on the debit of the subaccount “Other expenses” to account 91 “Other income and expenses” · Indicator for line 2330 “Interest payable” The indicator is indicated in brackets, no minus sign is used. |

| 2410 “Profit taxes (income)” | · If an organization pays income tax, then the value of line 180 of sheet 02 of the income tax declaration is recorded · If the organization is on the simplified tax system (income), then indicate the difference in indicators on lines 133 and 143 of section 2.1.1 of the declaration according to the simplified tax system · If the organization is on the simplified tax system (income minus expenses), then indicate the indicator on line 273 of section 2.2 of the declaration under the simplified tax system. When paying the minimum tax, the indicator is indicated on line 280 of section 2.2 of the declaration according to the simplified tax system. · If the organization is on UTII, then the amount of UTII for all quarters is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2400 “Net profit (loss)” | Calculate the value as follows: page 2110 – page 2120 – page 2330 + page 2340 – page 2350 – page 2410 |

If the resulting result of “Net profit (loss)” comes out with a minus sign, then it must be written down in the report, in brackets; the minus is not indicated. If the resulting value is positive, then there is no need to put it in brackets.

Despite the fact that the form of the balance sheet and the procedure for filling it out are approved at the legislative level, accountants often have questions regarding the interpretation of balance sheet lines. Today we will talk in detail about what this is a decoding of the balance sheet, how to decipher each of the sections of the balance sheet line by line, and also compare the specifics of filling out the form according to the old and new standards.

Explanation of the balance sheet according to the lines of section 4

This section of the balance sheet reflects the status of settlements on short-term loans, the amount of deferred tax liabilities, estimated and other liabilities:

| Balance sheet line | Decoding | How is the balance formed and from what accounts is it taken? | |

| Name | code | ||

| Borrowed funds | 1410 | Balance of outstanding long-term loan taken out for a period of more than 12 months | K/t 67 |

| Deferred tax liabilities (DTL) | 1420 | Formed if tax accounting in a company differs from accounting - the differences are formed according to the account. 77, the balance of outstanding obligations is the credit balance on the account. 77 | K/t 77 |

| Estimated liabilities | 1430 | The amount of reserves for upcoming expenses planned in the long term, for example, for reconstruction - the credit balance on the account. 96 | K/t 96 in terms of reserves formed for events that will occur no earlier than in a year |

| Other obligations | 1450 | Reflect borrowed (not own!) funds that are not indicated in line 1410. This may be long-term debt to a counterparty or the budget, incl. on bills of exchange, target receipts with a long-term perspective of coverage | K/t 60 + K/t 62 + K/t 68 + K/t 69 + K/t 76 + K/t 86 (for long-term debt) |

| Total for Section IV | 1400 | Total line | Sum of partition rows |

Practical examples of capitalization of fixed assets

Example 1

LLC "Medved" purchased a machine worth 250 thousand rubles. (including VAT - 38135.59). The price included additional costs for transporting the machine and installing it at the workplace.

All transactions are reflected in the accounting records of the LLC with the following entries:

RUB 211,864.41 — accounting for the costs of purchasing an asset (transportation and installation are carried out by the seller and are included in the price).

RUB 38,135.59 - input VAT shown.

211864.41 rub. — the initial cost of the equipment was formed, the machine was put into operation.

RUB 38,135.59 — input VAT is deductible.

Example 2

A manufacturing company decided to create a new warehouse for storing materials and goods. The construction of the building was carried out by the company’s workers, the final cost of the work according to the estimate was 10 million rubles.

The accounting transactions show:

Dt08.03 Kt60,10,70, 69, etc.

10 million rubles — the actual costs of building a warehouse are taken into account (salaries of employees involved in construction, insurance contributions from wages, cost of materials used (according to the act of writing off inventories), costs for additional services of contractors (for example, drawing up estimate documentation), etc.) .

Dt01 Kt08.03

10 million rub. — a new warehouse building was registered and put into operation

Reserves

On line 1210 of the second section of the balance sheet, you need to reflect data on materials, products, raw materials in production. Information about inventory, inexpensive office furniture, and stationery that are not written off at the end of the reporting period is also entered here. Information is entered into the balance sheet from account 10. If the organization uses accounting prices, then the report reflects the difference between the account. 10 and counting 16. If in addition the organization creates a reserve for the purchase of inventories, then the credit balance of the account should be subtracted from the resulting figure. 14.

Information about unfinished production is reflected from accounts 20-23 and accounts. 46. The cost of transportation costs for the delivery of goods is usually included in the cost price. Then information is entered into the balance sheet from account 41. Inventories are reflected at actual cost (account 41 - account 42).

Advantages

Speaking about tangible non-current assets, it is necessary to note:

- there is practically no exposure to inflation, due to which they are protected from its influence;

- have a small commercial risk of losses in operating activities;

- can bring stable profits, produce various products, depending on market conditions;

- help reduce losses during storage of inventory items;

- expand the volume of production activities when market conditions rise, thanks to the created reserves.

By degree, nature, place of use

The following non-current tangible assets are distinguished:

- Operating – those that are in operation.

- Inactive - in a state of conservation and not in use.

- In reserve - they are kept in stock and are used to continuously ensure the operation of production.

- They are being modified, reconstructed, liquidated.

- Manufacturing - take part in the creation of goods.

- Non-productive - do not take part in the creation of goods, but without them this process is not possible.

Flaws

But, alas, there were some negative aspects. Among them we should mention:

- Tangible non-current assets are property subject to obsolescence. Therefore, it loses its value even when idle.

- They are difficult to manage because their structure cannot be changed. Even when there is a decline in market conditions, the period of their use decreases.

- Most often, they are low-liquid assets, which is why they cannot act as means of payment.