( 5 votes, average rating: 5.00 out of 5)

lawyer Labor law

Today, almost every citizen of Russia has the right to conduct business. However, an individual entrepreneur needs to make contributions of a certain amount for himself, part of which is necessarily deducted to the Russian Pension Fund.

Issues covered:

- Does the individual entrepreneur receive a pension?

- Work experience for individual entrepreneur pension

- Which entrepreneurs are entitled to an insurance pension?

- Procedure for applying for a pension

- Indexing

How is a pension formed for an individual entrepreneur?

Since 2002, after a major reform of the system of material support for older citizens, the pension system of the Russian Federation abruptly switched to insurance principles. After 2002, length of service, that is, the number of years actually worked, ceased to be of great importance in matters of the formation of rights to material payments in old age.

The size of the pension, as well as the right to receive it, depends on the duration of the periods during which insurance contributions were transferred - sums of money sent by the employer for each employee. These funds go to the Pension Fund, which partially accumulates them in special personal accounts of citizens registered in the OPS system, and partially uses them to fulfill current obligations to current pensioners.

Reference! For employed citizens, the amount of contributions is directly tied to wages and is equal to 22% of it. That is, as a general rule, they are not paid in a fixed amount.

Individual entrepreneurs are the same participants in the OPS as all citizens of the Russian Federation. Therefore, the formation of their pension rights occurs in a similar way - by transferring funds to the Pension Fund of the Russian Federation in the form of contributions. At the same time, the responsibility for completing this financial transaction lies, strictly speaking, with the businessman himself.

Entrepreneurs, since they work for themselves, do not have an official salary, and in addition, their income depends on profits, the size of which is not constant. Therefore, 22% is calculated depending on the size of the minimum wage for each month.

Thus, for individual entrepreneurs, a minimum amount of contributions per year is established, which they are required to contribute to the state pension fund. In 2021 it is 29,354 rubles. This applies only to those businessmen whose income is less than 300 thousand rubles. If it is higher, then an additional 1% of the corresponding amount is paid. Also, contributions for health and social insurance in the amount of 6,884 rubles are paid separately.

Below are the dates before which the individual entrepreneur is obliged to pay funds:

- pension insurance – until December 31, 2019;

- social and health insurance – until December 31, 2019;

- Pension insurance for incomes over 300 thousand rubles – until 07/01/2020.

If a businessman does not conduct any profit-generating activities, then the obligation to make contributions to the Pension Fund remains with him. The basis for its termination is the cancellation of the entry in the Unified State Register of Individual Entrepreneurs.

The amounts received by the Pension Fund of the Russian Federation are transformed according to a special formula into points that form the IPC, which will influence both the very possibility of calculating an insurance pension in the future and its size.

Indexing order

Today, indexation is carried out for any pensions. Indexation refers to the adjustment of pension amounts to increase purchasing power, which is associated with high inflation in Russia. The indexation amount is usually equal to the inflation rate, to which 2% is added. Nowadays, such a rule is no longer valid, the main reason for this is the difficult situation in the country’s economy, very high inflation, which amounted to as much as 4% in 2021. But pensions are still increasing, although by a much smaller amount than before.

In recent years, pension indexation has acquired the following form: It is necessary to take into account the fact that officially employed pensioners who receive a salary have a non-indexed insurance part in 2021. By reducing indexation, the government plans to reduce the budget deficit and solve some other economic problems. To find out the exact amount of indexation for a specific time period, you need to contact the regional branch of the Pension Fund directly or go to the official website. All issues related to indexation are currently resolved by the State Duma of the Russian Federation.

The process of obtaining a singing IP today has some serious features. All these features are indicated in documents of a regulatory nature. Their list is quite extensive.

Conditions for calculating pensions for individual entrepreneurs

The insurance pension for entrepreneurs is calculated on the same basis as for all other citizens who have the corresponding right. The main criteria that are used to assess the possibility of receiving an insurance pension for elderly people are the IPC and the insurance period.

In 2021, the minimum parameters are:

- IPC – 16.2;

- Insurance experience – 10 years.

During the implementation of the latest pension reform, the criteria by which funds will be calculated for insurance coverage are becoming more stringent. Thus, by 2025, the IPC parameter cannot be less than 30, and the number of years of insurance experience less than 15 years.

Age

The pension reform, which is now in full swing in Russia, involves increasing the age when older citizens will receive the right to pension benefits.

Attention! In order to comply with the principles of social justice and maintain the stability of the pension system, the age is not increased at once, but gradually, gradually. So, in 2021 it is 55.5 years (women) and 60.5 years (men).

The above changes also affected entrepreneurs. They, as well as other citizens of the country, will retire later every year. In this regard, the status of “IP” does not imply any differences.

However, if, upon reaching retirement age, an entrepreneur cannot accumulate the required number of years of insurance experience and the value of the IPC, then he has no right to count on an insurance pension.

Is length of service important for former individual entrepreneurs when calculating a pension?

During the entire period when a citizen is engaged in entrepreneurial activity, he has an insurance period, provided that all necessary contributions are paid on his part. As mentioned earlier, the number of years of this type of experience directly affects the possibility of receiving a pension. Its size itself depends not on the length of service, but on the number of insurance points.

In addition, for citizens who, in addition to entrepreneurial activity, have had experience working as an employee, the corresponding periods are also included in the insurance period.

If an entrepreneur has a preferential period of service that gives him the right to retire early (for example, he worked in conditions harmful to life and health), then this will also be taken into account when calculating a pension, that is, the individual entrepreneur has the right to early retirement.

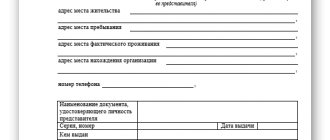

How is experience confirmed?

Considering the provisions of the current legislation, entrepreneurs cannot maintain work records for themselves, so many individual entrepreneurs have questions regarding documentary evidence of their work experience.

To confirm the fact of conducting business activities, you can provide the Pension Fund with:

- extract from the Unified State Register of Individual Entrepreneurs;

- payment documents confirming payment of contributions;

- certificate of termination of individual entrepreneur status;

Responsibilities of an individual entrepreneur

Having accepted responsibility and becoming an entrepreneur, you are obliged to obey the laws of our country. It is necessary to study administrative and state codes, monopoly and legislative acts. The main responsibility is the timely payment of taxes to the local, regional and state budgets.

Calculation of pension for individual entrepreneurs

The formula by which the amount of pension provision for an individual entrepreneur is determined is as follows:

SP = IPK*SB + FV, where:

SP – pension amount;

IPC – number of points;

SB – point value;

FV – fixed payment.

Example:

Individual Entrepreneur Petrov applied to the Pension Fund to accrue his pension benefits, having an IPC parameter of 50.

The price of a point in 2021 is 87.24 rubles.

FV in 2021 – 5334.19.

Using the above data, you can calculate the pension of IP Petrov:

50*87.2+5334.19 = 9694.19 rubles.

Are there additional coefficients?

One more value can be added to the formula above, which affects the size of the future pension. This is a premium factor. It will only be taken into account in case of late application for payments. For example, a pension can be increased by 40% if you apply for its appointment 5 years later than the corresponding age.

Registration of individual entrepreneurship by a pensioner

The procedure for registering an individual entrepreneur as a pensioner is quite complicated and requires collecting a package of documents. If you fill out the forms yourself, inaccuracies may occur, which will result in the return of documents.

You can avoid mistakes if you contact a consulting firm whose specialists have the necessary experience and information about currently accepted state standards. They guarantee that the paperwork will take place without unnecessary hassle and will not cause additional complications associated with financial expenses.

Here's what you need to do if you decide to register yourself:

- look at the OKVED directory;

- select the type of activity;

- correctly plan your activities, determine its direction in order to avoid unnecessary expenses when changing this plan in the future;

- fill out application form No. P21001, which you can;

- start collecting a package of documents (TIN, copies of passport, receipt of payment of state duty).

After you collect all the documents and deliver them to the tax office, the documentation package will be reviewed within five days. The registration procedure is standard, but from 2021 there are changes for entrepreneurs who have not registered. They will be able to legalize their paid activities and take advantage of “tax holidays”. These conditions are available only to individual entrepreneurs working under the simplified tax system and PSN.

Are there any benefits for individual entrepreneurs?

The mere fact that a citizen applying for a pension is an entrepreneur does not imply any benefits or preferences. They are provided on a general basis to all citizens who, among other things, worked:

- in difficult climatic conditions;

- in hazardous and hazardous industries;

- in the field of education (teachers) and medicine (medical personnel only).

In addition, for long overall work experience, some allowances or recalculation are due.

Recommendations

Before submitting documents for registration of an individual entrepreneur, a pensioner should choose the appropriate type of activity and tax regime. The simplified taxation system and patent are considered the most convenient for individual entrepreneurs. According to the simplified tax system, income is taxed with or without deduction of expenses.

The patent tax system consists of acquiring a patent for a certain type of activity. The price of a patent is determined based on the possible “net” profit, part of which is multiplied by 6%. Its validity period is 6-12 months. The law allows you to simultaneously acquire several patents

Subtleties that you should know about and need to take into account

When an individual entrepreneur retires, there are several points that he must take into account if he wants to continue to engage in entrepreneurial activity:

- The need to pay insurance premiums. Even if a businessman already receives a pension, he is required to pay insurance premiums, regardless of whether his business generates income.

- The pension is not indexed. An entrepreneur is, in fact, a working pensioner whose payments are not subject to indexation.

Individual entrepreneurs are persons insured in the compulsory pension insurance system, therefore in the future they have the right to an insurance pension, the amount of which depends on the amount of funds transferred to the account in the Pension Fund. In this case, the responsibility for administering contributions lies with the businessman himself.

RSD

Regional social supplement is financial assistance to citizens whose pension is equal to or less than the subsistence level adopted in the subject of the federation. Its size is determined by regional governments independently. The allowance is issued at the place of registration of the citizen, in the social protection authorities.

As stated above, RSD is only available to low-income pensioners. Most likely, this benefit will not be available to an individual entrepreneur. Because a business, no matter how small it may be, in any case makes the total income of a citizen above the subsistence level.

Additional odds

They are also taken into account when determining the pension of an individual entrepreneur (hereinafter denoted by the letter “DK”). There are several such coefficients:

- DC used to calculate the basic part of the pension.

- DK, which is equal to 5.

- DC, taking into account the time of military service. For each year, an indicator of 1.8 is assigned.

- DK for maternity leave.

- DC of maximum salary. 1 month = 2.3.

As you can see, the recalculation of pensions for individual entrepreneurs-pensioners occurs according to a formula that includes many influencing components. And in order to finally understand the topic, it is worth looking at a clear example.

Example

What kind of pension an individual entrepreneur will have depends on the income of his enterprise. Let’s say it brings in 4,000,000 rubles annually (for example, it’s better to take round sums). Contributions to funds from this income amount to 64,914 rubles. Every year, of course. Plus 175,085 rubles as a 6 percent tax payable in accordance with the simplified taxation system, to which the vast majority of entrepreneurs have now been transferred.

For example, we can assume that a person will contribute 64,914 rubles to the Pension Fund for another 35 years. What pension can he count on in this case? This can be found out by turning to the notorious calculator. In order for the system to perform the calculation, you will need to enter your personal data. These are gender, year of birth, type of employment, pension option, length of service and annual income.

And this is the answer the calculator gives: having worked as an entrepreneur for 35 years and earning 4 million rubles annually, a person can count on a monthly pension of 7,910 rubles. This is 94,920 rubles per year. By the way, the number of his individual odds will be 39.51.