Water tax declaration for the 2nd quarter of 2021: who submits it

A water tax declaration is mandatory for all persons (organizations, individuals, including individual entrepreneurs) using water resources, in accordance with a license, for the following purposes (clause 1 of article 333.8, clause 1 of article 333.9 of the Tax Code of the Russian Federation):

- water intake;

- use of water area;

- application in hydropower (without water intake);

- wood alloy (in rafts and wallets).

Depending on the method of use of water bodies, different methods are introduced for assessing the taxable base, as well as the tax rate (Article 333.10, 333.12 of the Tax Code of the Russian Federation).

How and where to submit

Reporting is controlled by the Federal Tax Service. The inspectorate where to submit the water tax declaration is determined by the place of registration of the reporting person (code on the title page of the declaration - 214) or by the place of registration of the largest taxpayers (code 215). If the objects used are located within the same region, but are specifically assigned to different districts, a consolidated report is submitted to any Federal Tax Service Inspectorate by agreement with all authorities. But you will have to pay the tax to several inspectorates - separately for each OKTMO. In the declaration, such payments are divided according to the location of the objects.

The form of delivery depends on the number of personnel. If the number of employees is less than 100 people, payers choose the delivery format independently: paper or electronic. For enterprises with a large number of employees (over 100 people), there is only one option for filing a declaration - only in electronic form via telecommunication channels.

Water tax declaration: deadline for reporting to the Federal Tax Service

Organizations and individuals (including individual entrepreneurs) report to the tax service at the end of each quarter. Tax is paid at the same frequency.

According to paragraph 2 of Art. 333.14 of the Tax Code of the Russian Federation, water tax is transferred to the budget system no later than the 20th day of the first month after the end. A similar period is provided for water tax and for filing a declaration (clause 1 of Article 333.15 of the Tax Code of the Russian Federation).

Features of the deadline for submitting the water tax return – 2020

The coronavirus pandemic has necessitated taking measures to reduce social contacts and support businesses. In this regard, the Government issued Resolution No. 409 dated 04/02/2020, according to clause 3 of which the deadlines for almost all types of reporting introduced by the Tax Code of the Russian Federation and falling for the period from March 1 to May 31, 2021, are postponed by 3 months.

Therefore, in fact, July 20, 2021 is the deadline for submitting a water tax return for the first half of 2021: no later than this date, taxpayers must report for both the 1st quarter and the 2nd quarter of 2021.

Fines

There are penalties for failure to submit or late submission of a water tax return. In accordance with paragraph 1 of Article 119 of the Tax Code , for violation of the deadline, a fine of 5% of the tax amount will be imposed for each full or partial month of delay. The minimum fine will be 1,000 rubles , the maximum - 30% of the tax amount .

blocking of a current account can be applied as a sanction . Such a decision may be made if the declaration is not received within 10 days after the deadline for acceptance.

Water tax declaration: form

The declaration form was introduced by the Federal Tax Service by Order No. ММВ-7-3 dated November 9, 2015/ [email protected] For the first time, payers reported on such a form for the 1st quarter of 2021. Since then, the form has not changed.

The declaration includes sections:

| Chapter | Content |

| Title page | Page 001 – information about the water user (to be completed by all taxpayers). Page 002 – information about the individual (not filled out by organizations and individual entrepreneurs) |

| 1 | Total amount payable by OKTMO |

| 2 | Calculation of taxable base and tax |

| 2.1 | Calculation for users collecting water. As many sections 2.1 are filled in as there are water intake facilities from the user |

| 2.2 | Calculation for other types of water resource use. As many sections 2.2 are filled in as there are water use facilities (except for the case of water intake) |

The procedure for filling out the report was approved by the same order No. ММВ-7-3/ [email protected] Let's look at filling out the declaration using an example.

How to fill out a declaration

The procedure is approved in Order No. ММВ-7-3/ [email protected] When filling out the water tax declaration, consider the following rules:

- You cannot go beyond the boundaries of graphs, rows and cells.

- The paper declaration must be filled out with a ballpoint or fountain pen and only in black ink.

- Correcting errors with correction fluid is prohibited.

- Stapling, staples and double-sided printing are not permitted.

- The form provides information on the use of resources and payment of water tax only for the reporting quarter, and not on an accrual basis.

- It is necessary to indicate actual data for the reporting period. Information is submitted separately for each quarter.

- The number 0 is indicated on the primary report, 1 on the adjusting report, and then in the order of adjustments.

Let's look at the procedure for filling out KND 1151072 in the table:

| Declaration section | Filling rules |

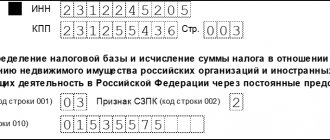

| Title page | Reflect the registration information about the taxpayer - TIN, KPP, name, OKVED, telephone, full name. leader. Be sure to indicate the adjustment number, reporting period (quarter) and year, location code: 214 for ordinary taxpayers and 215 for the largest companies. The explanations of the Federal Tax Service indicate how to fill out a water tax declaration if there are several checkpoints: it is necessary to place a checkpoint according to the territorial location of the water body (letter No. SD-4-3 / [email protected] dated 10/19/2016). |

| Page 2 | The next sheet after the title sheet is filled out only by those persons who use resources for non-commercial purposes, i.e. individuals who are not individual entrepreneurs. |

| 1 | In the first section, indicate the total amount of the contribution to be paid for each BCC and OKTMO. |

| 2 | Calculation of tax by type of water use. |

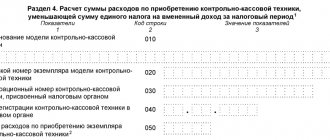

| 2.1 | Filled out by users who collect water. Here's what you need to indicate:

|

| 2.2 | Here information is recorded by users of water areas and resources for hydropower and wood rafting. The procedure for filling out section 2.2 is similar to block 2.1. |

IMPORTANT!

If you have a license and there is no actual water use, a zero water tax return is submitted in 2021. The taxpayer is required to report to the Federal Tax Service for the entire period of validity of the license to use water bodies.

Water tax: filling out the declaration

LLC "Gidrant" is engaged in the extraction of crude oil (OKVED code - 06.10.1) and uses the water resources of the river. Volga (Volga economic region) for the purposes of:

- water intake from underground sources for technological needs (water use type code from Appendix No. 4 to the Filling Rules - 12061; other purpose of intake - code 3 from Appendix No. 5);

- rafting of wood (use code from Appendix No. 4 – 40800).

The enterprise uses water measuring systems: the well is equipped with instruments for recording production volumes and measuring groundwater levels in accordance with the Rules for the protection of groundwater bodies, approved by Government Decree No. dated 02/11/2016.

Calculation of water tax when taking water - section 2.1 of the declaration

During the 2nd quarter of 2021, Hydrant LLC collected water in the amount of 52,523 cubic meters. m, including:

- 3,115 cu.m. m - for fire extinguishing (tax is not assessed according to clause 2, clause 2, article 333.9 of the Tax Code of the Russian Federation);

- 47,000 cu.m. m – within the limit specified by the license;

- 2,408 cu.m. m – over the limit (52,523 – 3,115 – 47,000).

Art. 333.12 of the Tax Code of the Russian Federation introduces a rate for the fence of 1,000 cubic meters. m of water:

- 348 rub. – until the limit is exceeded (Volga River basin);

- 348 x 5 = 1,740 rub. – for volumes exceeding the limit specified in the license, the rate increases 5 times.

Additionally, in 2021, the given rates are multiplied by a coefficient of 2.31 (in 2021, a coefficient of 2.01 was applied).

Let's calculate the tax for the 2nd quarter of 2021:

- 47,000 / 1,000 x 348 x 2.31 = 37,782 rubles. – within the limit;

- 2,408 / 1,000 x 1,740 x 2.31 = 9,679 rubles. – from exceeding the limit;

- 37,782 + 9,679 = 47,461 rubles. – the total amount of payment for water intake.

Calculation of water tax for timber rafting – section 2.2 of the declaration

In the 2nd quarter of 2021, Hydrant LLC melted 10.5 thousand cubic meters. m of wood along the river Volga at a distance of 60 km.

Tax rate – RUB 1,636.80. for every 100 km. In this case, the 2021 coefficient of 2.31 is also taken into account.

Let's calculate the tax for wood rafting: 10.5 x 60 / 100 x 1636.80 x 2.31 = 23,820 rubles.

Who pays for what?

Businessman holding sand and coin

First, let's talk about taxpayers. According to the provisions of Article 333.8 of the Tax Code, this definition applies to private owners, individual entrepreneurs and companies that engage in activities involving the use of water resources. Provided that such activities are subject to mandatory licensing. Here it is necessary to clarify that persons who acquired the right to use water after the Water Code came into force are not recognized as taxpayers.

The following water use options are subject to taxation:

- Water intake;

- Management of water areas, except for timber rafting;

- Water use by objects for the purpose of timber rafting;

- Management of water resources without water withdrawal: hydroelectric power plants.

Please note that the law provides for several exceptions. In particular, the following types of water use are not subject to taxation:

- Intake of underground or thermal waters that contain minerals or healing components;

- In order to ensure safety measures, for example, to extinguish fires or eliminate the consequences of natural disasters;

- For shipping, environmental or sanitary and epidemiological purposes;

- Water intake by vessels in order to ensure the functionality of the installed equipment;

- Use of such facilities for natural resource replenishment or fish farming;

- Arrangement of communication lines, buildings, watercraft and other objects related to environmental activities;

- Use of water areas for landing (one-time) aircraft, as well as movement on ships and small craft;

- Carrying out prospecting work, as well as topographical, geodetic and hydrographic surveys;

- Construction of hydraulic structures, including facilities for land reclamation, water supply, etc.;

- Use of facilities for organizing recreation for children, veterans and people with limited mobility;

- Carrying out work related to dredging and construction of hydroelectric structures;

- Use of water resources for the needs of the state and measures to increase the country’s defense capability;

- use of water for irrigation of household plots and agricultural needs;

- Allocation of aquatorial waters for hunting and fishing;

- Intake of mining and collector-drainage waters from underground reservoirs.

Water tax objects

Filling out the summary section

In section 1, tax amounts accrued in the subsections of section 2 are grouped by OKATO (OKTMO) codes. The total sum of tax values in section 1 must be equal to the sum of the total values of all sheets of subsections of section 2.

For information on what to do if you made a mistake in specifying the OKTMO code, read the article “An error in OKATO or OKTMO is not a reason for penalties and fines.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to punish for violations

Late submission of information or complete failure to provide it is punishable. The violator will face a fine. Amount - 5% of the amount of the unpaid contribution to the budget. The minimum amount of recovery is 1000 rubles.

What is the object of taxation under the water tax and who must pay it? When should you think about filling out a water tax return and where should you submit it? Our article will give a complete answer to all these and many other questions. Here you can download a free water tax declaration form.

Legal entities and individuals carrying out special and/or special water use in the course of their activities, in accordance with the norms of the current legislation of the Russian Federation, must pay water tax. This type of tax refers to federal taxes; this area is regulated by Articles 333.8-333.15 of the Tax Code of the Russian Federation.

Important! Organizations and individuals who use water on the basis of an agreement or decision on the provision of water bodies for use, concluded after the entry into force of the Water Code of the Russian Federation, are not recognized as taxpayers.

We decide on the deadlines and place for submitting the report

The main points regarding the deadlines for submitting the VN declaration and its recipients are indicated in Art. 333.15 Tax Code of the Russian Federation:

- You must send the declaration to the inspectorate at the location of your water body;

- submission deadline - no later than the 20th day of the month following the reporting quarter.

The said article of the Tax Code of the Russian Federation details 2 more nuances concerning:

- the largest taxpayers - they need to submit a report to the inspectorate with which they are registered;

- VN payers - foreigners: they need not only to send the original declaration to the inspectorate at the location of the water body, but also send a copy of it to the authority that issued the water use license.

This concludes the explanations of the Tax Code of the Russian Federation on this issue. But what about those who use water on the territory of several municipalities (MO) within one subject of the Russian Federation? Where should they submit “water” reporting?

The Federal Tax Service answered this question in a letter dated March 25, 2013 No. ED-4-3/: it indicated 2 acceptable ways to submit a report:

- according to the location of the taxpayer in this subject of the Russian Federation;

- to one of the inspectorates of this subject at the place of water use (after agreeing on the recipient of the report with the Federal Tax Service of this subject).

In such a situation, it will not be possible to transfer VN payments in a single amount. Payment orders must be issued to each municipality within the corresponding constituent entity of the Russian Federation on whose territory water bodies are used.

Tax benefits

Among the benefits that the water tax has, we can briefly describe the possibility of not paying money to the budget if the withdrawn water was used to eliminate the consequences of an accident, ensure fire safety, or for other reasons.

If water from facilities is used for the population to meet the needs of citizens, it is allowed to carry out calculations taking into account reduced tax rates. But for this, the enterprise must have a license and organize accounting of the volumes of water transferred to the population.

Title page

The title page of the declaration is filled out by the taxpayer, except for the section “To be filled out by a tax authority employee”

.

When filling out the “Adjustment number”

“0” is automatically entered in the primary declaration; in the updated one for the corresponding period, it is necessary to indicate the adjustment number (for example, “1”, “2”, etc.).

Field "Tax period"

is filled in automatically.

In the "Reporting year"

The calendar year for the tax period for which the declaration is submitted is automatically indicated.

When filling out the field “Submitted to the tax authority (code)”

The code of the tax authority to which the declaration is submitted is reflected. By default, the program enters the code of the tax authority specified in the taxpayer registration card.

In the field “at location (accounting) (code)”

select the code, the list of which is given in the drop-down list. If the declaration is submitted at the location of the water body, then code “255” is selected, etc.

In the "taxpayer"

the full name of the organization is reflected in accordance with the constituent documents, and if the declaration is submitted by an individual (including individual entrepreneur), his full last name, first name, patronymic (if any) are indicated in accordance with identity documents. This line is filled in automatically from the client registration card.

Field “Code of type of economic activity (OKVED)”

filled in automatically (if the client is already registered in the system), or selected from the classifier. These codes are determined by organizations and individual entrepreneurs independently and are contained in extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs.

Attention! Fields “Form of reorganization (liquidation) (code)”

and

“TIN/KPP of a reorganized organization”

are filled out only by those organizations that are reorganized or liquidated during the tax period.

In the “Contact phone number”

The taxpayer's telephone number specified during registration is automatically reflected.

In the field “On ____ pages”

The number of pages on which the declaration is drawn up is indicated. The field value is filled in automatically and recalculated when the composition of the declaration changes (adding/deleting sections).

When filling out the field “with supporting documents or their copies on ___ sheets”

the number of sheets of supporting documents and (or) their copies (if any) is reflected. Such documents may be: the original (or a certified copy) of a power of attorney confirming the authority of the taxpayer’s representative (if the declaration is submitted by the taxpayer’s representative).

In the section of the title page “I confirm the accuracy and completeness of the information:”

indicated:

“1” - if the declaration is submitted by the taxpayer,

“2” - if the document is submitted by a representative of the taxpayer. In this case, the name of the representative and the document confirming his authority are indicated.

Also in this section of the declaration, in the field “I confirm the accuracy and completeness of the information”

The date is automatically indicated.

REPORTING POINT

Skrigalovskaya E. A., practicing accountant

Some issues of calculating water tax

The organization that collects water from water bodies has obligations to the budget. In particular, it must have a license and pay water tax. When calculating this tax, special attention should be paid to the application of a reduced rate in relation to water supply to the population.

Water tax is paid by companies that use water bodies for business purposes, namely:

- water intake;

- exploitation of the water area (that is, the surface of the water) for timber rafting or other purposes;

- hydroelectric power.

Each type of water use has its own rates and tax calculation procedure. For example, when withdrawing, the tax rate is multiplied by the volume of water received (tax base); when operating a water area (with the exception of timber rafting), the tax rate is multiplied by the area of the reservoir used, and so on.

IMPORTANT IN WORK

If you take water to use a water body, you need to obtain a license from the territorial branch of the Ministry of Natural Resources. In it, the company sets a water intake limit.

In general, the calculation of water tax cannot be called a complex operation: the amount of tax at the end of each tax period is equal to the product of the tax base and the corresponding rate (clause 2 of Article 333.13 of the Tax Code of the Russian Federation). The tax period is a quarter (Article 333.11 of the Tax Code of the Russian Federation). The tax base for water abstraction is defined as the volume of water taken from a water body during the tax period (clause 2 of Article 333.10 of the Tax Code of the Russian Federation).

Rates are differentiated depending on the economic region and river basin (clause 1, clause 1, article 333.12 of the Tax Code of the Russian Federation). It is important to remember that when water is withdrawn for such a socially significant purpose as water supply to the population, tax is paid at a rate of 70 rubles. per 1000 cubic meters m of water, regardless of the water body (clause 3 of Article 333.12 of the Tax Code of the Russian Federation).

IMPORTANT IN WORK

The tax amount is paid at the location of the water body and is fully credited to the federal budget.

If an organization has drilled an artesian well, but water is not extracted from it, there is no obligation to pay tax (Resolution of the Federal Antimonopoly Service of the Central District of October 7, 2010 No. F10-4045/10 in case A48-2/2010). At the same time, according to the Ministry of Finance, in this situation, if you have a license to use subsoil, it is necessary to submit a tax return (letter dated November 7, 2006 No. 03-07-03-04/39).

The tax base

According to paragraph 1 of Art. 333.10 of the Tax Code of the Russian Federation, the tax base is determined separately for each water body for each type of water use recognized as an object of taxation. In addition, if different rates are established for a water body, the tax base and tax amount are determined in relation to each rate.

GOOD TO KNOW

The water tax declaration form was approved by order of the Ministry of Finance of Russia dated March 3, 2005 No. 29n. This order also contains instructions for filling it out.

Tax return

In the declaration, subsections 2.1–2.4 are first filled out. Which ones your organization needs to fill out depends on how it uses water bodies.

The numbers of subsections corresponding to the types of water use are given in the table.

| Type of water use | Section number |

| Water intake | 2.1 |

| Use of the water area of a water body (except for timber rafting) | 2.2 |

| Operation of hydroelectric power plants | 2.3 |

| Use of the water area for timber rafting | 2.4 |

In accordance with clause 5.1.1 of the Procedure for filling out a tax return for water tax, approved by order of the Ministry of Finance of the Russian Federation dated March 3, 2005 No. 29n, section 2.1 “Calculation of the tax base and the amount of water tax when withdrawing water from a water body,” the declaration is filled out separately not only for each water body, taking into account the intended use of the withdrawn water, but also for each license.

Based on clause 5.1.4 of the specified procedure, when collecting water from underground water bodies, the registration number of the artesian well is entered in line 025 “Water body (name)” of section 2.1 of the declaration. It turns out that if there are several wells, the tax base and the amount of tax are determined in relation to the water intake from each of them. Likewise, if an organization collects water from multiple locations on the same river, it needs to prepare as many copies of the subsections as it has licenses.

The procedure for filling out subsections 2.1–2.4 is identical. The only difference is that they indicate tax rates and tax bases that correspond to the type of water use.

The total amount of tax for the use of water bodies is determined as the product of the volume of water received by the corresponding tax rates.

GOOD TO KNOW

The tax period for water tax is a quarter.

To calculate, you can use the formula:

Line 080 x line 100 + Line 090 x line 110 = Line 120

Zero declaration

A “zero” water tax declaration exists. An explanation on this issue is given in paragraph 7 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71 “Review of the practice of resolving cases by arbitration courts related to the application of certain provisions of part one of the Tax Code of the Russian Federation.” It says that the obligation to submit a water tax return, including a “zero” one, arises due to the status of a water tax payer, that is, if there is a decision or license (agreement) for water use. The obligation to submit a declaration does not depend on the presence or absence of an object subject to water tax (whether the organization uses the water area, collects water or not).

IMPORTANT IN WORK

Firms submit a water tax declaration to the tax office at the location of the water bodies. This must be done no later than 20 days after the end of the tax period.

Responsibility

If a company is late in filing its return, it will be fined. The amount of the fine is the same, regardless of the timing: 5% of the untransferred tax (based on the declaration for each month), but not more than 30% of the untransferred amount and not less than 1000 rubles.

In addition, the head of the organization may also be fined. The amount of the fine will be from 300 to 500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

GOOD TO KNOW

If your company exceeds the established limit, then the tax rate for the excess volume of water intake increases five times.

You can also be fined if the company is required to submit declarations in electronic form, but does so on paper. The fine under this article is 200 rubles for each document submitted in the wrong way (Article 119.1 of the Tax Code of the Russian Federation).

Application of a reduced tax rate

As already indicated, for organizations that collect water for the purpose of water supply to the population, it is legal to apply a rate of 70 rubles. per 1000 cubic meters m of water. However, the right to such a bet is not always indisputable.

POSITION OF THE COURT

In tax and water legislation, as well as in regulatory legal acts regulating the activities of water supply and analysis organizations in the use of centralized water supply systems in populated areas, there is no definition of the concept of water supply to the population. Therefore, based on the provisions of paragraphs. 6 and 7 art. 3 of the Tax Code of the Russian Federation, it cannot be recognized as correct the conclusion that the controversial water tax rate established when water is withdrawn for water supply to the population is subject to application only in relation to the volume of water taken from water bodies for water supply to housing stock.

One of the problems is what exactly is meant by the purpose of water intake as water supply to the population (clause 3 of Article 333.12 of the Tax Code of the Russian Federation). In letters dated December 20, 2005 No. 03-07-03-02/64 and dated June 14, 2006 No. 03-07-03-02/24, the Ministry of Finance explained that taxpayers who withdraw water from a water body have the right to apply the tax rate in question on the basis licenses for water use for the purposes of drinking and domestic water supply to the population (water supply to housing stock).

However, as the Ministry of Finance rightly noted in letter dated November 1, 2010 No. ШС-37-3/14561, from the provisions of Art. 333.12 of the Tax Code of the Russian Federation does not mean that water supply to the population means water supply exclusively to housing stock. This letter, addressed to the Ministry of Finance in order to find out its opinion on this issue, contains two court decisions in which the arbitrators supported the taxpayers that the rate of 70 rubles. per 1000 cubic meters m applies to water taken not only for water supply to the housing stock, but also for the domestic needs of enterprises, institutions, organizations (see resolutions of the Federal Antimonopoly Service UO dated November 27, 2008 No. Ф09-8843/08-С3, Federal Antimonopoly Service SZO dated 06.08. 2007 No. A05-809/2007).

IMPORTANT IN WORK

Quarterly, before the 10th day of the month following the reporting quarter, the water user is obliged to submit free of charge to the territorial body of Rosvodresursy the results of accounting for the volume of water resources withdrawn and their quality (the accounting procedure is approved by order of the Ministry of Natural Resources of the Russian Federation dated July 8, 2009 No. 205).

Water intake from surface water bodies. Non-tax fee

According to paragraph 2 of Art. 333.8 of the Tax Code of the Russian Federation, organizations carrying out water use on the basis of agreements concluded after the entry into force of the Water Code of the Russian Federation are not recognized as payers of water tax. These water users are required to pay a non-tax fee to the budget, the amount of which is an essential condition of the water use agreement (clause 4, clause 1, article 13 of the RF Water Code).

If a water user withdraws water from surface water bodies on the basis of permits issued before 01/01/2007, he is obliged to pay water tax (letter of the Ministry of Finance of the Russian Federation dated 07/02/2009 No. 03-06-06-02/4). However, if the “old” license has ceased to be valid and the water use agreement was not concluded on time, the use of a surface water body in the absence of permitting documents does not mean the existence of obligations as a water tax payer (Resolution of the Federal Antimonopoly Service of the North-West District dated June 28, 2010 No. A21-8850/2009, dated February 4. 2010 No. A21-4283/2009).

POSITION OF ROSVODRESOURS

The recalculation of the fee will receive legal force only if an additional agreement to the water use agreement is signed and this agreement is registered in the state water register.

To conclude a water use agreement, the organization must submit to the authorized body an application with a number of attachments, in particular, with materials containing the calculation of the amount of payment for the use of a water body for the withdrawal (withdrawal) of water resources (clause “a”, clause 8 of the Rules for the preparation and conclusion of an agreement water use approved by Decree of the Government of the Russian Federation dated March 12, 2008 No. 165). To calculate fees for water use, you need to refer to the rules approved by Decree of the Government of the Russian Federation dated December 14, 2006 No. 764 (this document applies only to fees for the use of water bodies that are federally owned).

The formula for calculating the fee is as simple as the algorithm for calculating the water tax: you need to multiply the payment base (the volume of permissible withdrawal of water resources, including the volume of their withdrawal for transfer to subscribers) for the payment period (quarter) by the corresponding payment rate.

Rates of payment for the use of water bodies that are federally owned are approved by Decree of the Government of the Russian Federation dated December 30, 2006 No. 876. At the same time, the rate of payment for the withdrawal (withdrawal) of water resources from surface water bodies or parts thereof for drinking and domestic water supply to the population is established in the amount of 70 rubles. per 1000 cubic meters m of water resources taken (withdrawn) from a water body.

The water use agreement specifies the purpose, types and conditions of use of a water body or part thereof, including the volume of permissible intake (withdrawal) of water resources (clause 2, clause 1, article 13 of the RF Water Code), as well as the amount of payment calculated based on the volume permissible water intake. It is this fee that the water user is obliged to transfer quarterly no later than the 20th day of the month following the expired payment period.

What you need to know ↑

Let's figure out what regulations regulate the procedure for filling out documentation and paying. Such information is necessary for taxpayers who use water bodies for various purposes in accordance with the laws of the Russian Federation.

Payment procedure

At the end of the tax period, the water tax payer undertakes to carry out calculations (independently) in accordance with the procedure provided for in Art. 333.13 Tax Code.

To do this, determine the tax base (volume of water resources, what is taken, the area of the facility, what is used, etc.), multiply it by the tax rate, which corresponds to such types of water use, economic regions and water basins.

The water tax procedure contains Ch. 25.2 Tax Code according to the location of objects that are subject to tax. If a person uses several facilities, then he will need to pay to the department where he is registered as a taxpayer.

Then the received funds will be distributed among the constituent entities of the Russian Federation, within whose territory water resources are located.

When resolving issues regarding the transfer of taxes for water use, it is worth relying on the fact that a water resource is taxed, which means that the transfer of the calculated amount should be carried out at its location.

When objects are located in different regions, agreements should be drawn up with the state representation of these entities.

The conditions and deadlines for submitting reports in the form of a declaration are regulated by Art. 333.15 Tax Code. This law allows you to avoid problems that may arise when submitting a document.

The payer must submit one declaration at the location of the water resource. If a person has several objects in use, information is simply added to the reports being compiled.

In this case, you will need to submit the declaration itself and its photocopy: the original - at the place where the organization is registered, a photocopy - at the place of actual use of the resource.

Who submits the declaration

In accordance with Art. 333.8 of Chapter 25.2 of the Tax Code of the Russian Federation, payers of water tax are legal entities and individuals (IP) who use water bodies.

Water use can be special (this requires obtaining appropriate permission) and special.

These same persons undertake to calculate the amounts and draw up a declaration, which is subsequently submitted to the tax authority.

In the case where the payer does not use water bodies, a dash is placed in the relevant paragraphs in the report.

Legal grounds

The rules for calculating and paying water tax are regulated by Ch. 25.2 Tax Code (law of July 28, 2004 No. 83-FZ).

The object that is taxed is:

- abstraction of water from a water resource;

- use of water areas of rivers, seas and other bodies of water, except for timber rafting;

- if a reservoir is used to operate a hydroelectric power station;

- if the reservoir is used for timber rafting.

Objects that are not taxed are listed in Art. 333.9 NK.

The tax base is determined individually for each category of objects, and the rates at which the calculation is made differ:

| Condition | Description |

| If water is being collected | For the calculation, take the volume of water (m3), which is displayed by water measuring instruments and recorded on the pages of the primary journal. In the absence of a device that can measure the amount of water consumed, the operating time of the water intake equipment will be taken |

| For payers who use water bodies of water | Measure – area of a water body |

| If the taxpayer uses the reservoir for timber rafting | Sum of volumes of wood that is rafted (1000 m3) and distance (km) |

| To use water resource by hydroelectric power plant | kW of generated electrical energy |

Water tax benefits are not provided to persons. Tax period – 3 months (quarters).

The rates are described in Art. 333.12 Tax Code. If an organization or individual overspent, they will have to pay five times more tax.

Tax reporting is a declaration that should be submitted to the regional office of the entity where the taxpayer is registered or on whose territory the body of water used is located.

Which chapter of the Tax Code regulates the collection of water tax

The procedure for determining the amount of water tax is prescribed in Chapter. 25.2 Tax Code of the Russian Federation. Water tax must be paid by users of the following water bodies: seas (and their individual parts, for example, straits, bays, estuaries), rivers, lakes, swamps, springs, geysers, glaciers.

The water tax was introduced into the country's economic practice in 2005. Proceeds from it are sent to the federal budget.

To use state water resources, you must first obtain a special permit:

- Until 2007, such permits were issued on the basis of Decree of the Government of the Russian Federation dated April 3, 1997 No. 383.

- Since 2007, licenses have been issued in accordance with the provisions of the Water Code of the Russian Federation. Permits issued before the Water Code came into force are valid until their expiration date.

In 2015, amendments were made to the articles of the Tax Code of the Russian Federation regulating the water tax - increasing coefficients appeared. According to the amendments, by 2025 the tax will increase 4.5 times, and for the extraction of mineral water an additional coefficient will increase it 10 times.

With what coefficient is the water tax calculated in 2017, find out from the message “Water tax 2021: what’s new?”